A Current Snapshot of the Medicare Part D Prescription Drug Benefit

This post was edited on November 15, 2024 to update the number of stand-alone prescription drug plans for 2025, based on updated data on plan availability from the Centers for Medicare & Medicaid Services. CMS’s September 2024 Part D landscape file data initially used for this analysis incorrectly included data for Clear Spring Health PDPs, which were terminated for 2025. Using the October 2024 landscape file produces a lower total plan count and benchmark plan count for 2025.

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare provided through private plans that contract with the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan (PDP) to supplement traditional Medicare or a Medicare Advantage plan, mainly HMOs and PPOs, that provides all Medicare-covered benefits, including prescription drugs (MA-PD). This brief provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on KFF analysis of data from the Centers for Medicare & Medicaid Services (CMS), the Congressional Budget Office (CBO), and other sources. It also provides an overview of changes to the Part D benefit based on provisions in the Inflation Reduction Act. (A separate KFF brief provides more detail about Part D plan availability, premiums, and cost sharing.)

Key Takeaways

- In 2025, 464 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories), a 35% decrease from 2024. Despite the overall reduction, beneficiaries in each state will have a choice of at least a dozen stand-alone plans, plus many Medicare Advantage drug plans.

- Compared to 2024, fewer plans will be available for enrollment of Part D Low-Income Subsidy (LIS) beneficiaries for no premium (“benchmark” plans) in 2025 – 90 plans, a 29% reduction compared to 2024. The number of benchmark plans will vary across states from 1 to 5.

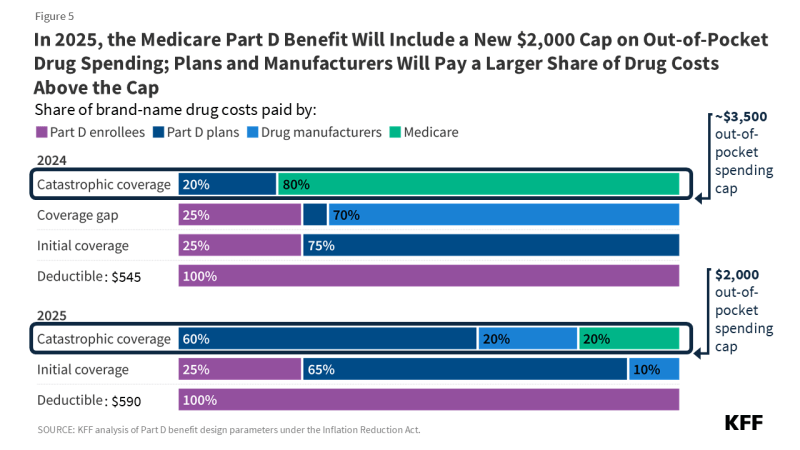

- Changes to the Medicare Part D benefit under the Inflation Reduction Act are taking effect in 2025, including a new $2,000 out-of-pocket cap, an increase in the share of drug costs above the cap paid for by Part D plans and drug manufacturers, and a reduction in Medicare’s share of these costs.

- In 2024, 53 million of the 67 million Medicare beneficiaries are enrolled in Medicare Part D plans, including employer-only group plans; of the total, 57% are enrolled in MA-PDs and 43% are enrolled in stand-alone PDPs. As of June 2024, 3 million Part D enrollees receive premium and cost-sharing assistance through the LIS program.

- The Congressional Budget Office (CBO) estimates that spending on Part D benefits will total $137 billion in 2025, representing 15% of net total Medicare spending. Funding for Part D comes from general revenues (75%), beneficiary premiums (15%), and state contributions (13%).

- Medicare’s aggregate reinsurance payments to Part D plans are projected to account for 17% of total Part D spending in 2025, a substantial reduction from 2024. This change reflects the reduction in Medicare’s liability for catastrophic drug costs from 80% in 2024 to 20% for brands and 40% for generics in 2025.

Medicare Prescription Drug Plan Availability in 2025

In 2025, 464 PDPs will be offered across the 34 PDP regions nationwide (excluding the territories), a 35% decrease from 2024 and the lowest number of PDPs available since the Part D program’s beginning in 2006 (Figure 1). While the availability of stand-alone PDPs has been trending downward over time, along with a decline in PDP enrollment, the availability of Medicare Advantage drug plans has expanded in recent years, and more people in Medicare are now getting Part D drug coverage through Medicare Advantage plans.

Despite the overall reduction in the number of PDPs for 2025, beneficiaries in each state will have a choice of at least a dozen stand-alone PDPs, ranging from 12 PDPs in 12 states and D.C. to 16 PDPs in California (Figure 2). In addition, beneficiaries will be able to choose from among many MA-PDs available at the local level.

Low-Income Subsidy Plan Availability in 2025

Beneficiaries with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. Through the Part D Low-Income Subsidy (LIS) program, additional premium and cost-sharing assistance is available for Part D enrollees with low incomes (less than 150% of poverty, or $22,590 for individuals/$30,660 for married couples in 2024) and modest assets (up to $17,220 for individuals/$34,360 for couples in 2024). As of 2024, anyone who qualifies for the LIS program receives full benefits, under a provision of the Inflation Reduction Act, meaning they pay only modest copayments for prescription drugs and are eligible for a full premium subsidy; in previous years, people with incomes between 135% and 150% of poverty received partial LIS benefits.

