Cost-Related Problems Are Less Common Among Beneficiaries in Traditional Medicare Than in Medicare Advantage, Mainly Due to Supplemental Coverage

Issue Brief

In recent years, the share of Medicare beneficiaries enrolled in Medicare Advantage, the private health plan alternative to the traditional Medicare program, has grown substantially. In 2021, 42% of all Medicare beneficiaries were enrolled in Medicare Advantage, up from 24% a decade earlier, with higher enrollment among some subgroups of beneficiaries than others. In 2018, half of all Black and Hispanic beneficiaries were enrolled in a Medicare Advantage plan, compared to 36% of White beneficiaries.

Given these shifts in enrollment and broader concerns about health inequities among Medicare beneficiaries, this analysis builds on our prior work examining rates of health care cost-related problems among Medicare beneficiaries, taking a closer look at cost-related problems among beneficiaries in traditional Medicare, including those with and without supplemental coverage, compared to those in Medicare Advantage, with a focus on equity.

Our analysis uses data from the 2018 Medicare Current Beneficiary Survey (MCBS) to examine the share of non-institutionalized Medicare beneficiaries reporting at least one of the following: trouble getting care due to cost or money, delay in care due to cost, or problems paying medical bills. All estimates reported in the text are statistically significant in bivariate (i.e., tabulations) and multivariate (i.e., based on a regression) analyses, except where noted. The multivariate analysis controls for income, race and ethnicity, and health status (see Methods). Due to sample size and data collection limitations, we were unable to analyze results by race and ethnicity for Asian adults, American Indian and Alaska Native adults, and Native Hawaiian and Other Pacific Islander adults, as well as certain subgroups of Hispanic adults.

Key findings include:

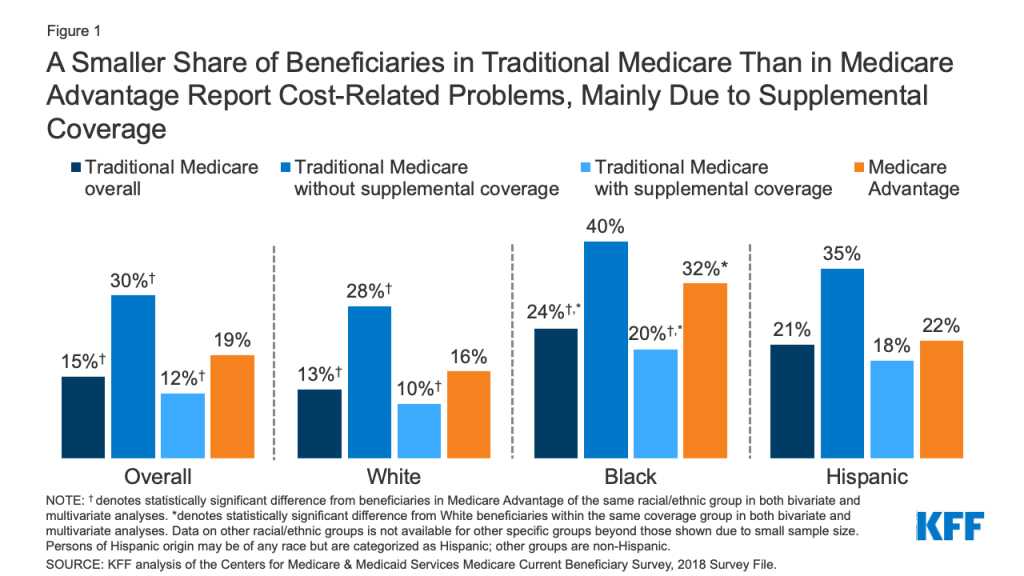

- Overall, about one in six Medicare beneficiaries (17%) reported a cost-related problem in 2018, with a somewhat lower rate among traditional Medicare beneficiaries (15%) than Medicare Advantage enrollees (19%), attributable to a lower rate of cost-related problems among the majority of traditional Medicare beneficiaries with supplemental coverage (12%) (Figure 1, Table 1). The rate of cost-related problems is highest (30%) among traditional Medicare beneficiaries without supplemental coverage, who account for about 10 percent of the Medicare population.

