Medicaid Section 1115 Waivers: The Basics

Section 1115 Medicaid demonstration waivers offer states an avenue to test new approaches in Medicaid that differ from what is required by federal statute, if [in the HHS Secretary’s view] the approach is likely to “promote the objectives of the Medicaid program.” They can provide states additional flexibility in how they operate their programs, beyond the considerable flexibility that is available under current law. Waivers generally reflect priorities identified by states as well as changing priorities from one presidential administration to another. Nearly all states have at least one active Section 1115 waiver and some states have multiple 1115 waivers. This brief explains what Section 1115 waivers are and how they are used, summarizes key waiver requirements, and outlines the application and approval process.

Section 1115 Medicaid demonstration waivers offer states an avenue to test new approaches in Medicaid that differ from what is required by federal statute, if [in the HHS Secretary’s view] the approach is likely to “promote the objectives of the Medicaid program.” They can provide states additional flexibility in how they operate their programs, beyond the considerable flexibility that is available under current law. Waivers generally reflect priorities identified by states as well as changing priorities from one presidential administration to another. Nearly all states have at least one active Section 1115 waiver and some states have multiple 1115 waivers. This brief explains what Section 1115 waivers are and how they are used, summarizes key waiver requirements, and outlines the application and approval process.

What are waivers and how are they used?

Authority & Purpose. Under Section 1115 of the Social Security Act, the Secretary of Health and Human Services (HHS) can waive certain federal Medicaid requirements.1 In addition, the Secretary may permit states to use federal Medicaid funds in ways that are not otherwise allowed. Each administration has some discretion over which waivers to approve and encourage (Table 1). While the Secretary’s waiver authority is broad, it is not unlimited. Section 1115 waivers have been challenged in court. The Secretary does not have authority to waive some elements of the program, such as the federal matching payment system for states, or requirements that are rooted in the Constitution, such as the right to a fair hearing.2

Waiver Scope/Use. Waivers have been used to expand coverage or benefits, change policies for existing Medicaid populations (e.g., testing premiums or other eligibility requirements), modify delivery systems, restructure financing or authorize new payments (e.g., supplemental payments or incentive-based payments), as well as make other program changes. Waivers vary in size and scope. States can obtain “comprehensive” Section 1115 waivers that make broad program changes or narrow waivers focused on a specific population. Some policies introduced through 1115 waivers can only be implemented through Section 1115 authority while others could be implemented under other authorities (e.g., State Plan authority or 1915(c)). MACPAC analysis found about half of all Medicaid spending (in FY 2019) was authorized under Section 1115 demonstrations, but most of that spending could have been covered without an 1115 waiver. States may seek to include some populations or services in Section 1115 waivers that could be covered under other authorities to capture “budget neutrality” savings (discussed in more detail below). For example, although states can implement mandatory managed care for most populations under other authorities (e.g., State Plan or 1915(b)), states may implement managed care under 1115 authority to show budget neutrality savings, which can be used to finance other waiver costs that are not otherwise covered / allowed by Medicaid. In addition, many states have comprehensive waivers that make broad and intertwined program changes and may include both provisions that require 1115 authority as well as provisions that could be implemented without a waiver.

What are the rules about waiver financing?

Financing. Under long-standing policy and practice (although not required by statute), waivers must be “budget neutral” to the federal government over the course of the waiver. In other words, federal costs under an 1115 waiver may not exceed what they would have been for that state without the waiver. Typically, budget neutrality calculations are determined on a per enrollee basis—so, per enrollee spending over the course of the waiver cannot exceed the projected per enrollee spending calculated in the “without-waiver baseline” (putting states at risk for the costs per individual but not for the number of individuals enrolled). Waiver budget neutrality—measured against the estimated without-waiver baseline over the entire demonstration period—is not the same as a federal per enrollee limit on spending set at rates lower than expected under current law to generate federal savings. Budget neutrality calculations and the use of “budget neutrality savings” (to fund the federal share of costs not otherwise allowed) are negotiated between states and CMS (and the Office of Management and Budget (OMB)).

Because Section 1115 budget neutrality is not defined in statute or regulations, CMS agency policy and guidance to states has changed over time. For example, the Trump administration made changes to 1115 waiver budget neutrality policy in 2018, limiting the amount of federal funds that could be used for waiver spending. Later, the Biden administration made changes to Section 1115 budget neutrality policies that could provide greater flexibility for states to design and implement 1115 demonstration programs, including health-related social needs initiatives.

What are waiver timelines and processes?

Waiver Timeframe. Section 1115 waivers generally are approved for an initial five-year period and can be renewed, typically for three-to-five-year periods. Some waivers have been continually renewed over many periods, allowing waiver operations to continue for many years. Under the Trump administration, in a departure from prior policy, CMS approved waiver extension requests for up to 10 years.

Incoming administrations may let waivers expire, choosing not to renew certain waiver provisions if they don’t align with the administration’s waiver priorities or if they determine the provisions do not promote the objectives of the Medicaid program. Additionally, outlined in waiver approval terms and conditions, CMS reserves the right to withdraw Section 1115 waiver or expenditure authorities at any time (including those already in operation under an active/approved waiver). The Biden administration withdrew Medicaid work requirement waivers in all states that had approvals, concluding that the provisions do not promote the objectives of the Medicaid program. States can appeal withdrawal decisions to the HHS Department Appeals Board and/or challenge recissions in court.

