2018 Employer Health Benefits Survey

Section 10: Plan Funding

Many firms, particularly larger firms, choose to pay for some or all of the health services of their workers directly from their own funds rather than by purchasing health insurance for them. This is called self funding. Both public and private employers use self funding to provide health benefits. Federal law (the Employee Retirement Income Security Act of 1974, or ERISA) exempts self-funded plans established by private employers (but not public employers) from most state insurance laws, including reserve requirements, mandated benefits, premium taxes, and many consumer protection regulations. Sixty-one percent of covered workers are in a self-funded health plan. Self-funding is common among larger firms because they can spread the risk of costly claims over a large number of workers and dependents.

Many firms with self-funded plans also use insurance, often called stoploss coverage, to limit their liability for very large claims or an unexpected level of expenses. Three-fifths of covered workers in fully or partially self-funded plans are in plans with stoploss insurance.

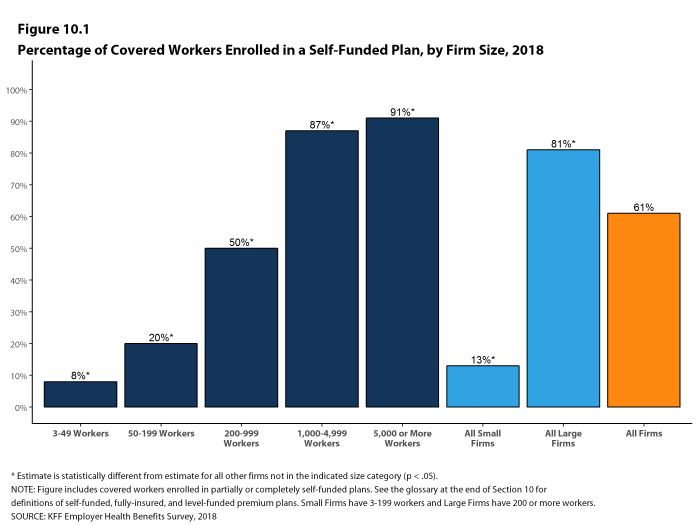

- Sixty-one percent of covered workers are in a plan that is completely or partially self-funded, similar to last year [Figures 10.1 and 10.2].

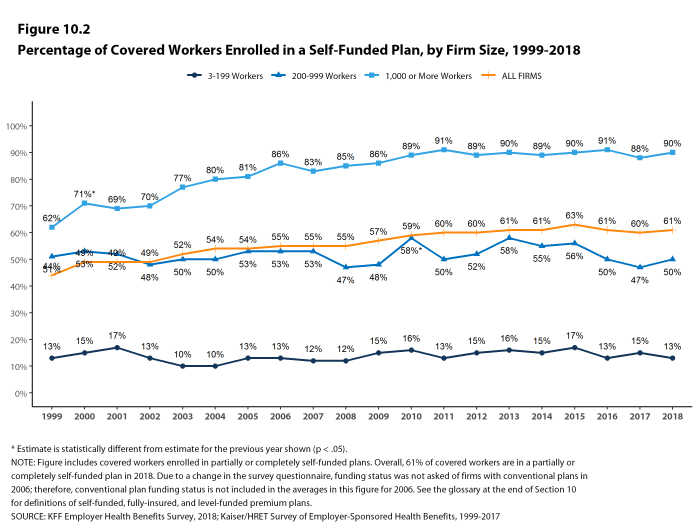

- The percentage of covered workers enrolled in self-funded plans has been stable in recent years across firm sizes [Figure 10.2].

