2020 Employer Health Benefits Survey

Section 8: High-Deductible Health Plans with Savings Option

To help cover out-of-pocket expenses not covered by a health plan, some firms offer high-deductible plans that are paired with an account that allows enrollees to use tax-preferred funds to pay plan cost sharing and other out-of-pocket medical expenses. The two most common types are health reimbursement arrangements (HRAs) and health savings accounts (HSAs). HRAs and HSAs are financial accounts that workers or their family members can use to pay for health care services. These savings arrangements are often (or, in the case of HSAs, always) paired with health plans with high deductibles. The survey treats high-deductible plans paired with a savings option as a distinct plan type – High-Deductible Health Plan with Savings Option (HDHP/SO) – even if the plan would otherwise be considered a PPO, HMO, POS plan, or conventional health plan. Specifically for the survey, HDHP/SOs are defined as (1) health plans with a deductible of at least $1,000 for single coverage and $2,000 for family coverage23 offered with an HRA (referred to as HDHP/HRAs); or (2) high-deductible health plans that meet the federal legal requirements to permit an enrollee to establish and contribute to an HSA (referred to as HSA-qualified HDHPs).24

PERCENTAGE OF FIRMS OFFERING HDHP/HRAS AND HSA-QUALIFIED HDHPS

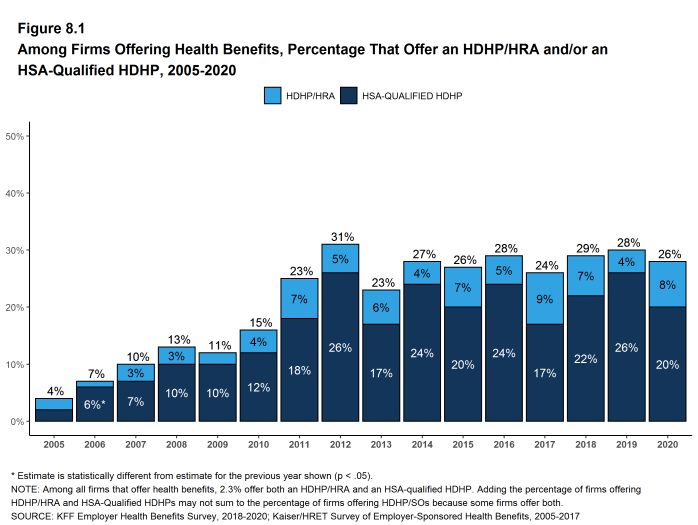

- Twenty-six percent of firms offering health benefits offer an HDHP/HRA, an HSA-qualified HDHP, or both. Among firms offering health benefits, 8% offer an HDHP/HRA and 20% offer an HSA-qualified HDHP [Figure 8.1]. The percentage of firms offering an HDHP/SO is similar to last year.

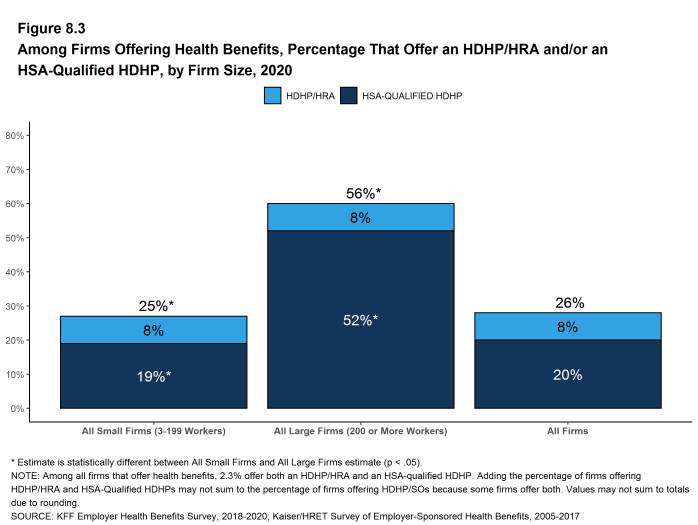

- Large firms (200 or more workers) are more much likely than small firms (3-199 workers) to offer an HDHP/SO (56% vs. 25%) [Figure 8.3].

Figure 8.1: Among Firms Offering Health Benefits, Percentage That Offer an HDHP/HRA And/Or an HSA-Qualified HDHP, 2005-2020

