A Look At CBO Projections For Medicaid and CHIP

Summary

Medicaid is the nation’s primary health insurance program for low-income and high-need Americans. States administer Medicaid within broad federal rules and have a lot of flexibility to design their programs. Medicaid is jointly financed by the states and the federal government. The Affordable Care Act (ACA) expands Medicaid to a national eligibility floor of 138% of the federal poverty level (FPL) and provides significant federal funding for this new coverage. The Supreme Court ruling on the ACA effectively made the Medicaid expansion a state choice. Medicaid and the Children’s Health Insurance Program (CHIP) play an important role in providing health coverage for millions of children across the country. Both programs are jointly financed by states and the federal government and largely administered by states within broad federal rules but differ in several key ways, including size and scope, financing, benefits and cost-sharing.1

Generally once a year, the Congressional Budget Office (CBO) releases a detailed “baseline” for federal spending for Medicaid, CHIP and the ACA that serves as a neutral benchmark for Congress to measure the budgetary effect of proposed legislation and as a reference point for analysis of Medicaid enrollment and spending. This baseline assumes current law remains in place, but adjusts for changes in the economy and other factors that will affect federal revenues and spending. CBO does not provide state-by-state projections or estimates of the effects of legislation. Key findings from the April 2014 CBO projections for federal Medicaid, CHIP and the ACA spending over the 2014-2024 period include the following:2

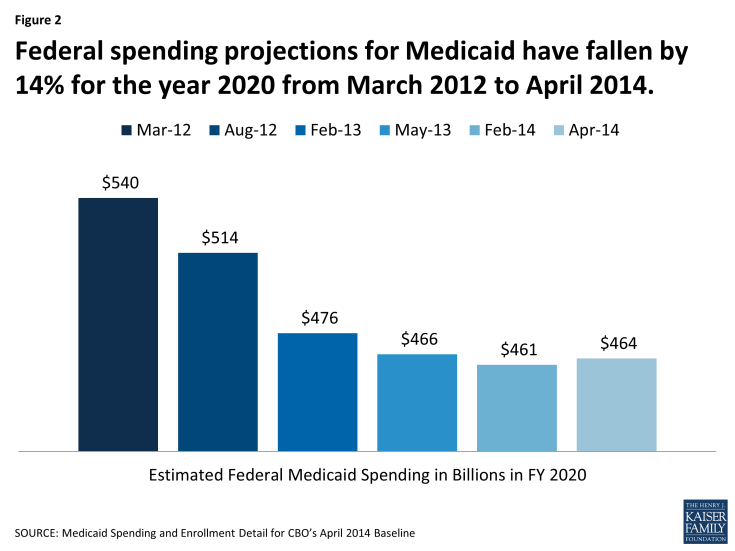

- Compared to the CBO Medicaid baseline from March 2012, federal spending projected for 2020 in the April 2014 baseline is 14% lower due to a number of factors including the Supreme Court decision effectively making the ACA Medicaid expansion an option.

- Under the current baseline, federal Medicaid expenditures are expected to grow by an average annual rate of about 7% (including the effects of the ACA) with enrollment increasing by 2% on average.

