2016 Employer Health Benefits Survey

Section Fourteen: Employer Opinions and Health Plan Practices

Employers play a significant role in health insurance coverage – so their opinions and experiences are important factors in health policy discussions. Employer practices continue to evolve, partially in response to Affordable Care Act provisions, including the employer shared responsibility provisions, which require large employers offer coverage or pay a fee, and the impending excise tax on high-cost plans.

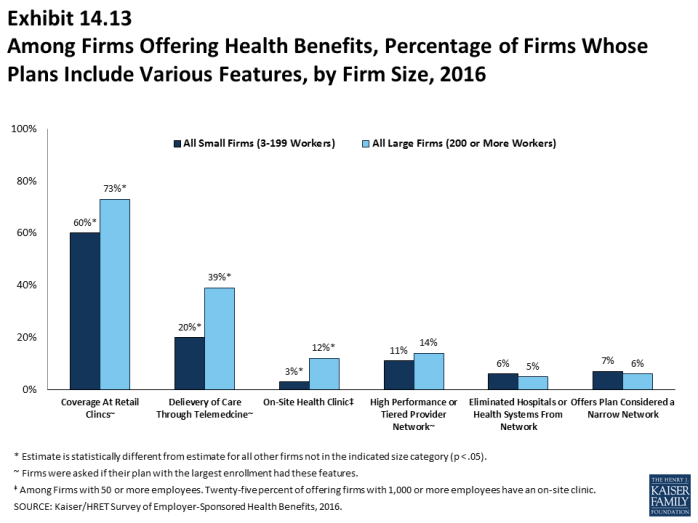

Employers continue to innovate as to how they offer, structure, and deliver their benefits. A considerable number of employers have developed strategies to reduce costs or improve quality through changes to their plan’s provider networks.

Shopping for Health Coverage

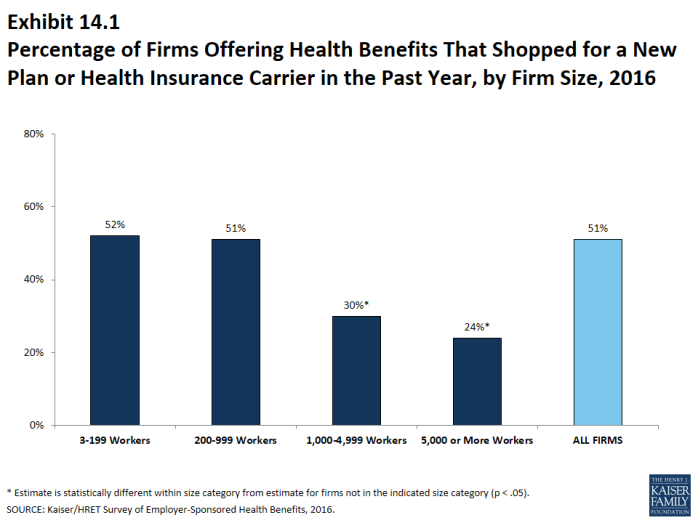

Fifty-one percent of firms offering health benefits reported shopping for a new health plan or a new insurance carrier in the past year, similar to the percentages in recent years (Exhibit 14.1)

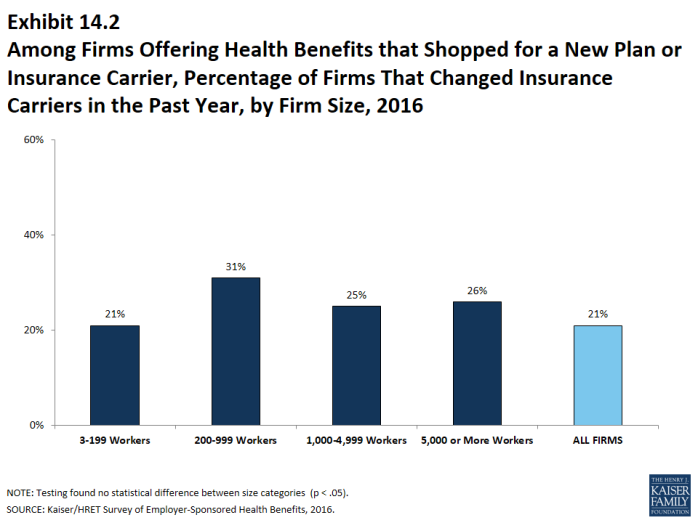

- Among firms that offer health benefits and who shopped for a new plan or carrier, 21% changed insurance carriers (Exhibit 14.2).