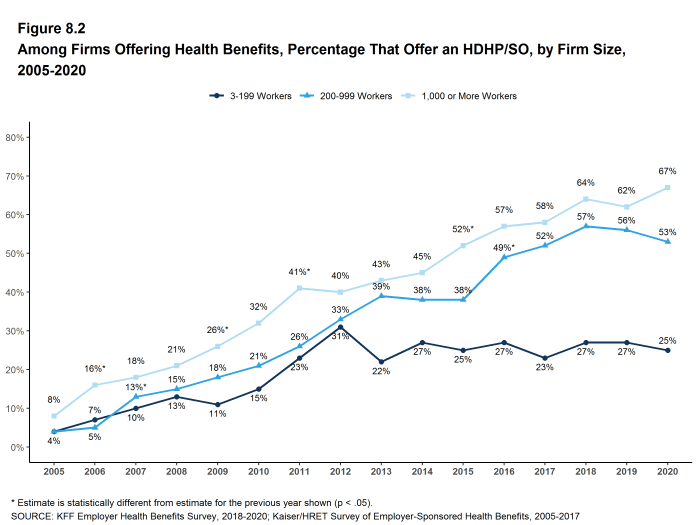

Figure 8.2: Among Firms Offering Health Benefits, Percentage That Offer an HDHP/SO, by Firm Size, 2005-2020

ENROLLMENT IN HDHP/HRAS AND HSA-QUALIFIED HDHPS

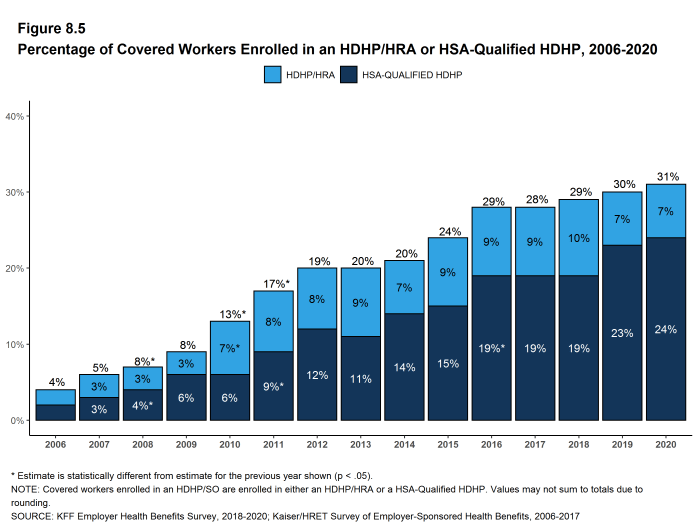

- Thirty-one percent of covered workers are enrolled in an HDHP/SO in 2020, similar to the percentage last year (30%) [Figure 8.5].

- Enrollment in HDHP/SOs has increased over the past five years, from 24% of covered workers in 2015 to 31% in 2020 [Figure 8.5].

- Seven percent of covered workers are enrolled in HDHP/HRAs and 24% of covered workers are enrolled in HSA-qualified HDHPs in 2020. These percentages are similar to the percentages last year [Figure 8.5].

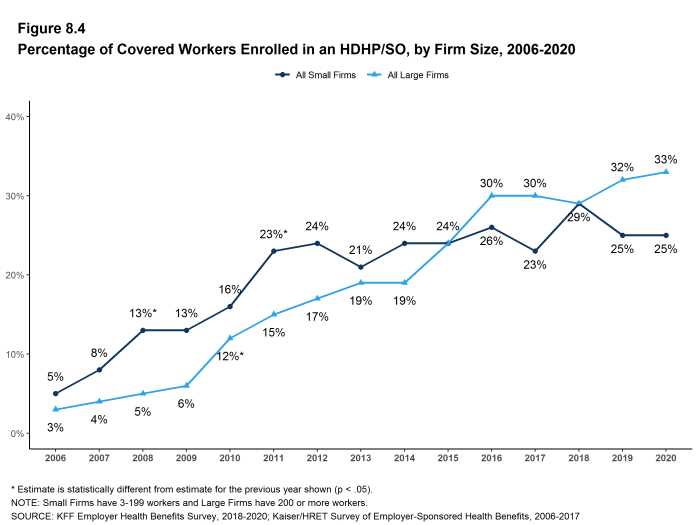

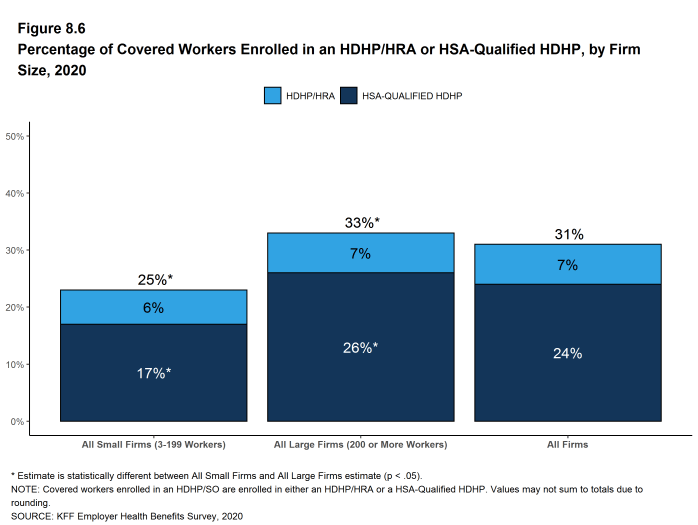

- The percentage of covered workers enrolled in HDHP/SOs is higher in large firms (33%) than in small firms (25%) [Figure 8.6].

