New Rules for Section 1332 Waivers: Changes and Implications

Introduction

On October 22, 2018, the Trump administration released new guidance on Section 1332 waivers established by the Affordable Care Act (ACA). This replaced earlier guidance released in 2015 and substantially changed the standards for evaluating waiver applications. While waiver activity to date has been limited and mostly used to implement state reinsurance programs to help reduce the cost of ACA-compliant individual market policies, the new guidance may encourage states to use 1332 waiver authority to make broader changes to insurance coverage for their residents, including to promote the sale of, and apply subsidies to, ACA non-compliant policies. On November 29, 2018, the Centers for Medicare and Medicaid Services (CMS) released a discussion paper outlining a set of waiver concepts designed to provide states with a roadmap for developing waiver applications that use the flexibility granted under the new guidance. This issue brief describes the new guidance, highlighting key changes from the 2015 guidance, describes how state waiver activity may change, particularly in light of the waiver concepts put forward by CMS, and discusses possible implications of the changes.

Background

Section 1332 authorizes state innovation waivers, allowing states to experiment with other strategies to provide residents with health coverage that delivers at least the same level of protections guaranteed under the ACA. The law allows states to waive only certain provisions of the ACA. States may seek waivers of requirements related to the essential health benefits (EHBs) and metal tiers of coverage (bronze, silver, gold, and platinum) along with the associated limits on cost sharing for covered benefits. They may alter the premium tax credits and cost-sharing reductions, including requesting an aggregate (pass-through) payment of what residents would otherwise have received in premium tax credits. States may also modify or replace the marketplaces and change or eliminate the individual and employer mandates (though Congress reduced the individual mandate tax penalty to zero starting in 2019). (See Appendix Table 1 for more detail on these provisions.) Importantly, states cannot use section 1332 authority to waive many of the ACA’s other consumer protections, including guarantee issue, rating rules, and the prohibition on pre-existing condition exclusions. The ACA also requires that states must enact a law authorizing actions to be taken under the waiver in order for the waiver to be approved.

The ACA includes so-called guardrails limiting how 1332 waivers will affect consumers and the federal deficit. The statutory language requires that state waiver applications must demonstrate that the plan will:

- Provide coverage that is at least as comprehensive in covered benefits;

- Provide coverage that is at least as affordable (taking into account premiums and excessive cost sharing);

- Provide coverage to at least a comparable number of state residents; and

- Not increase the federal deficit.

Earlier guidance, published by the Obama Administration in 2015, provided a strict interpretation of the statutory guardrails (see Appendix for a more detailed description). The 2015 guidance defined coverage as minimum essential coverage (MEC), which specifically excludes short-term, limited duration health insurance policies, and specified the number of people forecast to have coverage under the waiver could not be less than the number with coverage absent the waiver. It further specified that a waiver could not reduce the number of people with coverage as comprehensive as the state’s essential health benefits (EHB) benchmark plan. It measured affordability as residents’ spending on premiums, cost sharing, and other out-of-pocket costs relative to their income. Coverage could not be less affordable overall under the waiver and especially for those with high health care spending. Additionally, a waiver could not reduce the number of people with coverage meeting the minimum 60% actuarial value. Under the 2015 guidance, the effects of the waiver were assessed for residents overall and for vulnerable populations, both over the life of the waiver and in each year of the waiver.

1332 Waiver Activity

To date, eight states have won approval for 1332 waiver applications. All but one of these states has used the waiver authority to receive federal pass-through funding to implement reinsurance programs that reimburse insurers for certain high cost claims in order to lower premiums overall. However, other states, namely Iowa and Idaho, had proposed more significant changes to their insurance markets that the administration ultimately did not approve.

In 2017, Iowa submitted a 1332 waiver application that proposed several changes to the insurance marketplace. These changes included creating a single plan to be offered by insurers that would provide coverage similar to that offered under the standard silver marketplace plan; replacing the existing premium tax credits with flat premium subsidies based on age and income; and establishing a reinsurance program. Iowa withdrew its waiver when it became clear that CMS would not approve it.

