How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion?

Since implementation of the Affordable Care Act’s (ACA) Medicaid expansion in 2014, all but ten states have adopted the expansion to cover adults on Medicaid with income up to 138% of the federal poverty level (FPL) helping to drive the uninsured rate among the population under age 65 to record low levels. While the number of people who fall into the coverage gap has declined as more states implemented the expansion, 1.4 million uninsured individuals remain in the coverage gap in the ten states that have not expanded Medicaid.

Since implementation of the Affordable Care Act’s (ACA) Medicaid expansion in 2014, all but ten states have adopted the expansion to cover adults on Medicaid with income up to 138% of the federal poverty level (FPL) helping to drive the uninsured rate among the population under age 65 to record low levels. While the number of people who fall into the coverage gap has declined as more states implemented the expansion, 1.4 million uninsured individuals remain in the coverage gap in the ten states that have not expanded Medicaid.

Limited Medicaid eligibility in non-expansion states leaves many adults without children, people of color, and those with disabilities without coverage. Most adults in the coverage gap are in working families, though about one in six have a disability that requires ongoing health care and may limit their ability to work. Using data from 2023, this brief estimates the number and characteristics of uninsured individuals in these ten non-expansion states who could gain coverage if Medicaid expansion were adopted.

The future of the Affordable Care Act’s (ACA) Medicaid expansion is uncertain as Congress considers significant changes to Medicaid financing. Some proposals under consideration would eliminate the enhanced 90 percent federal matching rate for the expansion population or make other changes to federal payments to states for this group. Any cuts in federal funding for expansion enrollees would likely lead a number of states to rollback coverage for this population and would increase the number of people who fall into the coverage gap and become uninsured.

How many people are in the coverage gap?

The coverage gap exists in states that have not adopted the ACA’s Medicaid expansion. Under the ACA, Medicaid was expanded to cover adults ages 19 to 64 with incomes up to 138% FPL (or $21,597 for an individual in 2025). This income threshold applied to parents and to adults without dependent children who were previously not eligible for Medicaid. While the ACA intended to require all states to implement the Medicaid expansion, a 2012 Supreme Court ruling made expansion optional for states. As of February 2025, 41 states, including the District of Columbia, have adopted Medicaid expansion (Figure 1).

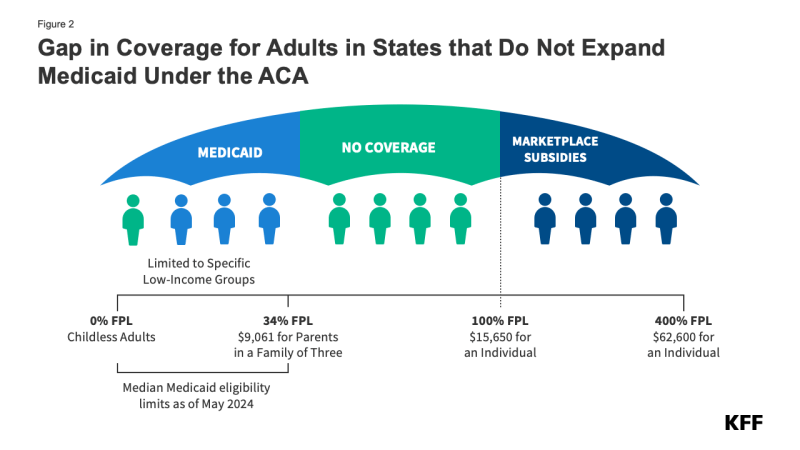

In the ten states that have not adopted Medicaid expansion, an estimated 1.4 million individuals remain in the coverage gap. These adults have incomes above their state’s Medicaid eligibility threshold but below the poverty level, making them ineligible for ACA Marketplace subsidies (Figure 2). Because the Medicaid expansion was expected to be mandatory for states, the ACA did not provide eligibility for subsidies in the Marketplaces for people below poverty.

Medicaid eligibility remains limited in states that have not expanded their programs. All non-expansion states, except Wisconsin (which provides coverage through a waiver), do not offer Medicaid to adults without children, regardless of their income (Figure 3). As a result, 80% of the individuals in the coverage group are adults without dependent children.

Uninsured rates in states without Medicaid expansion are nearly twice as high as those in expansion states (14.1% vs. 7.6%). People without insurance have more difficulty accessing care, with almost one in four uninsured adults in 2023 not receiving needed medical treatment due to cost. Uninsured individuals are also less likely than those with insurance to receive preventive care and treatment for major health conditions and chronic diseases.

What are the characteristics of people in the coverage gap?

Nearly three-quarters of adults in the coverage gap live in just three Southern states. Texas accounts for 42% of individuals in the coverage gap, the highest share of any state, while Florida and Georgia account for an additional 19% and 14%, respectively (Figure 4). Overall, 97% of those in the coverage gap live in the South. Of the 16 states in the region, seven have not adopted Medicaid expansion.

Nearly six in ten people in the coverage gap are in a family with a worker and over four in ten are working themselves. (Figure 5). However, these individuals work in low-wage jobs that leave them below the poverty level and often work for employers that do not offer affordable job-based insurance. Over half (53%) of workers in the coverage gap are in the service, retail, and construction industries, with common jobs including cashiers, cooks, servers, construction laborers, housekeepers, retail salespeople, and janitors. In non-expansion states, even part-time work can make parents ineligible for Medicaid.

About one in six (16%) people in the coverage gap have a functional disability. The share of people in the coverage gap with disabilities increases with age (Figure 6). Over a quarter (26%) of adults ages 55 to 64 in the coverage gap have a disability compared to one in ten adults under age 25. Adults ages 55 to 64, who often face increased health care needs, account for 17% of all people in the coverage gap. Despite these challenges, many of these individuals do not qualify for Medicaid through a disability pathway, leaving them uninsured. Research shows that uninsured people in this age group may delay necessary care until they become eligible for Medicare at 65.

People of color make up a disproportionate share of individuals in the coverage gap. Six in ten people in the coverage gap are people of color, a higher share than among adults in non-expansion states (49%) and nationwide (44%) (Figure 7). These differences in part explain persisting disparities in health insurance coverage across racial and ethnic groups.

How many uninsured could gain coverage if all states adopted the Medicaid expansion?

Approximately 2.7 million uninsured adults would gain coverage if all states adopted Medicaid expansion. This includes 1.4 million people in the coverage gap and 1.3 million uninsured adults with incomes between 100% and 138% of the FPL, most of whom are eligible for Marketplace coverage but not enrolled (Figure 7 and Table 1). While many of these adults above poverty qualify for zero-premium Marketplace plans, Medicaid generally provides more comprehensive benefits with lower out-of-pocket costs. The potential number of people who could gain coverage through expansion varies by state.

Sammy Cervantes, Clea Bell, and Jennifer Tolbert are with KFF. Anthony Damico is an independent consultant.