2014 Employer Health Benefits Survey

Employer-sponsored insurance covers about 149 million nonelderly people.1 To provide current information about employer-sponsored health benefits, the Kaiser Family Foundation (Kaiser) and the Health Research & Educational Trust (HRET) conduct an annual survey of private and nonfederal public employers with three or more workers. This is the sixteenth Kaiser/HRET survey and reflects employer-sponsored health benefits in 2014.

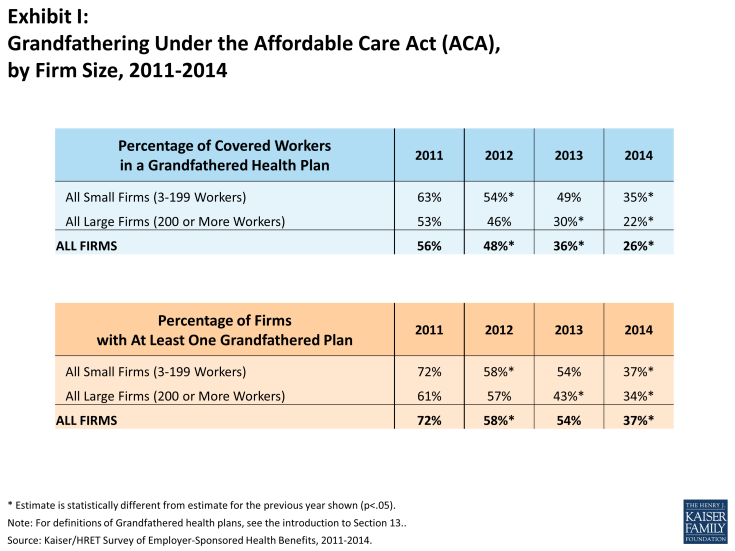

The key findings from the survey, conducted from January through May 2014, include a modest increase in the average premiums for family coverage (3%). Single coverage premiums are 2% higher than in 2013, but the difference is not statistically significant. Covered workers generally face similar premium contributions and cost-sharing requirements in 2014 as they did in 2013. The percentage of firms (55%) which offer health benefits to at least some of their employees and the percentage of workers covered at those firms (62%) are statistically unchanged from 2013. The percentage of covered workers enrolled in grandfathered health plans – those plans exempt from many provisions of the Affordable Care Act (ACA) – declined to 26% of covered workers from 36% in 2013. Perhaps in response to new provisions of the ACA, the average length of the waiting period decreased for those with a waiting period and the percentage with an out-of-pocket limit increased. Although employers continue to offer coverage to spouses, dependents and domestic partners, some employers are instituting incentives to influence workers’ enrollment decisions, including nine percent of employers who attach restrictions for spouses’ eligibility if they are offered coverage at another source, or nine percent of firms who provide additional compensation if employees do not enroll in health benefits.

