Potential Implications of Policy Changes in Medicaid Drug Purchasing

Executive Summary

While prescription drug pricing was an issue at state and federal levels even prior to the COVID-19 pandemic, there may be increased attention to Medicaid prescription drug policies as states face fiscal pressures from the economic effects of the pandemic and as the federal government may seek spending offsets to upcoming legislation aimed to expand coverage. Medicaid provides health coverage for millions of Americans, including many with substantial health needs who rely on Medicaid drug coverage both for acute problems and for managing ongoing chronic or disabling conditions. Though the pharmacy benefit is a state option, all states provide pharmacy benefit coverage. Due to federally required rebates (under the Medicaid Drug Rebate Program, or MDRP), Medicaid pays substantially lower net prices for drugs than Medicare or private insurers, but Medicaid must provide coverage for all approved drugs for manufacturers participating in the MDRP. Within federal guidelines, states have flexibility to administer the benefit with regard to pricing, utilization management and supplemental rebates.

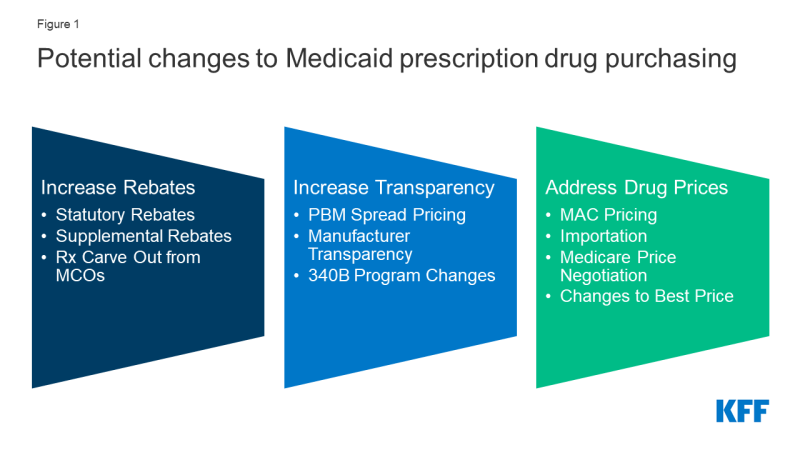

Policies designed to generate federal or state savings are likely to have implications for and invoke behavioral responses from other entities including drug manufacturers, pharmacies, managed care organizations (MCOs) and pharmacy benefit managers (PBMs). Because these policy changes do not affect federal rules limiting Medicaid cost-sharing to nominal amounts, we did not separately examine how each policy change would affect enrollee costs. This report examines how leading federal and state policy proposals that increase Medicaid drug rebates, increase price transparency, and target drug prices could affect these entities, which could influence debate over these proposals and what the effects would be (Figure 1).

Policy proposals to increase rebates reduce federal and/or state spending through lower net reimbursement to manufacturers. While Medicaid rebates already provide a significant offset to the program’s drug spending, several policy proposals aim to further increase drug rebates in Medicaid. Changes to the statutory rebate require changes in federal legislation; however, states have flexibility to use supplemental rebates and decide whether benefits are delivered through MCOs or are carved-out. Increased rebates under MDRP would lead to direct federal savings, though the effect on state spending is dependent on how the policy is structured. States efforts to increase supplemental rebate agreements generally aim to increase purchasing power or other leverage in negotiation with manufacturers. States may be able to pool purchasing power across or within states, but ability to increase supplemental rebates in the future is uncertain. States may also seek to carve out prescription drugs from MCO contracts to capture all supplemental rebates and concentrate negotiating power.