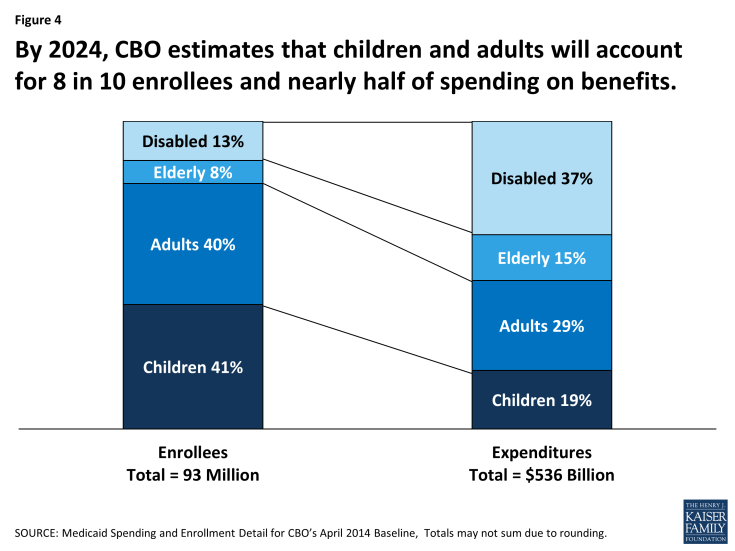

- Primarily due to expansion of coverage for adults under the ACA, by 2024, children and adults will account for 8 in 10 enrollees and nearly half of all spending which are higher shares compared to today.

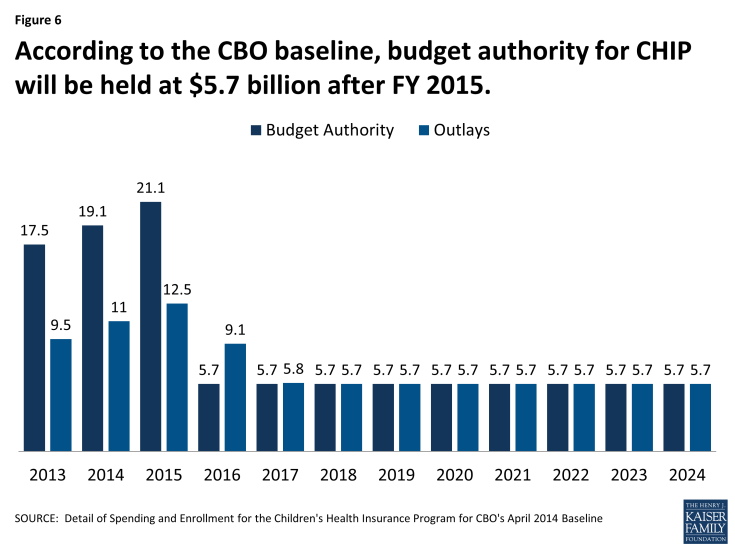

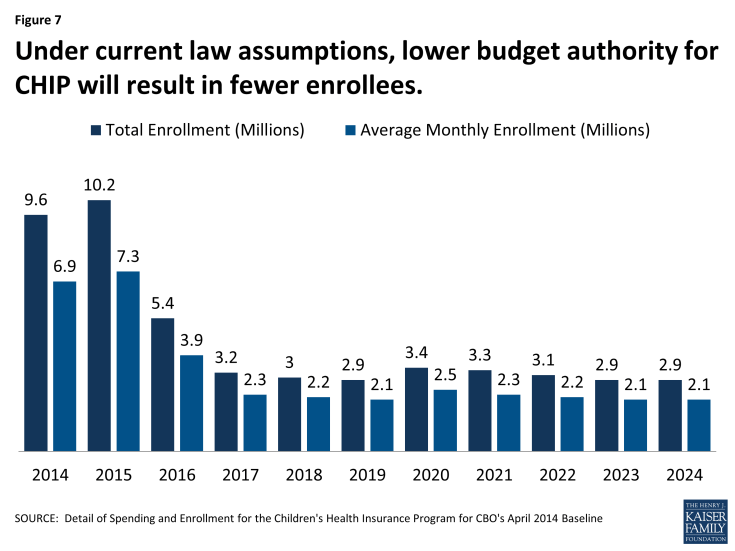

- Under current law CHIP funding expires in 2015. The CBO baseline continues the budget authority levels set in the ACA for 2015. As a way to reduce the costs for the ACA, budget authority for CHIP was reduced to $5.7 billion and the remaining funding was provided through a one-time appropriation. As a result of lower spending level, CHIP enrollment is expected to decline over the projection period.

