State Flexibility to Address Health Insurance Challenges under the American Health Care Act, H.R. 1628

The American Health Care Act, as passed by the House, (HR 1628 or AHCA) would make significant changes to the insurance market provisions established by the Affordable Care Act (ACA) and to the financial assistance provided to people who purchase non-group coverage. The proposal would reduce the federal role in health coverage and devolve authority to states over key market rules and consumer protections affecting access and affordability, albeit with federal back-up provisions if states fail to take action. This brief outlines the provisions in the AHCA providing flexibility for states and addresses some of the issues and tradeoffs they could face.

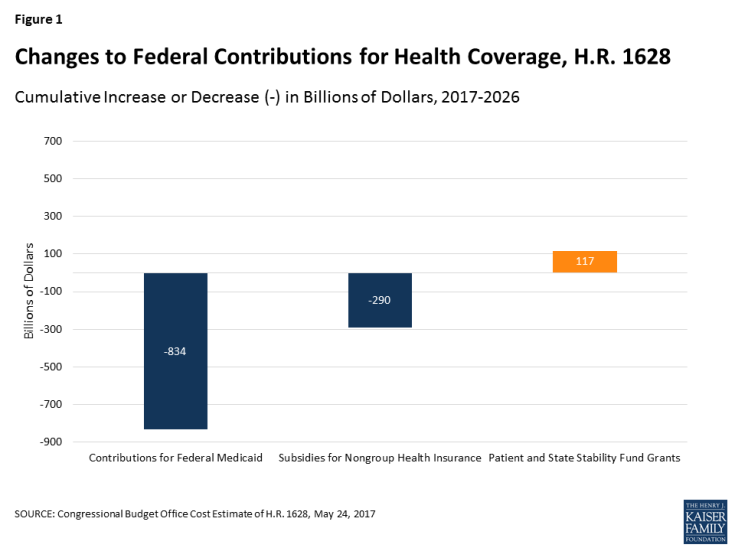

The AHCA would dramatically reduce federal spending on health coverage between 2018 and 2026, lowering federal contributions to Medicaid by $834 billion and subsidies for non-group health insurance by an additional $290 billion.1 The AHCA also would eliminate the tax penalty for people who do not have health insurance, replacing it with a premium surcharge (30% for up to one year) for non-group enrollees who have a gap of insurance of at least 63 days in the previous year. The tax penalty for employers that do not offer coverage to full-time workers also would be repealed. Overall, CBO estimates that the AHCA changes would result in an additional 23 million people being uninsured in 2026.2

To offset a portion of the federal spending reductions, the AHCA would create a federal fund called the Patient and State Stability Fund (“Fund.”) The bill appropriates up to $123 billion between 2018 and 2026 that states could use for a number of designated purposes related to coverage and the costs of care, plus an additional $15 billion for a federal invisible risk sharing program that states would have the option to administer. States also would have flexibility to modify important insurance provisions: through waivers, they could extend rate variation due to age, modify the essential health benefits, or permit insurers to use an applicant’s health as a rating factor for individuals applying for coverage if they have had a coverage gap in the year prior to their enrollment.

In the next sections, we describe the Fund and the waiver authority in the AHCA. After that, we discuss some of the issues and tradeoffs that states would need to address with the flexibility and funds provided.

Patient and State Stability Fund

The AHCA creates a new grant program that makes up to $123 billion available to states between 2018 and 2026. Of that, $100 billion ($15 billion for each of 2018 and 2019 and $10 billion each year from 2020 to 2026) would be available for a number of purposes described below, although in its estimate, CBO assumed that most of the funds would be used to reduce premiums or increase benefits in the non-group market.3 An additional $15 billion would be available in 2020 for maternity coverage and newborn care and prevention, treatment, or recovery support services for individuals with mental or substance use disorders. An additional $8 billion would be available between 2018 and 2023 to reduce premiums and other out-of-pocket costs for individuals paying higher premiums due to a waiver permitting insurers to use health status in setting premiums (discussed below).

Funds would be allocated among states through a formula that considers the total medical claims incurred by health insurers in the state, the number of uninsured in the state with incomes under poverty, and the number of health insurers serving, for 2018 and 2019, the state’s exchange, and for 2020 to 2026, the state’s insurance market.

