The independent source for health policy research, polling, and news.

Benchmark Employer Survey Finds Average Family Premiums Now Top $20,000

Amid Affordability Challenges, Workers at Lower-Wage Employers are Nearly Half as Likely as Other Workers to be Covered by Their Employer

Average Annual Deductibles Now at $1,655, Double the Average of a Decade Ago

San Francisco. – Annual family premiums for employer-sponsored health insurance rose 5% to average $20,576 this year, according to the 2019 benchmark KFF Employer Health Benefits Survey released today. Workers’ wages rose 3.4% and inflation rose 2% over the same period.

On average, workers this year are contributing $6,015 toward the cost of family coverage, with employers paying the rest.

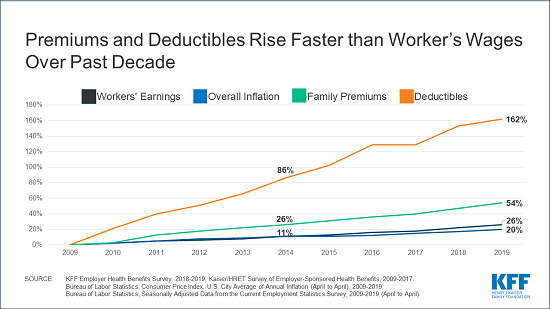

Despite the nation’s strong economy and low unemployment, what employers and workers pay toward premiums continues to rise more quickly than workers’ wages and inflation over time. Since 2009, average family premiums have increased 54% and workers’ contribution have increased 71%, several times more quickly than wages (26%) and inflation (20%).

Currently 82% of covered workers have a deductible in their plan, similar to last year and up from 63% a decade ago. The average single deductible now stands at $1,655 for workers who have one, similar to last year’s $1,573 average but up sharply from the $826 average of a decade ago. These two trends result in a 162% total increase in the burden of deductibles across all covered workers over the past decade.

More than a quarter (28%) of all covered workers, including nearly half (45%) of those at small employers with fewer than 200 employees, are now in plans with a deductible of at least $2,000, almost four times the share who faced such deductibles in 2009. One in eight (13%) now face deductibles of at least $3,000.

“The single biggest issue in health care for most Americans is that their health costs are growing much faster than their wages are,” KFF President and CEO Drew Altman said. “Costs are prohibitive when workers making $25,000 a year have to shell out $7,000 a year just for their share of family premiums.”

About 153 million Americans rely on employer-sponsored coverage, and the 21st annual survey of more than 2,000 small and large employers provides a detailed picture of the trends affecting it. In addition to the full report and summary of findings released today, the journal Health Affairs is publishing an article online with select findings. The article, “Health Benefits in 2019: Premiums Inch Higher, Employers Respond to Federal Policy,” will also appear in its October issue.

KFF is also releasing an updated interactive graphic that charts the survey’s premium trends by firm size, industry, and other firm characteristics, and a separate report highlighting the views and experiences of large employers based on focus-group discussions done in partnership with the Peterson Center on Healthcare.

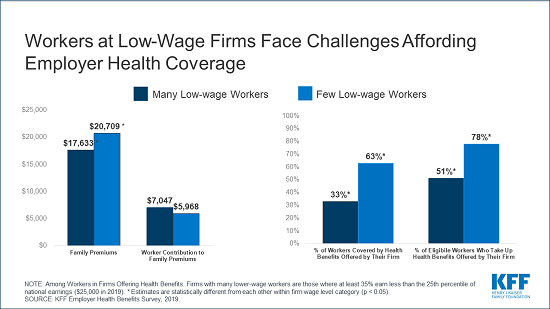

As the debate over Medicare-for-all in the Democratic presidential primary puts the spotlight on the role of employer-sponsored health benefits, the survey finds that workers at firms with many low-wage employees face some of the biggest challenges affording employer coverage for their families. Among firms offering coverage, employers with many lower-wage workers (earning $25,000 or less a year) offer health benefits to a smaller share of their workforce and require workers to pay a higher share of premiums than other employers. Specifically:

- Among firms that offer health benefits, two-thirds (66%) of workers at lower-wage firms are eligible for health benefits, significantly less than the share (81%) eligible at other firms.

