2024 Employer Health Benefits Survey

Section 2: Health Benefits Offer Rates

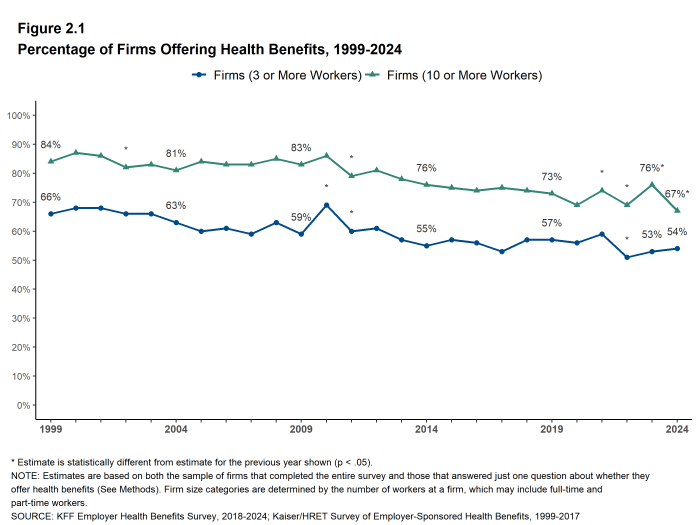

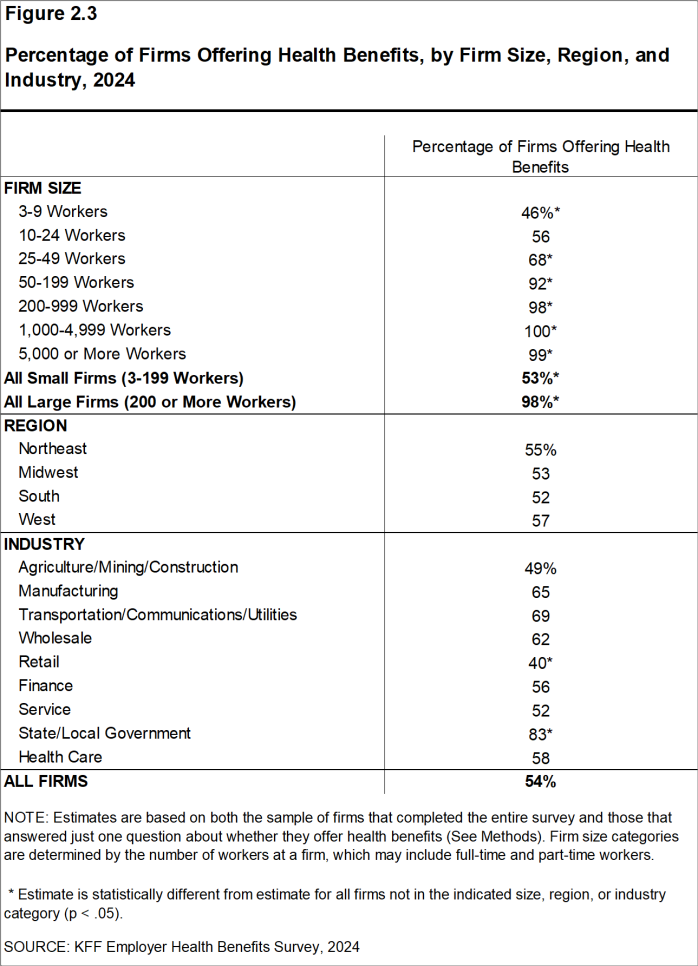

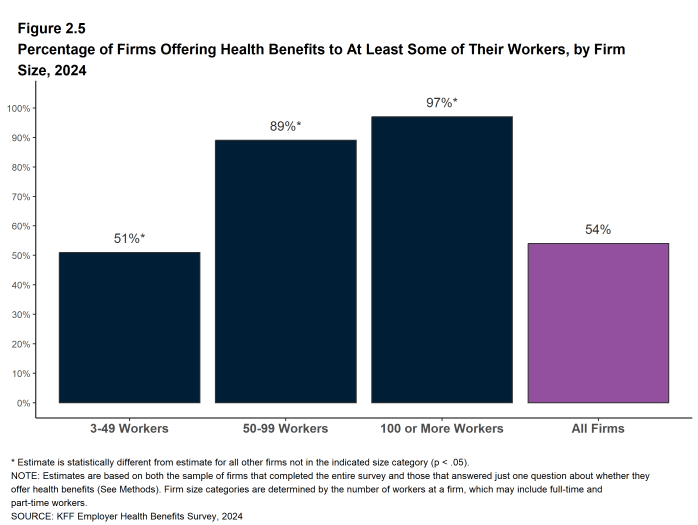

Nearly all (98%) firms with 200 or more workers offer health benefits to at least some workers, while just around one-half (53%) of smaller firms do so. The percentage of all firms offering health benefits in 2024 (54%) is similar to both the percentage of firms offering health benefits last year (53%), and five years ago (57%).

