Kaiser Family Foundation/LA Times Survey Of Adults With Employer-Sponsored Insurance

Section 3: The experiences of those with high deductibles and those with chronic conditions

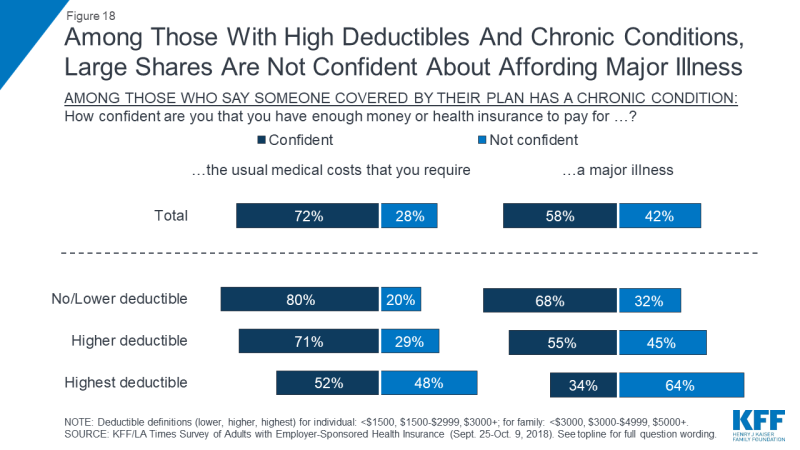

As noted above, people with employer sponsored health plans that have high deductibles are more likely to report problems affording health care, and more likely to postpone or forgo health care services for cost reasons. One contributing factor may be the fact that many people in higher deductible plans do not have enough savings to cover the full amount of their deductible. When asked how much they have in savings that could easily be accessed in the short term, three in ten (31 percent) of those in higher deductible plans and more than half (56 percent) of those in the highest deductible plans name an amount that is less than the amount of their deductible.

Figure 13: Over Half Of Those In Highest Deductible Plans Report Personal Savings Less Than Amount Of Their Deductible

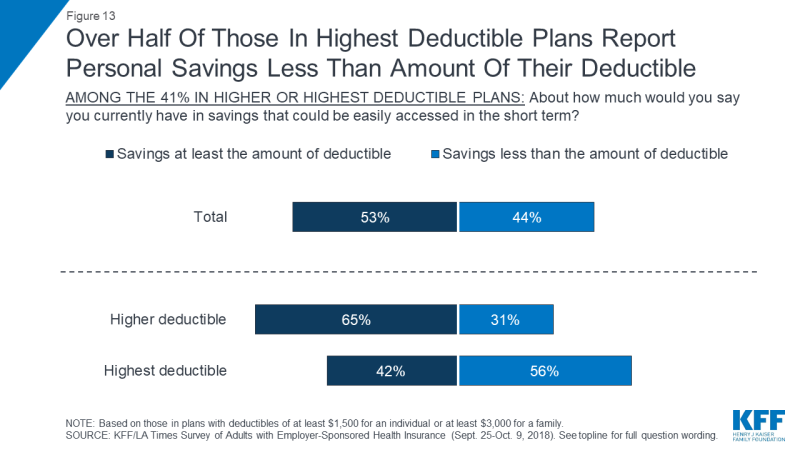

In addition, most people enrolled in plans with high deductibles say they would not be able to pay a bill equal to the full amount of their deductible without going into debt. When asked how they would pay an unexpected medical bill equal to the amount of their deductible, one-third of those in plans with high deductibles say they would either pay the bill at the time of service or put it on a credit card and pay it off at their next statement. About half say they would go into some type of debt to pay the bill, either by putting it on a credit card and paying it off over time (27 percent), setting up a payment plan with the provider (17 percent), or borrowing money from a bank, payday lender, or friends and family (5 percent). One in six (16 percent) say they would not be able to pay such a bill at all.