In January 2018, pursuant to an executive order by Governor Otter, the Idaho Department of Insurance issued a bulletin outlining provisions of new individual health insurance products that insurance companies would be permitted to sell under state law. The new “State-Based Health Benefit Plans” would not have to comply with certain ACA requirements that prohibit discrimination based on pre-existing conditions. These plans would likely be offered for premiums lower than those charged for ACA-compliant policies – at least for consumers when they are healthy. Though the Idaho State-based Health Plan proposal was not submitted as a 1332 waiver, CMS reviewed the proposal and determined that it was not in compliance with the ACA. In a letter to the governor, CMS concluded that the Idaho bulletin creating State-based Health Plans could not legally be implemented, but advised that, “with certain modifications, these state-based plans could be legally offered under the [federal law’s] exception for short-term, limited-duration plans.”

Key Changes in the 2018 Guidance

The new guidance lays out principles to direct states’ development of innovation waiver proposals—renamed State Relief and Empowerment waivers. These principles prioritize private coverage over public coverage, encourage sustainable spending growth by eliminating regulations that limit competition, foster state innovation, support and empower those in need by providing financial assistance to purchase private insurance, and promote consumer-driven health care.

The 2018 guidance also establishes new, less restrictive standards for evaluating whether waivers meet the statutory guardrails (Table 1). The most important changes include:

”Coverage” is re-defined to include plans that do not comply with ACA rules, including short-term, limited duration plans and association health plans. This change is accomplished by referencing a different term in federal law than the earlier guidance – “health insurance coverage,” which is defined to include short-term plans in addition to ACA-compliant policies.

Evaluation of the comprehensiveness and affordability of coverage under a waiver will focus on the nature of coverage that is made available to residents, rather than on coverage that residents actually have. Under the new guidance, state waiver programs could provide and promote coverage options that are less comprehensive or less affordable than marketplace plans today, as long as the waiver coverage is an additional option for residents to choose.

The number of people covered under a waiver will be evaluated separately from the comprehensiveness and affordability standard. Under the Trump Administration guidance, waivers will be evaluated by counting the number of people who would actually be enrolled in any type of coverage, including short-term policies. Separately, the Administration will evaluate whether policies as comprehensive and affordable as ACA policies are offered, even if fewer state residents buy them. The 2018 guidance also provides further flexibility to states under the comprehensiveness standard; instead of comparing comprehensiveness to the benchmark EHB plan states use for their marketplace, state waivers could be evaluated against a hypothetical benchmark plan, authorized under other Trump Administration rules, that could be less comprehensive. Under the affordability standard, the 2018 guidance indicates that in addition to considering the number of state residents for whom comprehensive coverage has become more or less affordable, the magnitude of change will be considered. For example, a waiver that “makes coverage slightly more affordable for some people but much less affordable for a comparable number of people would be less likely to be granted…[while] a waiver that makes coverage much more affordable for some people and only slightly more costly for a large number of people would likely meet this guardrail.”

Waiver effects will be assessed in aggregate rather than for specific populations and over the term of the waiver, not year-by-year. In a departure from previous guidance, which required a separate assessment of waiver effects on vulnerable populations, the new guidance requires only that the effects of the waiver on the population overall be evaluated. The 2018 guidance also indicates state waivers could be approved that don’t meet the 1332 guardrails in each year the waiver is in effect, as long as the state can demonstrate that the reduction in coverage in a given year is temporary and the guardrails will be met over the course of the waiver.