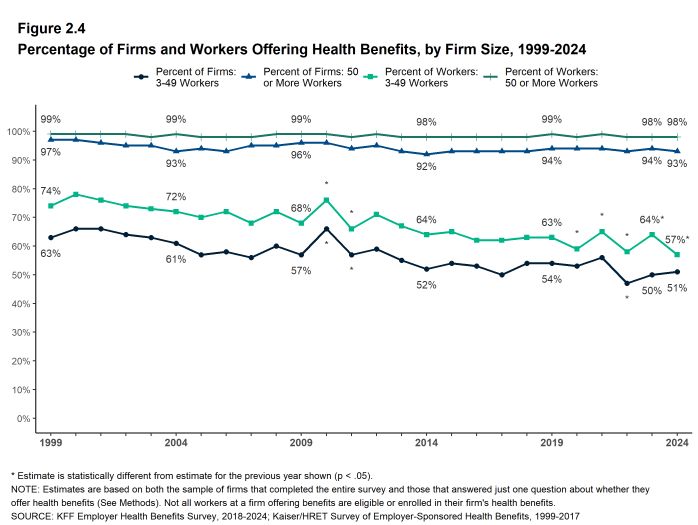

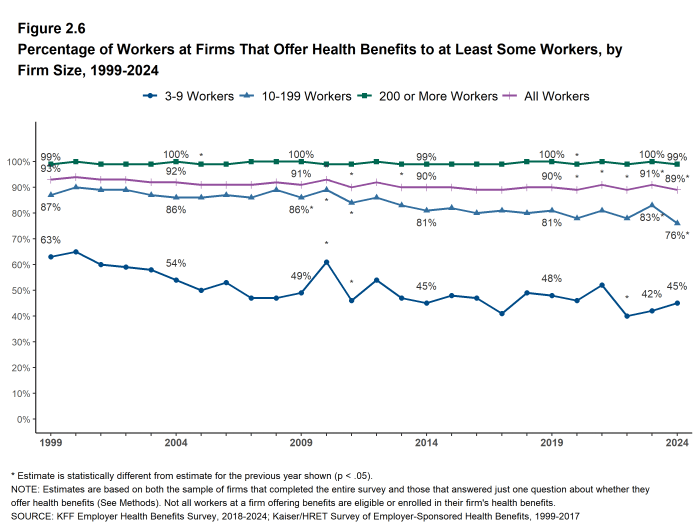

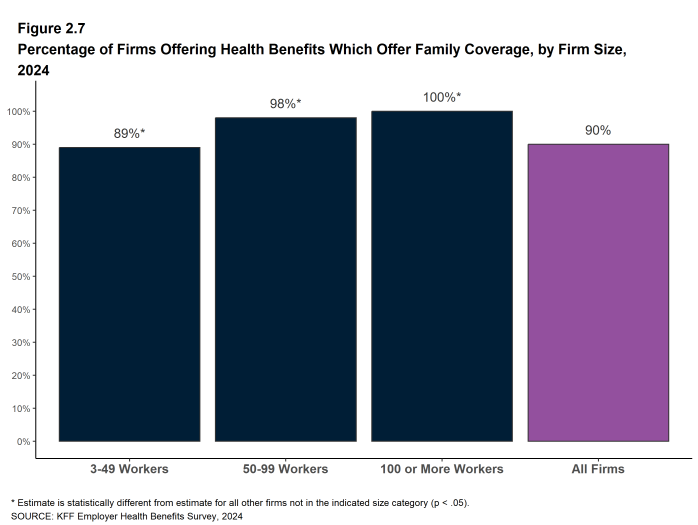

Most firms are very small, so the considerable fluctuation we see across years in the small firm offer rate drives fluctuations in the overall offer rate. However, most workers work for larger firms, where offer rates are high and much more stable. Over ninety percent (93%) of firms with 50 or more workers offer health benefits in 2024; this percentage has remained consistent over the last 10 years. Overall, 89% of workers at firms with 3 or more workers are employed at a firm that offers health benefits to at least some of its workers. Almost all (90%) firms that offer health benefits offer both single and family coverage.