Transparency, Public Input, and Evaluation. The Affordable Care Act (ACA) made Section 1115 waivers subject to new rules about transparency, public input, and evaluation.3 Regulations require public notice and comment periods to occur at the state and federal levels before CMS approves new Section 1115 waivers and extensions of existing waivers. Although the final regulations on public notice do not require a state-level public comment period for amendments to existing/ongoing demonstrations, CMS has historically applied these regulations to amendments as well. The Trump administration did not enforce state-level public notice and comment procedures maintained by previous administrations for certain 1115 waiver requests, including waivers that proposed significant changes.

The ACA also implemented new evaluation requirements for Section 1115 waivers, including that states must have a publicly available, CMS-approved evaluation strategy. States have traditionally also been required to submit quarterly reports as well as an annual report to HHS that describes the changes occurring under the waiver and their impact on access, quality, and outcomes.

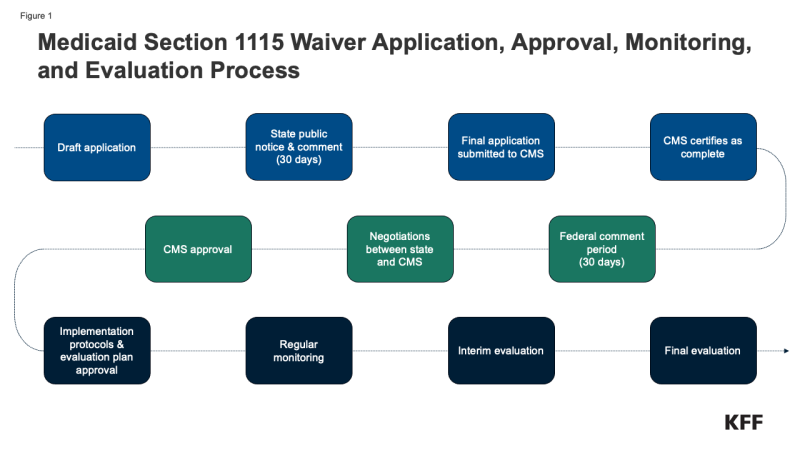

Waiver Application, Monitoring, and Evaluation Process. Medicaid policy changes, including through Section 1115 waivers, may require state legislative action or may be authorized at the direction of the governor. Once proposed policy changes have been formulated, a demonstration waiver proposal must be drafted. Key steps in the waiver process include (Figure 1):

- State public notice and comment.4 Prior to submitting an 1115 waiver application (or extension request) for official federal review, states must provide a 30-day public notice and comment period and must hold at least two public hearings, sharing sufficient detail about the proposed waiver to allow for meaningful public input. The state must share waiver proposal materials on its website. Federal rules also require tribal consultation (with federally recognized tribes) prior to application submission.

- Waiver application submission. State waiver applications must contain specific components including a comprehensive description of the demonstration, enrollment estimates (including for each category of beneficiaries impacted by the demonstration), a list of specific requested waiver and expenditure authorities, research hypotheses, and written documentation of the state’s compliance with public notice requirements, with a report of the issues raised and how the state considered those comments when developing the application.

- Federal public notice and comment.5 The federal government conducts a review for application completeness and sends the state a notice of receipt, indicating the start date of a 30-day federal comment period. CMS will publish the waiver application on its website and must make the comments received publicly available. Rules require CMS to review and consider all comments submitted by the deadline.

- Federal review and negotiation. CMS reviews the waiver application sometimes with the involvement of other HHS agencies and the Office of Management and Budget (which reviews the budget neutrality component). Significant negotiation may occur between the state and HHS.

- Approval. If a waiver is approved, CMS issues an award letter to the state (also published on Medicaid.gov), listing the specific sections of the Social Security Act and applicable regulations that are being waived or modified and the types of expenditures allowed as well as the “terms and conditions” of approval, including a budget neutrality agreement. There has been significant variation in the length of time it takes to get final approval of a waiver. NAMD has noted the typical negotiation / approval timeframe ranges from 6 months to 2 years.

- Implementation plans and protocols. For some waiver initiatives, CMS may require states to submit detailed implementation plans or protocol documents for review and approval.

- Monitoring & Evaluation.6,7 Because Section 1115 authority is intended for research and demonstration purposes, states must have an approved evaluation strategy in place that is publicly available. States are required to submit an interim evaluation report (one year before a waiver’s expiration or with a renewal application) and a summative evaluation (due 18 months after a waiver period ends). States have traditionally also been required to submit quarterly reports as well as an annual report to HHS that describes the changes occurring under the waiver and their impact on access, quality, and outcomes. States must also hold public forums to solicit feedback following waiver approval / implementation.

- Amendments & Renewals. States may submit “amendment” requests to CMS to alter existing / ongoing 1115 demonstrations. To ensure public transparency, CMS has historically required states to follow public notice and comment rules (even though final regulations left open the applicability of public notice requirements to proposed amendments). Extension / waiver renewal requests must contain specific components enumerated by CMS, including evaluation results.

*State waiver applications (including amendment and renewal requests), CMS issued approval documents, required implementation plans and protocols, and monitoring and evaluation reports are made publicly available on Medicaid.gov (search by state).

Endnotes

42 U.S.C. § 1315.

The Secretary’s waiver authority is limited to the provisions of 42 U.S.C. § 1396a, provided that waivers are demonstration projects that further Medicaid program objectives. 42 U.S.C. § 1315.

[3] §10201(i) of P.L. 111-148 added a new subsection (d) to Section 1115 of the Social Security Act. CMS issued final regulations implementing these provisions of the ACA (42 CFR Part 431 where a new Subpart G is added).

§ 431.408

§431.416

§431.424

§431.428