Lack of transparency through the prescription drug pricing process, both in general and specifically within Medicaid, has led to several proposed federal and state policy proposals that aim to provide accurate and public information on drug pricing. Drug list prices affect not only the reimbursement paid to the pharmacy but also the rebates the Medicaid program receives. While list prices are public, manufacturers do not provide public information on how they set list prices and historically have not been required to explain changes in a product’s list price. Price transparency policies aim to make pricing information public to identify cost drivers, provide evidence for policy makers, or sometimes apply pressure to get payers to lower prices. Such policies include efforts to ban or limit spread pricing by pharmacy benefit managers (PBMs), policies to make information about list prices more accessible and efforts to limit or monitor 340B programs. The estimated savings to federal and state governments from efforts to increase PBM transparency is uncertain because estimates of spread pricing or the effect of bans on it vary widely, making the scale of the cost savings to Medicaid difficult to predict. It is also difficult to predict how other price transparency changes would affect state or federal Medicaid drug spending. Early efforts in these areas have not yet reported their impact on prices or costs.

Several other policies under consideration directly target Medicaid drug prices or prices paid by other payers, which would affect Medicaid prices as well. Generally, proposals that reduce underlying drug prices will reduce federal and state spending and decrease manufacturer reimbursement overall. For example, policies to expand the number of drugs affected by price ceilings (state Maximum Allowable Cost, or SMAC) could lead states to pay less in drug reimbursement. Medicaid’s rebate formula ensures that the program receives “best price,” but the best price provision is often cited by manufacturers and other stakeholders as a barrier to discounts and value-based contracts for other payers. Proposals to eliminate best price would generally increase federal and state costs and increase reimbursement for manufacturers. Proposals to import drugs from foreign markets as a way to lower drug prices for consumers and state governments have gained attention in recent years but are unlikely to have a substantial effect on Medicaid drug spending. Proposals that would allow the federal government to negotiate the price of prescription drugs on behalf of people enrolled in Medicare Part D drug plans would, in general, increase state Medicaid drug costs due to lower rebate payments but would decrease federal spending overall.

Changes to Medicaid prescription drug policies have implications for manufacturers, MCOs, PBMs and pharmacies. As part of the Medicaid pharmacy supply and payment chain, these entities may also see payment and revenue effects due to changes to Medicaid spending. State Medicaid programs increasingly have relied on MCOs and PBMs to help administer the pharmacy benefit, and arrangements between those entities, manufacturers and pharmacies may also be impacted by changes to Medicaid prescription drug policy. For example:

- To mitigate lower reimbursement from increased rebates, manufacturers may alter other prices, such as launch prices. To the extent that changes affect both prices paid to pharmacies by state Medicaid programs and pharmacies’ costs to acquire the drug, net changes to pharmacies could be neutral. However, efforts to recoup lost profits or lost savings for MCOs through changes to dispensing fees could affect pharmacies.

- In response to efforts to curb spread pricing, PBMs will still have incentives to negotiate discounts, so effects on manufacturers are unclear. Eliminating or limiting spread pricing could lead to increased reimbursement to pharmacies, depending on how PBMs change their negotiating tactics with pharmacies.

- If statutory rebates are reduced, MCOs and PBMs may have a larger role to negotiate lower prices or rebates for certain drugs with manufacturers.

- The impact of price ceilings (through state maximum allowable cost programs) on MCOs and PBMs depends on how proprietary prices currently paid by PBMs compare to state price ceilings. Price ceilings for Medicaid reimbursement to pharmacies for ingredient costs would not directly impact manufacturers unless pharmacies attempted to negotiate lower purchase prices from manufacturers or wholesalers in response to lower reimbursement.

- Medicaid drug pricing policies also have implications for providers that participate in the 340B program. The ceiling price, the price paid by entities in the 340B program for prescription drugs, is currently tied to the Medicaid rebate calculation. In addition, changes to how states administer the pharmacy benefit, either through FFS or MCOs, may impact the rules for how 340B entities interact with the Medicaid program and their revenue.

Looking ahead, federal and state policymakers continue to show interest in proposals to lower prescription drug costs as the public remains concerned about high and rising drug prices. President Biden has voiced support for policy proposals related to Medicare drug price negotiation and drug inflation rebates, and Congress may look to enact drug pricing proposals that were voted on but not enacted into law in the previous session. In addition, drug pricing policies, including Medicaid proposals, that reduce federal spending may provide spending offsets for other legislative priorities. Assessment of the implications of these proposals for Medicaid, and the actors involved in state Medicaid drug policy, can help understand their potential direct and indirect effects.