Kaiser Health Tracking Poll - November 2017: The Role of Health Care in the Republican Tax Plan

KEY FINDINGS:

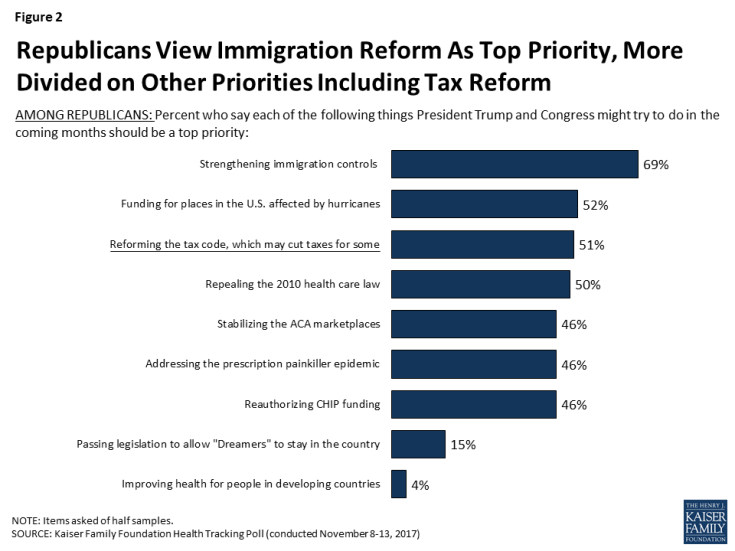

- As Republicans in Congress continue efforts to pass tax reform, the November Kaiser Health Tracking Poll examines views of the plans and how they relate to health care issues. Overall, reforming the tax code is seen as a “top priority” for President Trump and Congress by about three in ten (28 percent), falling well-behind several health care issues such as reauthorizing funding for the State Children’s Health Insurance Program (CHIP) (62 percent) and stabilizing the ACA marketplaces (48 percent). Among Republicans, about half (51 percent) say reforming the tax code is a “top priority” which is similar to the share who say the same about providing funding for places in the U.S. affected by hurricanes (52 percent), repealing the ACA (50 percent), reauthorizing CHIP (46 percent), stabilizing the ACA marketplaces (46 percent), and addressing the prescription painkiller epidemic (46 percent).

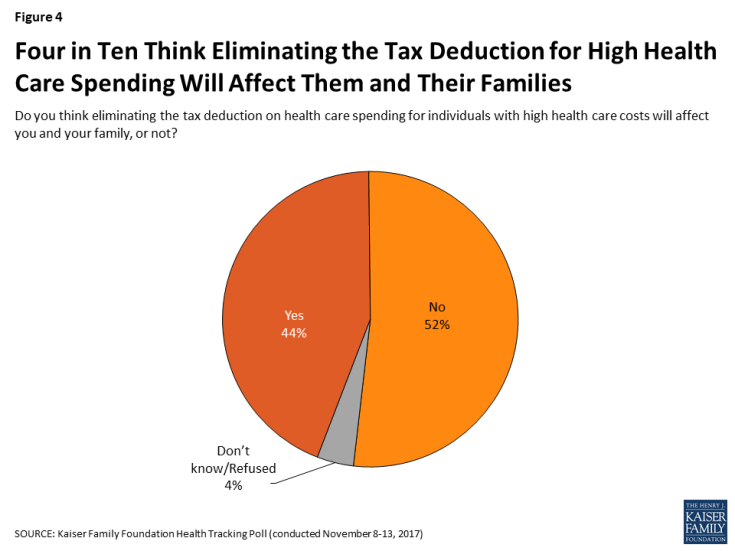

- One possible change in a Republican tax plan is eliminating the deduction allowed for high medical costs. The majority of the public (68 percent) – including majorities of Democrats (77 percent), independents (66 percent), and Republicans (61 percent) – oppose eliminating the tax deduction for individuals who have high health care costs. One reason why the majority of the public may oppose eliminating the tax deduction for high medical expenses is because more than four in ten (44 percent) think eliminating this tax deduction would affect them and their families.

