2013 Employer Health Benefits Survey

Section Seven: Employee Cost Sharing

In addition to any required premium contributions, most covered workers face cost sharing for the medical services they use. Cost sharing for medical services can take a variety of forms, including deductibles (an amount that must be paid before some or all services are covered by the plan), copayments (fixed dollar amounts), and/or coinsurance (a percentage of the charge for services). The type and level of cost sharing often vary by the type of plan in which the worker is enrolled. Cost sharing may also vary by the type of service, such as office visits, hospitalizations, or prescription drugs.

The cost-sharing amounts reported here are for covered workers using services provided in-network by participating providers. Plan enrollees receiving services from providers that do not participate in plan networks often face higher cost sharing and may be responsible for charges that exceed plan allowable amounts. The framework of this survey does not allow us to capture all of the complex cost-sharing requirements in modern plans, particularly for ancillary services (such as durable medical equipment or physical therapy) or cost-sharing arrangements that vary across different settings (such as tiered networks). Therefore, we do not collect information on all plan provisions and limits that affect enrollee out-of-pocket liability.

General Annual Deductibles

- A general annual deductible is an amount that must be paid by the enrollee before most services are covered by their health plan. Some plans require enrollees to meet a service specific deductible such as on prescription drugs or hospital admissions in lieu of or in addition to a general deductible. Federal law requires that some services such as preventative care are covered by some plans without cost sharing.

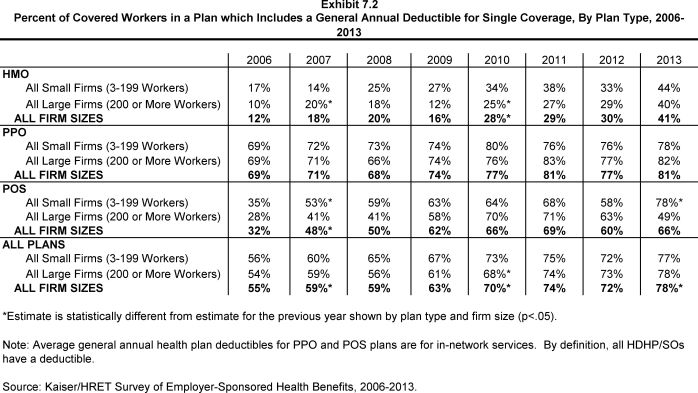

- Seventy-eight percent of covered workers are enrolled in a plan with a general annual deductible for single coverage. More covered workers are enrolled in a plan with a general annual deductible in 2013 than in 2012 (78% vs. 72%) (Exhibit 7.2). Since 2006, the percent of covered workers with a general annual deductible has increased from 55% to 78%.

- The percent of covered workers enrolled in a plan with a general annual deductible is similar for small (3-199 workers) and larger firms (77% and 78%) (Exhibit 7.2).

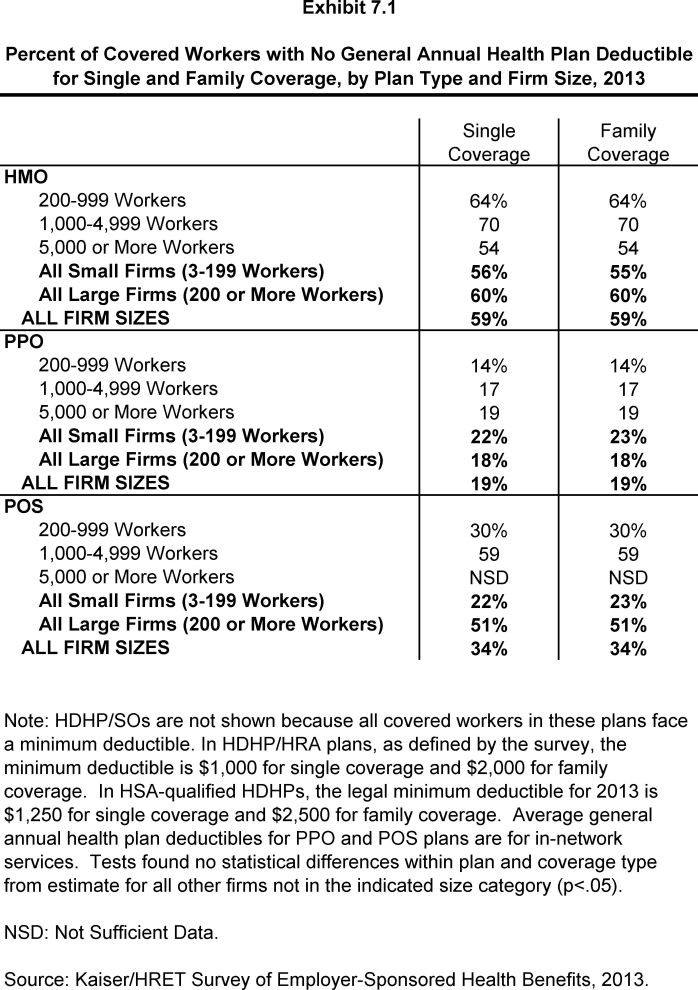

- The likelihood of having a deductible varies by plan type. Workers in HMOs are less likely to have a general annual deductible for single coverage compared to workers in other plan types. Fifty-nine percent of workers in HMOs do not have a general annual deductible, compared to 34% of workers in POS plans and 19% of workers in PPOs (Exhibit 7.1).

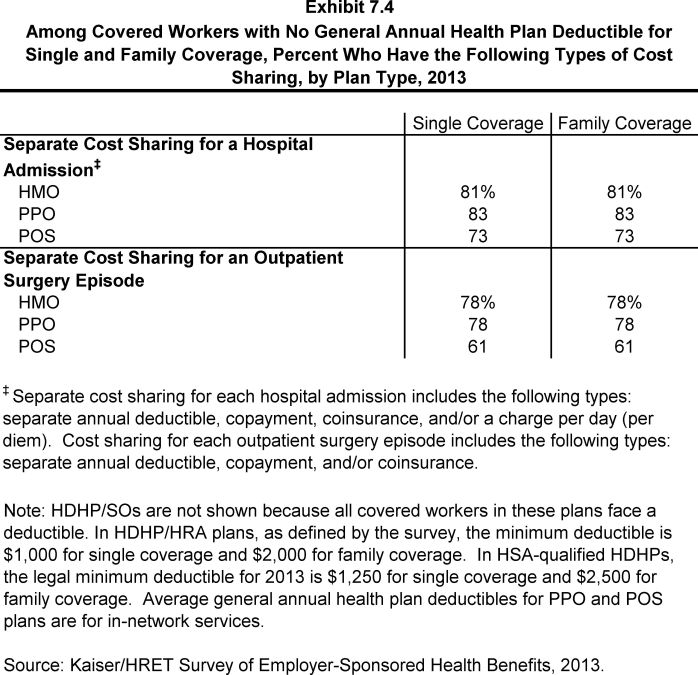

- Workers without a general annual plan deductible often have other forms of cost sharing for medical services. For workers without a general annual deductible for single coverage, 81% in HMOs, 83% in PPOs, and 73% in POS plans are in plans that require cost sharing for hospital admissions. The percentages are similar for family coverage (Exhibit 7.4).