- Seven percent of covered workers are enrolled in HDHP/HRAs and 24% of covered workers are enrolled in HSA-qualified HDHPs in 2020. These percentages are similar to the percentages last year [Figure 8.5].

OUT-OF-POCKET MAXIMUMS AND PLAN DEDUCTIBLES

- HSA-qualified HDHPs are legally required to have an annual out-of-pocket maximum of no more than $6,900 for single coverage and $13,800 for family coverage in 2020. Non-grandfathered HDHP/HRA plans are required to have out-of-pocket maximums of no more than $8,150 for single coverage and $16,300 for family coverage in 2020.[^803] Virtually all HDHP/HRA plans have an out-of-pocket maximum for single coverage in 2020.

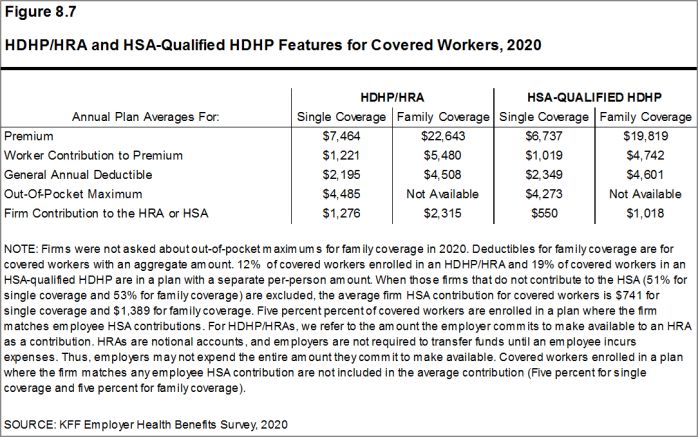

- The average annual out-of-pocket maximum for single coverage is $4,485 for HDHP/HRAs and $4,273 for HSA-qualified HDHPs [Figure 8.7].

- As expected, workers enrolled in HDHP/SOs have higher deductibles than workers enrolled in HMOs, PPOs, or POS plans.

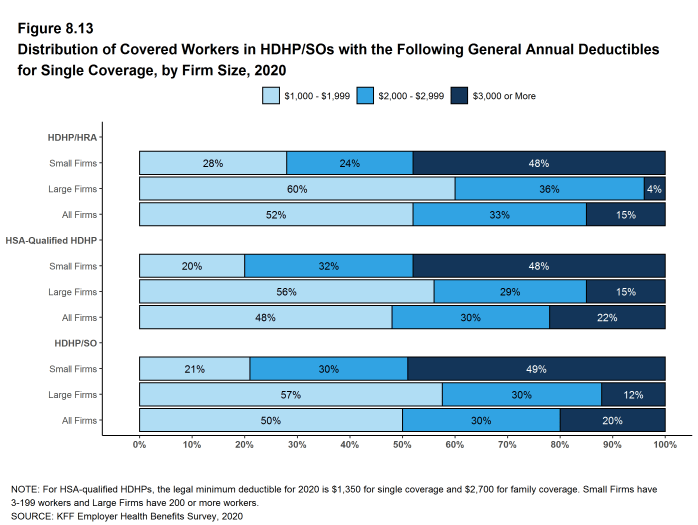

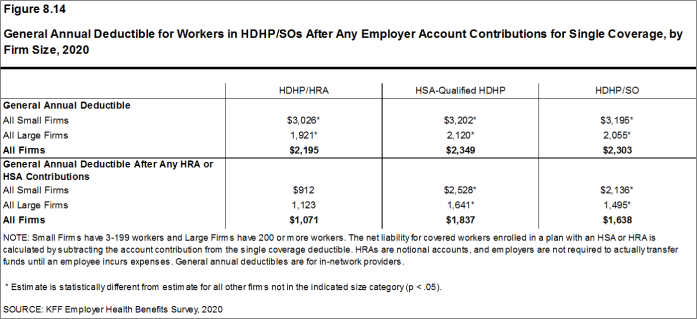

- The average general annual deductible for single coverage is $2,195 for HDHP/HRAs and $2,349 for HSA-qualified HDHPs [Figure 8.14]. These averages are similar to the amounts reported in recent years. There is wide variation around these averages: 50% of covered workers enrolled in an HDHP/SO are in a plan with a deductible of $1,000 to $1,999 for single coverage while 20% are in a plan with a deductible of $3,000 or more [Figure 8.13].

- The survey asks firms whether the family deductible amount is (1) an aggregate amount (i.e., the out-of-pocket expenses of all family members are counted until the deductible is satisfied), or (2) a per-person amount that applies to each family member (typically with a limit on the number of family members that would be required to meet the deductible amount) (see Section 7 for more information).

