Medicaid Financing Cliff: Implications for the Health Care Systems in Puerto Rico and USVI

Introduction

This brief provides an overview of the status of the health care systems and Medicaid programs in Puerto Rico and the U.S. Virgin Islands (USVI) about one and a half years after the storms. The brief focuses on these challenges and includes KFF analysis of the implications for the territories’ Medicaid program finances, as most of the temporary federal Medicaid funds provided through the Affordable Care Act (ACA) and disaster relief are set to expire at the end of September 2019. The brief draws on earlier work as well as recent public reports and on-the-ground interviews with territory officials, providers, Puerto Rico health plans, and enrollees.1

Background

Puerto Rico and USVI have historically experienced a range of health, health coverage, and health care infrastructure disparities compared to the states. In Puerto Rico, the population of 3.3 million2 has higher rates of fair/poor health, heart attack/heart disease, diabetes, and infant mortality than the United States overall. The USVI population of 107,0003 has higher rates of diabetes and infant mortality compared to the United States overall. In addition, 47% of Puerto Rico’s total population is enrolled in Medicaid, 13 percentage points higher than the rate of the highest state (New Mexico at 34%). In USVI, more than half of the population is uninsured (30%) or enrolled in Medicaid (22%), compared to the uninsured rates of Puerto Rico (7%) and the rest of the United States (12%). Furthermore, Puerto Rico and USVI suffer from health care infrastructure that is still in recovery following the hurricanes as well as ongoing provider outmigration, which has worsened after the storms.

Prior to the 2017 hurricanes, Puerto Rico and USVI faced longstanding economic challenges, including high rates of debt, poverty, and unemployment. In response to the debt crisis in Puerto Rico, Congress passed the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) in June 2016 to allow Puerto Rico to restructure its debts and manage its revenues and expenditures. PROMESA created the Financial Oversight and Management Board (FOMB), which in part requires Puerto Rico’s government to submit a fiscal plan that gains the FOMB’s approval. USVI has also faced financial challenges, as its economy declined by over 30% between 2008 and 2016, accompanied by population loss and job loss in certain industries.4 The September 2017 hurricanes exacerbated these challenges by accelerating outmigration of residents and health care providers and destroying homes, schools, businesses, and other infrastructure.

Unlike states, Puerto Rico and USVI receive capped federal Medicaid funds and a fixed federal Medicaid matching rate that is lower than the rate they would receive if they were states. The 50 states and D.C. receive federal Medicaid funding on an open-ended basis, with a federal matching rate (federal medical assistance percentage, or FMAP) that varies based on state per capita income. In contrast, annual federal Medicaid funding for the territories is subject to a statutory cap with a fixed FMAP of 55%. If Puerto Rico and USVI were treated as states, their FMAPs would be the maximum allowable rate of 83%.5 The funding caps leave the territories with significantly less funding than they need to operate their Medicaid programs. For example, if not for the temporary funds, Puerto Rico’s capped federal funds in fiscal year 2018 would have covered approximately 13% of the cost of its program.6 Puerto Rico and USVI also base Medicaid eligibility on local poverty levels rather than the federal poverty level, leading to lower income eligibility thresholds than exist in the states. In Puerto Rico, recent transition to modified adjusted gross income (MAGI) Medicaid eligibility determination methods mandated by the ACA have affected some individuals’ eligibility for Medicaid and caused them to lose coverage.

The federal government made additional Medicaid funds available for all territories under the Affordable Care Act (ACA) and for Puerto Rico and USVI after the hurricanes under the Bipartisan Budget Act of 2018 (BBA), but most of these funds are scheduled to expire at the end of September 2019. The ACA allotment consists of $6.3 billion available between July 2011 and September 2019 and another $1 billion, provided in lieu of the territories creating their own health insurance exchanges, which expires at the end of December 2019. Of these combined $7.3 billion, Puerto Rico received the large majority ($6.3 billion), and USVI received approximately $300 million. The BBA’s hurricane relief funds included $4.8 billion for Puerto Rico and $142.5 million for USVI. These BBA funds do not require a local match and will also expire at the end of September 2019. The expiration of ACA and BBA funds would return the territories to their pre-ACA funding levels with the 55% FMAP up to the statutory cap, beyond which point territories are fully responsible for program costs.

Key Findings

What is the role of federal Medicaid funds in the territories’ health care systems?