In 2025, fewer plans will be available for enrollment of LIS beneficiaries for no premium (“benchmark” plans) compared to 2024 – 90 plans, a 29% reduction, and the lowest number of benchmark plans available since Part D started (Figure 3). Less than one-fifth (19%) of PDPs in 2025 are benchmark plans.

Some enrollees have fewer benchmark plan options than others because benchmark plan availability varies at the Part D region level. The number of premium-free PDPs in 2025 ranges across states from 1 plan in 4 states (Florida, Illinois, Nevada, and Texas) to 5 plans in 1 state (Wisconsin) (Figure 4). LIS enrollees can select any plan offered in their area, but if they are enrolled in a non-benchmark plan, they may be required to pay some portion of their plan’s monthly premium.

Changes to Part D Under the Inflation Reduction Act

The Inflation Reduction Act contained several provisions to lower prescription drug spending by Medicare and beneficiaries, including major changes to the Medicare Part D program, which started to take effect in 2023. These changes were designed to address several concerns, including the lack of a hard cap on out-of-pocket spending for Part D enrollees; the inability of the federal government to negotiate drug prices with manufacturers; a significant increase in Medicare “reinsurance” spending for Part D enrollees with high drug costs; prices for many Part D covered drugs rising faster than the rate of inflation; and the relatively weak financial incentives faced by Part D plan sponsors to control high drug costs. Provisions in the law include:

- Limiting the price of insulin products to no more than $35 per month in all Part D plans and makes adult vaccines covered under Part D available for free, as of 2023.

- Requiring drug manufacturers to pay a rebate to the federal government if prices for drugs covered under Part D and Part B increase faster than the rate of inflation, with the initial period for measuring Part D drug price increases running from October 2022-September 2023.

- Expanding eligibility for full benefits under the Part D Low-Income Subsidy program in 2024.

- Adding a hard cap on out-of-pocket drug spending under Part D by eliminating the 5% coinsurance requirement for catastrophic coverage in 2024 and capping out-of-pocket spending at $2,000 in 2025.

- Shifting more of the responsibility for catastrophic coverage costs to Part D plans and drug manufacturers, starting in 2025.

- Authorizing the Secretary of the Department of Health and Human Services to negotiate the price of some drugs covered under Medicare, with negotiated prices first available for 10 Part D drugs in 2026.

Part D Plan Premiums and Benefits in 2025

Premiums

The 2025 Part D base beneficiary premium – which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment – is $36.78, a 6% increase from 2024. Annual growth in the base beneficiary premium is capped at 6% due to a provision in the Inflation Reduction Act. A new Part D premium stabilization demonstration for PDPs is also helping to moderate premium increases that Part D enrollees might otherwise have faced in 2025, as insurers adjust to higher costs associated with the new $2,000 out-of-pocket spending cap and increased liability for drug costs above the cap. The demonstration limits monthly PDP premium increases to $35 between 2024 and 2025.

The monthly amount that Part D enrollees pay for individual Part D plans is different from the base beneficiary premium, and enrollees may see their premium increase by more than 6% (or less, or even decrease) if they stay in the same plan for 2025. Actual monthly premiums paid by Part D enrollees in 2025 will vary considerably, ranging from $0 to $100 or more in most regions. In addition to the monthly premium, Part D enrollees with higher incomes ($103,000/individual; $206,000/couple) pay an income-related premium surcharge, ranging from $12.90 to $81.00 per month in 2024 (depending on income).

Most MA-PD enrollees pay no premium beyond the monthly Part B premium (although high-income MA enrollees are required to pay a premium surcharge). MA-PD sponsors can use rebate dollars from Medicare payments to lower or eliminate their Part D premiums, so the average premium for drug coverage in MA-PDs is heavily weighted by zero-premium plans. In 2024, the enrollment-weighted average monthly portion of the premium for drug coverage in MA-PDs is substantially lower than the average monthly PDP premium ($9 versus $43).

Benefits

The Part D defined standard benefit is changing for 2025 and will include a new $2,000 cap on out-of-pocket drug spending. The benefit will have three phases, including a deductible, an initial coverage phase, and catastrophic coverage. For 2025, under the standard benefit, Part D enrollees will pay a deductible of $590 (up from $545 in 2024), and will then pay 25% of their drug costs in the initial coverage phase until their out-of-pocket spending totals $2,000. At that point, they will qualify for catastrophic coverage and will pay no additional out-of-pocket costs.

