2022 Employer Health Benefits Survey

Published:

Section 1: Cost of Health Insurance

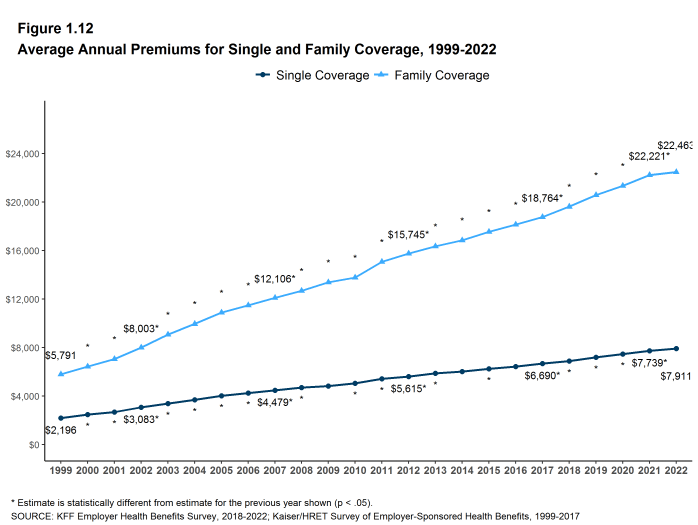

The average annual premiums in 2022 are $7,911 for single coverage and $22,463 for family coverage. These amounts are similar to the premiums in 2021 ($7,739 for single coverage and $22,221 for family coverage). The average family premium has increased 20% since 2017 and 43% since 2012.

This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: https://www.kff.org/interactive/premiums-and-worker-contributions/

PREMIUMS FOR SINGLE AND FAMILY COVERAGE

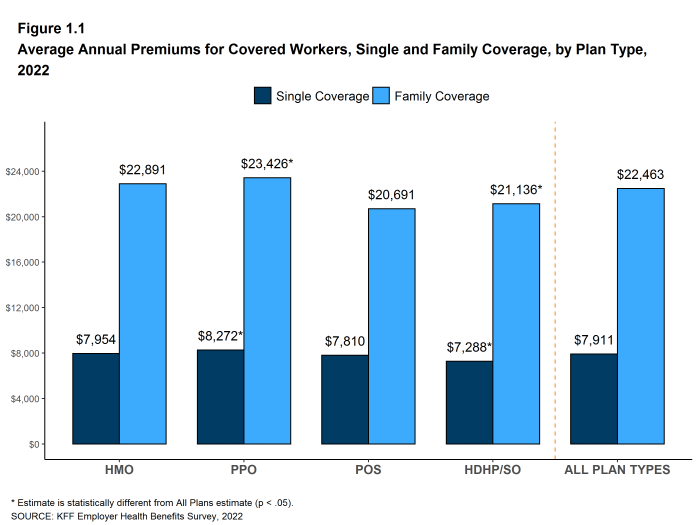

- The average premium for single coverage in 2022 is $7,911 per year. The average premium for family coverage is $22,463 per year [Figure 1.1].