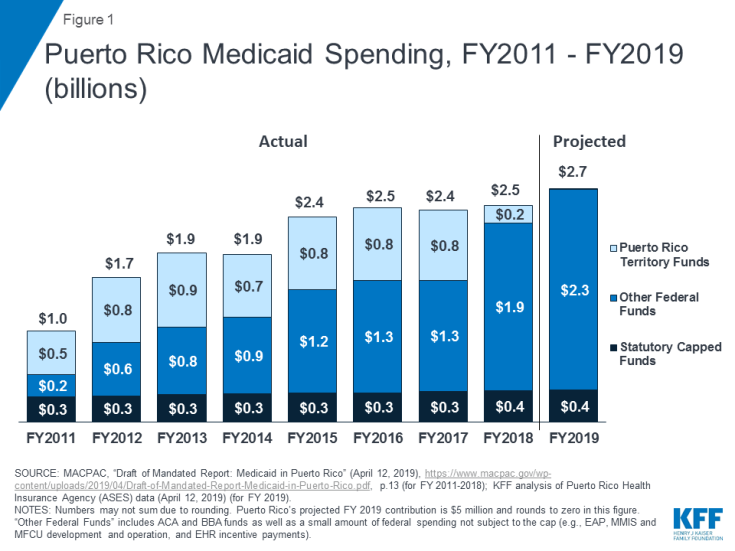

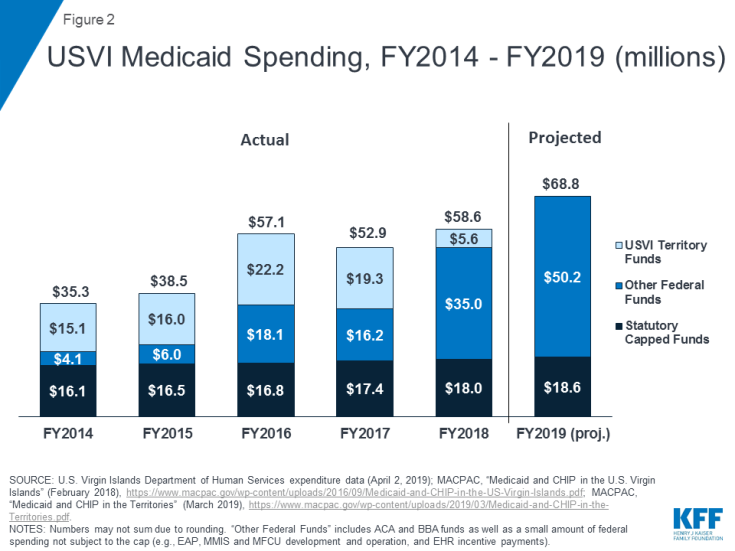

For both Puerto Rico and USVI, the ACA and BBA funds have been critical to supporting health care services and relieving pressure on local financing for Medicaid. Before receiving the federal funds, both territories had historically expended territory resources beyond the statutory cap to support their programs, placing strain on the local economies. Once ACA funds became available, the territories relied on these funds as a significant part of the federal support for their Medicaid programs (Figure 1; Figure 2). After the hurricanes hit in September 2017, the territories faced a spike in resident health care needs, loss of revenue with reduced tourism and economic activity, and damaged health care infrastructure. The BBA funds and temporary 100% FMAP thus provided crucial support for the territories’ Medicaid programs and health care systems, as constrained local resources made it difficult to finance the state share to access federal Medicaid dollars.

The territories have used temporary federal Medicaid funds from the ACA and BBA to expand and support coverage. Both Puerto Rico and USVI expanded Medicaid eligibility under the ACA, and enrollment increased further in the immediate aftermath of the hurricanes.7 In USVI, expanded Medicaid eligibility and outreach have more than doubled enrollment since 2013, to nearly 28,000 individuals as of March 2019.8 An estimated 20,000 individuals remain eligible but not enrolled in coverage.9 USVI has been conducting outreach to these individuals and trying to expand the use of presumptive eligibility to increase enrollment. While presumptive eligibility is effective in the short term, territory Medicaid officials and providers emphasized the need to ensure that individuals complete the full determination process to remain in the program and not lose coverage. Uninsured rates and uncompensated care burdens remain much higher in USVI compared to Puerto Rico, where Medicaid covers a larger share of the population.

