Help with Medicare Premium and Cost-Sharing Assistance Varies by State

While Medicare provides health and financial protections to more than 64 million Americans ages 65 and older and younger adults with long-term disabilities, gaps in coverage and high cost-sharing requirements can make health care difficult to afford, particularly for people with modest incomes. Medicare beneficiaries are responsible for Medicare’s premiums, deductibles, and other cost-sharing requirements unless they have private supplemental coverage, a Medicare Advantage plan that covers some of the cost-sharing, or have incomes and assets low enough to qualify for the Medicare Savings Programs (which provide assistance with Medicare Part A and Part B premiums and/or cost sharing) and the Part D Low-Income Subsidy (LIS) (which helps with Medicare Part D drug plan premiums and cost sharing). The Biden Administration has promoted awareness of these programs for low-income beneficiaries in an effort to increase enrollment.

To provide greater insight into the number and characteristics of beneficiaries enrolled in these programs in the U.S. overall and in each state, KFF created profiles of each state showing enrollment of Medicare beneficiaries in the Medicare Savings Programs and the Part D Low-Income Subsidy, and their demographic characteristics including race/ethnicity, age, and gender. (The profiles are now updated with 2020 data.) This data note provides an overview of these programs and highlights findings from the state-level profiles.

Takeaways

- In 2019, 10.3 million Medicare beneficiaries, or 16% of all beneficiaries, were enrolled in the Medicare Savings Programs. The share of state Medicare populations enrolled in the Medicare Savings Programs varies from 7% in North Dakota to 33% in the District of Columbia, due in part to differences across states in eligibility criteria for these programs and poverty rates among the Medicare population.

- Among the nine states and the District of Columbia that have the highest share of Medicare beneficiaries enrolled in the Medicare Savings Programs, eight either have eliminated the asset test or have asset limits higher than the federal limit (District of Columbia, Connecticut, Maine, Louisiana, Mississippi, Alabama, Massachusetts, New York).

- While Medicare beneficiaries enrolled in the Medicare Savings Programs automatically qualify to receive assistance through the Part D Low-Income Subsidy, the opposite is not true, in part because the income threshold to qualify for the Part D Low-Income Subsidy is higher. In 2019, nearly 1.6 million Medicare beneficiaries were enrolled in the Part D Low-Income Subsidy but not receiving premium or cost-sharing assistance through the Medicare Savings Programs, including just over 1.1 million beneficiaries who were eligible but not enrolled and nearly half a million (441,000) who did not meet eligibility criteria.

- Compared to Medicare beneficiaries overall, the Medicare Savings Programs and Part D Low-Income Subsidy disproportionately serve beneficiaries in communities of color, beneficiaries under 65 with disabilities, and women, who tend to have lower incomes and modest savings.

Overview of the Medicare Savings Programs and the Part D Low-Income Subsidy

Medicare Savings Programs

Under the Medicare Savings Programs, state Medicaid programs help pay for premium and/or cost-sharing assistance for Medicare beneficiaries who have income and assets below specified levels, up to 135% FPL under federal guidelines ($18,347 for individuals and $24,719 for couples annually in 2022) and limited assets (below $8,400 for individuals and $12,600 for couples in 2022). Beneficiaries may receive help with Medicare’s premiums ($2,041 in 2022 for Part B), deductibles ($1,156 for Part A, $233 for Part B) and other cost-sharing requirements. Most low-income Medicare beneficiaries who qualify for Medicare premium and cost-sharing assistance also qualify for full Medicaid benefits, which can include long-term services and supports and other services such as dental and vision; these beneficiaries are referred to as full-benefit Medicare-Medicaid beneficiaries.

