Medicare Advantage and Traditional Medicare: Is the Balance Tipping?

INTRODUCTION

Enrollment in Medicare Advantage plans nationwide is at an all-time high and continues to climb. Despite concerns that payment reductions enacted by the Affordable Care Act would cause enrollment to decline, Medicare Advantage enrollment has instead increased by 5.6 million, or 50 percent, since the law’s enactment.1 This steady rise in Medicare Advantage enrollment has led some to question whether the balance between traditional Medicare and private plans will soon tip, with more and more people enrolling in Medicare Advantage plans.2

With ongoing interest in the role and future of Medicare Advantage plans, this brief takes an in-depth look at Medicare Advantage enrollment and growth rates, by county, metropolitan areas, and state. We used publicly available Medicare Advantage State/County Penetration data from the Centers for Medicare and Medicaid Services (CMS) to determine Medicare Advantage penetration rates in 2015, and growth rates between 2010 and 2015. More information about the data and methods used is included in the Methodology box at the end of the brief. For the purpose of this analysis, we examined counties that had reached or exceeded 50 percent Medicare Advantage penetration, but use the term “relatively high” Medicare Advantage enrollment to incorporate counties in which at least 40 percent of beneficiaries are enrolled in a Medicare Advantage plan. We define relatively low penetration counties as counties with less than 20 percent of beneficiaries in a Medicare Advantage plan.

Variation in Medicare Advantage Penetration Rates

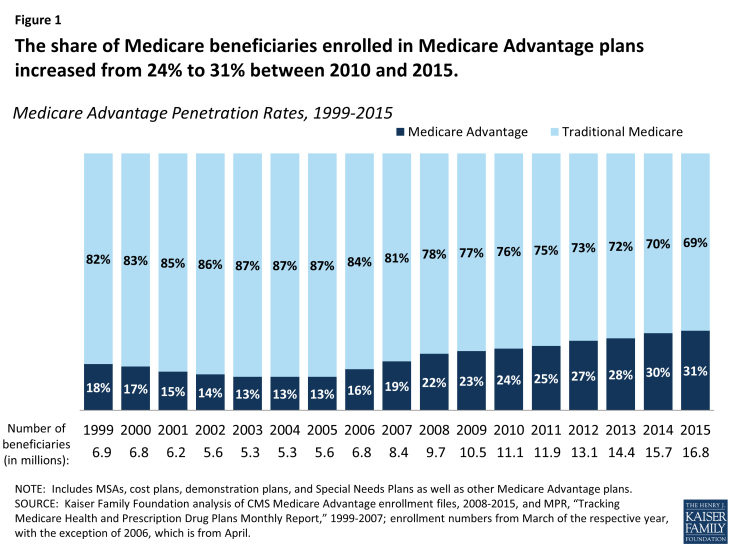

- In 2015, nearly one-third (31%) of Medicare beneficiaries is enrolled in a Medicare Advantage plan, an increase from nearly one-quarter (24%) in 2010 (Figure 1). Nationally, traditional Medicare continues to be the primary source of coverage for the Medicare population, but Medicare Advantage enrollment and penetration has been on the rise.

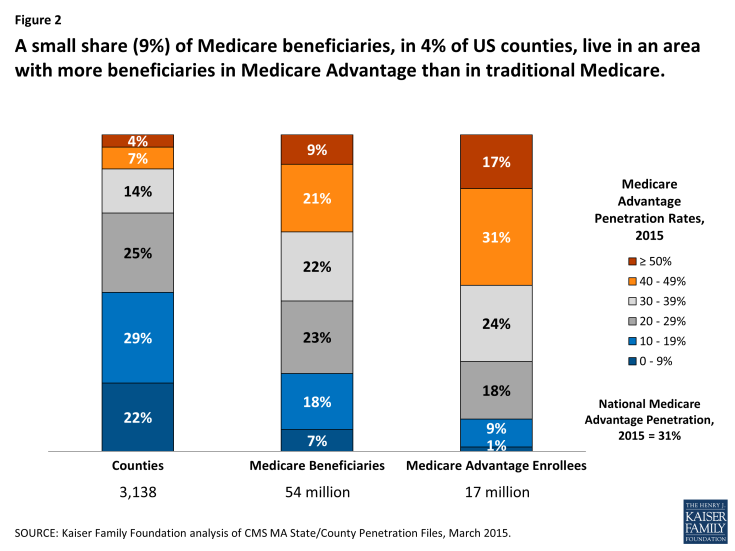

- A small share (9%) of Medicare beneficiaries lives in an area where at least half of all beneficiaries are enrolled in a Medicare Advantage plan (Figure 2). Medicare Advantage penetration is at or above 50 percent in just 4 percent of counties. Another 21 percent of all Medicare beneficiaries, in 7 percent of counties, are living in a county with 40-50 percent Medicare Advantage penetration.