COBRA Premiums

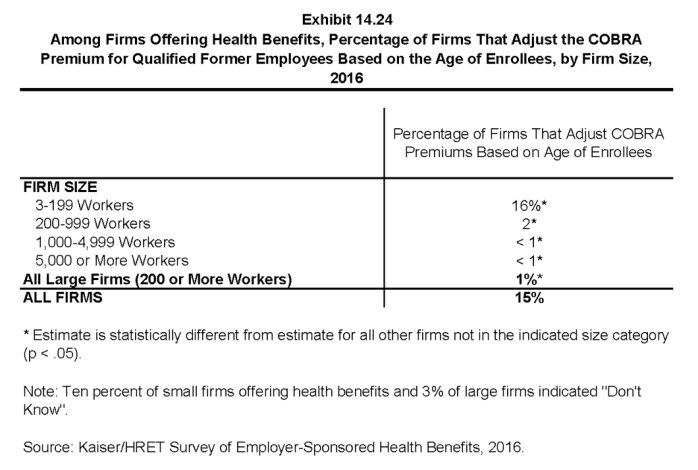

- Sixteen percent of small firms (3-199 workers) and 1% of large firms (200 or more workers) say they adjust the COBRA premium for former employees based on their age (Exhibit 14.24).

Networks and Delivery of Care

Many employers and health plans are delivering services through alternative sites of care.

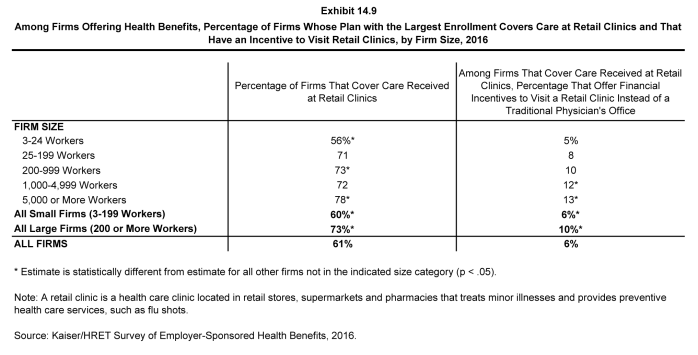

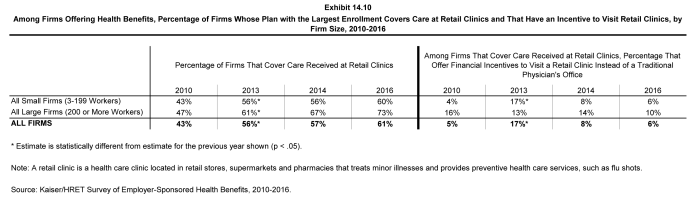

- Sixty-one percent of firms that offer health benefits cover services provided in retail health clinics, such as those found in pharmacies, supermarkets and retail stores (Exhibit 14.9). These percentages are similar to those reported in 2014 when this question was last asked.

- Large firms are more likely to cover services provided through retail health clinics than small firms (73% vs. 60%) (Exhibit 14.9).

- Six percent of firms that cover services provided in retail clinics have a financial incentive for enrollee to receive services in a clinic as compared to visiting a physician’s office (Exhibit 14.9). Large firms are more likely to have such a financial incentive than small firms (10% vs. 6%).