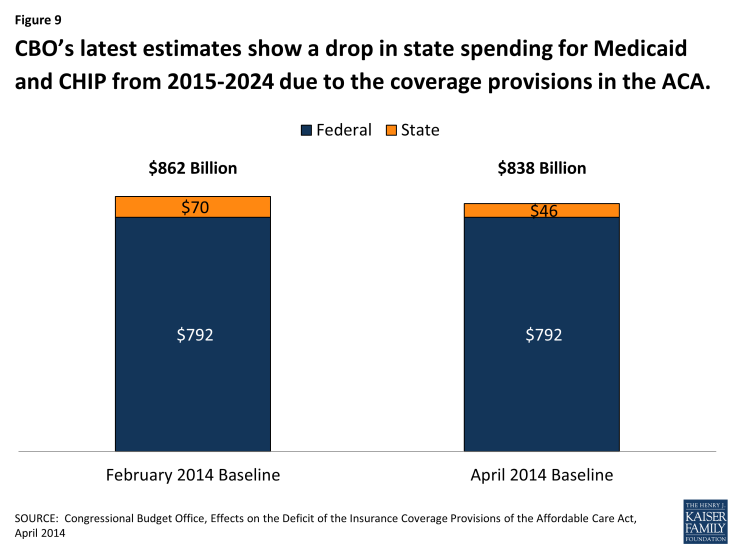

- Due to the ACA, the number of uninsured is expected to decline by 26 million by 2024. Federal Medicaid and CHIP outlays are expected to increase by $792 billion over the 2015-2024 period and state spending for matching funds by $46 billion (a reduction from $70 billion in the February 2014 projections primarily due to lower than expected take-up of current eligible).

Introduction

What is Medicaid?

Medicaid is the nation’s primary health insurance program for low-income and high-need Americans. CBO estimates show that Medicaid covered 72 million low-income Americans including children, pregnant women, parents, elderly and individuals with disabilities at some point in 2013. Medicaid provides critical assistance to low-income Medicare beneficiaries and is the primary payer for long-term services and supports. The program accounts for about one in six dollars spent on health care; is the largest source of funding for safety-net providers, and the largest insurer of births. States administer Medicaid within broad federal rules and have significant of flexibility to design their programs. Medicaid is jointly financed by the states and the federal government. The federal share (FMAP) averages 57 percent and ranges from a floor of 50 percent to a high of 73 percent based on a formula that relies on state per capita income and is recalculated each year.3

The Affordable Care Act expands Medicaid to a national eligibility floor of 138% of the federal poverty level (FPL) which will primarily expand Medicaid coverage to adults. In general, the ACA provides 100% federal financing for those newly eligible for Medicaid from 2014 to 2016 and then phases down the federal share to 90% by 2020 and beyond. The Supreme Court upheld the ACA but limited the federal government’s ability to enforce the Medicaid expansion to low-income adults, effectively making implementation of the Medicaid expansion a state choice.