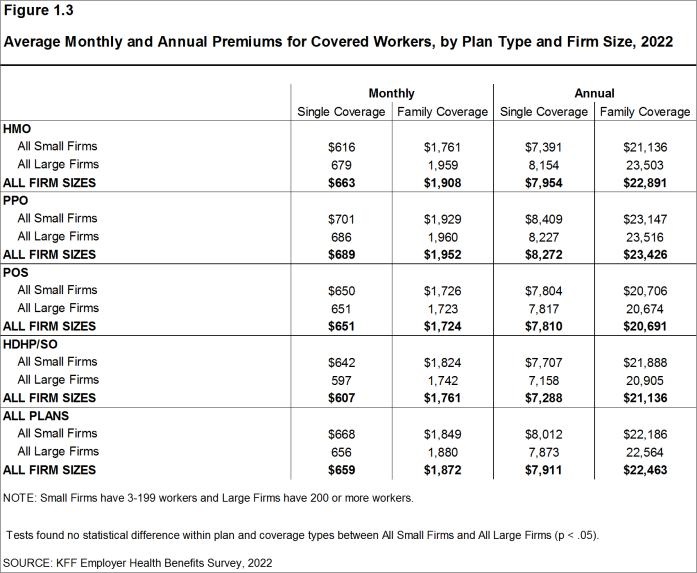

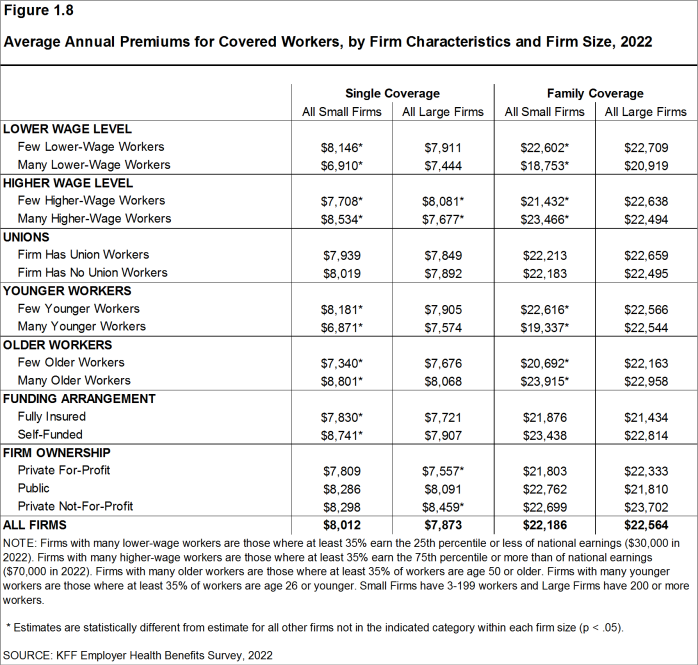

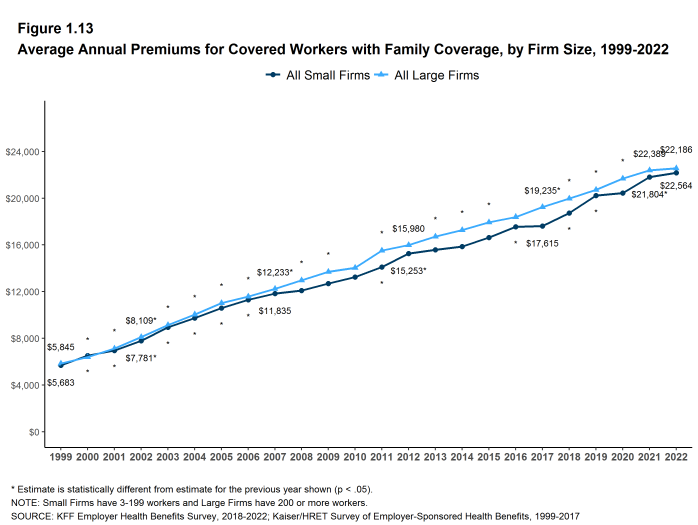

- The average annual premium for single coverage for covered workers in small firms ($8,012) is similar to the average premium for covered workers in large firms ($7,873). The average annual premium for family coverage for covered workers in small firms ($22,186) is similar to the average premium for covered workers in large firms ($22,564). [Figure 1.3].