States are encouraged to use private exchanges to offer subsidies for non-ACA compliant plans. The 2018 guidance notes that technical enhancements to healthcare.gov that created direct enrollment websites for use by agents and brokers can be used by states to implement 1332 plans. States could use private exchanges that display non-ACA compliant plans, such as short-term, limited duration plans, alongside compliant plans, in contrast to marketplace websites today that can only display ACA-compliant qualified health plans. States could also use private exchanges to distribute subsidy dollars, including to people who purchase these non-compliant plans. The guidance specifies that private exchange websites could still access the back-end functionality of healthcare.gov for purposes of conducting eligibility determinations, conducting data matching, and verifying special enrollment periods, among other functions. The 2018 guidance also offers new “data sharing functionality” that could make information on current healthcare.gov enrollees accessible to states outside of the Exchange context, subject to applicable privacy laws and standards.

The requirement that state 1332 waiver plans be authorized through legislation is relaxed. The ACA requires states to enact legislation to pursue and implement a 1332 waiver. The new guidance allows states to rely on existing legislation in combination with enacted regulations or executive orders. The guidance specifies that the state law must provide statutory authority to enforce ACA provisions, but it does not have to authorize specifically pursuit of a 1332 waiver. In this case, the waiver application must include a letter from the Governor describing the statutory authority for implementing the waiver.

| Table 1. Comparing Requirements in 2015 Section 1332 Waiver Guidance to 2018 Waiver Guidance | ||

| 2015 Guidance | 2018 Guidance | |

| Coverage | A comparable number of residents must be forecast to have coverage under the waiver as would have coverage absent the waiver | A comparable number of state residents eligible for coverage under Title I of ACA must be forecast to have coverage under the waiver as would have coverage absent the waiver |

| Coverage defined as minimum essential coverage | Coverage defined as minimum essential coverage AND “health insurance coverage” (which includes ACA non-compliant coverage) | |

| Requirement must be met in each year of the waiver | Longer-term impacts on coverage will be considered, such that temporary reductions in coverage may be acceptable if coverage levels are met or exceeded over the course of the waiver term | |

| Impact on all residents considered, including those with other forms of coverage | Impact on all state residents eligible for coverage under Title 1 of ACA considered, including those with other forms of coverage | |

| Effects measured across different groups, including low-income, elderly, and those with serious health issues; waiver cannot reduce coverage for a subgroup, even if it would provide coverage to a comparable number of residents overall | Effects not measured across subgroups; instead, waiver application should address how it will support and empower consumers with low income and high health costs | |

| Affordability | Health coverage under the waiver must be forecast to be as affordable overall for state residents as coverage absent the waiver | Affordability and comprehensiveness of coverage assessed together. Waiver must make available coverage that is as affordable and comprehensive as would have been available absent the waiver. Standard will be considered to be met if waiver provides access to affordable, comprehensive coverage, regardless of the coverage into which people enroll |

| Affordability measured by comparing residents’ net out-of-pocket spending on premiums and cost sharing to their incomes. Spending on non-covered health services also considered if affected by the waiver | Affordability measured by comparing individual’s expected out-of-pocket spending on premiums, cost sharing, and direct payments for health care to their income | |

| Waiver cannot increase the number of people with high health spending relative to their income; effects on low income, elderly, those with serious health issues also measured | Magnitude of any changes in affordability will be taken into account; a waiver may meet the affordability standard if it makes coverage much more affordable for some and only slightly more costly for a larger number of people | |

| Waivers prohibited from reducing the number of people with coverage that meets 60% actuarial value standard and protections against excessive out-of-pocket spending | ||

| Comprehensiveness | Health coverage under the waiver must be forecast to be at least as comprehensive overall for residents as coverage absent the waiver | Waiver must make available coverage that is as affordable and comprehensive as would have been available absent the waiver. Standard will be considered to be met if waiver provides access to affordable, comprehensive coverage, regardless of the coverage into which people enroll |

