Problems Getting Care Due to Cost or Paying Medical Bills Among Medicare Beneficiaries

While health care costs have long been a top concern for Americans, concerns about out-of-pocket costs have intensified due to the recent outbreak of coronavirus disease, with more than half of Americans saying saying they are worried they will not be able to afford testing or treatment for COVID-19 if they need it. Policymakers have recently taken steps to address these concerns by requiring public programs, including Medicare, and private insurers to cover the cost of coronavirus testing and testing-related services, but patients could still face significant costs for treatment. While some insurers have announced that they plan to waive cost sharing for COVID-19-related treatments, this is not required.

There is ongoing discussion as to whether Congress should waive COVID-19 treatment costs. To inform these discussions, this analysis examines the extent of health care cost-related problems among Medicare beneficiaries. Due to their older age and higher likelihood of having serious medical conditions than younger adults, virtually all Medicare beneficiaries are at greater risk of becoming seriously ill if they are infected with the new coronavirus that causes COVID-19. Our analysis is based on a composite measure that includes problems getting care due to cost, delays seeking care due to cost, and problems paying medical bills among people with Medicare (see Methods for detail on data and methods). While Medicare provides comprehensive coverage of health care services for 60 million people, beneficiaries can incur out-of-pocket costs for premiums, deductibles, and cost-sharing requirements for covered services, including prescription drugs, and costs for services that Medicare does not cover, including long-term services and supports and dental services.

Findings

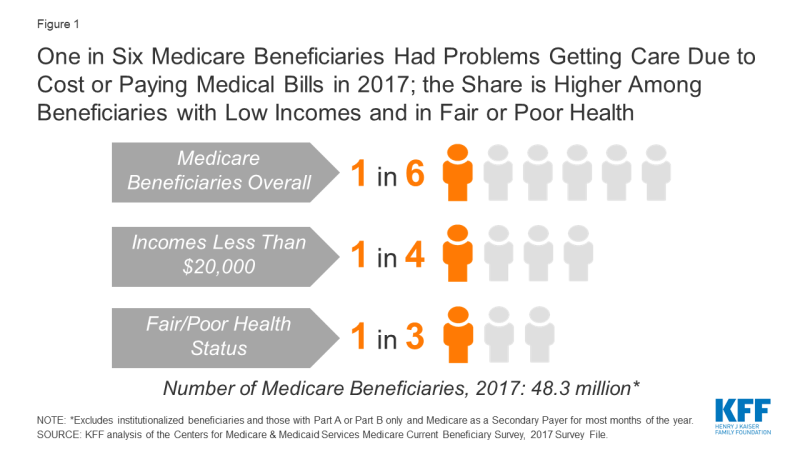

In 2017, 1 in 6 Medicare beneficiaries overall, 1 in 4 with low incomes, and 1 in 3 in fair or poor health had problems getting care due to cost or paying medical bills

In 2017, one in six (17%) Medicare beneficiaries living in the community reported problems getting care due to cost or paying medical bills (Figure 1).

Figure 1: One in Six Medicare Beneficiaries Had Problems Getting Care Due to Cost or Paying Medical Bills in 2017; the Share is Higher Among Beneficiaries with Low Incomes and in Fair or Poor Health

The rate of problems getting care due to cost or paying medical bills increased among beneficiaries with low incomes. In 2017, more than one-fourth (26%) of Medicare beneficiaries with incomes less than $20,000 had problems getting care due to cost or paying medical bills, compared to 7% of beneficiaries with incomes of at least $40,000 (Figure 2). The pattern holds true for enrollees in both traditional Medicare and Medicare Advantage: in 2017, 27% of Medicare Advantage enrollees with incomes less than $20,000 and 25% of beneficiaries in traditional Medicare at the same income level reported problems getting care due to cost or paying medical bills.

Figure 2: In 2017, Just Over One Fourth of Medicare Beneficiaries with Low Incomes Had Problems Getting Care Due to Cost or Paying Medical Bills

Among Medicare beneficiaries with incomes less than $20,000 who did not have any source of supplemental coverage, close to four in ten (37%) reported problems getting care due to cost or paying medical bills in 2017 (data not shown).

One third of Medicare beneficiaries in fair or poor health had problems getting care due to cost or paying medical bills

In 2017, one-third of beneficiaries in fair or poor health (33%) reported problems getting care due to cost or paying medical bills, nearly three times the share of beneficiaries in excellent, very good, or good health who did so (12%) (Figure 3). The pattern was similar among beneficiaries enrolled in Medicare Advantage plans and traditional Medicare, with 39% of Medicare Advantage enrollees in fair/poor health and 30% of traditional Medicare beneficiaries in fair/poor health reporting problems getting care due to cost or paying medical bills.

Figure 3: In 2017, One Third of Medicare Beneficiaries in Fair or Poor Health Had Problems Getting Care Due to Cost or Paying Medical Bills

Medicare beneficiaries in fair or poor health who did not have any source of supplemental coverage were more likely than beneficiaries overall in fair/poor health to report problems getting care due to cost or paying medical bills; nearly half (46%) reported such problems in 2017 (data not shown).