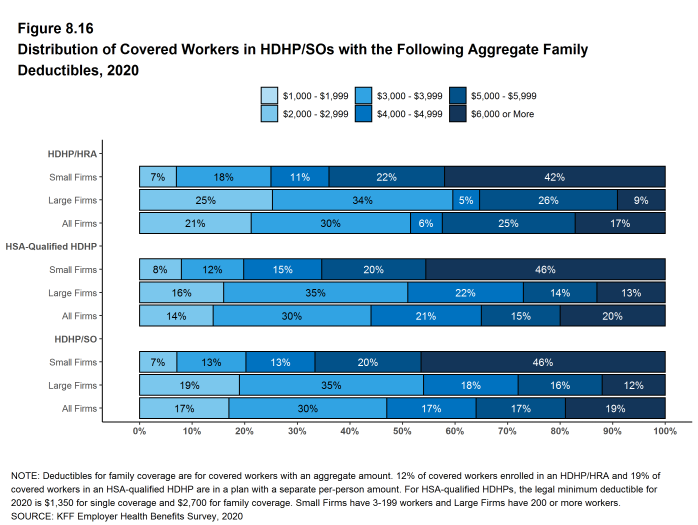

- The average aggregate deductibles for workers with family coverage are $4,508 for HDHP/HRAs and $4,601 for HSA-qualified HDHPs [Figure 8.7]. As with single coverage, there is wide variation around these averages for family coverage: 17% of covered workers enrolled in HDHP/SOs with an aggregate family deductible have a deductible of $2,000 to $2,999 while 19% have a deductible of $6,000 dollars or more [Figure 8.16].

Figure 8.13: Distribution of Covered Workers in HDHP/SOs With the Following General Annual Deductibles for Single Coverage, by Firm Size, 2020

Figure 8.14: General Annual Deductible for Workers in HDHP/SOs After Any Employer Account Contributions for Single Coverage, by Firm Size, 2020

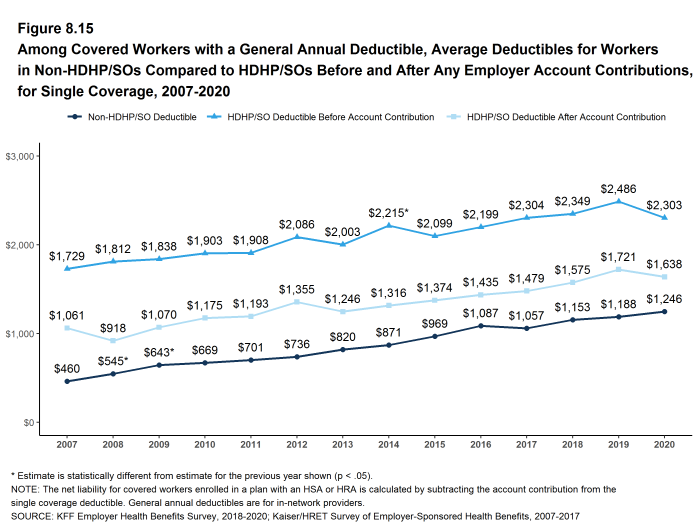

Figure 8.15: Among Covered Workers With a General Annual Deductible, Average Deductibles for Workers in Non-HDHP/SOs Compared to HDHP/SOs Before and After Any Employer Account Contributions, for Single Coverage, 2007-2020