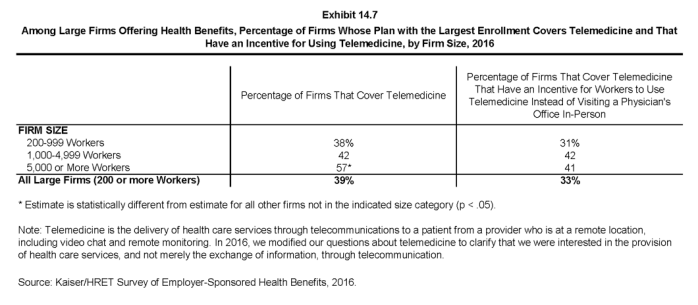

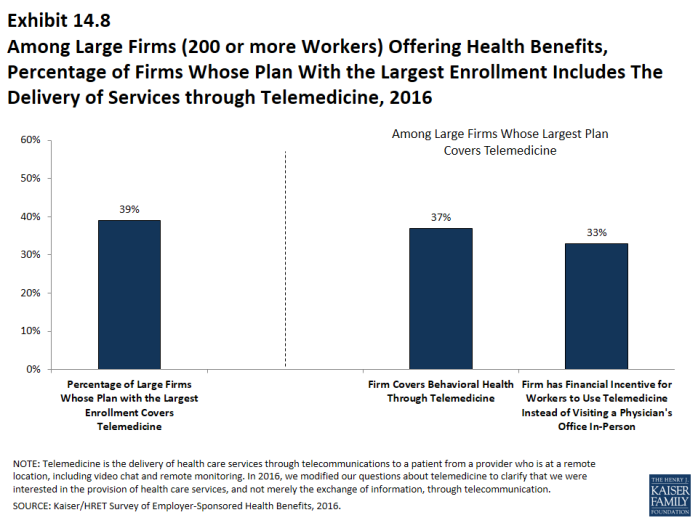

- Thirty-nine percent of large firms offering health benefits cover the provision of some health care services through telecommunication in their largest health plan (Exhibit 14.7). The question in the survey were revised for 2016 to clarify that we were asking about payment for services and not just the electronic exchange of information.

- Among these firms, 33% report that workers have a financial incentive to receive services through telemedicine rather than visiting a physician’s office (Exhibit 14.7).

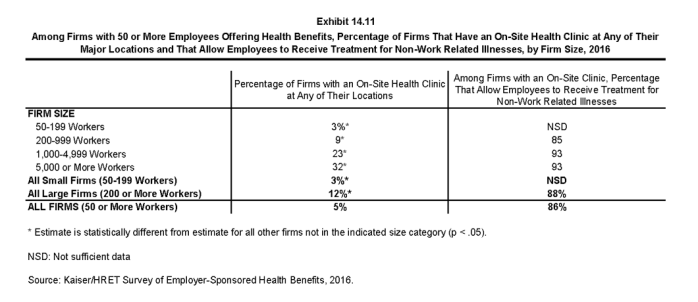

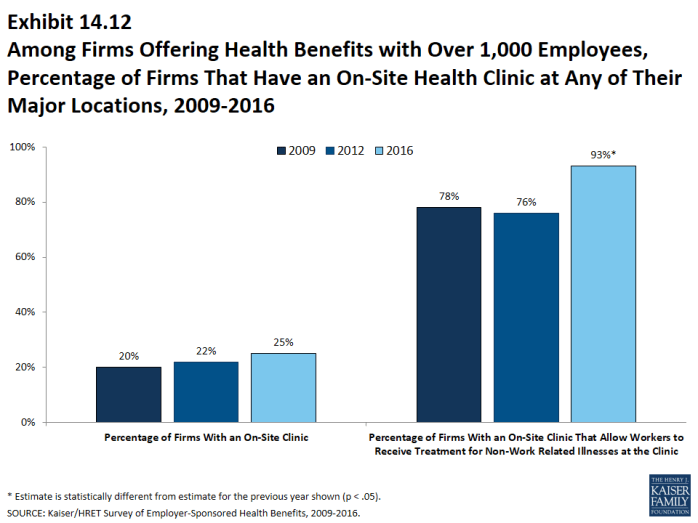

- Among firms with at least 50 employees offering health benefits, 5% provide health services to employees through an on-site health clinic at one of their major locations (Exhibit 14.11).

- Eighty-six percent of these firms allow employees to receive treatment for non-work-related services through the on-site clinic (Exhibit 14.11).

