Medicare’s Income-Related Premiums Under Current Law and Proposed Changes

The U.S. House of Representatives is considering legislation (H.R. 3922) to extend funding for the Children’s Health Insurance Program that includes a provision to increase Medicare premiums for some higher-income beneficiaries to help offset the cost of the legislation. The Congressional Budget Office (CBO) has estimated that this provision would increase Medicare’s premium revenues (and thereby reduce program spending) by $5.8 billion between 2018 and 2027. This issue brief describes current requirements with respect to Medicare’s Part B and Part D income-related premiums and proposed changes under the House legislation.

Overview of Current Law Related to Medicare Premiums

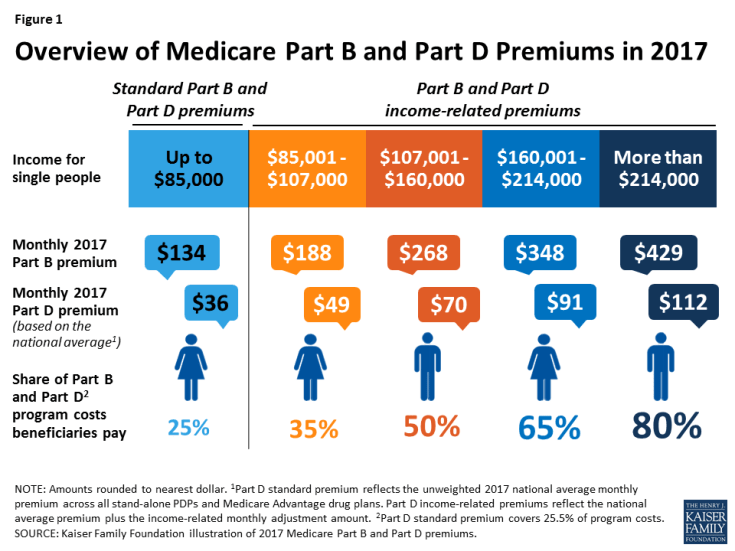

Today, most Medicare beneficiaries pay the standard monthly premium, which is set to cover 25 percent of Part B and Part D program costs, but a relatively small share of beneficiaries (around 6 percent in 2015) with incomes above $85,000 for single people and $170,000 for married couples are required to pay higher premiums for Medicare Part B and Part D—ranging from 35 percent to 80 percent of program costs, depending on their incomes (Figure 1).

Part B and Part D Standard Premiums

Monthly premiums for most people on Medicare equal 25 percent of average per capita Part B expenditures for Part B enrollees and 25.5 percent of average per capita Part D expenditures for drug plan enrollees. In 2017, the Part B standard monthly premium is $134; for Part D, the national average monthly premium, according to CMS, is $35.63. Actual monthly premiums for stand-alone Part D drug plans vary across plans and regions from a low of $14.60 to a high of $179 in 2017.

Income-Related Premiums for Part B and Part D

People on Medicare with incomes above $85,000 for individuals and $170,000 for couples are required to pay higher premiums for Medicare Part B and Part D. The Part B income-related premium was established by the Medicare Modernization Act of 2003 and took effect in 2007. The Part D income-related premium was established by the Affordable Care Act (ACA) and took effect in 2011. Under these provisions, beneficiaries with higher incomes pay a larger share of Part B and Part D program costs than 25 percent, ranging from 35 percent to 80 percent of per capita costs, depending on their income.

