The independent source for health policy research, polling, and news.

3 Charts: The Cost and Coverage of Opill—the First FDA-approved Over-the-Counter Daily Oral Contraceptive Pill in the United States

The first FDA-approved over-the-counter daily oral contraceptive pill in the United States— Perrigo’s Opill— is now available for pre-order at major online retailers and will soon be available in stores.

Although the new over-the-counter pill could broaden access to contraceptive options in the United States, KFF research suggests consumers are likely to face some hurdles if they seek to have their plan cover the costs. For example, while federal policy requires most private health insurance plans and Medicaid expansion programs to cover—without patient copays—the full range of FDA-approved contraceptive methods with a prescription, there is no federal requirement that plans cover nonprescription contraception.

As Opill officially launches and federal regulators consider public input on how best to ensure coverage and access to over-the-counter preventive services like it, these three charts provide insights into the coverage and affordability issues raised by the over-the-counter availability of these pills.

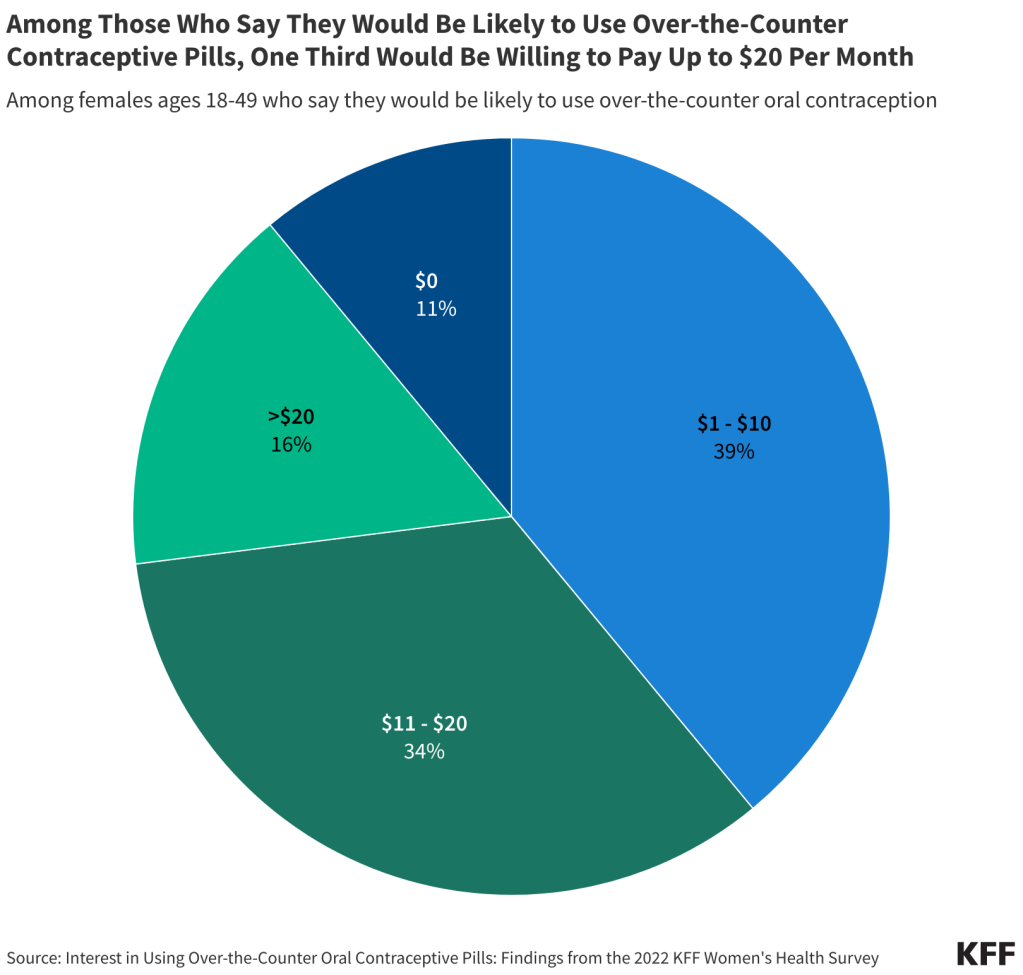

1) Many women who say they are likely to use an over-the-counter oral contraceptive pill say they would not be willing to pay Opill’s suggested retail price.

