2020 Employer Health Benefits Survey

Section 7: Employee Cost Sharing

In addition to any required premium contributions, most covered workers must pay a share of the cost for the medical services they use. The most common forms of cost sharing are: deductibles (an amount that must be paid before most services are covered by the plan), copayments (fixed dollar amounts), and coinsurance (a percentage of the charge for services). Sometimes cost sharing forms are mixed, such as assessing coinsurance for a service up to a maximum amount, or assessing coinsurance or copayment for a service, whichever is higher. The type and level of cost sharing often vary by the type of plan in which the worker is enrolled. Cost sharing may also vary by the type of service, such as office visits, hospitalizations, or prescription drugs.

The cost-sharing amounts reported here are for covered workers using in-network services. Plan enrollees receiving services from providers that do not participate in plan networks often face higher cost sharing and may be responsible for charges that exceed the plan’s allowable amounts. The framework of this survey does not allow us to capture all of the complex cost-sharing requirements in modern plans, particularly for ancillary services (such as durable medical equipment or physical therapy) or cost-sharing arrangements that vary across different settings (such as tiered networks). Therefore, we do not collect information on all plan provisions and limits that affect enrollee out-of-pocket liability.

GENERAL ANNUAL DEDUCTIBLES FOR WORKERS IN PLANS WITH DEDUCTIBLES

- We consider a general annual deductible to be an amount that must be paid by enrollees before most services are covered by their health plan. Non-grandfathered health plans are required to cover some services, such as preventive care, without cost sharing. Some plans require enrollees to meet a service-specific deductible, such as for prescription drugs or hospital admissions, in lieu of or in addition to a general annual deductible. As discussed below, some plans with a general annual deductible for most services exclude specified classes of care from the deductible, such as prescriptions or physician office visits.

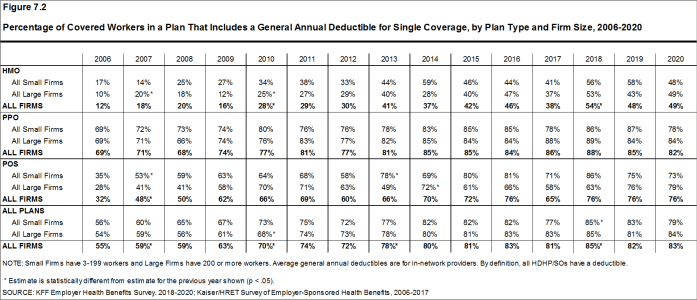

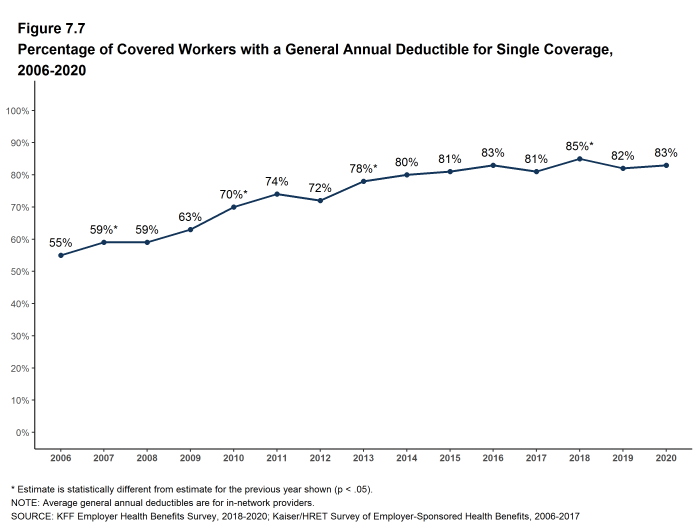

- In 2020, 83% of covered workers are enrolled in a plan with a general annual deductible for single coverage, similar to the percentage last year (82%) and much higher than the percentage ten years ago (70%) [Figure 7.2].

- The percentages of covered workers enrolled in a plan with a general annual deductible for single coverage are similar for small firms (3-199 workers) (79%) and large firms (200 or more workers) (84%) [Figure 7.2].

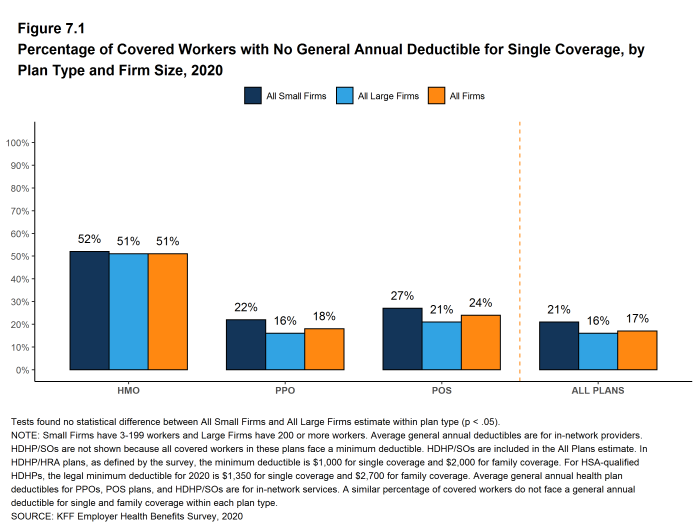

- The likelihood of being in a plan with a general annual deductible varies by plan type. Fifty-one percent of covered workers in HMOs do not have a general annual deductible for single coverage, compared to 24% of workers in POS plans and 18% of workers in PPOs [Figure 7.1].

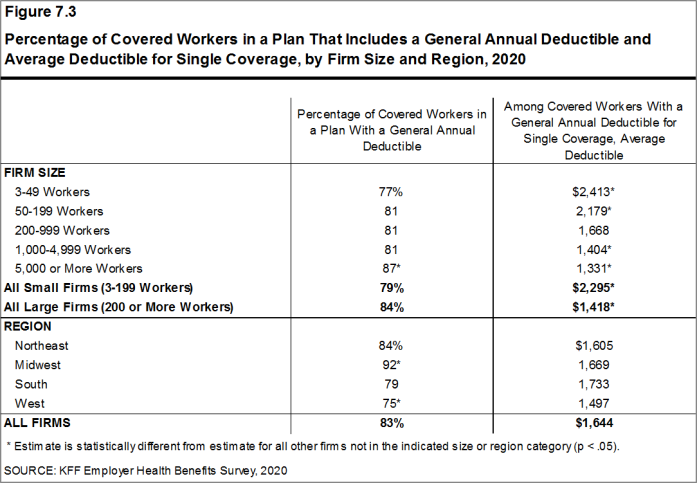

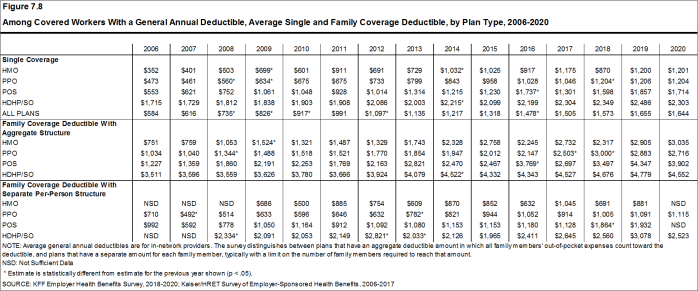

- For covered workers in a plan with a general annual deductible, the average annual deductible for single coverage is $1,644, similar to the average deductible ($1,655) last year [Figure 7.3] and [Figure 7.8].

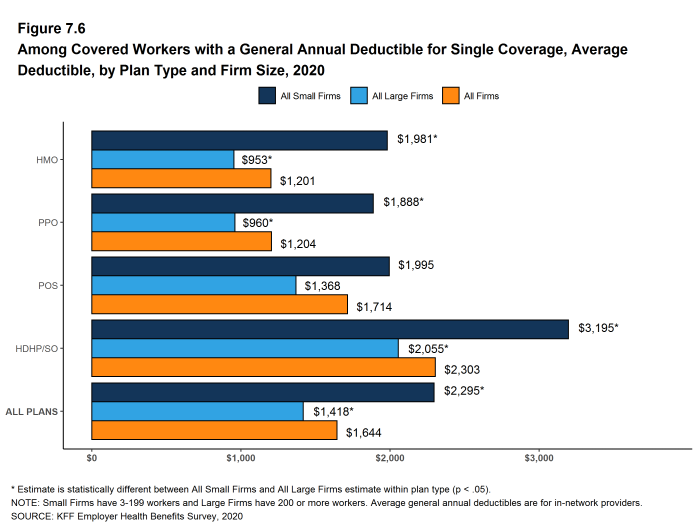

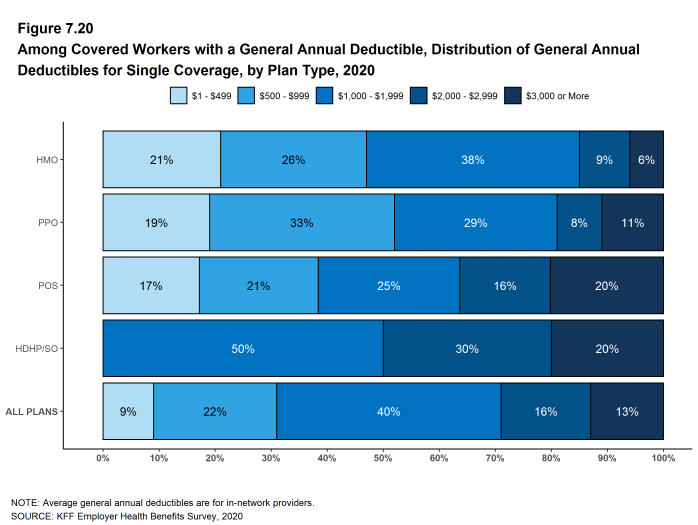

- For covered workers in plans with a general annual deductible, the average deductibles for single coverage are $1,201 in HMOs, $1,204 in PPOs, $1,714 in POS plans, and $2,303 in HDHP/SOs [Figure 7.6].