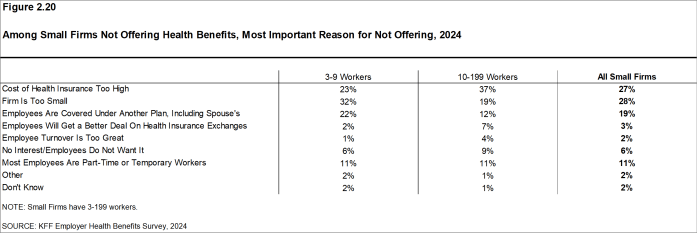

Small firms not offering health benefits say the most important reasons they do not offer coverage are that “the firm is too small” or that “the cost of insurance is too high”.

FIRM OFFER RATES

- In 2024, 54% of firms offer health benefits, similar to the percentage last year (53%) [Figure 2.1].

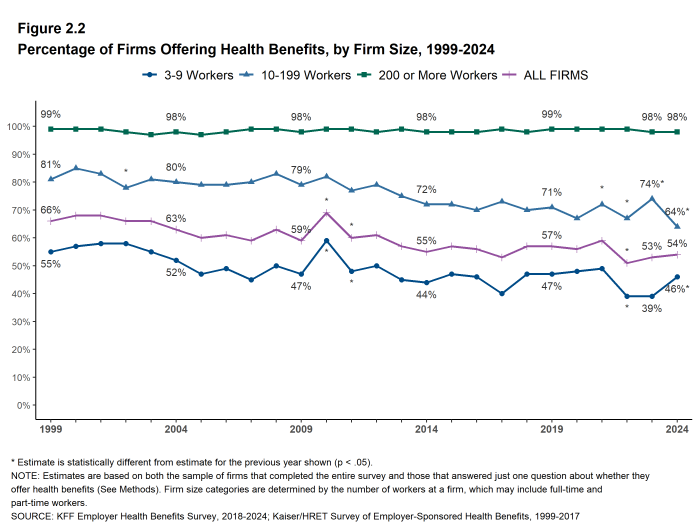

- The smallest firms are least likely to offer health insurance: 46% of firms with 3-9 workers offer coverage, compared to 56% of firms with 10-24 workers, 68% of firms with 25-49 workers, and 92% of firms with 50-199 workers [Figure 2.3].

- Since most firms in the country are small, variation in the overall offer rate is driven largely by changes in the offer rates of the smallest firms (3-9 workers) offering health benefits. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and [Figure M.5].

- Only 51% of firms with 3-49 workers offer health benefits to at least some of their workers, compared to 93% of firms with 50 or more workers [Figure 2.5].

- Because most workers are employed by larger firms, most workers work at a firm that offers health benefits to at least some of its employees. Eighty-nine percent of all workers are employed by a firm that offers health benefits to at least some of its workers [Figure 2.6].

Figure 2.5: Percentage of Firms Offering Health Benefits to at Least Some of Their Workers, by Firm Size, 2024

OFFERS TO SPOUSES AND DEPENDENTS

- Almost all firms offering health benefits offer family coverage; in 2024, nearly all large firms and 90% of smaller firms offer family coverage [Figure 2.7].

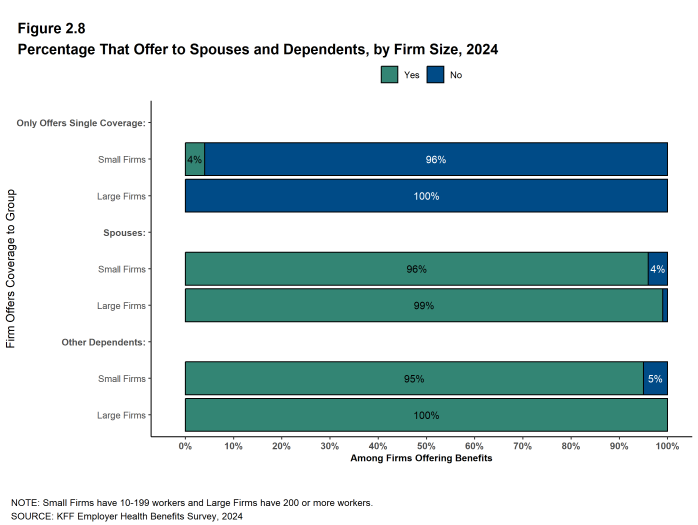

- The vast majority of firms with 10 or more workers offering health benefits offer to spouses and dependents, such as children. Ninety-six percent of firms with 10 to 199 workers and 99% of larger firms offering health benefits offer coverage to spouses. These percentages are similar to the percentages in 2023 [Figure 2.8].

- Ninety-five percent of firms with 10 to 199 workers and 100% of larger firms offering health benefits offer coverage to dependents other that spouses, such as children. These percentages are similar to the percentages in 2023 [Figure 2.8].