Territory officials have also drawn on additional funds to support enhanced provider reimbursement rates, clinic capacity, and infrastructure improvements. Clinics in Puerto Rico rely heavily on Medicaid revenues, as do the safety net hospitals in USVI due to the territory’s high share of uninsured residents and corresponding high levels of uncompensated care. Medicaid makes up 51% of community health center revenues in Puerto Rico (compared to 45% in the United States overall), while federal Section 330 grants make up 31% (compared to 18%). With the additional federal funds, Puerto Rico officials have temporarily adjusted capitation rates to align more closely with Medicare rates, and USVI similarly increased provider reimbursement rates and improved recruitment activities, particularly for nurses. Higher reimbursement levels help to support salaries, additional clinic services, and infrastructure expansions. As a result, these increases also support the broader economy.

What is the status of the territories’ health care systems and delivery system reforms?

Even with additional federal Medicaid funding, territory health care infrastructure has still not fully recovered from the hurricanes, particularly in USVI. In Puerto Rico, infrastructure recovery issues are largely geographic, with the central island region and offshore islands of Vieques and Culebra facing the greatest challenges with provider availability and adequate facilities for dialysis and other services. In USVI, the hospitals have not returned to pre-storm capacity and are just beginning to rebuild. See Box 1 for more detail on the hospitals in USVI.

Box 1: Hospital Infrastructure Update in USVI

The main hospital on St. Thomas, Schneider Regional Medical Center, is operational for most services except for radiation oncology, as its damaged cancer center remains closed. However, Schneider’s average patient census has decreased by about 30% (from 65,000 to 45,000), and revenues are down by about 45% after the storms. The hospital still needs to transfer about 15-20 patients off-island daily to receive trauma, cancer, and cardiology services. After many delays, the hospital has received approval to move forward with a major long-term rebuilding of the hospital in its current location, which will occur in phases and is currently in its design phase.

Juan F. Luis Hospital on St. Croix suffered more extensive damage and is still awaiting a determination from FEMA about rebuilding. As of late February 2019, modular units designed to provide temporary emergency services and dialysis were nearing operational status after many delays. The modular units required expensive retrofitting and adjustments to receive certification that were difficult to complete with limited on-island resources. While dialysis units are operational and most patients have returned to St. Croix, dialysis patients still need other wrap-around services, including housing and transportation, for treatment to be successful.

Provider capacity remains a challenge in both Puerto Rico and USVI. The storms exacerbated long-standing issues with provider capacity in Puerto Rico and USVI. Due to the debt crisis and limited reimbursement before the hurricanes, provider outmigration has caused shortages in certain specialties as well as with nursing staff. The territories have tried to address these challenges by contracting with temporary staff, increasing reimbursement rates, improving local recruiting, maximizing use of certified medical assistants (in place of more expensive registered nurses and licensed practical nurses), and reforming licensing procedures. However, the territories’ inability to compete with the states on salary, limited availability of housing and schools, limited access to state-of-the-art health care infrastructure and technology, and uncertainty about the availability of federal funding support make it difficult to recruit and retain providers.

Mental health remains a critical area of need in Puerto Rico and USVI. Mental health in both territories remains a challenge, as increased post-storm needs put additional pressure on already-limited service capacity. In Puerto Rico, Medicaid enrollees described persistent post-hurricane anxiety and trauma along with long wait times for mental health referrals and appointments. USVI has limited psychiatric providers, with only one psychiatrist each on St. Thomas and St. Croix, no inpatient capacity for long-term mental health care, and limited outpatient services. A shortage of outpatient services makes it challenging to discharge patients with acute psychiatric episodes to a continuum of care in the community. In this environment, USVI behavioral health and substance use disorder services are operating under a governor’s consent decree. An advisory group meets weekly and includes providers and agencies such as the Departments of Health, Corrections, and Education. Improvement efforts include plans to find options for long-term services and to build a hospital-based behavioral health unit for transitional care. Clinics are working to expand access to mental health services through telehealth and use of licensed clinical social workers or physician assistants. Due to the major storm damage to USVI Department of Health facilities, other clinics have stepped in to address behavioral health needs.