Beneficiaries living in areas with high Medicare Advantage penetration (≥40%) tend to be clustered in more populated urban areas because Medicare Advantage has historically had a stronger presence in more populated, urban areas, and in a small number of states (discussed below).

- Conversely, a quarter of all Medicare beneficiaries (25%) live in an area with relatively low Medicare Advantage penetration (≤20%). In these counties, Medicare Advantage plans play a more minor role as the vast majority of beneficiaries in the county are in traditional Medicare. Penetration rates are at or below 20 percent in half (51 percent) of all counties.

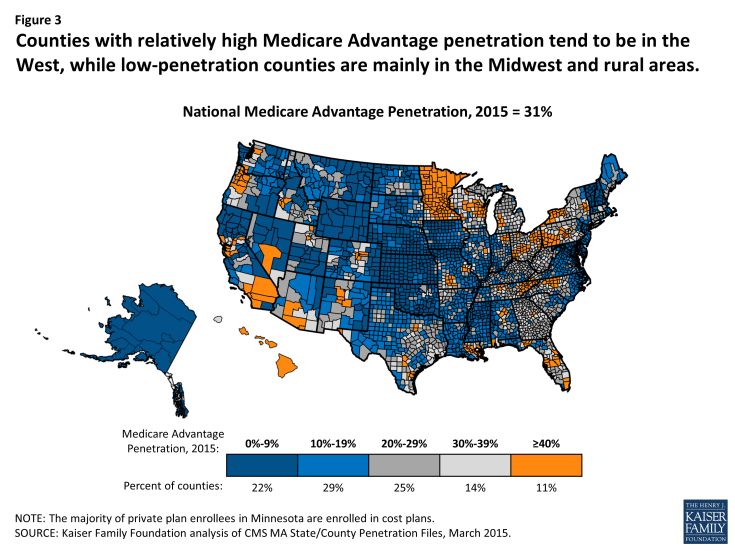

- Counties with relatively high Medicare Advantage penetration rates tend to be in the West, but are also scattered across the Midwest, Pennsylvania, New York, and Florida (Figure 3). Low penetration areas are mainly in the Midwest and in rural states, but also in the Northeast and Mid-Atlantic regions. Even in regions with a strong Medicare Advantage presence, such as Southern California, there is often a range in Medicare Advantage penetration across counties, reflecting local market conditions. For example, Medicare Advantage penetration is 58 percent in San Bernardino County but 15 percent in Santa Barbara.

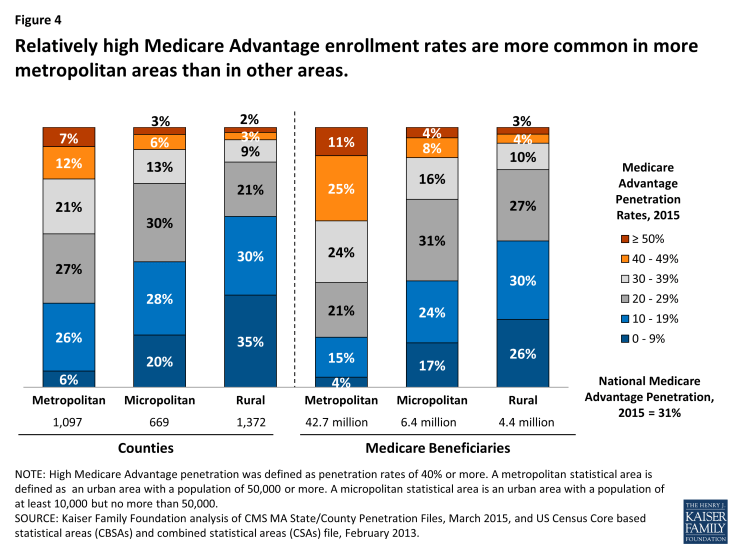

- Some of the variation in Medicare Advantage penetration across the country reflects the concentration of Medicare beneficiaries in urban areas, where Medicare Advantage plans have a stronger presence (Figure 4). While just over one-third (35%) of counties are classified as “metropolitan” (with a population of 50,000 or more), 80 percent of Medicare beneficiaries live in these counties. A much larger share of metropolitan than micropolitan or rural counties have relatively high Medicare Advantage penetration (19%, 9% and 5%, respectively).