- Firms with at least 1,000 workers were more likely to have an on-site health clinic than smaller firms (25% vs. 4%).

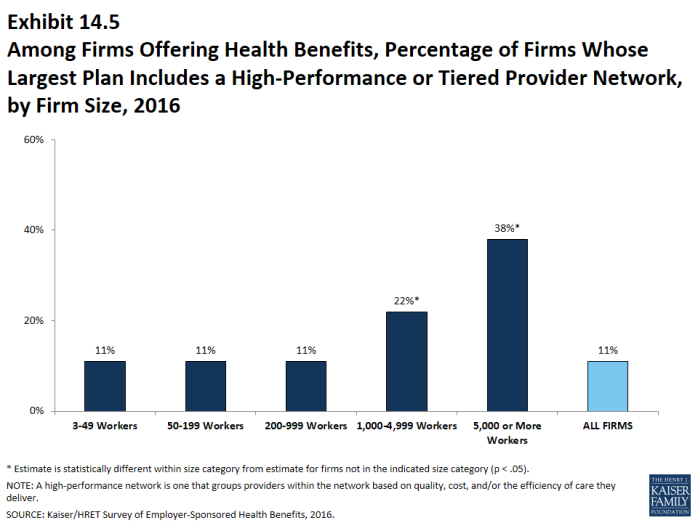

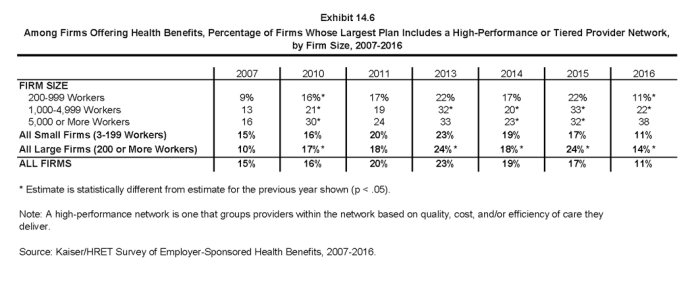

A tiered or high-performance network groups providers in the network together based on quality, cost, and/or the efficiency of the care they deliver. These networks encourage patients to visit preferred doctors by either restricting networks to efficient providers, or by having different cost sharing requirements based on the provider’s tier.

- Fourteen percent of large firms that offer health benefits include a high-performance or tiered provider network in their health plan with the largest enrollment, down from 24% in 2015. The largest firms (those with 1,000 or more employees) are more likely to incorporate a high-performance or tiered network into their largest plan (Exhibit 14.6).

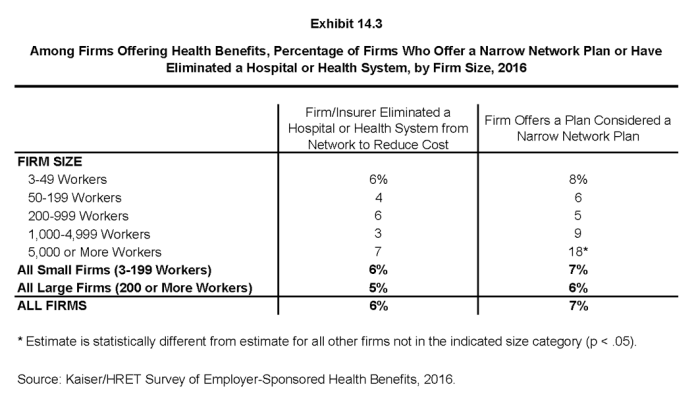

Firms offering health benefits were asked whether they offered a plan that they considered to be a narrow network. Narrow networks are plans that limit the number of providers who can participate in order to reduce costs. Narrow network plans are generally more restrictive than standard HMO networks.

