2023 Employer Health Benefits Survey

Section 13: Employer Practices, Telehealth, Provider Networks, Coverage Limits and Coverage for Abortion

Employers frequently review and modify their health plans to incorporate new options or adapt to new circumstances.

HEALTH CLINICS

- Many employers cover health services provided through retail health clinics. These clinics can be found in supermarkets, pharmacies or other retail locations and provide preventive services, such as vaccines and flu shots. Some also treat minor illnesses.

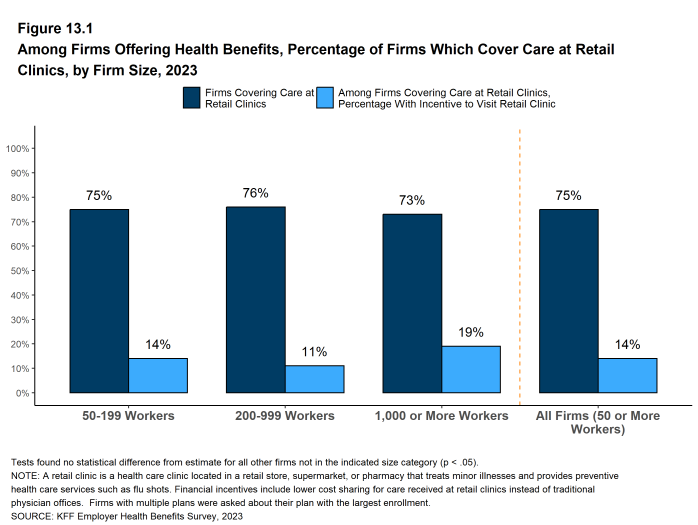

- Among firms with 50 or more employees that offer health benefits, 75% say their largest health plan covers services provided through these clinics [Figure 13.1]. This percentage is similar across firm sizes.

- Among firms with 50 or more employees whose largest plan covers health services received in retail clinics, 14% provide a financial incentive, such as lower cost sharing, for workers to use a retail health clinic instead of visiting a traditional physician’s office [Figure 13.1].

- Some employers provide health services to their employees through clinics that they establish or sponsor at or near their place of work. On-site and near-site clinics may treat work-related injuries, and may also provide other health services.

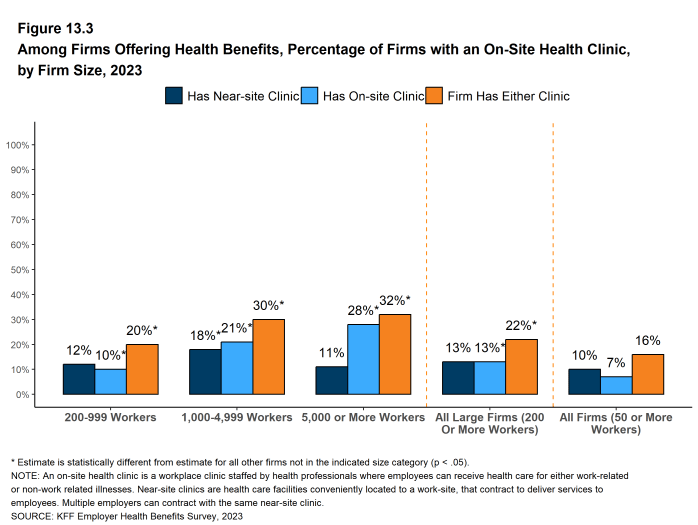

- Among firms with 50 or more employees that offer health benefits, 16% have an on-site or a near-site health clinic for their employees at one or more of their workplace locations. Firms with 1,000 to 4,999 workers and firms with 5,000 or more workers are more likely than smaller firms to have one of these clinics [Figure 13.3].

- Among firms reporting that they have an on-site or near-site clinic at one of their workplace locations, 34% say they have an on-site clinic, 57% say that they have a near-site clinic, and 10% say that they have both types of clinics. Generally, smaller firms are more likely to say that they have near-site clinics and larger firms are more likely to say that they have on-site clinics.

Figure 13.1: Among Firms Offering Health Benefits, Percentage of Firms Which Cover Care at Retail Clinics, by Firm Size, 2023

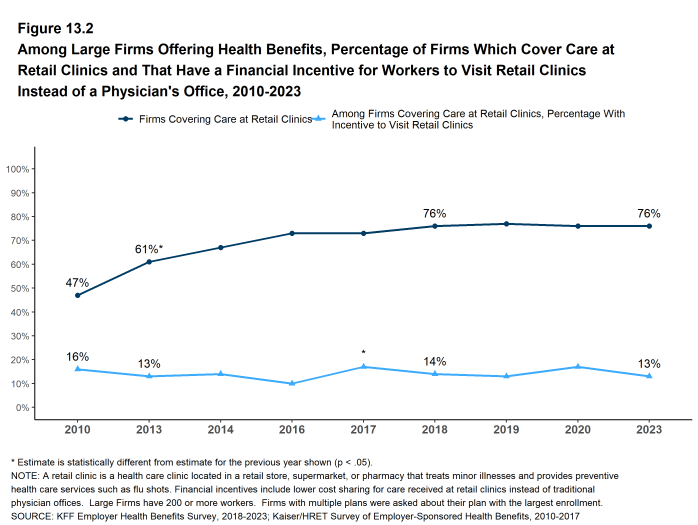

Figure 13.2: Among Large Firms Offering Health Benefits, Percentage of Firms Which Cover Care at Retail Clinics and That Have a Financial Incentive for Workers to Visit Retail Clinics Instead of a Physician’s Office, 2010-2023

CENTERS OF EXCELLENCE

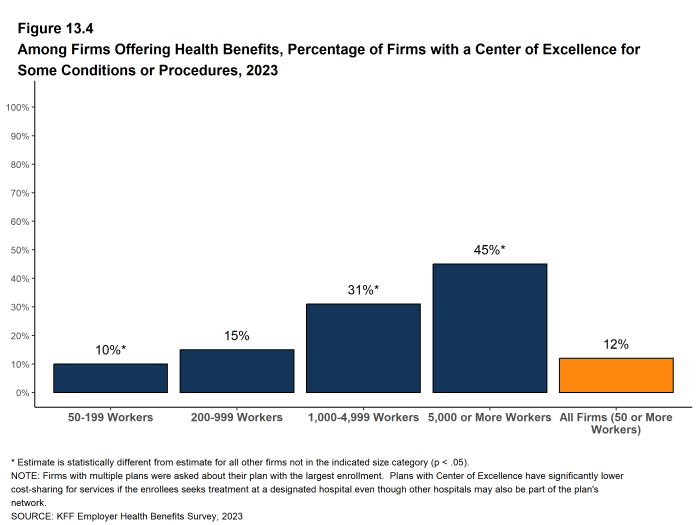

“Centers of Excellence” are facilities or providers which health plans and employers single out as providers of exceptionally high-value specialty care for specific conditions. Plans and employers may encourage or require enrollees to use these designated providers to receive coverage for certain types of care. Centers of excellence may provide care that is particularly complex or specialized, such as organ transplants, or care that employers and health plans believe may be subject to abuse or poor care delivery, such as care for musculoskeletal injuries.

