Few Consumers Use Information on Health Provider Quality or Price

This was published as a Wall Street Journal Think Tank column on April 27, 2015.

It’s widely assumed that Americans will become increasingly diligent and informed health-care consumers as higher deductibles and other forms of cost sharing push them to be more prudent purchasers and as they become aware of comparative provider quality and price information. That may well happen–but findings from the Kaiser Family Foundation’s April Health Tracking Poll show that the effort to bring provider quality and cost information to consumers is still in its infancy.

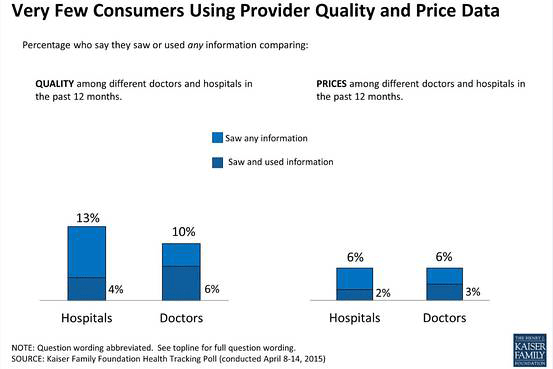

As the chart above shows, very small percentages of Americans say that they saw quality information comparing hospitals (13%) or doctors (10%) over the past 12 months. Of those who saw such data, the shares who said they used it were tiny: 4% for hospitals and 6% for doctors. Only 6% said they saw comparative price information for hospitals or doctors in the past year and only half as many say they used it.

There are many reasons consumers might not use comparative quality or price information. About eight in 10 people see a health professional each year, but not everyone goes to the hospital in a given year. Reputation and location may still dominate choice of providers. People may have established relationships with doctors and hospitals and may be less or uninterested in quality and price information, especially when a medical crisis calls for urgent decision-making. Some people are not online or are too busy working to compare data. Language barriers may impede some consumers. And pretty much everyone in the health-care sector agrees that the “state of the art” in the development of rigorous and reliable quality and price information has a long way to go.

So far, the growth of consumerism in health–with patients going online for medical information and empowering themselves to ask more from their medical providers–has not translated into widespread use of the provider quality and cost information available today. This suggests that employers and insurers may be the primary consumers of quality and cost information for the immediate future. But as cost-sharing grows so will the need for more useful information for consumers on provider quality and prices.