2016 Employer Health Benefits Survey

Section Six: Worker and Employer Contributions for Premiums

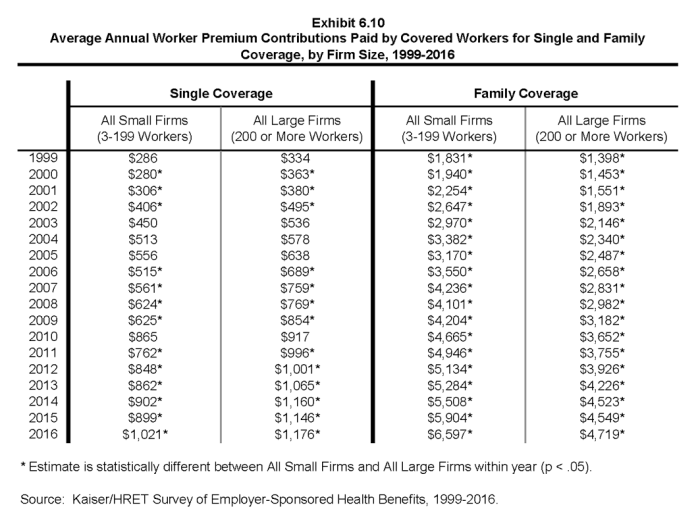

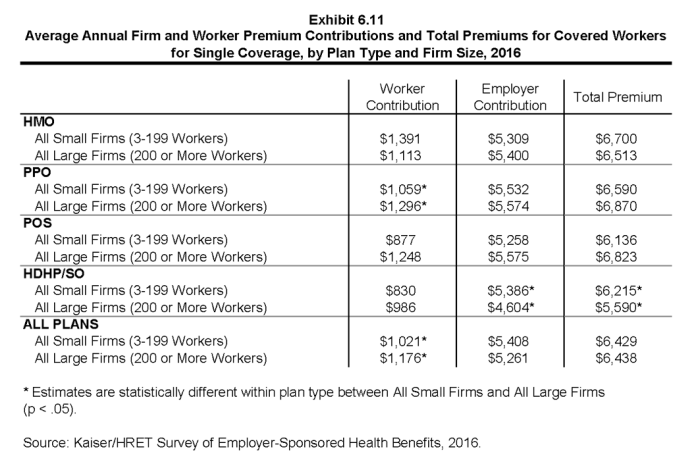

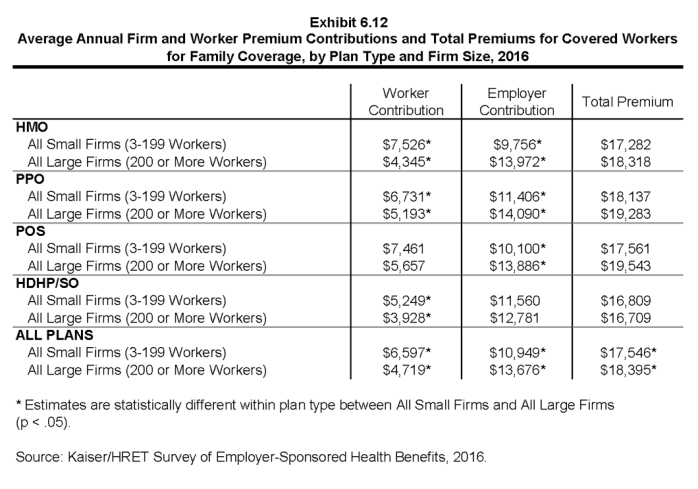

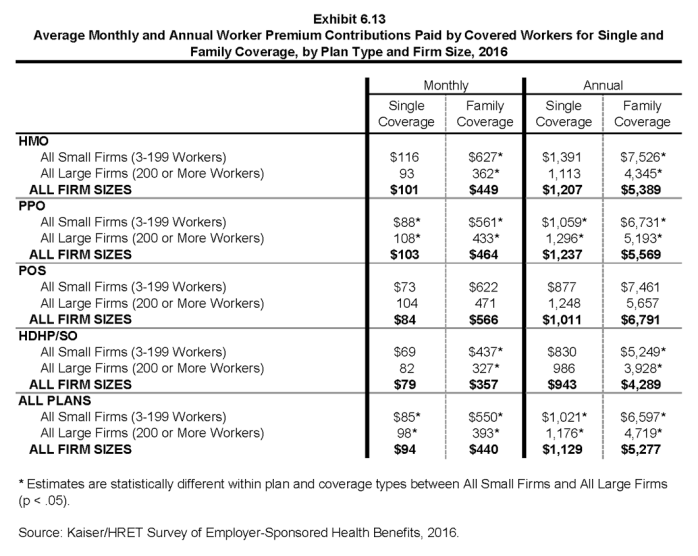

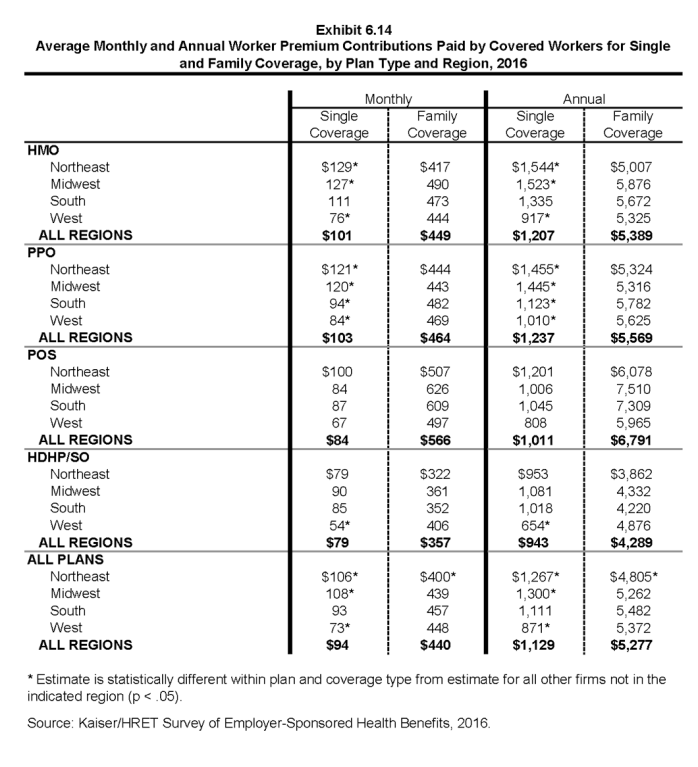

In 2016, premium contributions by covered workers average 18% for single coverage and 30% for family coverage.1 The average monthly worker contributions are $94 for single coverage ($1,129 annually) and $440 for family coverage ($5,277 annually).2 Covered