| Comprehensiveness refers to the scope of benefits provided by the coverage as measured by extent to which coverage meets the EHB requirements (or Medicaid or CHIP standards); coverage under the waiver would be compared to the state’s EHB benchmark and Medicaid/CHIP coverage in certain cases | States granted additional flexibility to select EHB benchmark; coverage under the waiver would be compared to the state’s EHB benchmark, any other state’s benchmark plan, or any other benchmark plan chosen by the state | |

| Waiver cannot decrease the number of individuals with coverage that satisfies EHB, the number with coverage in any particular category of EHB, or the number with coverage that includes XIX/CHIP services. | ||

| Deficit Neutrality | Waivers must not increase the federal deficit over the period of the waiver or over the 10-year budget plan | Same |

| Estimated effects include all changes in income, payroll, or excise tax revenue, and any other forms of revenue, changes in marketplace financial assistance, other direct spending, such as changes in Medicaid spending, and all administrative costs | Generally the same, except eliminates reference to changes in Medicaid spending | |

| State authorizing legislation | 1332 statute requires states to enact a law authorizing pursuit of a 1332 waiver. No changes were made to this requirement; however, any changes to the states’ health care system that, under state law, are contingent on approval of the 1332 waiver would be considered. | States may use existing legislation that provides authority to enforce ACA provisions in combination with an executive order or enacted state regulation to pursue a 1332 waiver |

How State 1332 Waiver Activities Might Change

By loosening the interpretation of the statutory guardrails and encouraging states to increase access to private coverage, specifically ACA non-compliant coverage, the new guidance appears to encourage states to develop waiver proposals that would make changes to their health coverage systems that are dramatically different from that provided under the ACA today. After the guidance was published, CMS released a set of “waiver concepts” to spur ideas that states could pursue through 1332 waivers.

Waiver programs could subsidize ACA non-compliant plans offered through parallel insurance markets. Using the pass-through authority under 1332 waivers, states could receive a lump-sum payment of some or all of the money the federal government would otherwise have paid in Marketplace subsidies in the absence of a waiver and then repurpose that pass-through funding to support other types of coverage – including medically underwritten short-term policies. This approach is described in one of the waiver concepts released by CMS. Shifting federal subsidy dollars to residents enrolled in ACA non-compliant plans would reduce resources available to subsidize ACA-compliant plans, because state waivers cannot result in increased federal spending. States considering such a change would need to demonstrate that residents would continue to have access to coverage that is as comprehensive and affordable as the ACA would provide. However, the guidance provides new flexibility in defining and evaluating these standards that could help states meet these guardrails.

States also could reallocate federal subsidy dollars across demographic groups. Another waiver concept put forward by CMS promotes the establishment of state-specific premium assistance programs. Under the new guidance, 1332 waiver guardrails would be evaluated in the aggregate, eliminating the previous requirement that coverage could not be reduced, or made less comprehensive or affordable, for vulnerable populations – specifically, residents with low incomes and/or high health care needs. As a result, state waiver programs might experiment with different subsidy structures, such as tax credits based on age and not income, similar to those proposed under some of the Congressional bills to repeal and replace the ACA. While states considering such a change would need to demonstrate that residents overall would continue to have access to coverage that is as comprehensive and affordable as the ACA would provide, the guidance provides new flexibility in defining and evaluating these standards that could help states meet these guardrails while redistributing subsidies across groups of people.

States could continue to seek waivers to establish reinsurance programs. The new guidance does not appear to affect states’ ability to obtain federal pass-through funds to finance a reinsurance program, as seven states have done to date. Implementing risk stabilization strategies, including a reinsurance program or high-risk pool was included as one of the waiver concepts released by CMS.

States are discouraged from proposing waivers that expand public programs. By prioritizing private coverage over public programs, the new guidance appears to make it more difficult for states to obtain waivers that would build on Medicaid, adopt a public plan option in the marketplace, or create a single payer plan.

Potential Implications

Under the Trump Administration guidance, states have substantially more flexibility in the design of 1332 waiver proposals, opening the door to approaches that could materially affect the stability of ACA marketplaces, redistribute subsidy dollars, and change consumers’ access to coverage based on health status, age, income, and other factors.

