2019 Employer Health Benefits Survey

Section 10: Plan Funding

Many firms, particularly larger firms, choose to pay for some or all of the health services of their workers directly from their own funds rather than by purchasing health insurance for them. This is called self-funding. Both public and private employers use self-funding to provide health benefits. Federal law (the Employee Retirement Income Security Act of 1974, or ERISA) exempts self-funded plans established by private employers (but not public employers) from most state insurance laws, including reserve requirements, mandated benefits, premium taxes, and many consumer protection regulations. Sixty-one percent of covered workers are in a self-funded health plan in 2019. Self-funding is common among larger firms because they can spread the risk of costly claims over a large number of workers and dependents.

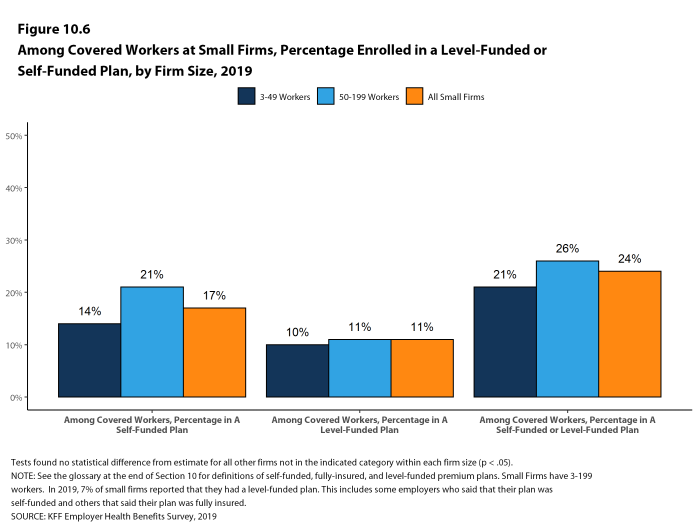

In recent years, a complex funding option, often called level-funding, has become more widely available to small employers. Level-funded arrangements are nominally self-funded options that package together a self-funded plan with extensive stoploss coverages that significantly reduces the risk retained by the employer. Seven percent of covered workers in small firms (3-199 workers) are in a level-funded plan.

SELF-FUNDED PLANS

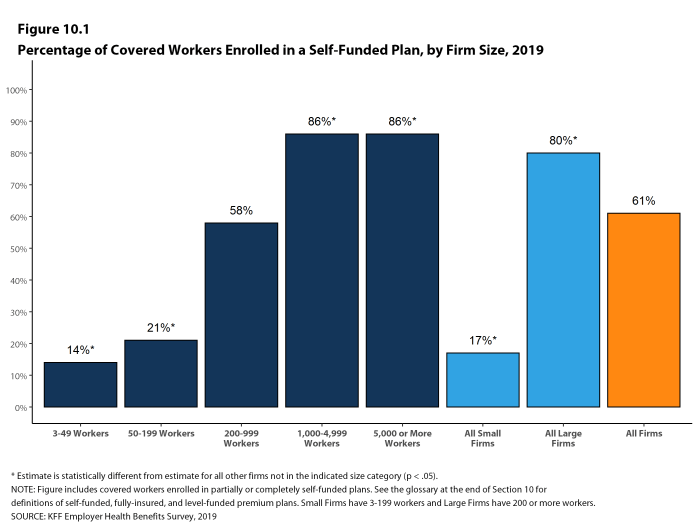

- Sixty-one percent of covered workers are in a plan that is completely or partially self-funded, similar to last year [Figure 10.1] and [Figure 10.2].