workers in small firms (3-199 workers) have a lower average contribution amount for single coverage ($1,021 vs. $1,176), but a higher average contribution amount for family coverage ($6,597 vs. $4,719) than covered workers in large firms (200 or more employees).

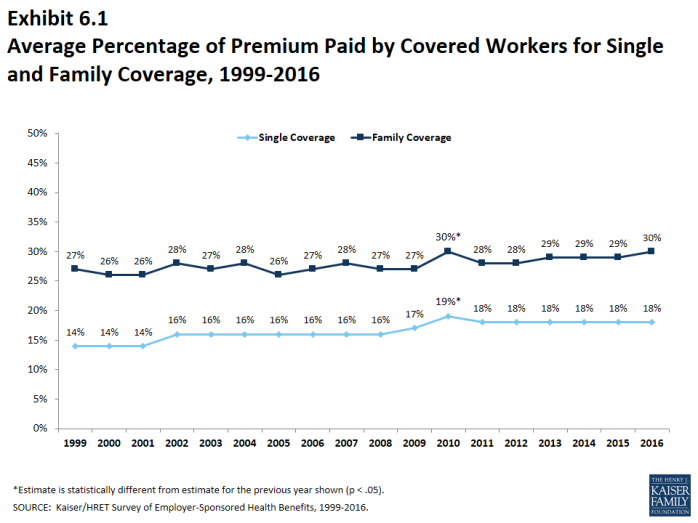

- In 2016, covered workers on average contribute 18% of the premium for single coverage and 30% of the premium for family coverage (Exhibit 6.1). These contribution percentages have remained stable in recent years for both single and family coverage.

