2013 Employer Health Benefits Survey

Section Six: Worker and Employer Contributions for Premiums

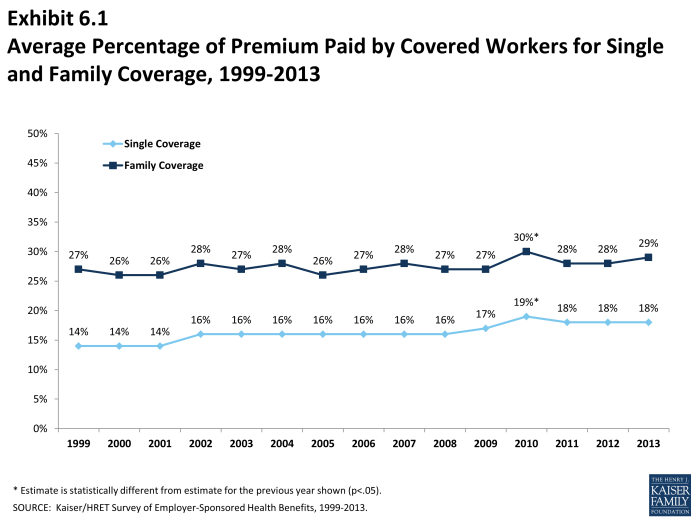

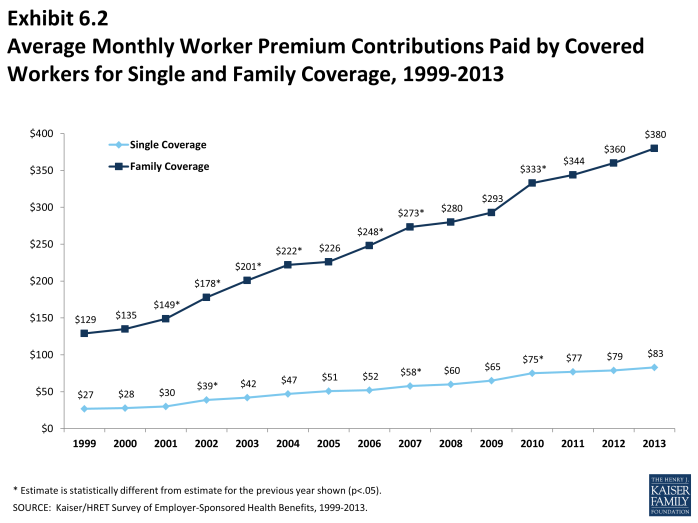

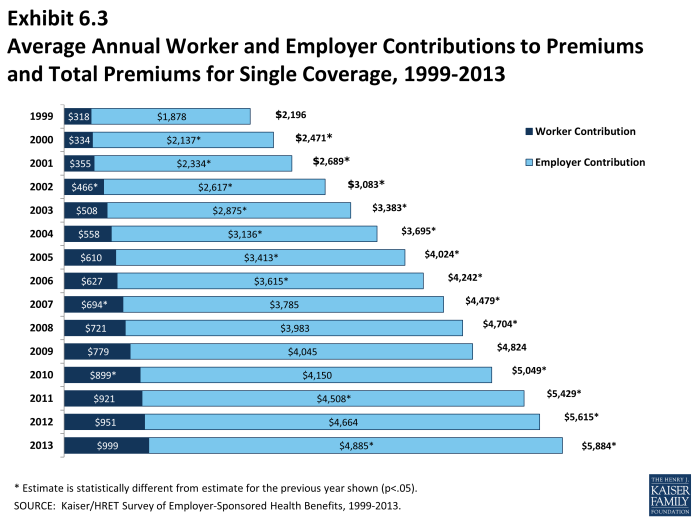

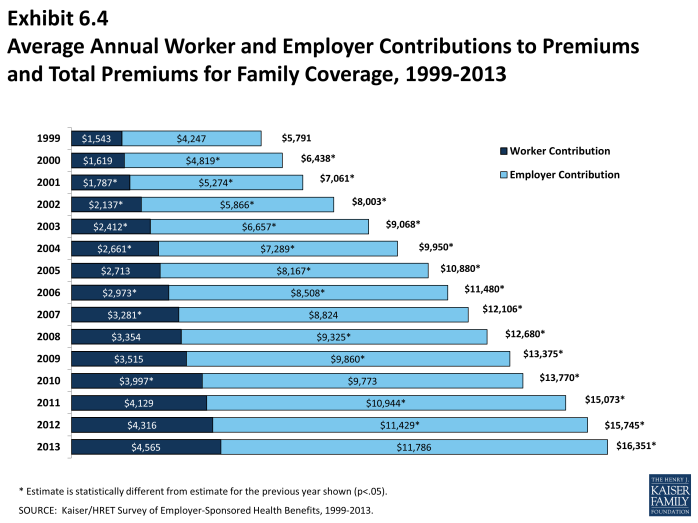

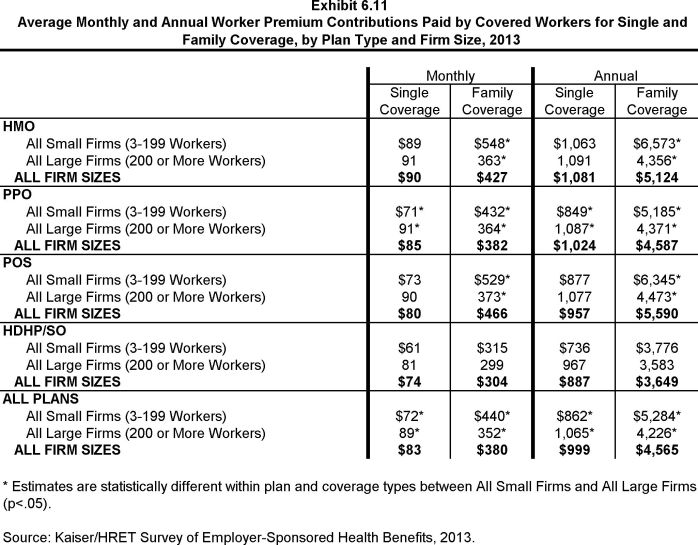

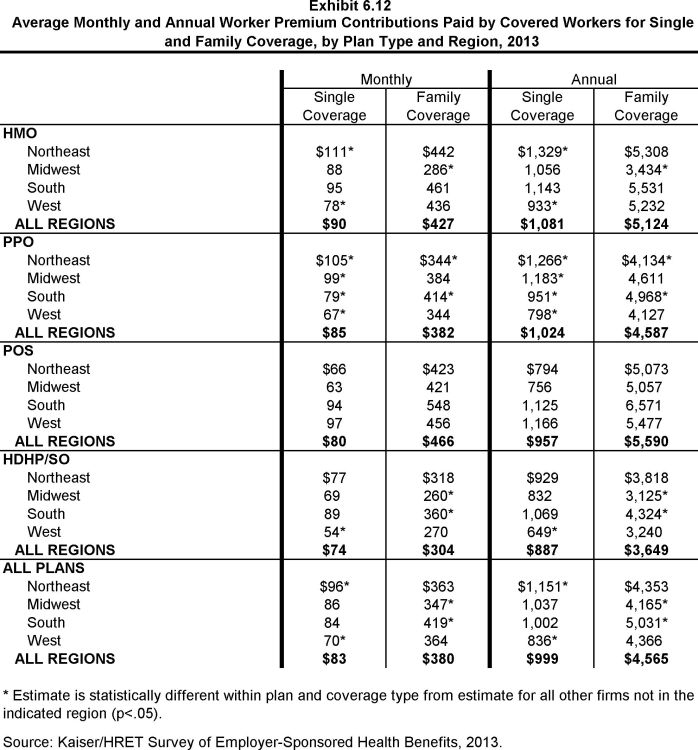

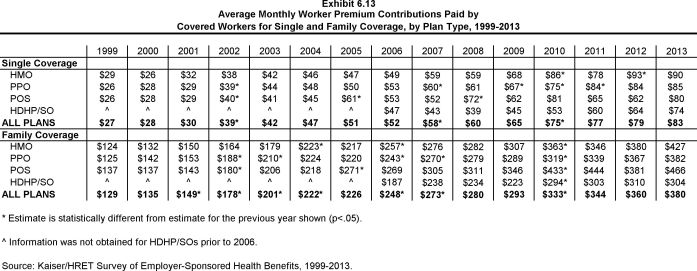

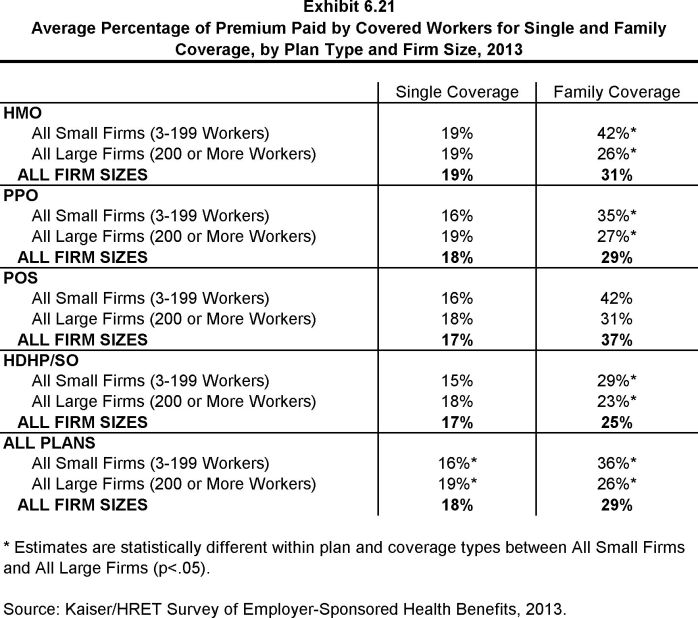

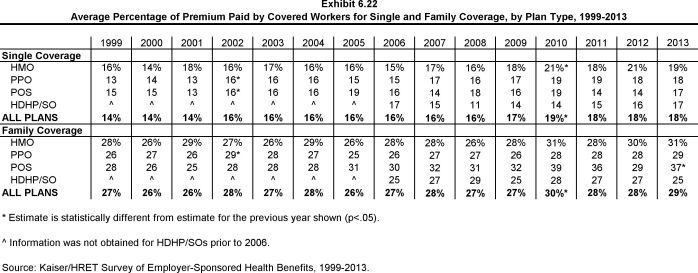

Premium contributions by covered workers average 18% for single coverage and 29% for family coverage.1 The average monthly