The Uninsured at the Starting Line in Missouri: Missouri findings from the 2013 Kaiser Survey of Low-Income Americans and the ACA

II. What to Look for in Enrolling in New Coverage

How Poor and Moderate-Income Adults in Missouri Sign Up For and View Their Coverage

While many currently uninsured adults in Missouri have limited experience in signing up for and using health coverage, past successes and challenges of insured poor and moderate-income adults can inform the experiences of those seeking coverage under the ACA. A majority of insured Missourians do not experience problems choosing, enrolling in, and using their coverage, and this pattern holds true for both those in Medicaid and private insurance. Still, based on the experience of their insured counterparts, the uninsured population in Missouri that is being targeted by the ACA coverage expansions is likely to encounter some barriers in the process of choosing and enrolling in coverage. While the ACA aims to make the process smoother, it is likely that some challenges inherent in the complexity of health coverage will require concerted efforts to address.

While many adults in Missouri reported facing no difficulty in applying for Medicaid coverage prior to the ACA, some encountered difficulties in the process of applying for public coverage in the past.

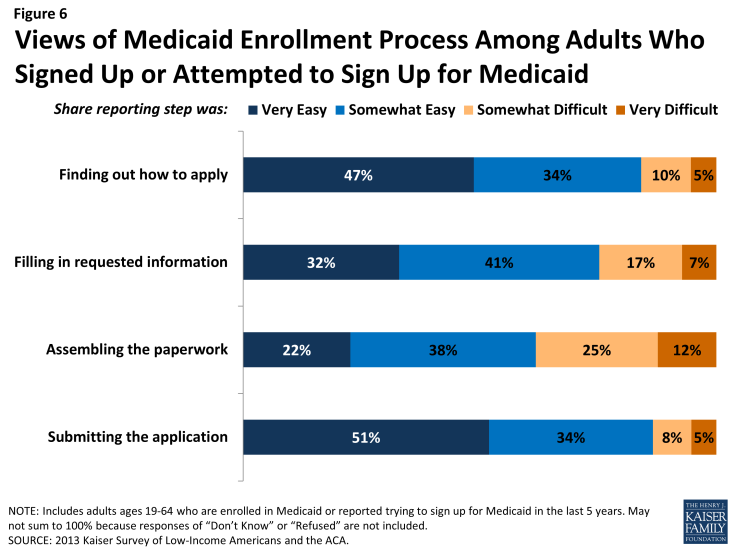

In comparison to the process for gaining coverage through an employer—which is typically facilitated by the firm or a representative and may require limited action on the part of the insured—applying for publicly-financed coverage typically requires proactive steps to gain coverage. Adults in Missouri who currently have Medicaid or who have attempted to enroll in the past five years reported little difficulty in enrolling in Medicaid. Almost half of adults (49%) who applied to Medicaid said the entire process was very or somewhat easy. However, the rest found at least one aspect of the process – finding out how to apply, filling out the application, assembling the required paperwork, or submitting the application – to be somewhat or very difficult. The most commonly reported difficulty was assembling the required paperwork, which over a third (37%) of Missourians who enrolled or applied said was somewhat or very difficult (Figure 6 and Appendix Table A3).

Figure 6: Views of Medicaid Enrollment Process Among Adults Who Signed Up or Attempted to Sign Up for Medicaid