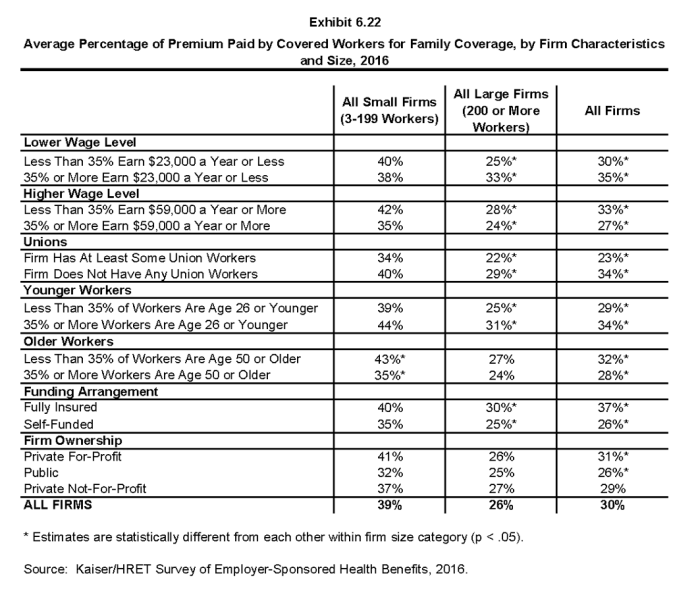

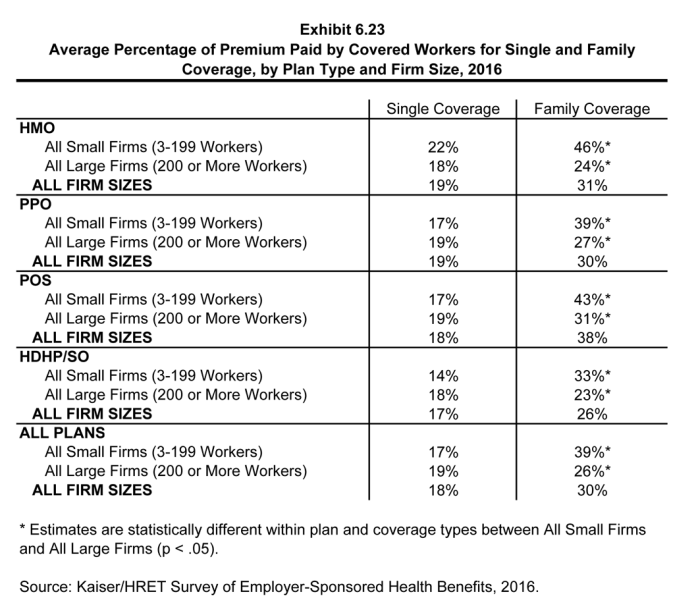

- Covered workers in small firms contribute a higher percentage of the premium for family coverage (39% vs. 26%) than covered workers in large firms (Exhibit 6.23).

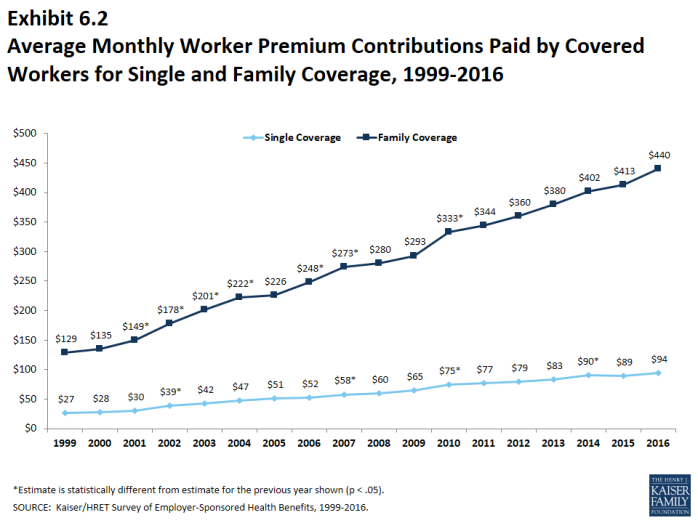

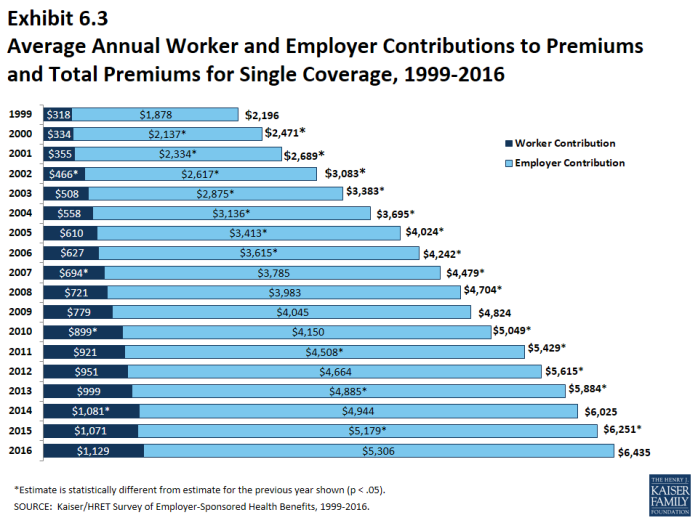

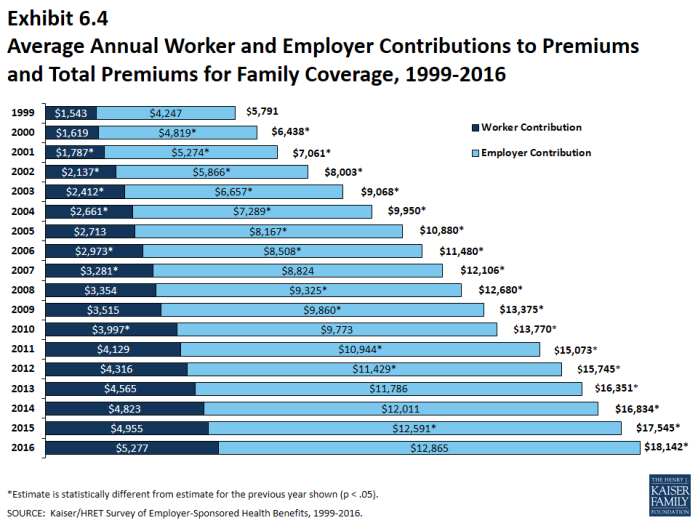

- On average, workers with single coverage contribute $94 per month ($1,129 annually), and workers with family coverage contribute $440 per month ($5,277 annually) towards their health insurance premiums (Exhibit 6.2), (Exhibit 6.3), and (Exhibit 6.4).