- Among firms with 50 or more employees that offer health benefits, 12% said that they offered a center of excellence program in 2023 [Figure 13.4].

- Larger firms are much more likely to say that they have a center of excellence program than smaller employers, with 31% of firms with 1,000 to 4,999 workers and 45% of firms with 5,000 or more workers saying that they offer this kind of program [Figure 13.4].

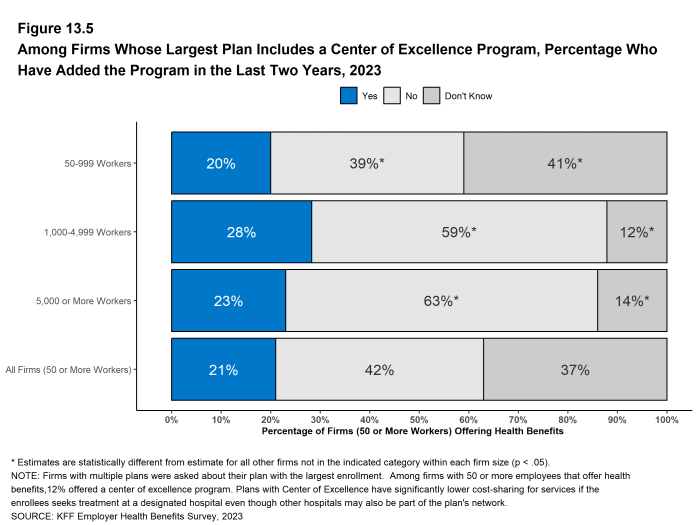

- Among firms with a center of excellence program, 21% have introduced a new center of excellence program within the last two years [Figure 13.5].

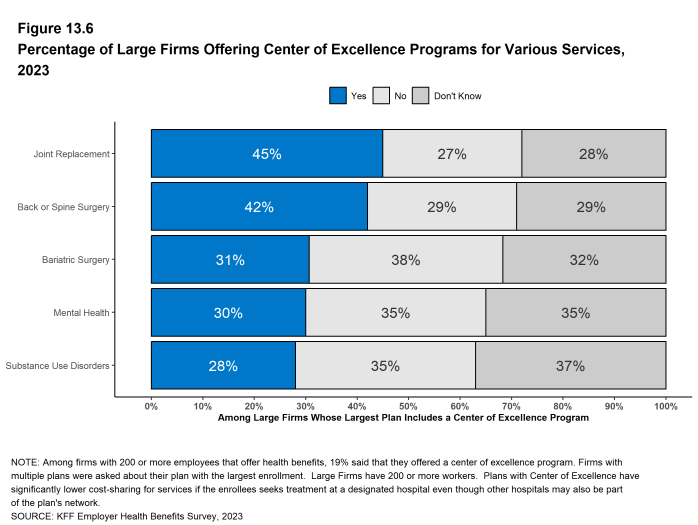

- Employers with 200 or more employees with a center of excellence program were asked about the types of services included in these programs.

- Among these employers, 42% have a center of excellence program for back or spine surgery, 28% for substance use disorders, 30% for mental health conditions, 31% for bariatric surgery, and 45% for joint replacement [Figure 13.6].

- Firms with 5,000 or more employees are less likely than other large firms with center of excellence programs to have a program for substance use or mental health conditions and more likely to have a program for bariatric surgery.

- It should be noted that a significant share of large employer respondents answered “don’t know” to the questions about the types of services covered by their center of excellence programs [Figure 13.6].

Figure 13.4: Among Firms Offering Health Benefits, Percentage of Firms With a Center of Excellence for Some Conditions or Procedures, 2023

Figure 13.5: Among Firms Whose Largest Plan Includes a Center of Excellence Program, Percentage Who Have Added the Program in the Last Two Years, 2023

TELEMEDICINE

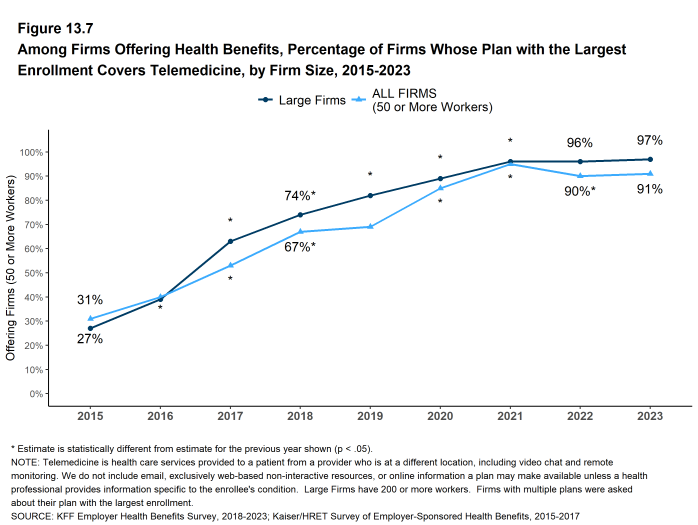

Coverage for telemedicine benefits, which had been growing steadily before the COVID-19 pandemic, skyrocketed during the initial lockdown period. Both state and federal policymakers took steps to reduce regulatory barriers to telemedicine services, while employers and insurers also took steps to make it easier for patients to use them. We asked employers about their telemedicine benefit offerings, as well as whether they view these benefits as an important source of access to health care in the future.

We define telemedicine as the delivery of health care services through telecommunications from a provider to a patient who is at a remote location, including video chat and remote monitoring. This generally does not include the mere exchange of information via email, exclusively web-based resources, or online information that a plan may make available, unless a health professional provides information specific to the enrollee`s condition.

- Among firms with 50 or more workers offering health benefits, 91% cover the provision of some health care services through telemedicine in their largest health plan, similar to the previous year (90%) [Figure 13.7]. Large firms are more likely than small firms (50-199 workers) to cover telemedicine services (97% vs. 89%) [Figure 13.7].