HEALTH INSURANCE PREMIUMS AND WORKER CONTRIBUTIONS

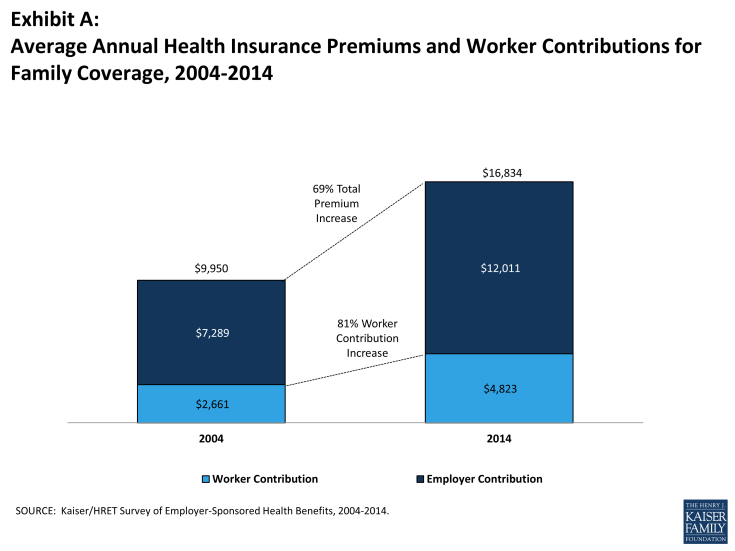

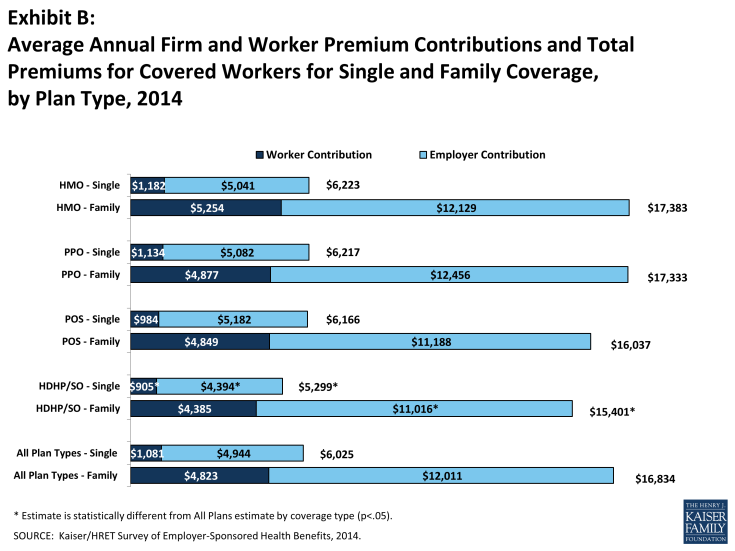

In 2014, the average annual premiums for employer-sponsored health insurance are $6,025 for single coverage and $16,834 for family coverage. The average family premium rose 3% over the 2013 average premium. Single coverage premiums rose 2% in 2014 but are not statistically different than the 2013 premium amounts. During the same period, workers’ wages increased 2.3% and inflation increased 2%.2 Over the last ten years, the average premium for family coverage has increased 69% (Exhibit A). Premiums have increased less quickly over the last five years (2009 to 2014), than the preceding five year period (2004 to 2009) (26% vs. 34%).

Average premiums for high-deductible health plans with a savings option (HDHP/SOs) are lower than the overall average for all plan types for both single and family coverage (Exhibit B), at $5,299 and $15,401, respectively. There are important differences in premiums by firm size: the average premium for family coverage is lower for covered workers in small firms (3-199 workers) than for workers in larger firms ($15,849 vs. $17,265).

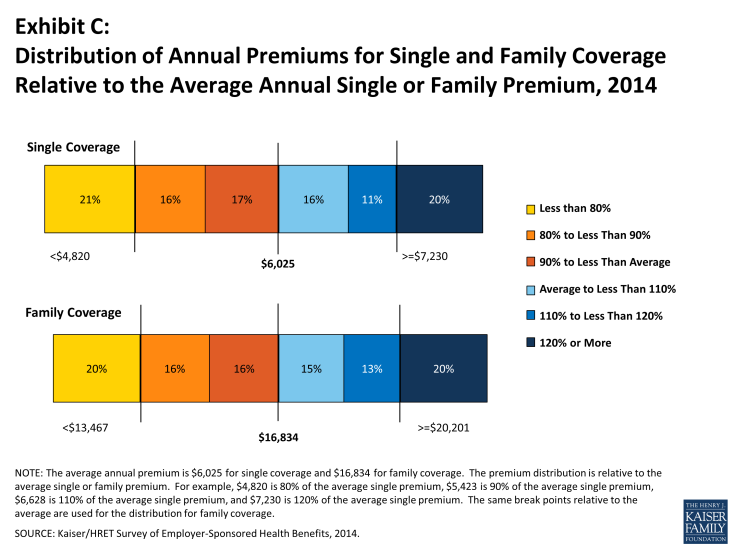

Premiums vary significantly around the averages for single and family coverage, resulting from differences in benefits, cost sharing, covered populations, and geographical location. Twenty percent of covered workers are in plans with an annual total premium for family coverage of at least $20,201 (120% of the average family premium), and 20% of covered workers are in plans where the family premium is less than $13,467 (80% of the average family premium). The distribution is similar around the average single premium (Exhibit C).