- Family premiums at firms with many lower-wage workers average $17,633, 15% less than the average at other firms. At the same time, workers covered by lower-wage firms have an annual family contribution of $7,047. Workers at other firms contribute an average of $5,968 annually.

- One result is that fewer workers at lower-wage firms take up their employer’s health benefits when offered. The net effect is that one in three (33%) workers at lower-wage firms offering health benefits are covered by their employer’s health benefits, well below the 63% share at other offering firms.

“Employer-sponsored coverage doesn’t come cheap for employers or workers, and many who work at low-wage firms or small business likely find it too costly to cover their families,” said Gary Claxton, a KFF senior vice president and director of the Health Care Marketplace Project, and the lead author of the study and Health Affairs article.

Few Firms See Impact from Individual Mandate Repeal

The survey also gauges employers’ experiences and views related to several provisions of the Affordable Care Act (ACA).

In 2017, Congress eliminated the ACA’s tax penalty for people who do not have health insurance effective for this tax year, raising questions about whether it would lead workers to drop their coverage. The survey finds 9% of offering firms with at least 50 workers say the elimination of the individual mandate penalty led to fewer workers and dependents enrolling this year.

The ACA also included a tax on high-cost health plans, sometimes called the “Cadillac tax,” that was originally set to take effect in 2018, though Congress delayed the tax until 2022, and the House recently voted to repeal it all together. The survey finds only 16% of offering employers with at least 50 workers say they expect the tax to take effect in 2022. One-third of those firms say the upcoming tax was either “very” or “somewhat” important in making their health benefit decisions for the current year.

Other survey findings include:

- Offer rate holds steady. The survey finds 57% of employers offer health benefits, the same as last year and similar to a decade ago (59%). The larger an employer is, the more likely it is to offer health benefits, with about half (47%) of the smallest firms (3-9 workers) and nearly all (99%) large firms (200 or more workers) offering coverage. Small employers who don’t offer health benefits most often cite cost as the primary reason.

- Provider networks. The vast majority (83%) of offering employers say they are satisfied with the choice of providers available through their insurance plans. Few (5%) say they offer a plan with a narrow provider network, which can help the plan negotiate lower payment rates but also reduces enrollee choices.

- Spousal coverage. While most large employers offering health benefits cover spouses, 11% do not allow spouses to enroll if they have coverage from another source. Among those that do allow such enrollment, 10% require spouses to pay more through a larger premium contribution or higher cost sharing.

- Response to the opioid epidemic. Many large employers (at least 200 workers) report taking specific steps over the past five years in response to the nation’s opioid crisis. These include creating or revising an employee assistance program (40%); providing health information to workers (38%); limiting or otherwise modifying coverage for prescription opioids (24%); and asking their insurer or pharmacy benefit manager to increase monitoring of opioid use (21%).

- Dental and vision coverage. Among offering firms, 60% (including 92% of large firms) also offer separate dental insurance, while 46% (including 83% of large firms) also offer separate vision insurance. Employers sometimes contribute toward the cost of these benefits, but employees sometimes are required to pay the full cost themselves.

Methodology

KFF conducted the annual employer survey between January and July of 2019. It included 2,012 randomly selected, non-federal public and private firms with three or more employees that responded to the full survey. An additional 2,383 firms responded to a single question about offering coverage. For more information on the survey methodology, see the Survey Design and Methods Section.

Filling the need for trusted information on national health issues, the Kaiser Family Foundation is a nonprofit organization based in San Francisco, California.

Health Affairs is the leading peer-reviewed journal at the intersection of health, health care, and policy. Published monthly by Project HOPE, the journal is available in print and online. Late-breaking content is also found through healthaffairs.org, Health Affairs Today, and Health Affairs Sunday Update.

Project HOPE is a global health and humanitarian relief organization that places power in the hands of local health care workers to save lives across the globe. Project HOPE has published Health Affairs since 1981.