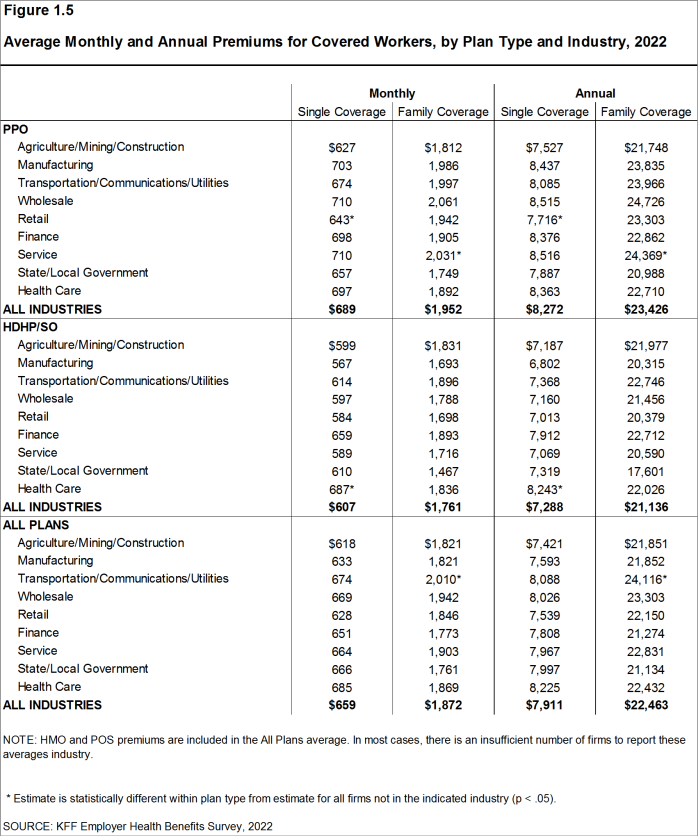

- The average annual premiums for covered workers in HDHP/SOs are lower than the average premiums for coverage overall for both single coverage ($7,288 vs. $7,911) and family coverage ($21,136 vs. $22,463). The average premiums for covered workers in PPOs are higher than the overall average premiums for both single coverage ($8,272 vs. $7,911) and family coverage ($23,426 vs. $22,463) [Figure 1.1].

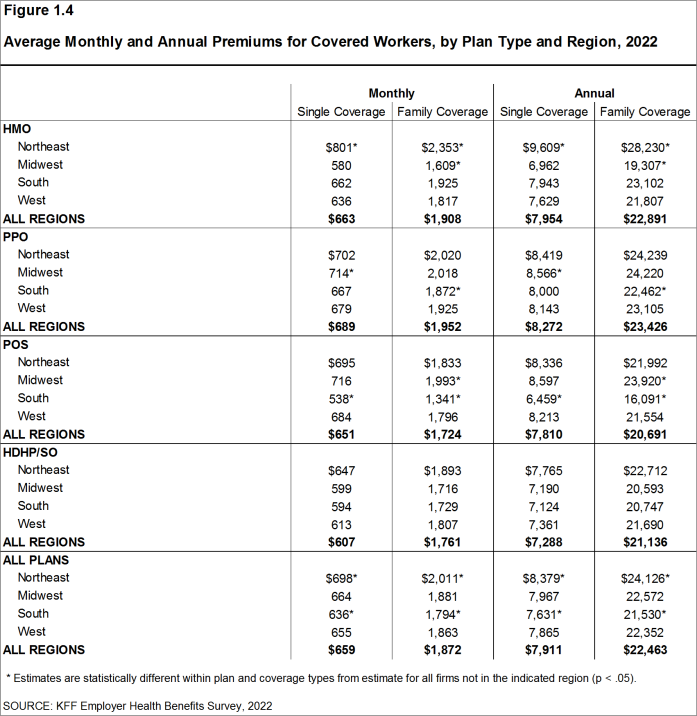

- The average premiums for covered workers with either single or family coverage are relatively higher in the Northeast and relatively lower in the South [Figure 1.4].

- The average premium for family coverage for covered workers in the the Transportation/Communications/Utilities categories is higher than the average single premium for covered workers in other industries [Figure 1.5].