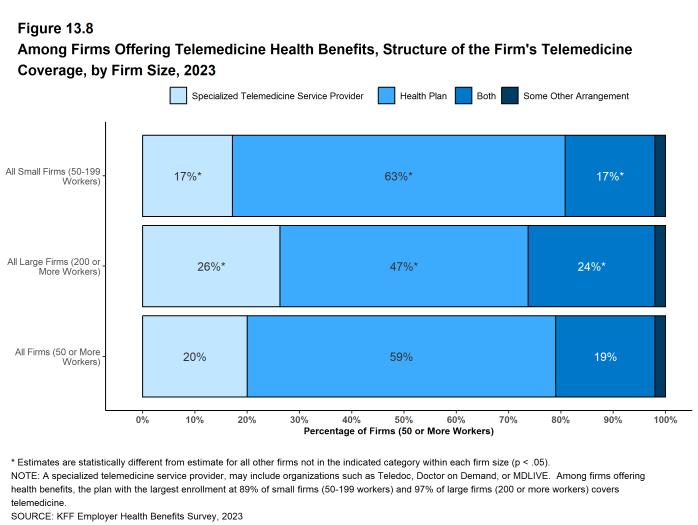

- Among firms with 50 or more employees offering telemedicine services, 20% use a specialized telemedicine service provider, such as Teledoc, Doctor on Demand, or MDLIVE, 59% offer these services through their health plan, 19% through both a specialized telemedicine provider and their health plan, and 2% through some other arrangement [Figure 13.8].

- Small firms are more likely than larger firms to provide telemedicine services only through their health plan (63% vs. 47%) [Figure 13.8].

- Large firms are more likely than small firms to provide telemedicine services through a specialized telemedicine provider (26% vs. 17%) or through both their health plan and a specialized telemedicine provider (24% vs. 17%) [Figure 13.8].

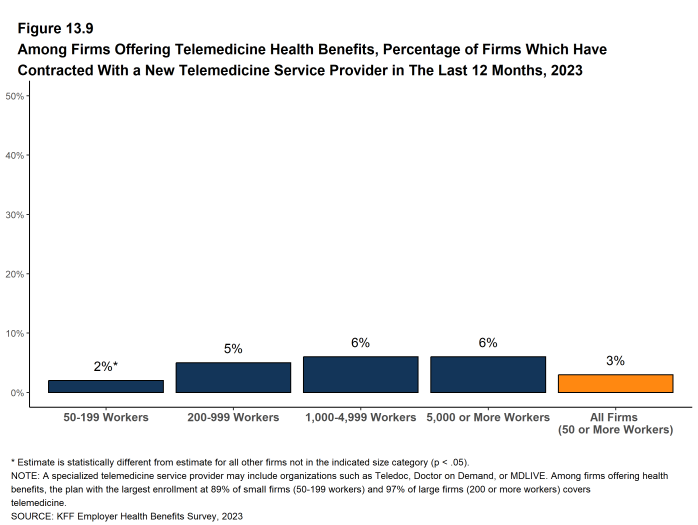

- Among firms with 50 or more employees offering health benefits, 2% of smaller firms (50-199 workers) and 5%of larger firms (200 or more workers) had contracted with a new telemedicine service provider within the last 12 months [Figure 13.9].

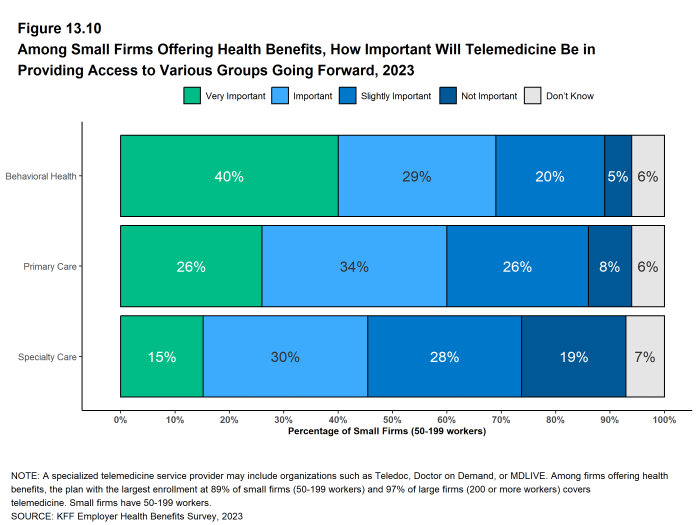

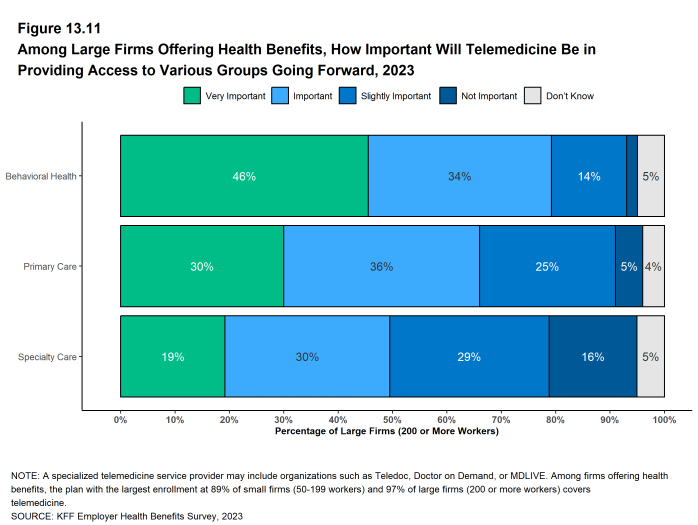

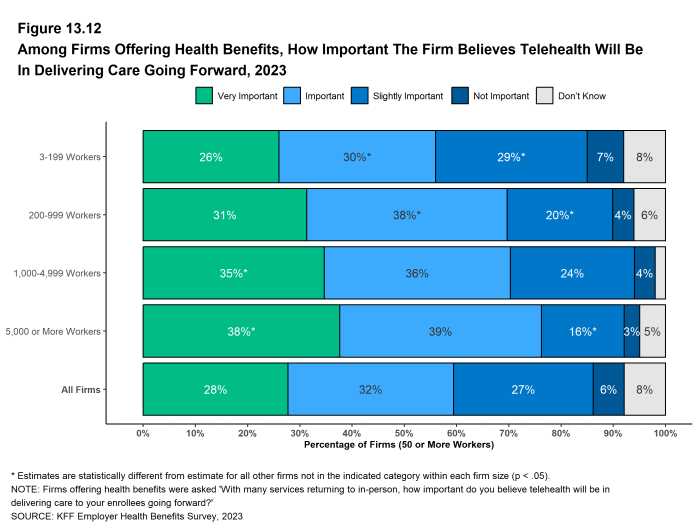

With the effects of the pandemic waning, medical services are generally available on an in-person basis and many employees have partially or fully returned to their workplaces. With this context, we asked employers how important they felt telemedicine would be in providing care to employees going forward, both overall and for several specific types of services. Among firms with 50 or more enrollees offering health benefits:

- Overall – Twenty-eight percent say that telemedicine will be “very important” in providing access to enrollees in the future, and another 32% say that it will be “important” to providing access to these services [Figure 13.12].

- Behavioral Health Services – Forty-one percent say that telemedicine will be “very important” in providing access to behavioral health services in the future, and another 30% say that it will be “important.” Larger firms (1,000 or more workers) are more likely than smaller firms to say that telemedicine will be “very important” to providing access to these services. (57% vs. 40%).