- Four percent of firms with 10 to 199 workers offering health benefits offer only single coverage to their workers, similar to the percentage (5%) last year [Figure 2.8].

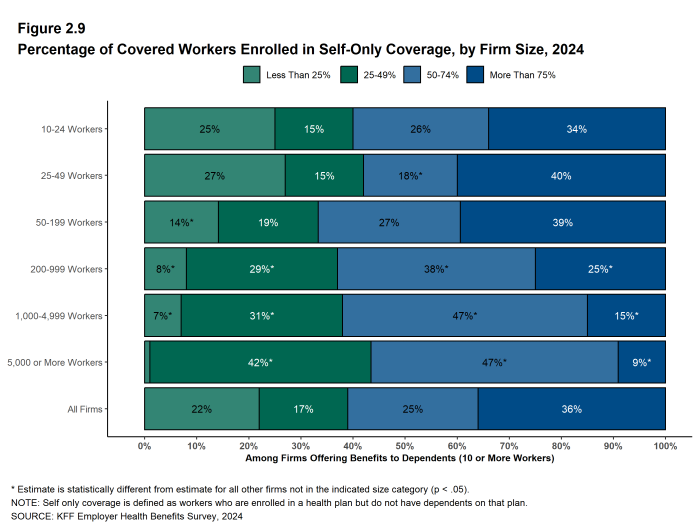

- Even when family coverage is offered, some workers may elect to enroll in self-only coverage, either because they do not have eligible dependents, or their family members have other coverage options. Among firms with 10 to 199 workers who offer coverage to dependents, 35% of firms report that more than three-quarters of their covered workers enroll in self-only coverage, compared to 23% at larger firms. Among firms offering health benefits to dependents with 5,000 or more workers, 9% of firms report that more than three-quarters of their covered workers enroll in self-only coverage [Figure 2.9].

Figure 2.7: Percentage of Firms Offering Health Benefits Which Offer Family Coverage, by Firm Size, 2024

PROVISIONS TO ENCOURAGE ENROLLMENT IN OTHER COVERAGE

Some firms have provisions to encourage workers or their spouses forgo enrolling in coverage or to choose other coverage when it is available.

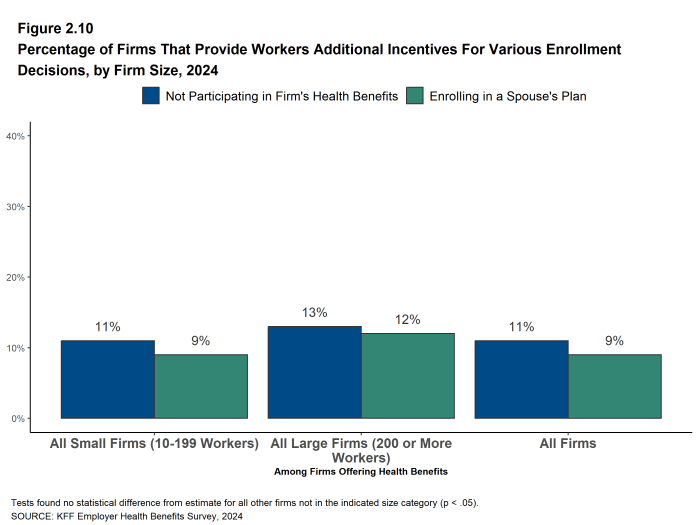

- Among firms with 10 or more workers offering coverage, 11% provide additional compensation or benefits to workers if they choose not to enroll in the firm’s health plan and 9% provide additional compensation or benefits to workers who choose to enroll in a spouses health plan [Figure 2.10].