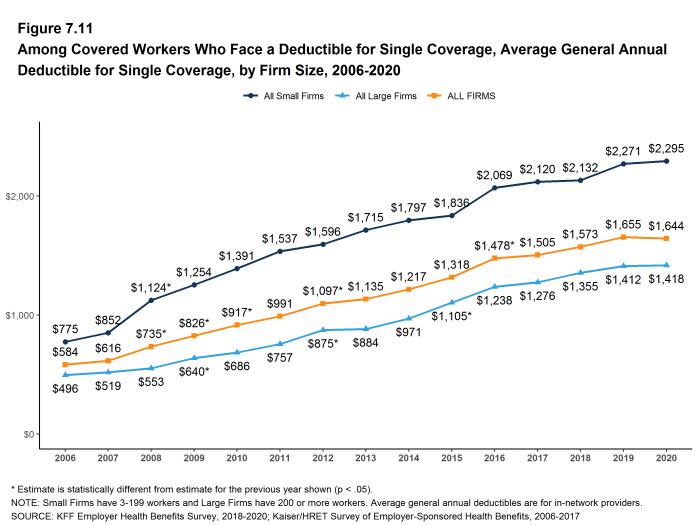

- The average deductibles for single coverage are higher for most plan types for covered workers in small firms than for covered workers in large firms. For covered workers in PPOs, the most common plan type, the average deductible for single coverage in small firms is considerably higher than the average deductible in large firms ($1,888 vs. $960) [Figure 7.6]. Overall, for covered workers in plans with a general annual deductible, the average deductible for single coverage in small firms ($2,295) is higher than the average deductible in large firms ($1,418) [Figure 7.3].

- The average general annual deductible for single coverage for covered workers in plans with a general annual deductible has increased 25% over the past five years, from $1,318 in 2015 to $1,644 in 2020 [Figure 7.8].

Figure 7.1: Percentage of Covered Workers With No General Annual Deductible for Single Coverage, by Plan Type and Firm Size, 2020

Figure 7.2: Percentage of Covered Workers in a Plan That Includes a General Annual Deductible for Single Coverage, by Plan Type and Firm Size, 2006-2020

Figure 7.3: Percentage of Covered Workers in a Plan That Includes a General Annual Deductible and Average Deductible for Single Coverage, by Firm Size and Region, 2020

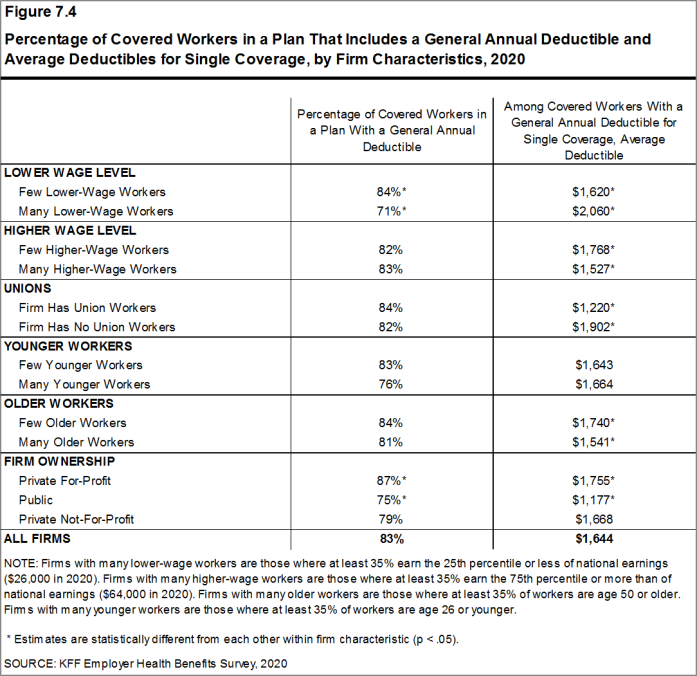

Figure 7.4: Percentage of Covered Workers in a Plan That Includes a General Annual Deductible and Average Deductibles for Single Coverage, by Firm Characteristics, 2020

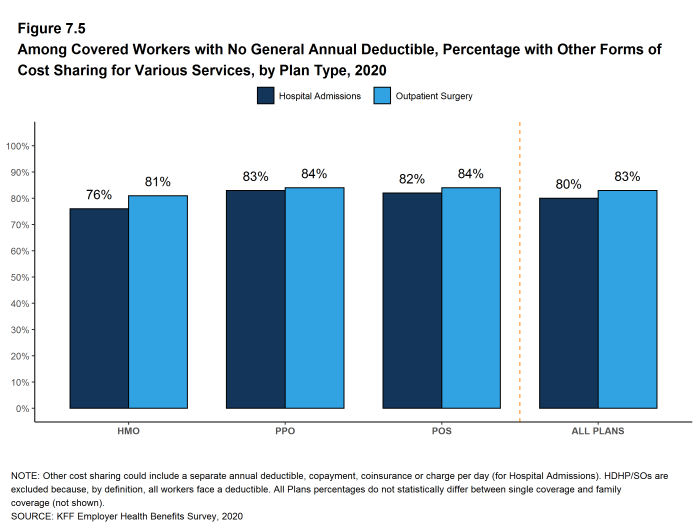

Figure 7.5: Among Covered Workers With No General Annual Deductible, Percentage With Other Forms of Cost Sharing for Various Services, by Plan Type, 2020

Figure 7.6: Among Covered Workers With a General Annual Deductible for Single Coverage, Average Deductible, by Plan Type and Firm Size, 2020

Figure 7.7: Percentage of Covered Workers With a General Annual Deductible for Single Coverage, 2006-2020

GENERAL ANNUAL DEDUCTIBLES AMONG ALL COVERED WORKERS

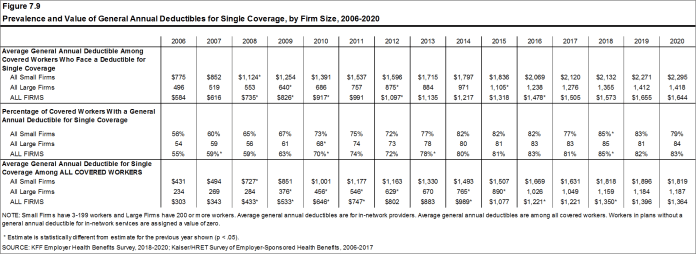

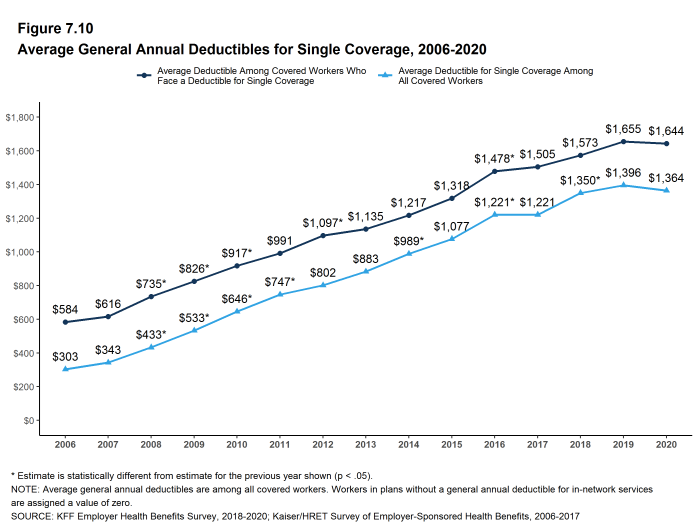

- As discussed above, the share of covered workers in plans with a general annual deductible has increased significantly over time, from 70% in 2010 to 83% in 2020 [Figure 7.9]. The average deductible amounts for covered workers in plans with a deductible have also increased, over the period, from $917 in 2010 to $1,644 in 2020 [Figure 7.10]. Neither trend by itself, however, captures the full impact of changes in deductibles on covered workers. We can look at the average impact of both trends together on covered workers by assigning a zero deductible value to covered workers in plans with no deductible and looking at how the resulting averages change over time. These average deductible amounts are lower in any given year but the changes over time reflect both the higher deductibles in plans with a deductible and the fact that more workers face them.