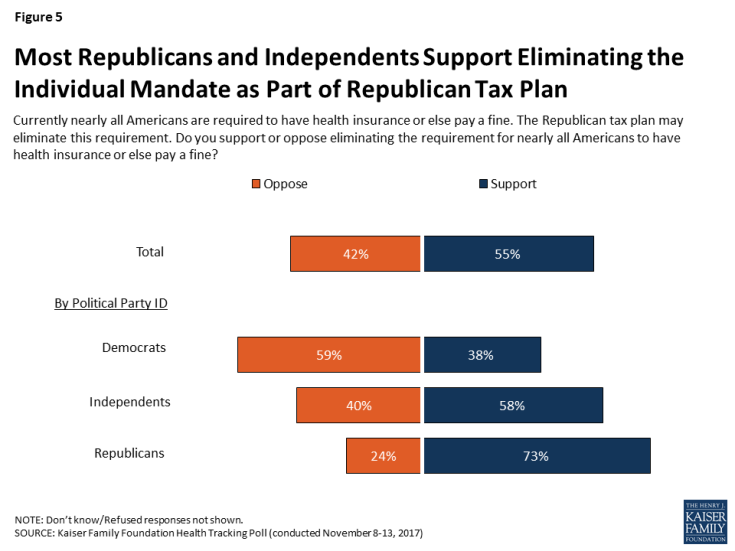

- The majority of the public (55 percent) support the idea of eliminating the requirement for all Americans to have health insurance or else pay a fine as part of the Republican tax plan. Views are largely driven by party with three-fourths of Republicans (73 percent) and six in ten independents (58 percent) supporting eliminating the individual mandate, while the majority of Democrats (59 percent) oppose eliminating the requirement as part of the Republican tax plan. Attitudes towards this idea are malleable with the share of the public who oppose eliminating the individual mandate growing to 62 percent when hearing that most people get their coverage through their employer or a public insurance program and therefore are not affected by the requirement.

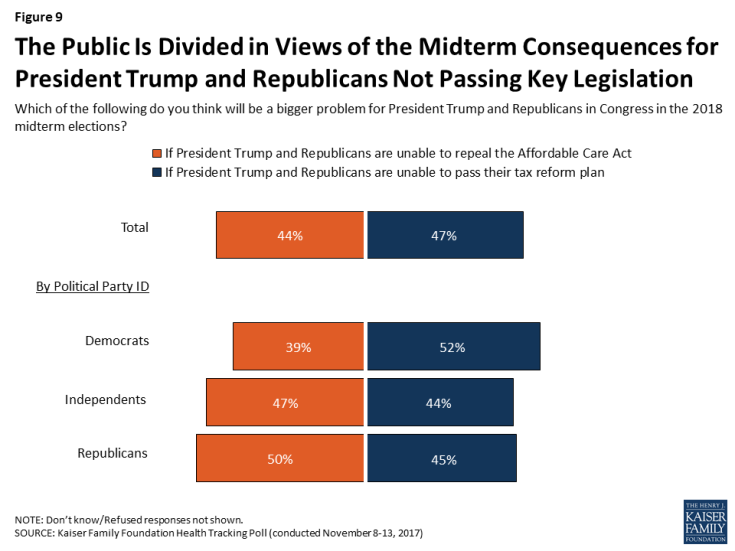

- Looking to the political landscape and the 2018 midterm elections, the public is divided in their views of which could prove to be a bigger deal for President Trump and Republicans in Congress: not passing a tax reform plan or not repealing the ACA. Nearly half of the public say it will be a bigger problem if the president and Republicans are unable to pass their tax reform plan (47 percent), which is similar to the share who say it will be a bigger problem if they have not repealed the ACA (44 percent). Republicans are also divided with half saying it will be a bigger problem if President Trump and Republicans are unable to repeal the ACA compared to a similar share who say it will be a bigger problem if they are unable to pass their tax reform plan (45 percent).