Beyond mental health, the territories are experiencing other elevated health needs as well as demographic changes that could affect the size and profile of their Medicaid populations. Clinics in Puerto Rico reported exacerbation of the most common conditions they treat, particularly diabetes, cardiovascular disease, hypertension, and obesity. In USVI, these conditions are also among the common, as well as dental care needs, which are widespread as patients face a shortage of dentists participating in the territory’s Medicaid program. In Puerto Rico, recent trends and projections show an expected decline in Medicaid enrollment from 1.5 million to 1.2 million from 2017 to 2020 due to expiration of a delayed redetermination period, outmigration, economic recovery that may increase residents’ incomes enough to make them ineligible for Medicaid, transition to MAGI Medicaid eligibility determination methods, and some confusion stemming from the managed care reforms.10 Puerto Rico’s birth rate has also declined, with one Puerto Rico hospital that used to deliver over 300 babies a month reporting that 190 births now constitute a good month. Puerto Rico’s clinics also reported serving an increasingly elderly population and efforts to recruit more geriatric providers.

Providers and officials in both Puerto Rico and USVI described the need for broader health education. Providers indicated that many patients do not understand how to use preventive services and primary care or how to manage health conditions. Providers noted that more focus on health education could be necessary given the high prevalence of people suffering from obesity, diabetes, and dental caries. In Puerto Rico, the hospital that delivers the largest share of babies on the island reported working with the March of Dimes on patient education programs about prenatal and postnatal care. Some providers reported issues with patient compliance with treatment plans, due in part to limited capacity for case management activities as well as lack of patient education about need for follow-up. They described a focus on preventive and primary care and health literacy as some of the most important social determinants of health in their communities. In addition, some providers noted the high cost of fresh fruits and vegetables, contributing to preventable health conditions.

Against the backdrop of fiscal pressures and hurricane recovery efforts, both territories are engaged in delivery system reform efforts to address key access and financing issues. In Puerto Rico, managed care reforms, called Vital, rolled out in 2018 and aim to reduce health care spending and streamline administrative costs (Box 1). Reforms in USVI are broader than Medicaid and are designed to improve access and coordinated care. Many USVI reforms are occurring through various federal funding streams (e.g., grants from SAMHSA, CDC, and FEMA). These efforts include a new “Community Paramedicine Care” program for homebound patients, a Behavioral Health Steering Committee, and a care management working group. See Box 2 for more information on Puerto Rico’s managed care reforms.

Box 2: Managed Care Reforms in Puerto Rico

Managed care reforms in Puerto Rico include a transition from one in which one MCO operated in each of nine regions to the new system, called Vital. Under Vital, five MCOs compete for enrollees across the territory. Puerto Rico’s health insurance agency, ASES, promoted Vital as offering patients more plan options, improving access to providers through a territory-wide model, and lowering costs through competition and streamlined administration.

The managed care reforms are part of a larger set of reforms included in the fiscal plan that FOMB approved in October 2018, which imposes significant cuts to the Medicaid program. In March 2019, the FOMB revised the FY 2023 targets from $826 million to $671 million to avoid “undue hardship to the Medicaid population in the form of service reductions”; 11 however, the FOMB and Puerto Rico’s government continue discussions over the levels and implications of these targets. In addition to the transition to Vital, the fiscal plan calls for Medicaid cost containment measures such as reduced per member per month (PMPM) payments to MCOs; new care programs for high-cost, high-need (HCHN) enrollees; fraud and abuse reduction mechanisms; and provider fee reductions.12 Additional benefit cuts or increases in beneficiary copays could result if savings targets are not achieved.

Beginning with the start of open enrollment on November 1, 2018, Vital’s rollout in Puerto Rico has created challenges for MCOs. At the time of interviews for this report, patients were still able to move across plans after open enrollment ended on January 31, 2019. MCOs were uncertain of total capitation payments because they did not know which plans enrollees would choose and to which rate cells enrollees would be assigned. Because of this uncertainty, MCOs were unable to determine provider reimbursement rates. MCOs also described challenges with constructing territory-wide provider networks after having operated in one limited region for years and dedicating resources to build programs in new regions that may only have a handful of enrollees. MCOs reported feeling constrained by Vital’s 92% medical loss ratio (MLR) given requirements to expend resources on new care models for their HCHN enrollees; while the HCHN program may help to improve care and reduce costs over time, it requires upfront investments. More broadly, MCOs expressed concerns about goals to reduce costs, since PMPM rates are already low, and about meeting high patient expectations tied to the reforms.

