Coronavirus Response and the Affordable Care Act

At a moment when anxiety over coronavirus is paramount, it is worth noting on the Affordable Care Act’s tenth anniversary that it will provide important coverage and access protections in this pivotal moment. The ACA still has its critics and challenges, but this would be the worst time to pull out a substantial health care safety net or consider a replacement.

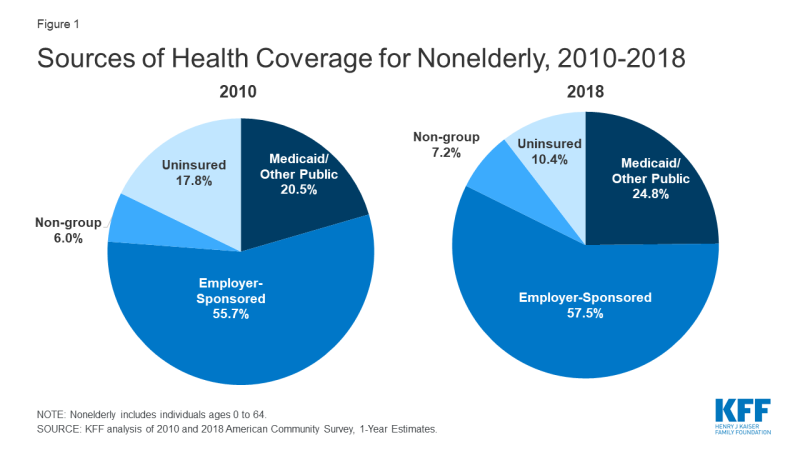

The ACA has increased coverage through an expansion of Medicaid eligibility and new subsidies and standards for private insurance (Figure 1) that have led to about 19 million fewer people lacking coverage in 2018 compared to 2010. As the coronavirus outbreak puts pressure on the economy and there is likely a coming recession,1 the ACA will provide additional coverage options for those losing their jobs or experiencing large declines in income. This would be the first recession since the ACA was implemented, and the health law will provide a safety net that never existed before for those losing job-based health insurance. The ACA also includes new private insurance standards that were designed to ensure that health insurance provides meaningful access to care. At the same time, gaps in the U.S. health insurance system remain. While the number of uninsured has declined, 27.9 million people in the United States still lack health insurance.

Even as the ACA has reshaped the health insurance coverage landscape and a clear majority (55%) of the public now views the law favorably, the law’s future is still uncertain. Later this year the Supreme Court is scheduled to hear arguments in California v. Texas2 (known as Texas v. U.S. in the lower courts). This ongoing litigation, supported by the Trump administration, challenges the ACA’s individual mandate and raises questions about the entire law’s survival.

If all or most of the law ultimately is struck down, it will have complex and far-reaching consequences and potentially eliminate many of the ACA provisions that would otherwise help some individuals avoid becoming uninsured due to the economic upheaval caused by the coronavirus pandemic.

For now, the ACA is the law of the land and is poised to help many people remain insured. However, access and affordability challenges remain for those with private insurance, including high deductibles, and some will be unable to qualify for Medicaid because they live in a state that has not expanded the program. Nationally, more than two million poor uninsured adults fall into the “coverage gap” that results from state decisions not to expand Medicaid, meaning their income is above current Medicaid eligibility but below the lower limit for Marketplace premium tax credits.

Gaps in private coverage remain as well, and deductibles and high coinsurance and copays are a hurdle for many and could lead to substantial out-of-pocket costs from a serious illness resulting from coronavirus infection. Additionally, balance billing from out of network claims—including surprise medical bills—can leave patients facing thousands in unexpected costs and do not count towards the annual maximum on out-of-pocket costs included in the ACA. A new analysis finds that nearly one in five (18%) patients hospitalized at in-network hospitals for pneumonia (one complication that can arise from COVID-19) incurred at least one out-of-network charge. Also, short-term health insurance and health sharing ministries are exempt from the ACA’s insurance standards and may not offer the comprehensive coverage that patients will need if they have complications from coronavirus. If affordability or coverage challenges lead to people delaying or forgoing care, it could have consequences for all of us.

However, despite the gaps, the ACA has led to improved access to care for millions in the United States. For a refresher on specific aspects of the law that will influence access and insurance coverage as our nation faces this new pandemic, see below for a link to a KFF resource on each topic.

- Medicaid expansion

- Individual Market Reforms, including marketplace subsidies and an end to medical underwriting

- Essential health benefit standard

- Dependent coverage up to age 26

- No lifetime or annual dollar limits

- Coverage of preventive services

Endnotes

P.F. Gruenwald et al., “Economic Research: COVID-19 Macroeconomic Update: The Global Recession Is Here And Now,” S&P Global (March 17, 2020).

No. 19-840, https://www.supremecourt.gov/search.aspx?filename=/docket/docketfiles/html/public/19-840.html. The case has been consolidated with Texas v. California, No. 19-1019, https://www.supremecourt.gov/search.aspx?filename=/docket/docketfiles/html/public/19-1019.html.