- Using this approach, the average general annual deductible for single coverage for all covered workers in 2020 is $1,364, similar to the amount last year ($1,396) [Figure 7.10].

- The 2020 value is 27% higher than the average general annual deductible of $1,077 in 2015 and 111% higher than the average general annual deductible of $646 in 2010 [Figure 7.10].

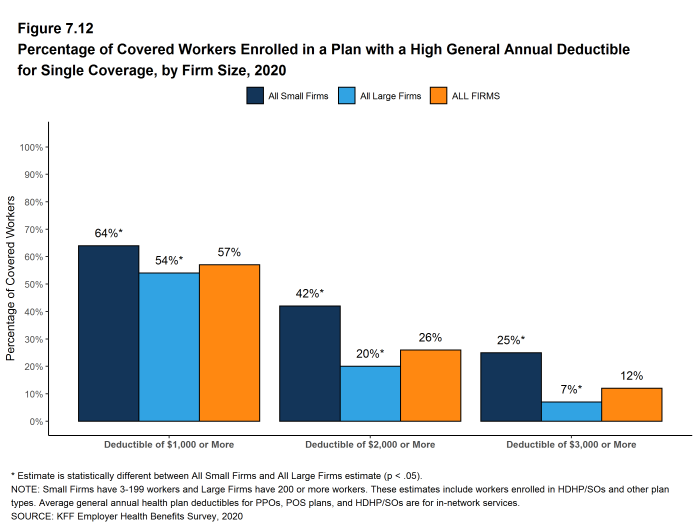

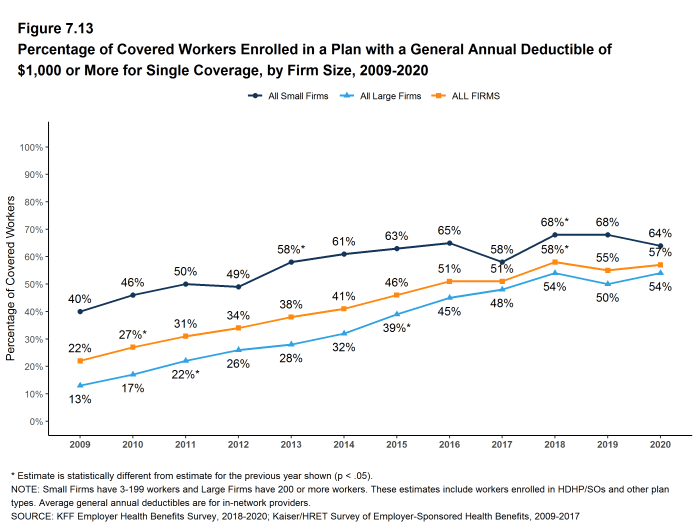

- Another way to look at deductibles is the percentage of all covered workers who are in a plan with a deductible that exceeds certain thresholds. Fifty-seven percent of covered workers are in plans with a general annual deductible of $1,000 or more for single coverage, similar to the percentage last year [Figure 7.13].

- Over the past five years, the percentage of covered workers with a general annual deductible of $1,000 or more for single coverage has grown 23%, from 46% to 57% [Figure 7.13].

- Workers in small firms are considerably more likely to have a general annual deductible of $1,000 or more for single coverage than workers in large firms (64% vs. 54%) [Figure 7.12].

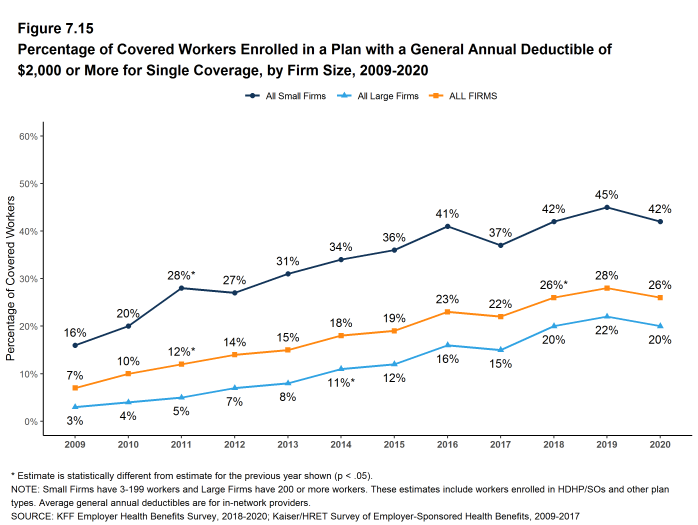

- In 2020, 26% of covered workers are enrolled in a plan with a deductible of $2,000 or more, similar to the percentage last year (28%) [Figure 7.15]. This percentage is much higher for covered workers in small firms than large firms (42% vs. 20%) [Figure 7.12].

GENERAL ANNUAL DEDUCTIBLES AND ACCOUNT CONTRIBUTIONS

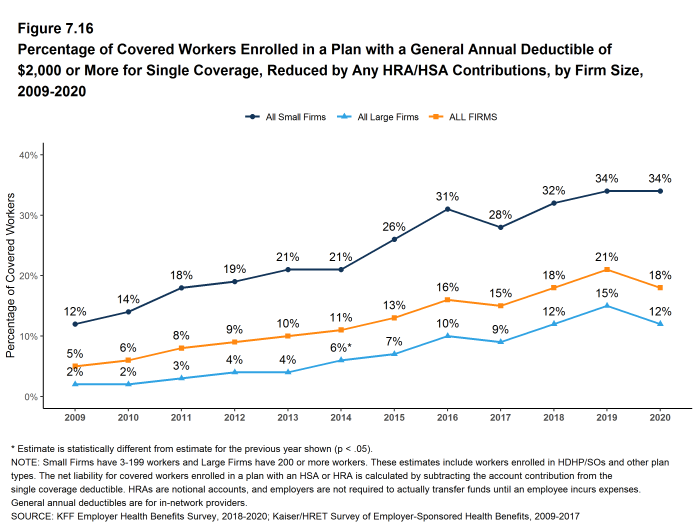

- One of the reasons for the growth in general annual deductibles has been the growth in enrollment in HDHP/SOs, which have higher deductibles than other plans. While growing deductibles in other plan types generally increases enrollee out-of-pocket liability, the shift in enrollment to HDHP/SOs does not necessarily do so because many HDHP/SO enrollees receive an account contribution from their employers, which in essence reduces the high cost sharing in these plans.

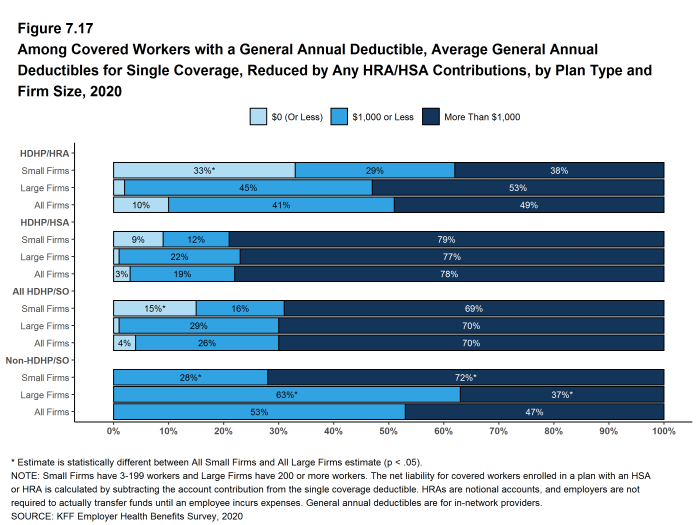

- Ten percent of covered workers in an HDHP with an HRA and 3% of covered workers in an HSA-qualified HDHP receive an account contribution from their employer for single coverage at least equal to their deductible, while another 41% of covered workers in an HDHP with an HRA and 19% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce the deductible to $1,000 or less [Figure 7.17].