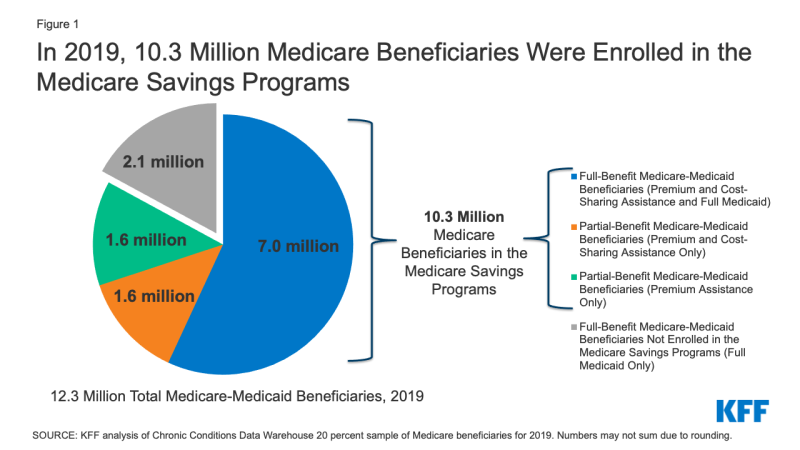

In 2019, 12.3 Medicare beneficiaries were enrolled in both Medicare and Medicaid. Of these beneficiaries, 9.1 million received full Medicaid benefits, including 7 million who also received financial assistance through the Medicare Savings Programs, and 2.1 million with full Medicaid benefits who do not qualify for the Medicare Savings Programs, though some states may choose to pay for Part B premiums for these beneficiaries.

In total, 10.3 million beneficiaries received financial assistance through the Medicare Savings Programs in 2019. This total includes the aforementioned 7 million beneficiaries who also receive full Medicaid benefits and 3.3 million beneficiaries who only receive premium and/or cost sharing assistance (Figure 1).

Figure 1: In 2019, 10.3 Million Medicare Beneficiaries Were Enrolled in the Medicare Savings Programs

Low-income beneficiaries who receive only financial assistance through the Medicare Savings Programs – meaning they qualify for payment of Medicare Part A and/or B premiums and, in some cases, Part A and Part B cost sharing but not full Medicaid benefits – are referred to as partial-benefit Medicare-Medicaid beneficiaries. (See MedPAC MACPAC Data Book: Beneficiaries Dually Eligible for Medicare and Medicaid — February 2022 for a full discussion of the different types of Medicare Savings Programs.)

Of the 3.3 million Medicare beneficiaries who received financial assistance through the Medicare Savings Programs, but not full Medicaid benefits, half (about 1.6 million) received assistance with Part B premium and cost-sharing assistance, while the other half received assistance with Part B premiums but did not qualify for help with Medicare Part A and B deductibles or cost-sharing requirements for covered services, despite having incomes below 135% of poverty.

Part D Low-Income Subsidy

Under the Medicare Part D Low-Income Subsidy (LIS), the federal government subsidizes premiums, deductibles, and cost sharing for the Part D prescription drug benefit, providing varying levels of assistance to beneficiaries at different income and asset levels up to 150% FPL ($20,385 for individuals and $27,465 for couples in 2022) and limited assets (below $14,010 for individuals and $27,950 for couples in 2022). The 150% FPL income threshold for LIS is higher than the 135% FPL threshold for the Medicare Savings Program. Unlike the Medicare Savings Programs, the Part D Low-Income Subsidy is a federal program and not part of the Medicaid program, nor is it administered by the states, so states do not have the option of setting higher income or asset thresholds for the Part D Low-Income Subsidy.

In 2019, 14.1 million (22% of all beneficiaries) were enrolled in the Part D Low-Income Subsidy. The vast majority (97%) of beneficiaries enrolled in the Part D Low-Income Subsidy receive full LIS benefits, while only 3% receive partial LIS benefits.

Both full-benefit and partial-benefit Medicare-Medicaid enrollees automatically receive full Medicare Part D LIS benefits, meaning they pay no Part D premium or deductible and only modest copayments for prescription drugs until they reach the catastrophic threshold, when they face no cost sharing. Beneficiaries who receive partial LIS benefits pay a reduced Part D premium and deductible and 15% coinsurance for drugs until they reach the catastrophic threshold, when they face modest copayments.