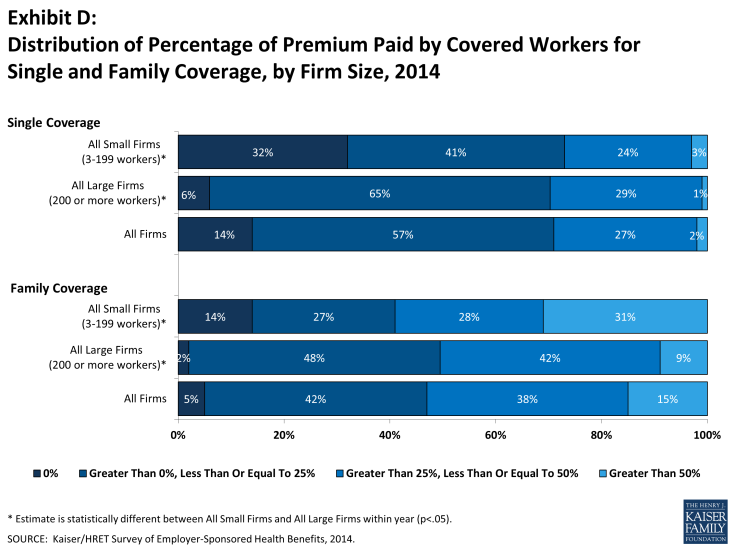

Most often, employers require that workers make a contribution towards the cost of the premium. Covered workers contribute on average 18% of the premium for single coverage and 29% of the premium for family coverage, the same percentages as 2013. Workers in small firms (3 – 199 workers) contribute a lower average percentage for single coverage compared to workers in larger firms (16% vs. 19%), but they contribute a higher average percentage for family coverage (35% vs. 27%). Workers in firms with a higher percentage of lower-wage workers (at least 35% of workers earn $23,000 or less) contribute higher percentages of the premium for single coverage (27% vs. 18%) and for family coverage (44% vs. 28%) than workers in firms with a smaller share of lower-wage workers.

As with total premiums, the share of the premium contributed by workers varies considerably among firms. For single coverage, 57% of covered workers are in plans that require them to make a contribution of less than or equal to a quarter of the total premium, 2% are in plans that require a contribution of more than half of the premium, and 14% are in plans that require no contribution at all. For family coverage, 42% of covered workers are in plans that require them to make a contribution of less than or equal to a quarter of the total premium and 15% are in plans that require more than half of the premium, while only 5% are in plans that require no contribution at all for family coverage (Exhibit D).

Looking at the dollar amounts that workers contribute, the average annual premium contributions in 2014 are $1,081 for single coverage and $4,823 for family coverage. Covered workers’ average dollar contribution to family coverage has increased 81% since 2004 and 37% since 2009 (Exhibit A). Workers in small firms (3 – 199 workers) have lower average contributions for single coverage than workers in larger firms ($902 vs. $1,160), but higher average contributions for family coverage ($5,508 vs. $4,523). Workers in firms with a higher percentage of lower-wage workers (at least 35% of workers earn $23,000 or less) have higher average contributions for family coverage ($6,472 vs. $4,693) than workers in firms with lower percentages of lower-wage workers.

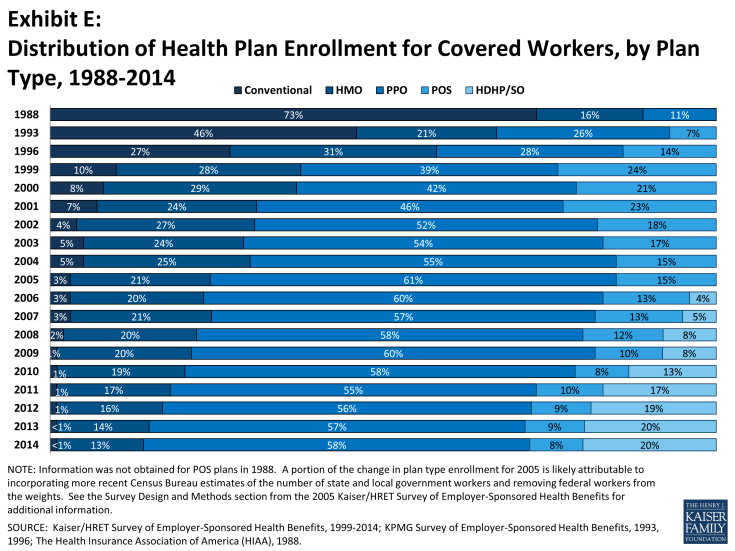

PLAN ENROLLMENT

PPO plans remain the most common plan type, enrolling 58% of covered workers in 2014. Twenty percent of covered workers are enrolled in a high-deductible plan with a savings options (HDHP/SO), 13% in an HMO, 8% in a POS plan, and less than 1% in a conventional (also known as an indemnity plan) (Exhibit E). Enrollment in HDHP/SOs increased significantly between 2009 and 2011, from 8% to 17% of covered workers, but has plateaued since then (Exhibit E). In 2014, twenty-seven percent of firms offering health benefits offer a high-deductible health plan with a health reimbursement arrangement (HDHP/HRA) or a health savings account (HSA) qualified HDHP.