Providers and enrollees have also experienced challenges with the rollout of Vital. For providers, these challenges included dealing with multiple MCOs, rates, and HCHN care models. Without knowing MCO reimbursement rates, it was difficult for clinics and hospitals to recruit clinicians. Providers also described uncertainty about their patients’ coverage status, and smaller providers, some without sophisticated IT systems, reported difficulty collecting patient encounter data (used by ASES to assign patients to the 37 new rate cells). Some smaller clinics banded together to address issues with contracting, reimbursement, and patient classifications. Enrollees expressed confusion related to auto-enrollment in new plans, ways to change plans to maintain existing providers, and new processes for obtaining referrals for specialist services or accessing prescriptions. Some enrollees may have lost their Medicaid benefits, thinking that choosing a new plan replaced the need to complete the redetermination process. ASES reported responding to these challenges by standardizing referral and prior authorization processes, streamlining eligibility redetermination processes, and making certain rate guarantees during the transition.

What are the potential consequences of no federal action to address the expiration of temporary federal Medicaid funds?

Expiration of temporary federal Medicaid funds is likely to result in fiscal pressures or substantial deficits for territories’ budgets. ACA and BBA funds have supported territory budgets and coverage, so expiration of these funds will result in significant fiscal gaps. Puerto Rico officials project that the return to traditional financing after September 2019 would mean that the territory’s federal funds for FY 2020 would run out by March or April 2020.13 Both territories have indicated that it would be impossible to use territory resources to make up for the lost federal funds. In anticipation of reduction in federal funds and the need to mitigate increases in local funding increases, the FOMB’s fiscal plan calls for spending reductions and reforms in Puerto Rico (see Box 2).

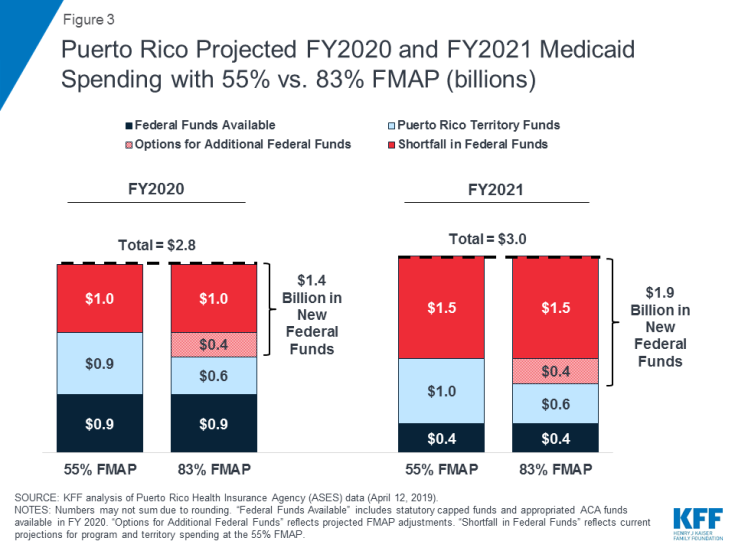

Projected FY 2020 and FY 2021 Medicaid expenditures show that, without additional federal funds, Puerto Rico and USVI would face funding shortfalls of one-third to one-half of program costs. For example, if Puerto Rico’s FMAP returned to 55% in October 2019 and the territory received no additional federal funds beyond the statutory cap and ACA funds remaining between September and December 2019, available funds would fall short of projected program costs by $1 billion in FY 2020 (Figure 3). In FY 2021, after all supplemental federal funds are set to expire, Puerto Rico would experience a shortfall of $1.5 billion, or half of projected program costs. In USVI, projected FY 2020 expenditures show that a return to traditional financing with the 55% FMAP would leave the territory with an approximately $31.3 million shortfall, about 40% of projected program costs (Figure 5).