Individuals who do not automatically qualify for LIS because they are not enrolled in the Medicare Savings Programs can enroll if they meet income and asset requirements set by the federal government. Depending on their income and assets, they could receive full or partial LIS benefits. However, even if their income and assets meet Medicare Savings Program requirements, individuals who qualify for Part D LIS are not automatically enrolled in Medicare Savings Programs. While states are statutorily required to initiate Medicare Savings Programs applications for beneficiaries who apply for Part D LIS to help facilitate enrollment, CMS has noted that not all states are meeting these standards.

| Box 1: Medicare Savings Programs and Part D Low-Income Subsidy Benefit Groups |

|

Findings

In 2019, 10.3 million Medicare beneficiaries, or 16% of all beneficiaries, were enrolled in the Medicare Savings Programs, but the share of state Medicare populations enrolled in the Medicare Savings Programs varies by state, from 7% in North Dakota to 33% in the District of Columbia (Figure 2).

States that have adopted more generous income and asset thresholds – as well as states with higher poverty rates among older adults – tend to have larger shares of beneficiaries enrolled in the Medicare Savings Programs.

The federal government sets minimum income and asset eligibility requirements for the Medicare Savings Programs, but states can expand eligibility to beneficiaries with higher incomes and/or assets. As of 2021:

- Four states and the District of Columbia have raised the qualifying federal poverty limits (Connecticut, Indiana, Maine, and Massachusetts) above the federally defined minimum level. For example, for the Qualified Medicare Beneficiary program where the income limit is typically 100% of the federal poverty level ($12,880 for individuals and $17,420 for couples in 2021), Indiana’s income limit is 150% ($19,320 for individuals and $26,130 for couples), while Connecticut’s is 211% ($25,760 for individuals and $34,840 for couples).

- Ten states and the District of Columbia have eliminated the asset test for the Medicare Savings Programs, and three states have adopted an asset limit above the federally defined minimum level (Figure 3).

These expanded income and asset limits only apply to Medicare premium and cost-sharing assistance through the Medicare Savings Programs. Beneficiaries still are required to meet state-defined eligibility criteria to receive full Medicaid benefits, including nursing home coverage and other long-term services and supports, in their state.

The variation across states in the share of Medicare beneficiaries receiving premium and cost-sharing assistance through the Medicare Savings Programs could be due to a number of reasons. One reason might be the higher asset limits in some states: eight of the nine states and the District of Columbia with the highest share of Medicare beneficiaries enrolled in the Medicare Savings Programs either have eliminated the asset test or have asset limits higher than the federal limit (District of Columbia, Connecticut, Maine, Louisiana, Mississippi, Alabama, Massachusetts, New York). This is not universally true, however; there are a few states with no asset limit or higher asset limits, which have relatively lower shares of enrollment, including Delaware, New Mexico, Oregon, and Minnesota.

Poverty rates among Medicare beneficiaries also vary across states, although the relationship between poverty and Medicare Savings Program enrollment rates is less clear. While some states with high poverty rates (e.g., more than 25% of beneficiaries below 150% of poverty) among the Medicare population have a relatively high share of beneficiaries enrolled in the Medicare Savings Programs, (e.g., more than 20% enrolled: District of Columbia, Louisiana, Mississippi, and Alabama), a handful of states with high poverty rates have a relatively low share of beneficiaries enrolled in the Medicare Savings Programs (e.g., West Virginia: 11%, New Mexico: 14%, Georgia: 14%).

In addition to these factors, variations across states in Medicare Savings Program enrollment may be related to differences in the application process via state Medicaid agencies, which could make it more difficult for beneficiaries in some states to apply, or beneficiaries’ lack of awareness of the Medicare Savings Programs.

In 2019, nearly 1.6 million Medicare beneficiaries (or 11%) received some help through the Part D Low-Income Subsidy, but no premium and/or cost-sharing assistance from the Medicare Savings Programs (Figure 4).

This includes more than 1.1 million people who were not enrolled in the Medicare Savings Programs, even though they were eligible, and another half a million beneficiaries (441,000) who did not qualify for the Medicare Savings Programs because either their incomes and/or assets were too high. These estimates do not include the approximately 2.1 million beneficiaries with full Medicaid benefits who do not qualify for the Medicare Savings Programs but receive the Part D Low-Income Subsidy.

