How Employer Actions Could Facilitate Equity in COVID-19 Vaccinations

Samantha Artiga and Liz Hamel

Published:

Despite experiencing higher rates of illness and death from COVID-19, Hispanic and Black people have been less likely than their White counterparts to receive COVID-19 vaccinations so far. With racial disparities in COVID-19 vaccinations persisting despite broadened eligibility for the vaccine across states, there are opportunities to close these gaps in vaccination by making it as easy as possible for people to get a vaccine and addressing their specific concerns. KFF COVID-19 Vaccine Monitor findings show that one particular concern among unvaccinated Hispanic and Black adults is having to miss work due to side effects. Providing employees with paid time off to get the vaccine and recover from side effects could help boost vaccination rates among these groups and narrow racial gaps in vaccination, as could other employer actions such as making the vaccines available at work and providing a financial incentive to get vaccinated.

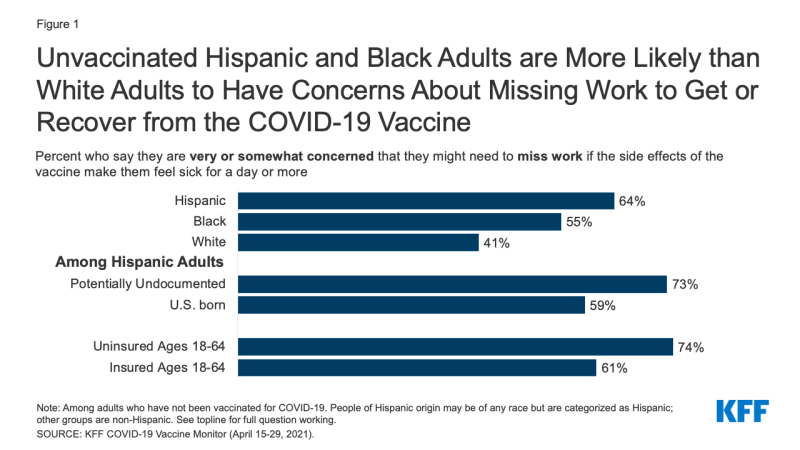

Hispanic and Black adults are more likely than their White counterparts to report concerns about missing work to get or recover from the COVID-19 vaccine. KFF COVID-19 Vaccine Monitor data from April 2021 show that nearly two-thirds (64%) of unvaccinated Hispanic adults and over half of Black adults (55%) are concerned that they might miss work due to side effects from the COVID-19 vaccine, compared to roughly four in ten unvaccinated White adults (41%) (Figure 1). The shares concerned about missing work due to side effects rise to nearly three-quarters among unvaccinated Hispanic adults who are potentially undocumented immigrants (73%) and nonelderly uninsured adults (74%). Further, three in ten (30%) Hispanic adults and about a quarter (23%) of Black adults are concerned that they might need to take time off work to get the COVID vaccine, compared to 16% of White adults. These increased concerns reflect that Hispanic and Black adults are more likely than their White counterparts to be employed in low-wage positions that are less likely to have access to paid leave. As such, they have less flexibility to take time off work and, if they do miss work, they often face lost wages that may leave them in a difficult financial situation due to more limited incomes.

Figure 1: Unvaccinated Hispanic and Black Adults are More Likely than White Adults to Have Concerns About Missing Work to Get or Recover from the COVID-19 Vaccine

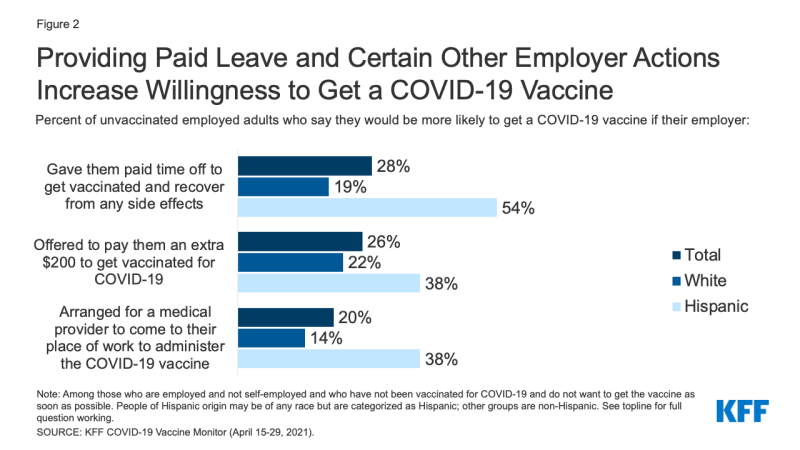

Providing paid time off to employees to get and recover from any side effects could help boost vaccination rates. Overall, nearly three in ten (28%) employed adults who are not yet ready to get the vaccine say that they would be more likely to get the COVID-19 vaccine if their employer gave them paid time off to get vaccinated and recover from any side effects. This strategy may be particularly effective for boosting vaccination rates among Hispanic adults, as over half (54%) of employed Hispanic adults who are not yet ready to get vaccinated say their employer providing paid time off would increase their willingness to get a shot, compared to 19% of their White counterparts (Figure 2). Certain other employer actions appear to be particularly effective for increasing willingness to get a vaccine among Hispanic adults. For example, four in ten (38%) employed Hispanic adults who are not yet ready to get vaccinated say they would be more likely to do so if their employer arranged for a medical provider to administer the vaccine at their workplace compared to 14% of their White counterparts. Similarly, 38% of Hispanic adults said that an employer financial incentive would increase their willingness to get vaccinated, higher than the share of White adults (22%). (Data were insufficient to examine these measures for employed Black adults who are unvaccinated and do not want to get the vaccine as soon as possible.)

Figure 2: Providing Paid Leave and Certain Other Employer Actions Increase Willingness to Get a COVID-19 Vaccine

The American Rescue Plan, which has been enacted into law, newly makes tax credits available to employers to cover the costs of providing paid leave to employees to receive and recover from COVID-19 vaccinations. Small and midsize employers and certain governmental employers are eligible to claim refundable tax credits that reimburse them for the cost of providing paid sick and family leave to their employees due to COVID-19, including leave taken by employees to receive or recover from COVID-19 vaccinations. Eligible employers include any business, including tax-exempt organizations, with fewer than 500 employees as well as certain governmental employers. Self-employed individuals are eligible for similar tax credits. The paid leave tax credits are tax credits against the employer’s share of the Medicare tax and are refundable, meaning that the employer is entitled to payment of the full amount of the credits if it exceeds the employer’s share of the Medicare tax. The tax credit for paid sick leave is equal to the sick leave wages paid for up to two weeks, limited to $511 per day and $5,110 in the aggregate, at 100% of the employee’s regular rate of pay. The tax credit for paid family leave is equal to wages paid for up to twelve weeks, limited to $200 per day and $12,000 in the aggregate, at 2/3rds of the employee’s regular rate of pay. Employer may claim these tax credits for wages paid for leave from April 1, 2021, through September 30, 2021.

Looking ahead, the American Families Plan, proposed by President Biden, would increase the availability of paid medical leave for workers, which could help reduce barriers to health care more broadly that disproportionately affect people of color. The concerns about missing work to get the vaccine illustrate how lack of paid leave can create a barrier to accessing health care, particularly for people of color. The American Families Plan would phase in 12 weeks of paid parental, family, and personal illness/safe leave for workers over ten years. Providing this leave could help reduce racial disparities in access to paid leave, which could facilitate individuals’ ability to access health care, including preventive care, as well as enable individuals take time off when they are sick or to care for a sick family member.