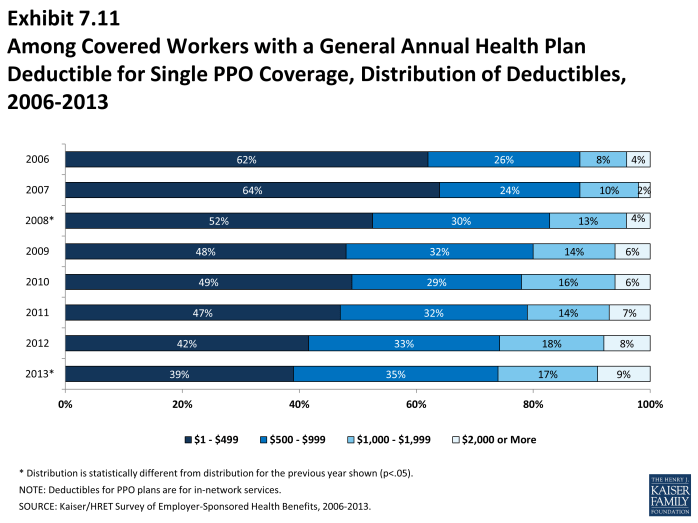

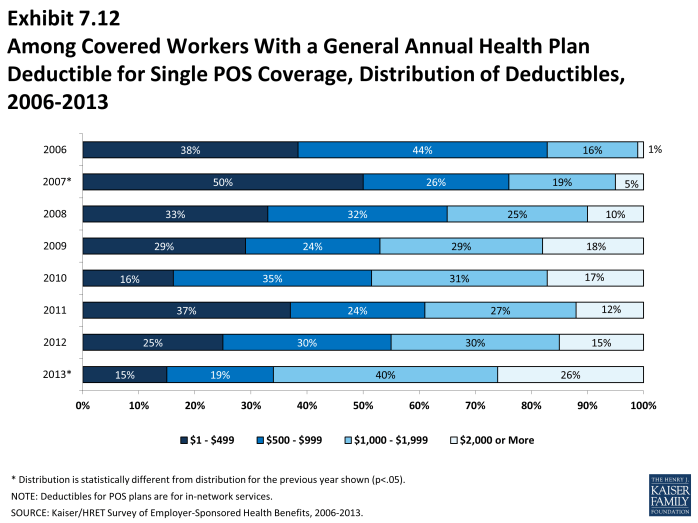

- The dollars amounts of general annual deductibles vary greatly by plan type and firm size.

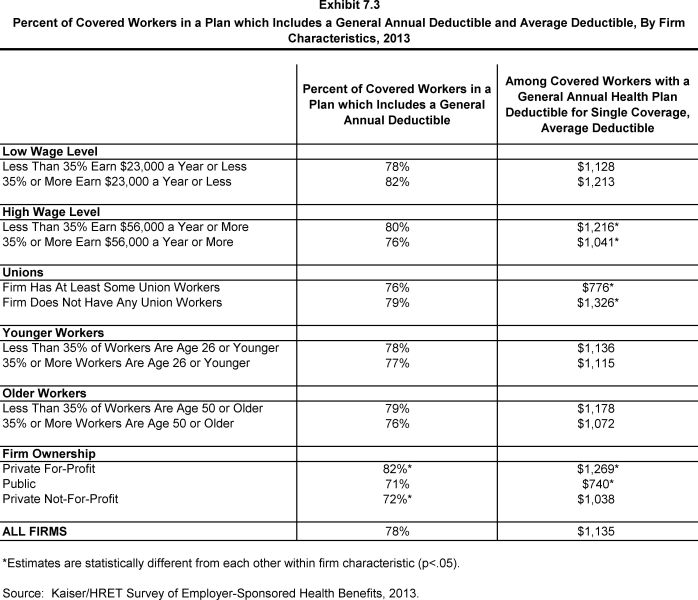

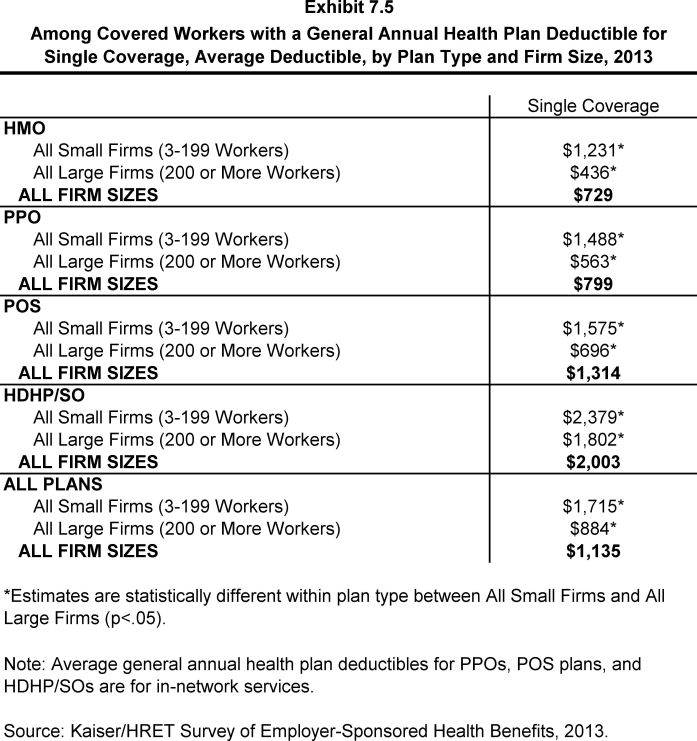

- The average annual deductible is $1,135. There are differences in the average general annual deductible by plan type. The average annual deductibles among those covered workers with a deductible for single coverage are $729 for HMOs, $799 for PPOs, $1,314 for POS plans, and $2,003 for HDHP/SOs (Exhibit 7.5). Overall, the average general annual deductible for all covered workers is $1,135.

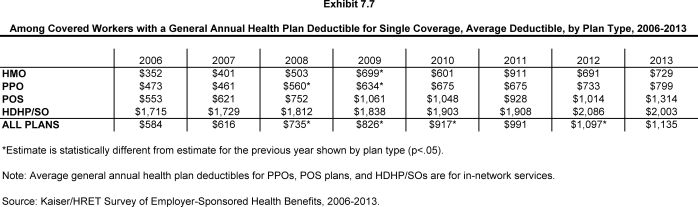

- There is no statistically significant change in deductible amounts from 2012 to 2013 for any plan type (Exhibit 7.7).

- Deductibles are generally higher for covered workers in small firms (3-199 workers) than for covered workers in large firms (200 or more workers) across plan types (Exhibit 7.5). For covered workers in PPOs, deductibles in small firms are more than twice as large as deductibles in large firms ($1,488 vs. $563). On average, covered workers at small firms face higher general annual deductibles than covered workers at large firms ($1,715 vs. $884) (Exhibit 7.5).