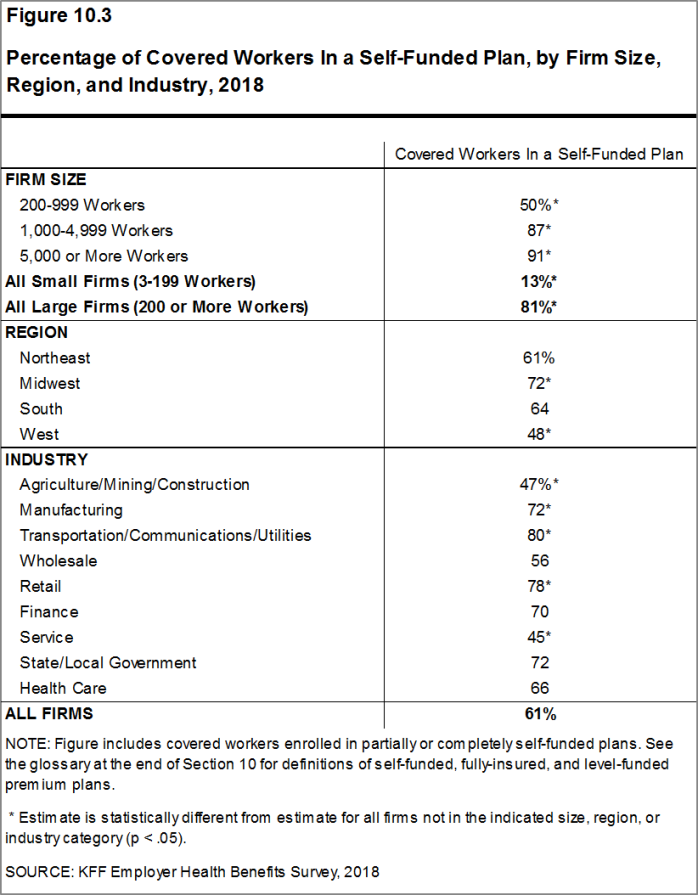

- As expected, covered workers in large firms are significantly more likely to be in a self-funded plan than covered workers in small firms (81% vs. 13%). The percentage of covered workers in self-funded plans increases as the number of workers in a firm increases. Eighty-seven percent of covered workers in firms with 1,000 to 4,999 workers and 91% of covered workers in firms with 5,000 or more workers are in self-funded plans in 2018 [Figures 10.1 and 10.3].

Figure 10.3: Percentage of Covered Workers In a Self-Funded Plan, by Firm Size, Region, and Industry, 2018

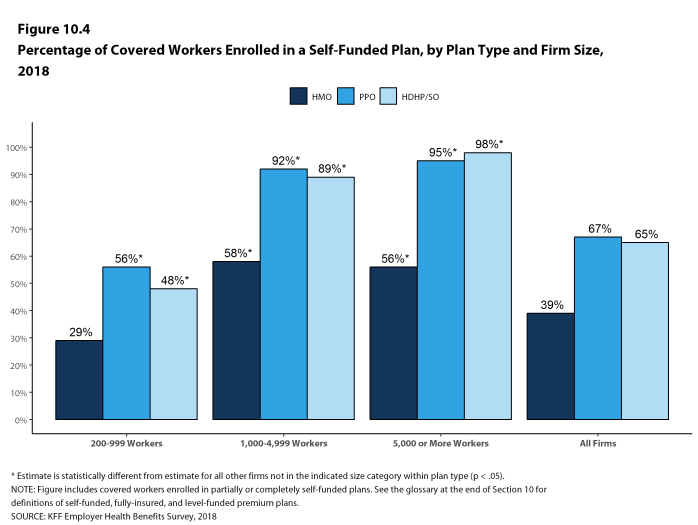

Figure 10.4: Percentage of Covered Workers Enrolled In a Self-Funded Plan, by Plan Type and Firm Size, 2018