Expiration of federal funds could lead to severe coverage losses, benefit cuts, and increases in uncompensated care. Territory officials expressed fear that they could not make up for the loss in expired federal funds with local funds, which would have severe implications for coverage, benefits, and providers. Some territory officials described the potential effects as “devastating,” “catastrophic,” and “scary.” MACPAC estimates project that, without additional federal funding, Puerto Rico would need to shrink total Medicaid enrollment of about 1.2 million by roughly one-third to one-half, depending on territory contributions,14 and territory officials predict large increases in the uninsured population. MACPAC estimates further show that even complete elimination of Puerto Rico’s coverage of dental services and prescription drugs (with drugs accounting for the largest share of the territory’s program costs) would not generate enough program savings to make up for the loss in federal funds.15 In USVI, the funding expiration could require the territory to cut up to 18,000 enrollees from a current member population of nearly 28,000.16 Across both territories, providers worry about loss of Medicaid revenues and increases in uncompensated care should the federal funds expire. For the safety net hospitals in USVI, funding expiration would be mean more uncompensated care and emergency room visits, straining their resources, threatening solvency, and risking potential hospital closure.

For Medicaid enrollees, loss of coverage would result in restricted access to health care services as well as financial instability. Medicaid enrollees in both territories described the importance of the program for their lives, health, and financial stability. Although some enrollees described challenges related to provider shortages, appointment wait times, and confusing referral procedures, they described Medicaid as “vital” and “the only option” for their health care coverage. Many enrollees in both Puerto Rico and USVI cited prescription drug access as one of their most critical needs and benefits of Medicaid coverage. Other services that enrollees cited as reasons for needing Medicaid coverage included mental health, screenings and preventative services, specialist and lab services, and emergency care. Some enrollees had heard rumors of potential funding cuts to the program and stated that, if they were to lose coverage as a result, they would be forced to take steps such as taking on a third job, paying health care costs out of pocket, or trying to use natural remedies. They noted that coverage loss would most seriously affect the elderly and people with health conditions, as those individuals often rely on Medicaid for management of chronic conditions.

Territory Medicaid agencies acknowledged the need for contingency plans in the event that federal funds expire, noting that these plans can lead to anxiety among enrollees and providers and divert focus from the implementation of new initiatives. Similar to the experience that many states encountered with the expiration of funds for CHIP in 2018, Medicaid agencies would need to expend administrative energy on developing notices to restrict benefits or coverage many months in advance of the funds expiring. These efforts could create confusion for enrollees, providers, and plans in Puerto Rico and increase outmigration, which would be unnecessary if Congress ultimately appropriates new funds. In the midst of this uncertainty, MCOs are still working to invest in their patient populations and implement programs for HCHN members. MCOs were working closely with Puerto Rico’s government to develop plans for the potential scenario in which they face insufficient funds to finance service delivery. In USVI, this planning for funding expiration runs counter to ongoing efforts to conduct enrollment outreach to those currently eligible but not participating in Medicaid.

What are the options for federal action?

Congress’s options for addressing the Medicaid financing issues in Puerto Rico and USVI (as well as the other territories) include raising or eliminating the funding cap and maintaining or increasing the FMAP. Raising the funding cap could include an option to add an additional allotment similar to the funding provided through the ACA or BBA. An increase in the FMAP could mean increasing the statutory FMAP or allowing the FMAP to be calculated based on per capita income as it is in the states. An 83% FMAP is the statutory maximum allowable FMAP and would reflect the lower per capita incomes in the territories. Congress would also decide whether additional federal financing is permanent or time-limited. The governors from the territories testified in front of the Senate Natural Resources Committee in February 2019 on the need for more adequate and permanent federal Medicaid support, describing the potentially “catastrophic damage” of the September 2019 fiscal cliff.

Specific options for Puerto Rico include proposed federal legislation as well as a request from the Governor. On May 1, 2019, Puerto Rico Governor Ricardo Rosselló sent a formal request to Congress for $15.1 billion in Medicaid funds over five years, subject to an 83% FMAP.17 In support of his request, Gov. Rosselló laid out five sustainability measures needed to stabilize Puerto Rico’s Medicaid program and health care system, noting that the requested funds would help implement these measures.18 These measures include provider retention, Hepatitis C medication therapy coverage, support for Puerto Rico’s hospitals, Medicare Part B premium coverage for dual eligible enrollees, and eligibility changes to address differences between local and federal poverty levels.19 Rosselló’s request emphasizes the need for multi-year funding to provide stability in Puerto Rico’s health care system, which would allow policymakers to work on longer-term financing reforms that could end the structural differences between state and territory Medicaid financing and reach parity in terms of uncapped funding. In addition, Rep. Jenniffer González-Colón of Puerto Rico introduced H.R. 2306, which would permanently eliminate the 55% FMAP starting in FY 2020 and increase the cap to $2.65 billion for both FY 2020 and FY 2021.