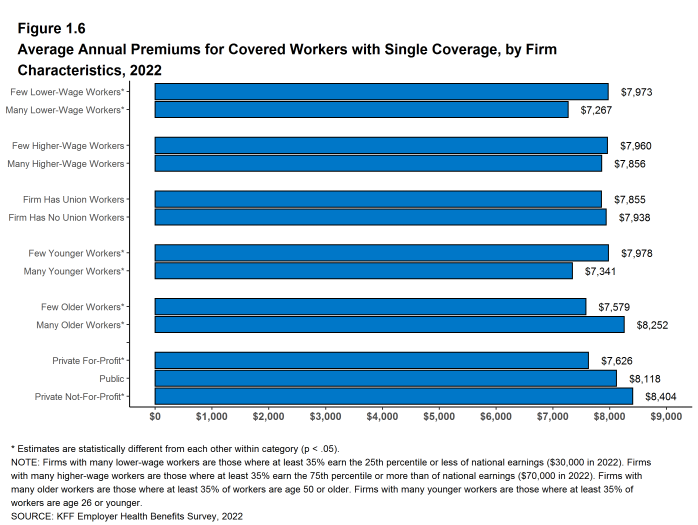

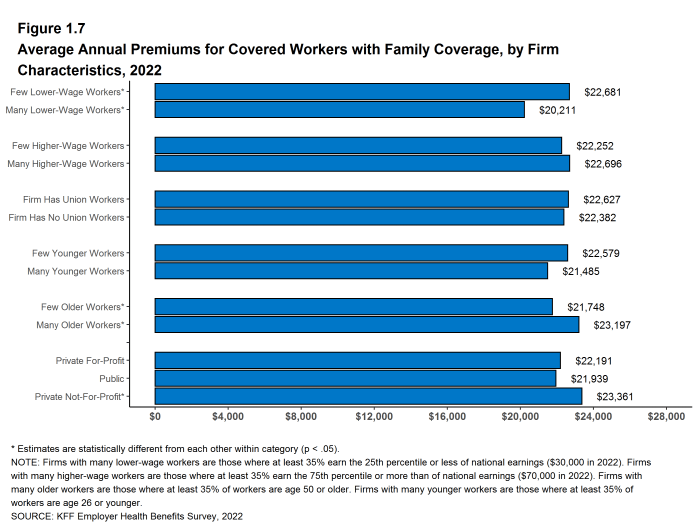

- The average premiums for covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of the workers earn $30,000 annually or less) are lower than the average premium for covered workers in firms with a smaller share of lower-wage workers for both single coverage ($7,267 vs. $7,973) and family coverage ($20,211 vs. $22,681) [Figure 1.6] and [Figure 1.7].

- The average annual premium for single coverage for covered workers in private for-profit firms is lower than the average annual premium for covered workers in other firms. The average annual premium for covered workers in private not-for-profit firms is higher than average annual premium for covered workers in other firms [Figure 1.6] and [Figure 1.7].

- Average premiums vary with the distribution of ages of workers within firms.

- The average annual premiums for covered workers in firms with a relatively large share of younger workers (where at least 35% of the workers are age 26 or younger) are lower than the average premium for covered workers in firms with a smaller share of younger workers for single coverage ($7,341 vs. $7,978) [Figure 1.6] and [Figure 1.7].

- The average annual premiums for covered workers in firms with a relatively large share of older workers (where at least 35% of the workers are age 50 or older) are higher than the average premium for covered workers in firms with a smaller share of older workers for both single coverage ($8,252 vs. $7,579) and family coverage ($23,197 vs. $21,748). [Figure 1.6] and [Figure 1.7].

Figure 1.1: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Plan Type, 2022

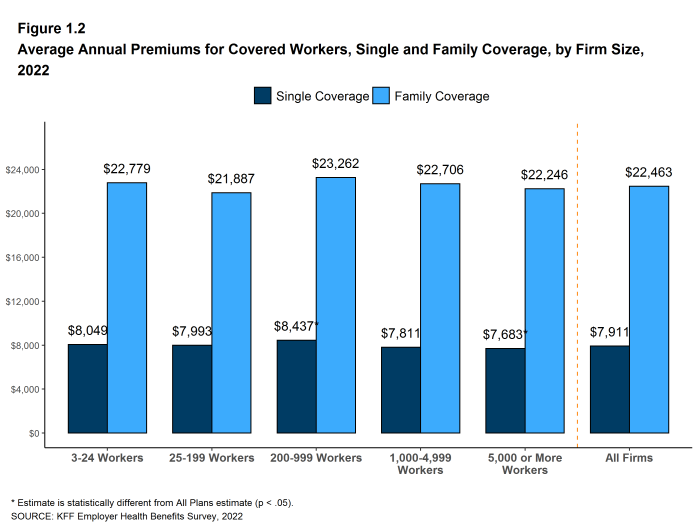

Figure 1.2: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Firm Size, 2022

Figure 1.3: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Firm Size, 2022

Figure 1.5: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Industry, 2022

Figure 1.6: Average Annual Premiums for Covered Workers With Single Coverage, by Firm Characteristics, 2022

Figure 1.7: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Characteristics, 2022

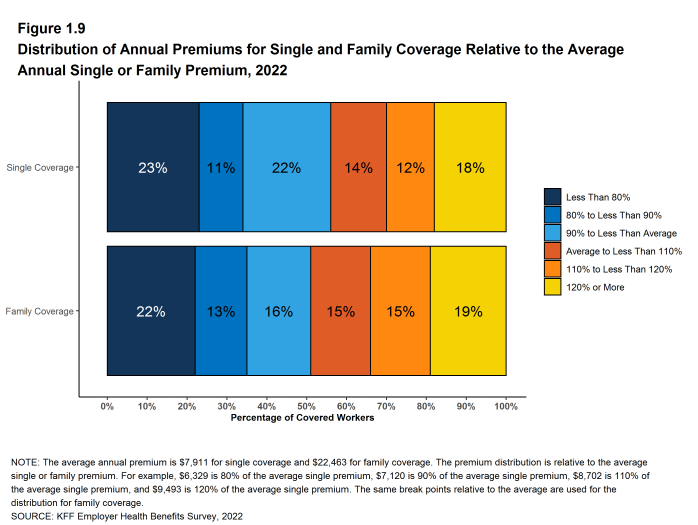

PREMIUM DISTRIBUTION

- There remains considerable variation in premiums for both single and family coverage.