worker contributions are $83 for single coverage ($999 annually) and $380 for family coverage ($4,565 annually). These percentage and dollar values are similar to the values reported in 2012.

- In 2013, covered workers on average contribute 18% of the premium for single coverage and 29% of the premium for family coverage, similar to the contribution percentages reported for 2012 (Exhibit 6.1). The premium contributions have remained stable over the last three years for both single and family coverage.

- On average, workers with single coverage contribute $83 per month ($999 annually), and workers with family coverage contribute $380 per month ($4,565 annually), towards their health insurance premiums, similar to the amounts reported in 2012 (Exhibit 6.2), (Exhibit 6.3), and (Exhibit 6.4).

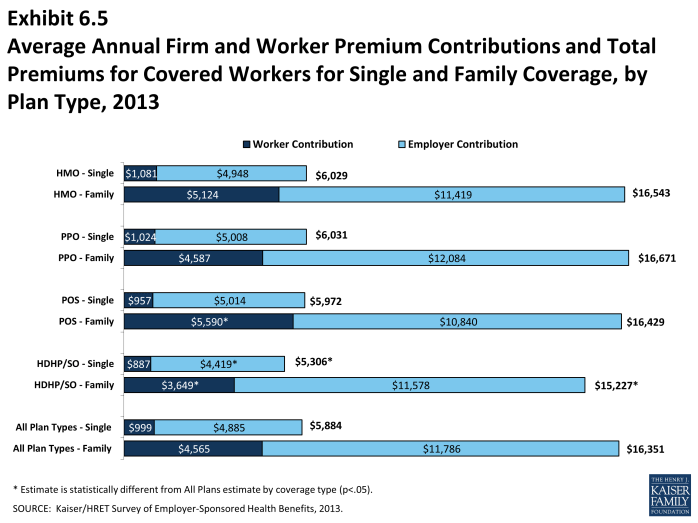

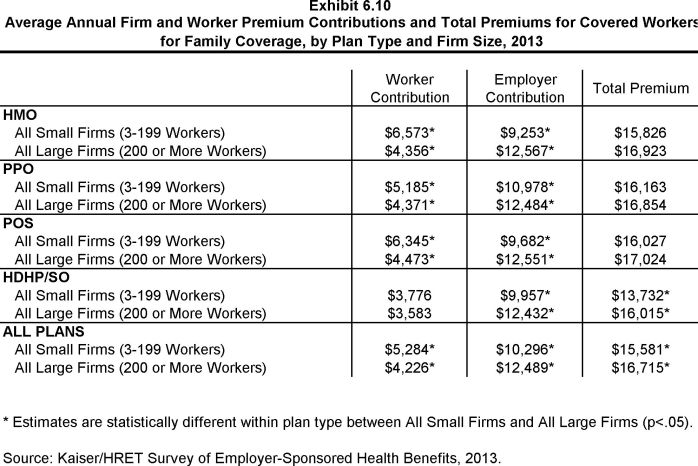

- Worker contributions in HDHP/SOs are lower than the overall average worker contributions for family coverage ($3,649 vs. $4,565) (Exhibit 6.5). Similarly, covered workers enrolled in HDHP/SO plans contribute less on average for family coverage than covered workers enrolled in other plan types ($3,649 vs. $4,787).