States could apply for funding for any of the permitted purposes under an expedited process, with applications automatically approved unless the federal government denies the application within 60 days for cause. Starting in 2020, state matching funds would be required to draw down the allocated federal funds: states would be required to match 7% of the federal funds in 2020, phasing up to 50% in 2026.4 No funds would be appropriated for years after 2026.

States could seek funds for one or more of the specified purposes:

- Providing financial assistance to high-risk individuals not eligible for employer-based coverage who enroll in the individual market. The bill language is vague, but this provision appears to permit states to use their allocation to set up a high-risk pool or other mechanisms to provide or subsidize coverage for individuals with preexisting conditions without access to employer-sponsored coverage. By covering high-cost people in a separate pool, their costs are removed from the premium calculations of non-group insurers, lowering the premiums for other enrollees in private insurance. The AHCA does not address how people with preexisting conditions might be encouraged or required to participate in separate high-risk pools in states without waivers, because people with preexisting conditions generally would have access to non-group coverage at a community rate during open and special enrollment periods. A high-risk pool could be an option in states with a waiver to use health as a rating factor, where the pool could provide coverage to people with preexisting conditions who are offered coverage at very high premiums due to their health.

- Providing incentives to entities (e.g., insurers) to enter into arrangements with the state to stabilize premiums in the individual market. This provision appears to permit states to use their allocation for a reinsurance program. Reinsurance programs lower premiums in a market because they reimburse health insurers for a portion of the claims for people with high-costs, reducing the premiums they need to collect from enrollees. A reinsurance program operated during the first three years of the ACA; the Congressional Budget Office estimated that the reinsurance program ($10 billion in 2014) reduced non-group premiums by about 10% in 2014.

- Reducing the cost of providing non-group or small-group coverage in markets to individuals facing high costs due to high rates of utilization or low population density. Premiums vary significantly across and within states. This provision would allow states to use resources in higher cost or rural areas.

- Promoting participation in the non-group and small-group markets and increasing options in these markets. In the past, for example, state based marketplaces that devote resources to outreach and enrollment assistance have been able to help more applicants during open enrollment periods.

- Promoting access to preventive, dental and vision care services and to maternity coverage, newborn care, and prevention, treatment and recovery support services for people with mental health or substance disorders. This purpose was added to the bill as the House considered changes to the ACA essential health benefits standard. Fifteen billion dollars in Fund resources are dedicated for spending on maternity, newborn, mental health, and substance abuse services in the year 2020.

- Providing direct payments to providers for services identified by the Administrator of the Centers for Medicare and Medicaid Services (CMS). For example, states might use Fund resources to expand services provided by public hospitals, free clinics, and other safety net providers that offer treatment to residents who are uninsured or under-insured.

- Providing cost-sharing assistance for people enrolled in health insurance in the state. The AHCA would repeal current law cost sharing subsidies ($97 billion between 2020 and 2026), which pay insurers for the cost of providing reduced cost sharing to low-income marketplace enrollees. States could use their fund allocation to offset some of this reduction or assist others with private health insurance (such as those with employer-based coverage) who have high out-of-pocket costs.

These categories are quite broadly specified, providing states with discretion about what policies they may want to pursue and how to how to design programs to address different health care needs in their state. The options include ways to reduce premiums (through reinsurance, for example), to make direct payments to health care providers, or to help insurance enrollees with high out-of-pocket costs. States could pursue one or more of these approaches, although they are constrained by the amount of funds available and by their need to match the federal funds after 2020.

CBO estimated that $102 billion of the $123 billion provided to states would be claimed by states by 2026. CBO assumed that states would use most of their Fund allocations to reduce premiums or increase benefits in the non-group market; it assumed $14 billion of the available $15 billion available for maternity coverage, newborn care, and mental health and substance abuse care would be used for direct payments for services.5

Federal default program. In states without an approved application for monies from the Fund for a year, the bill would authorize the CMS administrator, in consultation with the insurance commissioner for the state, to operate a reinsurance program in the state for that year. The program would reimburse insurers 75% of the cost of claims between $50,000 and $350,000 for years 2018 and 2019; the CMS Administrator would adjust these parameters for 2020 through 2026. To receive funds through the default program, the state would be required to match the federal funds, with matching rates starting at 10% in 2018 and increasing to 50% by 2024, remaining at 50% through 2026.