- Primary Care – Twenty-seven percent say that telemedicine will be “very important” in providing access to primary care in the future, and another 34% say that it will be “important.”

- Specialty Care – Sixteen percent say that telemedicine will be “very important” in providing access to specialty care in the future, and another 30% say that it will be “important.”

- Enrollees in Remote Areas – Forty-three percent say that telemedicine will be “very important” in providing future access to care for enrollees in remote areas, and another 26% say that it will be “important.”

Figure 13.7: Among Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine, by Firm Size, 2015-2023

Figure 13.8: Among Firms Offering Telemedicine Health Benefits, Structure of the Firm’s Telemedicine Coverage, by Firm Size, 2023

Figure 13.9: Among Firms Offering Telemedicine Health Benefits, Percentage of Firms Which Have Contracted With a New Telemedicine Service Provider in the Last 12 Months, 2023

Figure 13.10: Among Small Firms Offering Health Benefits, How Important Will Telemedicine Be in Providing Access to Various Groups Going Forward, 2023

Figure 13.11: Among Large Firms Offering Health Benefits, How Important Will Telemedicine Be in Providing Access to Various Groups Going Forward, 2023

PROVIDER NETWORKS

Firms and health plans structure their networks of providers to ensure access to care, and to encourage enrollees to use providers who are lower cost, or who provide better care.

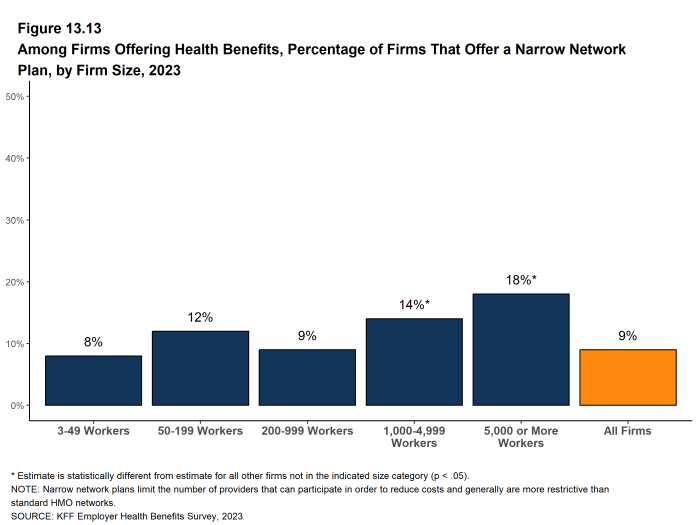

- Some employers offer a health plan with a relatively small, or narrow, network of providers to their employees. Narrow network plans limit the number of providers that can participate in order to reduce costs, and are generally more restrictive than standard HMO networks.

- Nine percent of firms offering health benefits report that they offer at least one plan that they considered to be a narrow network plan, the same as the percentage reported last year (9%) [Figure 13.13].

- Firms with 1,000 to 4,999 workers and firms with 5,000 or more workers offering health benefits are more likely than firms of other sizes to offer at least one plan with a narrow network [Figure 13.13].

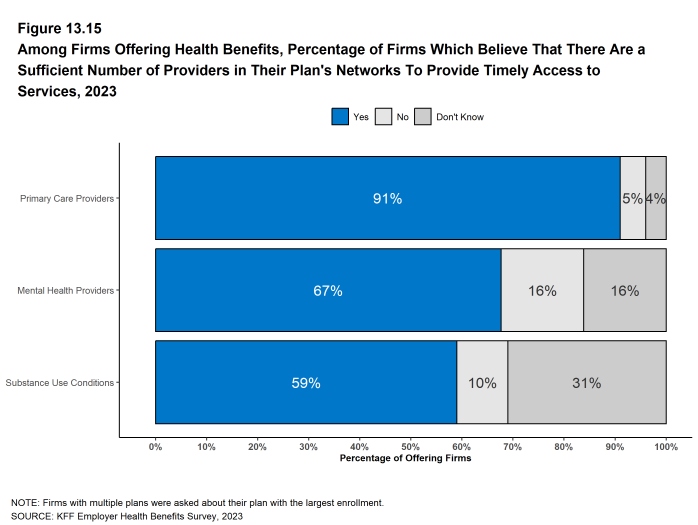

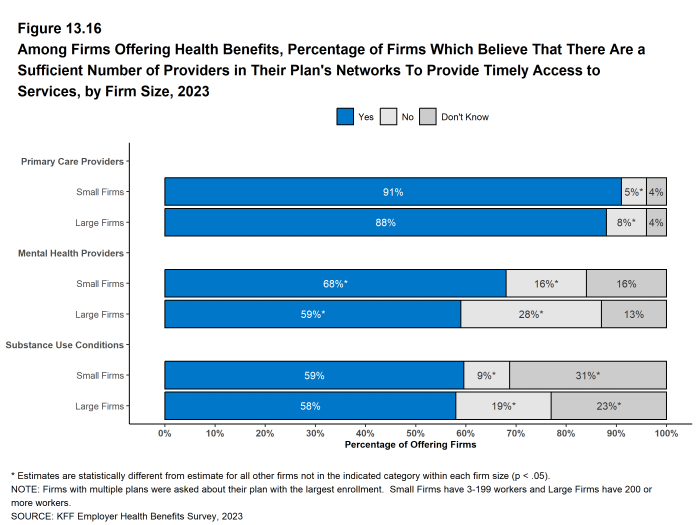

- Firms offering health benefits were asked whether they believed that the provider network for their health plan with the largest enrollment provided timely access to certain services.

- Over nine in ten (91%) firms offering health benefits believe that there are a sufficient number primary care providers in the plan’s networks to provide timely access to services for workers and their family members [Figure 13.15].

- By contrast, only 67% of firms offering health benefits believe that there is a sufficient number of mental health providers in the plan’s network to provide timely access to services for workers and their family members [Figure 13.15]. Large firms are less likely than small firms to say that there were a sufficient number of these providers to provide timely access to behavioral health services [Figure 13.16].

- Similar to the percentage for mental health providers, 59% of firms offering health benefits believe that there is a sufficient number of substance use providers in the plan network to provide timely access to substance use services for workers and their family members [Figure 13.15]. Thirty-one percent of small firms and 23% of large firms offering health benefits did not know the answer to this question [Figure 13.16].