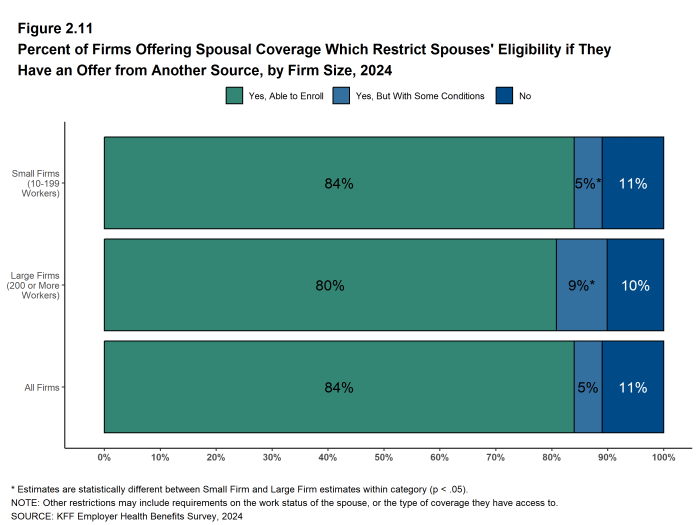

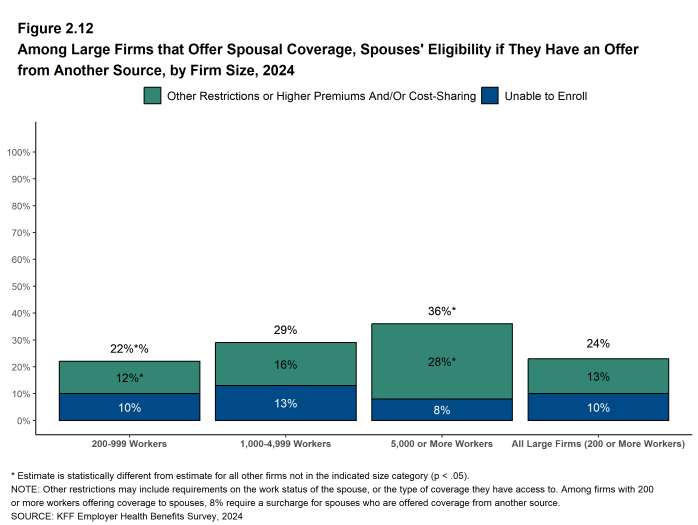

- Among firms with 200 or more workers offering coverage to spouses, 10% do not allow the spouse to enroll if they are offered health insurance from another source, 13% place conditions on spouses wishing to enroll, such as limiting plan choice, or requiring a surcharge for enrolling spouses if they are offered coverage from another source [Figure 2.12]. Among firms with 200 or more workers offering coverage to spouses, 8% require a surcharge for spouses who are offered coverage from another source. In total, 24% of firms with 200 or more workers offering coverage to spouses place a restriction on eligibility or require a surcharge for spouses who have an offer from another source [Figure 2.12].

Figure 2.10: Percentage of Firms That Provide Workers Additional Incentives for Various Enrollment Decisions, by Firm Size, 2024

Figure 2.11: Percent of Firms Offering Spousal Coverage Which Restrict Spouses’ Eligibility If They Have an Offer From Another Source, by Firm Size, 2024

PART-TIME WORKERS

Among firms offering health benefits, relatively few offer benefits to part-time workers.

The Affordable Care Act (ACA) defines “full-time” workers as those who work an average of at least 30 hours per week, and “part-time” workers as those who work fewer than 30 hours. The employer shared responsibility provision of the ACA requires that firms with at least 50 full-time equivalent employees offer most of their full-time employees coverage that meets minimum standards or be assessed a penalty.10

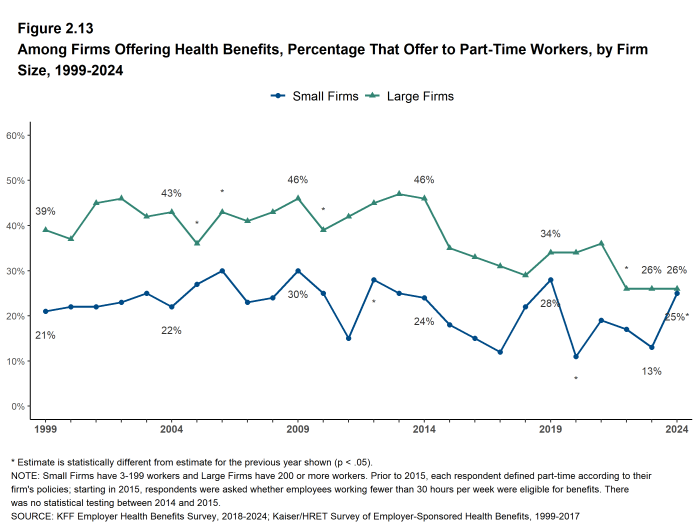

Beginning in 2015, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours per week. The question did not previously include a definition of “part-time.” For this reason, historical data on part-time offer rates are shown, but we did not test whether the differences between 2014 and 2015 were significant. Many employers use multiple definitions of “part-time” – one for compliance with legal requirements, and another for internal policies and programs.