EMPLOYER ACCOUNT CONTRIBUTIONS

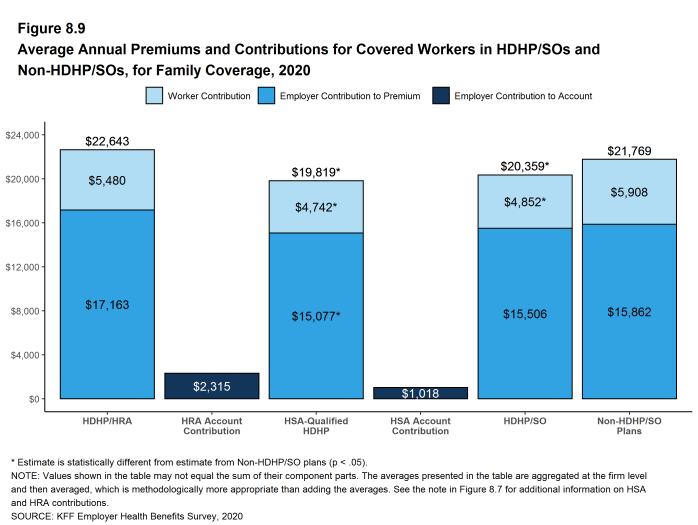

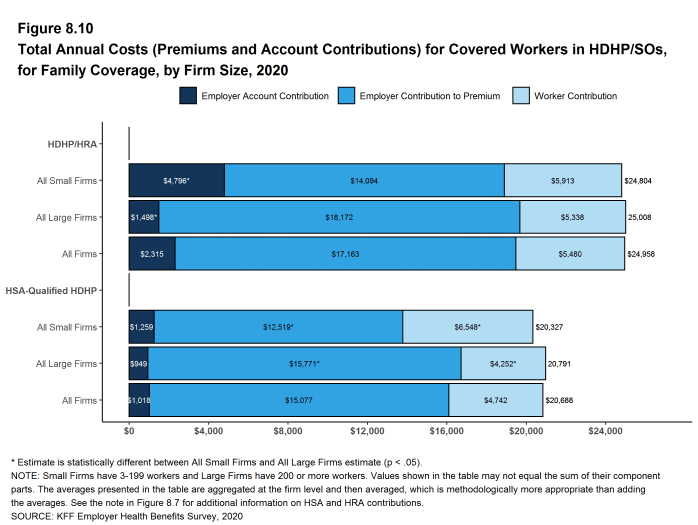

- Employers contribute to HDHP/SOs in two ways: through their contributions toward the premium for the health plan and through their contributions (if any, in the case of HSAs) to the savings account option (i.e., the HRAs or HSAs themselves).

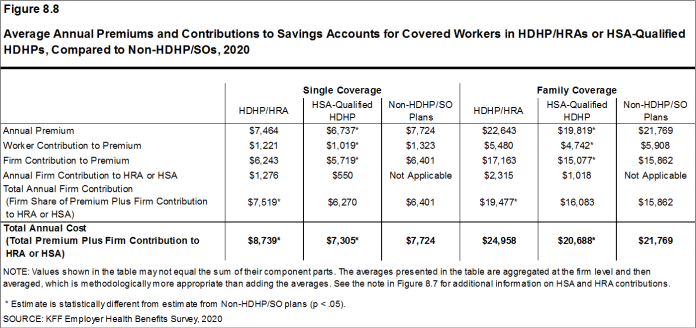

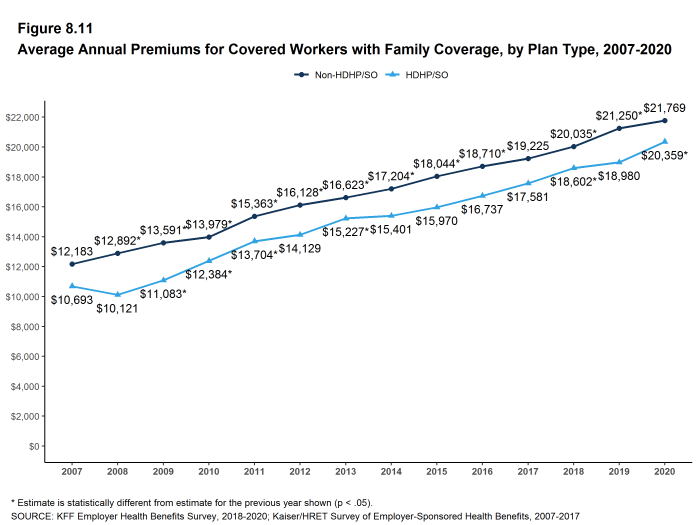

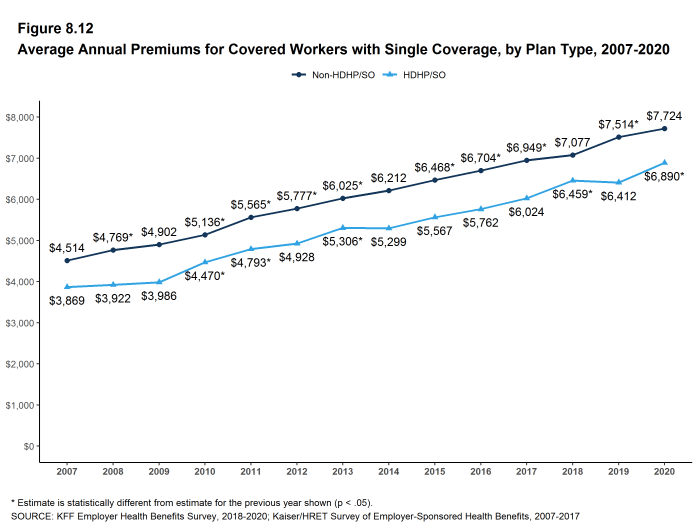

- Looking at only the annual employer contributions to premiums, covered workers in HDHP/HRAs on average receive employer contributions of $6,243 for single coverage and $17,163 for family coverage [Figure 8.8]. These amounts are similar to the contribution amounts last year.

- The average annual employer contributions to premiums for workers in HSA-qualified HDHPs are $5,719 for single coverage and $15,077 for family coverage. Both amounts are significantly higher than the contribution amounts last year. The average employer contributions for covered workers in HSA-qualified HDHPs for single coverage and family coverage are lower than the average contribution for covered workers in plans that are not HDHP/SOs [Figure 8.8].