- Worker contributions in POS plans are higher for family coverage ($5,590) compared to the overall worker contribution for family coverage (Exhibit 6.5).

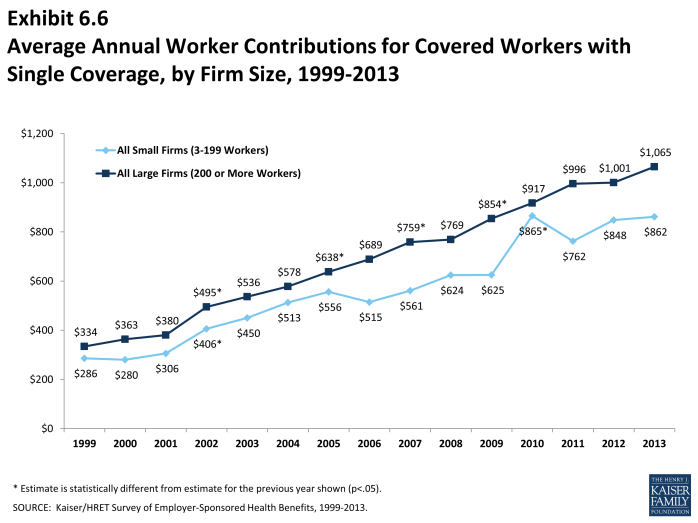

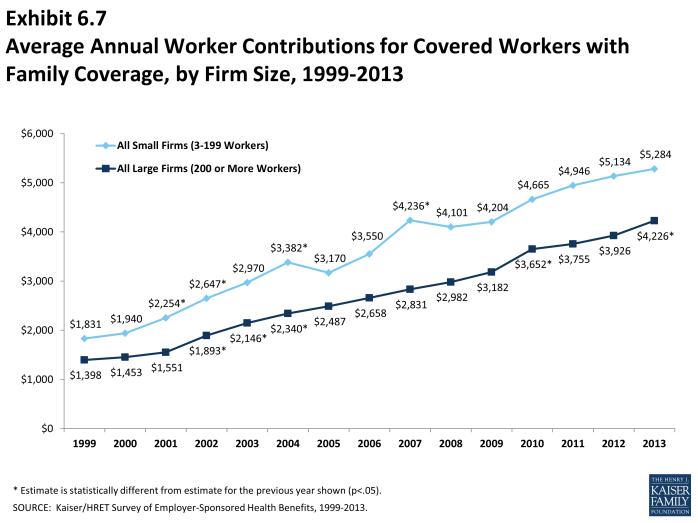

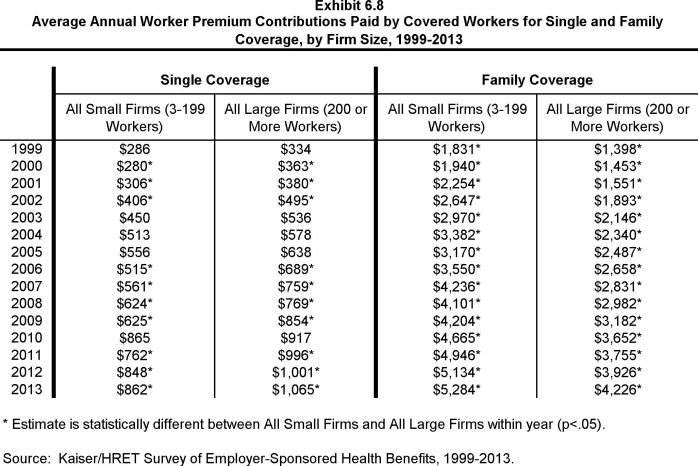

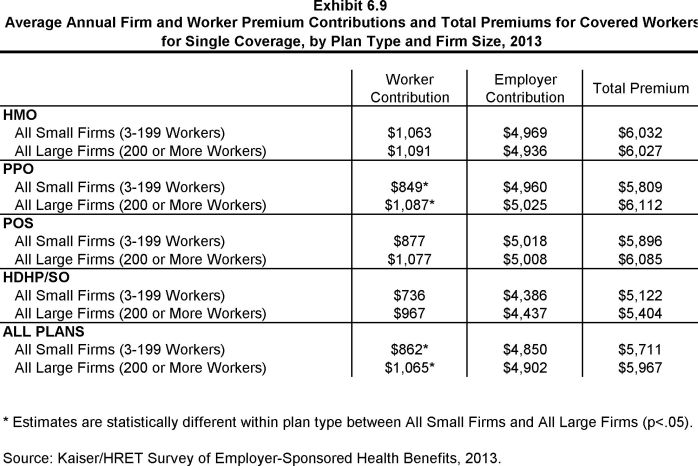

- In addition to differences between plan types, there are differences in worker contributions by type of firm. As in previous years, workers in small firms (3-199 workers) contribute a lower amount annually for single coverage than workers in large firms (200 or more workers), $862 vs. $1,065. In contrast, workers in small firms with family coverage contribute significantly more annually than workers with family coverage in large firms ($5,284 vs. $4,226) (Exhibit 6.8).

