State and Local Coverage Changes Under Full Implementation of the Affordable Care Act

Data Sources

The American Community Survey. Pooled American Community Survey (ACS) data from 2008, 2009, and 2010 form the core data set for this model and the resultant estimates. The ACS is an annual survey fielded by the United States Census Bureau with a reported response rate of 98.0 percent in 2009.1 The estimates presented here are derived from the data that were collected from approximately 2.5 million non-elderly sample respondents (ages 0 to 64) in the civilian non-institutionalized population each year, yielding a total sample of approximately 7.5 million. The ACS is a mixed mode survey that includes households with and without telephones (landline or cellular.) The ACS is designed to be state-representative, including samples from each county in the country.

Since 2008, the ACS has asked respondents about the health insurance coverage status at the time of the survey of each individual in the household. In an effort to correct for potential measurement errors in the ACS coverage data and to define coverage as including only comprehensive health insurance as opposed to single-service plans (e.g., dental coverage), we apply a set of logical coverage edits in the cases where other information collected in the ACS implies that coverage for a sample case likely has been misclassified.2 The edits target under-reported Medicaid/CHIP coverage among children and over-reported non-group coverage among both adults and children, which in turn, affect other coverage types. We draw from approaches that have been applied to other surveys3 and build on ACS edit rules used by the Census Bureau.4

American Community Survey-Health Insurance Policy Simulation Model. We use the Urban Institute’s American Community Survey – Health Insurance Policy Simulation Model (ACS-HIPSM) to estimate the effects of the ACA on the non-elderly at the state and local level.5 The ACS-HIPSM model builds off of HIPSM, which uses the Current Population Survey (CPS) as its core data source, matched to several others, including the Medical Expenditure Panel Survey-Household Component (MEPS-HC). We apply the micro-simulation approach developed in HIPSM/CPS to model decisions of individuals in response to policy changes, such as Medicaid expansions, new health insurance options, subsidies for the purchase of health insurance, and insurance market reforms with data from the ACS. With the large ACS sample, we are able to produce more precise estimates for state and sub-state areas than available from models based on other data sources. Under our model, eligibility for Medicaid/CHIP and exchange subsidies are simulated using ACS data from 2008, 2009, and 2010 based on state-level eligibility guidelines for Medicaid and CHIP in 2010 and available information on the regulations for implementing the ACA.

We combine three years of ACS data to achieve sufficient precision at the state and local level. This process involves adjusting all dollar amounts such as income and wages to 2011 levels using the Consumer Price Index (CPI-U) and reweighting the combined file so that the distributions of demographic, employment, income, and health insurance coverage in the merged file match those of the 2011 ACS.

We simulate the main coverage provisions of the ACA as if they were fully implemented and the impacts were fully realized and compare the results to the model’s pre-reform baseline results. The HIPSM models use a micro-simulation approach based on the relative desirability of the health insurance options available to each individual and family under reform, taking into account a number of factors such as premiums and out-of-pocket health care costs for available insurance products, health care risk, whether or not the individual mandate would apply to them, and family disposable income.

Medicaid/CHIP Eligibility Simulation Model. We use The Urban Institute Health Policy Center’s ACS Medicaid/CHIP Eligibility Simulation Model to simulate pre-ACA eligibility for Medicaid/CHIP by comparing family income and other characteristics to the Medicaid and CHIP rules in each sample person’s state of residence.6 The model uses available information on eligibility guidelines, including income thresholds for the appropriate family size,7 asset tests, parent/family status, and the amount and extent of income disregards for each program and state in place as of the middle of each year.8 The model takes into account disregards for child care expenses, work expenses, and earnings in determining eligibility, but does not take into account child support disregards. For non-citizens, the model also takes into account length of U.S. residency in states where term of residency is a factor in eligibility.9 Because the ACS does not contain sufficient information to determine whether an individual is an authorized immigrant and therefore potentially eligible for Medicaid/CHIP coverage, we impute documentation status for non-citizens based on a model developed using CPS ASEC data.10

Estimates from our ACS models of pre-ACA eligibility have been extensively benchmarked to assess their validity and have been found to line up with those from other sources; for instance, despite the differences between the ACS and the CPS ASEC, the models from the two surveys produce fairly comparable results in terms of participation rates and the number of uninsured children who are eligible for Medicaid/CHIP but not enrolled for the same time frame.11 The number and characteristics of individuals according to their eligibility for Medicaid/CHIP and their eligibility pathway (Medicaid vs. CHIP, etc.) are also quite similar across the two models.