- Looking at only the annual employer contributions to premiums, covered workers in HDHP/HRAs on average receive employer contributions of $6,243 for single coverage and $17,163 for family coverage [Figure 8.8]. These amounts are similar to the contribution amounts last year.

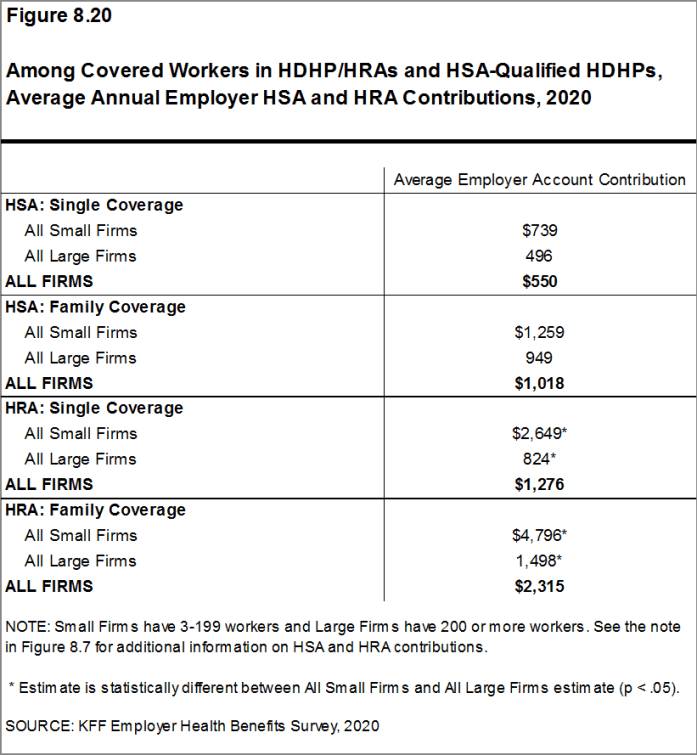

- Looking at employer contributions to the savings options, covered workers enrolled in HDHP/HRAs on average receive an annual employer contribution to their HRA of $1,276 for single coverage and $2,315 for family coverage [Figure 8.8].

- HRAs are generally structured in such a way that employers may not actually spend the whole amount that they make available to their employees’ HRAs.25 Amounts committed to an employee’s HRA that are not used by the employee generally roll over and can be used in future years, but any balance may revert back to the employer if the employee leaves his or her job. Thus, the employer contribution amounts to HRAs that we capture in the survey may exceed the amount that employers will actually spend.

- Covered workers enrolled in HSA-qualified HDHPs on average receive an annual employer contribution to their HSA of $550 for single coverage and $1,018 for family coverage [Figure 8.8].