Invisible risk sharing program. The AHCA also would create a separate reinsurance program as part of the Fund, called the Federal Invisible Risk Sharing Program (FIRSP). The FIRSP is not a grant program, but would make payments to health insurers in every state to offset a portion of the claims for eligible individuals (e.g., enrollees with high claims or with specified conditions). The CMS Administrator would determine the parameters of the program and would administer the program, although states would be authorized to assume operation of the program beginning in 2020. The bill appropriates $15 billion to the FIRSP for 2018 through 2026. Additionally, at the end of each year, any unallocated monies in the Fund (which could occur if a state did not agree to match the federal funds) would be reallocated to FIRSP as well.

The AHCA does not specify how FIRSP would be coordinated with states that adopt a reinsurance program or for which the CMS Administrator is operating a federal default program. These issues could be addressed as the Administrator specifies the parameters of the FIRSP. CBO assumed that all of the $15 billion in FIRSP funding would be used over the period.6

State Waiver Options

The AHCA would permits states to seek waivers to federal minimum standards for non-group and small-group coverage to (1) modify the limit for age rating,7 (2) modify the essential health benefit package, and (3) permit insurers to consider the health status of applicants for non-group coverage if they have had a coverage gap in the past year.

To obtain a waiver, state must show that the waiver would do one or more of the following: reduce average premiums, increase health insurance enrollment, stabilize the market for health insurance, stabilize premiums for people with preexisting conditions or increase choice of health plans. The waiver permitting health as a rating factor has an additional requirement, discussed below.

Waiver to permit rating based on health

The AHCA generally would require non-group insurers to assess a premium surcharge of 30% to all applicants (regardless of their health) who have had a coverage gap of at least 63 consecutive days in the 12 months preceding enrollment. The surcharge would apply during an enforcement period (which ends at the end of a calendar year).

In lieu of the 30% premium surcharge, the bill also authorizes states to seek a waiver that would permit insurers to consider an applicant’s health in determining premiums. Health status rating could apply for people with a coverage gap in the year preceding enrollment. States could seek a waiver for enrollments during special enrollment periods for 2018 and beyond, and for signups during open enrollment periods for 2019 and beyond. Insurers would not be permitted to deny coverage to an applicant based on their health, but the bill does not limit the additional amount that an applicant can be charged based on their health (the state could limit the amount of the health surcharge but is not required to do so). Similar to the rules regarding the 30% surcharge, insurers would be able to apply the health status rating through December 31 of the plan year for which the individual enrolled.

To be eligible for a community-rating waiver, in addition to the general waiver requirements, the state must have in place a program that either provides financial assistance to high risk individuals (e.g., a high risk pool) or provide incentives to help stabilize premiums in the individual health insurance market (e.g., reinsurance payments to insurers) or it must participate in the FIRSP. Because the FIRSP would operate in all states, with no requirement for state matching funds, it would appear that all states would be eligible for the community-rating waiver without having to set up a separate high-risk pool or reinsurance program. The bill imposes no additional requirements for the state programs. The bill would provide $8 billion to the Fund over five years (2018 through 2022) for states with these waivers to help reduce the premiums out-of-pocket costs for people who have higher premiums due to waiver. State matching funds would seem to be required to draw down funds starting in 2020. CBO estimates that $6 billion of the $8 billion would be used.

Because there is no limit on the amounts by which insurers could vary premiums based on health, a premium surcharge for people with pre-existing conditions who have had gaps in coverage could provide a stronger incentive for people to maintain continuous coverage than the 30% surcharge that would otherwise apply. Before passage of the ACA, insurers declined applicants frequently, even when they could have charged a higher premium instead, suggesting that insurers would likely assess very high health premium surcharges for people with potentially costly preexisting conditions. While not an actual denial, very high surcharges would likely have in practice the same effect for many people subject to surcharges based on their health.