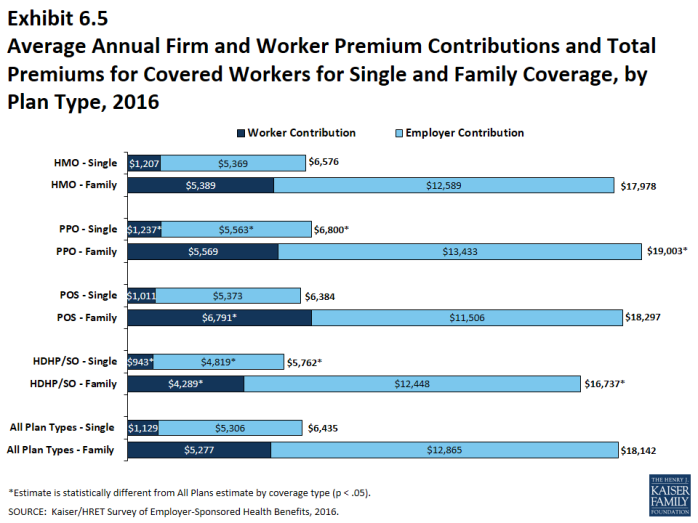

- The average worker contribution in HDHP/SOs is lower than the overall average worker contribution for single coverage ($943 vs. $1,129) and family coverage ($4,289 vs. $5,277) (Exhibit 6.5).

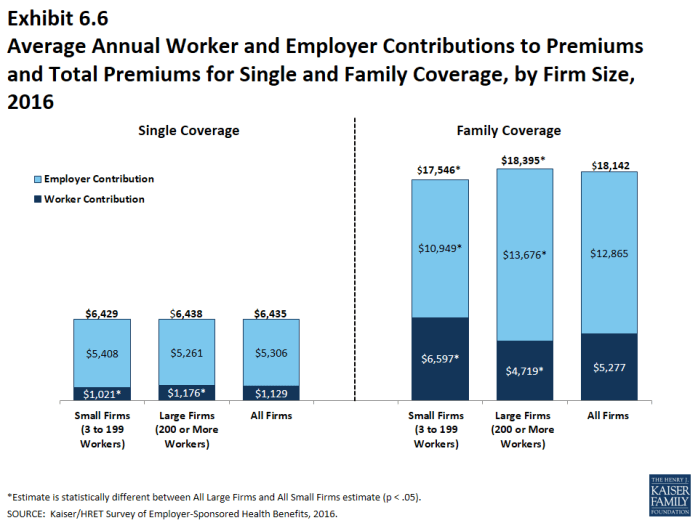

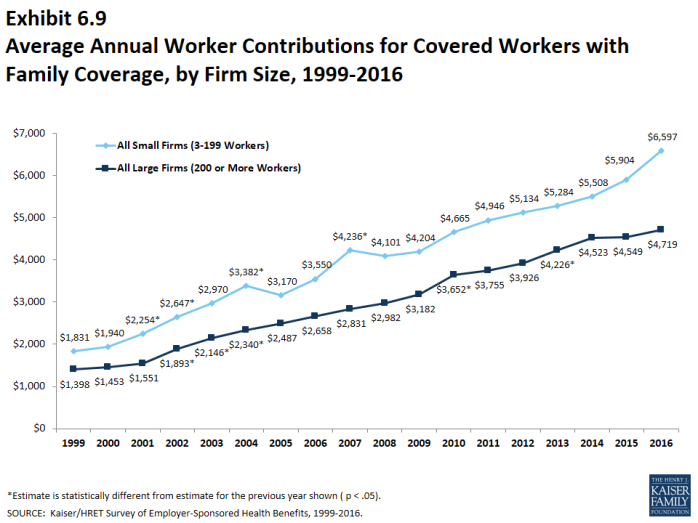

- Worker contributions also differ by firm size. As in previous years, workers in small firms contribute a lower amount annually for single coverage than workers in large firms ($1,021 vs. $1,176). In contrast, workers in small firms with family coverage contribute significantly more annually than workers in large firms ($6,597 vs. $4,719) (Exhibit 6.6).

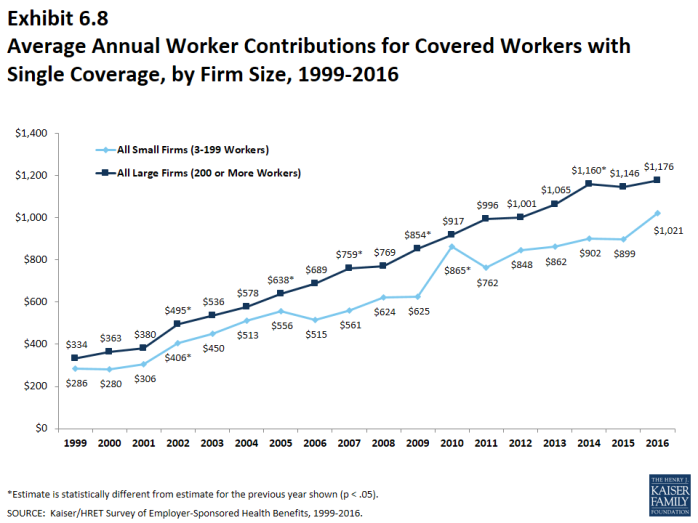

- The average worker contributions for single coverage and family coverage are similar to last year for both small firms and large firms (Exhibit 6.8) and (Exhibit 6.9).