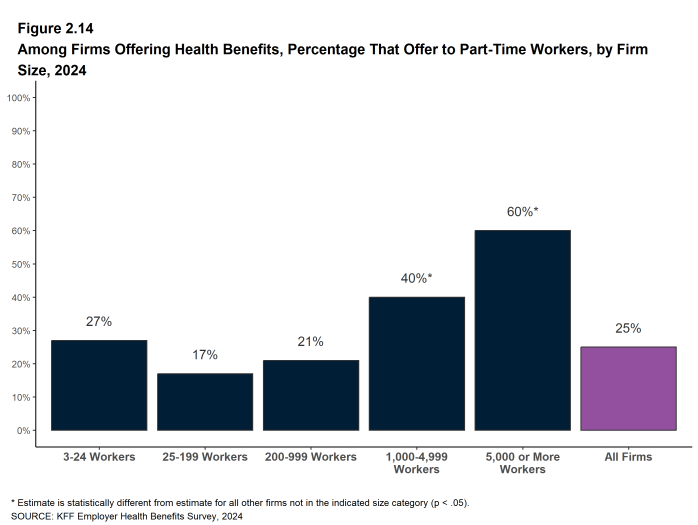

- Twenty-six percent of large firms that offer health benefits in 2024 offer health benefits to part-time workers, the same percentage that did so in 2023 [Figure 2.13]. The share of large firms offering health benefits to part-time workers increases with firm size [Figure 2.14].

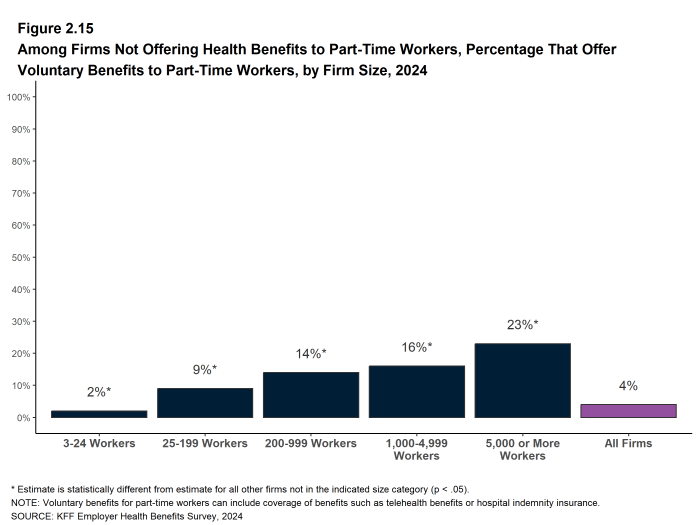

Many firms offer voluntary benefits to their workers, separate from coverage provided through their health plans. These plans can help with costs that are not covered by the health plan, or provide additional financial assistance if an enrollee is hospitalized or for specialized services such as telehealth. Employers might contribute toward the cost of these benefits, or employees might pay the entire cost. Some employers extend coverage of voluntary benefits to part-time workers who are not enrolled in the firm’s health plans. In 2024, 3% of small firms and 14% of large firms not offering coverage to part-time workers offered them a voluntary benefit [Figure 2.15].

Figure 2.13: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 1999-2024

Figure 2.14: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 2024

ICHRA AND ASSISTING EMPLOYEES WITH PURCHASING COVERAGE IN THE NON-GROUP MARKET

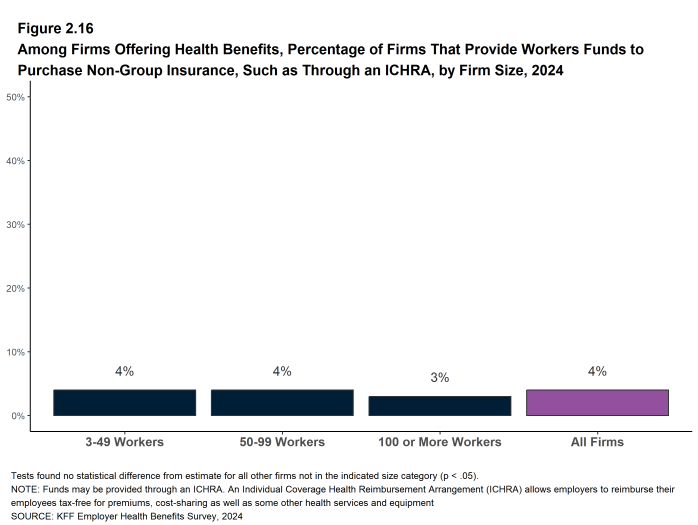

Some employers provide funds to some or all of their employees to help them purchase coverage in the individual (“non-group”) market. Employers that do not otherwise offer health benefits may offer these funds as an alternative to offering a group plan. Additionally, employers that offer a group plan to some employees may use this approach for other types or classes of workers, such as part-time employees. One way an employer can provide tax-preferred assistance for employees to purchase non-group coverage is through an Individual Coverage Health Reimbursement Arrangement, or ICHRA. Both employers that offer and those that do not offer health benefits were asked if they provide funds to any employee to purchase non-group coverage.