Projections of Eligibility Under the ACA. Under the ACA, income eligibility will be based on the Internal Revenue Service tax definition of modified adjusted gross income (MAGI) and will include the following types of income for everyone who is not a tax-dependent child: wages, business income, retirement income, Social Security, investment income, alimony, unemployment compensation, and financial and educational assistance. The ACS asks only indirectly about unemployment compensation, alimony, and financial and educational assistance when it asks about “other income” so we imputed income from other sources using a model developed for the CPS which has more detail on income sources than the ACS.

To compute family income as a ratio of the poverty level, we sum the person-level MAGI across the tax unit.12 In situations where a dependent child is away at school, the ACS does not contain data on the family income and other family information on the child’s record or the presence of the dependent child on the records of family members, so we assign some college students to families before beginning the simulation. Eligibility for Medicaid or subsidies under the ACA also depends on immigration status; HIPSM uses documentation status imputations described above.

We simulate ACA eligibility for adults and children for the eligibility pathways which correspond roughly to the order in which we expect eligibility to be determined. For children, we check for disability (SSI or Aged/Blind/Disabled eligibility under current rules), new Medicaid eligibility (family income up to 138 percent of FPL and meets immigration requirements), CHIP eligibility under current rules, and other eligibility under current rules, otherwise known as maintenance-of-eligibility. For adults, we check for disability (SSI or Aged/Blind/Disabled eligibility under current rules), Title IV-E/foster care, new Medicaid eligibility, and maintenance-of-eligibility.13

We model subsidy eligibility, which depends on whether the family was offered affordable health insurance benefits, based on imputations of the presence of an insurance offer in the family and the value of the employee’s contribution towards the cost of the insurance premium among those with ESI. We impute offer status using regression models estimated from CPS data collected in 2005, the last year that the CPS included information on ESI offers in its February supplement. We first impute firm size on the ACS because offers are highly dependent on firm size. Similarly, we impute policyholder status to people in families with ESI because the ACS does not ask whose job offered the ESI.

Projections of Health Insurance Coverage Under the ACA. Once we have modeled eligibility status for Medicaid/CHIP and subsidized coverage in the exchanges, we use HIPSM to simulate the decisions of employers, families, and individuals to offer and enroll in health insurance coverage. To calculate the impacts of reform options, HIPSM uses a micro-simulation approach based on the relative desirability of the health insurance options available to each individual and family under reform.14 The approach (known as a “utility-based framework”) allows new coverage options to be assessed without simply extrapolating from historical data, as in previous models. The health insurance coverage decisions of individuals and families in the model take into account a number of factors such as premiums and out-of-pocket health care costs for available insurance products, health care risk, whether or not the individual mandate would apply to them, and family disposable income. Our utility model takes into account people’s current choices as reported on the survey data. We use such preferences to customize individual utility functions so that their current choices score the highest, and this in turn affects behavior under the ACA. The resulting health insurance decisions made by individuals, families, and employers are calibrated to findings in the empirical economics literature, such as price elasticities for employer-sponsored and non-group coverage.