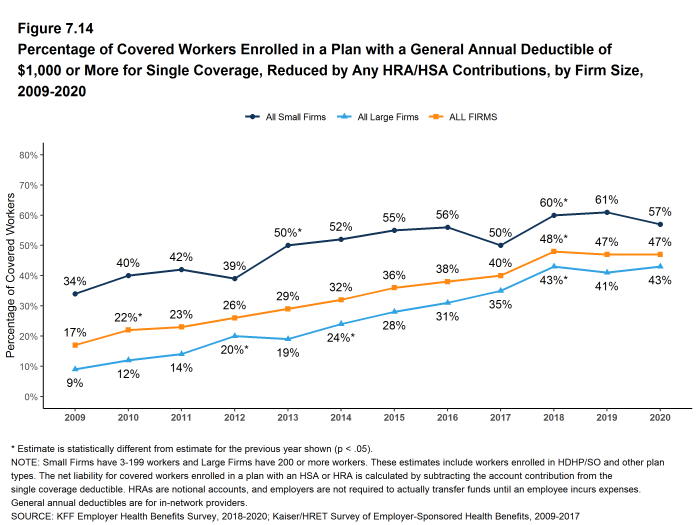

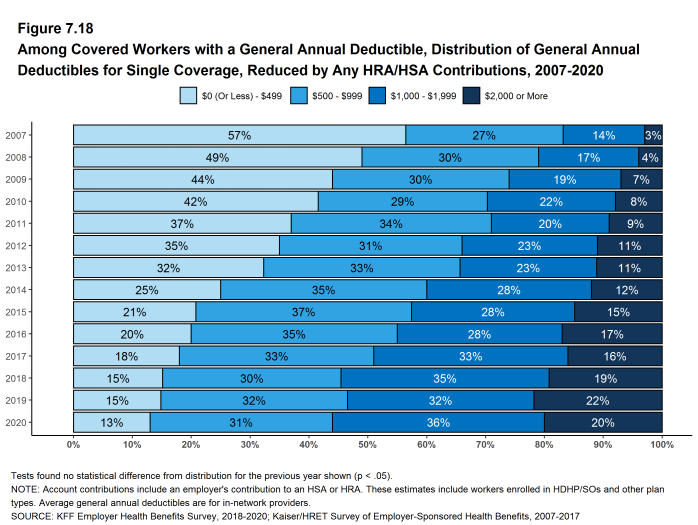

- If we reduce the general annual deductibles by employer account contributions, the percentage of covered workers with a deductible of $1,000 or more would be reduced from 57% to 47% [Figure 7.13] and [Figure 7.14].

Figure 7.11: Among Covered Workers Who Face a Deductible for Single Coverage, Average General Annual Deductible for Single Coverage, by Firm Size, 2006-2020

Figure 7.12: Percentage of Covered Workers Enrolled in a Plan With a High General Annual Deductible for Single Coverage, by Firm Size, 2020

Figure 7.13: Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $1,000 or More for Single Coverage, by Firm Size, 2009-2020

Figure 7.14: Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $1,000 or More for Single Coverage, Reduced by Any HRA/HSA Contributions, by Firm Size, 2009-2020

Figure 7.15: Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $2,000 or More for Single Coverage, by Firm Size, 2009-2020

Figure 7.16: Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $2,000 or More for Single Coverage, Reduced by Any HRA/HSA Contributions, by Firm Size, 2009-2020

Figure 7.17: Among Covered Workers With a General Annual Deductible, Average General Annual Deductibles for Single Coverage, Reduced by Any HRA/HSA Contributions, by Plan Type and Firm Size, 2020

Figure 7.18: Among Covered Workers With a General Annual Deductible, Distribution of General Annual Deductibles for Single Coverage, Reduced by Any HRA/HSA Contributions, 2007-2020

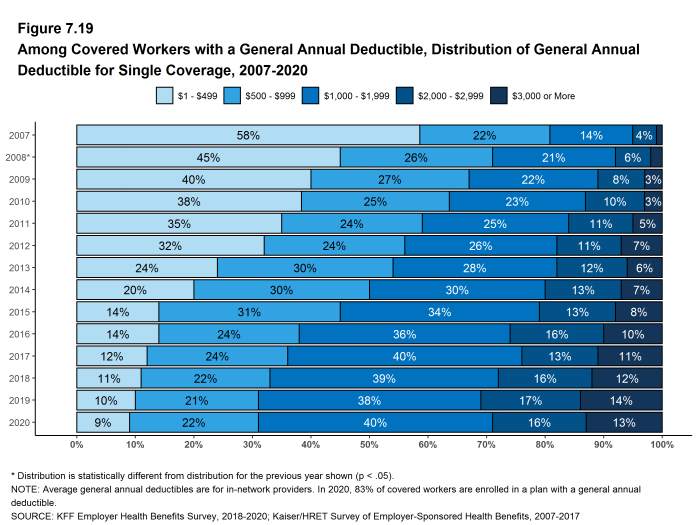

Figure 7.19: Among Covered Workers With a General Annual Deductible, Distribution of General Annual Deductible for Single Coverage, 2007-2020

GENERAL ANNUAL DEDUCTIBLES FOR WORKERS ENROLLED IN FAMILY COVERGE

General annual deductibles for family coverage are structured in two primary ways: (1) with an aggregate family deductible, the out-of-pocket expenses of all family members count against a specified family deductible amount, and the deductible is considered met when the combined family expenses exceed the deductible amount; (2) with a separate per-person family deductible, each family member is subject to a specified deductible amount before the plan covers expenses for that member, although many plans consider the deductible for all family members met once a specified number (typically two or three) of family members meet their specified deductible amount.20

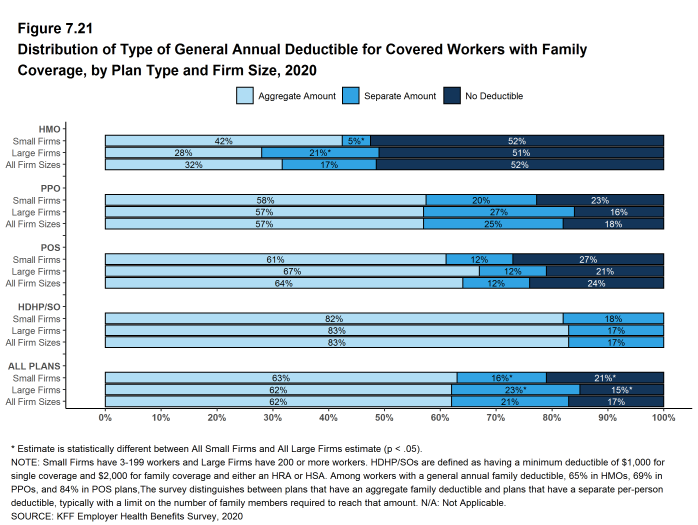

- About one-half (52%) of covered workers in HMOs are in plans without a general annual deductible for family coverage; the percentages in plans without family dedictibles are lower for workers in PPOs (18%) and POS plans (24%). As defined, all covered workers in HDHP/SOs have a general annual deductible for family coverage [Figure 7.21].

- Among covered workers enrolled in family coverage, the percentages of covered workers in a plan with an aggregate general annual deductible are 32% for workers in HMOs; 57% for workers in PPOs; 64% for workers in POS plans; and 83% for workers in HDHP/SOs [Figure 7.21].

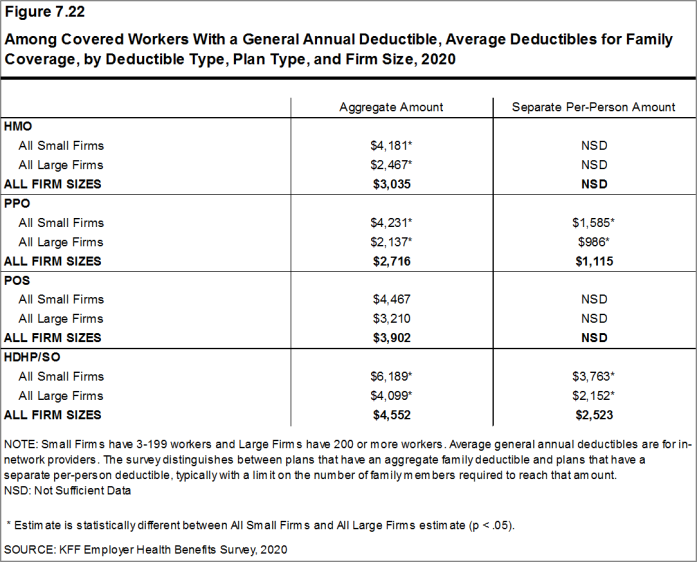

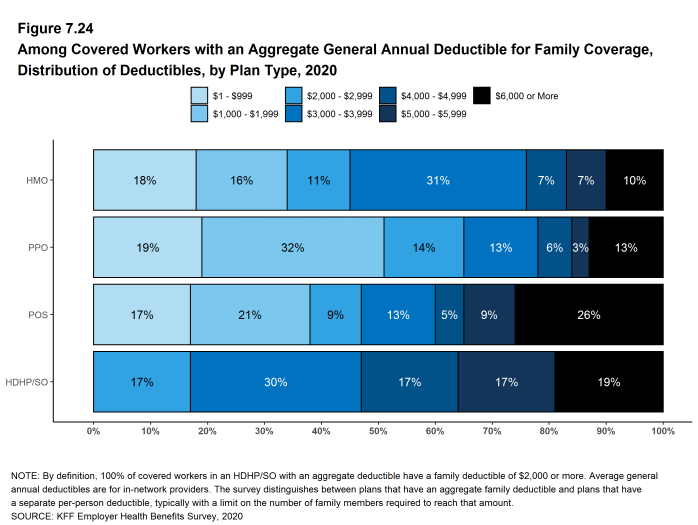

- The average deductible amounts for covered workers in plans with an aggregate annual deductible for family coverage are $3,035 for HMOs; $2,716 for PPOs; $3,902 for POS plans; and $4,552 for HDHP/SOs [Figure 7.22]. Deductible amounts for aggregate family deductibles are similar to last year for each plan type.