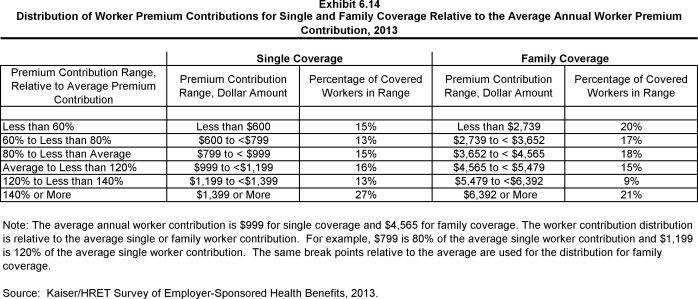

- There is a great deal of variation in worker contributions to premiums.

- Twenty-seven percent of covered workers contribute $1,399 or more annually (140% or more of the average worker contribution) for single coverage, while 15% of covered workers have an annual worker contribution of less than $600 (less than 60% of the average worker contribution) (Exhibit 6.14).

- For family coverage, 21% of covered workers contribute $6,392 or more annually (140% or more of the average worker contribution), while 20% of covered workers have an annual worker contribution of less than $2,739 (less than 60% of the average worker contribution) (Exhibit 6.14).

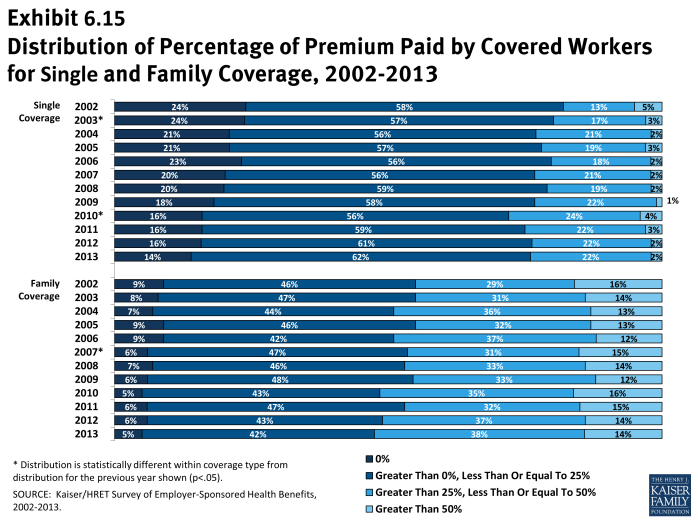

- The majority of covered workers are employed by a firm that contributes at least half of the premium for single and family coverage.

- Fourteen percent of covered workers with single coverage and 5% of covered workers with family coverage work for a firm that pays 100% of the premium (Exhibit 6.15).