- Eighteen percent of covered workers are employed in a firm with a single premium at least 20% higher than the average single premium, while 23% of covered workers are in firms with a single premium less than 80% of the average single premium [Figure 1.9].

- For family coverage, 19% of covered workers are employed in a firm with a family premium at least 20% higher than the average family premium, while 22% of covered workers are in firms with a family premium less than 80% of the average family premium [Figure 1.9].

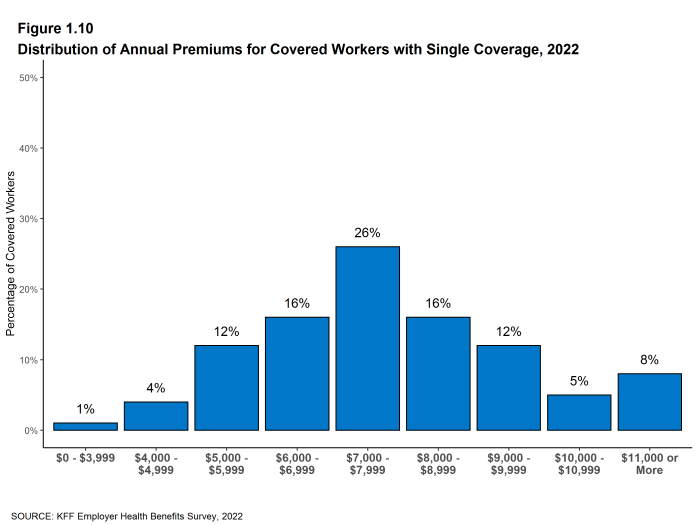

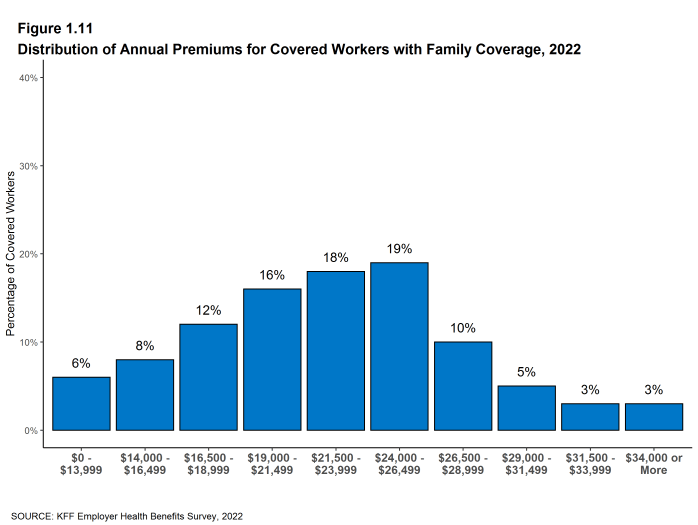

- Thirteen percent of covered workers are in a firm with an average annual premium of at least $10,000 for single coverage [Figure 1.10]. Eleven percent of covered workers are in a firm with an average annual premium of at least $29,000 for family coverage [Figure 1.11].

Figure 1.9: Distribution of Annual Premiums for Single and Family Coverage Relative to the Average Annual Single or Family Premium, 2022

PREMIUM CHANGES OVER TIME

- The average premiums for single and family coverage are similar to the premiums from last year [Figure 1.12].

- The average premium for single coverage has grown 18% since 2017, similar to the growth in the average premium for family coverage (20%) over the same period [Figure 1.12].