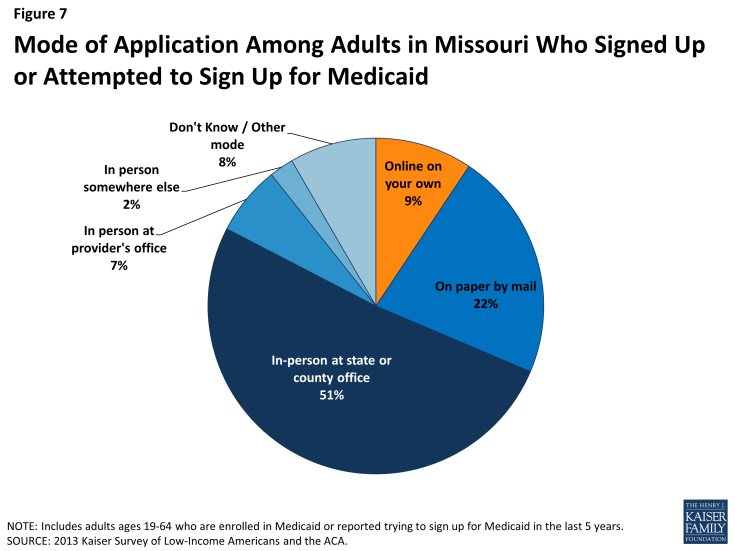

In recent years, Missouri, along with many other states, has made strides towards providing individuals multiple avenues to enroll in coverage, including through online applications to facilitate access to coverage and ease administrative burdens.1 However, more than half of Missourian adults (51%) who applied to Medicaid in the past five years reported that they did so through traditional routes—that is, in person at a state or county government office—and only 9% reported using an online application (Figure 7).

Figure 7: Mode of Application Among Adults in Missouri Who Signed Up or Attempted to Sign Up for Medicaid

The ACA includes provisions to further simplify the application, enrollment, and renewal process for coverage in all states, regardless of whether they expand their Medicaid programs under the ACA. These requirements include the adoption of a single streamlined application that is available online, by phone, and on paper and that screens for all health coverage options; electronic transfers of accounts between agencies to facilitate transitions across health coverage programs; and reliance on trusted sources of electronic data, rather than requesting paper documentation, to verify eligibility criteria.2 As of late 2013, Missouri and other states were still in the process of implementing many of these changes and coordinating enrollment processes with the Marketplace.3 Once simplified enrollment processes are fully implemented, it is possible that people applying for MO Health Net will experience a smoother application and enrollment process than applicants have in the past.

When adults with Medicaid or private insurance plan have a choice of plan, they do not always prioritize costs over other plan features in making that choice, and many find some aspect of the plan choice process to be a challenge.

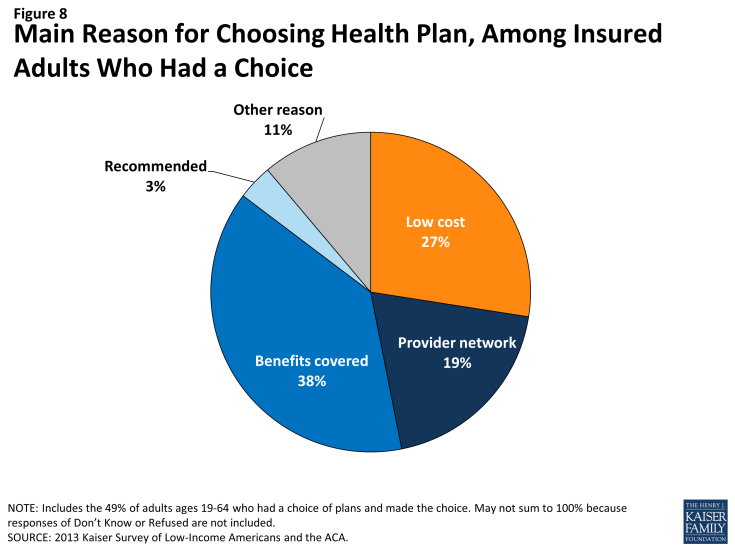

As Missourians gain coverage, many will have the option to select an insurance plan. People may chose a particular plan for a variety of reasons, including low cost, choice of providers, recommendations from friends and family, or coverage of a particular benefit. Among the 49% of insured adults in Missouri who had a choice of plans,4 a plurality (38%) reported that they chose their plan because it covered a wide range of benefits or a specific benefit that they need, roughly three in ten (27%) because their costs would be low, and 19% because of its provider network (Figure 8 and Appendix Table A4).