Other proposed legislation would address Medicaid financing for all five of the U.S. territories, including American Samoa, the Commonwealth of the Northern Mariana Islands, and Guam. For example, H.R. 1354, the Territories Health Equity Act of 2019, would provide a longer-term or permanent option to sunset the Medicaid financing cap and eliminate the 55% FMAP starting in FY 2020. Under H.R. 1354, the territories would receive uncapped federal Medicaid funds subject to an FMAP calculated as it is for states. Congress could also consider more narrow options to address the funding shortfall and/or FMAP, as well as other options to further increase federal support.

Estimates of federal options for puerto rico

Increasing federal funding to address the shortfall in program funding that would occur if financing returned to the statutory cap at a 55% FMAP, plus an increase in the FMAP to 83%, could provide $1.9 billion in additional federal funds to Puerto Rico in FY 2021. Projected FY 2020 and FY 2021 Medicaid expenditures show that, without additional federal funds, Puerto Rico would face funding shortfalls of $1 billion in FY 2020 and $1.5 billion in FY 2021, half of projected program costs. Estimates of these shortfalls reflect current projections for program and territory spending at the 55% FMAP. In addition to addressing the shortfalls with new federal funds, increasing the FMAP to 83%, the rate that Puerto Rico would receive if it were a state, would provide additional federal funds and reduce the required territory contributions. Addressing the shortfall in addition to increasing the FMAP to 83% would provide Puerto Rico with $1.4 billion in new federal dollars in FY 2020 and $1.9 billion in FY 2021 (Figure 3).

Figure 3: Puerto Rico Projected FY2020 and FY2021 Medicaid Spending with 55% vs. 83% FMAP (billions)

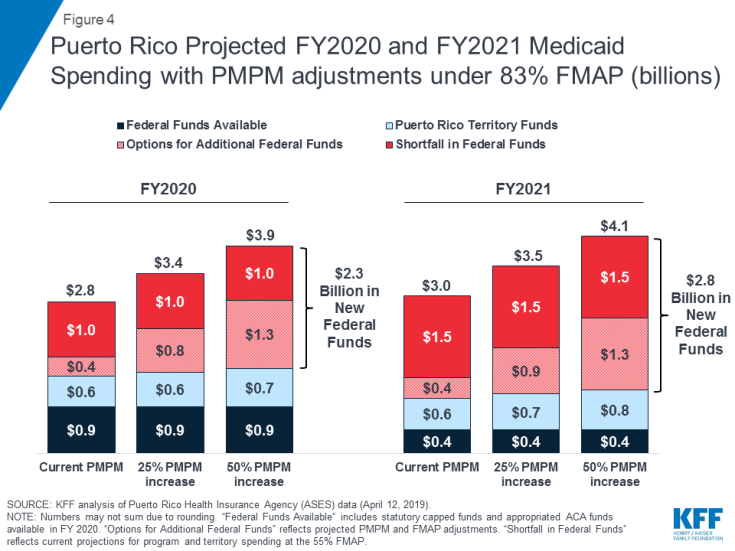

In addition to new federal funds to address the shortfalls and increase the FMAP, Congress could consider providing additional federal funds to enable Puerto Rico to address gaps in reimbursement or benefits. MACPAC analyses show that current per-enrollee spending in Puerto Rico is considerably lower than comparable spending in the states; Puerto Rico would need to increase its spending by 56% to match the per-enrollee spending of the lowest-spending state.20 With sufficient federal funding, Puerto Rico could increase its per-enrollee spending to improve low provider reimbursement rates and access to certain services or prescriptions such as drugs for treatment of Hepatitis C. Such changes would result in higher PMPM spending. KFF analysis of data from ASES and MACPAC shows that a 50% increase in the PMPM at an 83% FMAP would provide $2.8 billion in new federal funds in FY 2021 ($1.5 billion to address the shortfall in maintaining the current program at the 55% FMAP and an additional $1.3 billion to raise the FMAP and increase PMPM spending) (Figure 4). Addressing changes in eligibility or other program changes could require additional federal funding.