Enrollment distribution varies by firm size; for example, PPOs are relatively more popular for covered workers at large firms (200 or more workers) than smaller firms (63% vs. 46%) and POS plans are relatively more popular among smaller firms than large firms (17% vs. 4%).

EMPLOYEE COST SHARING

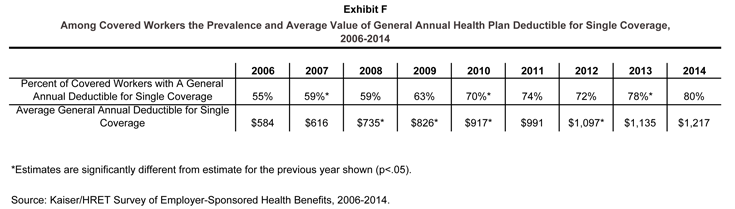

Most covered workers face additional out-of-pocket costs when they use health care services. Eighty percent of covered workers have a general annual deductible for single coverage that must be met before most services are reimbursed by the plan. Even workers without a general annual deductible often face other types of cost sharing when they use services, such as copayments or coinsurance for office visits and hospitalizations.

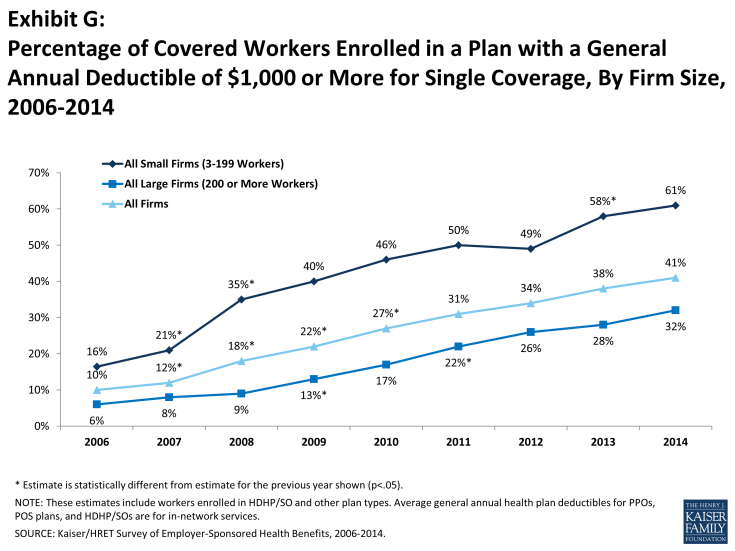

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,217. The average annual deductible is unchanged from last year ($1,135), but has increased from $826 dollars in 2009. Deductibles differ by firm size: for workers in plans with a deductible, the average deductible for single coverage is $1,797 in small firms (3-199 workers), compared to $971 for workers in larger firms (Exhibit F). Covered workers in small firms are significantly more likely to have high general annual deductibles compared to those in larger firms. Sixty-one percent of covered workers in small firms are in a plan with a deductible of at least $1,000 for single coverage compared to 32% in larger firms; a similar pattern is seen for those in plans with a deductible of at least $2,000 (34% for small firms vs. 11% for larger firms) (Exhibit G).

The large majority of workers also have to pay a portion of the cost of physician office visits. Almost three-in-four covered workers pay a copayment (a fixed dollar amount) for office visits with a primary care physician (73%) or a specialist physician (72%), in addition to any general annual deductible their plan may have. Smaller shares of workers pay coinsurance (a percentage of the covered amount) for primary care office visits (18%) or specialty care visits (21%). For in-network office visits, covered workers with a copayment pay an average of $24 for primary care and $36 for specialty care. For covered workers with coinsurance, the average coinsurance for office visits is 18% for primary and 19% for specialty care. While the survey collects information only on in-network cost sharing, it is generally understood that out-of-network cost sharing is higher.