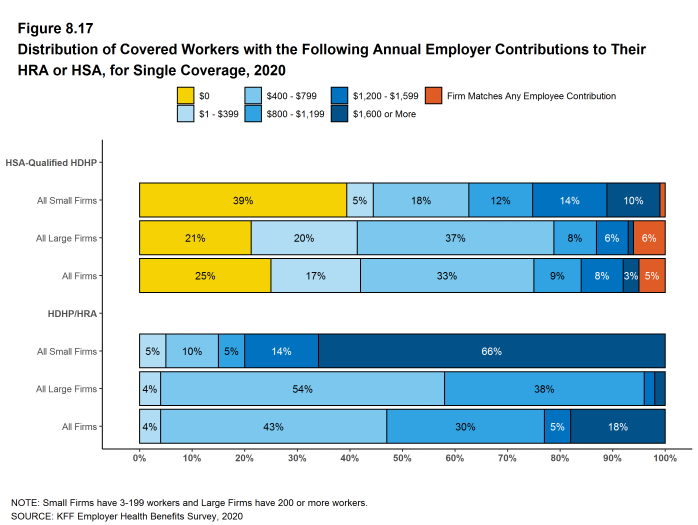

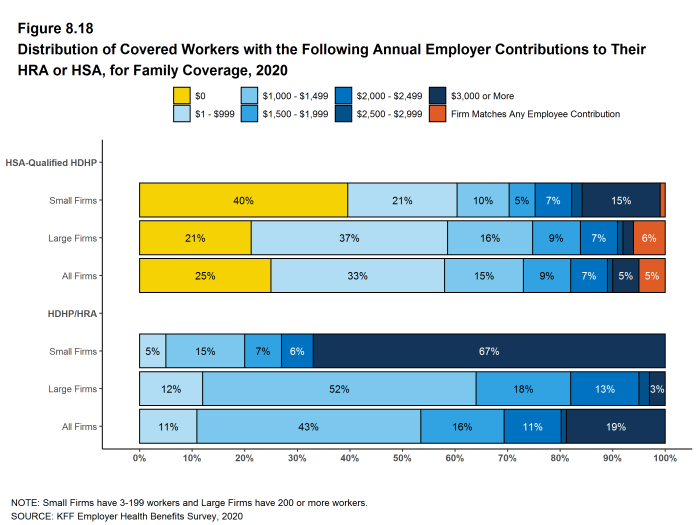

- In many cases, employers that sponsor HSA-qualified HDHP/SOs do not make contributions to HSAs established by their employees. Fifty-one percent of employers offering single coverage and 53% offering family coverage through HSA-qualified HDHPs do not make contributions toward the HSAs that their workers establish. Among covered workers enrolled in an HSA-qualified HDHP, 25% enrolled in single coverage and 25% enrolled in family coverage do not receive an account contribution from their employer [Figure 8.17] and [Figure 8.18].

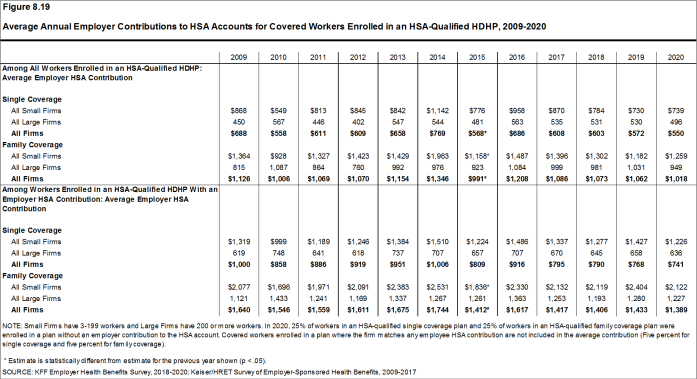

- The average HSA contributions reported above include the portion of covered workers whose employer contribution to the HSA is zero. When those firms that do not contribute to the HSA are excluded from the calculation of the average amounts, the average employer contribution for covered workers is $741 for single coverage and $1,389 for family coverage.

- The percentages of covered workers enrolled in a plan where the employer makes no HSA contribution (25% for single coverage and 25% for family coverage) are similar to the percentages in recent years [Figure 8.17] and [Figure 8.18].

- There is considerable variation in the amount that employers contribute to savings accounts.

- Forty-seven percent of covered workers in an HDHP/HRA receive an annual HRA contribution of less than $800 for single coverage, while 18% receive an annual HRA contribution of $1,600 or more [Figure 8.17].

- Forty-one percent of covered workers in an HSA-qualified HDHP receive an annual HSA contribution of less than $400 for single coverage, including 25% that receive no HSA contribution from their employer [Figure 8.17]. In contrast, 11% of covered workers in an HSA-qualified HDHP receive an annual HSA contribution of $1,200 or more. Five percent of covered workers have an employer that matches any HSA contribution for single coverage.

- Employer contributions to savings account options (i.e., the HRAs and HSAs themselves) for their workers can be added to their health plan premium contributions to calculate total employer contributions toward HDHP/SOs. We note that HRAs are a promise by an employer to pay up to a specified amount and that many employees will not receive the full amount of their HRA in a year, so adding the employer premium contribution amount and the HRA contribution represents an upper bound for employer liability that overstates the amount that is actually expended. Since employer contributions to employee HSAs immediately transfer the full amount to the employee, adding employer premium and HSA contributions is an instructive way to look at their total liability under these plans.

- For HDHP/HRAs, the average annual total employer contribution for covered workers is $7,519 for single coverage and $19,477 for family coverage. The average total employer contributions for covered workers for single coverage and family coverage in HDHP/HRAs are higher than the average firm contributions toward single and family coverage in plans that are not HDHP/SOs [Figure 8.8].

- For HSA-qualified HDHPs, the average total annual firm contribution for covered workers is $6,270 for single coverage and $16,083 for workers with family coverage. The average total firm contribution amounts for single coverage and family coverage in HSA-qualified HDHPs are similar to the average firm contributions toward health plans that are not HDHP/SOs [Figure 8.8].

Figure 8.17: Distribution of Covered Workers With the Following Annual Employer Contributions to Their HRA or HSA, for Single Coverage, 2020

Figure 8.18: Distribution of Covered Workers With the Following Annual Employer Contributions to Their HRA or HSA, for Family Coverage, 2020

Figure 8.19: Average Annual Employer Contributions to HSA Accounts for Covered Workers Enrolled in an HSA-Qualified HDHP, 2009-2020