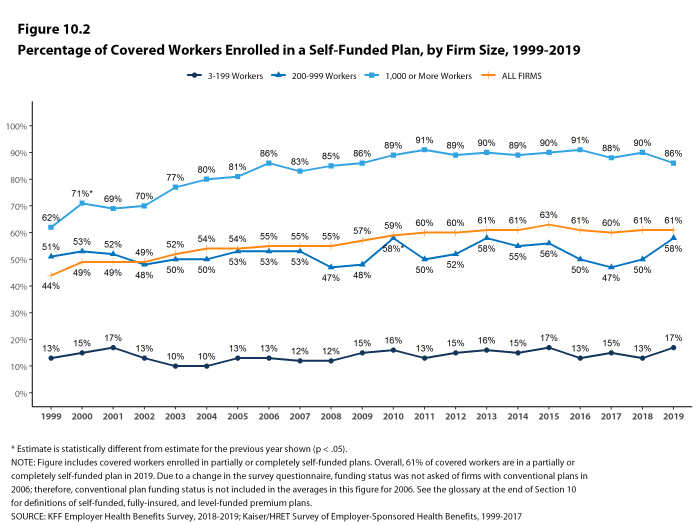

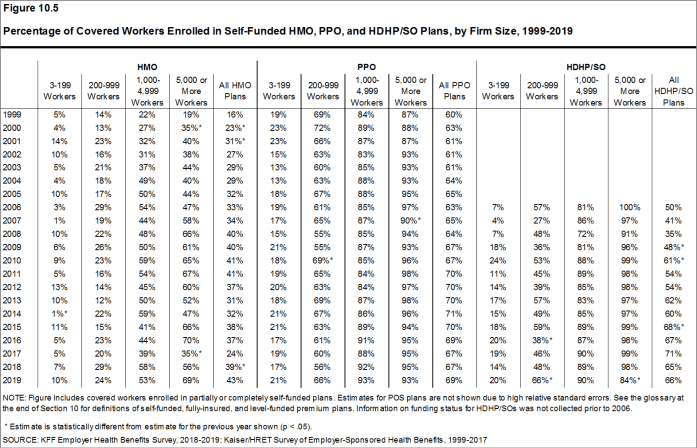

- The percentage of covered workers enrolled in self-funded plans has been stable in recent years across firm sizes [Figure 10.2]. The percentage of covered workers enrolled in a self-funded health plan is similar to ten years ago.

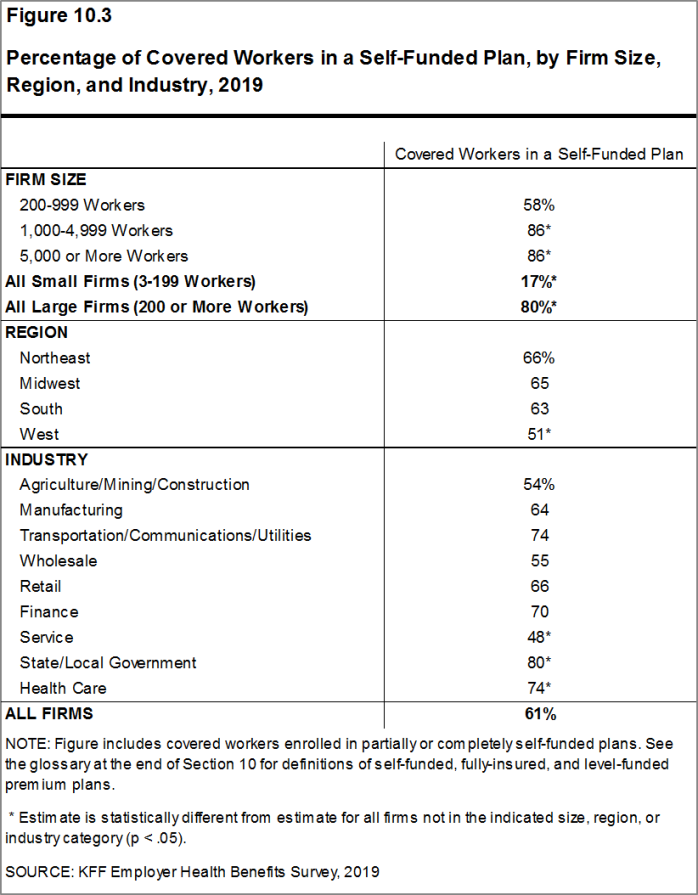

- As expected, covered workers in large firms are significantly more likely to be in a self-funded plan than covered workers in small firms (80% vs. 17%). The percentage of covered workers in self-funded plans generally increases as the number of workers in a firm increases. [Figure 10.1] and [Figure 10.3].