The share of beneficiaries who received assistance through the Part D Low-Income Subsidy Program, but were not enrolled in the Medicare Savings Programs, ranged from 1% in Connecticut to 21% in South Carolina. Variations across states may be due to differences in the administrative complexity of enrolling in the Medicare Savings Programs across states (in contrast to the Low-Income Subsidy where beneficiaries apply through the Social Security Administration), differences in methodologies in how eligibility is determined for the Low-Income Subsidy versus the Medicare Savings Programs in many states, and lack of awareness of the Medicare Savings Programs, which may result in some beneficiaries applying for the Part D Low-Income Subsidy but not the Medicare Savings Programs.

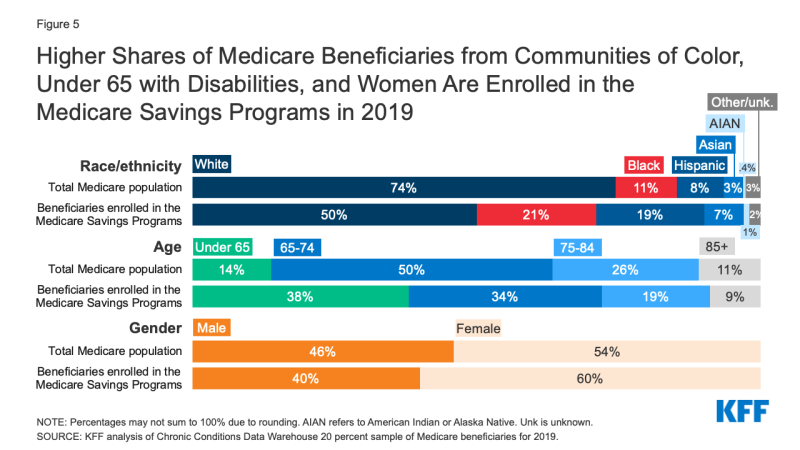

The Medicare Savings Programs and Part D Low-Income Subsidy disproportionately serve beneficiaries in communities of color, beneficiaries under 65 with disabilities, and women, who tend to have lower incomes and modest savings than beneficiaries who are White, 65 or older, or men (Figure 5).

Figure 5: Higher Shares of Medicare Beneficiaries from Communities of Color, Under 65 with Disabilities, and Women Are Enrolled in the Medicare Savings Programs in 2019

Race/ethnicity. One in five (21%) of beneficiaries enrolled in the Medicare Savings Programs are Black, nearly double the share of Black beneficiaries (11%) in the total Medicare population. Similarly, 19% of beneficiaries enrolled in the Medicare Savings Programs are Hispanic, more than double the share of Hispanic beneficiaries (8%) in the total Medicare population.

There are differences in the characteristics of beneficiaries who are enrolled in these programs across states, which may be due to state-level variation in the composition of the Medicare population, as well as variation in the factors mentioned above, such as eligibility thresholds and methods of determining eligibility, poverty rates, and the characteristics of enrollees who have lower incomes. For example, in Alabama, South Carolina, Maryland, and Georgia, Black beneficiaries comprise about a quarter of each state’s Medicare population, but about half of Medicare Savings Program enrollees in the state, ranging from 44% to 50%.

The share of Hispanic beneficiaries enrolled in the Medicare Savings Programs also varies by state. In New Jersey, Colorado, New York, and Nevada, Hispanic beneficiaries comprise one in ten of all Medicare beneficiaries, but about a quarter of Medicare Savings Programs enrollees in the state, ranging from 24% to 27%.

Age. The Medicare Savings Programs also reach a disproportionate share of beneficiaries under age 65 who qualify for Medicare due to long-term disabilities. For example, 38% of Medicare beneficiaries who are under age 65 due to disability are enrolled in the Medicare Savings Programs, nearly three times the share of under age-65 beneficiaries as their share of the total Medicare population (14%).

The share of Medicare beneficiaries who are under age 65 with long-term disabilities enrolled in the Medicare Savings Programs also varies by state, ranging from 23% in California to 59% in New Hampshire.