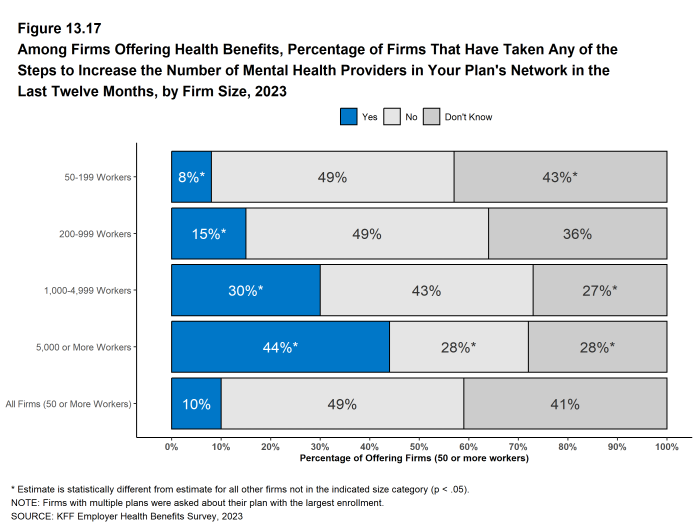

- Among larger firms offering health benefits, 30% of firms with 1,000 to 4,999 workers and 44% of firms with 5,000 or more workers took steps within the past 12 months to increase the number of mental health providers in their plan networks [Figure 13.17]

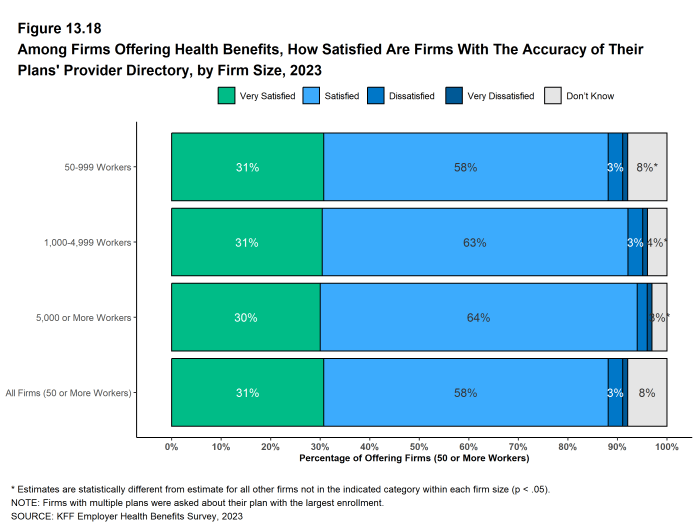

- Firms offering health benefits are generally satisfied with the accuracy of plan provider directories, with 31% reporting they are “very satisfied” and an additional 58% saying they are “satisfied” with their accuracy [Figure 13.18].

Figure 13.13: Among Firms Offering Health Benefits, Percentage of Firms That Offer a Narrow Network Plan, by Firm Size, 2023

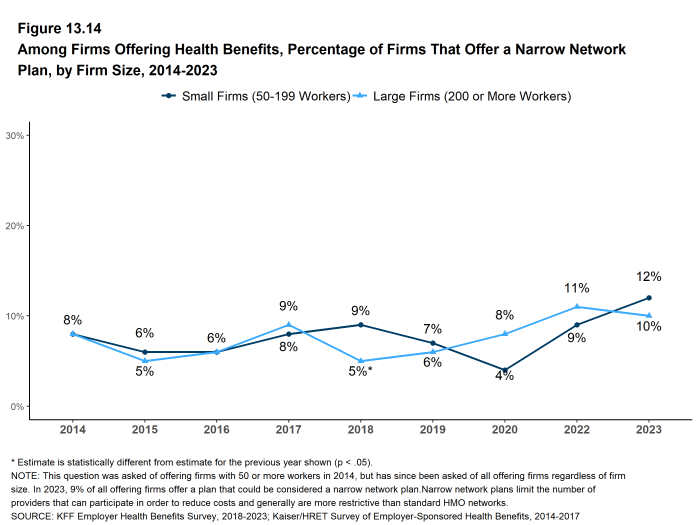

Figure 13.14: Among Firms Offering Health Benefits, Percentage of Firms That Offer a Narrow Network Plan, by Firm Size, 2014-2023

Figure 13.15: Among Firms Offering Health Benefits, Percentage of Firms Which Believe That There Are a Sufficient Number of Providers in Their Plan’s Networks to Provide Timely Access to Services, 2023

Figure 13.16: Among Firms Offering Health Benefits, Percentage of Firms Which Believe That There Are a Sufficient Number of Providers in Their Plan’s Networks to Provide Timely Access to Services, by Firm Size, 2023

Figure 13.17: Among Firms Offering Health Benefits, Percentage of Firms That Have Taken Any of the Steps to Increase the Number of Mental Health Providers in Your Plan’s Network in the Last Twelve Months, by Firm Size, 2023

PLAN MANAGEMENT AND COVERAGE LIMITS

Employers use health benefits to attract and keep workers, making them an important part of the overall compensation that employers provide. Employers therefore have strong interest in assuring that their health benefit plans perform well and are viewed favorably by their workers. At the same time, health benefits are expensive. Therefore, employers manage plan costs within the broader context of the overall compensation they offer to their employees.

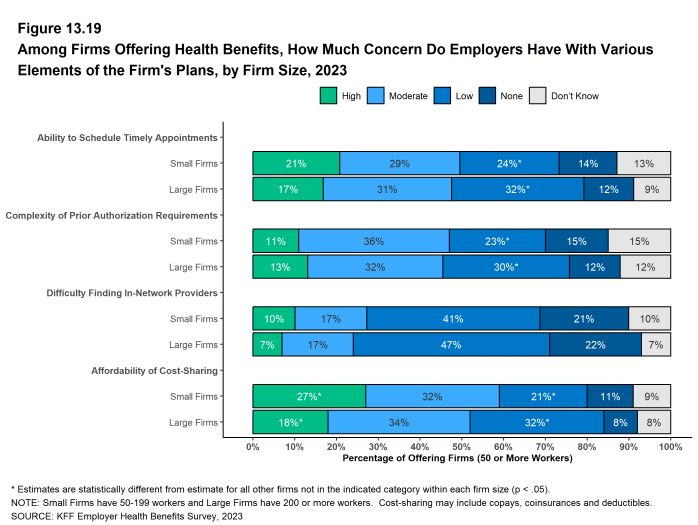

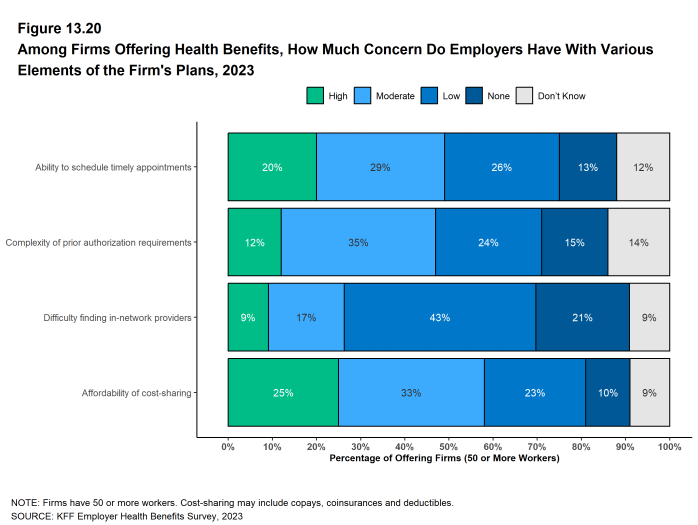

- Employers with 50 or more employees offering health benefits were asked about their views regarding the level of concern their employees had over certain aspects of their health benefit plans:

- Appointments – Twenty percent of these employers believe that their employees have a ‘high’ level of concern about their ability to schedule timely appointments for care, and another 29% believe that their employees have a ‘moderate’ level of concern [Figure 13.20].