- For covered workers in plans with an aggregate deductible for family coverage, the average annual family deductibles in small firms are higher than the average annual family deductibles in large firms for covered workers in HMOs, PPOs and HDHP/SOs [Figure 7.22].

- Among covered workers enrolled in family coverage, the percentages of covered workers in plans with a separate per-person annual deductible for family coverage are 17% for workers in HMOs; 25% for workers in PPOs; 12% for workers in POS plans; and 17% for workers in HDHP/SOs [Figure 7.21].

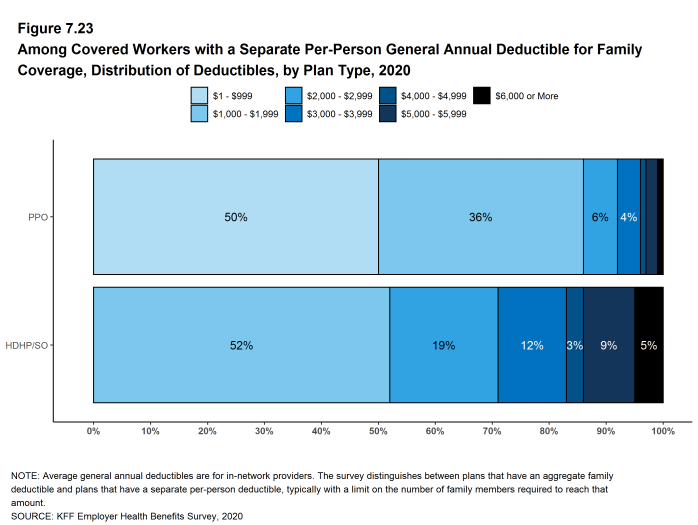

- The average deductible amounts for covered workers in plans with separate per-person annual deductibles for family coverage are $1,115 for PPOs and $2,523 for HDHP/SOs [Figure 7.22].

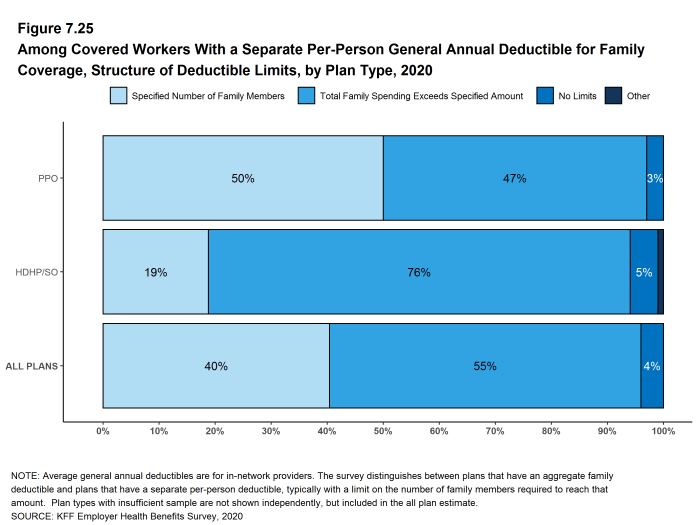

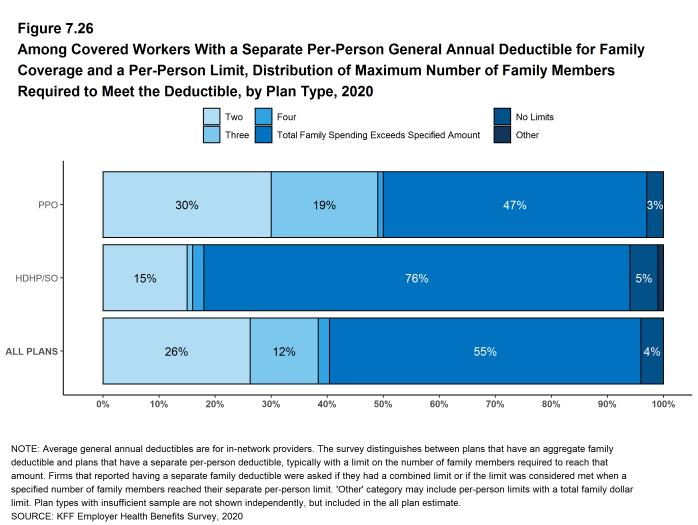

- Forty percent covered workers in plans with a separate per-person annual deductible for family coverage have a limit for the number of family members required to meet the separate deductible amounts [Figure 7.25]. Among those covered workers in plans with a limit on the number of family members, the most frequent number of family members required to meet the separate per-person deductible is two [Figure 7.26].

Figure 7.21: Distribution of Type of General Annual Deductible for Covered Workers With Family Coverage, by Plan Type and Firm Size, 2020

Figure 7.22: Among Covered Workers With a General Annual Deductible, Average Deductibles for Family Coverage, by Deductible Type, Plan Type, and Firm Size, 2020

Figure 7.23: Among Covered Workers With a Separate Per-Person General Annual Deductible for Family Coverage, Distribution of Deductibles, by Plan Type, 2020

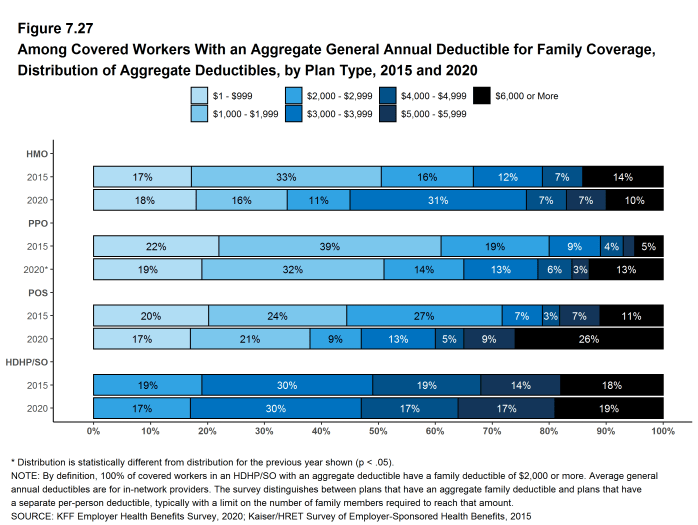

Figure 7.24: Among Covered Workers With an Aggregate General Annual Deductible for Family Coverage, Distribution of Deductibles, by Plan Type, 2020

Figure 7.25: Among Covered Workers With a Separate Per-Person General Annual Deductible for Family Coverage, Structure of Deductible Limits, by Plan Type, 2020

Figure 7.26: Among Covered Workers With a Separate Per-Person General Annual Deductible for Family Coverage and a Per-Person Limit, Distribution of Maximum Number of Family Members Required to Meet the Deductible, by Plan Type, 2020

CHARACTERISTICS OF GENERAL ANNUAL DEDUCTIBLES

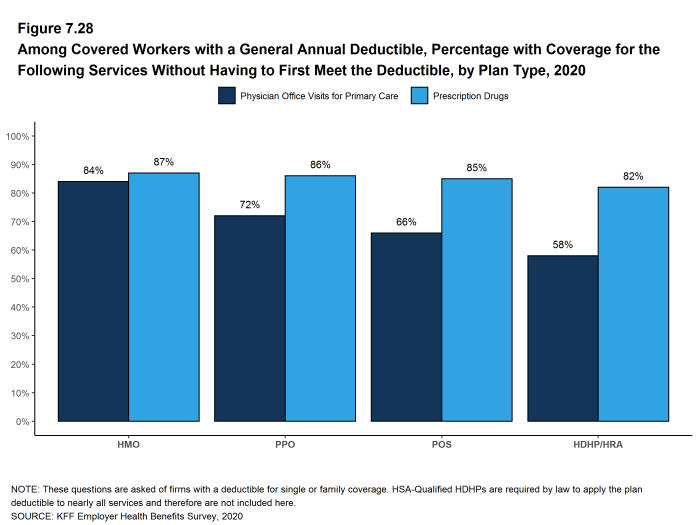

- The majority of covered workers with a general annual deductible are in plans where the deductible does not have to be met before certain services, such as physician office visits or prescription drugs, are covered.

