The ‘Value’ Trade-Off in High-Deductible Health Plans

This was published as a Wall Street Journal Think Tank column on May 21, 2015.

A Kaiser Family Foundation survey published Thursday of people who buy insurance in the non-group market found that while many people may choose higher-deductible plans so they can pay a lower premium, they aren’t all that happy about it. It may just be the only way they can get a premium they feel they can afford.

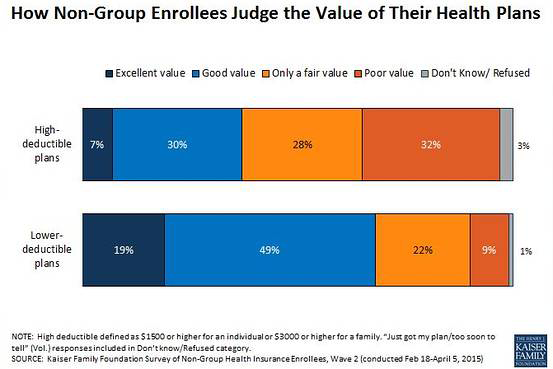

As the chart above shows, 37% of people with high-deductible plans described their plan as an “excellent” or “good” value for what they pay, compared with 68% of people with lower-deductible plans saying the same. A high deductible was defined as $1,500 or more for an individual and $3,000 or more for a family. Sixty percent of those with higher-deductible plans rated the value of their plan as “fair” or “poor.”

People with higher deductibles are significantly more likely than those with lower deductibles to say they feel vulnerable to high medical bills (55% vs. 22%). Whether a deductible is a barrier to seeking needed care or a blow to a family budget depends on income. People with higher incomes are more likely to have larger deductibles and to be able to afford them. People with lower incomes are more likely to be getting premium and cost-sharing subsidies under the Affordable Care Act, but in the new Kaiser survey people with both lower and higher incomes gave high-deductible plans lower marks.

When asked what they would do if they had a $1,500 medical bill, 43% of those with high-deductible plans said they would have to borrow money or go into credit-card debt to cover a $1,500 medical bill. Fifteen percent said they would not be able to pay such a bill.

Insurers and employers may feel that they have no recourse but to keep raising deductibles to constrain premium increases. Many people will feel a high-deductible plan is their best option, either because they presume they won’t need care or because they can’t afford a plan with a higher premium. But the survey found that choosing a plan with a very high deductible can feel like a Faustian bargain if deductibles bite when people do need care. Deductibles, like all forms of cost-sharing, help keep health-care use and costs down, but finding the right balance between appropriate and excessive cost-sharing has become a major challenge for employers, insurers, the government, and consumers.