The cost sharing that a person pays when they fill a prescription usually varies with the type of drug – for example whether it is a generic, brand-name, or specialty drug – and whether the drug is considered preferred or not on the plan’s formulary. These factors result in each drug being assigned to a tier that represents a different level, or type, of cost sharing. Eighty percent of covered workers are in plans with three-or-more tiers of cost sharing. Copayments are the most common form of cost sharing for tiers one through three and coinsurance is the most common form of cost sharing for drugs on the fourth or higher tier of formularies. Among workers with three-or-more tier plans, the average copayments in these plans are $11 for first-tier drugs, $31 for second-tier drugs, $53 for third-tier drugs, and $83 for fourth-tier drugs. Apart from first-tier drugs, the average copayment amounts are similar to those reported last year. HDHP/SOs have a somewhat different cost-sharing pattern for prescription drugs than other plan types: just 62% of covered workers are enrolled in a plan with three-or-more tiers of cost sharing, while 15% are in plans that pay the full cost of prescriptions once the plan deductible is met, and 17% are in a plan with the same cost sharing for all prescription drugs.

Most workers also face additional cost sharing for a hospital admission or an outpatient surgery episode. After any general annual deductible is met, 62% of covered workers have a coinsurance and 15% have a copayment for hospital admissions. Lower percentages have per day (per diem) payments (5%), a separate hospital deductible (3%), or both copayments and coinsurance (10%). The average coinsurance rate for hospital admissions is 19%, the average copayment is $280 per hospital admission, the average per diem charge is $297, and the average separate annual hospital deductible is $490. The cost-sharing provisions for outpatient surgery are similar to those for hospital admissions, as most covered workers have either coinsurance (64%) or copayments (16%). For covered workers with cost sharing for each outpatient surgery episode, the average coinsurance is 19% and the average copayment is $157.

Most plans limit the amount of cost sharing workers must pay each year, generally referred to as an out-of-pocket maximum. The ACA, requires that non-grandfathered health plans, with a plan year starting in 2014 have an out-of-pocket maximum of $6,350 or less for single coverage and $12,700 for family coverage or less. In 2014, 94% percent of covered workers have an out-of-pocket maximum for single coverage, significantly more than 88% in 2013. While most workers have out-of-pocket limits, the actual dollar limits differ considerably. For example, among covered workers in plans that have an out-of-pocket maximum for single coverage, 54% are in plans with an annual out-of-pocket maximum of $3,000 or more, and 10% are in plans with an out-of-pocket maximum of less than $1,500.

AVAILABILITY OF EMPLOYER-SPONSORED COVERAGE

Fifty-five percent of firms offer health benefits to their workers, statistically unchanged from 57% last year and 61% in 2012 (Exhibit H). The likelihood of offering health benefits differs significantly by size of firm, with only 44% of employers with 3 to 9 workers offering coverage, but virtually all employers with 1,000 or more workers offering coverage to at least some of their employees. Ninety percent of workers are in a firm that offers health benefits to at least some of its employees, similar to 2013 (90%). Offer rates also differ by other firm characteristics; 53% of firms with relatively fewer younger workers (less than 35% of the workers are age 26 or younger) offer health benefits compared to 30% of firms with a higher share of younger workers.

Even in firms that offer health benefits, not all workers are covered. Some workers are not eligible to enroll as a result of waiting periods or minimum work-hour rules. Other workers do not enroll in coverage offered to them because of the cost of coverage or because they are covered through a spouse. Among firms that offer coverage, an average of 77% of workers are eligible for the health benefits offered by their employer. Of those eligible, 80% take up their employer’s coverage, resulting in 62% of workers in offering firms having coverage through their employer. Among both firms that offer and do not offer health benefits, 55% of workers are covered by health plans offered by their employer, similar to 2013 (56%).

RETIREE COVERAGE

Twenty-five percent of large firms (200 or more workers) that offer health benefits in 2014 also offer retiree health benefits, similar to the percentage (28%) in 2013 but down from 35% in 2004. Among large firms (200 or more workers) that offer retiree health benefits, 92% offer health benefits to early retirees (workers retiring before age 65), 72% offer health benefits to Medicare-age retirees, and 3% offer a plan that covers only prescription drugs. There may continue to be evolution in the way that employers structure and deliver retiree benefits. Among large firms offering health benefits, 25% of firms are considering changing the way they offer retiree coverage because of the new public health insurance exchanges established by the ACA. In addition to the public exchanges, there is considerable interest in exchange options offered by private firms. Four percent of large employers currently offer their retiree benefits through a private exchange.