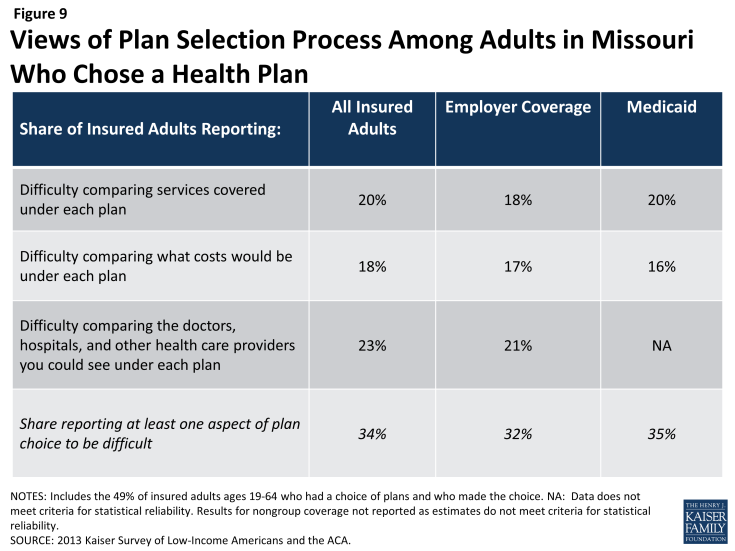

In choosing a plan, Missourians may face challenges in comparing costs, services, and provider networks across plans, as these factors typically varied greatly across plans in the past. In general, insured adults in Missouri reported that they did not have difficulty in comparing their plan choices, but 34% found some aspect of plan choice—comparing services, comparing costs, and comparing providers— to be difficult (Figure 9 and Appendix Table A4). Insured adults in Missouri were least likely to report difficulty comparing costs (versus providers or services) across plans (18%).

As enrollment numbers for particular plans are released and policymakers in Missouri begin to assess plan choice among new enrollees, these findings can inform evaluations of plan choice under the ACA. While the ACA requires health plans in the Marketplaces to provide a standard set of benefits and provide detailed information about what services are covered, which could make it easier for individuals to select a plan, it is important to bear in mind that, even before the ACA, insured adults faced some challenges in comparing and selecting insurance coverage. While provisions in the ACA could address these challenges, some are inherent to the complexity of insurance coverage.

Further, contrary to expectations that people may opt for the lowest cost plan,5 survey findings indicate that Missourians place value on a range of factors related to insurance, including scope of services and provider networks. Thus, assessments of whether people are choosing the optimal plan for themselves and their families will need to consider the multiple priorities that people balance in plan selection.

Overall, insured adults in Missouri reported satisfaction with their current coverage but also reported gaps in covered services and problems when using their coverage.

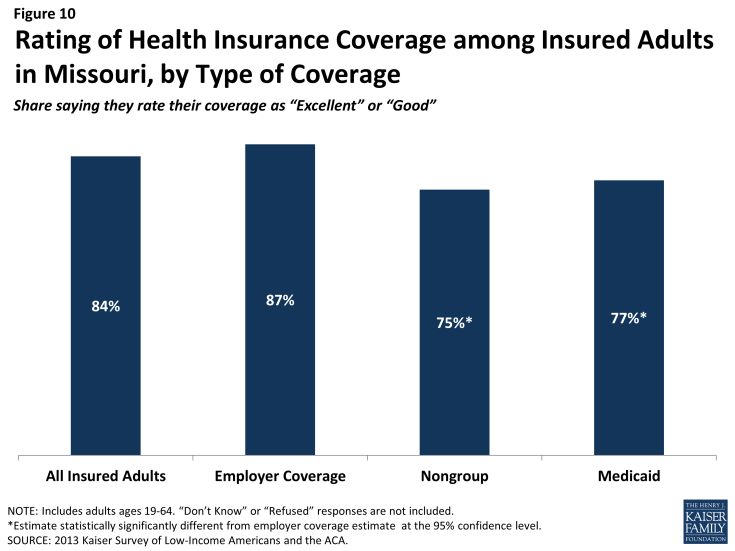

Most insured adults in Missouri reported high levels of satisfaction with their current coverage, but they also reported gaps in services that are covered by their current insurance. Eighty-four percent of insured adults in Missouri rate their coverage as excellent or good (Figure 10). Adults with employer coverage gave plans high ratings, with 87% grading their plans as excellent or good. Adults with Medicaid or nongroup coverage were less likely to give their plans high ratings, but over three-quarters in each coverage group (77% and 75%, respectively) rated their plans as excellent or good.