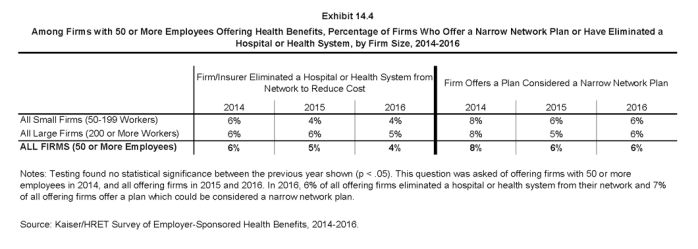

- Six percent of offering firms with 50 or more employees indicated that they offer a plan they considered to be a narrow network plan, similar to the percentages reported in the last few years (Exhibit 14.4).

Six percent of firms offering health benefits said that either they or their insurer eliminated a hospital or health system from a provider network in order to reduce the plan’s cost (Exhibit 14.3).

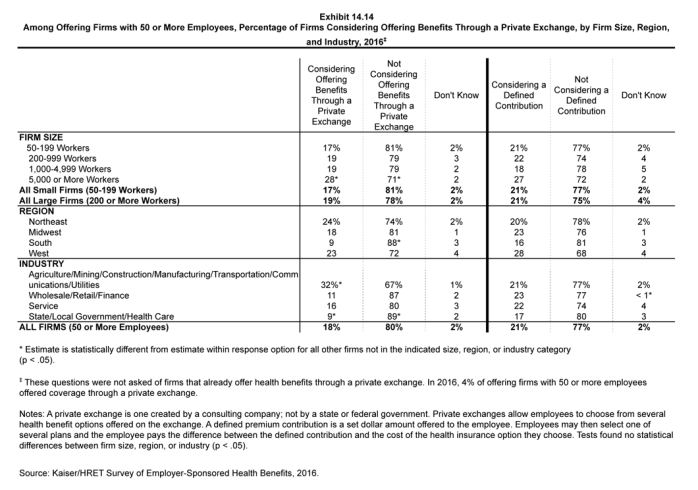

Private exchanges

There has been considerable interest in private exchanges recently. An exchange is a marketplace for health insurance. Private exchanges allow employees to choose from several health benefit options offered on the exchange. Private exchanges generally are created by consulting firms, insurers, or brokers, and are different than the public exchanges that have been created by states or the federal government. There is considerable variation in the types of exchanges currently offered; some exchanges allow workers to choose between multiple plans offered by the same carrier while in other cases multiple carriers participate. The exchange operator may establish strict standards for the plans offered or allow the insurers more flexibility in determining their plan offerings.

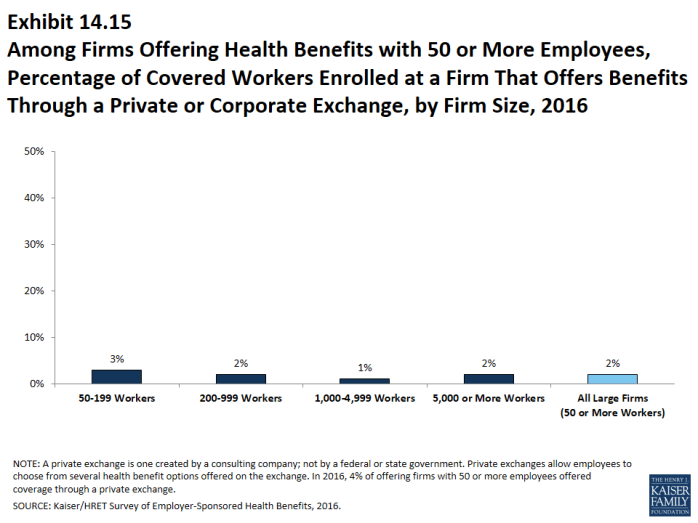

- Four percent of firms offering health benefits with 50 or more employees offer coverage through a private exchange. Looking at worker enrollment, private exchanges cover 2% of covered workers at firms with 50 or more employees (Exhibit 14.15). These percentages are similar to those in 2015.

- Firms offering health benefits with 50 or more employees and who do not already offer health benefits through a private exchange were asked whether they were considering private exchanges in the future. Eighteen percent of these firms are considering offering benefits through a private exchange, similar to the percentage last year (Exhibit 14.14).

- Firms offering health benefits with 50 or more employees and who do not already offer health benefits through a private exchange were asked whether they were considering a defined contribution approach. Twenty-one percent of these firms were considering such an approach (Exhibit 14.14).