Variation in Worker Contributions to the Premium

- The majority of covered workers are employed by a firm that contributes at least half of the premium for single and family coverage.

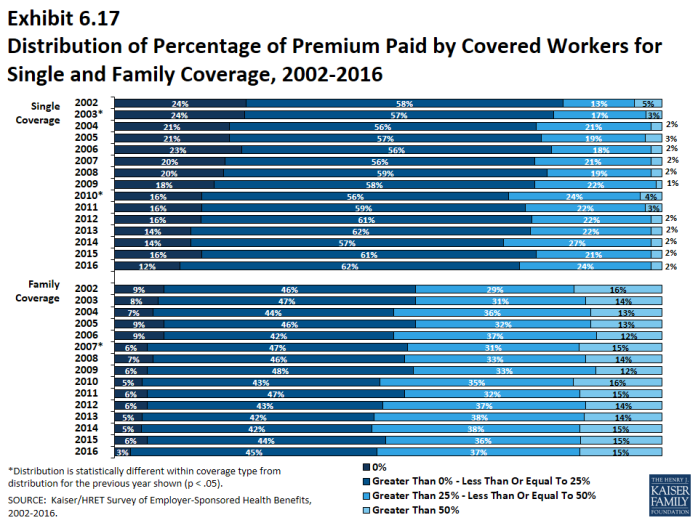

- Twelve percent of covered workers are in plans where the employer pays the entire premium for single coverage; three percent of covered workers are in plans where the employer pays the entire premium for family coverage (Exhibit 6.17).

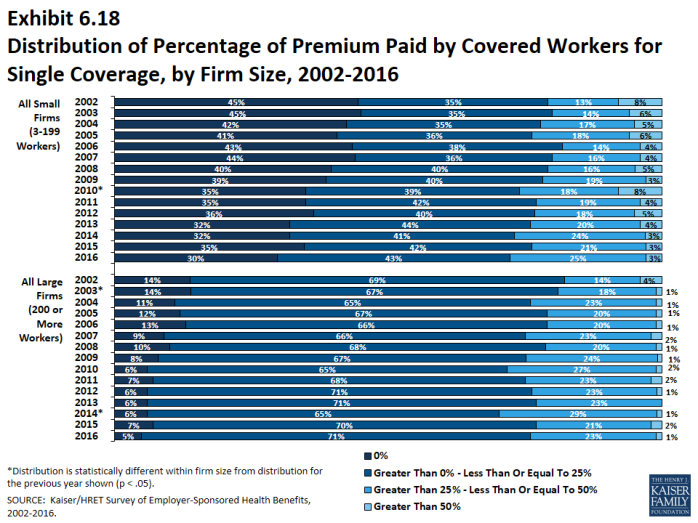

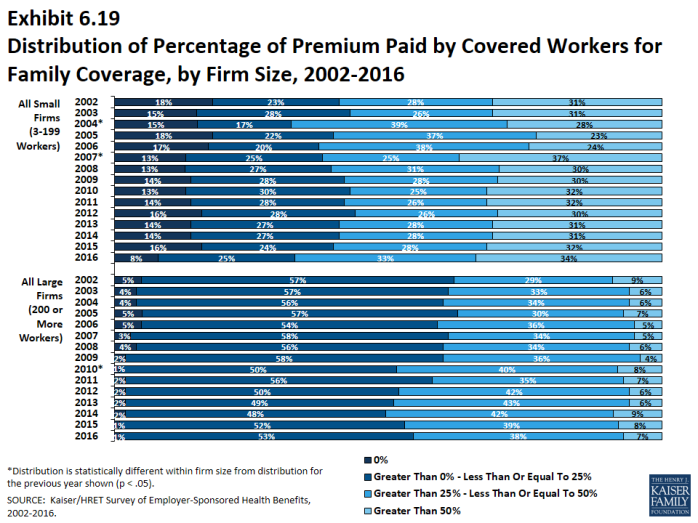

- Covered workers in small firms are much more likely to work for a firm that pays 100% of the premium than workers in large firms. Thirty percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to five percent of covered workers in large firms (Exhibit 6.18). For family coverage, eight percent of covered workers in small firms have an employer that pays the full premium, compared to one percent of covered workers in large firms (Exhibit 6.19).

- Fifteen percent of covered workers have a plan where they are required to contribute more than 50% of the cost of family coverage.

- Three percent of covered workers in small firms and 1% of covered workers in large firms contribute more than 50% of the premium for single coverage (Exhibit 6.18). For family coverage, 34% of covered workers in small firms work in a firm where they must contribute more than 50% of the premium, compared to seven percent of covered workers in large firms (Exhibit 6.19).