- The percentage of covered workers enrolled in self-funded plans has been stable in recent years across firm sizes [Figure 10.2]. The percentage of covered workers enrolled in a self-funded health plan is similar to ten years ago.

Figure 10.3: Percentage of Covered Workers in a Self-Funded Plan, by Firm Size, Region, and Industry, 2019

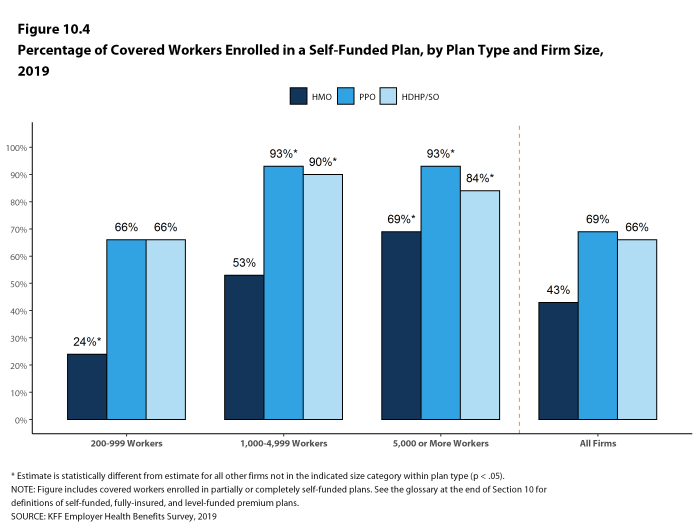

Figure 10.4: Percentage of Covered Workers Enrolled in a Self-Funded Plan, by Plan Type and Firm Size, 2019

LEVEL-FUNDED PLANS

In the past few years, insurers have begun offering health plans that provide a nominally self-funded option for small or mid-sized employers that incorporates stoploss insurance with relatively low attachment points. Often, the insurer calculates an expected monthly expense for the employer, which includes a share of the estimated annual cost for benefits, premium for the stoploss protection, and an administrative fee. The employer pays this “level premium” amount, with the potential for some reconciliation between the employer and the insurer at the end of the year, if claims differ significantly from the estimated amount. These policies are sold as self-funded plans, so they generally are not subject to state requirements for insured plans and, for those sold to employers with fewer than 50 employees, are not subject to the rating and benefit standards in the ACA for small firms.

Due to the complexity of the funding (and regulatory status) of these plans, and because employers often pay a monthly amount that resembles a premium, respondents may be confused as to whether or not their health plan is self-funded or insured. We asked employers with fewer than 200 workers whether they have a level-funded plan.

- Twenty-four percent of covered workers in small firms are in a plan that is either self-funded or level-funded [Figure 10.6].

Figure 10.6: Among Covered Workers at Small Firms, Percentage Enrolled in a Level-Funded or Self-Funded Plan, by Firm Size, 2019

- Self-Funded Plan

- An insurance arrangement in which the employer assumes direct financial responsibility for the costs of enrollees’ medical claims. Employers sponsoring self-funded plans typically contract with a third-party administrator or insurer to provide administrative services for the self-funded plan. In some cases, the employer may buy stoploss coverage from an insurer to protect the employer against very large claims.

- Fully-Insured Plan

- An insurance arrangement in which the employer contracts with a health plan that assumes financial responsibility for the costs of enrollees’ medical claims.

- Level-Funded Plan

- An insurance arrangement in which the employer makes a set payment each month to an insurer or third party administrator which funds a reserve account for claims, administrative costs, and premiums for stop-loss coverage. When claims are lower than expected, surplus claims payments may be refunded at the end of the contract.

- Stoploss Coverage

- Stoploss coverage limits the amount that a plan sponsor has to pay in claims. Stoploss coverage may limit the amount of claims that must be paid for each employee or may limit the total amount the plan sponsor must pay for all claims over the plan year.

- Attachment Point

- Attachment points refer to the amount at which the insurer begins to pay its obligations for stoploss coverage, either because plan, individual or claim spending exceed a designated value.