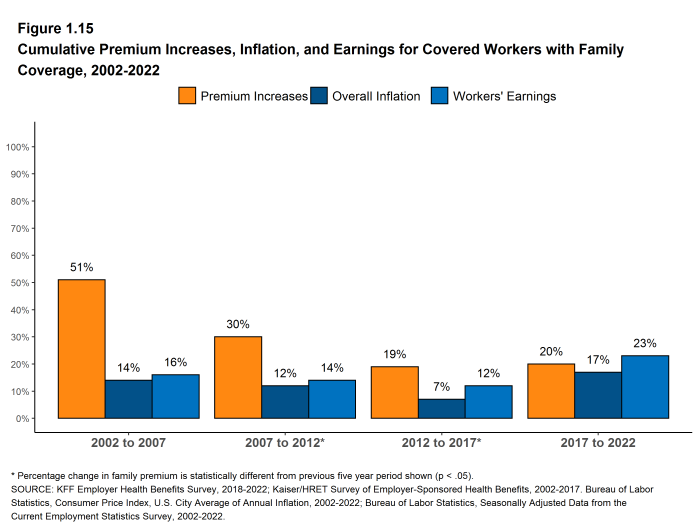

- The $22,463 average family premium in 2022 is 20% higher than the average family premium in 2017 and 43% higher than the average family premium in 2012. The 20% family premium growth in the past five years is similar to the 19% growth between 2012 and 2017 [Figure 1.15].

- The average family premium has grown faster since 2017 for covered workers in small firms as compared to covered workers in large firms (26% for small firms and 17% for large firms). For small firms, the average family premium rose from $17,615 in 2017 to $22,186 in 2022. For large firms, the average family premium rose from $19,235 in 2017 to $22,564 in 2022 [Figure 1.13].

- The average family premium has grown at a similar rate since 2012 for covered workers in small firms as compared to covered workers in large firms (45% in small firms and 41% in large firms). In small firms, the average family premium rose from $15,253 in 2012 to $22,186 in 2022. In large firms, the average family premium rose from $15,980 in 2012 to $22,564 in 2022 [Figures 1.13].

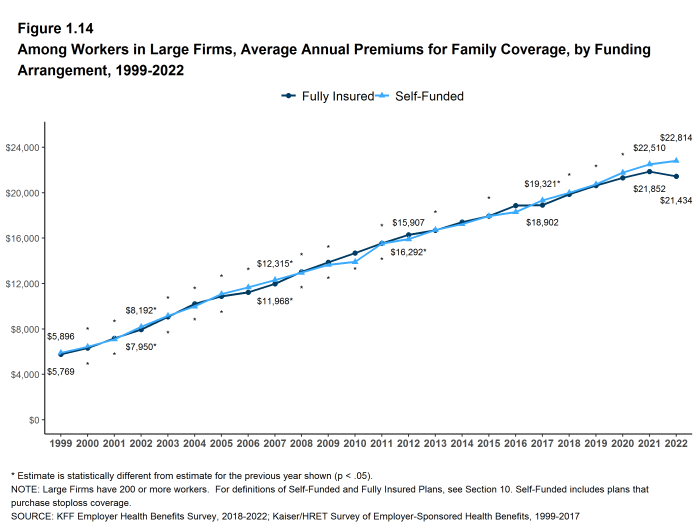

- For covered workers in large firms, over the past five years, the average family premium in firms that are fully insured has grown at a similar rate to the average family premium for covered workers in fully or partially self-funded firms (13% for fully insured plans and 18% for self-funded firms) [Figure 1.14].

- The average family premium in 2022 is similar to the average family premium in 2021, which compares to a substantial jump in inflation between the first three months of 2021 and the same period in 2022, 8%. This significant jump in inflation brings the growth in the average premium for family coverage over the last 5 years much closer to the rate of inflation over the same period (20% vs. 17%). The growth in the average premium for family coverage still outpaces the rate of inflation over the last ten years (43% vs. 25%) [Figure 1.15].

Figure 1.13: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Size, 1999-2022

Figure 1.14: Among Workers in Large Firms, Average Annual Premiums for Family Coverage, by Funding Arrangement, 1999-2022

Sections

- Section 1: Cost of Health Insurance

- Section 2: Health Benefits Offer Rates

- Section 3: Employee Coverage, Eligibility, and Participation

- Section 4: Types of Plans Offered

- Section 5: Market Shares of Health Plans

- Section 6: Worker and Employer Contributions for Premiums

- Section 7: Employee Cost Sharing

- Section 8: High-Deductible Health Plans with Savings Option

- Section 9: Prescription Drug Benefits

- Section 10: Plan Funding

- Section 11: Retiree Health Benefits

- Section 12: Health Screening and Health Promotion and Wellness Programs

- Section 13: Employer Practices, Telehealth, Provider Networks and Coverage for Mental Health Services