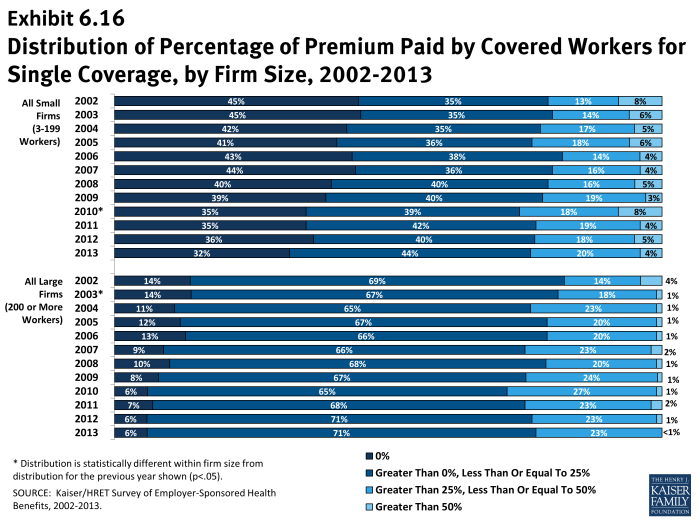

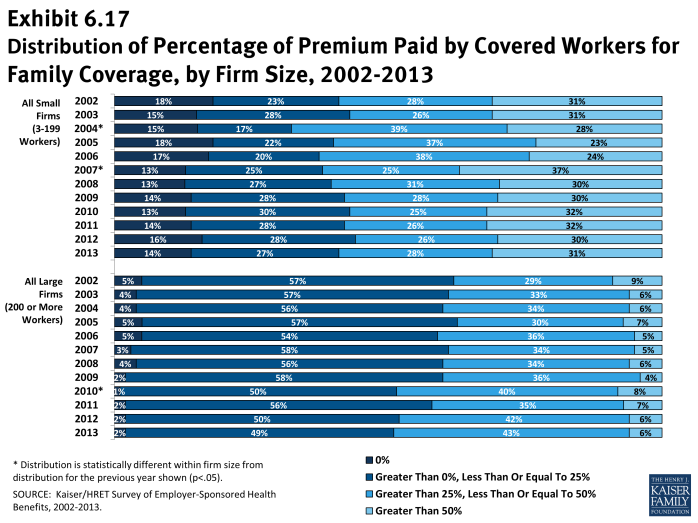

- Covered workers in small firms (3-199 workers) are more likely to work for a firm that pays 100% of the premium for single coverage than workers in large firms (200 or more workers). Thirty-two percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to 6% of covered workers in large firms (Exhibit 6.16). For family coverage, 14% percent of covered workers in small firms have an employer that pays the full premium, compared to 2% of covered workers in large firms (Exhibit 6.17).

- Four percent of covered workers in small firms (3-199 workers) contribute more than 50% of the premium for single coverage, compared to less than one percent of covered workers in large firms (200 or more workers) (Exhibit 6.16). For family coverage, 31% of covered workers in small firms work in a firm where they must contribute more than 50% of the premium, compared to 6% of covered workers in large firms (Exhibit 6.17).