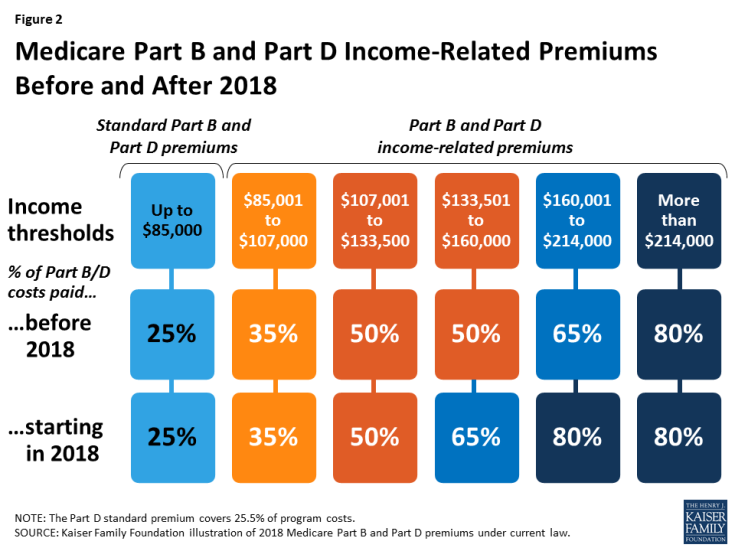

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) made changes to Medicare’s income-related premiums that will affect beneficiaries with incomes above $133,500 ($267,000 for married couples) by requiring them to pay a larger share of Part B and Part D program costs beginning in 2018 (Figure 2):

- Beneficiaries with incomes above $133,500 and up to $160,000 ($267,000-$320,000 for married couples) will pay 65 percent of Part B and Part D program costs starting in 2018, up from 50 percent prior to 2018. As a result of this change, monthly Part B premiums are expected to be $348 in 2018 for beneficiaries in this income group, rather than $268 that year, based on projections of Part B program costs from the Medicare Trustees.

- Beneficiaries with incomes above $160,000 and up to $214,000 ($320,000-$428,000 for married couples) will be required to pay 80 percent of Part B and Part D program costs, rather than 65 percent. As a result of this change, Part B premiums in 2018 are expected to be $429 per month for beneficiaries in this income group, rather than $348 per month in that year, based on projections from the Medicare Trustees.

The income thresholds that determine the income-related premium payments are frozen through 2019, but will increase by about 2 percent in 2020 and will be indexed after that for general price inflation.

How Much are Beneficiaries Currently Paying For Part B and Part D Income-Related Premiums?

In 2017, Part B premiums for higher-income beneficiaries range from $188 per month for individuals with annual incomes above $85,000 up to $107,000, to $429 per month for individuals with incomes above $214,000. For Part D, higher-income beneficiaries pay a monthly premium surcharge in addition to the premium for their specific Part D plan; in 2017, the monthly premium surcharge ranges from around $13 for individuals with annual income above $85,000 up to $107,000, to an additional $76 for individuals with incomes above $214,000. When combined with the national average premium amount, higher-income Part D enrollees pay between $49 and $112 per month in 2017.

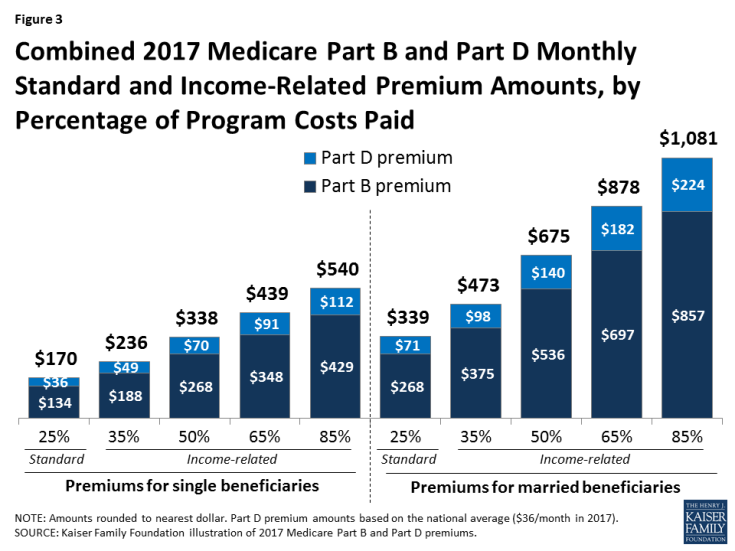

For beneficiaries enrolled in both Part B and Part D, the combined income-related monthly premiums range from $236 (35 percent of program costs) for single beneficiaries with incomes above $85,000 up to $107,000, to $540 (80 percent of program costs) for beneficiaries with incomes above $214,000 (Figure 3). Monthly income-related premiums for married couples who are both enrolled in Part B and Part D are twice these amounts, ranging from $473 for those with incomes up from above $170,000 up to $214,000, to $1,081 for couples with incomes above $428,000.