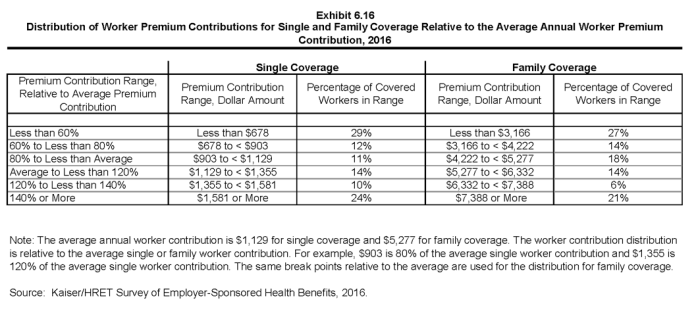

- There is considerable variation around the distribution of the average dollar contribution amounts. Note that we changed our methods beginning in 2016: previously, the percentages were calculated excluding workers who do not make a premium contribution; now all covered workers are included (with a zero dollar contribution value for those workers where the employer pays 100% of the premium).

- For single coverage, 34% of covered workers contribute $1,355 or more annually (120% or more of the average worker contribution), while 41% of covered workers have an annual worker contribution of less than $903 (less than 80% of the average worker contribution) (Exhibit 6.16).

- For family coverage, 27% of covered workers contribute $6,332 or more annually (120% or more of the average worker contribution), while 41% of covered workers have an annual worker contribution of less than $4,222 (less than 80% of the average worker contribution) (Exhibit 6.16).