Gender. Women represent 60% of those beneficiaries enrolled in the Medicare Savings Programs but 54% of the Medicare population overall. There is somewhat less variation across states in enrollment by gender, with the share of women enrolled in these programs varying from 52% in Alaska to 63% in Alabama, Georgia, and Wyoming.

Overall enrollment patterns in the Part D-Low Income Subsidy by race/ethnicity, age, and gender are similar to the Medicare Savings Programs in large part due to the overlap of enrollment in these programs.

Despite the important financial protections the Medicare Savings Programs and Part D Low-Income Subsidy provide to low-income people on Medicare, many low-income beneficiaries are not receiving these benefits. Historically these programs have had low participation, despite some state and federal efforts to increase enrollment. Based on prior KFF work, the share of Medicare beneficiaries with incomes below 150% FPL who are enrolled in the Part D Low-Income Subsidy is estimated to be between 55% and 70%, while 50% to 65% are estimated to be enrolled in the Medicare Savings Programs (lower because beneficiaries with incomes between 135%-150% FPL are not eligible for these programs under federal guidelines) – though not everyone with incomes at or below this level are eligible for either of these programs due to the asset tests.

Additionally, certain groups of low-income beneficiaries are less likely than others to be receiving assistance from the Medicare Savings Programs, which could expose them to higher health care costs. For example, based on our analysis of data from the Medicare Current Beneficiary Survey, in 2019, nearly one in five Black and Hispanic Medicare beneficiaries (19% and 17%, respectively) had incomes below 150% of poverty but were not enrolled in the Medicare Savings Programs, compared to 11% of White beneficiaries.

One reason for relatively low participation rates overall in these programs could be the asset test used to determine eligibility for both the Medicare Savings Programs and the Part D Low-Income Subsidy, requiring beneficiaries to have countable resources, such as money in savings and checking accounts, stocks, and bonds, below a certain limit. This contrasts with eligibility requirements established under the Affordable Care Act that use income, but not assets, to determine eligibility for Medicaid expansion or Marketplace coverage. This means individuals living in states that expanded Medicaid up to 138% FPL would be subject to an asset test when they turn 65 or qualify for Medicare based on having a long-term disability in order to get help from the Medicare Savings Programs with Medicare premiums and cost sharing (unless they live in a state that has eliminated the asset test). This “Medicare cliff” can result in low-income people losing access to valuable financial protections that they qualified for prior to becoming eligible for Medicare.

Discussion

In 2019, 10.3 million Medicare beneficiaries received help through the Medicare Savings Programs. Enrollment in these programs varies by state, due to differences in income and asset eligibility criteria and administrative requirements across states. While 14.1 million beneficiaries received help through the Part D Low-Income Subsidy, nearly 1.6 million of these beneficiaries did not receive premium or cost-sharing help through the Medicare Savings Programs, because either they were ineligible or did not enroll. Both programs disproportionately serve communities of color, adults under 65 with disabilities, and women on Medicare, who tend to have relatively low incomes and modest savings.

There has been some discussion among policymakers of improving financial protections for low-income Medicare beneficiaries, for example, by expanding income eligibility thresholds for both the Medicare Savings Programs and Part D Low-Income Subsidy, aligning eligibility criteria between these two programs, and by raising or eliminating the federal asset test for the Medicare Savings Programs, as some states have done. Such changes could provide stronger financial protections to low-income beneficiaries living just above current eligibility income and asset levels who are now responsible for payment of full Medicare premiums, deductibles, and cost sharing. They would also increase government spending, and do not appear to have strong prospects for passage in the current political environment.

| Methods |

| This analysis uses data from the Chronic Conditions Data Warehouse 20 percent sample of Medicare beneficiaries for 2019. For this analysis, we use an ever-enrolled approach for counting beneficiaries enrolled in the Medicare Savings Program beneficiaries and the Part D Low-Income Subsidy, rather than an average monthly measure, which may explain differences in our estimates compared to other published estimates. This analysis excludes beneficiaries living in Puerto Rico and the territories. |

This work was supported in part by AARP Public Policy Institute (PPI). We value our funders. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

Meredith Freed, Juliette Cubanski, and Tricia Neuman are with KFF.

Anthony Damico is an independent consultant.