Current Priorities for President Trump and Congress

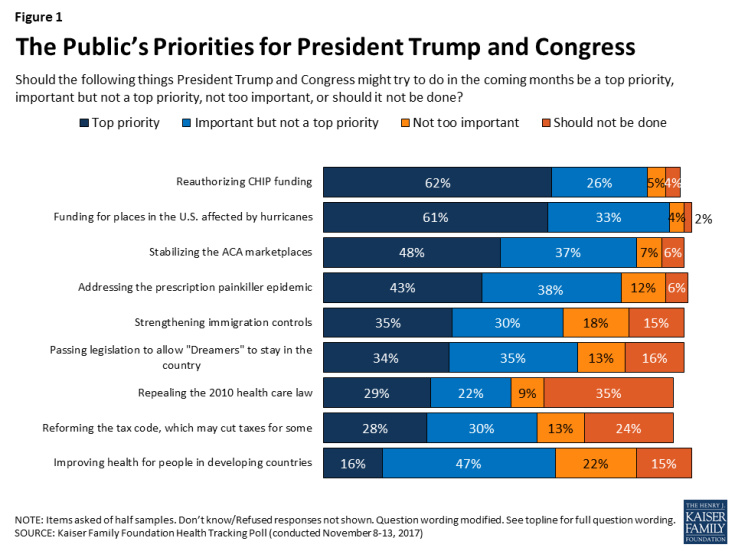

When asked about a series of things that President Trump and Congress might try to do in the coming months, about six in ten of the public say reauthorizing funding for the State Children’s Health Insurance Program (CHIP) (62 percent) and providing funding for places in the U.S. affected by hurricanes (61 percent) should each be a “top priority.” This is followed by half (48 percent) who say stabilizing the ACA marketplaces where people who don’t get health insurance through their employer can buy coverage should be a “top priority” and four in ten (43 percent) who say addressing the prescription painkiller addiction epidemic should be a “top priority” for President Trump and Congress. Other issues, like strengthening immigration controls (35 percent) and passing legislation to allow Dreamers to stay in the U.S. (34 percent) have about a third of the public reporting each should be a “top priority.”

Despite the recent attention given to the Republican tax reform plan, it falls lower on the list of the public’s priorities, with about three in ten (28 percent) saying it should be a “top priority.” It ranks similar to repealing the 2010 Affordable Care Act (ACA) with about three in ten (29 percent) saying it should be a “top priority.” The share who say repealing the 2010 health care law should be a “top priority” for President Trump and Congress has decreased over the past year (down from 37 percent in December 2016). Among Republicans, the share who say repealing the ACA is a top priority has decreased 13 percentage points over the past year, from 63 percent in December 2016 to 50 percent this month.

Partisans Hold Differing Views on Top Priorities

Views of what should be the top priorities for the President and Congress vary across party. A majority of Democrats and independents say reauthorizing CHIP (72 percent and 65 percent) and providing funding for places in the U.S. affected by hurricanes (72 percent and 61 percent) are top priorities for the president and Congress. For Republicans, seven in ten (69 percent) say strengthening immigration controls should be a “top priority.”

| Table 1: Views of Top Priorities by Party Identification | ||||||

| Percent who say the following should be a top priority for President Trump and Congress: | Total | Party ID | ||||

| Democrats | Independents | Republicans | ||||

| Reauthorizing funding for the State Children’s Health Insurance Program (CHIP) | 62% | 72% | 65% | 46% | ||

| Providing funding for places in the U.S. affected by hurricanes | 61 | 72 | 61 | 52 | ||

| Stabilizing the ACA marketplaces | 48 | 54 | 45 | 46 | ||

| Addressing the prescription painkiller addiction epidemic | 43 | 43 | 42 | 46 | ||

| Strengthening immigration controls to limit who enters the country | 35 | 13 | 32 | 69 | ||

| Passing legislation to allow “Dreamers” to legally stay in this country | 34 | 48 | 36 | 15 | ||

| Repealing the 2010 health care law | 29 | 15 | 28 | 50 | ||

| Reforming the tax code, which may cut taxes for some individuals and corporations | 28 | 12 | 30 | 51 | ||

| Improving health for people in developing countries | 16 | 19 | 21 | 4 | ||

There is not another issue besides strengthening immigration controls in which a clear majority of Republicans say it should be a “top priority” for President Trump and Congress to work on in the coming months. Roughly half of Republicans say providing funding for places in the U.S. affected by hurricanes (52 percent), reforming the tax code (51 percent), repealing the ACA (50 percent), stabilizing the ACA marketplaces (46 percent), addressing the prescription painkiller epidemic (46 percent), and reauthorizing CHIP (46 percent) should each be a “top priority” for the president and Congress.

Figure 2: Republicans View Immigration Reform As Top Priority, More Divided on Other Priorities Including Tax Reform

The Republican Tax Reform Plan

In addition to overall attitudes towards the Republicans’ plan to reform the tax code, which may reduce taxes for some individuals and corporations, this month’s Kaiser Health Tracking Poll also examines attitudes towards some proposed aspects of the plan pertaining to health care.

