Annual Family Premiums for Employer Coverage Rise 7% to Average $25,572 in 2024, Benchmark Survey Finds, After Also Rising 7% Last Year

Most Large Firms Don’t Cover Costly GLP-1 Drugs for Weight Loss; Many Say They Impose Various Conditions or Requirements to Limit Their Use

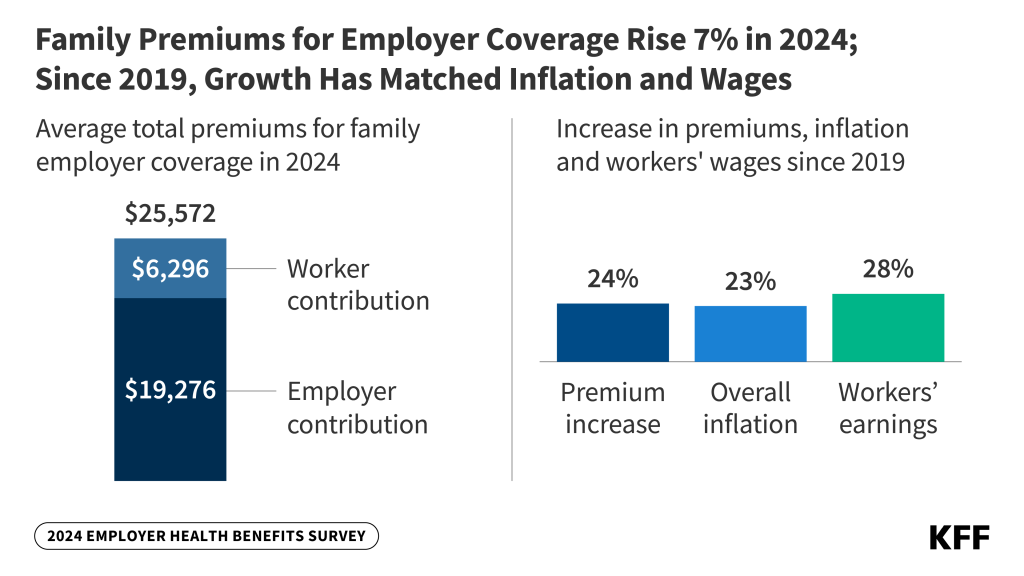

Family premiums for employer-sponsored health insurance rose 7% this year to reach an average of $25,572 annually, KFF’s 2024 benchmark Employer Health Survey finds. On average, workers contribute $6,296 annually to the cost of family coverage.

This marks the second year in a row that premiums are up 7%. Over the past five years—a period of high inflation (23%) and wage growth (28%)—the cumulative increase in premiums has been similar (24%).

While employers are seeing total premiums for family coverage rise steadily, the amount that workers, on average, pay toward their annual premiums is little changed over the past five years—up less than $300 since 2019, or a total of 5% over five years. This may be due to a tight labor market.

Among workers who face an annual deductible for single coverage, the average this year stands at $1,787, similar to last year’s $1,735 and up a modest 8% since 2019 when the average was $1,655.

On average, workers with a deductible at small firms (under 200 workers) face much larger deductibles than workers at larger firms ($2,575 vs. $1,538). Among all covered workers, nearly a third (32%) of covered workers at smaller firms face an average single deductible of at least $3,000.

“Employers are shelling out the equivalent of buying an economy car for every worker every year to pay for family coverage,” KFF President and CEO Drew Altman said. “In the tight labor market in recent years, they have not been able to continue offloading costs onto workers who are already struggling with health care bills.”

About 154 million non-elderly Americans rely on employer-sponsored coverage, and the 26th annual survey of more than 2,100 large and small employers provides a detailed picture of the trends affecting it. In addition to the full report and summary of findings released today, Health Affairs is publishing an article with select findings online. The article will also appear in its November issue.

The survey finds that some of the nation’s largest employers (at least 5,000 workers) are taking steps to shield lower-wage workers from the full impact of rising health care costs. Of these jumbo firms, 29% say they have a program to reduce lower-wage workers’ premiums, and 19% say they offer a reduced-benefit plan with more affordable coverage.

Employer Coverage of GLP-1 Drugs for Weight Loss is Limited and Restricted

Amid a boom in interest in costly GLP-1 drugs such as Wegovy to treat weight loss, this year’s survey also gauges how widely available such coverage is in employer plans.