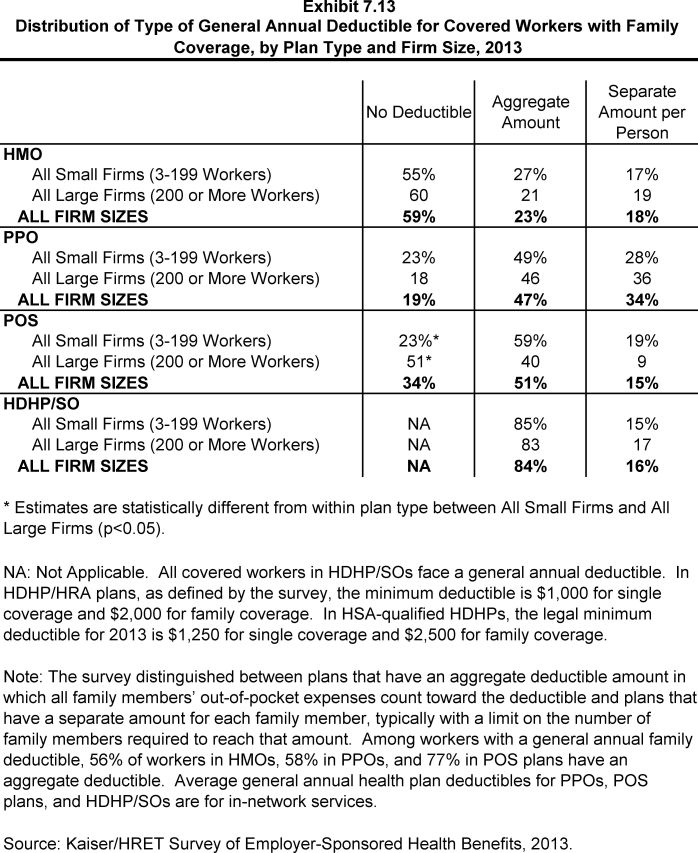

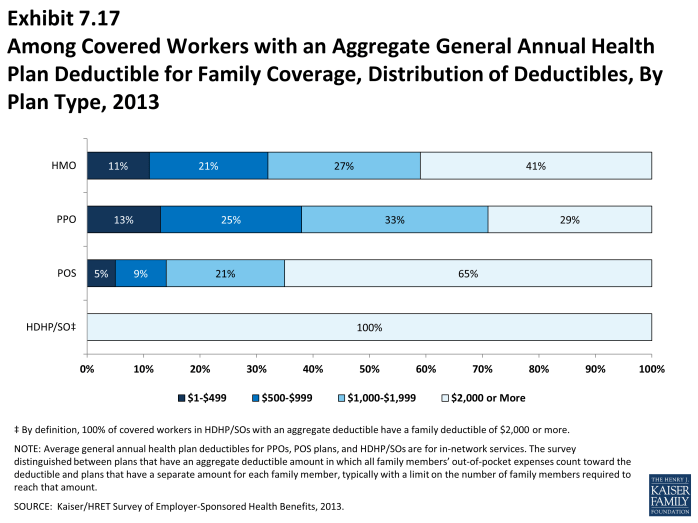

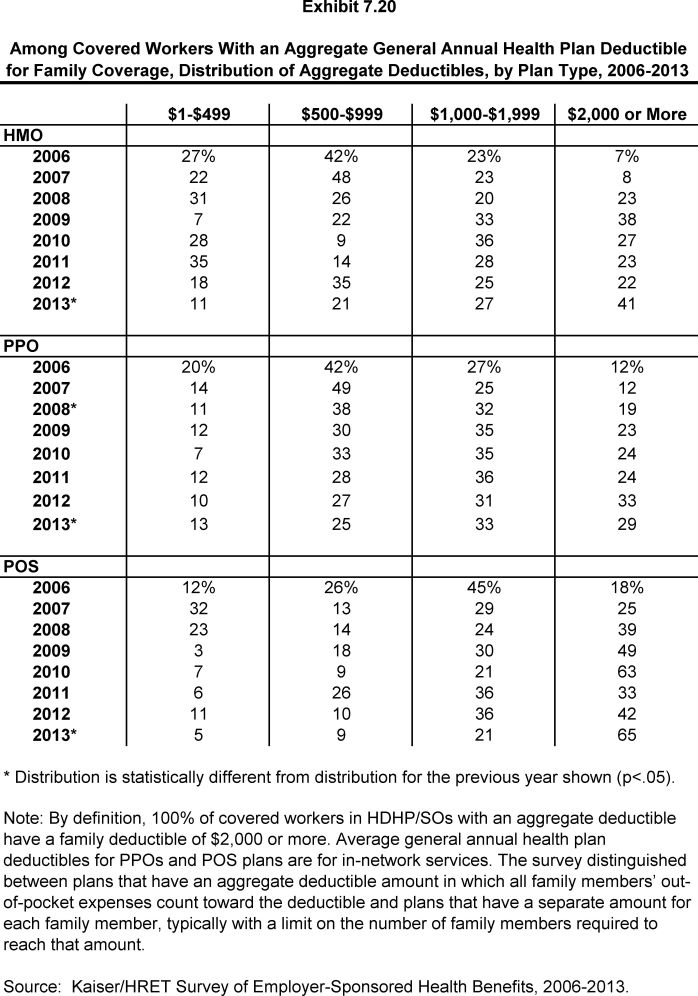

- For family coverage, the majority of workers with general annual deductibles have an aggregate deductible, meaning all family members’ out-of-pocket expenses count toward meeting the deductible amount. Among those with a general annual deductible for family coverage, the percentage of covered workers with an average aggregate general annual deductible is 56% for workers in HMOs, 58% for workers in PPOs, 77% for workers in POS plans and 84% for workers in HDHP/SOs (Exhibit 7.13).

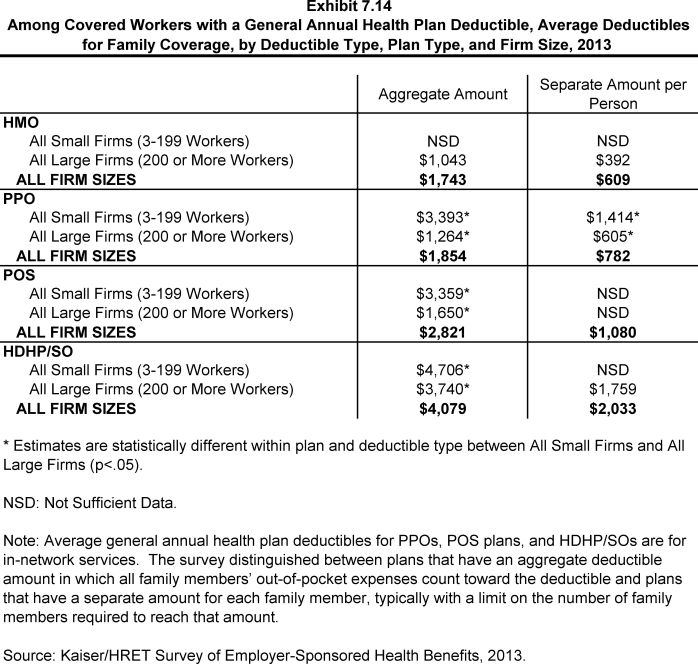

- The average amounts for workers with an aggregate deductible for family coverage are $1,743 for HMOs, $1,854 for PPOs, $2,821 for POS plans, and $4,079 for HDHP/SOs (Exhibit 7.14).

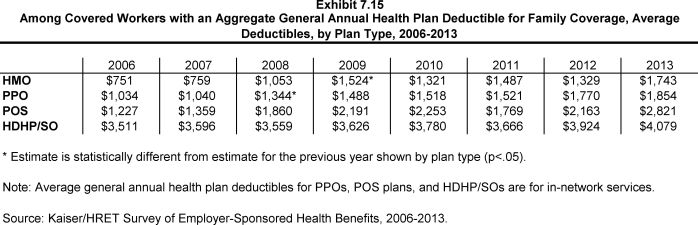

- The average aggregate deductible amounts for family coverage are similar to last year for each plan type (Exhibit 7.15).