- Majorities of covered workers (84% in HMOs, 72% in PPOs, 66% in POS plans, and 58% in HDHP/HRAs) who are enrolled in plans with general annual deductibles are in plans where the deductible does not have to be met before physician office visits for primary care are covered [Figure 7.28].

- Similarly, among workers with a general annual deductible, large shares of covered workers in HMOs (87%), PPOs (86%), POS plans (85%), and HDHP/HRAs (82%) are enrolled in plans where the general annual deductible does not have to be met before prescription drugs are covered [Figure 7.28].

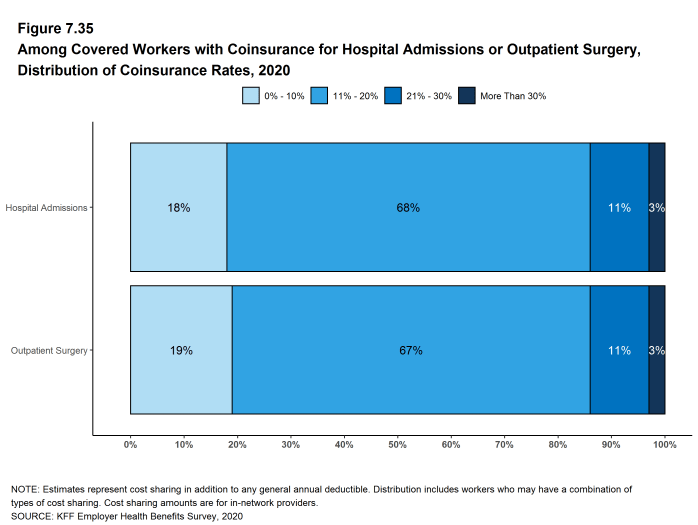

HOSPITAL ADMISSIONS AND OUTPATIENT SURGERY

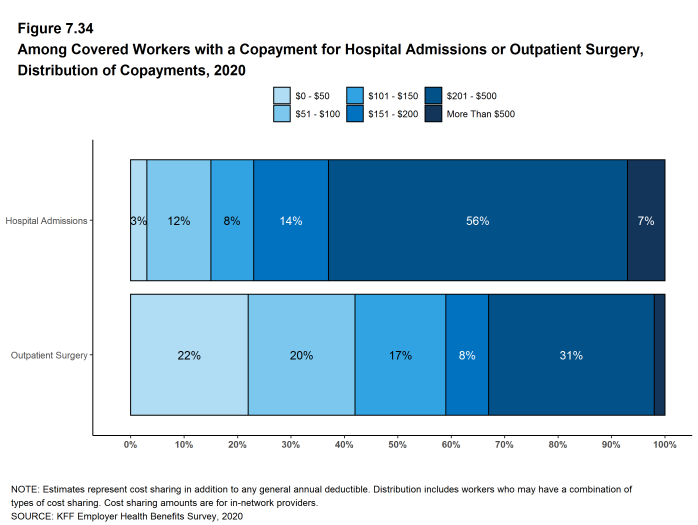

- Whether or not a worker has a general annual deductible, most workers face additional types of cost sharing (such as a copayment, coinsurance, or a per diem charge) when admitted to a hospital or having outpatient surgery. The distribution of workers with cost sharing for hospital admissions or outpatient surgery does not equal 100%, as workers may face a complex combination of types of cost sharing. For this reason, the average copayment and coinsurance rates include workers who may have a combination of these types of cost sharing.

- Beginning in 2017, to reduce the burden on respondents, we revised the survey to ask about cost sharing for hospital admissions and outpatient surgery only for their largest health plan type; previously, we asked for this information for each of the plan types that they offered.

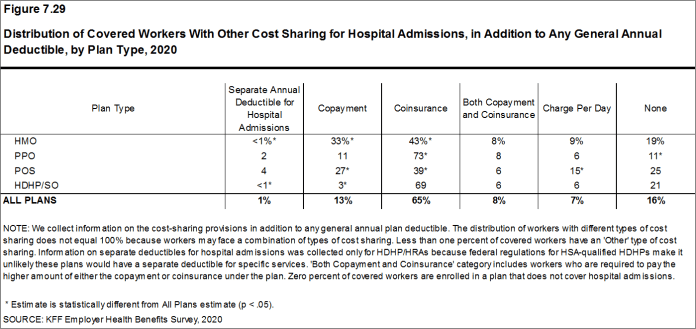

- In addition to any general annual deductible that may apply, 65% of covered workers have coinsurance and 13% have a copayment that apply to inpatient hospital admissions. Lower percentages of workers have per day (per diem) payments (7%), a separate hospital deductible (1%), or both a copayment and coinsurance (8%), while 16% have no additional cost sharing for hospital admissions after any general annual deductible has been met [Figure 7.29].

- For covered workers in HMOs, copayments are more common (33%) and coinsurance (43%) is less common than the average for all covered workers [Figure 7.29].

- HDHP/SOs, on average, have a different cost-sharing structure than other plan types for hospital admissions. Only 3% of covered workers in HDHP/SOs have a copayment for hospital admissions, lower than the average for all covered workers [Figure 7.29].

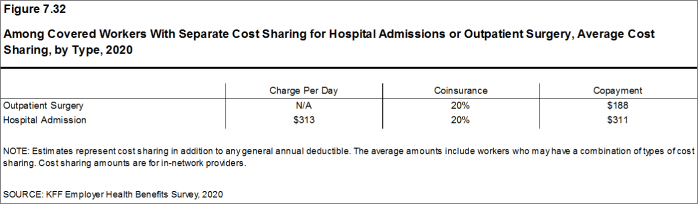

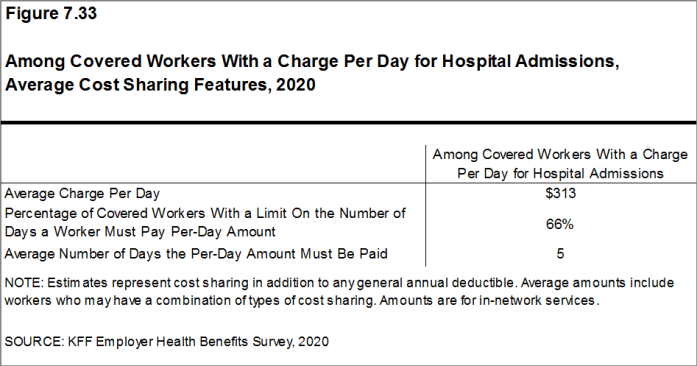

- The average coinsurance rate for a hospital admission is 20%, the average copayment is $311 per hospital admission, and the average per diem charge is $313 [Figure 7.32]. Sixty-six percent of workers enrolled in a plan with a per diem for hospital admissions have a limit on the number of days a worker must pay the amount [Figure 7.33].

- The cost-sharing provisions for outpatient surgery are similar to those for hospital admissions, as most workers have coinsurance or copayments. In 2020, 15% of covered workers have a copayment and 68% have coinsurance for outpatient surgery. In addition, 6% have both a copayment and coinsurance, while 16% have no additional cost sharing after any general annual deductible has been met [Figure 7.30] and [Figure 7.31].

- For covered workers with cost sharing for outpatient surgery, the average coinsurance rate is 20% and the average copayment is $188 [Figure 7.32].