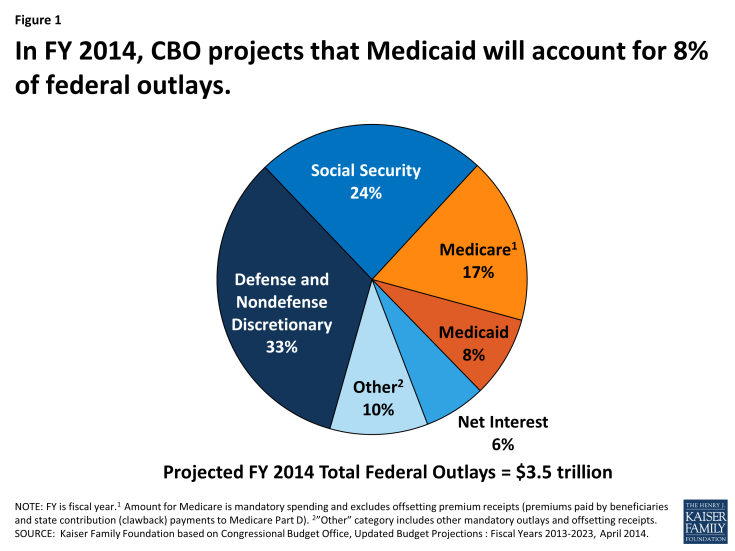

Medicaid is the third-largest domestic program in the federal budget following Medicare and Social Security. In federal fiscal year 2014, spending from Medicaid will account of an estimated 8% of federal spending. (Figure 1)

What is the Role of the Congressional Budget Office?

The Congressional Budget Office (CBO) prepares reports and analyses with economic forecasts and budget projections that cover a 10 year period for all spending in the federal budget that is used in the Congressional budget process. In addition, CBO prepares other reports for Congress including long-term budget projections, an analysis of the President’s budget, cost estimates, analysis of federal mandates, budget options, reports and estimates related to appropriations and other program specific reports affecting the federal budget like health care. For legislation being considered by Congress, CBO provides cost estimates of the impact and offsets on the federal budget. In this role, CBO is often referred to as the “scorekeeper.” CBO provides aggregate estimates of the effects of legislative proposals on states, but CBO does not provide state-by-state Medicaid projections or estimates of the effects of legislation.

CBO regularly publishes projections of economic and budget outcomes which incorporate the assumption that current law regarding federal spending and revenues generally remains in place. Those baseline projections cover the 10-year period used in the Congressional budget process. Most of the reports on those projections also describe the differences between the current projections and previous ones; compare the economic forecast with those of other forecasters; and show the budgetary impact of some alternative policy assumptions. The budget projections and economic forecast are generally issued each January and updated in August; the budget projections are also generally updated in March.4 The March (sometimes April or May) update includes more detailed “baseline” projections for federal spending for Medicaid, CHIP and the ACA which include estimates of federal spending by eligibility group and service as well as enrollment and spending by eligibility group.

What Are CBO’s Estimates for Medicaid?

Each year, CBO produces a fact sheet that provides more detail about federal Medicaid spending projections over the next decade. The fact sheet shows federal Medicaid payments for benefits (acute and long-term care), disproportionate share hospital (DSH) payments, spending for the Vaccines For Children program and administrative expenses. The fact sheet also shows estimates of federal benefit payments by eligibility category, enrollment by eligibility category and average federal spending on benefits per enrollee. For the baseline released in April 2014, the projection period is for 2014-2024. Given that the Affordable Care Act (ACA) was enacted and is now current law, the CBO baseline Medicaid projections include the effects of the ACA. These projections also estimate the effect on federal spending of the Supreme Court decision that effectively gave states the option to implement the Medicaid expansion.

CBO generally reports on the legislative, economic and technical changes in the baseline from one projection period to the next; however, significant details about the underlying assumptions beyond what is included in the baseline fact sheet are not generally available. Projections for Medicaid spending have declined from the CBO projections released in 2012 due to state decisions on whether to expand Medicaid, lower than anticipated year to date spending and other technical corrections. Examining the components of the baseline fact sheet may help to better understand the overall projections.

Current Compared to Earlier CBO Medicaid Projections

For the year 2020, the CBO projections for federal Medicaid spending declined by 14% from the baseline issued in March 2012 to the baseline issued in April 2014. (Figure 2)

- From March 2012 to August 2012, the primary reason for lower spending was primarily driven by the Supreme Court decision which effectively gave states the option to implement the Medicaid expansion. The August 2012 baseline were the first projections to assume that some states will not expand their Medicaid programs at all or will not expand coverage to the full extent authorized by the ACA.

- From August 2012 to February 2013 the Medicaid baseline declined primarily due to lower anticipated enrollment (primarily tied to lower enrollment in the Supplemental Security Income program which is linked to Medicaid enrollment) and lower expected costs per person.