Under the bill, states with a waiver could also permit insurers to use health rating to charge healthy applicants with a coverage gap a lower than standard premium available to people with continuous coverage. Under this approach, healthy applicants would have an incentive to submit to health rating, even if they had continuous coverage. This could have a destabilizing effect on the market because healthy people could have an incentive to switch to new coverage at renewal, without submitting proof of continuous coverage, in hopes of finding a lower premium based on their good health, which would cause the standard rates generally available for people with continuous coverage to increase.

As a condition of receiving a community-rating waiver, the AHCA does not require that a state must assure access to non-group coverage or make an alternative source of coverage available to people subject to health rating if the rate they are offered is very high. For example, a state participating in the FIRSP is eligible for this waiver, and that program reimburses health insurers for people that become enrollees; a person offered a very high health status rate might never become covered. It is unclear how much authority the Secretary of Health and Human Services (HHS) would have to address this issue in the waiver process, given the expedited waiver approval provisions in the bill.

Waiver to Modify the Essential Health Benefits Package

Under current law, insurance policies offered in the non-group and small-group markets must cover a fairly comprehensive list of defined essential health benefits: ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, including behavioral health treatment, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services and chronic disease management, and pediatric services, including oral and vision care. The essential health benefits are a minimum that must be offered; insurers may offer additional benefits as well.

In addition to the list of essential health benefit categories, a number of constraints and consumer protections apply to their definition by the Secretary of HHS, including:

- that the scope of the essential health benefits offered in these markets is equal to the scope of benefits provided under a typical employer plan;

- that coverage decisions, determination of reimbursement rates, establishment of incentive programs, and design benefits cannot be made in ways that discriminate against individuals because of their age, disability, or expected length of life;

- that essential health benefits take into account the needs of diverse segments of the population, including women, children, and people with disabilities;

- that essential health benefits not be subject to denial to individuals against their wishes on the basis of the individuals’ age or expected length of life or of the individuals’ present or predicted disability, degree of medical dependency, or quality of life;

- that emergency services provided by out-of-network providers would be provided without prior authorization or other limits on coverage, and would be subject to in-network cost sharing requirements;

Current law also prohibits insurers from applying annual or lifetime dollar limits to essential health benefits.

The AHCA would authorize states, for years 2020 and beyond, to seek a waiver to modify the essential health benefits that insurers would need to offer in the non-group and small group markets. States also could seek to modify the provisions relating to the scope of the benefits and to their definition. There are no limits or parameters in the AHCA regarding the changes a state could make to the essential health benefit list or its definitions, although several provisions of current law could limit their discretion. For example, the current prohibition on applying annual and lifetime maximum dollar limits to essential health benefits may prevent states from using dollar limits in defining the scope of benefits they include as essential health benefits, and the application of mental health parity rules to qualified health plans may prohibit a state that includes mental health or substance abuse services as an essential health benefit from applying limits to the scope of those benefits that are not applicable to other benefits.

The waiver authority gives states wide latitude in defining essential health benefits that would be required in non-group and small group coverage. A state could remove one or more benefits from the list, which would mean that insurers could offer plans without those benefits or could offer them as an option in some policies or with limits. Maternity benefits, for example, were often not included in non-group policies prior to the ACA. A state also could limit the scope of a benefit; for example, determine that only generic drugs were essential health benefits or limit the scope of hospitalization to 60 days per year. Insurers would then be required to offer at least the limited scope of the benefit, with the option to cover a broader scope of the benefit (in our example, hospital coverage without no day limit) in some or all of their policies in the state. A state could also eliminate the standard, defining essential benefits to mean whatever insurers in a competitive market offer. As discussed below, however, adverse selection concerns would make it difficult for insurers to offer coverage that is much more comprehensive than the defined minimum at a reasonable premium.

Waiver to modify the limit on age rating

The AHCA would generally amend current law to expand the permissible premium variation due to age from 3 to 1 to 5 to 1, or any other ratio a State might elect. States also would be authorized to seek a waiver, for years 2018 and beyond, to put in place a higher rate permissible ratio. There are no limits in the AHCA on the ratio that a state could permit insurers to use. The waiver authority here appears to be redundant, as the underlying bill would authorize states to elect different ratios without seeking a waiver.

Issues and Tradeoffs that States May Need to Resolve

The AHCA would reduce the federal role and resources in providing health insurance coverage, particularly for people who are lower and moderate income and are covered though the Medicaid coverage expansion or through the non-group market. States would assume an expanded role, both financially and in making key decisions about the access and scope of benefits available to these people.