- A smaller share of Black beneficiaries in traditional Medicare (24%) than in Medicare Advantage (32%) reported cost-related problems. Rates of cost-related problems were lower among Black beneficiaries in traditional Medicare with Medicaid and other forms of supplemental insurance (20%).

- One in five Hispanic beneficiaries overall reported a cost related problem (21%) and the share was similar among those in traditional Medicare with supplemental coverage (18%) and Medicare Advantage (22%).

- The share of Black Medicare beneficiaries reporting cost-related problems was higher than among White beneficiaries in both traditional Medicare and Medicare Advantage. Additionally, the difference in the share of Black beneficiaries reporting cost-related problems in Medicare Advantage compared to traditional Medicare with supplemental coverage was larger than for White beneficiaries.

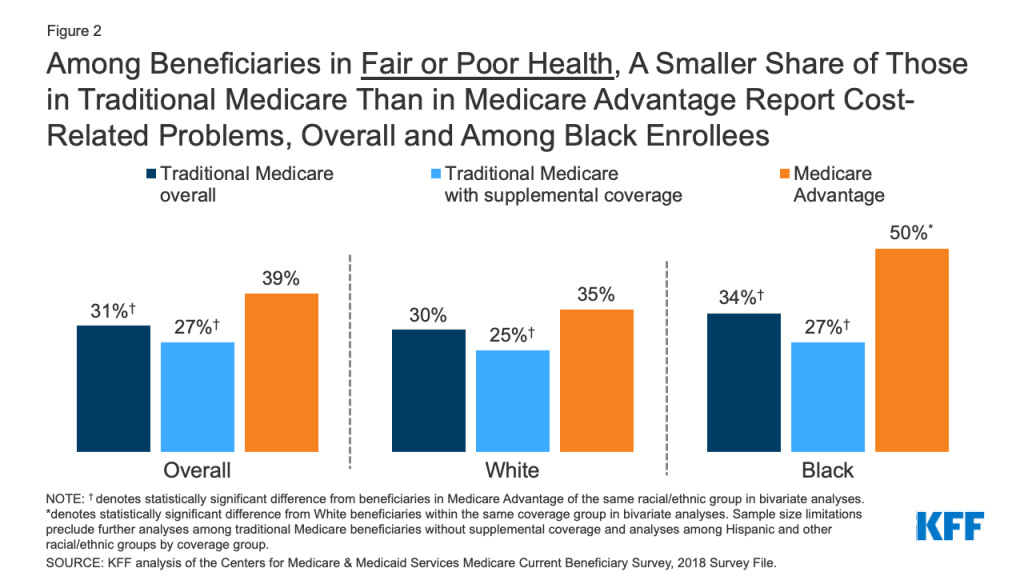

- Half of Black Medicare Advantage enrollees in fair or poor self-assessed health reported cost-related problems, compared to one-third of Black beneficiaries in traditional Medicare overall and just over one-fourth of Black beneficiaries in traditional Medicare with supplemental coverage.

Findings

Overall, 17% of all Medicare beneficiaries living in the community reported health care cost-related problems in 2018. The rate of cost-related problems was twice as high among Black beneficiaries compared to White beneficiaries (28% vs. 14%), three times higher among beneficiaries in fair or poor self-reported health than among those in excellent, very good, or good self-reported health (34% vs. 11%), and 3.5 times higher among beneficiaries under age 65 with long-term disabilities than among those ages 65 and older (42% vs. 12%). Additionally, a larger share of Hispanic beneficiaries than White beneficiaries reported cost-related problems (21% vs. 14%), but the difference did not hold in multivariate analyses. As previously documented, cost-related problems were more common among lower-income Medicare beneficiaries with per capita income below $20,000 (27%) than beneficiaries with incomes at or above $40,000 (8%) (Table 1).