The first stage in the simulation process is to estimate additional enrollment in Medicaid and CHIP, both by those gaining eligibility under the ACA and those who are currently eligible, but not enrolled. Many characteristics are used to determine take-up, but the two most important are new eligible status and current insurance coverage, if any. The ACA includes a number of policies aimed at promoting enrollment, including a “no wrong door” enrollment policy whereby children and families will be screened and evaluated for Medicaid, CHIP, and subsidy eligibility no matter whether they apply for coverage (through Medicaid, CHIP or an exchange); new outreach funding; and procedures that minimize application and enrollment barriers. As a consequence, the model projects that Medicaid/CHIP participation rates will rise under the ACA for children and nonelderly adults who are eligible for Medicaid under current rules (see Holahan, Buettgens et al. 2012 for more on this issue.) While the HIPSM model projects that participation among children and non-elderly adults will increase with full implementation of the ACA, it projects that some individuals will remain uninsured despite being eligible for Medicaid/CHIP coverage. In subsequent stages, we model the following sequentially: enrollment in the non-group exchange, additional enrollment of the uninsured in employer-sponsored coverage, additional enrollment of the uninsured in non-group coverage outside of the exchange, transitions from single to family ESI and transition from non-group to ESI.

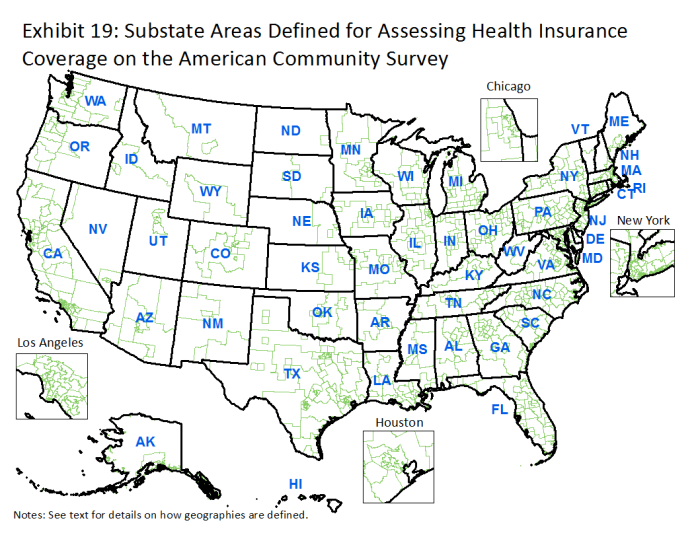

Geographies Used for Local Estimates

The geographies used for this analysis are constructed from available county-level information and Super Public Use Microdata Area (SuperPUMA) definitions on the 2008, 2009, and 2010 pooled American Community Survey. The 531 SuperPUMAs are made up of combinations of the more than 2,000 PUMAs. PUMAs and SuperPUMAs have been defined by Census in conjunction with state and local governments to reflect areas that generally follow the boundaries of county groups, single counties, or census-defined “places,” constrained by the necessity to have a minimum population size (100,000 for PUMAs, 400,000 for SuperPUMAs). County of residence is available on the public-use files for residents of 374 counties, which together account for about 60% of the US population. Identifiable counties all have a population of at least 100,000, and include many of the nation’s largest counties, but do not include all such counties.

In defining local geographies, our methodology uses the county of residence to define a sub-state area unless the county is larger than one of its constituent SuperPUMAs, in which case the SuperPUMA is assigned as the geographic unit instead. When a SuperPUMA is partially composed of an identifiable county according to the rules above, a “Rest of SuperPUMA” area is assigned to individuals in the SuperPUMA who do not reside in the identifiable county. In five small states that are composed of just one SuperPUMA (AK, DC, SD, VT, and WY), we constructed two sub-state areas in each state based on the PUMA definitions for the state.

The result is that each individual is assigned to either a county or an “other area” which could be either: a full SuperPUMA, a “Rest of SuperPUMA,” or a specially constructed area. No resulting area is smaller than 100,000, and none is larger than the largest SuperPUMA of approximately 400,000 people. This yields 781 mutually exclusive geographies which span the entire US (Exhibit 3.1). Of those, 316 are counties, and 465 are “other areas,” either full SuperPUMAs, “Rest of SuperPUMA areas”, or specially constructed areas.