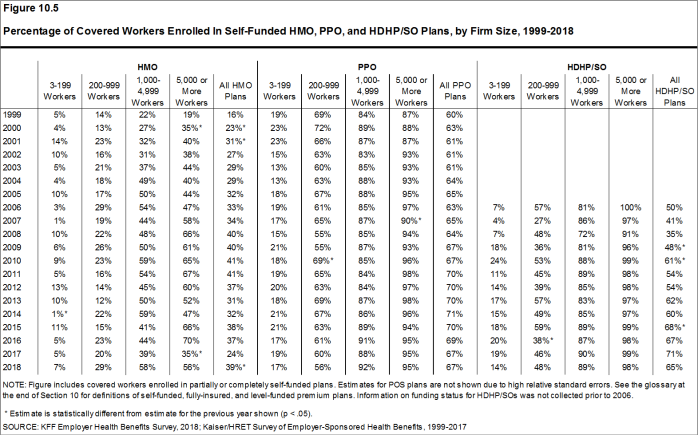

Figure 10.5: Percentage of Covered Workers Enrolled In Self-Funded HMO, PPO, and HDHP/SO Plans, by Firm Size, 1999-2018

LEVEL-FUNDED PLANS

In the past few years, insurers have begun offering health plans that provide a nominally self-funded option for small or mid-sized employers that incorporates stoploss insurance with relatively low attachment points. Often, the insurer calculates an expected monthly expense for the employer, which includes a share of the estimated annual cost for benefits, premium for the stoploss protection, and an administrative fee. The employer pays this “level premium” amount, with the potential for some reconciliation between the employer and the insurer at the end of the year if claims differ significantly from the estimated amount. These policies are sold as self-funded plans, so they generally are not subject to state requirements for insured plans and, for those sold to employers with fewer than 50 employees, are not subject to the rating and benefit standards in the ACA for small firms.

Due to the complexity of the funding (and regulatory status) of these plans, and because employers often pay a monthly amount that resembles a premium, they may be confused as to whether or not their health plan is self-funded or insured. This year we asked employers with fewer than 200 workers that responded that they had an insured health plan whether it was a level-funded plan.

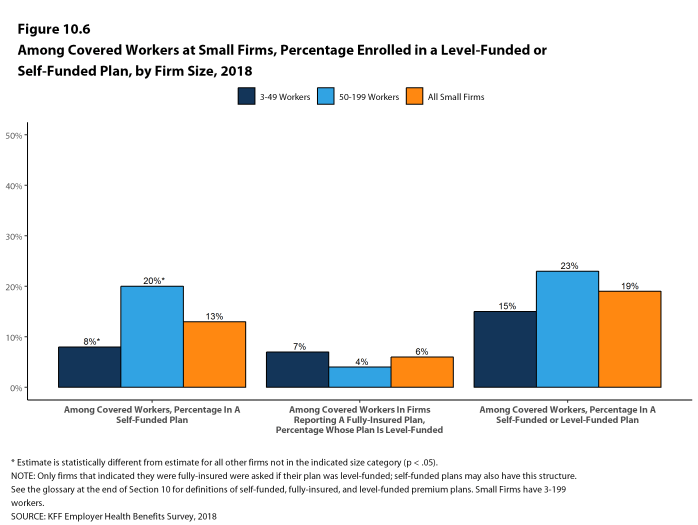

- Among small firms that responded that they had an insured plan, 6% reported that they had a level-funded plan [Figure 10.6].

- If we consider the small firms reporting that they had a level-funded plan to actually be self-funded, the percentage of small firms with a self-funded health plan increases to 19% [Figure 10.6].