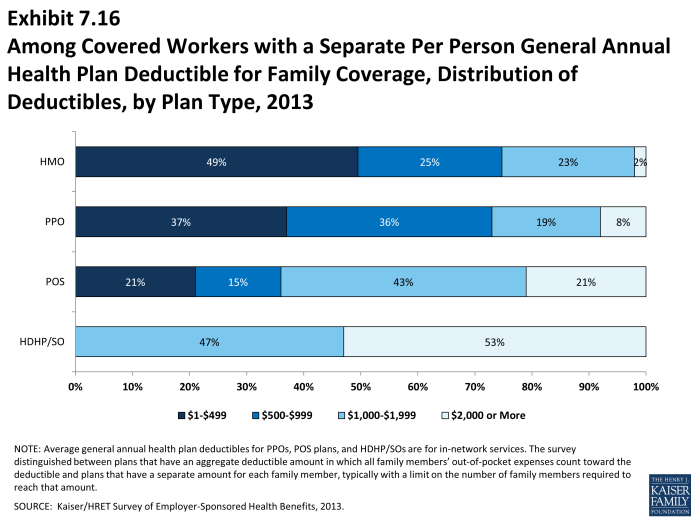

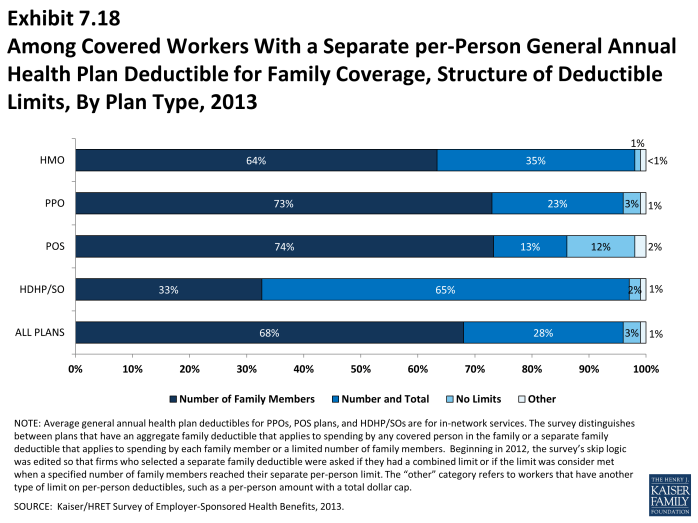

- The other type of family deductible, a separate per-person deductible, requires each family member to meet a separate per-person deductible amount before the plan covers expenses for that member. Most plans with separate per-person family deductibles consider the deductible met for all family members if a prescribed number of family members each reach their separate deductible amounts. Plans may also require each family member to meet a separate per-person deductible until the family’s combined spending reaches a specified dollar amount.

- For covered workers in health plans that have separate per-person general annual deductible amounts for family coverage, the average plan deductible amounts are $609 for HMOs, $782 for PPOs, $1,080 for POS plans, and $2,033 for HDHP/SOs (Exhibit 7.14).

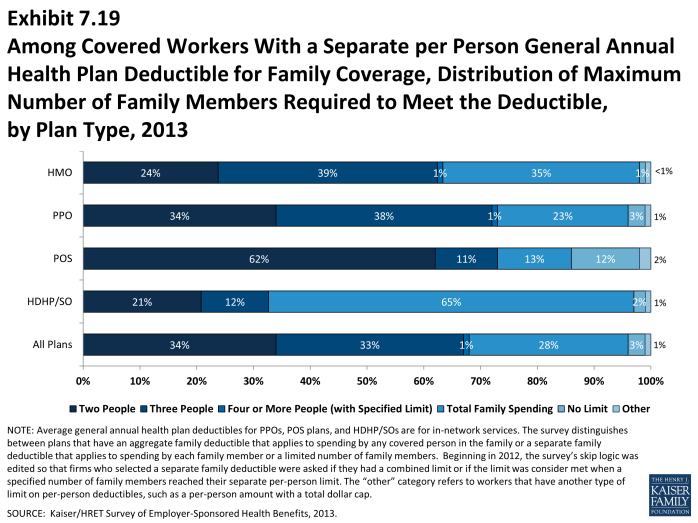

- Most covered workers in plans with a separate per-person general annual deductible for family coverage have a limit to the number of family members required to meet the separate deductible amounts (Exhibit 7.18).1 Among those workers in plans with a limit on the number of family members, the most frequent number of family members required to meet the separate deductible amounts is three for HMO and PPO plans, and two for POS plans (Exhibit 7.19).

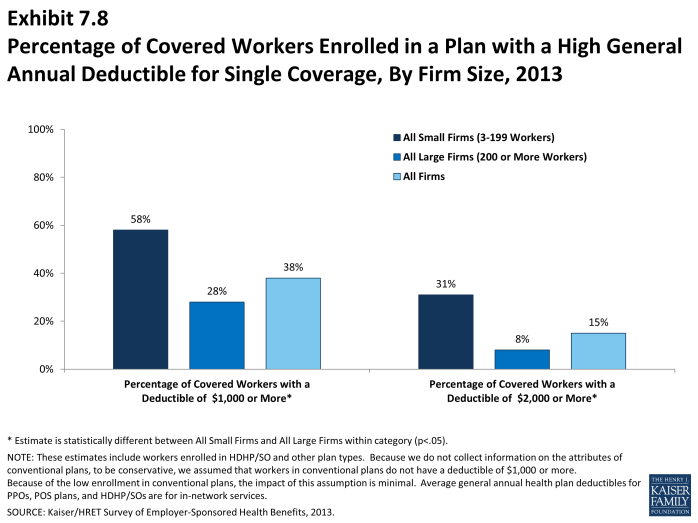

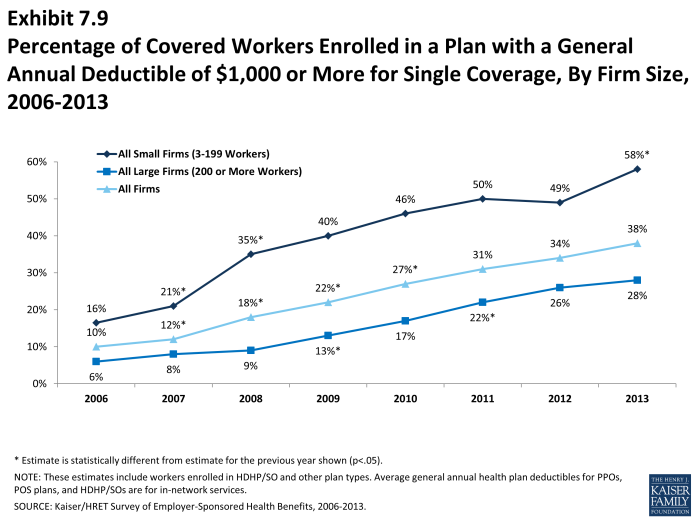

- Thirty-eight percent of covered workers are in plans with a deductible of $1000 or more for single coverage, similar to the percentage (34%) in 2012 (Exhibit 7.9).

- Over the last five years, the percentage of covered workers with a deductible of $1,000 or more for single coverage has increased from 18% to 38% (Exhibit 7.9). Workers in small firms (3-199 workers) are more likely to have a general annual deductible of $1,000 or more for single coverage than workers in large firms (200 or more workers) (58% vs. 28%) (Exhibit 7.8). The percent of covered workers at small firms (3-199 workers) who have a deductible of a $1,000 or more increased from 49% in 2012 to 58% in 2013 (Exhibit 7.9).