Employer shared responsibility

The Affordable Care Act (ACA) provision requiring employers with at least 50 full-time equivalent employees (FTEs) to offer health benefits that meet minimum standards for value and affordability to their full-time workers or pay a penalty took full effect in 2016.

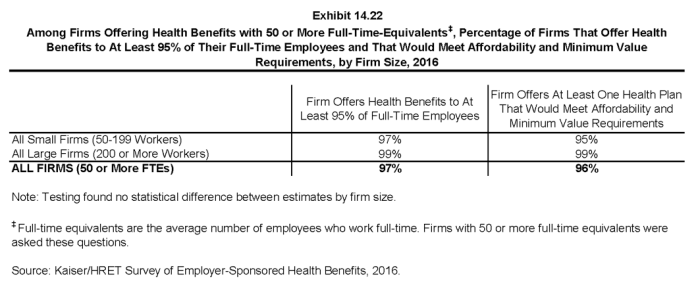

- Among firms offering health benefits with at least 50 FTEs, 97% report that they offer a health plan to at least 95% of their employees who worked on average 30 hours per week or more, and 96% report that they offer at least one health plan that meets the ACA standards for affordability and minimum value (Exhibit 14.22).

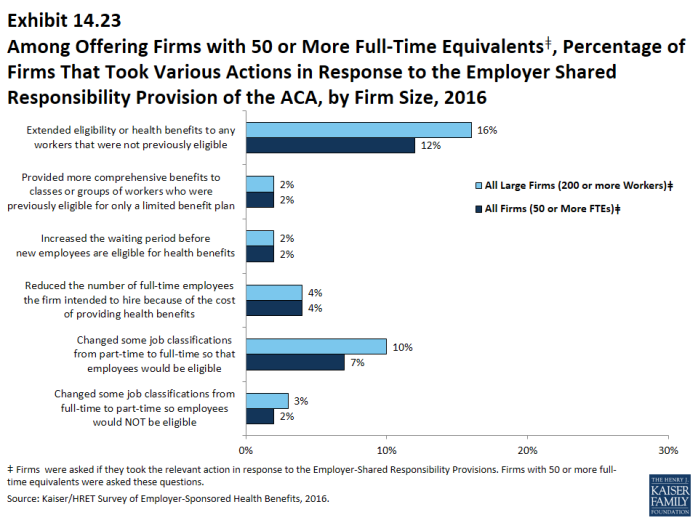

- Firms made changes to their employment practices in response to the employer shared responsibility requirement:

- Two percent of firms offering health benefits say they changed or planned to change the job classifications of some employees from full-time to part-time so that they would not be eligible for health benefits, while 7% said they changed or planned to change job classifications of some employees from part-time to full-time so that they would become eligible for health benefits (Exhibit 14.23).

- Two percent of firms offering health benefit say they increased or were planning to increase the waiting period before new employees become eligible for benefits (Exhibit 14.23).

- Twelve percent of firms offering health benefits say they extended or were planning to extend eligibility for health benefits to workers who were not previously eligible, and 2% reported extending or planning to extend eligibility for more comprehensive benefits to employees previously eligible only for limited benefits (Exhibit 14.23). Four percent of these firms reported that they reduced the number of employees they intended to hire because of the cost of providing health benefits (Exhibit 14.23).