The rate of cost-related problems was somewhat lower among beneficiaries in traditional Medicare (15%) than among those enrolled in Medicare Advantage (19%), reflecting a lower rate among traditional Medicare beneficiaries with supplemental coverage (12%). Over 80% of traditional Medicare beneficiaries have supplemental coverage, such as employer-sponsored retiree health coverage, self-purchased Medigap policies, or Medicaid. However, among the roughly one in five people covered under traditional Medicare with no supplemental coverage – more than 5 million beneficiaries – 30% reported cost-related problems (Figure 1, Table 1). The differences across coverage types were significant after controlling for demographics, including income, and health status indicators.

Among lower-income Medicare beneficiaries (those with annual per capita income below $20,000), rates of cost-related problems were less common among traditional Medicare beneficiaries with supplemental coverage (primarily from Medicaid) than among traditional Medicare beneficiaries with no supplemental coverage and Medicare Advantage enrollees in the multivariate model. Among modest- and higher-income beneficiaries, a somewhat smaller share of traditional Medicare beneficiaries than Medicare Advantage enrollees reported cost-related problems, likely driven by the prevalence of supplemental coverage, such as Medigap or retiree health benefits, particularly among beneficiaries with per capita incomes over $40,000 (Table 1).

Rates of cost-related problems were lower among Black beneficiaries in traditional Medicare than among Black Medicare Advantage enrollees. A smaller share of Black traditional Medicare beneficiaries (24%) than Black Medicare Advantage enrollees (32%) reported cost-related problems, with the subset of Black traditional Medicare beneficiaries with supplemental coverage reporting the lowest rates of cost-related problems (20%). Differences in the rates of cost-related problems between Medicare Advantage and traditional Medicare were larger for Black beneficiaries than for White beneficiaries. The majority of Black beneficiaries in traditional Medicare have some form of supplemental coverage, primarily from Medicaid, but overall, 22% of Black beneficiaries in traditional Medicare have no supplemental coverage, versus 15% of White beneficiaries in traditional Medicare, based on our analysis of the 2018 MCBS.

Hispanic beneficiaries reported similar rates of cost-related problems in traditional Medicare with supplemental coverage and Medicare Advantage. About one in five (21%) Hispanic beneficiaries overall reported a cost-related problem. We did not detect a statistically significant difference in the share of Hispanic beneficiaries with a cost-related problem between those in traditional Medicare with supplemental coverage (18%) and those in Medicare Advantage (22%).

Among beneficiaries covered by either traditional Medicare or Medicare Advantage, Black Medicare beneficiaries reported higher rates of cost-related problems than White beneficiaries. The share of Black Medicare Advantage enrollees who reported a cost-related problem (32%) was twice as large as the share of White Medicare Advantage enrollees (16%) who reported a cost-related problem. Among traditional Medicare beneficiaries with supplemental coverage, the share of Black beneficiaries who reported a cost-related problem (20%) was also twice as large as the share of White traditional Medicare beneficiaries who reported a cost-related problem (10%). Hispanic beneficiaries had higher rates of cost-related problems than White beneficiaries in both traditional Medicare and Medicare Advantage based on bivariate analyses; however, differences did not hold in multivariate analyses controlling for demographic factors and health status.

Beneficiaries in fair or poor self-assessed health reported a higher rate of cost-related problems in Medicare Advantage than in traditional Medicare overall. Overall, 39% of Medicare Advantage enrollees in fair or poor self-reported health experienced cost-related problems in 2018, compared to 31% of traditional Medicare beneficiaries overall, and about the same share (27%) of the subset of traditional Medicare beneficiaries with supplemental coverage (Figure 2, Table 1). Due to sample size limitations, we were unable to examine rates of cost-related problems among beneficiaries in fair/poor health in traditional Medicare without supplemental coverage.

The rate of cost-related problems was particularly high among Black Medicare Advantage enrollees in fair or poor health. Among Black beneficiaries in fair or poor self-reported health, half (50%) of Medicare Advantage enrollees experienced cost-related problems, compared to one-third (34%) of those in traditional Medicare overall, and just over one-fourth (27%) of those in traditional Medicare with supplemental coverage. Likewise, among White beneficiaries in fair or poor self-reported health, a larger share of Medicare Advantage enrollees reported cost-related problems (35%) than beneficiaries in traditional Medicare with supplemental coverage (25%). These findings were significant at the bivariate level; however, we were unable to generate reliable multivariate estimates for this subgroup of the Medicare population due to sample size limitations. Additionally, due to sample size limitations, we were unable to examine rates of cost-related problems among Hispanic beneficiaries in fair/poor health in traditional Medicare compared to Medicare Advantage.