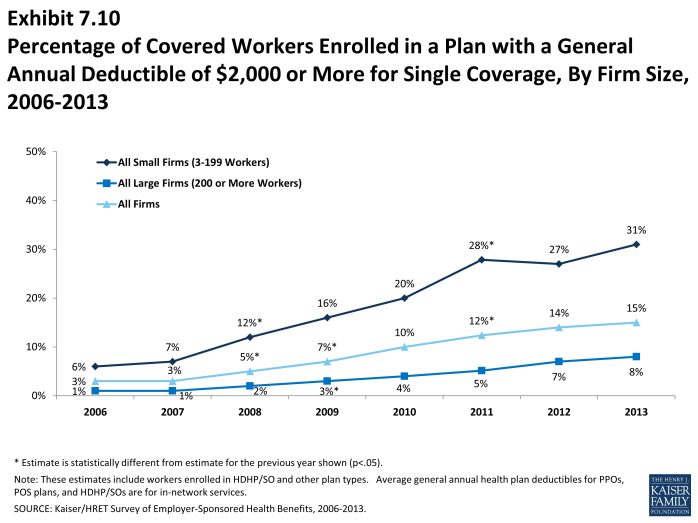

- Fifteen percent of covered workers are enrolled in a plan with a deductible of $2,000 or more. Thirty-one percent of covered workers at small firms (3-199 workers) have a general annual deductible of $2,000 or more (Exhibit 7.8).

- The majority of covered workers with a deductible are in plans where the deductible does not have to be met before certain services, such as physician office visits or prescription drugs, are covered.

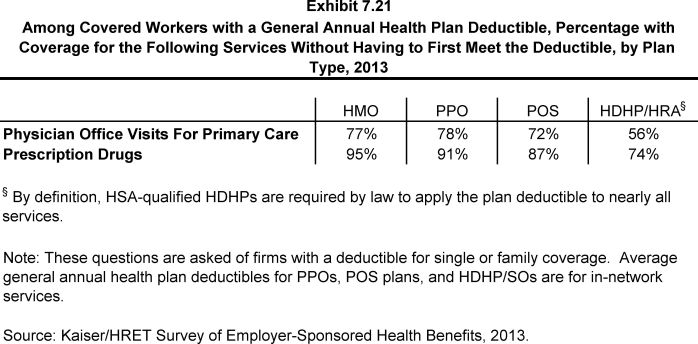

- Large majorities of covered workers (77% in HMOs, 78% in PPOs, and 72% in POS plans) with general plan deductibles are enrolled in plans where the deductible does not have to be met before physician office visits for primary care are covered (Exhibit 7.21).

- Similarly, among workers with a general annual deductible, large shares of covered workers in HMOs (95%), PPOs (91%), and POS plans (87%) are enrolled in plans where the general annual deductible does not have to be met before prescription drugs are covered (Exhibit 7.21).

Hospital and Outpatient Surgery Cost Sharing

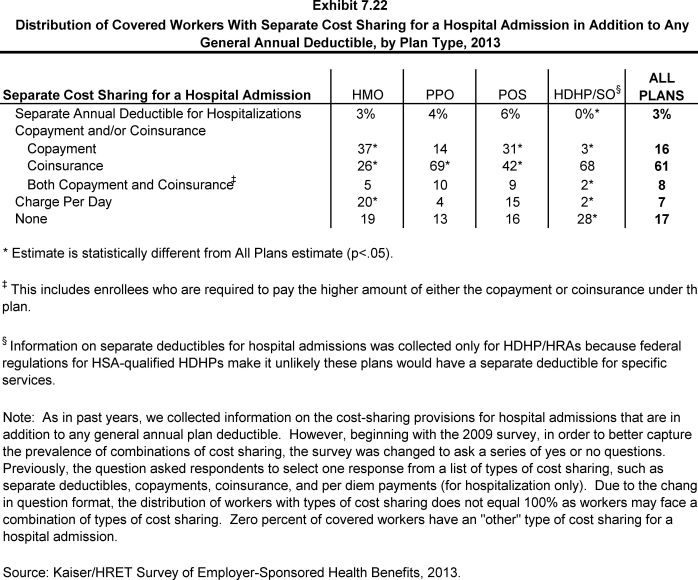

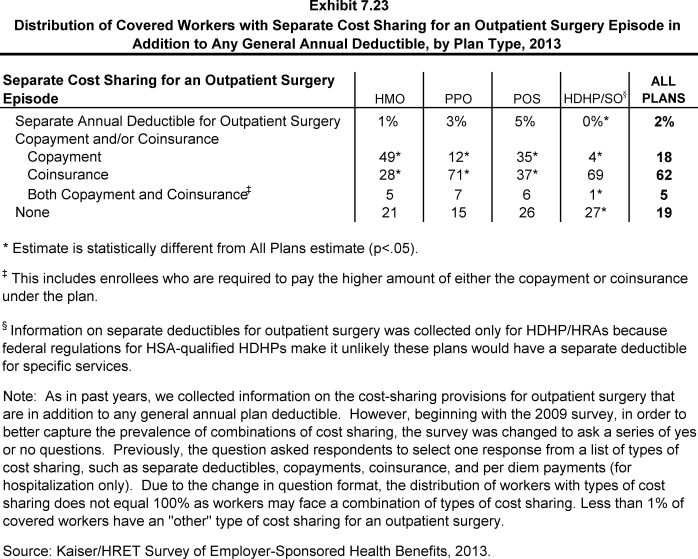

- In order to better capture the prevalence of combinations of cost sharing for inpatient hospital stays and outpatient surgery, the survey was changed to ask a series of yes or no questions beginning in 2009. The new format allowed respondents to indicate more than one type of cost sharing for these services, if applicable. Previously, the questions asked respondents to select just one response from a list of types of cost sharing, such as separate deductibles, copayments, coinsurance, and per diem payments (for hospitalization only). Due to the change in question format, the distribution of workers with types of cost sharing does not equal 100% as workers may face a combination of types of cost sharing. In addition, the average copayment and coinsurance rates for hospital admissions include workers who may have a combination of these types of cost sharing.

- Whether or not a worker has a general annual deductible, most workers face additional types of cost sharing when admitted to a hospital or having outpatient surgery (such as a copayment, coinsurance, or a per diem charge).

- For hospital admissions, 61% of covered workers have coinsurance and 16% have copayments. Lower percentages of workers have per day (per diem) payments (7%), a separate hospital deductible (3%), or both copayments and coinsurance (8%), while 17% have no additional cost sharing for hospital admissions after any general annual deductible has been met (Exhibit 7.22). For covered workers in HMO plans, copayments are more common (37%) and coinsurance (26%) is less common than in other plan types.

- The percent of covered workers in a plan which requires coinsurance for hospital admission has increased from 53% in 2010 to 61% in 2013.

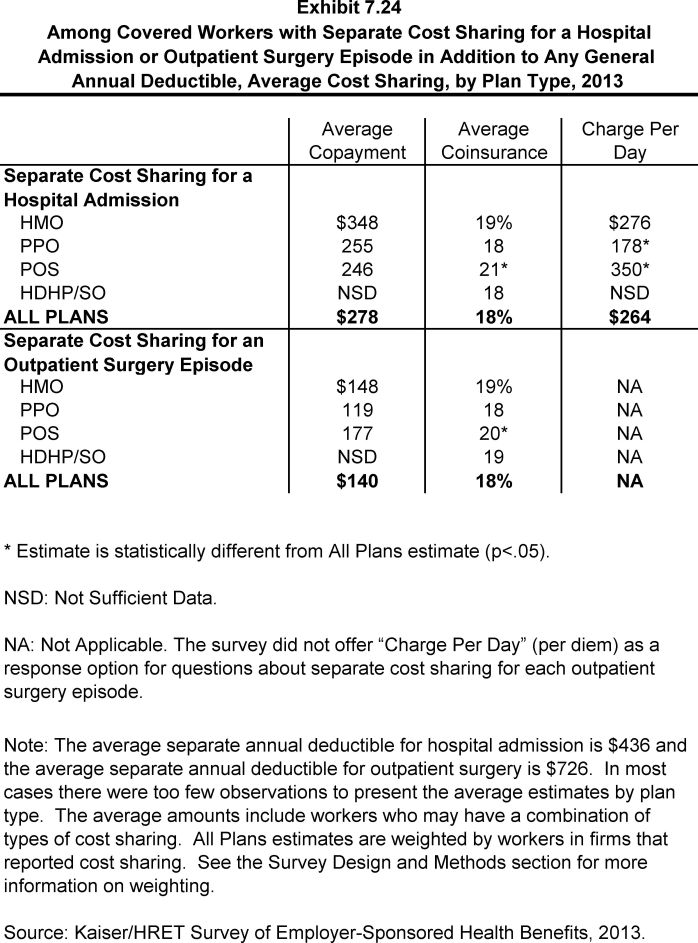

- The average coinsurance rate is 18%; the average copayment is $278 per hospital admission; the average per diem charge is $264; and the average separate annual hospital deductible is $436 (Exhibit 7.24).