States would undertake this role facing some significant challenges.

Competing demands for reduced federal funding

The AHCA, by reducing the overall amount of federal premium tax credits, eliminating cost-sharing subsidies, and reducing federal contributions for the Medicaid expansion population and overall, would significantly reduce federal health care payments received by insurers, providers and people, leaving fewer people covered and more people with higher out-of-pocket costs. CBO estimates that, between 2018 and 2026, the AHCA would reduce federal Medicaid spending by $834 billion and federal spending on subsidies for non-group health insurance by $290 billion (Figure 1).8 By 2026, 23 million fewer people would have health insurance. States would have access to grant money through the Fund to try to address some of the issues, but the resources available through the Fund would be far less than the spending reductions. CBO estimates that states would use $102 billion from the Fund, with an additional $15 billion being spent by the FIRSP.9 States would be faced with a number of competing demands for the federal grant money, including lowering premiums, helping people with high cost sharing, and helping people and providers address access and financial issues resulting from the greater number of people without insurance.

Challenges in reducing premiums and maintaining coverage

A second challenge for states relates to the cost of non-group health insurance premiums. Proponents of the AHCA have identified lowering the cost of non-group health insurance as a significant goal of the proposed law, but the underlying federal portions of the bill do not really do that. In fact, replacing the individual requirement to have health coverage with the continuous coverage provision would initially increase premium rates as compared with current law.10 A few provisions, including the elimination of the health insurance and the medical device taxes, the FIRSP, and the elimination of standard cost-sharing tiers would offset some of the increase from repealing the individual coverage requirement. The most significant tools to potentially lower premiums, however, would be under state discretion: using Fund dollars for reinsurance to offset premiums and seeking waivers to modify the essential health benefits and to permit the insurers to use health as a rate factor for applicants with a coverage gap. Each of these options, however, would involve significant policy and political tradeoffs.

Applying the grant dollars from the Fund could have a significant additional impact on premium rates, particularly because fewer people would likely be covered than under current law. CBO has assumed in its cost estimates of the AHCA that states would use most of their grants from the Fund to reduce non-group premiums or increase benefits.11 Based on a previous CBO cost estimate for the AHCA, researchers at the Brookings Institution estimated that the AHCA increased average premiums by about four percent when age is held constant (see box below). This suggests that states would need to use most of their grant Funds to bring premiums back to current levels. As just discussed, however, applying all or a large percentage of the grant funds to reduce premiums would mean that other potential needs might remain unaddressed.

Measuring Premium Change

Determining how much premiums would change due to changes in law is complicated because a number of factors affect what people pay and who would actually buy coverage. There are a few ways to look at this. One is the change in the average premium; this is the change in the average amount that people are expected to pay under current law and under the change. This is a good measure of how overall costs will change, but not a very good measure of how a particular person might see their premium change. Because premiums vary by things, such as where people live and what age they are, the average can change just because the distribution of enrollees changes; for example, if more young people enroll, the average premium goes down, but the premium that a person at any given age sees might remain the same. Looking at changes for people in certain rating classes, such as by age, comes closer to looking at what particular people may see, although the changes still may vary by location or by health status if insurers can use them in rating. Premiums for a person of a particular age or health also could vary due to changes in benefits or to the cost sharing they face.

Waiving essential benefits could reduce premiums but also limit availability

The waiver options would also pose difficult decisions for states. For example, a state could lower premium rates by using an essential health benefits waiver to reduce the required benefits in non-group or small-group policies. The argument for this approach is that some people could choose policies that cost less because they cover less, and others who want additional benefits could pay more for policies that covered those benefits. There are several difficulties with this, however.