Figure 7.29: Distribution of Covered Workers With Other Cost Sharing for Hospital Admissions, in Addition to Any General Annual Deductible, by Plan Type, 2020

Figure 7.30: Distribution of Covered Workers With Other Cost Sharing for Outpatient Surgery, in Addition to Any General Annual Deductible, by Plan Type, 2020

Figure 7.31: Percentage of Covered Workers With the Following Types of Cost Sharing for Hospital Admissions and Outpatient Surgery, in Addition to Any General Annual Deductible, 2020

Figure 7.32: Among Covered Workers With Separate Cost Sharing for Hospital Admissions or Outpatient Surgery, Average Cost Sharing, by Type, 2020

Figure 7.33: Among Covered Workers With a Charge Per Day for Hospital Admissions, Average Cost Sharing Features, 2020

Figure 7.34: Among Covered Workers With a Copayment for Hospital Admissions or Outpatient Surgery, Distribution of Copayments, 2020

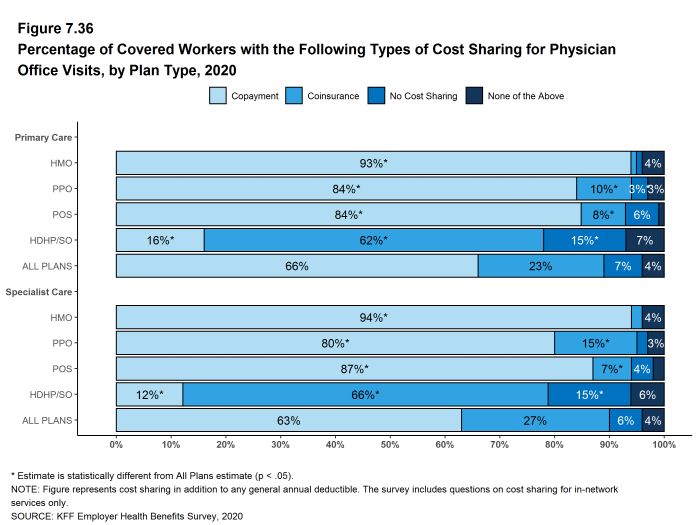

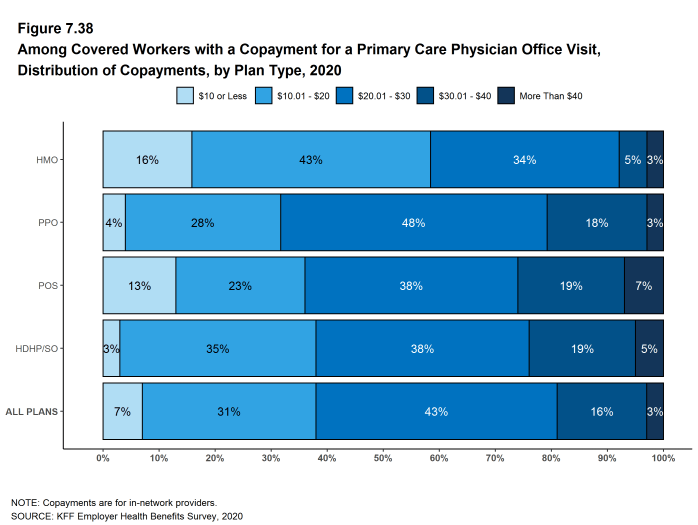

COST SHARING FOR PHYSICIAN OFFICE VISITS

- The majority of covered workers are enrolled in health plans that require cost sharing for an in-network physician office visit, in addition to any general annual deductible.21

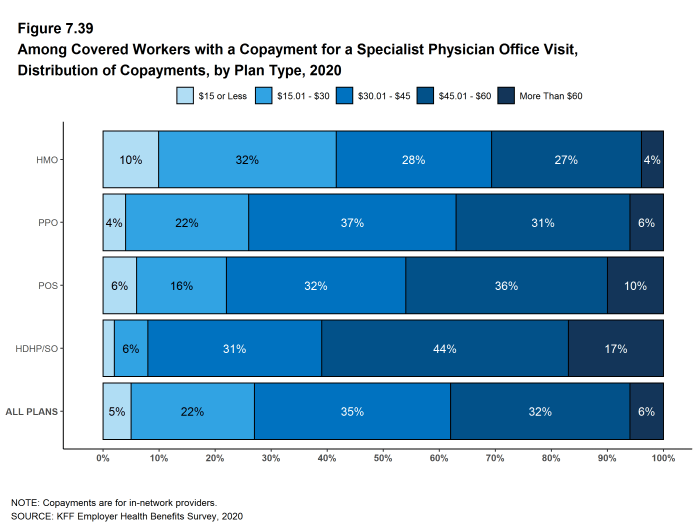

- The most common form of physician office visit cost sharing for in-network services is a copayment. Sixty-six percent of covered workers have a copayment for a primary care physician office visit and 23% have coinsurance. For office visits with a specialty physician, 63% of covered workers have a copayment and 27% have coinsurance [Figure 7.36].

- Covered workers in HMOs, PPOs, and POS plans are much more likely to have copayments for both primary care and specialty care physician office visits than workers in HDHP/SOs. For primary care physician office visits, 16% of covered workers in HDHP/SOs have a copayment, 62% have coinsurance, and 15% have no cost sharing after the general annual plan deductible is met [Figure 7.36].

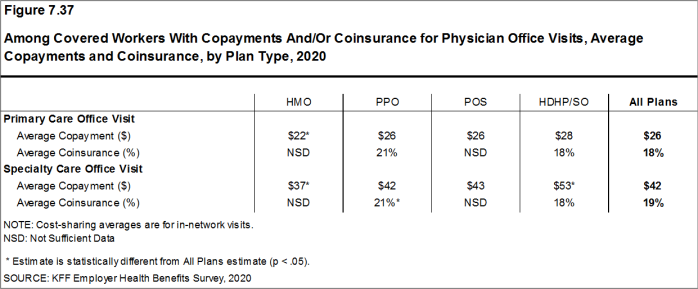

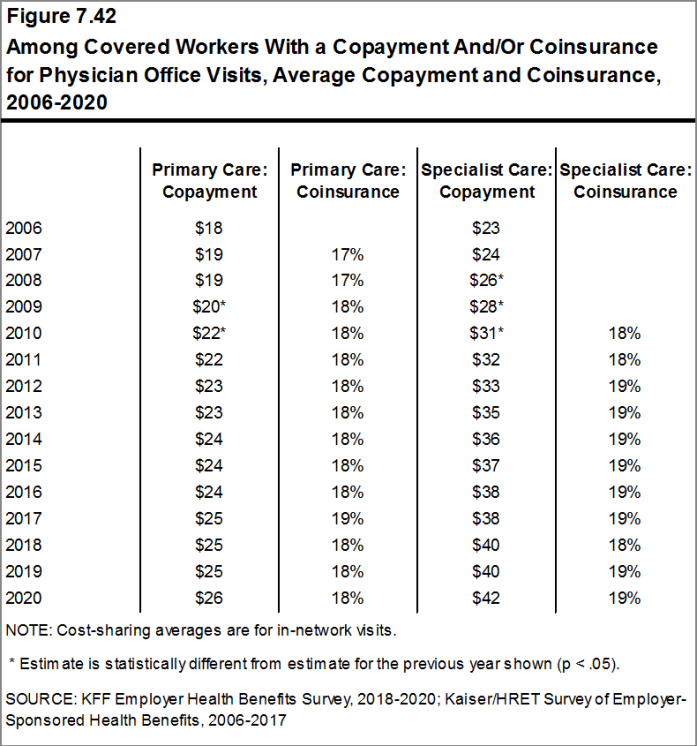

- Among covered workers with a copayment for in-network physician office visits, the average copayment is $26 for primary care and $42 for specialty physician office visits [Figure 7.37], similar to the amounts last year.

- Among covered workers with coinsurance for in-network physician office visits, the average coinsurance rates are 18% for a visit with a primary care physician and 19% for a visit with a specialist [Figure 7.37], similar to the rates last year.

Figure 7.36: Percentage of Covered Workers With the Following Types of Cost Sharing for Physician Office Visits, by Plan Type, 2020

Figure 7.37: Among Covered Workers With Copayments And/Or Coinsurance for Physician Office Visits, Average Copayments and Coinsurance, by Plan Type, 2020

Figure 7.38: Among Covered Workers With a Copayment for a Primary Care Physician Office Visit, Distribution of Copayments, by Plan Type, 2020

Figure 7.39: Among Covered Workers With a Copayment for a Specialist Physician Office Visit, Distribution of Copayments, by Plan Type, 2020

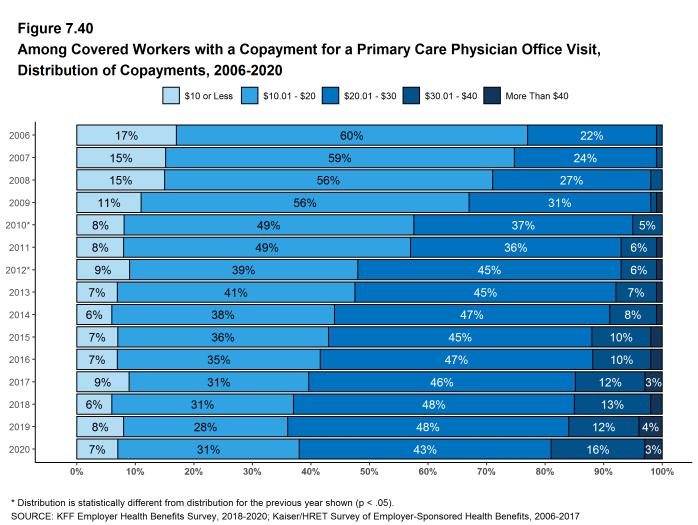

Figure 7.40: Among Covered Workers With a Copayment for a Primary Care Physician Office Visit, Distribution of Copayments, 2006-2020