- The cost-sharing provisions for outpatient surgery are similar to those for hospital admissions, as most workers have coinsurance or copayments. Sixty-two percent of covered workers have coinsurance and 18% have copayments for an outpatient surgery episode. In addition, 2% have a separate annual deductible for outpatient surgery, and 5% have both copayments and coinsurance, while 19% have no additional cost sharing after any general annual deductible has been met (Exhibit 7.23).

- For covered workers with cost sharing, the average coinsurance is 18%, the average copayment is $140, and the average separate annual outpatient surgery deductible is $726 (Exhibit 7.24).

Cost Sharing for Physician Office Visits

- The majority of covered workers are enrolled in health plans that require cost sharing for an in-network physician office visit, in addition to any general annual deductible.2

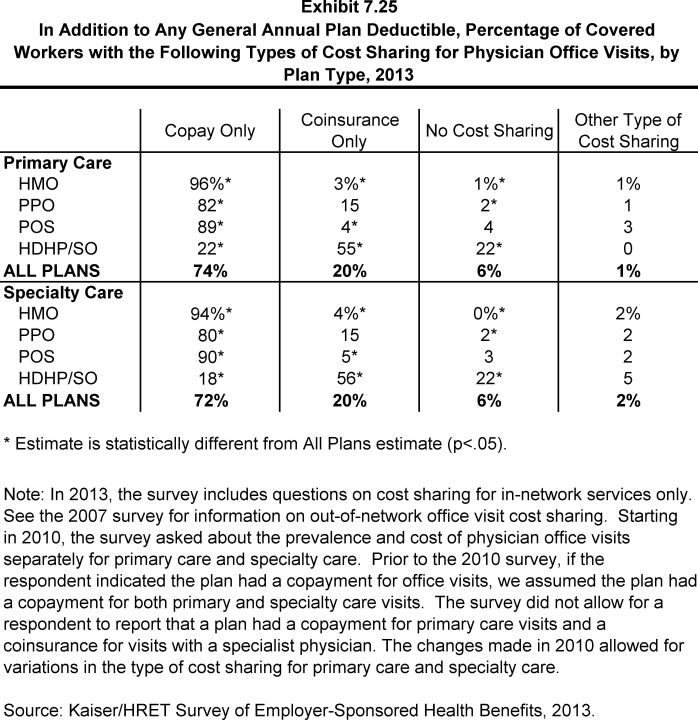

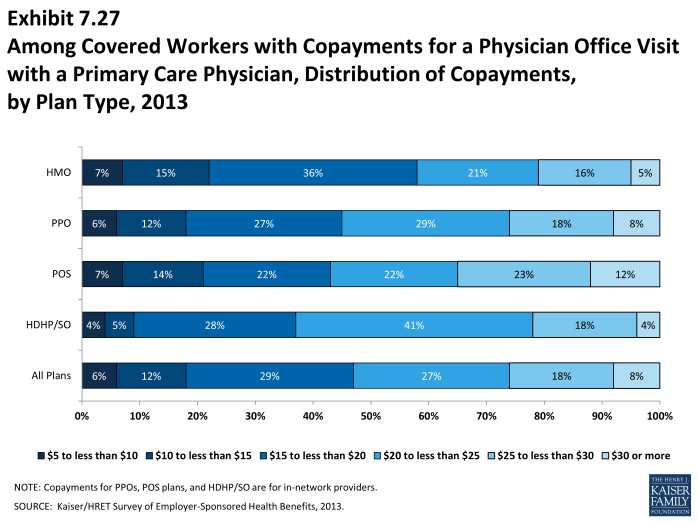

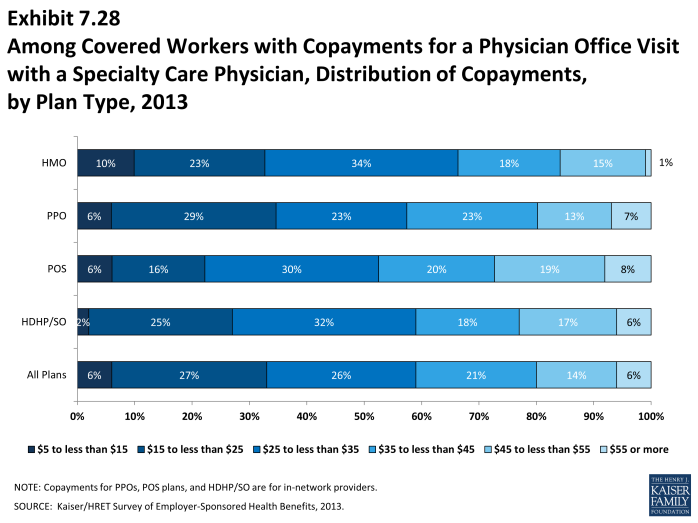

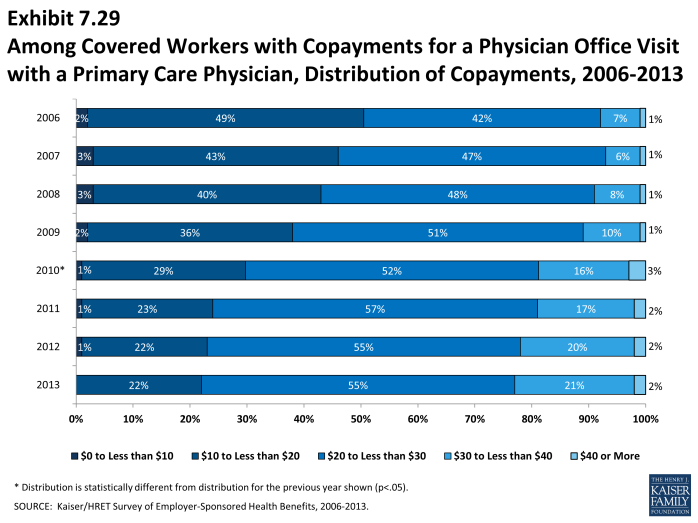

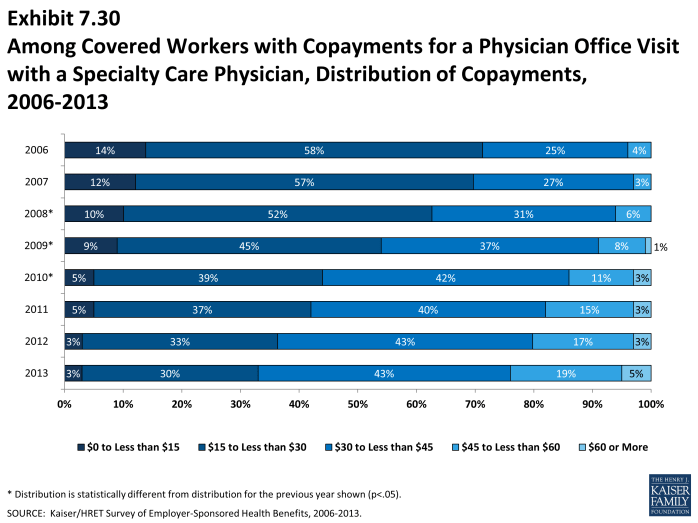

- The most common form of physician office visit cost sharing for in-network services is copayments. Seventy-four percent of covered workers have a copayment for a primary care physician office visit and 20% have coinsurance. For office visits with a specialty physician, 72% of covered workers have copayments and 20% have coinsurance. Workers in HMOs, PPOs, and POS plans are much more likely to have copayments than workers in HDHP/SOs for both primary care and specialty care physician office visits. For example, the majority of workers in HDHP/SOs have coinsurance (55%) or no cost sharing after the general annual plan deductible is met (22%) for primary care physician office visits (Exhibit 7.25).

