2017 Employer Health Benefits Survey

Section 4: Types of Plans Offered

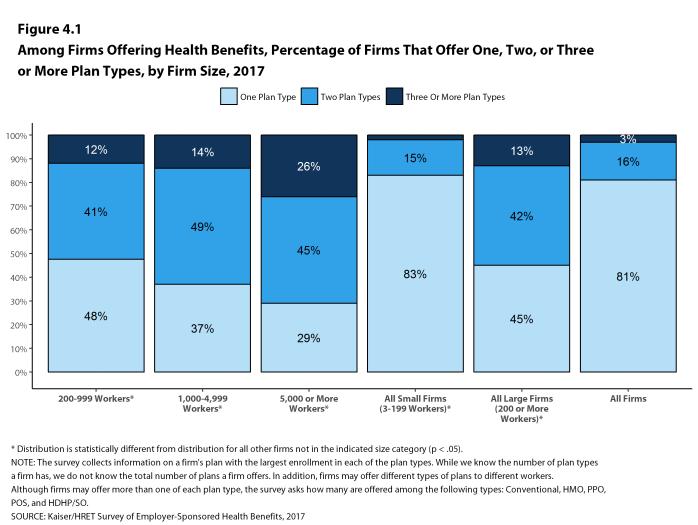

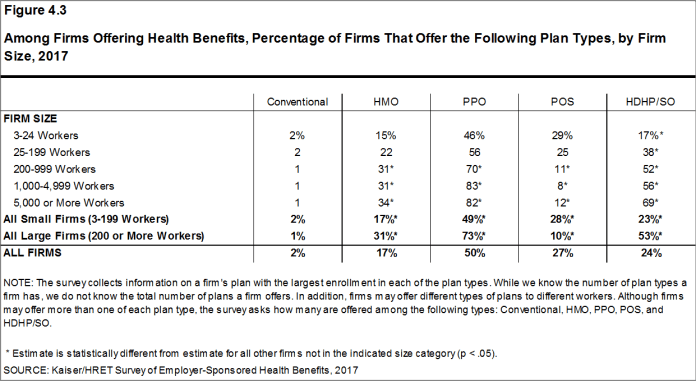

Most firms that offer health benefits offer only one type of health plan (81%). Large firms (200 or more workers) are more likely to offer more than one type of health plan than small firms (3-199 workers). Firms are most likely to offer their workers a PPO plan and are least likely to offer a conventional plan (sometimes known as indemnity insurance).

- Eighty-one percent of firms offering health benefits in 2017 offer only one type of health plan. Large firms are more likely to offer more than one plan type than small firms (55% vs. 17%) [Figure 4.1].

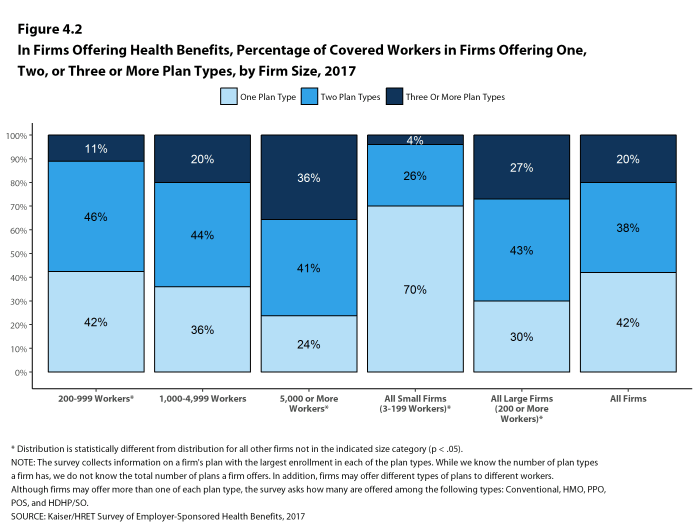

- The percentage of covered workers at firms that offer multiple plan types can also be analyzed. Fifty-eight percent of covered workers are employed in a firm that offers more than one health plan type. Seventy percent of covered workers in large firms are employed by a firm that offers more than one plan type, compared to 30% in small firms [Figure 4.2].

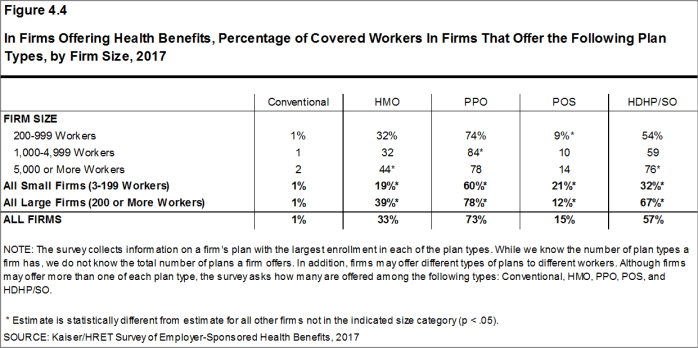

- About three-quarters (73%) of covered workers in firms offering health benefits work in firms that offer one or more PPO plans; 57% work in firms that offer one or more HDHP/SO plans; 33% work in firms that offer one or more HMO plans; 15% work in firms that offer one or more POS plans; and 1% work in firms that offer one or more conventional plans [Figure 4.4].20