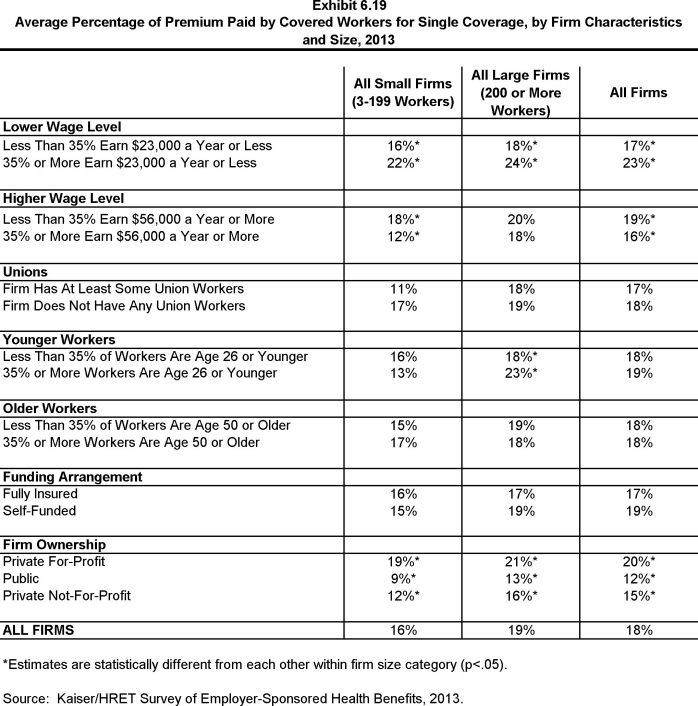

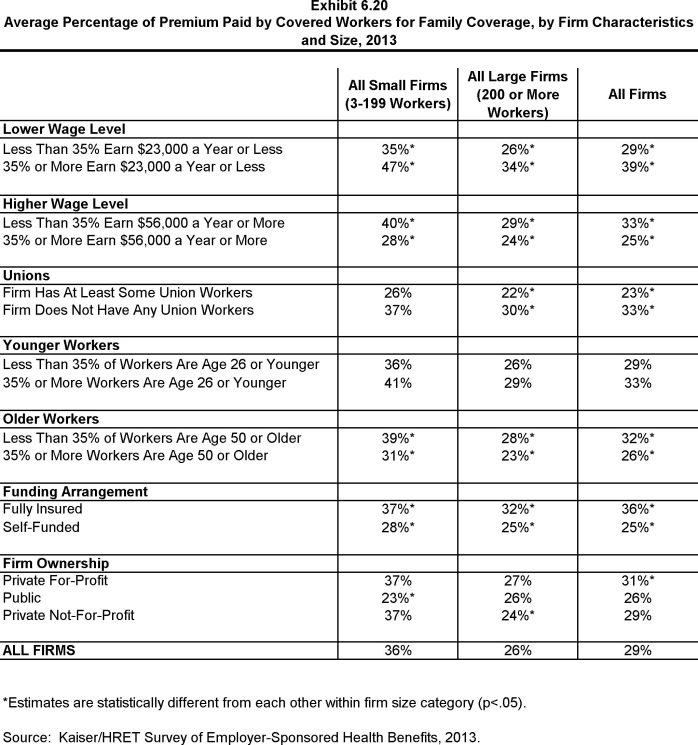

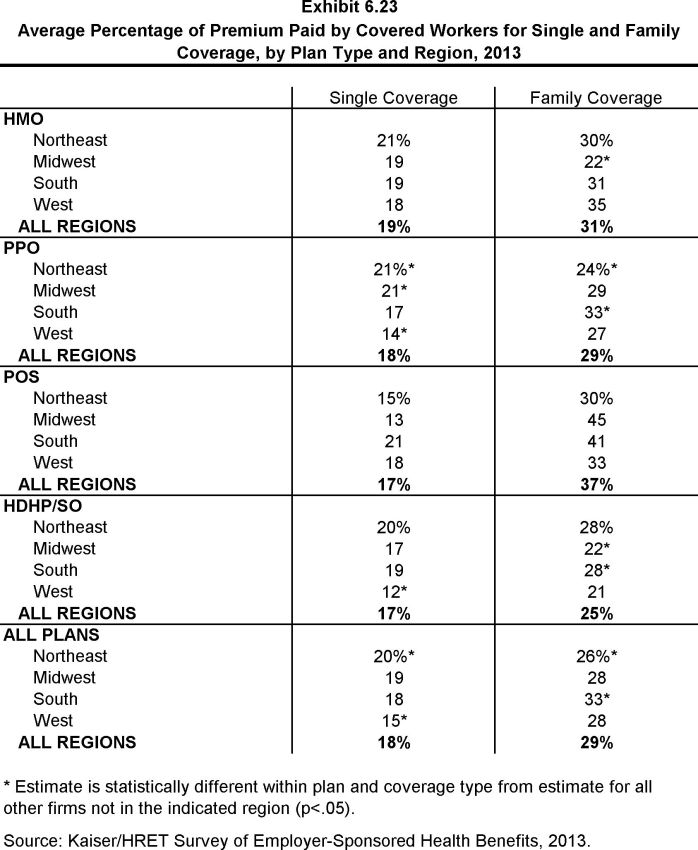

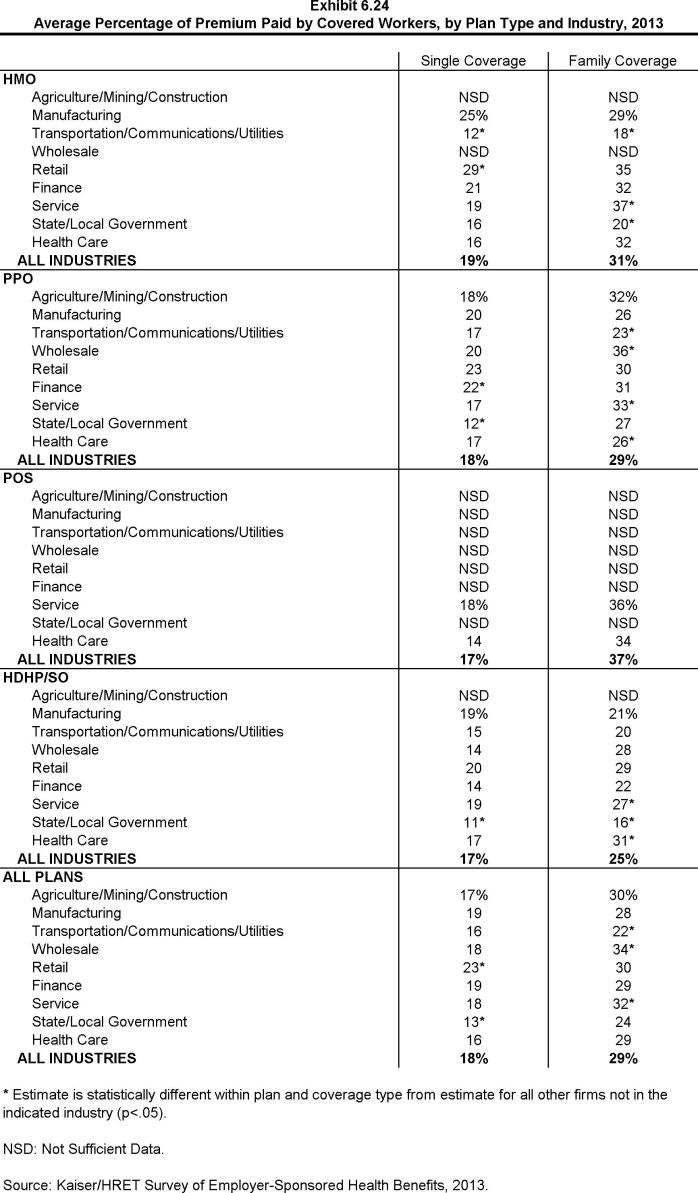

- The percentage of the premium paid by covered workers varies by several firm characteristics.

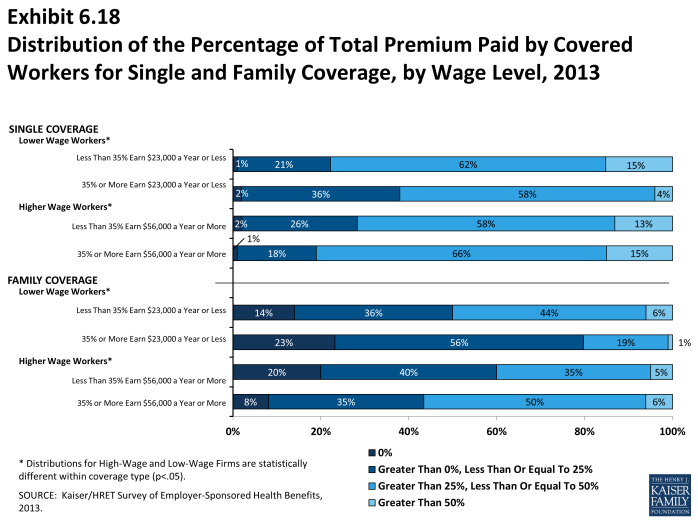

- For family coverage, covered workers in firms with many lower-wage workers (35% or more earn $23,000 or less annually) contribute a greater percentage of the premium than those in firms with fewer lower-wage workers (39% vs. 29%).

- Covered workers with family coverage in firms that have at least some union workers contribute a significantly lower percentage of the premium than those in firms without any unionized workers (23% vs. 33%) (Exhibit 6.20).

- For workers with family coverage in large firms (200 or more workers), the average percentage contribution for workers in firms that are partially or completely self-funded is lower than the average percentage contributions for workers in firms that are fully insured (25% vs. 32%)2 (Exhibit 6.20).