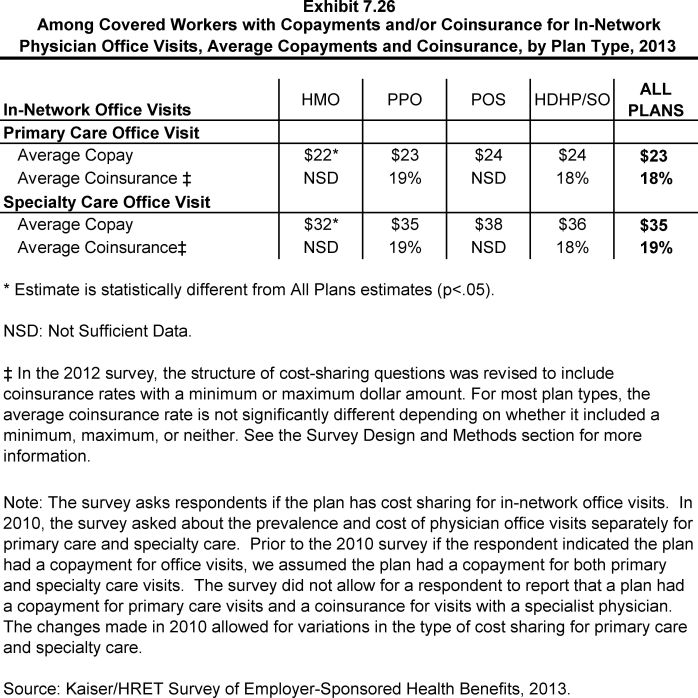

- Among covered workers with a copayment for in-network physician office visits, the average copayment is $23 for primary care and $35 for specialty physicians (Exhibit 7.26), similar to $23 and $33 reported in 2012.

- Among workers with coinsurance for in-network physician office visits, the average coinsurance rates are 18% for a visit with a primary care physician and 19% for a visit with a specialist (Exhibit 7.26).

Out-Of-Pocket Maximum Amounts

- Most covered workers are in a plan that partially or totally limits the cost sharing that a plan enrollee must pay in a year. These limits are generally referred to as out-of-pocket maximum amounts. Enrollee cost sharing, such as deductibles, office visit cost sharing, or spending on prescription drugs, may or may not apply to the out-of-pocket maximum. Therefore, the survey asks what types of out-of-pocket expenses count when determining whether a covered worker has met the plan out-of-pocket maximum. When a plan does not count certain types of spending, it effectively increases the amount a worker may pay out-of-pocket.

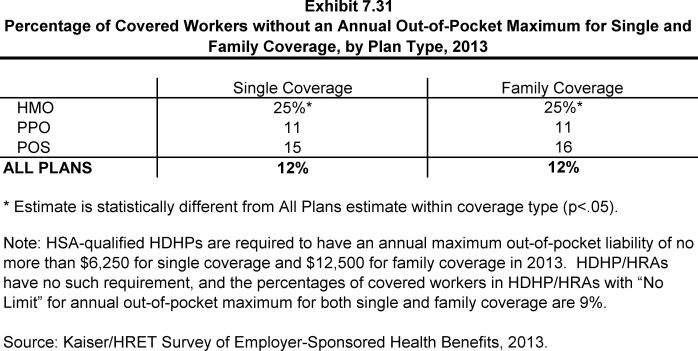

- Twelve percent of covered workers are in a plan that does not limit the amount of cost sharing enrollees have to pay for either single or family coverage (Exhibit 7.31).

- Covered workers with single or family coverage in HMOs (25%) are more likely to be enrolled in a plan that does not limit the amount of cost sharing than workers in PPOs (11%) (Exhibit 7.31).

- Covered workers without an out-of-pocket maximum, however, may not have large cost-sharing responsibilities. For example, 76% of covered workers in HMOs with no out-of-pocket maximum for single coverage have no general annual deductible, only 2% have coinsurance for a hospital admission and less than 1% have coinsurance for outpatient surgery episodes.

- HSA-qualified HDHPs are required by law to have an out-of-pocket maximum of no more than $6,250 for single coverage and $12,500 for family coverage in 2013. HDHP/HRAs have no such requirement, and among workers enrolled in these plans, 9% have no out-of-pocket maximum for single or family coverage.

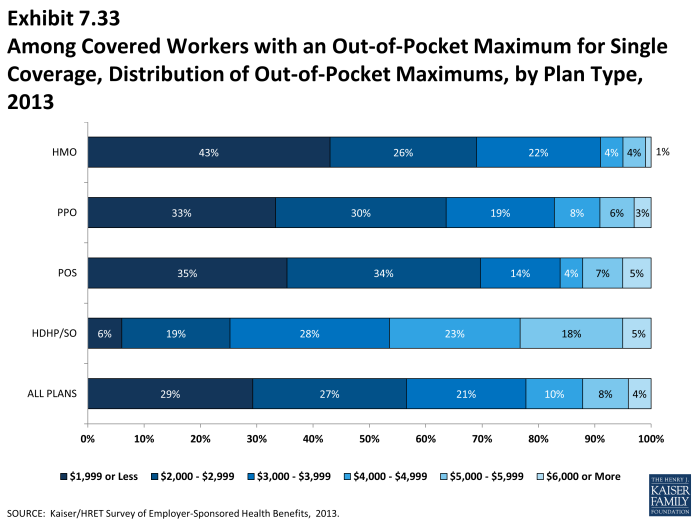

- For covered workers with out-of-pocket maximums, there is wide variation in spending limits.

- Twenty-nine percent of covered workers with an out-of-pocket maximum for single coverage have an out-of-pocket maximum of less than $2,000, while 12% have an out-of-pocket maximum of $5,000 or more (Exhibit 7.33). Covered workers with an out-of-pocket maximum in small firms (3 to 199 workers) are more likely than such workers in larger firms to be covered by a plan with an out-of-pocket maximum of $3,000 or more (52% vs. 39%).

