Medicare Part D: A First Look at Prescription Drug Plans in 2017

During the Medicare open enrollment period, which runs from October 15 to December 7 each year, beneficiaries can enroll in a plan that provides Part D drug coverage, either a stand-alone prescription drug plan (PDP) as a supplement to traditional Medicare, or a Medicare Advantage drug plan (MA-PD), which provides all Medicare-covered benefits including drugs. Of the nearly 41 million beneficiaries enrolled in Part D plans, about 6 in 10 are in PDPs and the rest in MA-PD plans.1 This issue brief provides an overview of the 2017 PDP marketplace,2 based on our analysis of data from the Centers for Medicare & Medicaid Services (CMS).3 Key findings include:

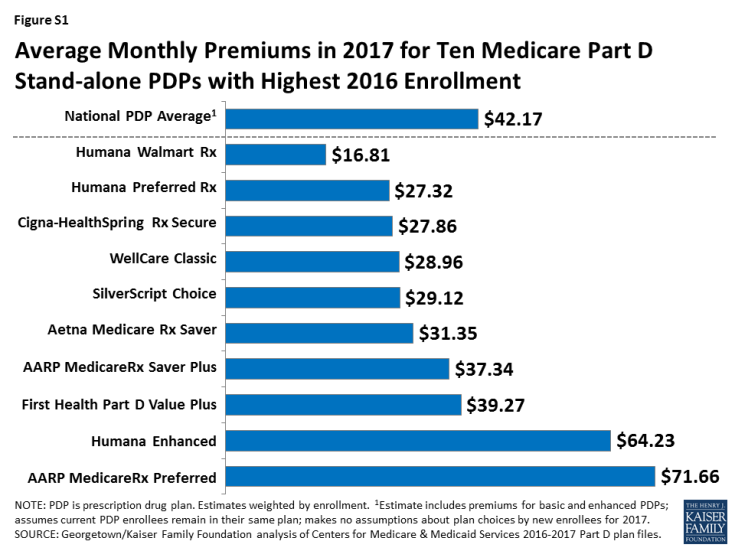

- The average monthly PDP premium in 2017 will increase by 9 percent from 2016, to $42.17 (weighted by 2016 plan enrollment). This estimate includes premiums for both basic and enhanced PDPs, assumes current PDP enrollees remain in their same plan, and does not make assumptions about plan choices by new enrollees for 2017. The average Part D PDP deductible is projected to rise by 7 percent.

- PDP premiums will continue to vary widely across plans in 2017, as in previous years. Among the ten PDPs with the highest enrollment, average premiums in 2017 will range from a low of $16.81 per month, or $202 annually, for the Humana Walmart Rx PDP to a high of $71.66 per month, or $860 annually, for the AARP Medicare Rx Preferred PDP—an annual premium difference of $658 (Figure S1).

- Average PDP premiums will continue to vary across states in 2017, from a low of $31.27 in New Mexico to a high of $50.95 in New Jersey. Between 2016 and 2017, enrollees in some regions will see larger premium increases than in others, with average PDP premiums increasing by 6 percent or less in seven regions, but by as much as 18 percent in Arizona and 20 percent in California.

- Virtually all PDPs in 2017 have five cost-sharing tiers, as in recent years, but specific cost-sharing amounts vary widely across PDPs. Nearly all PDPs charge coinsurance for higher-cost specialty and non-preferred drugs, which usually results in enrollees paying higher out-of-pocket costs than when plans charge copayment amounts. About one-third of PDPs charge $0 for preferred generics to encourage use of these drugs.

- Medicare beneficiaries in each region will have a choice of 22 PDPs, on average, in 2017—fewer than in any year since 2006—yet still a substantial number of PDP options.

- On average, beneficiaries receiving the Low-Income Subsidy (LIS) will have a choice of 7 premium-free PDPs in 2017; 1.4 million low-income beneficiaries who are eligible for premium-free Part D coverage will begin paying Part D premiums in 2017, averaging nearly $24 per month or $286 per year, if they do not switch plans or are not reassigned to a new plan by CMS.