State waiver programs could reduce health insurance premiums for some, even many, state residents. The new guidance makes clear that states can redistribute federal subsidy dollars to improve affordability of premiums for residents in the aggregate. For example, one of the CMS waiver concepts describes restructuring subsidy eligibility to make premiums even cheaper for young adults in order to promote enrollment by people in this age cohort, or to extend subsidies to higher-income residents to address the “subsidy cliff” that now occurs for people when income exceeds 400% FPL. Under a budget neutral waiver, however, increasing subsidy resources for one population group would necessitate reducing subsidy dollars available to other groups. Under the new evaluation framework, this approach could be possible.

Parallel markets could divide the risk pool, isolating people with pre-existing conditions. Although the Section 1332 authority expressly does not permit waiver of the ACA market rules that prohibit insurance discrimination against people with pre-existing conditions, the new 2018 guidance allows states to set up and subsidize parallel, less-regulated insurance markets, featuring short-term health insurance that is medically underwritten and provides less comprehensive coverage. Even though states would need to retain an ACA-compliant market with comprehensive policies that do not discriminate based on health status, this uneven playing field could fragment the insurance market, steering healthy consumers to less-regulated coverage and driving up premiums for people with pre-existing conditions whose only options are ACA-compliant plans.

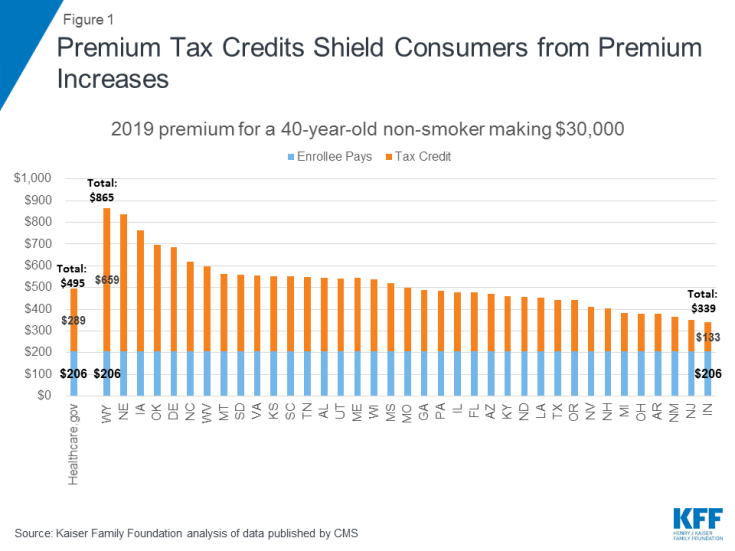

Shifting ACA subsidies to medically underwritten policies could destabilize ACA-compliant markets. Under current law, marketplace subsidies play a substantial role in stabilizing the risk pool, even in the face of adverse selection. Premium subsidies shield most marketplace enrollees from rate increases, (Figure 1) which helps maintain enrollment in marketplace coverage and stabilize the risk pool. For example, in 2019 premiums for benchmark marketplace plans are estimated to be 16% higher than they would otherwise be, on average, as insurers price for adverse selection due to repeal of the individual mandate penalty, more aggressive marketing of short-term policies, and termination of cost-sharing subsidy payments to insurers. While enrollment by unsubsidized individuals may decline as a result of these increases, subsidy-eligible individuals will be better positioned to remain in affordable coverage.

Under the new waiver guidance, however, states could provide subsidies for the purchase of ACA non-compliant plans, thus shifting at least some federal subsidy resources out of the ACA marketplace. Reducing the availability of subsidies for plans sold in the ACA marketplace would make the cost of ACA-compliant plans less affordable for people who rely on them. With fewer subsidies, more people will likely be forced to drop marketplace coverage, increasing instability in the market. How far states will be allowed to go in redistributing federal subsidies will likely depend on how CMS operationalizes the requirement in the 2018 guidance to consider the magnitude of changes on the affordability of coverage. By saying that a waiver may be approved even if it makes coverage less affordable for some, the new guidance appears to give CMS fairly broad discretion to determine whether a waiver meets the affordability guardrail.