- However, not all metropolitan areas have higher than average Medicare Advantage penetration rates (See Table 1). While Medicare Advantage penetration tends to be well above average in counties such as Los Angeles County (48%) and Miami-Dade (62%) in 2015, counties that include the Baltimore, Annapolis, and Wilmington metropolitan areas have penetration rates of 10 percent or less in 2015. Penetration is near average in the counties that include Detroit, Atlanta, Seattle, Milwaukee, and Chicago.

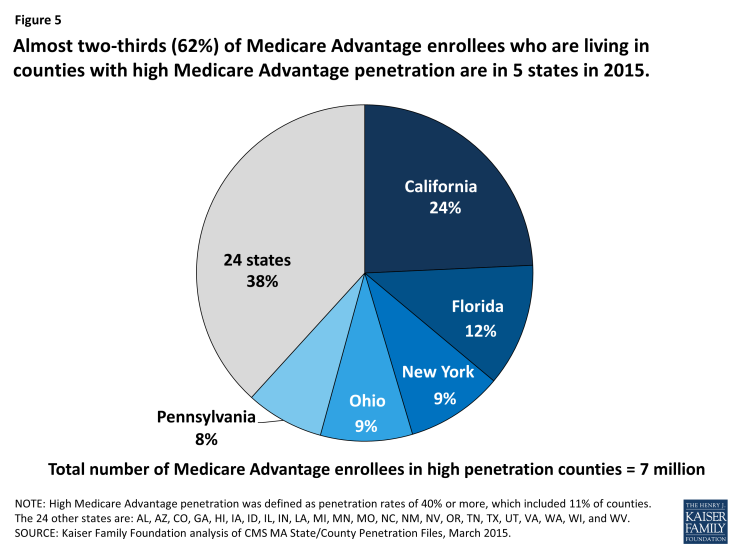

- Almost two-thirds of Medicare Advantage enrollees who live in counties with relatively high Medicare Advantage penetration are clustered in five states (Figure 5). California alone accounts for about one-quarter (24%) of all Medicare Advantage enrollees living in high-penetration areas, in large part due to high enrollment rates in southern California, including Los Angeles, Orange, Riverside, San Bernardino, and San Diego counties (Table 2). Other states in which high-penetration counties are clustered include Florida, New York, Ohio and Pennsylvania.

Change in Medicare Advantage Penetration Over Time

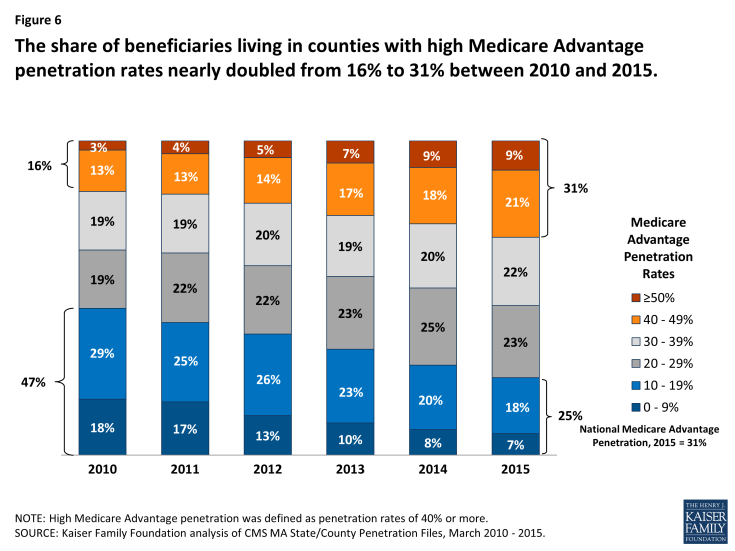

- Between 2010 and 2015, the share of beneficiaries living in counties with more than 50 percent Medicare Advantage penetration has tripled from 3 percent to 9 percent (Figure 6). Overall, the share of beneficiaries living in relatively high Medicare Advantage penetration areas (≥ 40%) has nearly doubled, from 16 percent to 31 percent during this period. Conversely, the share of beneficiaries living in areas with relatively low Medicare Advantage penetration has declined.

