Medicare Part D at Ten Years: The 2015 Marketplace and Key Trends, 2006-2015

Section 1: Part D Enrollment and Plan Availability

Beneficiary Participation in Part D

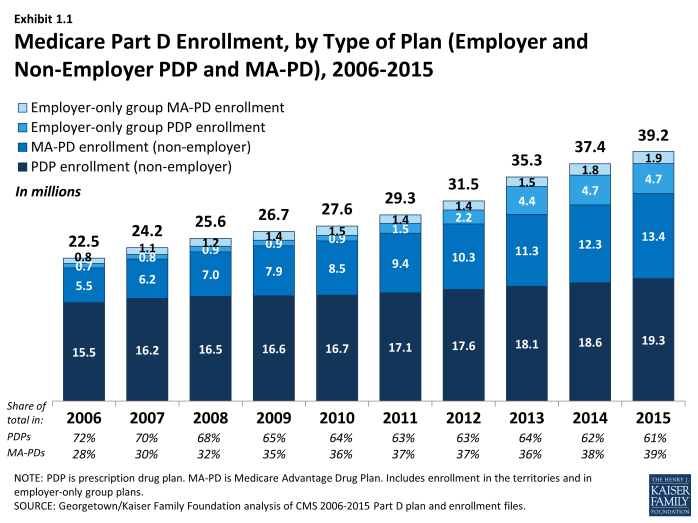

More than 39 million Medicare beneficiaries are enrolled in a Part D plan, either a PDP or MA-PD in 2015, representing 72 percent of all eligible Medicare beneficiaries. This is an increase of nearly 2 million beneficiaries since 2014 and of nearly 17 million beneficiaries since 2006 when only 53 percent of eligible beneficiaries were enrolled in Part D plans (Exhibit 1.1). In 2006, a larger share of Medicare beneficiaries received drug coverage from other sources such as former employers, so that a total of 90 percent of beneficiaries had coverage for their drugs from some source.1 In 2012 (the most recent year for which data are available), 88 percent had drug coverage at least comparable to Part D coverage and 12 percent of Medicare beneficiaries had no drug coverage whatsoever.2

More than half of the ten-year increase comes from additional enrollment in MA-PD plans, which is likely a mix of enrollees new to Part D or to Medicare altogether and those who switched from traditional Medicare supplemented by PDP coverage to MA-PD plans.3 The rest of the increase is a mix of higher PDP enrollment and more enrollment in employer-only Part D plans. About two-thirds of the increase from 2014 to 2015 is from enrollment gains for MA-PD plans.

The 4.8 percent enrollment increase from 2014 to 2015 is lower than some earlier years. Growth was higher in 2007 and 2008 as the program ramped up and higher again in 2012 and 2013 as a result of increased enrollment of retirees in employer-only Part D plans. Over ten years, the average annual rate of increase is 6.4 percent.

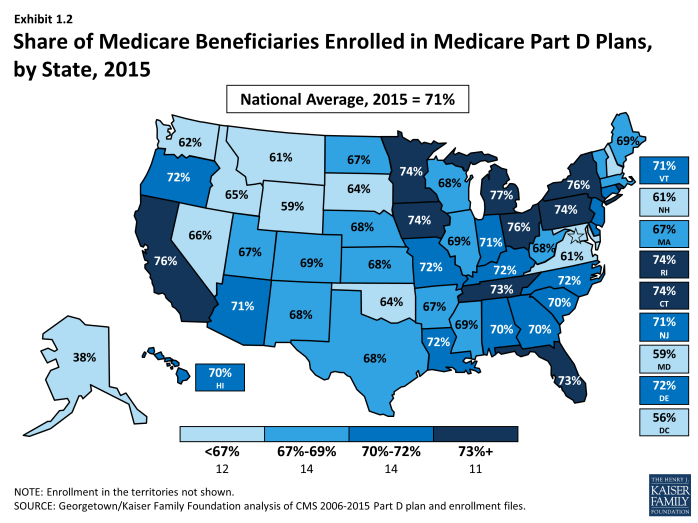

The share of Medicare beneficiaries with Part D coverage varies by state, ranging from 38 percent (Alaska) to 77 percent (Michigan) (Exhibit 1.2). States with the highest shares of Part D enrollment are California, Michigan, New York, and Ohio, each with 75 percent of Medicare beneficiaries in Part D. Alaska, Maryland, Wyoming, and the District of Columbia have fewer than 60 percent of their residents on Medicare in Part D plans. Some of these states have high shares of federal employment; federal retirees get drug coverage outside Part D through the Federal Employees Health Benefits Program.