Part D plans must offer either the defined standard benefit or an alternative equal in value (“actuarially equivalent”) and can also provide enhanced benefits. Both basic and enhanced benefit plans vary in terms of their specific benefit design, coverage, and costs, including deductibles, cost-sharing amounts, utilization management tools (i.e., prior authorization, quantity limits, and step therapy), and which drugs are covered on their formularies. Plan formularies must include drug classes covering all disease states, and a minimum of two chemically distinct drugs in each class. Part D plans are required to cover all drugs in six “protected” classes: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

Part D and Low-Income Subsidy Enrollment in PDPs and MA-PDs

Enrollment in Medicare Part D plans is voluntary, except for beneficiaries who are eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. However, beneficiaries face a penalty equal to 1% of the national average premium for each month they delay enrollment unless they have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”).

In 2024, 53 million Medicare beneficiaries are enrolled in Medicare Part D plans, including employer-only group plans; of the total, 57% are enrolled in MA-PDs and 43% are enrolled in stand-alone PDPs (Figure 6). Another 0.8 million beneficiaries are estimated to have drug coverage through employer-sponsored retiree plans where the employer receives a subsidy from the federal government equal to 28% of drug expenses between $590 and $12,150 per retiree in 2025. Several million beneficiaries are estimated to have other sources of drug coverage, including employer plans for active workers, FEHBP, TRICARE, and Veterans Affairs (VA). Around 11% of people with Medicare are estimated to lack creditable drug coverage.

Recent years have seen a growing divide in the Part D plan market between stand-alone PDPs, where the number of plans has generally been trending downward over time in conjunction with a reduction in PDP enrollment, and MA-PDs, where plan availability and enrollment have grown steadily in recent years. The widespread availability of low or zero-premium MA-PDs, while PDPs charge substantially higher premiums, could tilt enrollment even more towards Medicare Advantage plans in the future.

As of June 2024, 14.3 million Part D enrollees receive premium and cost-sharing assistance through the LIS program. As with overall Part D enrollment, more people receiving LIS are enrolled in MA-PDs than PDPs. Beneficiaries who are dual-eligible individuals, those enrolled in Medicare Savings Programs (QMBs, SLMBs, Qis), and those who receive Supplemental Security Income payments from Social Security automatically qualify for the additional assistance, and Medicare automatically enrolls them into PDPs with premiums at or below the regional average (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the Low-Income Subsidy through either the Social Security Administration or Medicaid.

Part D Spending and Financing

Part D Spending

In its June 2024 Medicare baseline projections, the Congressional Budget Office (CBO) estimated that spending on Part D benefits would total $137 billion in 2025, representing 15% of total Medicare outlays (net of offsetting receipts from premiums and state transfers). However, based on actual bid data submitted by Part D plans for coverage in 2025, CBO estimates higher federal spending on Part D of between $10 billion and $20 billion relative to its initial projections for 2025. CBO also estimates that Medicare will spend an additional $5 billion in 2025 on subsidies to plans that are participating in the Part D premium stabilization demonstration.

In general, Part D spending depends on several factors, including the total number of people enrolled in Part D, their health status and the quantity and type of drugs used, the number of people with high drug costs (above the catastrophic threshold), the number of people receiving the Low-Income Subsidy, the price of drugs covered by Part D and the ability of plan sponsors to negotiate discounts (rebates) with drug companies and preferred pricing arrangements with pharmacies, and to manage use (e.g., promoting use of generic drugs, prior authorization, step therapy, quantity limits, and mail order).

Part D Financing

Financing for Part D comes from general revenues (75%), beneficiary premiums (15%), and state contributions (13%). The monthly premium paid by Part D enrollees was initially set to cover 25.5% of the cost of standard drug coverage, but with the Inflation Reduction Act’s 6% premium stabilization provision and the new Part D premium stabilization program in effect, enrollees are paying a lower share of costs overall. Medicare subsidizes the remainder, based on bids submitted by plans for their expected benefit payments, and taking into account the additional payments that insurers participating in the Part D premium stabilization demonstration are receiving. Higher-income Part D enrollees pay a larger share of standard Part D costs, ranging from 35% to 85%, depending on income.

Payments to Plans

For 2025, Medicare’s actuaries estimate that Part D plans will receive direct subsidy payments averaging $1,417 per enrollee overall, $1,504 for enrollees receiving the LIS, and $445 in reinsurance payments for high-cost enrollees; employers are expected to receive, on average, $640 for retirees in employer-subsidy plans. Part D plans also receive additional risk-adjusted payments based on the health status of their enrollees, and plans’ potential total losses or gains are limited by risk-sharing arrangements with the federal government (“risk corridors”).

As of 2025, Medicare’s reinsurance payments to plans for total spending incurred by Part D enrollees above the catastrophic coverage threshold will subsidize 20% of brand-name drug spending and 40% of generic drug spending, down from 80% in previous years, due to a provision in the Inflation Reduction Act. With this change in effect, Medicare’s aggregate reinsurance payments to Part D plans are projected to account for 17% of total Part D spending in 2025, based on KFF analysis of data from the 2024 Medicare Trustees report. This is a substantial reduction from 2024, when reinsurance spending had grown to account for close to half of total Part D spending (46%) (Figure 7). Moving forward, the largest portion of total Part D spending will be accounted for by direct subsidy payments to plans (54% of total spending in 2025).