The suggested retail price of Opill is $19.99 for one month’s supply or $49.99 for three months’ supply. Four in ten (39%) of those who say they are likely to use over-the-counter pills say they would be willing and able to pay $1-$10 per month and 11% would not be willing to pay anything ($0) for the pills. A third (34%) would pay $11-$20.

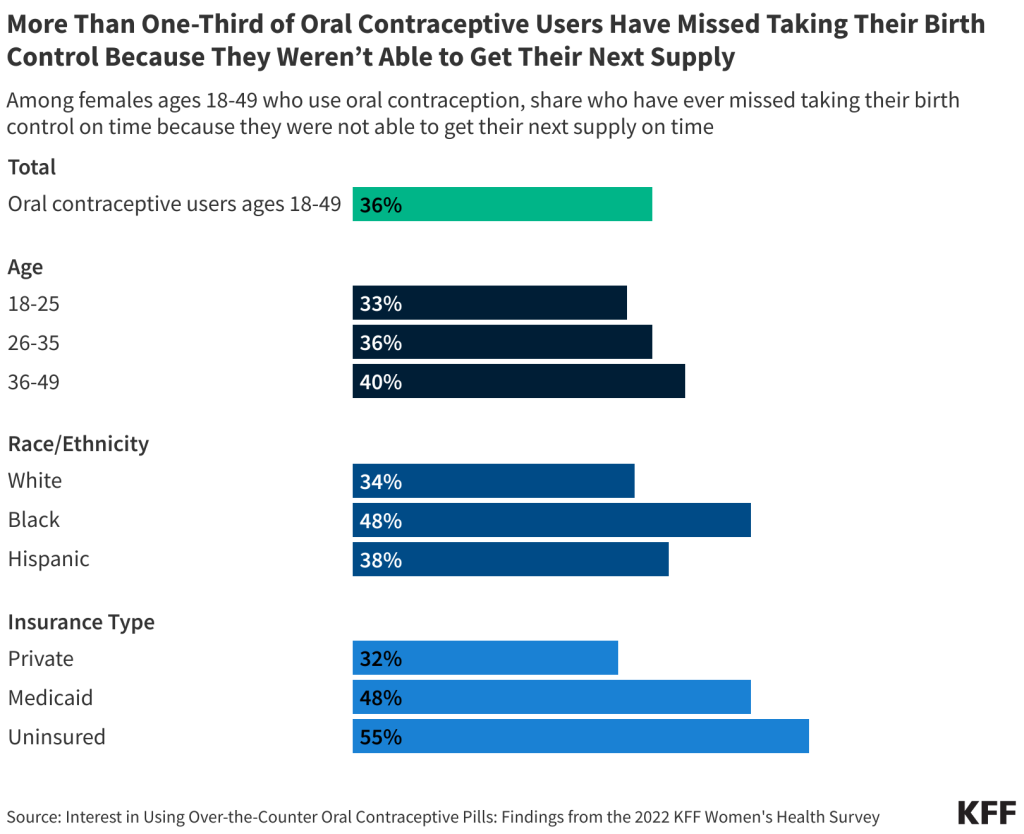

2) More than one third of oral contraceptive users have missed taking their birth control because they were unable to get their next supply on time.

Traditionally, patients need to get a prescription for oral contraceptives from a clinician and then pick up their supply at a pharmacy. Dispensing qualities vary by insurer, but the vast majority of oral contraceptive pills users receive fewer than 6 packs of pills at a time. The added convenience and time saved by obtaining oral contraception directly in stores or having them delivered from online retailers could reduce the share of women who miss taking their contraception on time because of difficulties in keeping a continuous supply on hand.