Figure 4: Puerto Rico Projected FY2020 and FY2021 Medicaid Spending with PMPM adjustments under 83% FMAP (billions)

Estimates of federal options for USVI

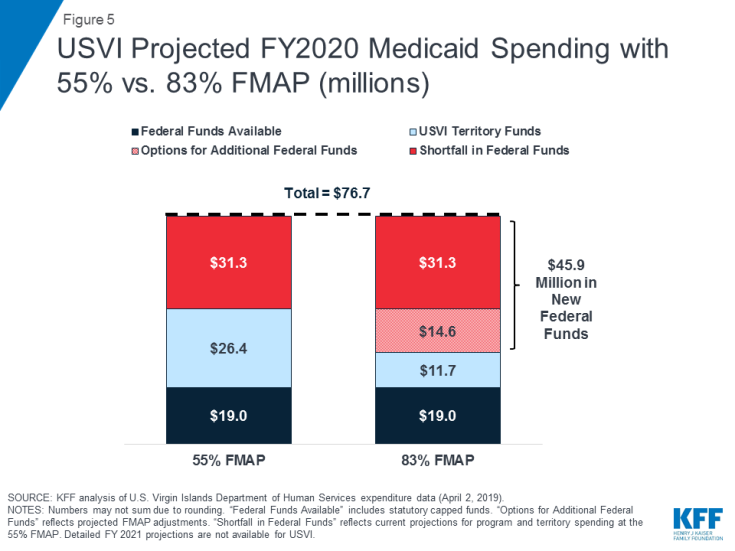

Similar options to increase federal financing and the FMAP are available for USVI. In USVI, projected FY 2020 expenditures show that a return to traditional financing with the 55% FMAP and the statutory cap would leave USVI with an approximately $31.3 million shortfall, about 40% of projected program costs. Increasing the FMAP to 83% could require $45.9 million in federal funds above currently appropriated levels ($14.6 million more than the baseline projected shortfall) (Figure 5). Similar to estimates in Puerto Rico, additional federal support beyond addressing the shortfall and the 83% FMAP could help the territory address provider reimbursement rates or expand Medicaid benefits.

What comes next?

As of early May 2019, territory elected officials were pursuing legislation to support disaster relief and the Puerto Rico Nutrition Assistance Program (NAP), for which federal funding expired at the end of March 2019. Like its Medicaid program, Puerto Rico’s NAP differs from states’ Supplemental Nutrition Assistance Programs (SNAP) in that NAP is a capped benefit and relies on congressional appropriations. Approximately one-third of Puerto Ricans are enrolled in NAP,21 and Puerto Rico started cutting benefits for these beneficiaries in early March as funding began to lapse.22 Funding for NAP has been included in the broad disaster relief House and Senate bills under consideration, but proposals have differed on the level of disaster recovery funds for Puerto Rico beyond NAP. When Congress returned from recess in May 2019, members continued debate over disaster relief, as a new Senate bill included $300 million in additional funds to Puerto Rico. The disaster relief bills do not include provisions on Medicaid financing.

If Congress does not address the Medicaid financing cliff, Puerto Rico and USVI will face severe funding shortfalls. Among Congress’s options for action is Governor Rosselló’s request for five years of increased federal funding with an 83% FMAP, as well as consideration of longer-term or permanent options such as H.R.1354, the Territories Health Equity Act of 2019. Congress could also consider more narrow options to address the funding shortfall and/or FMAP, as well as other options to further increase federal support.

Conclusion

As Puerto Rico and USVI continue to rebuild from the September 2017 hurricanes that devastated their economies and health care systems, the scheduled September 2019 expiration of the majority of temporary federal Medicaid funds could cause significant funding shortfalls that affect Medicaid coverage and residents’ access to health care services. Options for Congress to address the Medicaid financing issues in Puerto Rico and USVI include raising or eliminating the cap on financing and maintaining or increasing the FMAP. Territory elected officials and members of Congress are considering policy proposals to avert the Medicaid fiscal cliff and stabilize territory Medicaid programs in the short term while addressing longer-term permanent solutions to Medicaid financing issues. In the interim, however, uncertainty over funding contributes to instability in the health care system by requiring administrative resources to establish contingency plans, creating confusion for providers and enrollees, and limiting the territories’ abilities to move forward with complex delivery system reforms. While the expiration of the disaster funding is unique to Puerto Rico and USVI, the other U.S. territories (American Samoa, the Commonwealth of the Northern Mariana Islands, and Guam) are also facing the expiration of the ACA funds. As such, Medicaid financing reforms that examine issues around the cap and the FMAP could be considered for all of the territories.