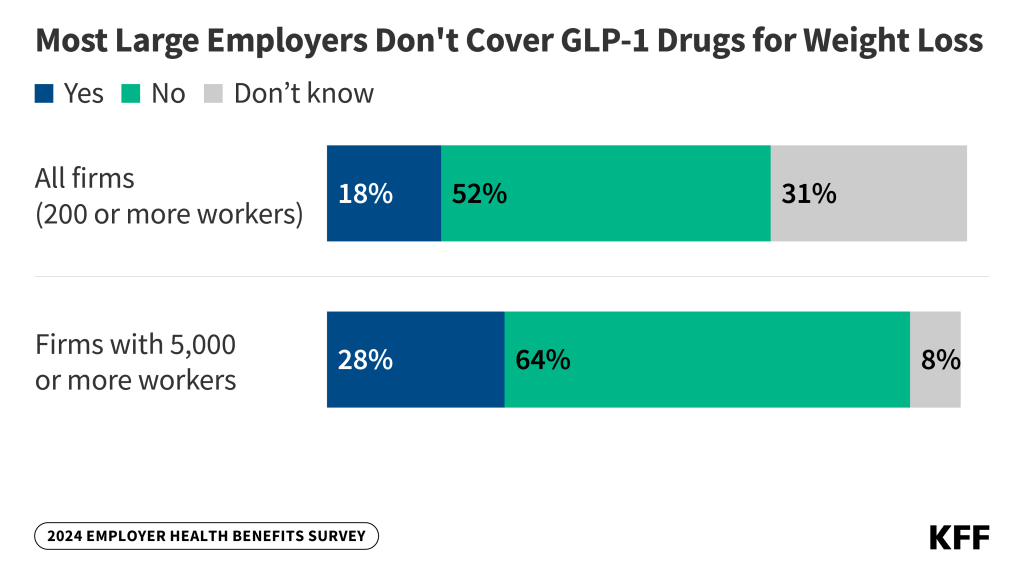

Fewer than 1-in-5 large employers with at least 200 workers offering health benefits (18%) say that they cover GLP-1 drugs for weight loss, while half (52%) say they don’t cover them, and the others (31%) are unsure. Among the largest firms with at least 5,000 workers, more than a quarter (28%) say they cover GLP-1 drugs, and nearly two thirds (64%) say they don’t.

Among large firms that offer the drugs, about half (53%) have conditions or requirements associated with their coverage. These conditions could present obstacles to accessing the drugs, such as first requiring a meeting with a dietician, psychologist, or other professional (24%); requiring participation in a lifestyle or weight-loss program either before (8%) or while (10%) taking the drugs; or another type of condition or requirement (26%).

Coverage for these weight-loss drugs has significant cost implications for employers, as a previous KFF analysis estimated that almost 50 million adults in employer plans meet the clinical criteria for taking such drugs, which can cost thousands of dollars annually per person.

Among large firms covering GLP-1 drugs for weight loss, a third (33%) say it will have a “significant impact” on their plan’s prescription drug spending. Among all large firms, nearly half (44%) say it will be “very important” or “important” to cover GLP-1 drugs for their employees’ satisfaction with their health plan.

Among large firms that do not currently cover GLP-1 drugs for weight loss, few (3%) say they are “very likely” to do so in the next year. A quarter (23%) say they are somewhat likely to do so.

“Employers face the challenge of integrating these potentially important treatments into their already costly benefit plans,” KFF Vice President and study author Gary Claxton said.

Other findings include:

- IVF and other family-building benefits. Among large employers with at least 200 workers, about a quarter (27%) say they cover in-vitro fertilization (IVF), and a similar share (26%) say they cover artificial insemination. More say they cover fertility medications (37%), while fewer say they cover egg or sperm freezing (12%). Roughly a third of firms are unsure if their plans cover each item.

- Rebates from pharmacy benefit managers (PBMs). PBMs manage prescription drug benefits on behalf of payers, including employers, and typically negotiate rebates with drug manufacturers in exchange for favorable placement of their drugs on formularies. Among the largest firms with at least 5,000 workers, 34% say they receive “most” of the rebates negotiated by their PBM or health plan; 34% say they receive “some,” and 8% say they receive “very little.” The rest are unsure how much of the rebates they receive.

- Abortion. Among large employers with at least 200 workers, 8% say that their plan does not cover legally provided abortions under any circumstances, and another 18% say that they cover such abortions under limited circumstances, such as rape, incest, or the life or health of the pregnant enrollee. Most (45%) other large employers say they were not sure whether and how their plans covered abortion. These numbers are little changed from 2023.

- Mental health and substance abuse. About a quarter of offering employers say their plan’s network for mental health and substance abuse services is “somewhat” or “very” narrow, compared to 10% who say the same about their networks generally. About half (48%) of large firms with at least 200 workers say they have increased the mental health counseling resources available to their workers through an employee assistance program or third-party vendors such as Headspace or Lyra Health.

- Spousal coverage and incentives not to enroll. Among large firms with at least 200 workers that offer health benefits to spouses of workers, a quarter (24%) either require higher premiums or restrict coverage when spouses were offered health insurance from another source. In addition, 12% of large firms offering health benefits provide extra compensation or benefits to employees who enroll in a spouse’s plan, and 13% provide extra compensation or benefits to employees if they do not participate in the firm’s health benefits.