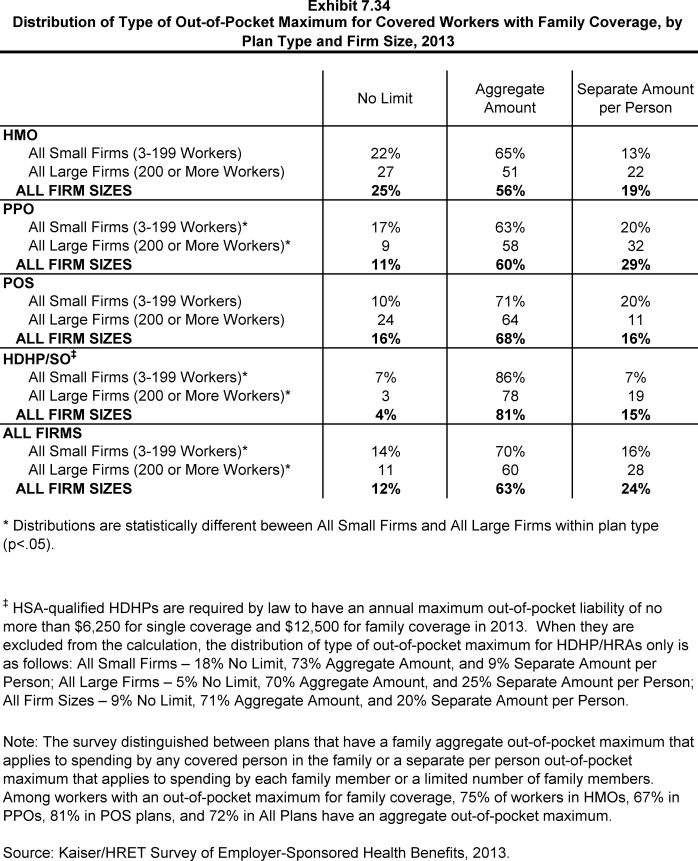

- Like deductibles, some plans have an aggregate out-of-pocket maximum amount for family coverage that applies to cost sharing for all family members, while others have a per-person out-of-pocket maximum that limits the amount of cost sharing that the family must pay on behalf of each family member. Sixty-three percent of covered workers in a plan with an out-of-pocket maximum are in a plan with an aggregate limit (Exhibit 7.34).

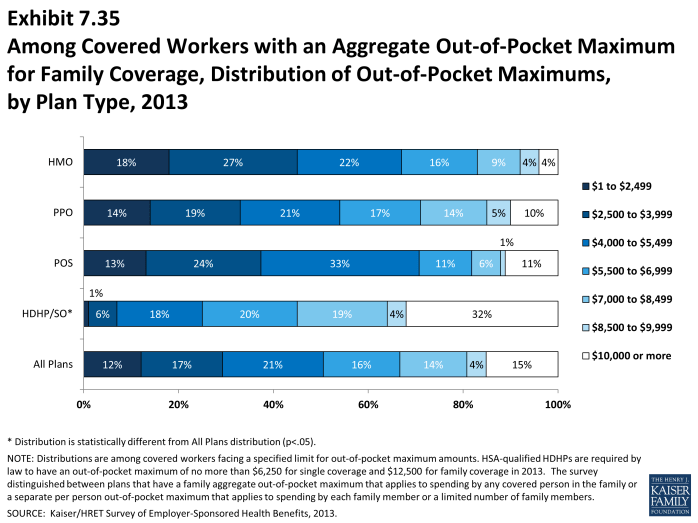

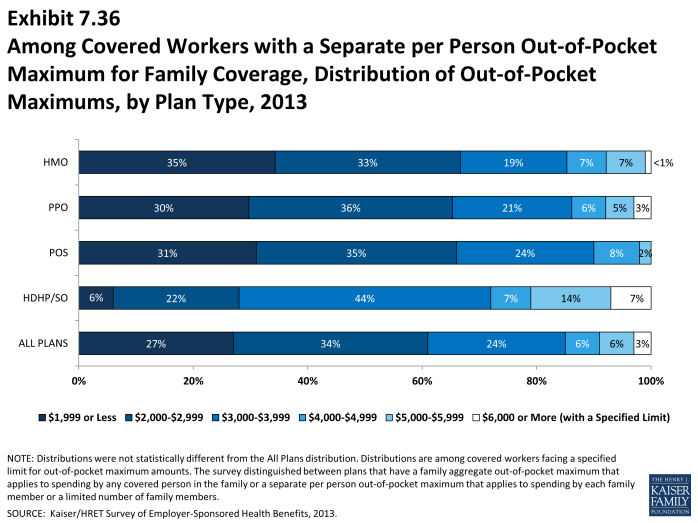

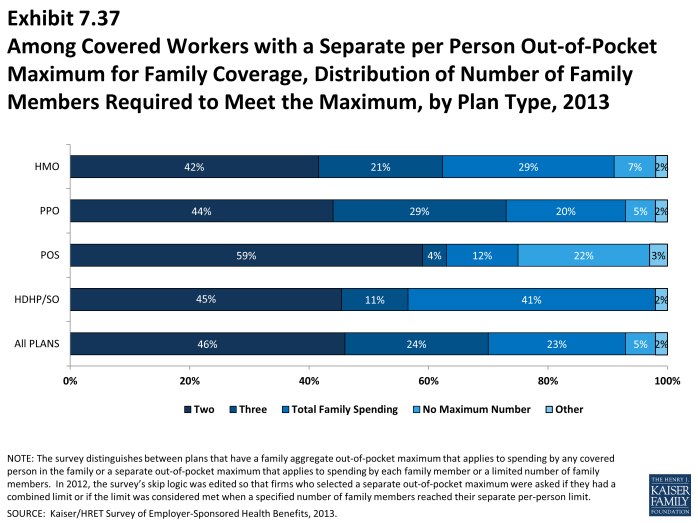

- For covered workers with an aggregate out-of-pocket maximum for family coverage, 29% have an out-of-pocket maximum of less than $4,000 and 24% have an out-of-pocket maximum of $8,000 or more (Exhibit 7.35). Among workers with separate per-person out-of-pocket limits for family coverage, 85% have out-of-pocket maximums of less than $4,000 (Exhibit 7.36).

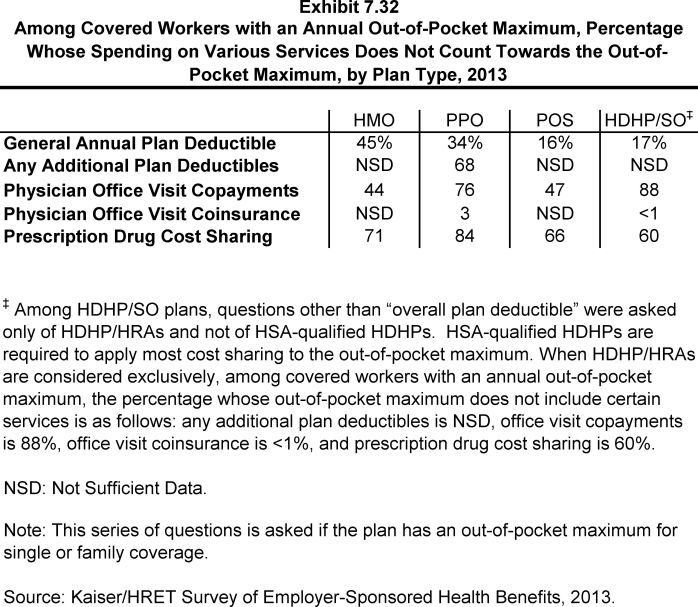

- As noted above, covered workers with an out-of-pocket maximum may be enrolled in a plan where not all spending counts toward the out-of-pocket maximum, potentially exposing workers to higher out-of-pocket spending.

- Among workers enrolled in PPO plans with an out-of-pocket maximum for single or family coverage, 34% are in plans that do not count spending for the general annual plan deductible toward the out-of-pocket limit (Exhibit 7.32).

- It is more common for covered workers to be in plans that do not count prescription drug cost sharing toward the out-of-pocket limit. Eighty-four percent of workers enrolled in PPO plans and 71% enrolled in HMO plans with an out-of-pocket maximum for single or family coverage are in plans that do not count prescription drug spending towards the out-of-pocket maximum (Exhibit 7.32). The ACA will require that all non-grandfathered plans have an out-of-pocket maximum that counts all cost sharing towards the limit.