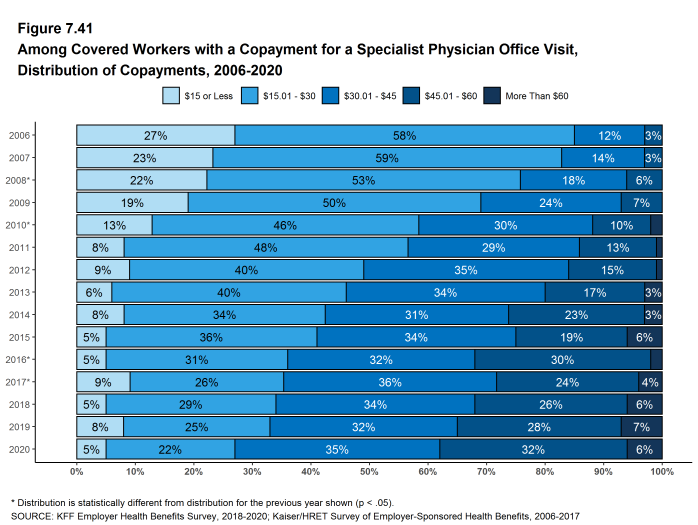

Figure 7.41: Among Covered Workers With a Copayment for a Specialist Physician Office Visit, Distribution of Copayments, 2006-2020

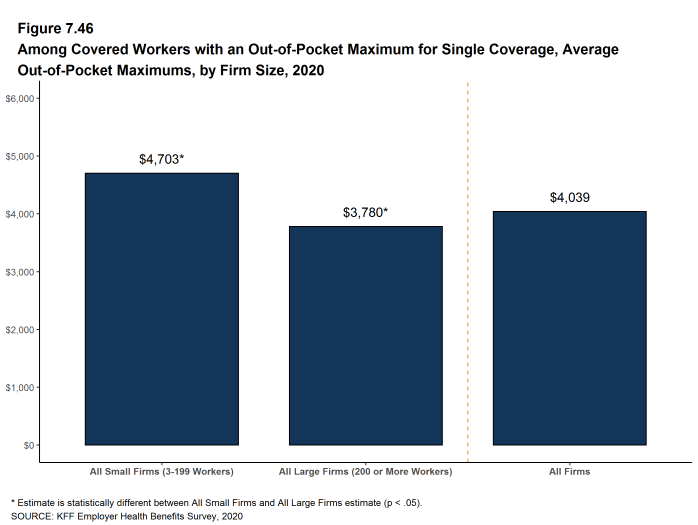

OUT-OF-POCKET MAXIMUMS

- Most covered workers are in a plan that partially or totally limits the cost sharing that an enrollee must pay in a year. This limit is generally referred to as an out-of-pocket maximum. The Affordable Care Act (ACA) requires that non-grandfathered health plans have an out-of-pocket maximum of no more than $8,150 for single coverage and $16,300 for family coverage in 2020. Out-of-pocket limits in HSA qualified HDHP/SOs are required to be somewhat lower.22 Many plans have complex out-of-pocket structures, which makes it difficult to accurately collect information on this element of plan design.

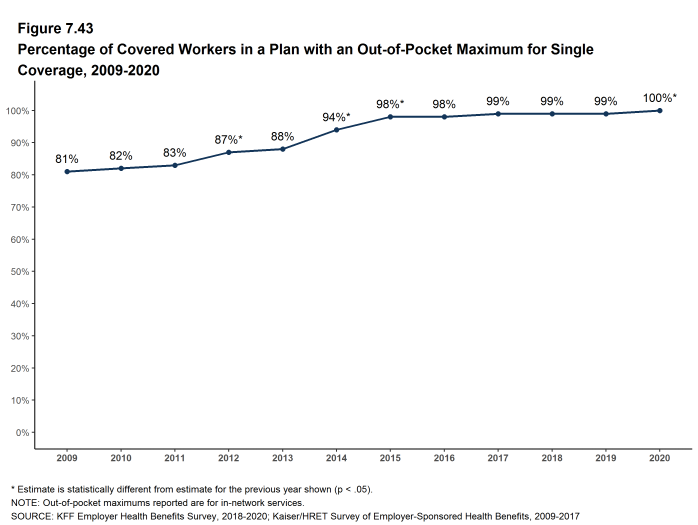

- In 2020, 100% of covered workers are in a plan with an out-of-pocket maximum for single coverage. This is a significant increase from 98% in 2015 [Figure 7.43].

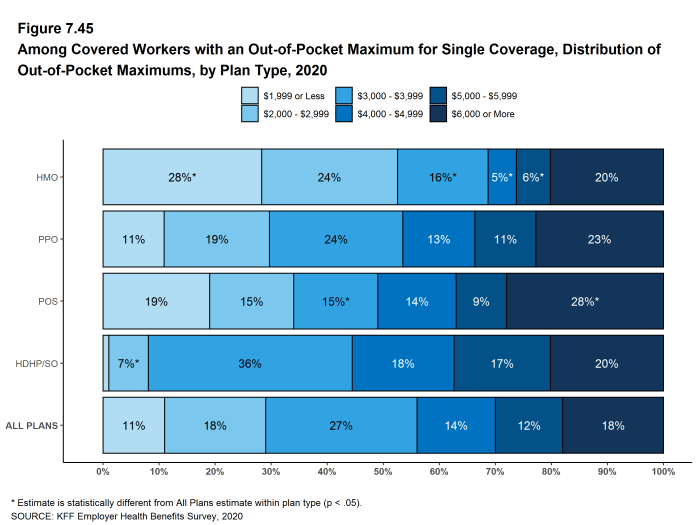

- For covered workers in plans with an out-of-pocket maximum for single coverage, there is wide variation in spending limits.

- Eleven percent of covered workers in plans with an out-of-pocket maximum for single coverage have an out-of-pocket maximum of less than $2,000, while 18% have an out-of-pocket maximum of $6,000 or more [Figure 7.45].

Figure 7.43: Percentage of Covered Workers in a Plan With an Out-Of-Pocket Maximum for Single Coverage, 2009-2020

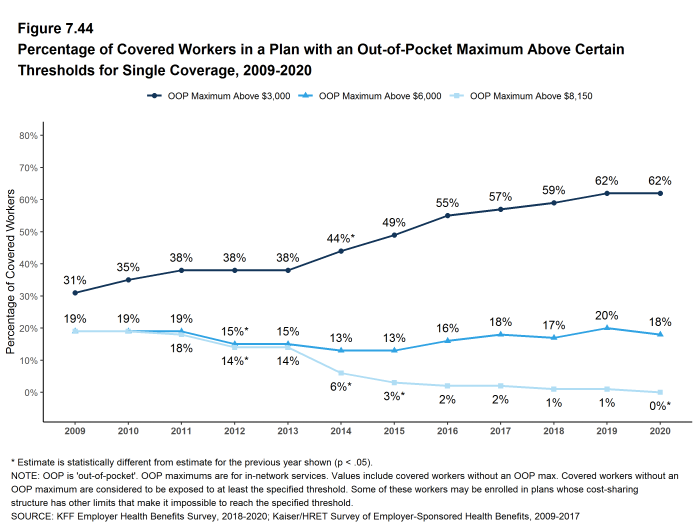

Figure 7.44: Percentage of Covered Workers in a Plan With an Out-Of-Pocket Maximum Above Certain Thresholds for Single Coverage, 2009-2020

Figure 7.45: Among Covered Workers With an Out-Of-Pocket Maximum for Single Coverage, Distribution of Out-Of-Pocket Maximums, by Plan Type, 2020

- Some workers with separate per-person deductibles or out-of-pocket maximums for family coverage do not have a specific number of family members that are required to meet the deductible amount and instead have another type of limit, such as a per-person amount with a total dollar amount limit. These responses are included in the averages and distributions for separate family deductibles and out-of-pocket maximums.↩︎

- For those enrolled in an HDHP/HSA, the out-of-pocket maximum may be no more than $6,900 for an individual plan and $13,800 for a family plan in 2020. See https://www.irs.gov/irb/2019-22_IRB#REV-PROC-2019-25↩︎

- Starting in 2010, the survey asked about the prevalence and cost of physician office visits separately for primary care and specialty care. Prior to the 2010 survey, if the respondent indicated the plan had a copayment for office visits, we assumed the plan had a copayment for both primary and specialty care visits. The survey did not allow for a respondent to report that a plan had a copayment for primary care visits and coinsurance for visits with a specialist physician. The changes made in 2010 allow for variations in the type of cost sharing for primary care and specialty care visits. The survey includes cost sharing for in-network services only.↩︎