- Four percent of firms offering health benefits, and 7% of firms not offering health benefits, offered funds to one or more of their employees to purchase non-group coverage in 2024 [Figure 2.16].

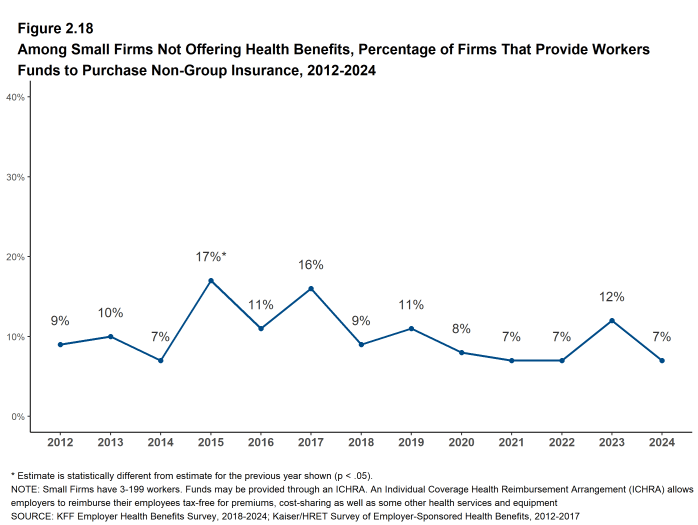

- Among small firms not offering health benefits, 7% offered funds to one or more of their employees to purchase non-group coverage, a similar percentage (12%) as last year [Figure 2.18].

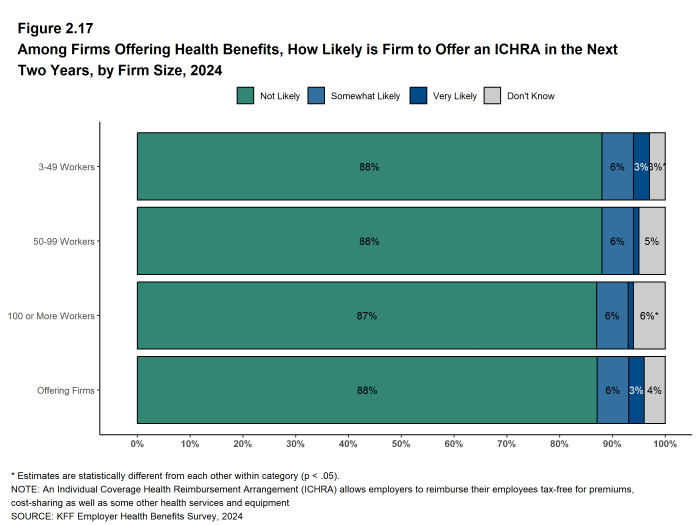

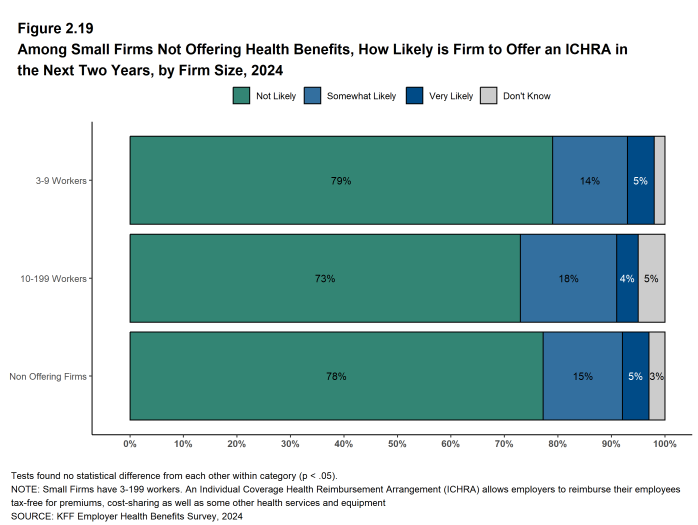

- Among firms offering health benefits that do not offer funds to any employees to purchase non-group coverage in 2024, 3% say they are “very likely” and an additional 6% are “somewhat likely” to offer an ICHRA to at least some employees in the next two years [Figure 2.17]. Among small firms not offering health benefits that do not offer funds to any employees to purchase non-group coverage in 2024, only 5% say they are “very likely” and an additional 15% say they are “somewhat likely” to offer an ICHRA to at least some employees in the next two years [Figure 2.19].