Figure 3: Combined 2017 Medicare Part B and Part D Monthly Standard and Income-Related Premium Amounts, by Percentage of Program Costs Paid

How Would the Proposed Legislation Change Medicare’s Income-Related Premiums?

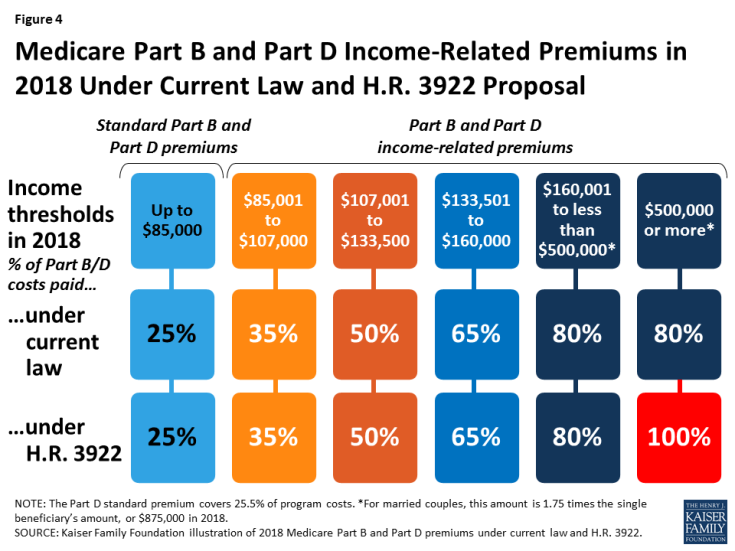

The proposed legislation would modify the income thresholds that determine which beneficiaries pay 80 percent of Part B and Part D program costs, and would create an additional category requiring certain higher-income beneficiaries to pay 100 percent of program costs, beginning in 2018 (Figure 4):

Figure 4: Medicare Part B and Part D Income-Related Premiums in 2018 Under Current Law and H.R. 3922 Proposal

- Beneficiaries with incomes above $160,000 but less than $500,000 would pay 80 percent of Part B and Part D program costs, consistent with current law.

- Beneficiaries with incomes of $500,000 or more would pay 100 percent of Part B and Part D program costs. For married couples, this income threshold would be set at 1.75 times the amount that single beneficiaries pay, or $875,000 in 2018.

The proposal would also change the inflation adjustment applied to the highest income-related premium category beginning in 2027.

Policy Implications

Increasing premiums for some beneficiaries who are already subject to income-related premiums will affect a relatively small share of the Medicare population. Part of the appeal of requiring higher-income beneficiaries to pay a greater share of Medicare costs is that these higher costs are imposed on only a relatively small share of beneficiaries who arguably have greater financial means to bear the additional expenses, thereby protecting the majority of people on Medicare with relatively modest incomes.

At the same time, there is some concern that the income thresholds used to trigger the payment of higher premiums by Medicare beneficiaries ($85,000 for individuals and $170,000 for couples) are lower than the thresholds used to define higher-income people in other policy discussions. There is also concern that imposing higher premiums could discourage higher-income people from enrolling in Part B and Part D, which could further erode Medicare’s financial status in the future. Adopting the House proposal would also mean that for the first time, some beneficiaries would not receive any federal subsidy for their Medicare Part B and Part D coverage and would be required to pay these costs in full. Another concern is that the Medicare savings associated with this proposal are not dedicated to Medicare but instead used to fund other priorities.