- Prior Authorization – Twelve percent of these employers believe that their employees have a ‘high’ level of concern about the complexity of prior authorization requirements in their health plan, and another 35% believe that their employees have a ‘moderate’ level of concern [Figure 13.20].

- Finding In-Network Providers – Nine percent of these employers believe that their employees have a ‘high’ level of concern about the difficulty of finding in-network providers, and another 17% believe that their employees have a ‘moderate’ level of concern [Figure 13.20].

- Affordability of Cost Sharing – Twenty-five percent of these employers believe that their employees have a ‘high’ level of concern about the affordability of cost sharing, and another 33% believe that their employees have a ‘moderate’ level of concern [Figure 13.20].

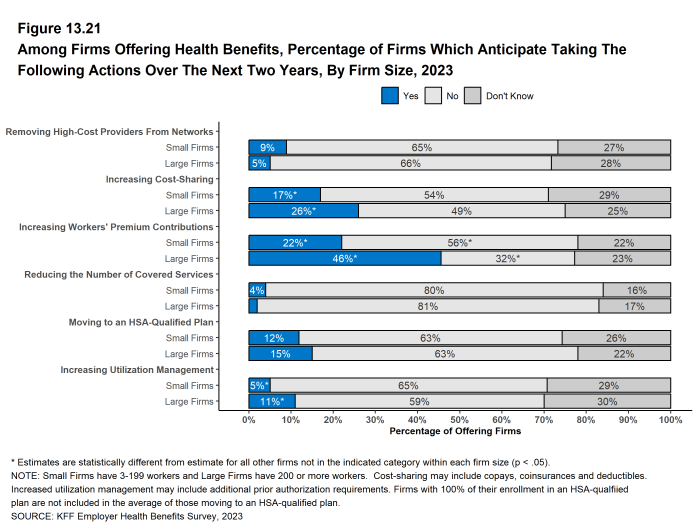

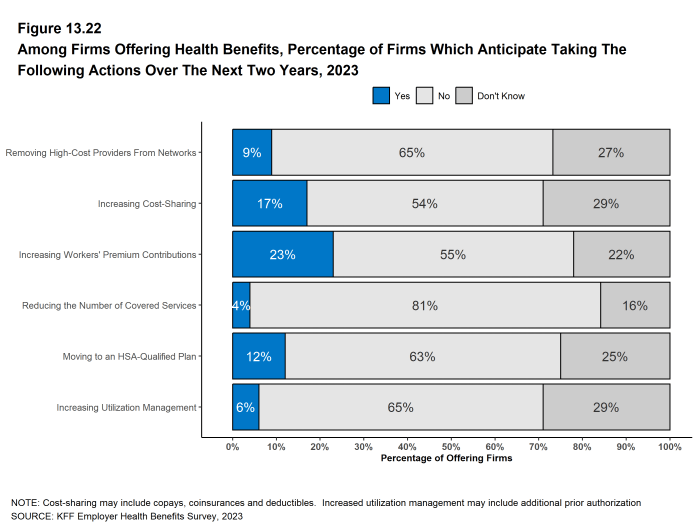

- Employers offering health benefits were asked whether they anticipated making certain changes to their health benefits over the next two years:

- High-Cost Providers – Nine percent of these employers plan to remove high-cost providers from their networks [Figure 13.22].

- Increase Cost-Sharing – Seventeen percent of these employers plan to increase cost sharing, such as copayments and deductibles. Large firms are more likely than smaller firms to anticipate making this change (26% vs. 17%) [Figure 13.21].

- Increase Worker’s Premium Contributions – Twenty-three percent of these employers plan to increase worker’s premium contributions. Large firms are more likely than smaller firms to anticipate making this change (46% vs. 22%) [Figure 13.21].

- Reduce Covered Services – Four percent of these employers plan to reduce the number of covered services [Figure 13.22].

- Move to an HSA-Qualified Plan – Twelve percent of these employers plan to offer an HSA-qualified health plan [Figure 13.22].

- Increase Utilization Management – Six percent of these employers plan to increase utilization management, such as prior authorization of services. Large firms are more likely than smaller firms to anticipate making this change (11% vs. 5%) [Figure 13.21].

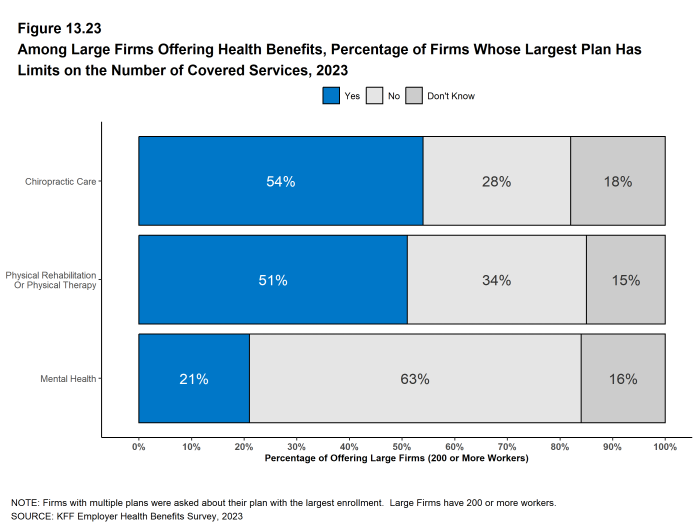

- One way that employers manage health plan costs is by limiting the number of services that enrollees can receive for certain types of care. The Affordable Care Act (ACA) generally prohibits health plans from imposing annual or lifetime dollar limits on benefits but does not prohibit plans from limiting the number of visits or services provided. The Mental Health Parity and Addiction Equity Act (MHPAEA) prohibits treatment limits that are more restrictive on mental health and substance use disorder benefits than on medical/surgical benefits. Large employers (200 or more workers) offering health benefits were asked if their largest health plan had limits on the number of visits they covered for certain types of care. Among these employers:

- Fifty-one percent have limits on the number of covered visits for physical rehabilitation or physical therapy. Employers with 1,000 or more employees are more likely than firms with 200 to 999 employees to have this type of limit (59% vs. 49%) [Figure 13.23].

- Twenty-one percent have limits on the number of covered visits for mental health services. Employers with 5,000 or more employees are less likely than smaller firms to have this type of limit [Figure 13.23].