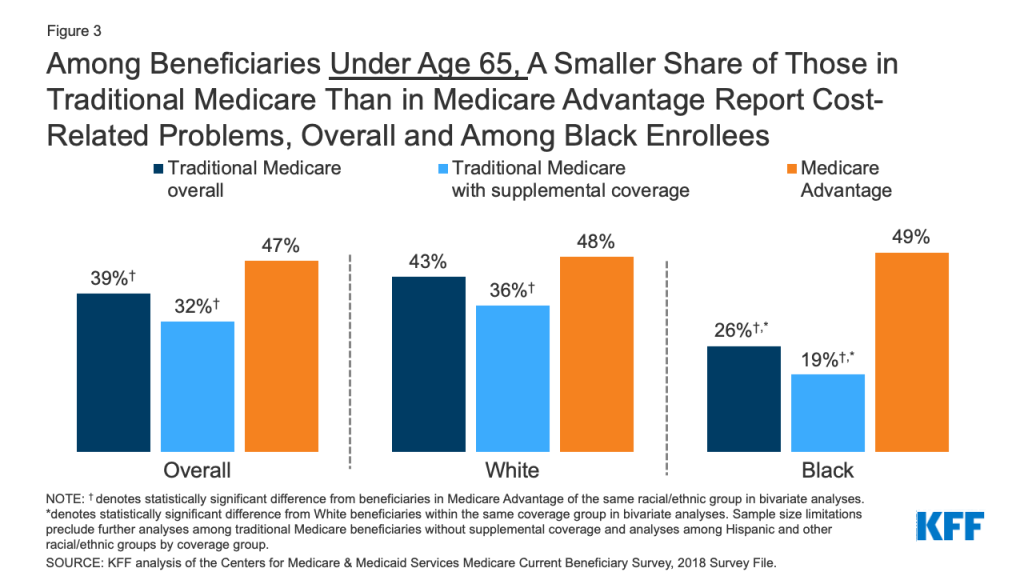

A smaller share of beneficiaries under age 65 in traditional Medicare than in Medicare Advantage reported cost-related problems, overall and particularly among Black beneficiaries. Among Medicare beneficiaries who are under age 65 and qualify for Medicare because of a long-term disability, nearly half of Medicare Advantage enrollees (47%) reported a cost-related problem in 2018, compared to 39% of traditional Medicare beneficiaries overall, and 32% of traditional Medicare beneficiaries with supplemental coverage. Among Black Medicare beneficiaries who are under age 65 with disabilities, about half (49%) of those enrolled in Medicare Advantage reported a cost-related problem, nearly twice the rate reported among those covered by traditional Medicare overall (26%), and considerably higher than the rate reported among traditional Medicare beneficiaries with supplemental coverage (19%) (Figure 3, Table 1).

Among White Medicare beneficiaries under age 65, the rate of cost-related problems was higher among Medicare Advantage enrollees (48%) than among traditional Medicare beneficiaries with supplemental coverage (36%). In contrast to patterns observed for other findings, a larger share of White beneficiaries than Black beneficiaries in traditional Medicare who are under age 65 with disabilities reported cost-related problems, both overall (43% versus 26%) and among those with supplemental coverage (36% versus 19%). This may be because Black beneficiaries are more likely to be dually enrolled in Medicare and Medicaid, which provides relatively comprehensive supplemental coverage. These findings are significant at the bivariate level; however, we were unable to generate reliable multivariate estimates comparing cost-related problems by race for the subgroup of beneficiaries in fair or poor health by coverage type (i.e., Medicare Advantage and traditional Medicare) due to sample size limitations.