WELLNESS, HEALTH RISK ASSESSMENTS AND BIOMETRIC SCREENINGS

Employers continue to offer programs in large numbers that help employees identify issues with their health and engage in healthier behavior. These include offering their employees the opportunity to complete a health risk assessment, and offering a variety of wellness programs that promote healthier lifestyles, including better diet and more exercise. Some employers collect biometric information from employees (e.g., cholesterol levels and body mass index) to use as part of their wellness and health promotion programs.

Almost one-third of employers (33%) offering health benefits provide employees with an opportunity to complete a health risk assessment. A health risk assessment includes questions about medical history, health status, and lifestyle, and is designed to identify the health risks of the person being assessed. Large firms (200 or more workers) are more likely than smaller firms to ask employees to complete a health risk assessment (51% vs. 32%). Among these firms, 51% of large firms (200 or more workers) report that they provide a financial incentive to employees that complete the assessment. Thirty-six percent of firms with a financial incentive for completing a health risk assessment reported that the maximum value of the incentive is $500 or more.

Fifty-one percent of large firms (200 or more workers) and 26% of smaller firms offering health benefits report offering biometric screening to employees. A biometric screening is a health examination that measures an employee’s risk factors, such as body weight, cholesterol, blood pressure, stress, and nutrition. Of these firms, one percent of large firms require employees to complete a biometric screening to enroll in the health plan; and 8% of large firms report that employees may be financially rewarded or penalized based on meeting biometric outcomes.

Virtually all large employers (200 or more workers) and most smaller employers offer at least one wellness program. Seventy-four percent of employers offering health benefits offer at least one of the following wellness programs in 2014: 1) weight loss programs, 2) gym membership discounts or on-site exercise facilities, 3) biometric screening, 4) smoking cessation programs, 5) personal health coaching, 6) classes in nutrition or healthy living, 7) web-based resources for healthy living, 8) flu shots or vaccinations, 9) Employee Assistance Programs (EAP), or a 10) wellness newsletter. Large firms (200 or more workers) are more likely to offer one of these programs than smaller firms (98% vs. 73%). Of firms offering health benefits and a wellness program, 36% of large firms (200 or more workers) and 18% of smaller firms offer employees a financial incentive to participate in a wellness program, such as smaller premium contributions, smaller deductibles, higher HSA/HRA contributions or gift cards, travel, merchandise or cash. Among firms with an incentive to participate in wellness programs, only 12% of small firms and 33% of large firms believe that incentives are “very effective” at encouraging employees to participate. In lieu of or in addition to incentives for participating in wellness programs, 12% of large firms have an incentive for completing wellness programs.

PROVIDER NETWORKS

High Performance or Tiered Networks. Nineteen percent of employers offering health benefits have high performance or tiered networks in their largest health plan. These programs identify providers that are more efficient or have higher quality care, and may provide financial or other incentives for enrollees to use the selected providers. Employers may use different criteria to determine which providers are in which tiers. Fifty-nine percent of firms whose largest plan includes a high performance or tiered provider network stated that the network tiers were determined both by providers’ “quality and cost/efficiency”, followed by 33% who selected “cost-efficiency”.

Narrow Networks. Some employers are limiting their provider networks to reduce the cost. Six percent of employers with 50 or more employees reported that their plan eliminated hospitals to reduce cost and eight percent offer a plan considered a narrow network plan. Only six percent of employers with 50 or more workers offering health benefits stated that “narrow networks” are a very effective strategy to contain cost, less than other strategies such as “wellness program” (28%) and “consumer drive health plans” (22%).

Retail Health Clinics. Fifty-seven percent of employers offering health benefits cover services provided by retail health clinics. These may be health clinics located in grocery stores or pharmacies to treat minor illnesses or provide preventive services, such as vaccines or flu shots. Among firms covering services in these settings, eight percent provide a financial incentive to receive services in a retail clinic instead of a physician’s office.