- Fifty-four percent have limits on the number of covered visits for chiropractic care. Employers with 1,000 or more employees are more likely than firms with 200 to 999 employees to have this type of limit (64% vs. 51%) [Figure 13.23]

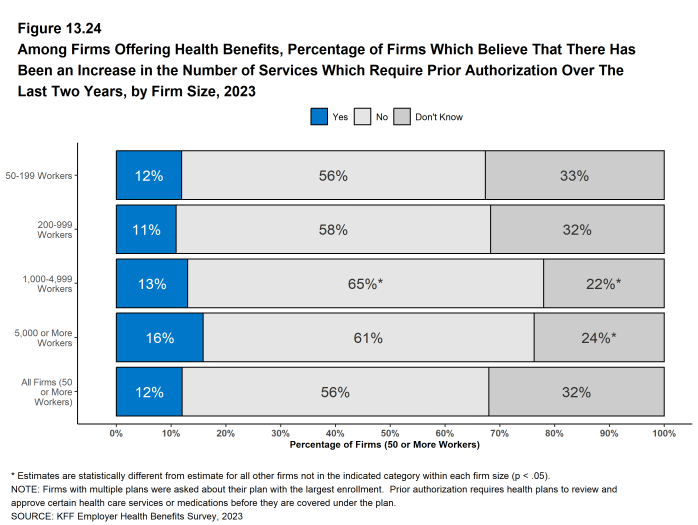

- Prior authorization is a tool used by health plans to review the appropriateness of certain services or prescriptions before they are covered. It may be used as an additional layer of scrutiny for services that plans believe are often recommended inappropriately, or to encourage less expensive alternatives. Prior authorization practices have recently come under public scrutiny over concerns of delayed care and complexity for plan enrollees.

- Employers with 50 or more employees offering health benefits were asked if they had increased the number of services subject to prior authorization in their health plan with the largest enrollment in the last two years. Among these employers, 12% said they had increased the services subject to prior authorization over the period. A large share of both small and large employer respondents did not know the answer to this question [Figure 13.24].

Figure 13.19: Among Firms Offering Health Benefits, How Much Concern Do Employers Have With Various Elements of the Firm’s Plans, by Firm Size, 2023

Figure 13.20: Among Firms Offering Health Benefits, How Much Concern Do Employers Have With Various Elements of the Firm’s Plans, 2023

Figure 13.21: Among Firms Offering Health Benefits, Percentage of Firms Which Anticipate Taking the Following Actions Over the Next Two Years, by Firm Size, 2023

Figure 13.22: Among Firms Offering Health Benefits, Percentage of Firms Which Anticipate Taking the Following Actions Over the Next Two Years, 2023

Figure 13.23: Among Large Firms Offering Health Benefits, Percentage of Firms Whose Largest Plan Has Limits on the Number of Covered Services, 2023

ABORTION SERVICES

In June 2022, the United States Supreme Court ruled in Dobbs v. Jackson that states could limit the

coverage and delivery of abortion services. This ruling and subsequent state activity to limit access to abortion services has increased public interest in coverage for abortion services in employer plans.

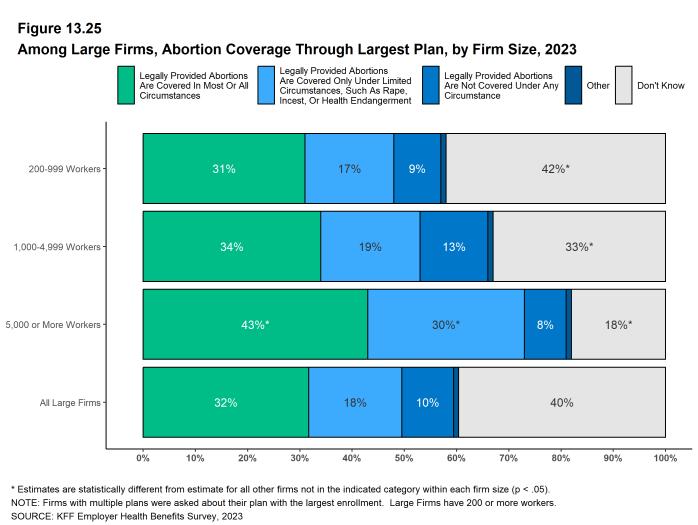

- Large employers (200 or more workers) offering health benefits were asked which of several statements best described coverage of abortion in their largest health plan.

- Thirty-two percent of these firms said that legally provided abortions are covered in most or all circumstances (sometimes referred to as elective or voluntary abortion). Firms with 5,000 or more workers were more likely than smaller firms to give this reply [Figure 13.25].

- Eighteen percent of these firms said that legally provided abortions are covered only under limited circumstances, such as rape, incest, or danger to the health or life of the pregnant enrollee. Firms with 5,000 or more workers were more likely than smaller firms to give this reply [Figure 13.25].

- Ten percent of these firms said that legally provided abortions are not covered under any circumstance [Figure 13.25].

- Forty percent of these responding firms answered “don’t know” to this question. Respondents with 200 to 999 workers were more likely than other respondents to answer “don’t know” to this question and respondents with 1,000 to 4,999 workers and 5,000 or more workers were less likely to do so [Figure 13.25].

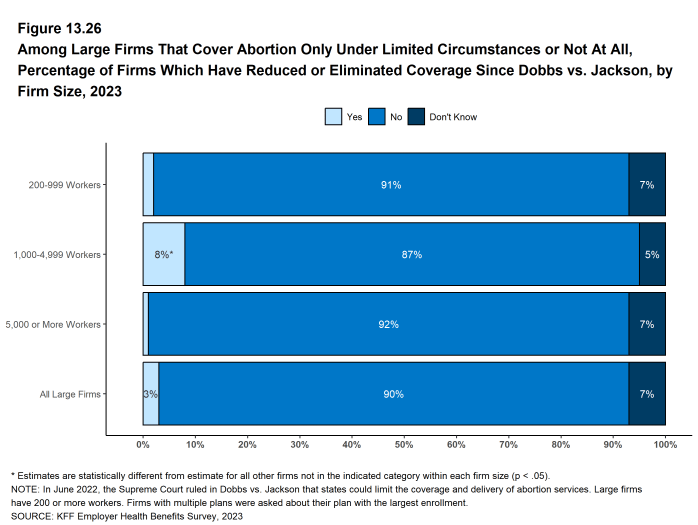

- Large employers offering health benefits also were asked if they or their health plan had taken certain actions related to coverage of abortion following the Supreme Court decision.

- Among firms that responded that they did not cover legally provided abortion services or covered them only in limited circumstances, 3% of these firms had reduced or eliminated coverage for abortion services in circumstances where they could be legally provided. Firms with 1,000 to 4,999 workers were more likely than larger or smaller firms to make this change [Figure 13.26].