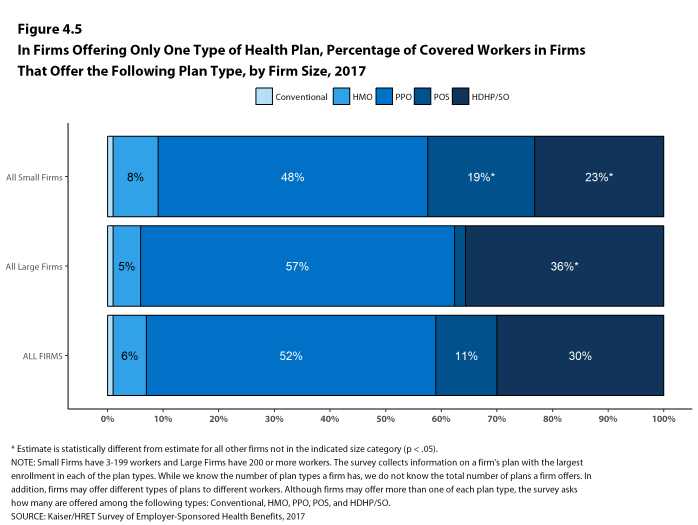

- Among covered workers in firms offering only one type of health plan, those in large firms are more likely to be offered an HDHP/SO (36%) than those in small firms (23%). Covered workers in small firms offering only one type of plan are more likely to be offered a POS plan than covered workers in large firms (19% vs. 2%) [Figure 4.5].

- Among covered workers in firms offering only one type of health plan, 30% are in firms that only offer an HDHP/SO and 52% are in firms that only offer a PPO [Figure 4.5].

Figure 4.1: Among Firms Offering Health Benefits, Percentage of Firms That Offer One, Two, or Three or More Plan Types, by Firm Size, 2017

Figure 4.2: In Firms Offering Health Benefits, Percentage of Covered Workers In Firms Offering One, Two, or Three or More Plan Types, by Firm Size, 2017

Figure 4.3: Among Firms Offering Health Benefits, Percentage of Firms That Offer the Following Plan Types, by Firm Size, 2017

Figure 4.4: In Firms Offering Health Benefits, Percentage of Covered Workers In Firms That Offer the Following Plan Types, by Firm Size, 2017

Figure 4.5: In Firms Offering Only One Type of Health Plan, Percentage of Covered Workers In Firms That Offer the Following Plan Type, by Firm Size, 2017

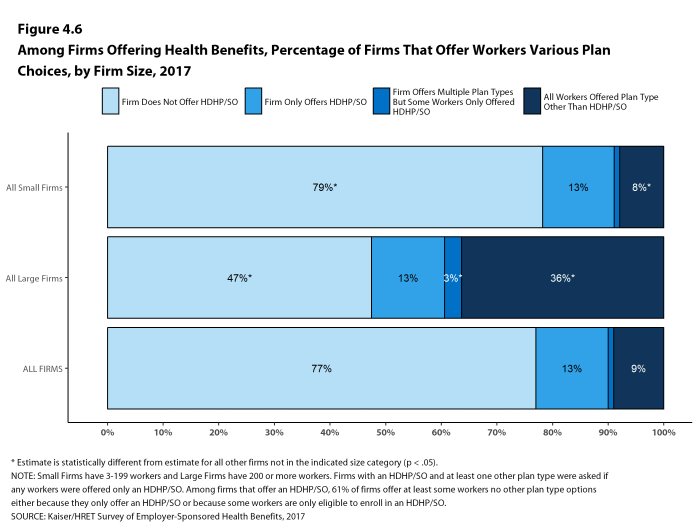

Figure 4.6: Among Firms Offering Health Benefits, Percentage of Firms That Offer Workers Various Plan Choices, by Firm Size, 2017

The survey collects information on a firm’s plan with the largest enrollment in each of the plan types. While we know the number of plan types a firm has, we do not know the total number of plans a firm offers workers. In addition, firms may offer different types of plans to different workers. For example, some workers might be offered one type of plan at one location, while workers at another location are offered a different type of plan.

- HMO

- is a health maintenance organization. The survey defines an HMO as a plan that does not cover non-emergency out-of-network services.

- PPO

- is a preferred provider organization. The survey defines PPOs as plans that have lower cost sharing for in-network provider services, and do not require a primary care gatekeeper to screen for specialist and hospital visits.

- POS

- is a point-of-service plan. The survey defines POS plans as those that have lower cost sharing for in-network provider services, but do require a primary care gatekeeper to screen for specialist and hospital visits.

- HDHP/SO

- is a high-deductible health plan with a savings option such as an HRA or HSA. The survey treats HDHP/SOs as a distinct plan type even if the plan would otherwise be considered a PPO, HMO, POS plan, or indemnity plan.

- Starting in 2010, we included firms that said they offer a plan type even if there are no covered workers enrolled in that plan type.↩