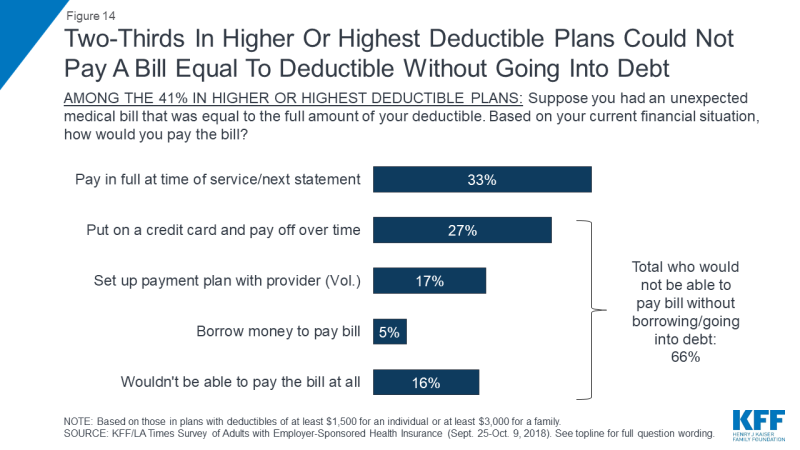

Those in high deductible plans who have lower incomes are even less likely to say they could afford such a bill. Among those in high deductible plans who have annual household incomes of $40,000 or less, one-third (32 percent) say they would not be able to pay a bill in the full amount of their deductible at all, while just 14 percent say they would pay it off right away or at the next credit card statement.

Figure 14: Two-Thirds In Higher Or Highest Deductible Plans Could Not Pay A Bill Equal To Deductible Without Going Into Debt

Figure 15: One-Third Of Those With Low Incomes And High Deductibles Would Not Be Able To Pay Bill Equal To Deductible

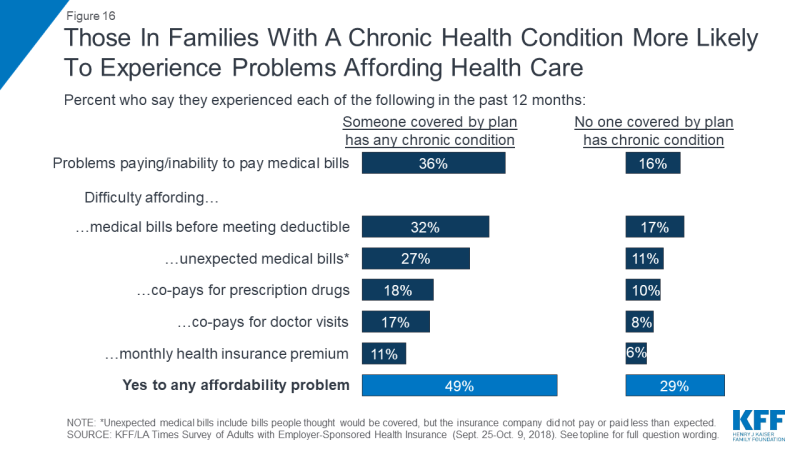

Another group that is particularly vulnerable to health care affordability issues are people with chronic conditions. Those who say someone covered by their plan has a chronic health condition (a group that makes up 54 percent of people with employer plans) are about twice as likely as others to report problems paying medical bills (36 percent versus 16 percent). They are also much more likely to say they’ve had difficulty affording medical bills before meeting their deductible, unexpected medical bills, co-pays, and monthly health insurance premiums.

Figure 16: Those In Families With A Chronic Health Condition More Likely To Experience Problems Affording Health Care