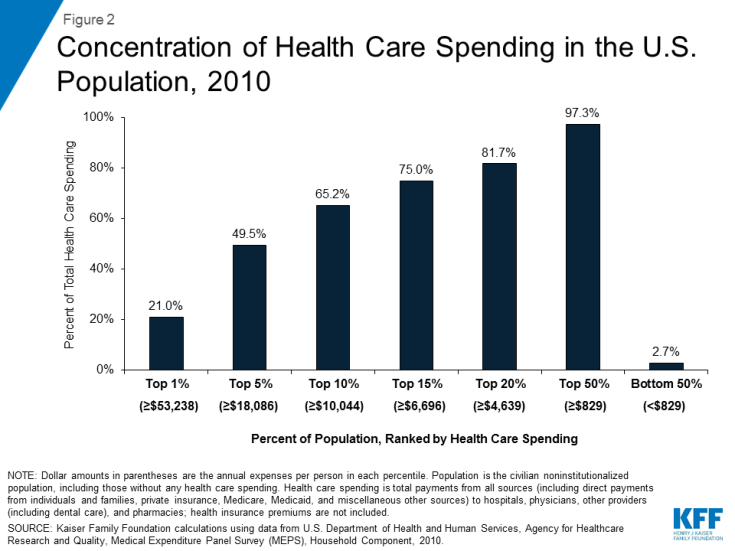

New counting rules could reduce protection for people with pre-existing conditions. The 2018 guidance measures only the number of people with an insurance card of any type (including for a short-term policy) without measuring the affordability or comprehensiveness of coverage that state residents would actually have under the waiver. Further, the 2018 guidance eliminates the requirement to demonstrate comparable protections for people with high health risks. This change is significant. In the US population, the sickest 5% of the population accounts for about half of all health care spending in any given year (Figure 2). Given this distribution, it would be possible for a waiver to cover more residents, albeit with cheaper, less comprehensive policies, at the expense of a relatively small number of residents with costly pre-existing conditions. That outcome would not have been allowed under the 2015 guidance, which specified that “increasing the number of state residents with large health care spending burdens would cause a waiver to fail…”

Other marketplace services and protections could be weakened under 1332 waiver programs. The guidance permits and encourages states to use private marketplace alternatives in their waiver programs. Currently ACA marketplaces must provide consumers a no-wrong-door avenue for obtaining an eligibility determination for tax credits and assessing eligibility for Medicaid and CHIP. ACA marketplaces also must display standardized, comparable information on ACA-compliant plans. Under waiver programs, however, private marketplaces might change or reduce these services, possibly affecting the ability of some consumers to find and remain covered under comparable coverage. For example, private marketplaces might not advise consumers about their eligibility for Medicaid and CHIP, leaving it to individuals to go elsewhere to learn about and apply for such coverage.

Looking Ahead

The 1332 waiver guidance released by the administration reinterprets the statutory requirements for these waivers, giving states increased flexibility to make significant changes to what coverage is available and weakening protections for vulnerable populations, including those with pre-existing conditions. Along with the new guidance, CMS developed and released a series of “Waiver Concepts” to stimulate ideas and serve as templates for approvable waiver applications. These templates provide further insights into the kinds of state waiver programs the Trump Administration supports and illustrates how it hopes states will use the enhanced flexibility afforded under the new guidance. Taken in its entirety, the new waiver guidance appears to lay out a path for state officials to pursue, via waivers, changes to the ACA that Congress has not been able to achieve through legislation. Whether and how states respond to the new waiver guidance remains to be seen.