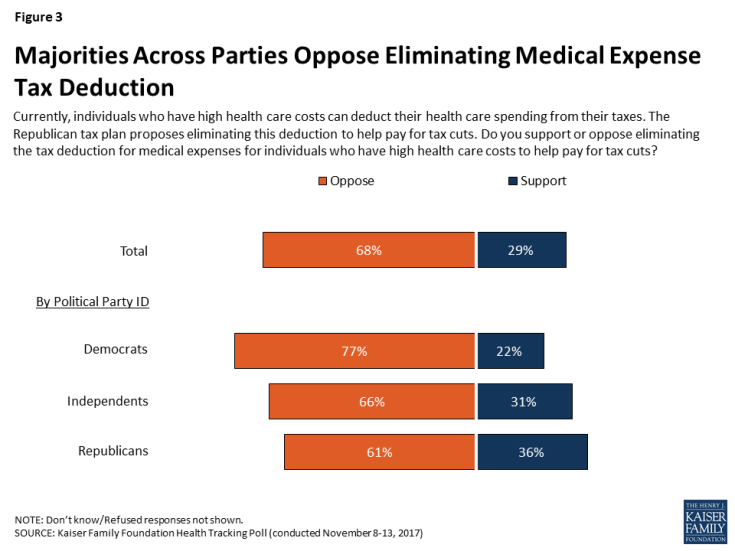

Tax Deductions for Major Medical Costs

One possible change in the tax reform proposals is an elimination of the deduction allowed for high medical costs. Currently, individuals who have health care expenses exceeding 10 percent of their income are allowed to deduct their unreimbursed medical and dental expenses from their taxes. The U.S. House Republican tax plan proposes cutting this tax deduction. The majority of the public (68 percent) – including majorities of Democrats (77 percent), independents (66 percent), and Republicans (61 percent) – oppose eliminating the tax deduction for individuals who have high health care costs.

One reason why the majority of the public may oppose eliminating the tax deduction for high medical expense is because more than four in ten (44 percent) think eliminating this tax deduction will affect them and their families. According to the Tax Policy Center, about 9 million households out of 150 million (roughly six percent) claim medical expenses.1

Figure 4: Four in Ten Think Eliminating the Tax Deduction for High Health Care Spending Will Affect Them and Their Families

The Individual Mandate

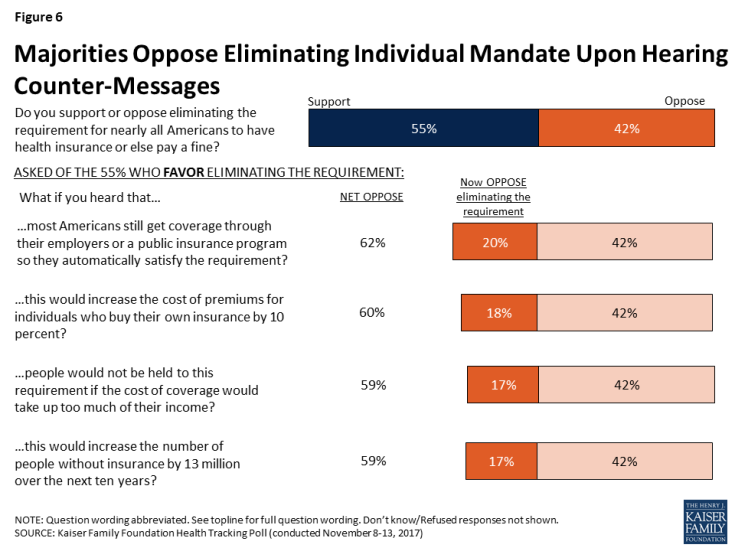

The majority of the public (55 percent) support the idea of eliminating the requirement for all Americans to have health insurance or else pay a fine as part of the Republican tax plan. Attitudes are largely driven by party with three-fourths of Republicans (73 percent) and six in ten independents (58 percent) supporting eliminating the individual mandate, while the majority of Democrats (59 percent) oppose eliminating the requirement.

Figure 5: Most Republicans and Independents Support Eliminating the Individual Mandate as Part of Republican Tax Plan

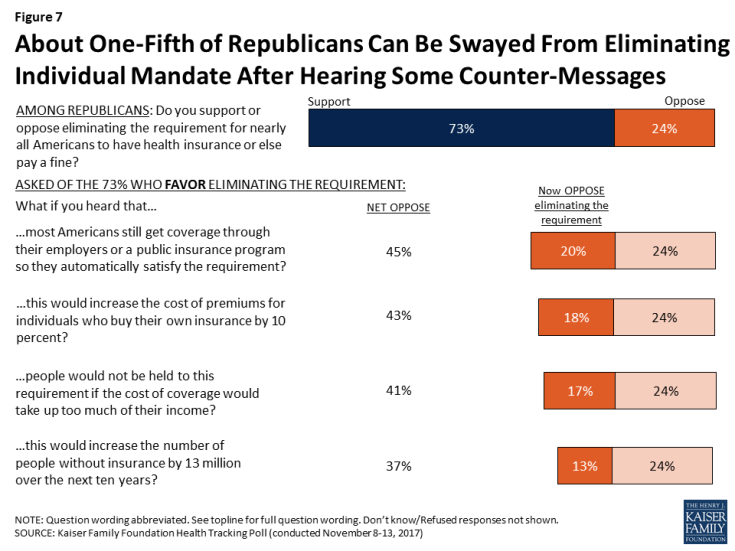

However, some of these attitudes can be swayed upon hearing counter-messages. About one-third of those who initially support eliminating the individual mandate as part of the Republican tax plan (about one in five public overall), change their view upon hearing messages about who is impacted by the mandate and the possible consequences of no longer enforcing this requirement as reported by the Congressional Budget Office.2