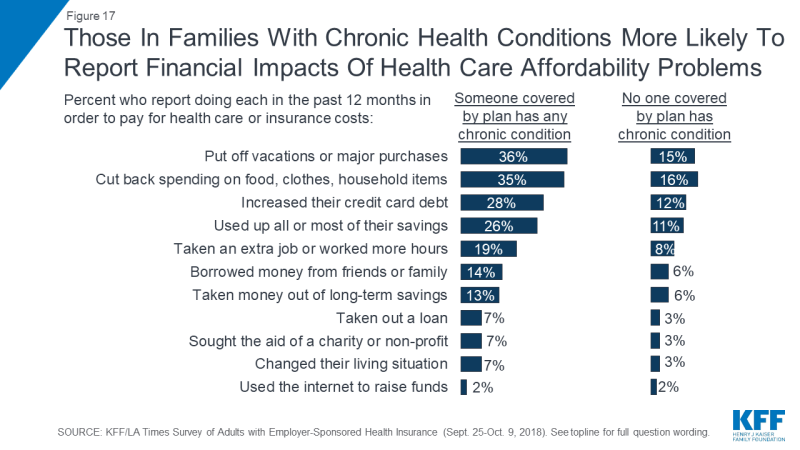

Drilling down into the consequences of these affordability problems reveals more about the financial burden of health care on families with chronic conditions. Overall, more than one-third of those with a chronic condition in the family say they put off vacations or major household purchases (36 percent) or cut back spending on food, clothing, or basic household items (35 percent) in order to pay for health care and insurance costs. Nearly three in ten (28 percent) say they increased their credit card debt, about a quarter (26 percent) say they used up all or most of their savings, and one in five (19 percent) say they took on an extra job or worked more hours in order to pay for health care. Other consequences, such as borrowing money, seeking charity aid, or changing living situation were less common, but still occurred at about twice the rate among people in families with a chronic condition compared to those without such a condition.

Figure 17: Those In Families With Chronic Health Conditions More Likely To Report Financial Impacts Of Health Care Affordability Problems

Those with chronic conditions are also more likely to report forgoing or delaying health care because of the cost, and this is particularly true for those in plans with high deductibles. For example, 42 percent of those who say someone covered by their plan has a chronic condition say there was a time in the past year when they or another family member put off or postponed getting health care they needed, compared with 23 percent of those without a chronic condition. Among those with chronic conditions who are in the highest deductible plans, the share rises to 60 percent. Similarly, three in ten (31 percent) of those in families with a chronic condition say they skipped a doctor-recommended test or medical treatment in the past year for cost reasons, twice the share as among those with no chronic condition, and rising to 44 percent among those with chronic conditions in the highest deductible plans. Overall, 60 percent of all those with a family chronic condition say someone in their household skipped or postponed some type of care or medicine for cost reasons, rising to 75 percent among those in the highest deductible plans.

| Table 2: Skipping And Postponing Needed Care Because Of Cost, By Family Chronic Condition And Health Plan Deductible Level | |||||

| Percent who say they or a family member did the following in the past 12 months… | No chronic condition in family | Any family member covered by plan has chronic condition | |||

| Total | No/Lower Deductible | Higher Deductible | Highest Deductible | ||

| Put off or postponed getting health care they needed | 23% | 42% | 34% | 49% | 60% |

| Relied on home remedies or OTC drugs instead of going to see a doctor | 28 | 41 | 33 | 46 | 58 |

| Have not gotten a medical test or treatment recommended by a doctor | 15 | 31 | 24 | 35 | 44 |

| Not filled a prescription, cut pills in half, or skipped doses of a medicine | 12 | 23 | 19 | 23 | 35 |

| Yes to any | 40 | 60 | 52 | 69 | 75 |

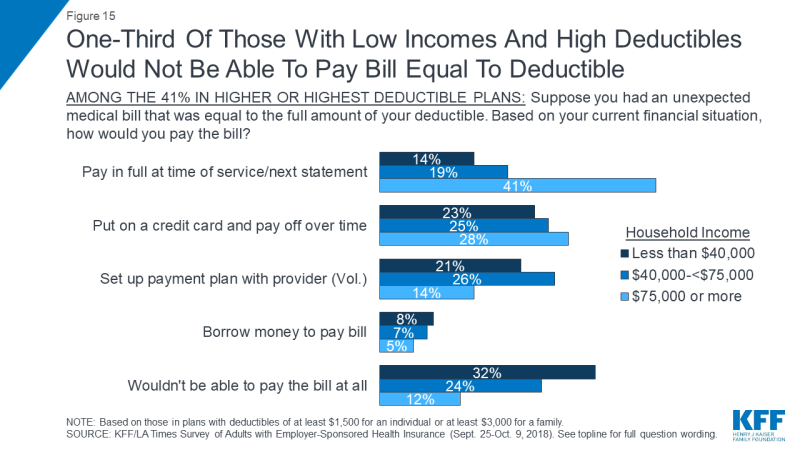

The combination of a chronic condition and a high deductible can also lead families to worry about affording health care in the future. For example, among those with a chronic condition in the family, about half of those in the highest deductible plans say they are not confident in their ability to pay for the usual medical costs they and their family require, and almost two-thirds are not confident they could pay for a major illness.