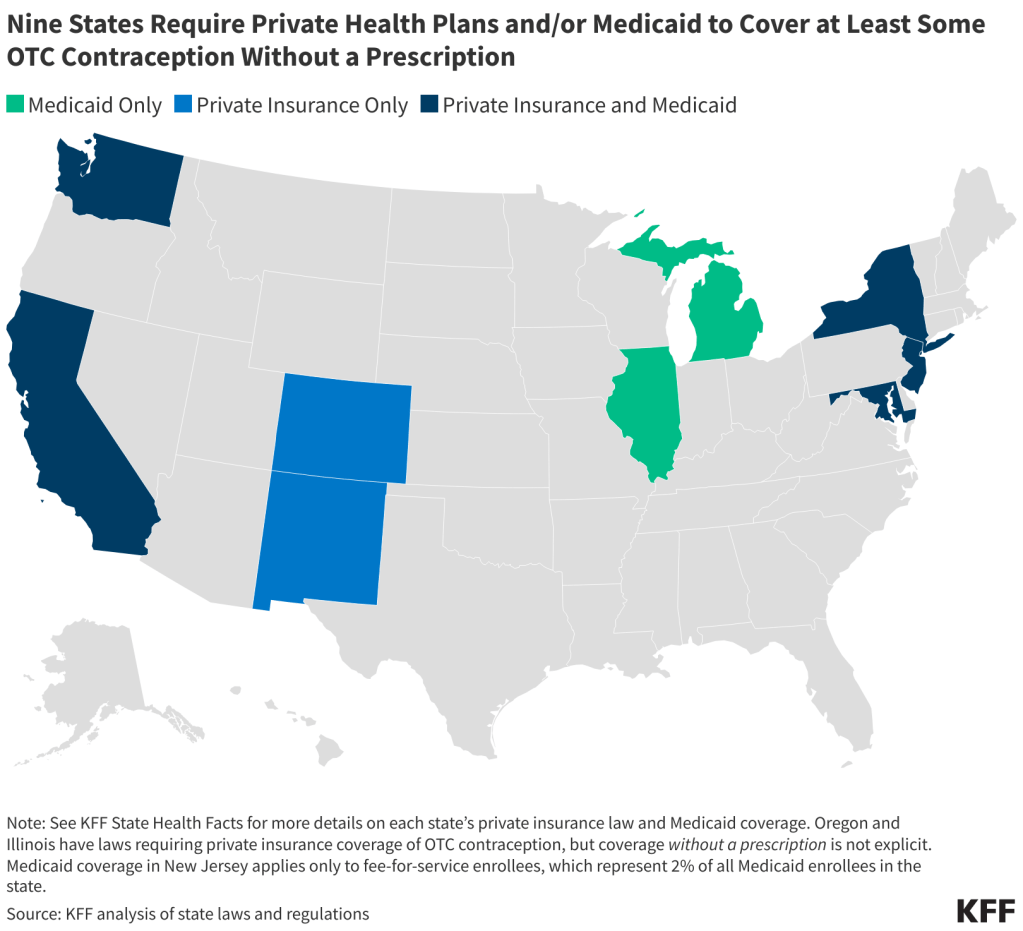

3) Seven states require state-regulated private health insurance plans to cover at least some methods of over-the-counter contraception without a prescription free of cost-sharing, and seven states use state funds to offer the same coverage for Medicaid enrollees.

Several states have taken action to address affordability barriers to over-the-counter contraception by requiring plans to cover certain products such as emergency contraception and condoms without a prescription. However, the reach of these measures is limited because the majority of those with private health insurance are enrolled in plans that are only subject to federal laws, not to state laws. In most of these states, the language of these private health insurance policies is broad enough to include an over-the-counter daily oral contraceptive such as Opill without a change in policy.

KFF has many resources about Opill’s potential impact and the coverage landscape in which the pill will be available. Take a deeper dive into the following:

- Insurance Coverage of OTC Oral Contraceptives: Lessons from the Field

- Will Insurance Cover Over-the-Counter Contraceptive Pills? A Discussion of Coverage Options and Challenges

- Over-the-Counter Oral Contraceptive Pills

- Oral Contraceptive Pills: Access and Availability

- Interest in Using Over-the-Counter Oral Contraceptive Pills: Findings from the 2022 KFF Women’s Health Survey