Conclusion

Our analysis finds that a slightly smaller share of traditional Medicare beneficiaries than enrollees in Medicare Advantage reported cost-related problems in 2018, mainly attributable to lower rates of cost-related problems reported by traditional Medicare beneficiaries with supplemental coverage. These findings hold for both White and Black beneficiaries, although among Black beneficiaries, rates of cost-related problems in all coverage groups are generally higher, and differences between Medicare Advantage and traditional Medicare with supplemental coverage are larger. Hispanic beneficiaries reported similar rates of cost-related problems in both traditional Medicare with supplemental coverage and Medicare Advantage. The rate of cost-related problems was highest among beneficiaries in traditional Medicare with no supplemental coverage, both overall and within racial and ethnic groups.

Differences in cost-related problems between people with Medicare Advantage and traditional Medicare with supplemental coverage are not fully explained by differences in the characteristics of beneficiaries, such as income and health status. Similarly, higher rates of cost-related problems among Black beneficiaries compared to White beneficiaries persist after controlling for income, health status, and demographic characteristics. This may reflect the fact that Black beneficiaries have fewer financial resources, including savings and home equity, than White beneficiaries. Savings and other assets can serve as an important safety net, providing resources from which to draw when faced with high or unexpected expenses, such as health care costs. In addition, Black beneficiaries have more inpatient admissions and emergency department visits than White beneficiaries, which may increase their liability for associated health care spending, contributing to a greater financial burden. Further, racism and inequities in other factors, such as access to transportation, access to health care, and other social determinants of health likely contribute to cost-related problems obtaining or paying for health care.

These findings may run counter to expectations, given that Medicare Advantage plans, unlike traditional Medicare, have an out-of-pocket limit for Medicare-covered services, may have reduced cost-sharing for Medicare-covered services and often include coverage of vision, hearing, and dental services. Additionally, most Medicare Advantage enrollees pay no premium beyond the monthly Part B premium required of all Medicare beneficiaries. In contrast, traditional Medicare beneficiaries typically pay premiums for Part D and supplemental coverage (Medigap or retiree health benefits).

However, Medicare Advantage plans, like traditional Medicare, generally impose cost-sharing requirements for covered services, subject to certain limits, such as daily copayments for inpatient hospital stays or coinsurance for physician administered drugs, which means that Medicare Advantage enrollees may incur thousands of dollars in out-of-pocket costs for covered benefits before reaching their plan’s maximum out-of-pocket limit. In contrast, the majority of traditional Medicare beneficiaries have supplemental coverage that covers some or most of their Medicare deductibles and cost-sharing requirements, helping to mitigate cost-related problems. For example, the most common Medigap plans cover nearly all cost sharing for Medicare-covered services. Medicaid and the Medicare Savings Programs provide wrap-around support for low-income beneficiaries in both traditional Medicare and Medicare Advantage, though many low income beneficiaries do not receive these benefits.

This analysis is consistent with both our prior analysis and other research documenting cost-related problems among Medicare beneficiaries, which also found larger shares of beneficiaries in Medicare Advantage plans reporting cost-related problems compared to those in traditional Medicare, driven in large part by supplemental coverage. Analysis that focused more narrowly on the specific question of problems paying medical bills also showed higher rates of problems among Medicare Advantage enrollees than among adults age 65 and over with either traditional Medicare and private supplemental coverage or a stand-alone private health insurance plan.

Although our analysis documents that a somewhat smaller share of traditional Medicare beneficiaries than Medicare Advantage enrollees experience cost-related problems, we are unable to estimate actual differences in average out-of-pocket spending between these two groups. The MCBS reports out-of-pocket spending for all Medicare beneficiaries, but it cannot be used to derive comparable and accurate estimates of spending for Medicare Advantage enrollees like it can for beneficiaries in traditional Medicare. This is because it is not possible to verify survey-reported events in the MCBS with administrative claims data for Medicare Advantage enrollees, as is done for beneficiaries in traditional Medicare. This has the effect of biasing downward survey-reported out-of-pocket spending amounts for Medicare Advantage enrollees compared to beneficiaries with traditional Medicare. It is not possible to determine whether observed differences between the two groups are real or due to underlying differences in the data collection, verification, and imputation process for out-of-pocket spending by beneficiaries in traditional Medicare and Medicare Advantage.