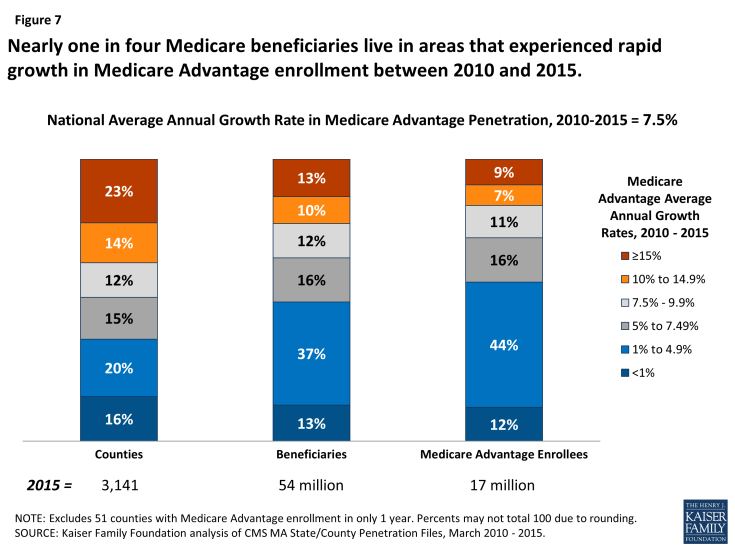

- About 13 percent of Medicare beneficiaries live in an area where Medicare Advantage penetration rates have grown very rapidly in recent years (defined as ≥ 15% average annual growth rate since 2010) – double the 7.5 percent national average (Figure 7). Another 5.1 million beneficiaries (10 percent) of all Medicare beneficiaries live in an area that experienced average annual growth in Medicare Advantage enrollment of 10 to 15 percent between 2010 and 2015.

- More than three-quarters (77%) of the 1.5 million Medicare Advantage enrollees who live in counties that experienced high growth (≥ 15%) in Medicare Advantage penetration between 2010 and 2015 reside in four states: Michigan, Illinois, North Carolina and Texas. These high-growth counties tend to have below average Medicare Advantage penetration in 2015 (averaging 24%).

Figure 7: Nearly one in four Medicare beneficiaries live in areas that experienced rapid growth in Medicare Advantage enrollment between 2010 and 2015.

- About half of all beneficiaries live in counties where Medicare Advantage penetration increased by less than 5 percent annually between 2010 and 2015. These slower-growth counties tend to have above average Medicare Advantage penetration rates in 2015 (averaging 43% in 2015).

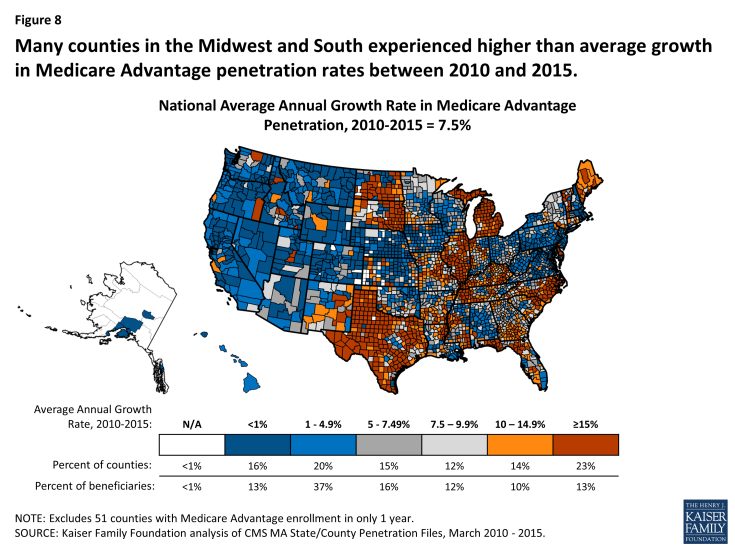

- The average annual growth in Medicare Advantage penetration between 2010 and 2015 varied widely across the country (Figure 8). The average annual growth in Medicare Advantage penetration between 2010 to 2015 ranges from a high of 34 percent (Lake County, IN and Lake County, IL) to a low of negative 5 percent in Santa Barbara County, California (Tables 4 and 5).