One is that most claims costs fall into the basic insurance categories that would be hard to exclude. A recent report from Milliman based on their commercial claims database, found that claims from hospital care, outpatient care including physician costs, and prescription drugs accounted for around 70% of claims costs; adding emergency care and laboratory services brings that to over 80%. Redefining essential health benefits to meaningfully lower premiums would require either placing meaningful limits on these categories (for example, only including generic drugs as an essential benefit) or eliminating whole other categories. Looking at some of the categories that were sometimes excluded prior to the ACA: maternity coverage accounts for 3.4% of claims, mental health and substance abuse accounts for 4.2% of claims and preventive benefits account for 5.6% of claims.12 To obtain policies with lower premiums, people would need to choose policies with important limitations. CBO also notes that, should such categories be dropped from the definition of essential health benefits, non-group enrollees who need such care could see their out-of-pocket medical care spending increase by thousands of dollars in any given year.

A second difficulty is that this approach would lead to significant adverse selection against plans with benefits that were more comprehensive than the minimum required. Because market rules permit applicants to choose any policy at initial enrollment, and change their level of coverage annually at renewal, people who have or develop higher needs for a benefit that is not a defined essential health benefit can enroll or switch a plan that covers it without any impediment. For example, if a state were to determine that prescription drugs were not an essential health benefit, people without current drug needs would be more likely to take policies that did not provide drug coverage while people with current needs would be more likely to take policies that did. This would increase premiums for policies covering prescriptions to relatively high levels, discouraging people without drug needs from purchasing them, which would lead to even higher premiums. While the risk adjustment program could offset some of the impacts of selection, developing a risk adjustment methodology where there is substantial benefit variation is difficult.13 This dynamic would discourage insurers from offering coverage for important benefits not defined as essential health benefits, or if they were to offer it, they would do so at high premiums. People at average risk would likely not have reasonable options if they wanted to purchase coverage with significant benefits beyond those that were required for all policies. CBO also estimates that insurers generally would not want to sell policies that include benefits that were not required by state law.

The AHCA requires that $15 billion of the money in the Fund be used for maternity coverage, newborn care, and prevention, treatment and recovery support services for mental health and substance abuse disorders. States that chose not to include any of these services as essential health benefits could use these funds to make these services available, for example, by subsidizing optional coverage or providing direct services. The funds would only be available in 2020, although it might be possible for a state to use them over a longer period. The $15 billion was added to the Fund along with the authority to waive essential health benefits, which suggests that the sponsors may be anticipating that these services are at risk of not being defined as essential health benefits by states.

The second significant waiver option for states in the AHCA, allowing insurers to use health as a rating factor for applicants with a coverage gap within the previous year, would put states in the middle of one of the most contentious issues in this debate: how to provide access to coverage for people with preexisting health conditions. There are few specifics in the bill, but generally, as discussed above, a state could seek a waiver to allow insurers to use health in rating applicants with a coverage gap and to apply the health rate until the end of the calendar year (their enforcement period).

Waiving community rating vs. protecting access for people who are sick

This provision has the potential to reduce non-group premiums overall because permitting health-based rates that exceed 30% penalty that otherwise would apply to applicants with a coverage gap rating would make it more expensive for them to buy non-group plans, either generating more premiums from them or, more likely, diverting them from enrolling in the non-group market. If the permitted health surcharges were sufficiently high, the effect would be very close to a denial. As noted above, the AHCA does not require states seeking this waiver to have any alternative method of access for people facing very high premiums based on their health. The state would at least have to participate in the FIRSP (and it appears that the program operates in all states), but that mechanism only assists insurers when high-risk or high-cost people enroll, and people assessed a very high premium might not have an opportunity to enroll.

States electing this waiver would have tools to protect access for people with coverage gaps and preexisting conditions. One option that has been mentioned by supporters would be to create a high-risk pool that could offer coverage to people facing a high health surcharge. The bill would permit states to use monies from the Fund to support a high-risk pool, and the bill would appropriate an additional $8 billion for 2018 through 2023 that could be used to reduce premiums or other out-of-pocket costs for people assessed a higher premium because of the waiver to use health status as a factor. States could use their share of the $8 billion to reduce premiums for high-risk pool coverage as an alternative for people who could not afford the health status surcharge for non-group coverage, and could use their general allocation from the Fund to support the costs of the pool if the $8 billion were to be insufficient or when it ends in 2023.