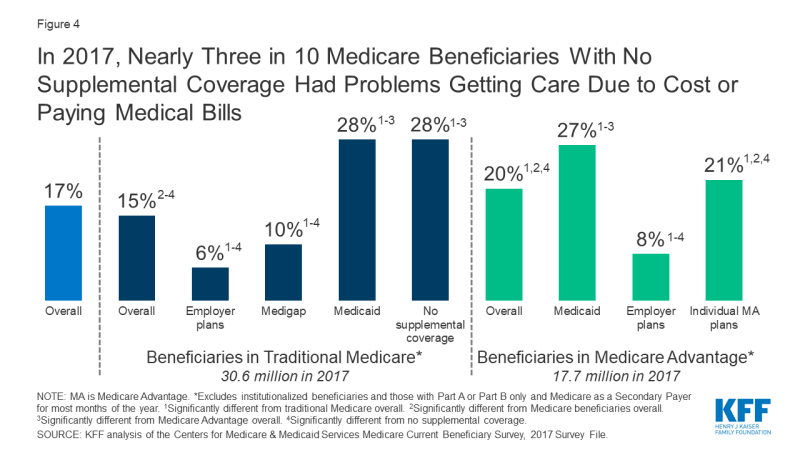

Nearly 3 in 10 Medicare beneficiaries with no supplemental coverage had problems getting care due to cost or paying medical bills

Among the five million community-dwelling Medicare beneficiaries with no source of supplemental coverage in 2017, nearly three in 10 (28%) reporting problems getting care due to cost or paying medical bills (Figure 4). This share is nearly five times higher than among beneficiaries in traditional Medicare with employer-sponsored insurance (6%) and nearly three times higher than among those with Medigap (10%).

Figure 4: In 2017, Nearly Three in 10 Medicare Beneficiaries With No Supplemental Coverage Had Problems Getting Care Due to Cost or Paying Medical Bills

Compared to beneficiaries in traditional Medicare, a larger share of beneficiaries enrolled in Medicare Advantage plans reported problems getting care due to cost or paying medical bills in 2017 (20% vs. 15%). This difference is significant even after controlling for income and health status.

Among beneficiaries in both traditional Medicare and Medicare Advantage, more than one in four of those with Medicaid – sometimes called dual eligible beneficiaries because they are eligible for both Medicare and Medicaid – reported problems getting care due to cost or paying medical bills in 2017. Although Medicaid helps low-income Medicare beneficiaries with their Medicare premiums and costs for Medicare-covered and other services, this finding suggests that many low-income Medicare beneficiaries with additional Medicaid coverage still struggle to pay their medical bills.

Conclusion

Amid the ongoing public health and economic crisis created by the coronavirus pandemic, there is ongoing concern about the cost of treatment for patients who become seriously ill and require hospitalization. Some Medicare beneficiaries could incur significant expense for a lengthy inpatient stay associated with COVID-19, including beneficiaries in traditional Medicare without supplemental coverage, and Medicare Advantage enrollees who are in plans that charge a daily copayment. This analysis demonstrates that having Medicare coverage does not alleviate the burden of medical costs for all beneficiaries. In 2017, one in six Medicare beneficiaries had problems getting care or delayed care due to cost, or had problems paying medical bills, and the percentage was significantly higher among beneficiaries in fair or poor health, those with low incomes, and those without supplemental coverage. Overall, a larger percentage of beneficiaries enrolled in Medicare Advantage plans reported problems getting care due to cost or paying medical bills than beneficiaries in traditional Medicare, even after controlling for income and health status.

These findings suggest that, in addition to being among those most at risk of serious illness if they get COVID-19, many Medicare beneficiaries may also be financially ill-equipped to afford the care they may need to treat the disease, raising questions about whether treatment costs should be waived.

Juliette Cubanski and Tricia Neuman are with KFF. Anthony Damico is an independent consultant.

| Methods |

| This analysis is based on data from the Centers for Medicare & Medicaid Services’ Medicare Current Beneficiary Survey, 2017 Survey File. The analysis includes beneficiaries enrolled in Part A and Part B for most months of the year, excluding those with Part A or Part B only and Medicare as a Secondary Payer for most months of the year. The analysis also excludes institutionalized beneficiaries since the analysis was based on questions asked of community residents only.

In this analysis, we define “problems getting care due to cost or paying medical bills” based on positive responses to any of the following four questions:

Since (12 months prior) have you had problems paying or were unable to pay any medical bills? All differences referred to in the text are statistically significant. Additionally, we conducted a logistic regression to confirm these bivariate findings held when in a multivariate analysis. Adjusting for age and race/ethnicity, we found statistically significant associations between our composite variable and each of the characteristics discussed in this data note: self-reported health status, income, and supplemental coverage. |