Figure 10: Rating of Health Insurance Coverage among Insured Adults in Missouri, by Type of Coverage

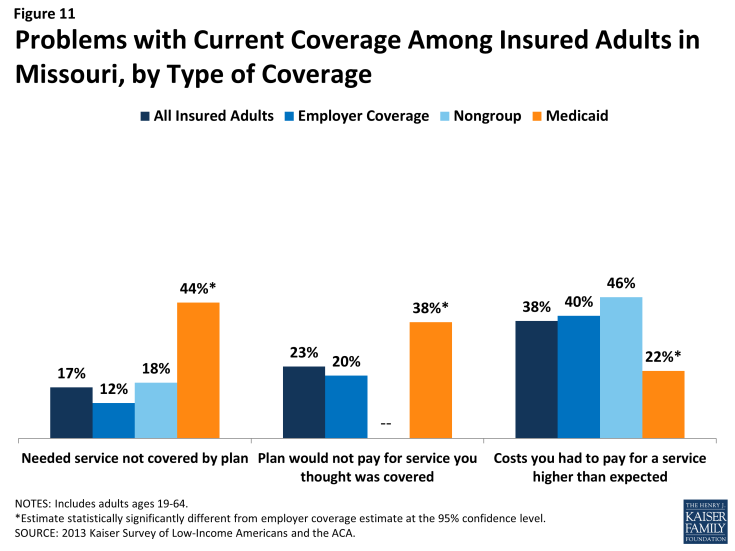

Despite the high ratings, notable shares of insured adults in Missouri reported a problem with their plan. Specifically, one in six (17%) insured adults reported needing a service that is not covered by their current plan (Figure 11 and Appendix Table A5). People with Medicaid coverage (44%) are more likely to report that their plan does not cover certain services compared to those with employer coverage (12%). The most frequently reported services people say they need but lack coverage for are ancillary services, such as dental, vision care, and chiropractor services. In private health coverage, these ancillary services are often covered under stand-alone private insurance policies that must be purchased separately from health coverage, and in Medicaid, most are not federally-required benefits, but rather are covered at state option. Lack of coverage for adult dental services in Medicaid—the most frequently reported service needed but excluded from coverage—has been a longstanding issue facing beneficiaries and providers, despite a particularly high need among the low-income population.6

Insured adults in Missouri also reported experiencing other problems with their insurance plans. Many insured adults reported facing a problem with their current insurance plan covering a specific benefit, either because they were denied coverage for a service they thought was covered (23%) or their out-of-pocket costs for a service were higher than they expected (38%). Some of these services may be over-the-counter products, which are excluded from the majority of insurance plans but which people may believe their plans should cover. Reports of these difficulties varied by insurance coverage. Missouri adults with Medicaid coverage (38%) were more likely than those with employer coverage (20%) to report they were surprised that their plan would not cover a service they believed was covered. Adults with Medicaid coverage have particularly high health needs, which could explain why they reported relatively high rates of problems. Adults with Medicaid (22%) were less likely to report facing higher costs than expected than privately insured adults (40% among those employer coverage and 46% among those with nongroup). This pattern most likely reflects the nominal out of pocket costs Medicaid beneficiaries are required to pay compared to the high cost-sharing of many private plans.

Among the goals of the ACA was ensuring that the coverage people gained provided at least a basic level of coverage and that the Marketplaces helped people navigate their insurance coverage. Thus, new coverage must include a set of essential health benefits (EHB), and participating plans in the Missouri Marketplace must report information on claims payment policies, cost-sharing requirements, out-of-network policies, and enrollee rights in plain language. These provisions may address some of the problems that insured adults in Missouri have experienced with their coverage in the past. However, many of the services that people report needing coverage for—such as dental services—are not included in the EHB. Many newly-insured Missourians may be surprised to learn that some ancillary services are not included in their plan, and education efforts will be needed to make sure people understand their coverage. In addition, some uninsured people who gain coverage may need help with plan selection, having not navigated the process before. Despite these possible challenges, most insured people—even those who reported difficulties—are overall satisfied with their coverage.