- More recent estimates have been more stable. Changes from February 2014 to April 2014 reflect increases in enrollment as a result of updates to the size and demographic characteristics of the overall population as well as increases in the cost of incentive payments related to the adoption of health information technology. These increases were partially offset by a continued downward revision to SSI enrollment and a decrease in the projected costs per-person for newly eligible adults under the ACA.

Spending

Over the next decade CBO expects federal Medicaid expenditures to grow from $299 billion in 2014 to $576 billion in 2024, an average annual rate of about 7 percent. This growth rate includes higher federal Medicaid spending over the decade related to the implementation of the ACA. The CBO baseline consists of four key parts: benefits, Disproportionate Share Hospital (DSH) payments, the Vaccines for Children Program and Administrative expenses. More than 90 percent of federal Medicaid spending is on benefits (acute care, long-term care and payments for Medicare premiums for low-income Medicare beneficiaries).

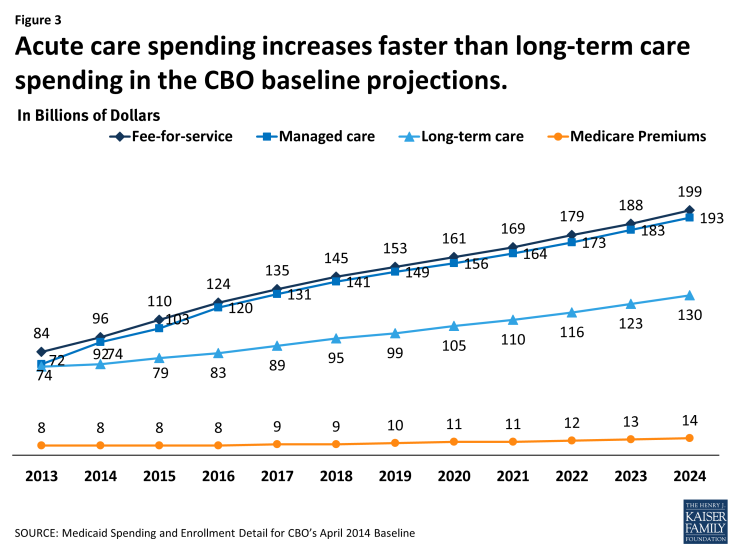

Over the projection period, acute care spending (fee-for-service spending, payments to managed care and payments for Medicare premiums) accounts for about 75 percent of spending for Medicaid benefits. Long-term care, which includes both institutional and community-based long-term care spending, accounts for the remaining 25 percent. Fee-for-service and managed care spending both are projected to increase sharply in 2014 as the ACA expansion of Medicaid coverage become effective. This translates to faster growth for these categories of spending over the 10 year period relative to long-term care spending. (Figure 3)

Figure 3: Acute care spending increases faster than long-term care spending in the CBO baseline projections.

Enrollment and Spending by Eligibility Group

CBO estimates that total Medicaid enrollment will grow from 72 million in 2013 to 93 million by 2024. These figures are based on the total number of individuals enrolled in Medicaid at any point during the fiscal year. Average monthly enrollment is expected to increase from 58 million in 2013 to 73 million in 2024. CBO projects enrollment for four categories: the aged, disabled, children and adults. Overall enrollment is expected to grow at an average annual rate of about 2 percent per year between 2014 and 2024. Generally, enrollment growth accounts for underlying population growth trends, economic assumptions (i.e. unemployment rates) and assumptions about state or individual behavior that may affect participation. Since Medicaid enrollment is based on income, projections about the economy and unemployment will affect Medicaid.

Over the projection period, growth for adults is expected to increase significantly (from 21 million in 2013 to 37 million in 2024) due to the Medicaid expansion; however, these estimates assume that not all states will implement the expansion and in states that implement the expansion not all of those newly eligible will participate. By 2024, adults account for 4 in 10 enrollees. (Figure 4) Prior to the implementation of the ACA Medicaid expansion, children accounted for nearly half of all enrollees.