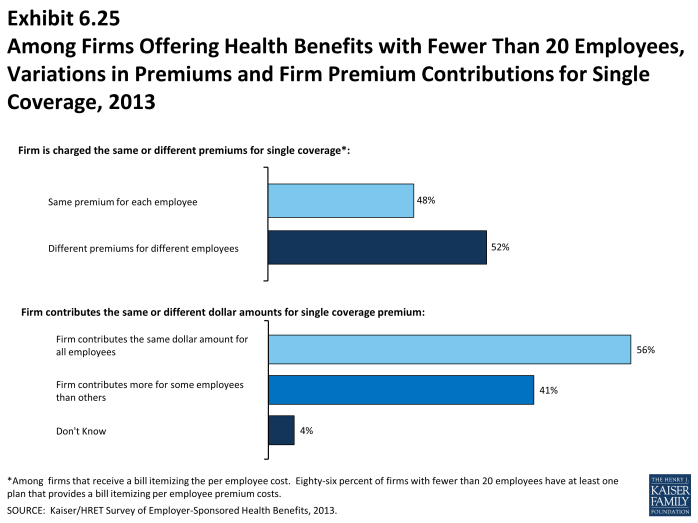

- Among firms offering health benefits with fewer than 20 employees, 41% contribute different dollar amounts toward premiums for different employees (Exhibit 6.25). Employer may contribute different amounts to different employees based for a variety of reasons, including workers’ age, smoking status, seniority, job title or location.

Changes over Time

- The amount which workers contribute to single coverage premiums has increased 97 percent since 2003 and 39% since 2008. Covered workers’ contributions to family coverage have increased 89% since 2003 and 36% since 2008.

x

Exhibit 6.1

x

Exhibit 6.2

x

Exhibit 6.3

x

Exhibit 6.4

x

Exhibit 6.5

x

Exhibit 6.8

x

Exhibit 6.14

x

Exhibit 6.15

x

Exhibit 6.16

x

Exhibit 6.17

x

Exhibit 6.20

x