DISCUSSION

Medicare Advantage has become a larger part of the Medicare program over the past several years. Despite concerns that enrollment would drop in response to payment reductions included in the Affordable Care Act of 2010, enrollment has climbed steadily over the past five years, and is projected to continue to rise over the next decade.3 Medicare Advantage enrollment has increased across the country, although penetration and growth rates have been much higher in some parts of the country than others. Some areas have experienced more rapid growth than others in the past few years which may be due to a number of factors, such as market conditions, consumer preferences, and payment rates.

All signs suggest Medicare Advantage penetration will continue to rise but unevenly across the country. As of now, just nine percent of beneficiaries live in an area where more beneficiaries are enrolled in Medicare Advantage plans than traditional Medicare, and it seems likely this share will increase. Nonetheless, for the vast majority of beneficiaries, traditional Medicare is likely to remain the primary source of coverage for the foreseeable future. While the balance between traditional Medicare and Medicare Advantage may tip in the future, it hasn’t happened yet.

The authors appreciate the informative and helpful comments that Marsha Gold, Sc.D., Senior Fellow Emeritus at Mathematica Policy Research, Inc. provided on an earlier draft of this brief.

| Methodology |

| Most of the data used in this analysis come from the Centers for Medicare and Medicaid Services (CMS) MA State/County Penetration file for March of 2015. These files contain the number of Medicare beneficiaries and Medicare Advantage enrollees at the county level. Medicare Advantage enrollment includes data for all plan types, including Local and Regional CCP, MSA, PFFS, demonstrations, national PACE, cost, and employer-sponsored plans. Data for counties with 10 or fewer enrollees are not included due to privacy laws and are thus not included in this analysis. The analysis also uses the Census Core based statistical areas (CBSAs) and combined statistical areas (CSAs) file, February 2013 to examine differences in penetration and growth rates in metropolitan, micropolitan, and rural areas.

To examine the extent to which Medicare Advantage penetration and growth rates are associated with county-level market and demographic characteristics, correlations were calculated separately between Medicare Advantage penetration in 2015 and average annual growth rates and the following variables: average traditional Medicare spending in a county; Medicare Advantage risk-adjusted rebate amounts; percent of Medicare Advantage enrollees in employer-sponsored (group) plans; percent of Medicare Advantage enrollees in Preferred Provider Organizations (PPOs); percent of Medicare Advantage enrollees in Health Maintenance Organizations (HMOs); percent of seniors with incomes below the poverty threshold; percent of county residents with incomes below the poverty threshold; median household income; share and number of Medicare beneficiaries that were new to Medicare; average age of Medicare beneficiaries 65 or older; average age of all Medicare beneficiaries; share of Medicare beneficiaries who were disabled; year of the oldest active Medicare Advantage plan; rural county designation; and Medicare Advantage payment quartiles. All correlation coefficients indicated relatively weak relationships. Correlation coefficients were less than 10 percent (positive or negative) when testing the relationship between Medicare Advantage penetration in 2015 and the following variables: Medicare Advantage payment quartiles; average beneficiary age; share of beneficiaries that were new to Medicare in 2015; local poverty rates; the share of beneficiaries who were disabled; and the percent of Medicare Advantage enrollees in employer-sponsored (group) plans. The correlations between Medicare Advantage penetration in 2015 and the percent of Medicare Advantage enrollees in PPOs and between Medicare Advantage penetration in 2015 and the average traditional Medicare spending in a county were each negative 18 percent. More moderate correlation coefficients were observed between 2015 penetration rates and the following variables: number of new Medicare beneficiaries (23%); rural county designation (-27%); risk-adjusted Medicare Advantage rebate amounts (30%); the percent of Medicare Advantage enrollees in HMOs (38%); and year of the oldest active Medicare Advantage plan (-40%). Correlations were similarly weak (less than positive or negative 10%) between the Medicare Advantage annual penetration growth rate in a given county between 2010 and 2015 and the following county-based variables: share of beneficiaries new to Medicare; average beneficiary age; Medicare Advantage payment quartiles; percent of Medicare Advantage enrollees in Special Needs Plans; percent of Medicare Advantage enrollees in employer-sponsored (group) plans; share of beneficiaries who were disabled; rural county designation; year of the oldest active Medicare Advantage plan; and average traditional Medicare spending in a county. The relationship between growth rates and the remaining variables – percent of Medicare Advantage enrollees in HMOs, percent of Medicare Advantage enrollees in PPOs, risk-adjusted Medicare Advantage rebate amounts, and local poverty rates – did not exceed 18 percent. |