Cost-sharing requirements and gaps in the traditional Medicare benefit, including no annual out-of-pocket limit and no coverage for dental, vision, and hearing services, undermine the financial protection provided by Medicare, and more so for some groups of beneficiaries, most notably for those with no supplemental coverage. At the same time, our findings suggest that enrollees in Medicare Advantage do not generally receive greater protection against cost-related problems than beneficiaries in traditional Medicare with supplemental coverage, particularly for some enrollees, such as Black beneficiaries in relatively poor health, despite having an out-of-pocket cap and additional benefits.

As policymakers consider proposals to lower the age of Medicare eligibility to 60 and improve benefits for the current Medicare population, and as Medicare Advantage enrollment continues to grow, the relatively high rate of cost-related problems in Medicare Advantage and inequities in who faces cost-related problems warrant attention, as do the high rates of cost-related problems among people in traditional Medicare without supplemental coverage.

This work was supported in part by Arnold Ventures. We value our funders. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

Methods

This analysis is based on data from the Centers for Medicare & Medicaid Services’ Medicare Current Beneficiary Survey (MCBS), 2018 Survey File. The analysis includes beneficiaries enrolled in Part A and Part B for most months of the year and excludes those with Part A or Part B only and Medicare as a Secondary Payer for most months of the year. The analysis also excludes institutionalized beneficiaries since the analysis was based on questions asked of community residents only.

In this analysis, we define “cost-related problems” based on positive responses to any of the following four questions:

- Since (12 months prior), have you had any trouble getting health care that you wanted or needed because the cost was too high?

- Since (12 months prior), have you had any trouble getting health care that you wanted or needed because you did not have enough money?

- Since (12 months prior), have you delayed seeking medical care because you were worried about the cost?

- Since (12 months prior) have you had problems paying or were unable to pay any medical bills?

We used a bivariate analysis to assess differences in the share of beneficiaries reporting cost-related problems across groups. All numbers reported in the text, figures, and table are a result of this analysis and we indicate where differences were statistically significant at the 5% level.

To account for differences in demographic characteristics and health status of Medicare beneficiaries enrolled in Medicare Advantage, traditional Medicare with supplemental coverage, and traditional Medicare without supplemental coverage, we modeled the likelihood of reporting a cost-related problem using a multivariate logistic regression. Specifically, we estimate the following:

E[Yi] = g(X’β)

where g(·) is a logit link function; Y is equal to 1 if beneficiary i reported a cost-related problem, Xi is a vector of individual-level covariates, including coverage type (Medicare Advantage, traditional Medicare with supplemental coverage, and traditional Medicare without supplemental coverage), income, age category, race/ethnicity, self-reported health status, number of chronic conditions, whether a beneficiary had a cognitive impairment, number of limitations in activities of daily living, and Medicare-Medicaid dual status.

To further examine the relationship between cost-related problems and coverage types, we estimated the same model on subsets of the full sample, including those with Medicare Advantage, those in traditional Medicare with supplemental coverage, those with traditional Medicare without supplemental coverage, White beneficiaries, Black beneficiaries, Hispanic beneficiaries, beneficiaries with per capita income below $20,000, income $20,000-$39,999, and income $40,000 and above, beneficiaries in fair/poor health, and beneficiaries under the age of 65 with a long-term disability. Tables 2 to 6 provide the odds-ratios and confidence intervals from each of the models.

Due to sample size limitations (as estimated by power and sample size calculations), we do not report data on self-reported health status and age group among Medicare beneficiaries without supplemental coverage, or among Hispanic beneficiaries and other racial and ethnic groups by sources of coverage. Additionally, while the collection of race and ethnicity data in survey data has improved over time, sample size and other limitations hinder our ability to display results comparing the share of Medicare beneficiaries reporting cost-related problems for certain racial and ethnic groups or subgroups within certain racial and ethnic groups in our analysis, especially Asian adults, American Indian and Alaska Native adults, Native Hawaiian and Other Pacific Islander adults, and adults who identify as two more races. Throughout this brief, individuals of Hispanic origin may be of any race, but are classified as Hispanic for the analysis; all other groups are non-Hispanic.