Differences by Firm Characteristics

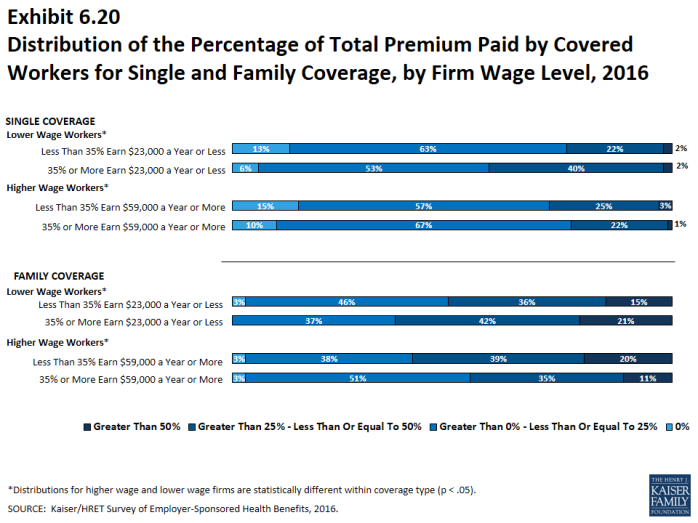

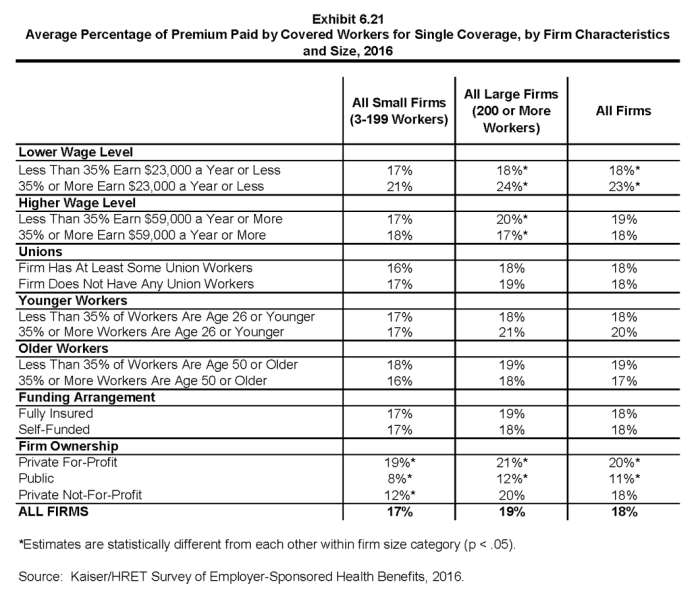

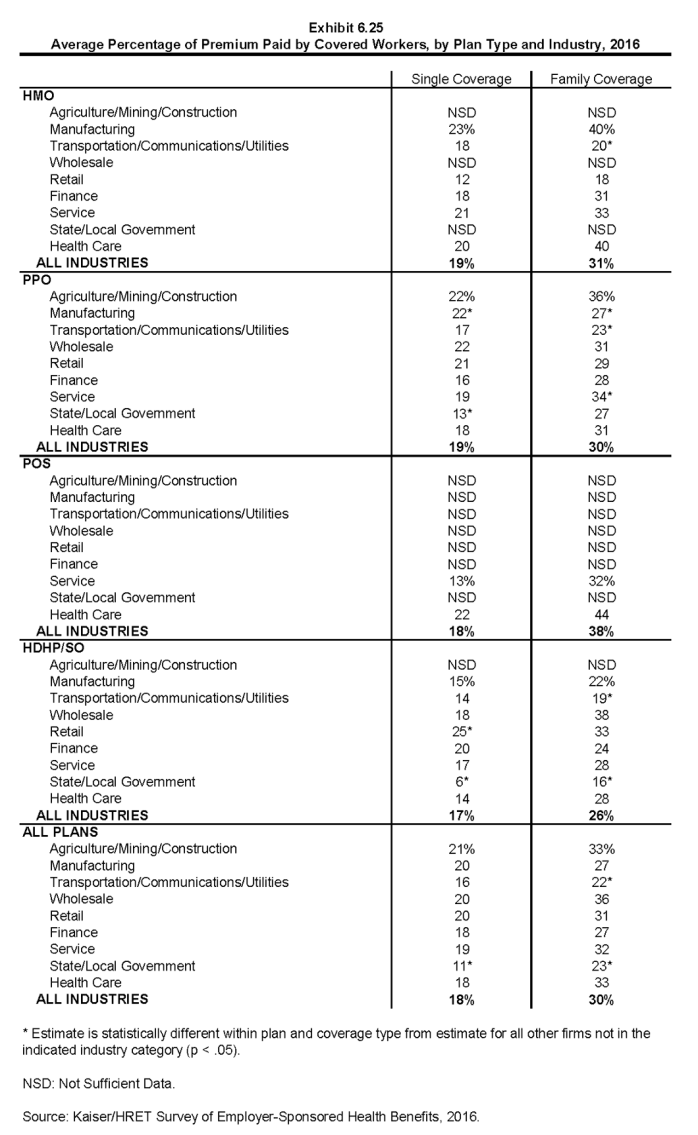

- The percentage of the premium paid by covered workers varies by several firm characteristics.

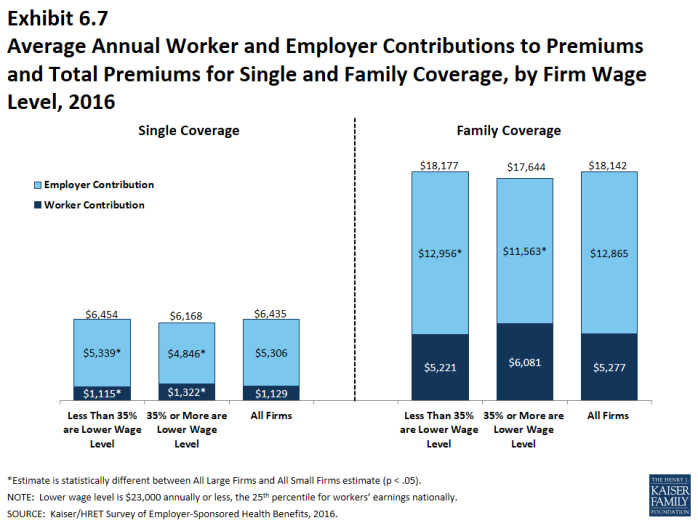

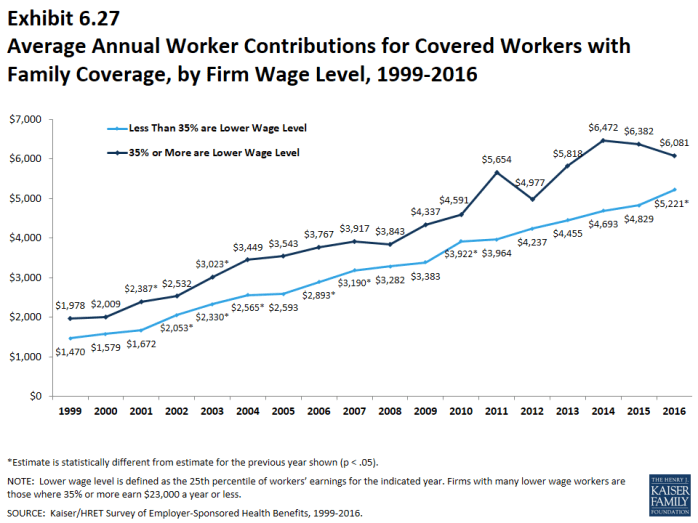

- Covered workers in firms with a larger share of lower-wage workers (35% or more earn $23,000 or less annually) contribute a greater percentage of the premium for single coverage (23% v. 18%) and family coverage (35% vs. 30%) than those in firms with a smaller share of lower-wage workers (Exhibit 6.21) and (Exhibit 6.22). Covered workers in firms with a larger share of higher-wage workers (35% or more earn $59,000 or more a year) contribute less on average for family coverage (27% vs. 33%) than those in firms with a smaller share of higher-wage workers.

