Medicaid Program Integrity and Current Issues

Medicaid provides health coverage and long-term care services and supports for low-income individuals and families, covering more than 76 million Americans and accounting for about 1 in 6 dollars spent on health care.1 Medicaid is a large source of spending in both state and federal budgets, making program integrity efforts important to prevent waste, fraud, and abuse and ensure appropriate use of taxpayer dollars. Recent audits and improper payment reports have brought program integrity issues back to the forefront. This brief explains what program integrity is, recent efforts at the Centers for Medicare and Medicaid Services (CMS) to address program integrity, and current and emerging issues. It finds:

Program integrity refers to the proper management and function of the Medicaid program to ensure it is providing quality and efficient care while using funds–taxpayer dollars–appropriately, with minimal waste. Improper payments, which are often cited when discussing program integrity, are not necessarily the same as criminal activities like fraud and abuse, which are a subset of improper payments. The federal government and states share the responsibility of promoting program integrity. CMS conducts a range of actions focused on program integrity. Outside of CMS, other federal agencies, including the Office of Inspector General (OIG) and the Government Accountability Office (GAO), undertake program integrity and oversight efforts.

Recent CMS actions to promote program integrity have focused on federal audit and oversight functions. CMS released a program integrity strategy in June 2018 and a notice in June 2019 highlighting program integrity as a priority and emphasizing new and planned actions centered on stronger audit and oversight functions, increased beneficiary eligibility oversight, and enhanced enforcement of state compliance with federal rules

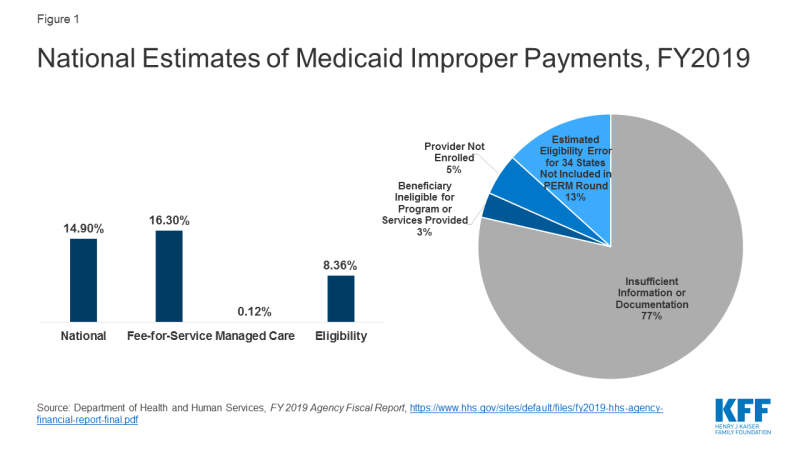

CMS released Payment Error Rate Measurement (PERM) estimates for Medicaid that include eligibility determinations for the first time since implementation of the Affordable Care Act (ACA). The PERM estimate is based on reviews of fee-for-service and managed care claims and eligibility determinations. The eligibility component was suspended for several years as states implemented the ACA and was reintegrated into the 2019 rate. The national Medicaid improper payment rate for 2019 is 14.90% or $57.36 billion.2 A separate HHS report shows a 16.3% error rate for fee-for-service claims, an 8.36% error rate for eligibility, and a 0.12% error rate for the managed care claims (Figure 1). HHS reports that 77% of improper payments were due to missing information and/or states not following the appropriate process for enrolling providers and/or determining beneficiary eligibility. These payments do not necessarily represent payments for ineligible providers or beneficiaries, since they may have been payable if the missing information had been on the claim and/or the state had complied with requirements. It finds 8% of improper payments were for ineligible providers or beneficiaries.

CMS’s heightened focus on reducing errors in eligibility determinations could have trade-offs that make it more difficult for eligible people to obtain and maintain coverage. CMS plans to change eligibility rules to tighten standards for eligibility verification.3 While such changes could reduce instances of ineligible people being enrolled in the program and other eligibility errors, they also could also result in greater enrollment barriers for people who are eligible for the program at the same time. PERM error rates do not capture errors associated with eligible people being disenrolled or denied enrollment.

Focusing program integrity efforts on areas identified as contributing to larger amounts of improper payments could yield greater returns on program integrity efforts. HHS indicates that Medicaid improper payment rates have been driven by errors associated with screening and enrollment of providers.4 Moreover, PERM only represents one tool to measure improper payments and does not fully capture all losses associated with program waste, fraud, and abuse.

Through administrative actions related to program integrity, CMS is making changes that could have broader implications for eligibility and spending. As noted, CMS guidance and planned changes to eligibility rules to tighten standards for verification could restrict enrollment in the program. Further, through guidance and regulation, CMS has heightened oversight of state claiming for the ACA expansion, increased oversight of and made changes to state claiming for federal funds under Section 1115 waivers, and proposed changes to supplemental payments. These changes could reduce federal spending on the program and limit states ability to access federal matching funds. In some cases, reduced federal spending may be tied to additional oversight to ensure states are complying with current rules, while in other cases the reductions may reflect CMS changes or proposed changes in policies.