STOPLOSS COVERAGE AND ATTACHMENT POINTS

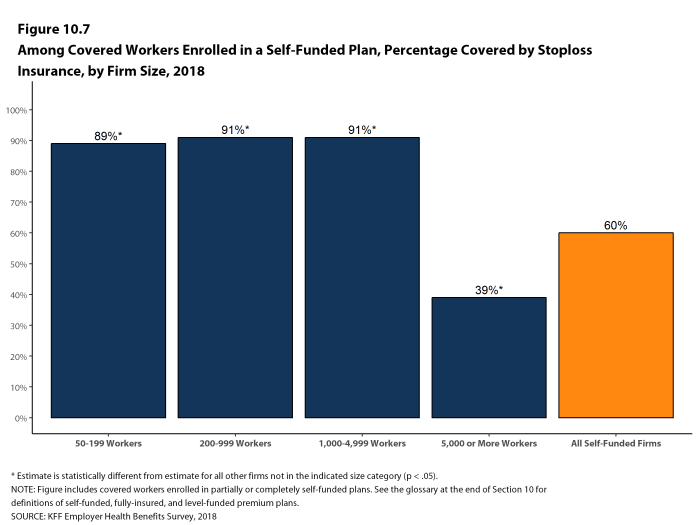

- Stoploss coverage may limit the amount of claims that must be paid for each worker or may limit the total amount the plan sponsor must pay for all claims over the plan year. Sixty percent of covered workers in self-funded health plans are in plans that have stoploss insurance [Figure 10.7].

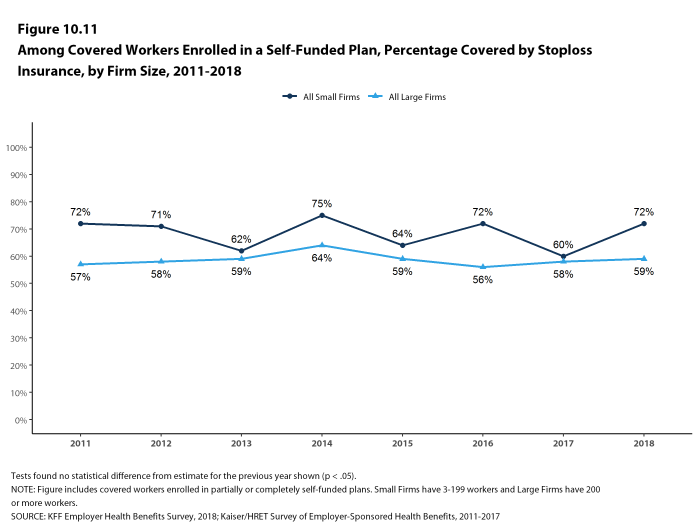

- The percentage of covered workers in self-funded plans with stoploss insurance (60%) is similar to the value when the survey first asked about stoploss insurance in 2011 (58%). This is also true for both small firms and large firms [Figure 10.11].