Excise tax on high cost health plans

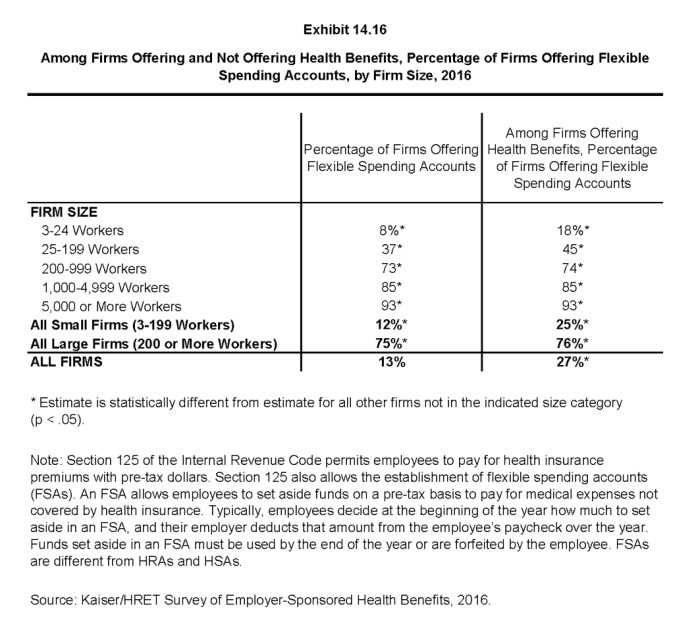

Under the ACA, employer health plans in 2020 will be subject to an excise tax of 40% on the amount by which their cost exceeds specified thresholds.1 The tax was scheduled to take effect in 2018, but its effective date was delayed two years. The tax is calculated with respect to each employee based on the combinations of health benefits received by that employee, including the employer and employee share of health plan premiums (or premium equivalents for self-funded plans), Flexible Spending Account (FSA) contributions, and employer contributions to health savings accounts and health reimbursement arrangement contributions. In anticipation of the high-cost plan tax (sometimes referred to as the “Cadillac plan tax”), some employers have begun making changes to their health benefits.

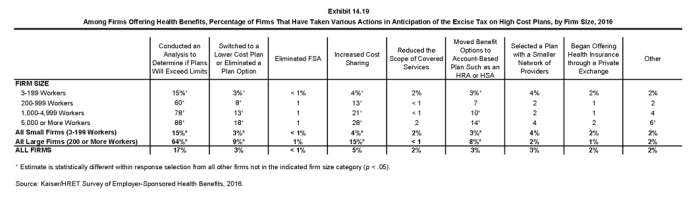

- Among firms offering health benefits, 15% of small firms and 64% of large firms say that they have conducted an analysis to determine if one of their plans will be subject to the tax when it takes effect (Exhibit 14.19).

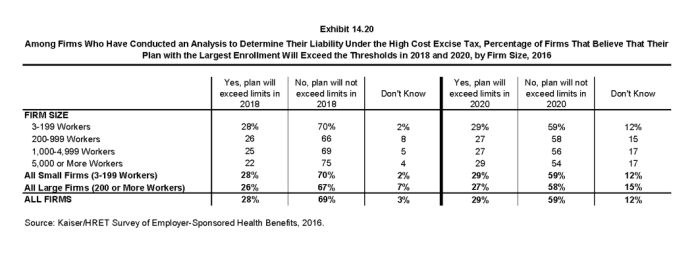

- Among firms who have conducted an analysis, 29% report their plan with the largest enrollment will exceed the thresholds in 2020 (Exhibit 14.20).

- Some employers have already taken action to mitigate the anticipated impacts of the high-cost plan excise tax.

- Three percent of small firms and 9% of large firms say they have switched to a lower cost plan or eliminated a plan option (Exhibit 14.19).

- Four percent of small firms and 15% of large firms say they have increased cost sharing (Exhibit 14.19).

- Four percent of small firms and 2% of large firms say they selected a plan with a smaller network of providers (Exhibit 14.19).

- Three percent of small firms and 8% of large firms say they moved benefit options to an account-based plan such as an HRA or HSA (Exhibit 14.19).

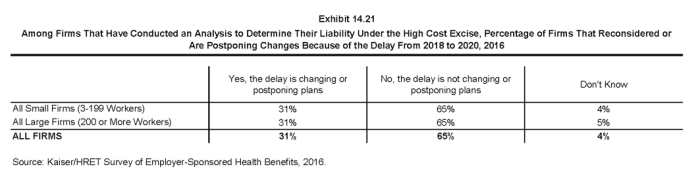

- Thirty-one percent of employers who conducted an analysis of the anticipated impact of the high-cost plan excise tax say that the delay in the implantation date from 2018 to 2020 caused them to reconsider or postpone changes that they had planned to make (Exhibit 14.21).