COST SHARING FOR OFFICE VISITS

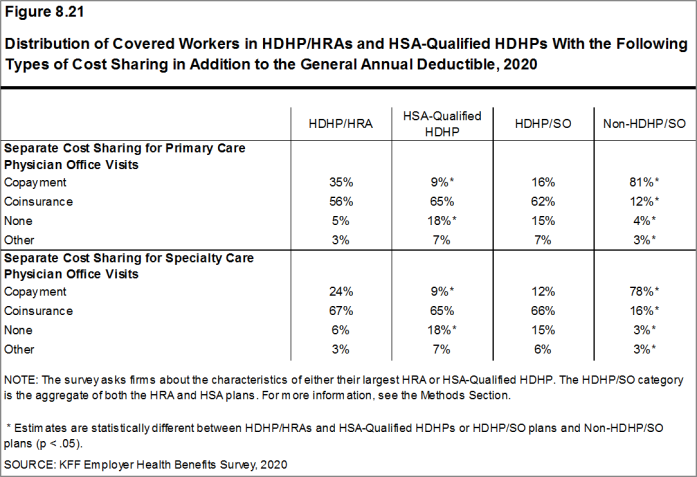

- The cost-sharing pattern for primary care office visits differs for workers enrolled in HDHP/SOs. Thirty-five percent of covered workers in HDHP/HRAs have a copayment for primary care physician office visits compared to 9% enrolled in HSA-qualified HDHPs [Figure 8.21]. Workers in other plan types are much more likely to face copayments than coinsurance for physician office visits (see Section 7 for more information).

Figure 8.21: Distribution of Covered Workers in HDHP/HRAs and HSA-Qualified HDHPs With the Following Types of Cost Sharing in Addition to the General Annual Deductible, 2020

- Health Reimbursement Arrangements (HRAs)

- are medical care reimbursement plans established by employers that can be used by employees to pay for health care. HRAs are funded solely by employers. Employers may commit to make a specified amount of money available in the HRA for premiums and medical expenses incurred by employees or their dependents. HRAs are accounting devices, and employers are not required to expend funds until an employee incurs expenses that would be covered by the HRA. Unspent funds in the HRA usually can be carried over to the next year (sometimes with a limit). Employees cannot take their HRA balances with them if they leave their job, although an employer can choose to make the remaining balance available to former employees to pay for health care. HRAs often are offered along with a high-deductible health plan (HDHP). In such cases, the employee pays for health care first from his or her HRA and then out-of-pocket until the health plan deductible is met. Sometimes certain preventive services or other services such as prescription drugs are paid for by the plan before the employee meets the deductible.

- Health Savings Accounts (HSAs)

- are savings accounts created by individuals to pay for health care. An individual may establish an HSA if he or she is covered by a “qualified health plan” – a plan with a high deductible (at least $1,400 for single coverage and $2,800 for family coverage in 2020 or $1,350 and $2,700, respectively, in 2019) that also meets other requirements. Employers can encourage their employees to create HSAs by offering an HDHP that meets the federal requirements. Employers in some cases also may assist their employees by identifying HSA options, facilitating applications, or negotiating favorable fees from HSA vendors.

Both employers and employees can contribute to an HSA, up to the statutory cap of $3,550 for single coverage and $7,100 for family coverage in 2020. Employee contributions to the HSA are made on a pre-income tax basis, and some employers arrange for their employees to fund their HSAs through payroll deductions. Employers are not required to contribute to HSAs established by their employees but if they elect to do so, their contributions are not taxable to the employee. Interest and other earnings on amounts in an HSA are not taxable. Withdrawals from the HSA by the account owner to pay for qualified health care expenses are not taxed. The savings account is owned by the individual who creates the account, so employees retain their HSA balances if they leave their job. See https://www.federalregister.gov/d/2019-08017/p-850 For those enrolled in an HDHP/HSA, see https://www.irs.gov/pub/irs-pdf/p969.pdf

- There is no legal requirement for the minimum deductible in a plan offered with an HRA. The survey defines a high-deductible HRA plan as a plan with a deductible of at least $1,000 for single coverage and $2,000 for family coverage. Federal law requires a deductible of at least $1,400 for single coverage and $2,800 for family coverage for HSA-qualified HDHPs in 2020 (or $1,350 and $2,700, respectively, for plans in their 2019 plan year). Not all firms’ plan years correspond with the calendar year, so some firms may report a plan with limits from the prior year. See definitions at the end of this Section for more information on HDHP/HRAs and HSA-qualified HDHPs.↩︎

- The definitions of HDHP/SOs do not include other consumer-driven plan options, such as arrangements that combine an HRA with a lower-deductible health plan or arrangements in which an insurer (rather than the employer as in the case of HRAs or the enrollee as in the case of HSAs) establishes an account for each enrollee. Other arrangements may be included in future surveys as the market evolves.↩︎

- The survey asks “Up to what dollar amount does your firm promise to contribute each year to an employee’s HRA or health reimbursement arrangement for single coverage?” We refer to the amount that the employer commits to make available to an HRA as a contribution for ease of discussion. As discussed, HRAs are notional accounts, and employers are not required to actually transfer funds until an employee incurs expenses. Thus, employers may not expend the entire amount that they commit to make available to their employees through an HRA. Some employers may make their HRA contribution contingent on other factors, such as completing wellness programs.↩︎