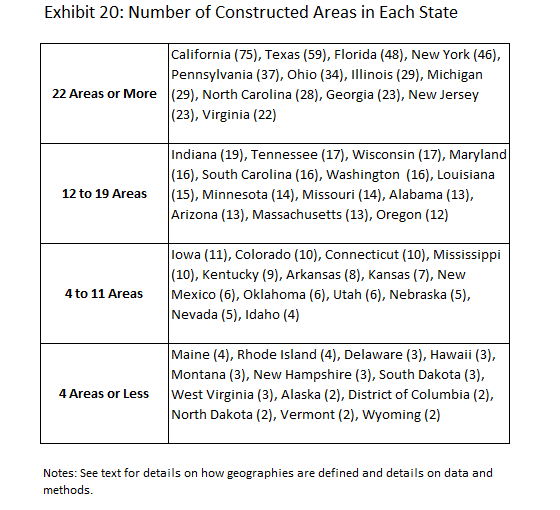

Five states have just two areas, six have three areas, but over half have twelve or more areas (Exhibit 3.2). The states with the largest number of local geographies are California, for which we have defined 78 sub-state areas using the above described methods, followed by Texas and Florida, with 59 and 48 sub-state areas, respectively. We assigned non-county geographies names based on the cities/towns/etc. that are located in the area. We also separately provide estimates for all 374 counties that are identifiable in the ACS.

Individual and Family Characteristics

The estimates that are available on kff.org/zooming-in-aca explore the composition of 1) individuals with Medicaid coverage/who were uninsured before implementation of the major coverage provisions of the ACA, 2) individuals who are projected to gain Medicaid under the ACA, and 3) individuals with Medicaid/who were uninsured after implementation of the ACA with respect to the following characteristics:

- Age—Reported age of individual defined categorically (between 0-18, 19-24, 25-44, or 44-64).

- Race—Reported race of individual. We define anyone who reported being “Hispanic” or “Latino” as Hispanic, and define single race-only for self-identified white or black respondents. Other ethnicities or those identifying multiple ethnicities are classified as “Other” race or ethnicity.

- Gender—Reported gender of individual.

- Language spoken at home—Reported language spoken at home by residents of the household aged 19 to 64. We define households where only English is spoken, only Spanish is spoken, English and some other language are spoken, or no English and not exclusively Spanish are spoken.

In this brief, we present estimates for all states; estimates are also presented for Texas and Illinois to spotlight the local variation in ACA impacts within a particular state. We also provide estimates of the share of Medicaid/CHIP enrollees who live in Spanish-speaking households to highlight the variation in the demographic and socio-economic composition of enrollees within states. We report estimates for all geographies with sufficient sample size to provide reliable estimates along these socio-demographic dimensions. Additional dimensions were modeled for this population but the data was not published. Our sample size cutoff for estimate suppression was 150 respondents in that cell in the geographic area. Only estimates of those newly gaining Medicaid under reform (between 5 and 10 percent of all geographies) were suppressed by this rule.

Limitations

Both the baseline and the ACA estimates presented here have a number of limitations, including measurement error in reported health insurance coverage on the ACS, which may not be fully addressed by the edits that were implemented and in the Medicaid and CHIP eligibility simulation model. Efforts to simulate eligibility for public coverage based on survey data are inherently challenging, particularly for adults. Challenges include misreporting of income, insurance coverage, or other information used to model eligibility and lack of specific information needed to simulate all the pathways to eligibility. The ACS, like many other surveys, does not contain information on such factors as pregnancy status, legal disability status,15 child support amounts, whether custodial parents meet child support cooperation requirements, medical spending (which would be used to calculate spend-down for medically needy eligibility), and duration of Medicaid enrollment or income history to determine Transitional Medical Assistance (TMA) and related eligibility. Finally, there is additional uncertainty in any projection of ACA coverage impacts related to difficulties associated with predicting take up of different types of coverage under the ACA, federal and state actions that could number of implementation issues related to state and federal actions and guidance and a host of behavioral responses that are difficult to predict.