For states, the tradeoff would be balancing providing reasonable access to people with coverage gaps and preexisting conditions against the goal of lowering premiums for others. A state could have the biggest impact on premiums for non-group coverage by permitting insurers to assess a health surcharge without limits and not providing an alternative means of access. This would result in many people with coverage gaps and preexisting conditions being priced out of the market, which would not only lower claims costs immediately, but would also prevent them from establishing continuous coverage and migrating to non-group plans at regular rates after their enforcement periods end. Possibly more likely is that states would take some steps to assist people subject to health rating from being effectively declined through high premiums. Options could include establishing a high-risk pool with premiums that are more affordable than the health adjusted premiums people would be assessed under the waiver, limiting the health surcharges that insurers could assess, or using a portion of their share of the $8 billion to reduce premium costs to a more affordable level. For states weighing these choices, as they improve access and affordability for people who would be subject to the health adjusted rates, they generally lessen the impact that the waiver would have on premiums overall.

Likely, the high-risk pool option would have the largest impact on non-group premiums of these options, because it would move the claims for some high-risk people outside of the non-group market, at least until the people established continuous coverage and moved to non-group plans with premiums not adjusted for their health. The bill does not establish any parameters for a high-risk pool, such as the premiums that could be charged, what the coverage and cost sharing would be, and whether there would be any limits on coverage. For example, it is not clear if a high-risk pool would need to offer essential health benefits, would be subject to provisions prohibiting dollar limits, or would be considered coverage for which people could receive a premium tax credit. States would need to establish parameters in all of these areas.

CBO estimated that about one-half of people live in states that would seek a waiver to modify the essential health benefits, use health as a rating factor, or both. About two-thirds of these people would live in states that would choose to make moderate changes to market regulations, which would result in a modest reduction in premiums. One-third of these people live in states that CBO assumed would choose to substantially modify the essential health benefits and allow health status rating in their non-group markets.14 In these states, CBO estimated that people in good health would face significantly lower premiums while people less healthy people would be unable to purchase comprehensive coverage at premiums similar to current law and might not be able to purchase coverage at all.15 Although the additional grant funds for states with waivers to use health status rating would lower premiums and out-of-pocket premiums, CBO found that the premium effects would be small because “. . . the funding would not be sufficient to substantially reduce the large increases in premiums for high-cost enrollees”16 . CBO did not produce illustrative premiums for this scenario.

Addressing funding limitations over time

A third challenge for states is that the annual appropriations to the Fund do not grow over time and end entirely after 2026, even though the underlying health care needs continue to grow. For example, the cost of health care would continue to increase over the period, while the number of uninsured would also increase. Adding to the increasing cost burden, the federal premium tax credits would grow more slowly than premium over time, shifting more costs to enrollees and reducing their impact on affordability. The appropriations for the Fund also end in 2023 (for the $8 billion) and 2026 for the rest of the Fund. At the same time, the state matching requirements for money from the Fund grow over time, from 7% in 2020 to 50% in 2026. This means that states would need to invest an increasing amount of resources on policies and programs for which federal funds may end, perhaps abruptly, in the foreseeable future. Unless the federal government would agree to commit to appropriate funds several years in advance, states might be reluctant to make budget or program commits to programs that they may be unable to maintain without significant federal assistance.

Discussion

Overall, the AHCA would present states with a number of difficult problems and choices, and with limited resources with which to address them. The bill would reduce federal contributions for Medicaid and federal payments to subsidize non-group insurance by about $1 trillion dollars, while repealing the federal tax penalty for not having health insurance would increase non-group premiums significantly above current levels. These provisions would disproportionately affect the affordability of coverage and care for lower income and older people, and would cause millions of people to become uninsured.

States would be eligible for $123 billion in grant funds to help offset these impacts, but would face difficult tradeoffs. If states use most of their grant funds to reduce premiums, as CBO has assumed, there would not be funds left to address other needs, such as helping lower income and older people facing higher premium and out-of-pocket costs and health care providers who would be serving a growing number of uninsured people. States also would have the options of reducing covered benefits or allowing insurers to increase premiums for applicants with pre-existing conditions, each of which would lower premiums but would raise out-of-pocket costs for people with health problems.

State also would need to find an increasing amount of matching state funds to be eligible for the federal grant fund, and could face uncertainty if federal funds are not appropriated in advance. States choosing not to participate (by not providing matching funds) would be left without resources to address the higher premiums and affordability issues that would arise.