EMPLOYEE AND DEPENDENT ELIGIBILITY

Waiting Period. The ACA limits waiting periods to no more than 90 days for non-grandfathered plans with plan years beginning after January 1, 2014. The average length of waiting periods for covered workers who face a waiting period decreased from 2.3 months in 2013 to 2.1 months in 2014. Twenty-three percent of large firms and 10% of small firms with a waiting period indicated that they decreased the length of their waiting period during the last year. As more firms renew their plans in 2014 and lose grandfathering status more firms will be subject to this provision.

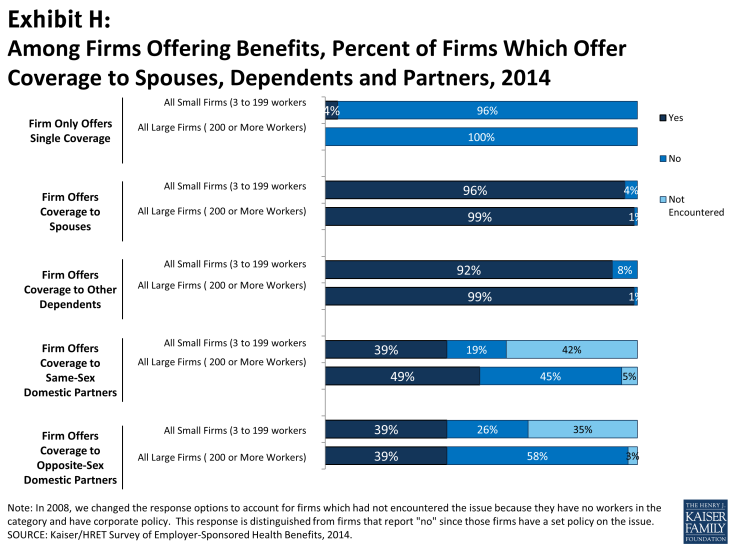

Dependent Coverage. The overwhelming majority of firms which offer coverage to at least some employees offer coverage to dependents (96%) (Exhibit H). Thirty-nine percent of firms offer coverage to same-sex domestic partners, the same percentage that offers coverage to opposite-sex domestic partners. Both percentages are similar to 2012, the last time the survey included this question. Some employers are requiring additional cost sharing (5%) or restricting eligibility for spouses (9%) to enroll if they have an offer of coverage from another source. Eighteen percent of large firms provide compensation or benefits to employees who do not enroll in coverage.

OTHER TOPICS

Grandfathered Health Plans. The ACA exempts “grandfathered” health plans from a number of its provisions, such as the requirements to cover preventive benefits without cost sharing or the new rules for small employers’ premiums ratings and benefits. An employer-sponsored health plan can be grandfathered if it covered a worker when the ACA became law (March 23, 2010) and if the plan has not made significant changes that reduce benefits or increase employee costs.3 Thirty-seven percent of firms offering health benefits offer at least one grandfathered health plan in 2014, less than 54% in 2013. Looking at enrollment, 26% of covered workers are enrolled in a grandfathered health plan in 2014, down from 36% in 2013 (Exhibit I).

Self-Funding. Fifteen percent of covered workers at small firms (3-199 workers) and 81% of covered workers at larger firms are enrolled in plans which are either partially or completely self-funded. The percent of covered workers enrolled in self-funded plans has increased for large firms since 2004, but has remained stable for both large and small firms over the last couple of years.

Private Exchanges for Large Employers. While relatively few covered workers at large employers currently receive benefits through a private or corporate health insurance exchange (3%), many firms are looking at this option. Private exchanges allow employees to choose from several health benefits options offered on the exchange. A private exchange is created by a consulting company or insurer, rather than a governmental entity. Thirteen percent of large firms are considering offering benefits through a private exchange and 23% are considering using a defined contribution method. This interest may signal a significant change in the way that employers approach health benefits and the way employees get coverage.

CONCLUSION

The 2014 survey found considerable stability among employer-sponsored plans. Similar percentages of employers offered benefits to at least some employees and a similar percentage of workers at those firms were covered by benefits compared to last year. Family premiums increased at a modest rate and single premiums are not statistically different than those reported last year. On average, covered workers contribute the same percentage of the premium for single and family coverage as they did last year.