Figure 2.16: Among Firms Offering Health Benefits, Percentage of Firms That Provide Workers Funds to Purchase Non-Group Insurance, Such As Through an ICHRA, by Firm Size, 2024

Figure 2.17: Among Firms Offering Health Benefits, How Likely Is Firm to Offer an ICHRA in the Next Two Years, by Firm Size, 2024

Figure 2.18: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Provide Workers Funds to Purchase Non-Group Insurance, 2012-2024

FIRMS NOT OFFERING HEALTH BENEFITS

- The survey asks firms that do not offer health benefits several questions, including whether they have offered insurance or shopped for insurance in the recent past, what their most important reasons for not offering coverage are, and their opinion on whether their employees would prefer an increase in wages or health insurance if additional funds were available to increase their compensation. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms only.

- The “firm is too small” and the “cost of insurance is too high” are the most common reasons small firms cite for not offering health benefits. Among small firms asked about the most important reason for not offering health benefits, 28% say the “firm is too small,” 27% say the cost of insurance is too high, 19% say their “employees are covered under another plan, including coverage on a spouse’s plan” and 6% say their “employees are not interested.” A small share (3%) of small firms indicate that they do not offer health benefits because they believe employees will get a better deal on the health insurance exchanges [Figure 2.20].

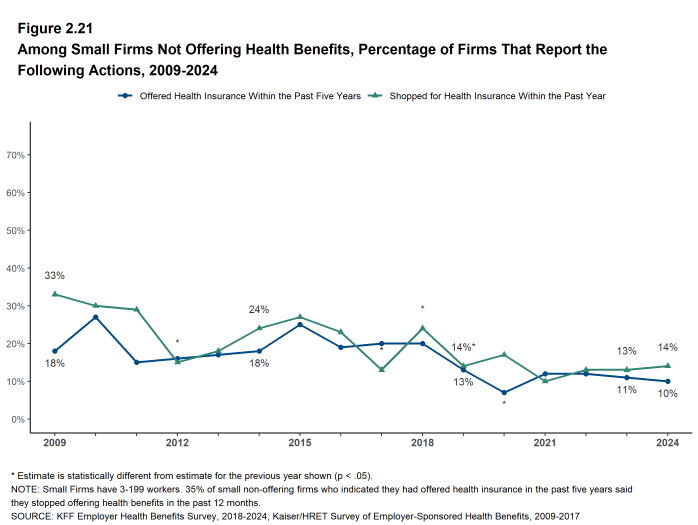

- Some small non-offering firms have either offered health insurance in the past five years or shopped for health insurance in the past year.

- Ten percent of small non-offering firms have offered health benefits in the past five years, similar to the percentage reported last year [Figure 2.21]. Among these small non-offering firms, 35% stopped offering coverage within the past year.

- Fourteen percent of small non-offering firms have shopped for coverage in the past year, the same as the percentage last year (13%) [Figure 2.21].

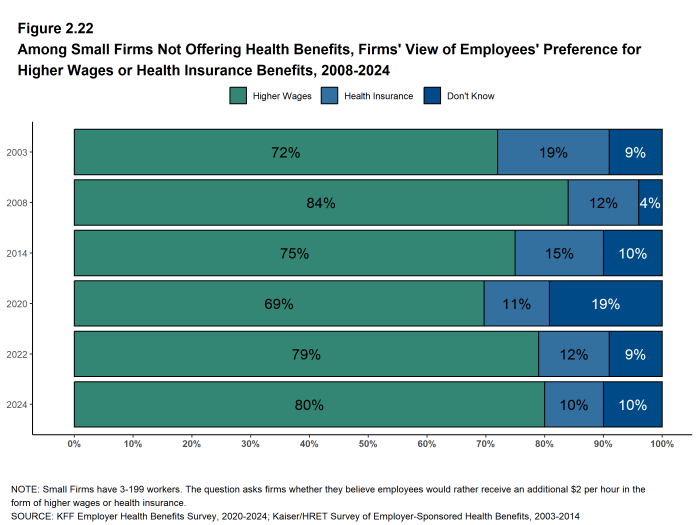

- Eighty percent of small firms not offering health benefits agreed with the statement that their employees would prefer a two dollar per hour increase in wages rather than health insurance [Figure 2.22].

Figure 2.20: Among Small Firms Not Offering Health Benefits, Most Important Reason for Not Offering, 2024

Figure 2.21: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Report the Following Actions, 2009-2024

- Employer Responsibility Under the Affordable Care Act. KFF. https://www.kff.org/infographic/employer-responsibility-under-the-affordable-care-act/.↩︎