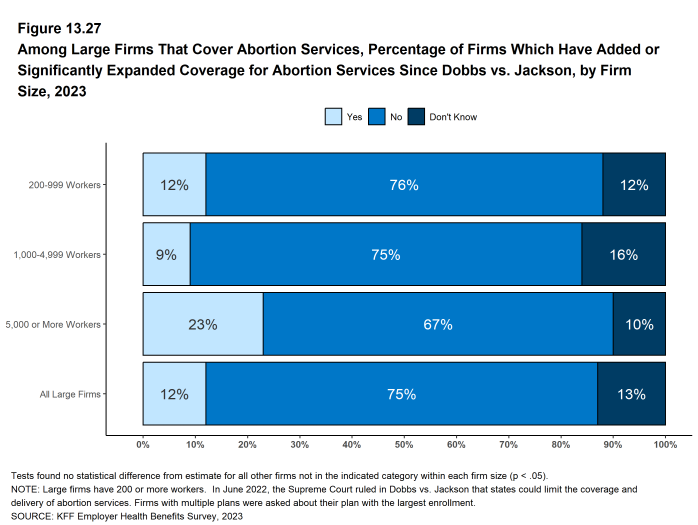

- Among firms that responded that legally provided abortion services were generally covered, 12% of these firms had added or significantly expanded coverage for abortion services in circumstances where they could be legally provided [Figure 13.27].

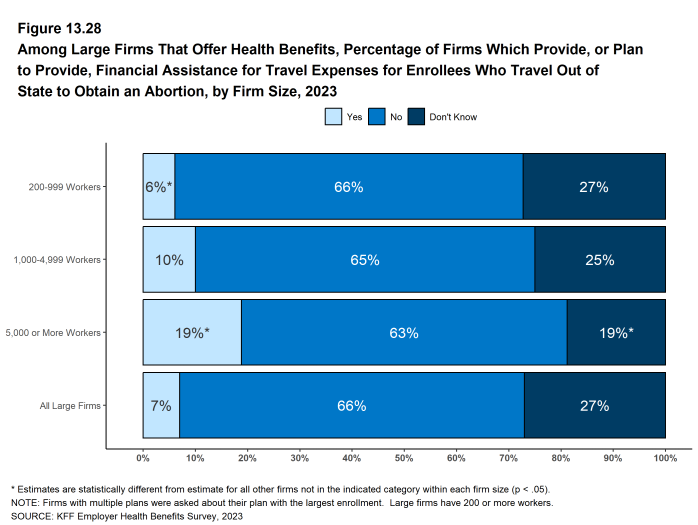

- Among large firms offering health benefits, 7% provide, or plan to provide, financial assistance for travel expenses for enrollees who travel out of state to obtain abortion care if they do not have access near their home. Firms with 5,000 or more workers are more likely than smaller firms to say they provide or plan to provide travel benefits for enrollees who travel out of state to obtain an abortion (19% vs. 7%) [Figure 13.28].

Figure 13.26: Among Large Firms That Cover Abortion Only Under Limited Circumstances or Not at All, Percentage of Firms Which Have Reduced or Eliminated Coverage Since Dobbs Vs. Jackson, by Firm Size, 2023

Figure 13.27: Among Large Firms That Cover Abortion Services, Percentage of Firms Which Have Added or Significantly Expanded Coverage for Abortion Services Since Dobbs Vs. Jackson, by Firm Size, 2023

COVERAGE FOR GENDER-AFFIRMING SURGERIES

Gender-affirming surgeries are one component of gender-affirming care, a model of care which includes a spectrum of services aimed at supporting and affirming an individual’s gender identity. Gender-affirming surgeries may include, but are not limited to, facial surgery, top surgery, and bottom surgery. Not all transgender or gender nonconforming people elect to have surgery. The purpose of these surgeries is to give individuals a physical appearance and/or functional abilities aligned with their gender identity.

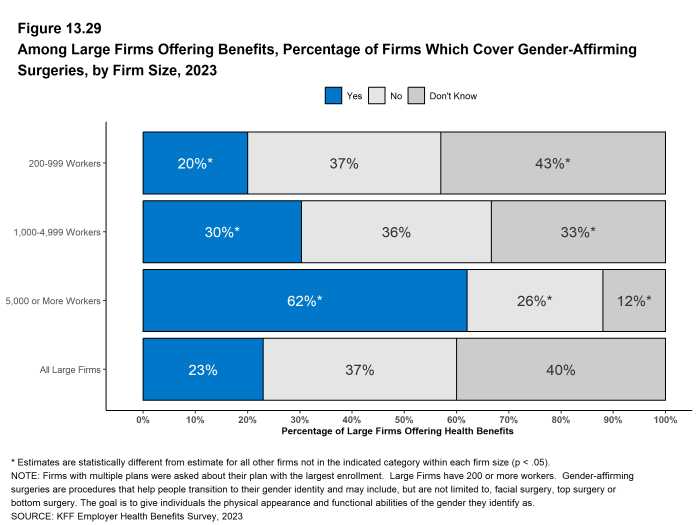

- Among large employers (200 or more workers) offering health benefits, 23% provide coverage for gender-affirming surgery in their largest health plan [Figure 13.29].

- Firms with 1,000 to 4,999 workers (30%) and firms with 5,000 or more workers (62%) are more likely than firms with 200 to 999 workers (20%) to cover these surgeries [Figure 13.29].

- Large shares of employers with 200 to 999 workers (43%) and 1,000 to 4,999 workers (33%) answered “don’t know” to this question. Among all large firms, 40% answered “don’t know” to this question [Figure 13.29].

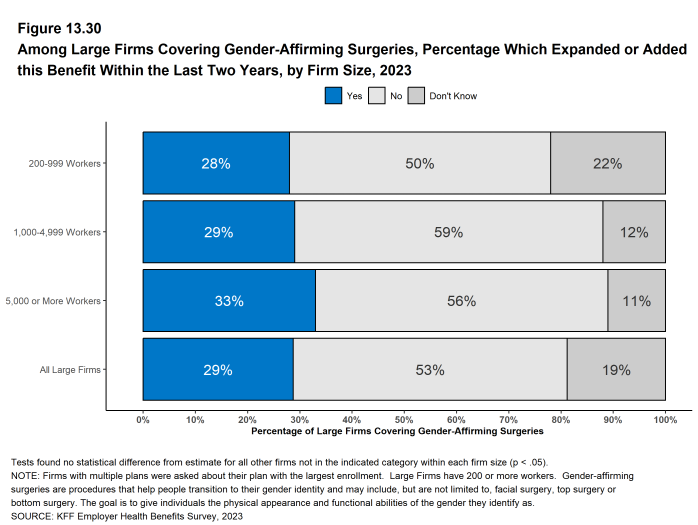

- Among firms that offer coverage for gender-affirming surgeries, 29% had added or expanded this benefit within the last two years [Figure 13.30].

Figure 13.29: Among Large Firms Offering Benefits, Percentage of Firms Which Cover Gender-Affirming Surgeries, by Firm Size, 2023