The relatively quiet period in 2014 may give way to bigger changes in 2015 as the employer shared-responsibility provision in the ACA takes effect for large employers. This provision requires firms with more than 100 full time equivalent employees (FTEs) in 2015 and more than 50 FTEs in 2016 to provide coverage to their full-time workers or possibly pay a penalty if workers seek subsidized coverage in health care exchanges. While most large employers provide coverage to workers, not all do, and not all cover all of their full-time workers. In addition, the coverage offered by these larger employers must meet a certain value and must be offered at an affordable amount to workers. We expect some employers to revise eligibility and contributions for benefits in response to the new provisions.

The continued implementation of major reforms in the non-group market also may affect employer strategies going forward. For smaller firms not subject to the employer-responsibility requirement, the ability of their employees to receive subsidized nongroup coverage in health insurance exchanges may be an attractive alternative which would relieve the employer of the burden of sponsoring coverage. Small firms that have struggled to offer good coverage options may decide to stop offering now that other alternatives are available. In addition, a quarter of large firms offering retiree coverage to active workers indicated they were considering changes to the way they offered retiree coverage because of the implementation of the public exchanges. We may see shifts in the coverage options offered by some employers in response to these new options and new tax incentives.

Employer-sponsored coverage also will continue to evolve for reasons that are not related to the ACA. Employers and insurers continue to develop more integrated approaches to assessing individuals’ personal health risks and offering programs to address them. Wellness programs present enrollees with opportunities and challenges, including the possibility of much higher out-of-pocket costs if their health profile is a potentially costly one. Narrow networks and provider networks and new tools like reference pricing can lower premiums but also require enrollees to have a more active role in ensuring that they have access to the providers they want to use. And the development of private marketplaces for larger employers, if it continues, may signal a new direction where individual employers are less engaged in plan design and management and where more decisions and economic responsibility is shifted to employees.

Finally, the continuing improvement in the economy is likely to put new cost pressure on employers and insurers. Costs grew at low levels while the economy struggled, but are likely to rebound if the growth in the economy is sustained. The potential of higher premiums may push employers and insurers to accelerate some of the changes we already are seeing.

METHODOLOGY

The Kaiser Family Foundation/Health Research & Educational Trust 2014 Annual Employer Health Benefits Survey (Kaiser/HRET) reports findings from a telephone survey of 2,052 randomly selected public and private employers with three or more workers. Researchers at the Health Research & Educational Trust, NORC at the University of Chicago, and the Kaiser Family Foundation designed and analyzed the survey. National Research, LLC conducted the fieldwork between January and May 2014. In 2014 the overall response rate is 46%, which includes firms that offer and do not offer health benefits. Among firms that offer health benefits, the survey’s response rate is also 46%.

We ask all firms with which we made phone contact, even if the firm declined to participate in the survey: “Does your company offer a health insurance program as a benefit to any of your employees?” A total of 3,139 firms responded to this question (including the 2,052 who responded to the full survey and 1,087 who responded to this one question). Their responses are included in our estimates of the percentage of firms offering health coverage. The response rate for this question is 70%.

Since firms are selected randomly, it is possible to extrapolate from the sample to national, regional, industry, and firm size estimates using statistical weights. In calculating weights, we first determine the basic weight, then apply a nonresponse adjustment, and finally apply a post-stratification adjustment. We use the U.S. Census Bureau’s Statistics of U.S. Businesses as the basis for the stratification and the post-stratification adjustment for firms in the private sector, and we use the Census of Governments as the basis for post-stratification for firms in the public sector. Some numbers in the exhibits in the report do not sum up to totals due to rounding effects, and, in a few cases, numbers from distribution exhibits referenced in the text may not add due to rounding effects. Unless otherwise noted, differences referred to in the text and exhibits use the 0.05 confidence level as the threshold for significance. In 2014 we adjusted the premiums for a small number of firms which gave a composite family/single amount.

For more information on the survey methodology, please visit the Survey Design and Methods Section at http://ehbs.kff.org/.

The Kaiser Family Foundation, a leader in health policy analysis, health journalism and communication, is dedicated to filling the need for trusted, independent information on the major health issues facing our nation and its people. The Foundation is a non-profit private operating foundation, based in Menlo Park, California.

The Health Research & Educational Trust is a private, not-for-profit organization involved in research, education, and demonstration programs addressing health management and policy issues. Founded in 1944, HRET, an affiliate of the American Hospital Association, collaborates with health care, government, academic, business, and community organizations across the United States to conduct research and disseminate findings that help shape the future of health care.