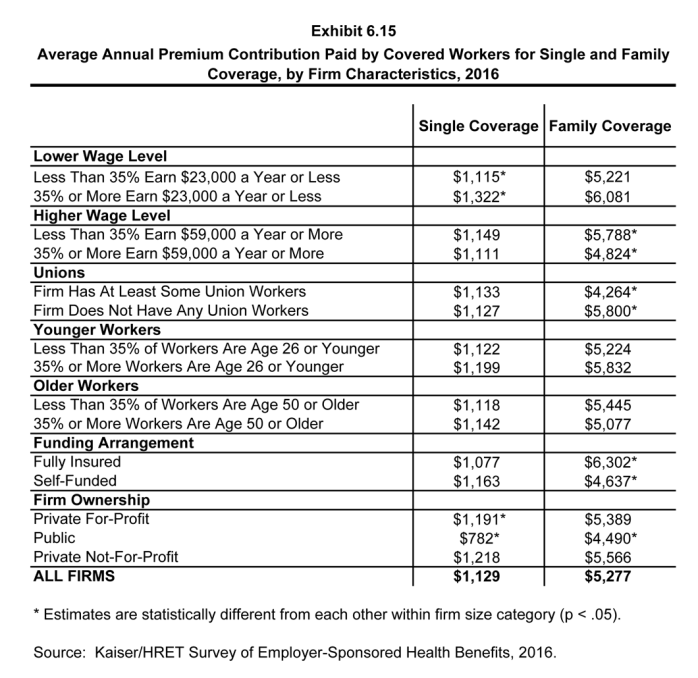

- Looking at dollar amounts, covered workers in firms with a larger share of lower-wage workers (35% or more earn $23,000 or less annually) on average contribute $1,322 for single coverage compared with $1,115 for covered workers in firms with a smaller share of lower-wage workers (Exhibit 6.15).

- Covered workers in large firms that have at least some union workers have lower average contribution percentages for family coverage than those in firms without any unionized workers (22% vs. 29%). Covered workers at firms with some union workers have a lower average contribution amount for family coverage ($4,264 vs. $5,800) (Exhibit 6.15) and (Exhibit 6.22).

- Covered workers in large firms that are partially or completely self-funded have a lower average percentage contribution for family coverage than workers in large firms that are fully insured (25% vs. 30%) (Exhibit 6.22).3

- Covered workers in public organizations have lower average premium contributions for single and family coverage than workers in private for-profit firms (Exhibit 6.21) and (Exhibit 6.22).

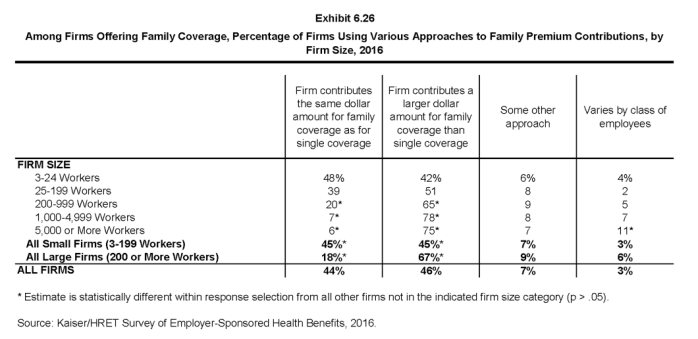

contribution approaches

- Firms take different approaches for contributing towards family coverage. Among firms offering health benefits, 45% of small firms and 18% of large firms contribute the same dollar amount for single coverage as for family coverage, which means that the worker must pay the entire difference between the cost of single and family coverage if they wish to enroll their family members. Forty-five percent of small firms and 67% of large firms make a larger dollar contribution for family coverage than for single coverage (Exhibit 6.26).

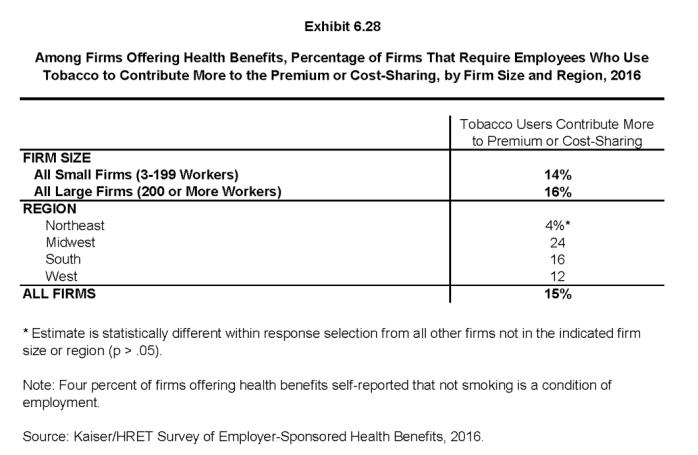

- Among firms offering health benefits, 15% require workers who use tobacco to contribute more towards the premium or cost-sharing than those who do not use tobacco (Exhibit 6.28).

Changes over Time

- The average worker contributions for single and family coverage have increased 80% and 78%, respectively, over the last 10 years, and 23% and 28%, respectively, over the last five years.

- The average premium contributions for covered workers with single and family coverage have grown at similar rates in small firms and large firms (Exhibit 6.8) and (Exhibit 6.9).

x

Exhibit 6.1

x

Exhibit 6.23

x

Exhibit 6.2

x

Exhibit 6.3

x

Exhibit 6.4

x

Exhibit 6.5

x

Exhibit 6.6

x

Exhibit 6.8

x

Exhibit 6.9

x

Exhibit 6.17

x

Exhibit 6.18

x

Exhibit 6.19

x

Exhibit 6.16

x

Exhibit 6.21

x

Exhibit 6.22

x

Exhibit 6.15

x

Exhibit 6.26

x