The share of the public who oppose eliminating the individual mandate can increase up to 62 percent after hearing that most people get their coverage through their employer or a public insurance program and therefore are not affected by the requirement. This is similar to the share who change their views once they hear it could increase the cost of premiums for people who by their own insurance by about 10 percent (60 percent), that people could not be held to the requirement if the cost would take up too much of their income (59 percent), or that it would increase the number of the uninsured by 13 million people over the next ten years (59 percent).

Initially, about a quarter of Republicans (24 percent) oppose eliminating the individual mandate as part of the Republican tax plan, but this increases up to nearly half (45 percent) after hearing most people are not impacted. Four in ten Republicans oppose eliminating the individual mandate after hearing that getting rid of the requirement would increase the cost of premiums for people who buy their own insurance by about 10 percent (43 percent) or that it doesn’t affect people who would be adversely affected by the cost of coverage (41 percent). Slighly fewer Republicans change their minds after hearing that getting rid of the individual mandate would increase the number of uninsured individuals (resulting in 37 percent of Republicans opposing the individual mandate).

Figure 7: About One-Fifth of Republicans Can Be Swayed From Eliminating Individual Mandate After Hearing Some Counter-Messages

Few Support Reducing Spending on Government Programs to Pay For Tax Plan

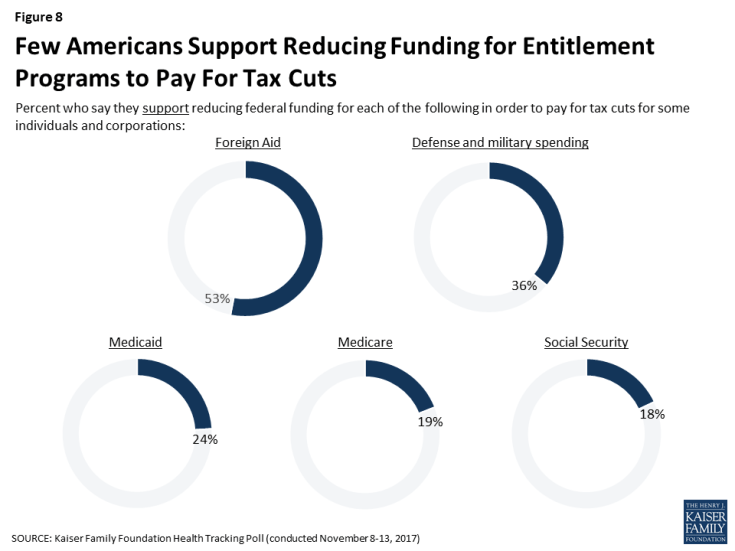

As lawmakers debate how to pay for the proposed tax plan, few Americans want to see the president and Congress decrease funding for most government programs. About half of the public (53 percent) say they support reducing federal funding for foreign aid in order to pay for the Republican tax plan. In addition, about one-third of the public (36 percent) support reducing federal funding for defense and the military to pay for the tax plan. Across Medicaid, Medicare, and Social Security – relatively few Americans, regardless of party identification, support reducing funding for these programs in order to pay for the tax cut (24 percent, 19 percent, and 18 percent, respectively).

Consequences of Not Passing a Tax Reform Plan or Health Care Plan before the 2018 Midterm Elections

Looking to the political landscape and the 2018 midterm elections, the public is divided in their views of which could prove to be a bigger deal for President Trump and Republicans in Congress: not passing a tax reform plan or not repealing the ACA. Nearly half of the public say it will be a bigger problem if the president and Republicans are unable to pass their tax reform plan (47 percent), which is similar to the share who say it will be a bigger problem if they are unable to repeal the ACA (44 percent). Republicans are also divided with half saying it will be a bigger problem if President Trump and Republicans are unable to revive a repeal of the ACA compared to a similar share who say it will be a bigger problem if they are unable to pass their tax reform plan (45 percent).