As the share of enrollment shifts over the projection period, the share of spending by eligibility group is expected to shift as well. Prior to the ACA, the elderly and disabled had historically accounted for about two-thirds of spending on Medicaid. By 2024, children and adults are expected to account for slightly under half of Medicaid spending and the aged and disabled categories are expected to account for just over half of spending on Medicaid benefits. (Figure 4)

Figure 4: By 2024, CBO estimates that children and adults will account for 8 in 10 enrollees and nearly half of spending on benefits.

Spending Per Enrollee

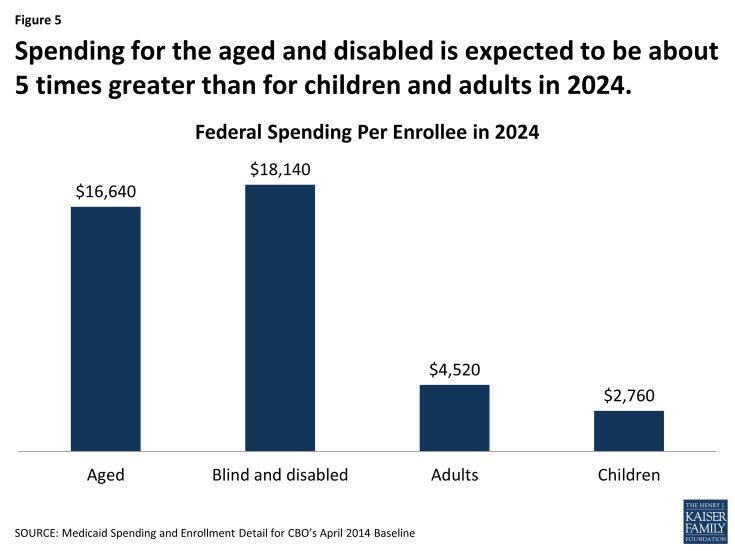

Growth in spending per enrollee largely reflects inflation and expectations of the costs to purchase medical services in the health care market place. By 2024, spending for an aged or disabled enrollee is projected to be about five times greater than spending for a child or adult enrollee. (Figure 5) The aged and disabled tend to use more complex acute care services as well as expensive long-term care services. Over the 2014 to 2024 period, spending per enrollee is expected to increase at rates ranging from 4 percent for the aged to 6 percent for adults. Historically, Medicaid spending has increased at rates faster than inflation, but slower than per person increases for private health care premiums.

Figure 5: Spending for the aged and disabled is expected to be about 5 times greater than for children and adults in 2024.

What Are CBO’s Estimates for CHIP?

Under current law, CHIP was funded through FY 2015 as part of the ACA. Generally, the CBO assumes that funding for an expiring program will be funded at a level equal to the last year it was financed in the law. However, to reduce costs for the ACA in the CBO score, when CHIP financing was set in the ACA, the final year funding authority was reduced from $21.1 billion in FY 2015 to $5.7 billion in 2016. (Figure 6) The rest of the CHIP financing was provided through a one-time appropriation that is not assumed to continue in the baseline but would be required to maintain the program at current levels. While this lowered the cost of the ACA, it increases the costs of extending CHIP beyond 2015 because these funds need to be paid for. A similar financing mechanism was used during the CHIP Reauthorization Act (CHIPRA) in 2009.

Figure 6: According to the CBO baseline, budget authority for CHIP will be held at $5.7 billion after FY 2015.