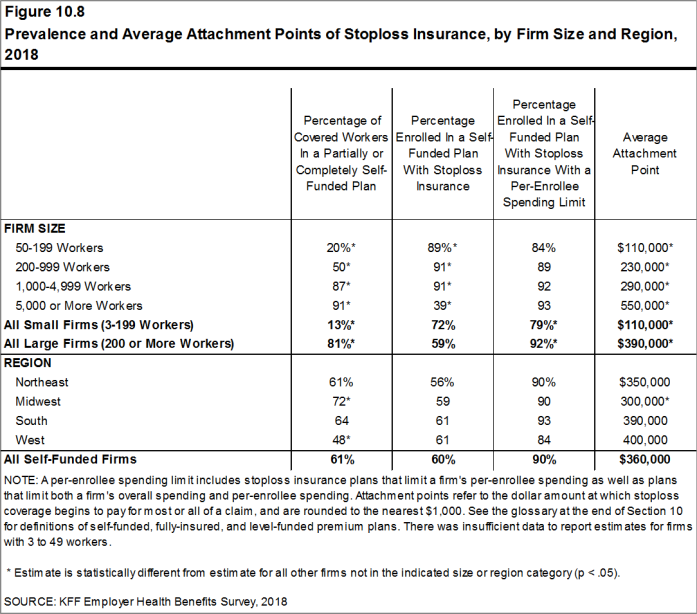

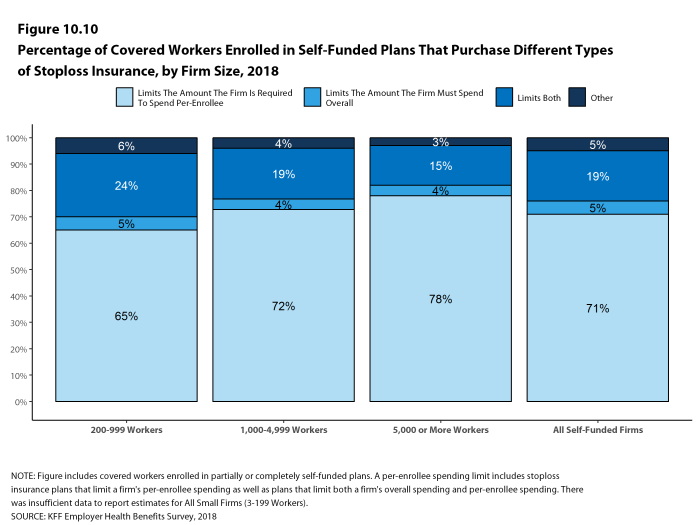

- Ninety percent of covered workers in self-funded plans that have stoploss protection are in plans where the stoploss insurance limits the amount the plan must spend on each worker. This includes stoploss insurance plans that limit a firm’s per-employee spending and plans that limit both a firm’s overall spending and per-employee spending [Figures 10.8 and 10.10].

- Firms with per-enrollee stoploss coverage were asked for the dollar amount where the stoploss coverage would start to pay for most or all of the claim (called an attachment point). The average attachment points for firms with a per-person limit are $110,000 for small firms and $390,000 for large firms [Figure 10.8].

Figure 10.7: Among Covered Workers Enrolled In a Self-Funded Plan, Percentage Covered by Stoploss Insurance, by Firm Size, 2018

Figure 10.8: Prevalence and Average Attachment Points of Stoploss Insurance, by Firm Size and Region, 2018

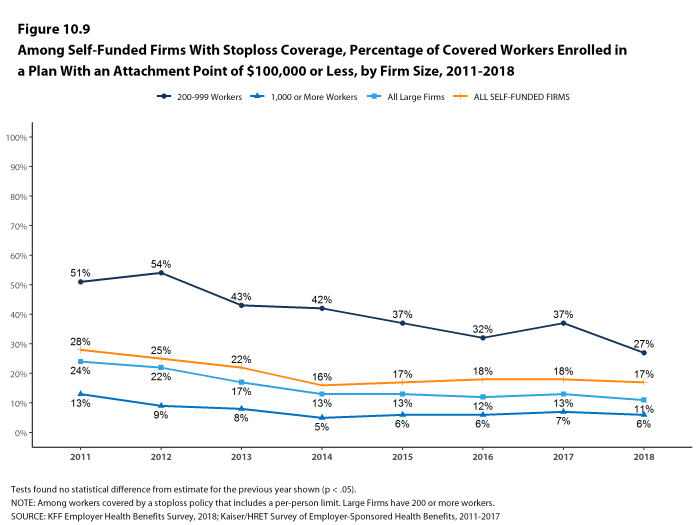

Figure 10.9: Among Self-Funded Firms With Stoploss Coverage, Percentage of Covered Workers Enrolled In a Plan With an Attachment Point of $100,000 or Less, by Firm Size, 2011-2018

Figure 10.10: Percentage of Covered Workers Enrolled In Self-Funded Plans That Purchase Different Types of Stoploss Insurance, by Firm Size, 2018

Figure 10.11: Among Covered Workers Enrolled In a Self-Funded Plan, Percentage Covered by Stoploss Insurance, by Firm Size, 2011-2018

- Self-Funded Plan

- An insurance arrangement in which the employer assumes direct financial responsibility for the costs of enrollees’ medical claims. Employers sponsoring self-funded plans typically contract with a third-party administrator or insurer to provide administrative services for the self-funded plan. In some cases, the employer may buy stoploss coverage from an insurer to protect the employer against very large claims.

- Fully-Insured Plan

- An insurance arrangement in which the employer contracts with a health plan that assumes financial responsibility for the costs of enrollees’ medical claims.

- Level-Funded Plan

- An insurance arrangement in which the employer makes a set payment each month to an insurer or third party administrator which funds a reserve account for claims, administrative costs, and premiums for stop-loss coverage. When claims are lower than expected, surplus claims payments may be refunded at the end of the contract.