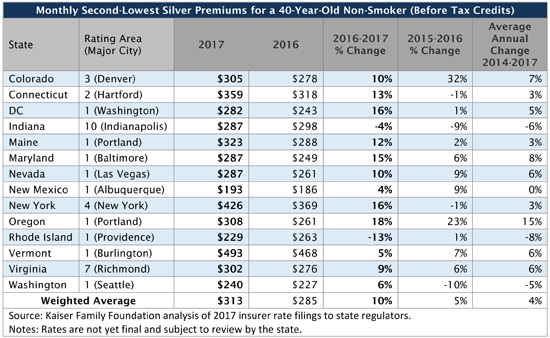

Early Analysis of 14 Major Cities Finds Benchmark Silver Plan Premiums in ACA Marketplaces Estimated to Rise 10 Percent on Average in 2017

A Kaiser Family Foundation analysis of Affordable Care Act proposed marketplace rates finds benchmark silver plan premiums are projected to increase 10 percent in 2017 on average across 14 major metropolitan areas.

Based on proposed rate filings in 13 states plus the District of Columbia where complete information is currently available, the analysis assesses how premiums for the second lowest-cost silver plan – which is the basis for enrollees’ tax credits — would change in 2017. The average increase, weighted by 2016 state marketplace enrollment, is higher this year than in the previous years. However, the analysis notes that the vast majority of marketplace customers who receive premium subsidies under the health law would be protected from premium increases if they shop around and choose one of their market’s lowest-cost plans.

The analysis finds changes in benchmark premiums vary widely from market to market, ranging from a decrease of 13 percent in Providence, R.I., to an increase of 18 percent in Portland, Ore. Generally, about two-thirds of ACA marketplace enrollees choose silver plans; and in 2015, about half of those who selected a plan selected one of the two lowest-cost within a metal tier. By charting the most commonly-selected plans available to consumers, the analysis reflects new plans in the marketplaces and the effects of insurer competition to attract consumers with lower premiums. The results may differ from increases for any one insurer or averages across all insurers in the market.

As in the past, the analysis finds shifts among the insurers offering the two lowest-cost silver plans – a change that impacts what consumers pay and underscores the potential savings from actively shopping in the marketplace. In nine of the 14 major cities, at least one insurer with one of the two lowest-cost silver plans in 2016 isn’t among the two lowest-cost silver plans in 2017, the analysis finds. Consumers receiving tax credits in those plans may need to change plans to avoid paying a larger share of their income on premiums.

Additionally, the analysis finds that the number of insurers participating in 2017 ACA marketplaces in half of the states (including DC) will hold steady or increase relative to the beginning of 2016, while the remaining will see a net decrease, often as a result of the withdrawal of UnitedHealth. Complete 2017 rate information isn’t yet available for all states, and plans’ final rates may differ from the proposals as a result of each state’s rate review process. As more states report complete and updated data, Kaiser will update the Analysis of 2017 Premium Changes and Insurer Participation in the Affordable Care Act’s Health Insurance Marketplaces.