Under the CBO baseline assumptions, CHIP enrollment is expected to decline due to limited financing. By 2024, CHIP enrollment is expected to fall to 2.9 million over the course of the year or 2.1 million on an average monthly basis from a high of 10.2 ever-on and 7.3 average monthly enrollment in 2015. (Figure 7) CBO assumes that when states face federal CHIP funding shortfalls, children enrolled in CHIP-funded Medicaid coverage will be shifted to regular Medicaid (at the regular Medicaid matching rate). Other children will lose their CHIP coverage and shift to subsidized coverage in the marketplaces, and some children previously on CHIP will end up uninsured because coverage through ESI is unaffordable and they are not eligible for marketplace subsidies. The affordability test in the law is based on whether the policy for a worker (not the family) is less than 9% of family income.

Figure 7: Under current law assumptions, lower budget authority for CHIP will result in fewer enrollees.

Medicaid, CHIP and the ACA

While the effects of the ACA are included in the current baseline projects for Medicaid, CBO also released updated estimates of the effects on the deficit and coverage related to the health insurance coverage provisions in the ACA.

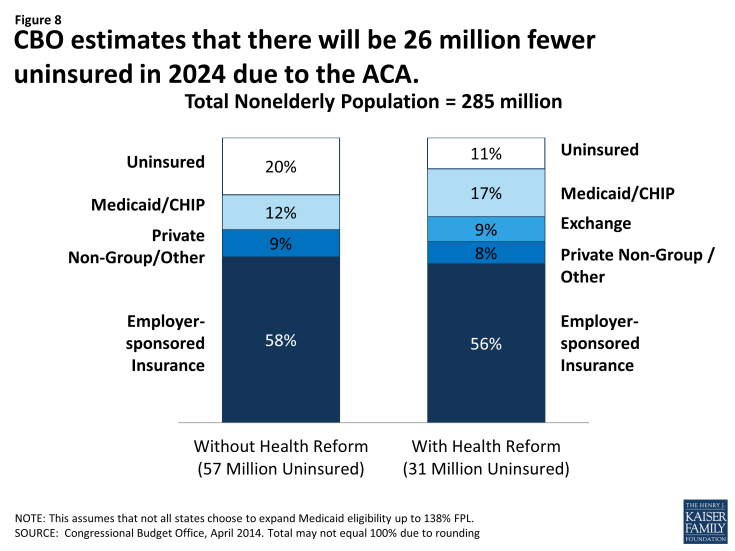

Overall, the most recent estimates assume a reduction in the uninsured of 26 million (from 57 million to 31 million) by 2024 which is attributable to increases in coverage through the new marketplaces and Medicaid and CHIP. The CBO estimates that 25 million will be newly covered in marketplaces and Medicaid and CHIP enrollment will increase by 13 million by 2024. These estimates assume that not all states will implement the expansion. The increase is a combination of those made newly eligible by the ACA as well as increased participation among those eligible but not enrolled prior to the ACA. (Figure 8)

CBO estimates that on net the ACA is expected to reduce the federal deficit, but since the passage of the law, CBO has only continued to update the estimates for the coverage provisions of the ACA which are expected to result in increases in federal spending. Overall, the coverage provisions in the ACA are expected to increase gross federal costs by $1.8 trillion over the 2015-2024 period. Medicaid and CHIP outlays are expected to increase by $792 billion over the 2015 to 2024 period as a result of the ACA coverage provisions accounting for 43 percent of the total gross costs.

CBO estimates that state spending would increase by about $46 billion from 2015 to 2024 as a result of the ACA coverage provisions. Compared to the February 2014 estimates, the federal cost estimates did not change but the estimate for state costs declined from $70 billion to $46 billion. (Figure 9) While CBO does not provide a direct explanation for this, the majority of this change is likely tied to reducing the estimate of those eligible for coverage without the ACA Medicaid expansion (reimbursed at the regular state match rate). Since overall enrollment and federal costs are the same as February, the higher estimate of newly eligible enrollees appears to be offset by a lower estimate of cost per enrollee.

Figure 9: CBO’s latest estimates show a drop in state spending for Medicaid and CHIP from 2015-2024 due to the coverage provisions in the ACA.