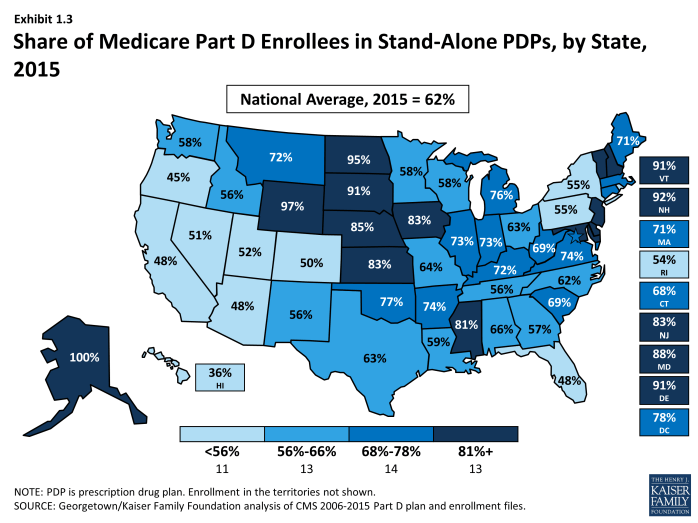

Nationally, about 61 percent of Part D enrollees are in PDPs; the remaining 39 percent are in MA-PD plans, with considerable variation by state (Exhibit 1.2), Appendix Table 1, Appendix Table 2. PDP enrollment accounted for 72 percent of total enrollment in 2006, but this share has been declining over time as MA-PD plan enrollment has grown more rapidly than PDP enrollment in recent years. From 2006 to 2015, non-employer MA-PD plan enrollment grew by 10.5 percent annually, whereas non-employer PDP enrollment grew by only 2.4 percent annually. The more rapid growth in MA-PD enrollment from 28 percent to 39 percent of Part D enrollees reflects the broader trend of greater enrollment in Medicare Advantage.

PDPs account for 100 percent of Part D enrollees in Alaska and more than 90 percent of enrollees in six other states with low populations (Delaware, New Hampshire, North Dakota, South Dakota, Vermont, and Wyoming). By contrast, MA-PD plans account for half or more of Part D enrollees in five states: Arizona, California, Florida, Hawaii, and Oregon.

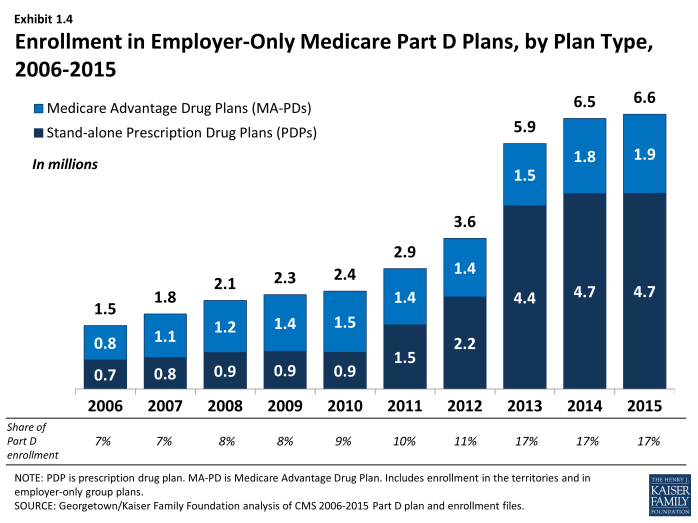

Between 2011 and 2013, total enrollment in employer-only Part D plans doubled from 2.9 million to 5.9 million beneficiaries, rising more modestly to 6.6 million in 2015 (Exhibit 1.4), Appendix Table 2). Total enrollment in employer-only Part D plans in 2015 is more than four times the level in 2006. The biggest increase was between 2012 and 2013, when enrollment in these plans grew 63 percent. The growth rate slowed to less than 1 percent in 2015.

The major impetus for this growth was a provision in the ACA that eliminated the tax deductibility of the 28 percent Retiree Drug Subsidy (RDS), effective in 2013.4 This subsidy, paid to employers who provide creditable prescription drug coverage to Medicare beneficiaries, was included in the original Part D legislation to encourage employers to maintain existing drug coverage for their retirees. In 2006, 7.2 million Medicare beneficiaries were covered in retiree health plans that received the RDS (with an average subsidy payment of $527 per person in 2006, rising to a projected $625 in 2015). With the changed tax status of the RDS, enrollment in subsidized retiree plans dropped to 2.7 million in 2014, and the Medicare Trustees project a drop to 2.2 million in 2015 and 0.9 million by 2019.5

Most employers that no longer elected to receive the subsidy after the change in tax treatment have shifted their retirees to employer-only Part D plans. Most of the new enrollment was in employer-only PDPs. In 2013, enrollment was up 99 percent in employer-only PDPs and just 7 percent in employer-only MA-PD plans. In 2014 and 2015, as growth in employer plans slowed overall, there was a modest shift toward MA-PD plan enrollment.

Continuity of Part D Plan Offerings

About one-fifth of the PDPs that participated in Part D in its first year are still in the market today. There are 315 PDPs operating under the same contract and plan identification number in 2015 as in 2006. About one-fourth of these PDPs operate under the same plan name, while others have similar names. For example, what was originally the AARP MedicareRx Plan, sponsored by UnitedHealth, is now called AARP MedicareRx Preferred. Others have changed as a result of acquisitions; for example, five PDPs offered by Sterling in 2006 are now known as WellCare Simple PDPs. About one-fourth of these continuously operating PDPs have changed their benefit type; in most cases, PDPs originally offering the basic benefit now operate as enhanced benefit PDPs (a change in status no longer allowed by CMS).

These continuously operating PDPs accounted for about 44 percent of all PDP enrollees in 2006, and 55 percent of total enrollment in 2015. Most of the remaining PDP enrollees are in other plans offered by sponsors that have participated in Part D since 2006. Of the six plan sponsors that entered the Part D market after the program’s first year, none have attracted a significant market share. The most successful new entrant has been Envision RxPlus, which held a 2.5 percent share of PDP enrollment in 2013, declining to 2 percent in 2015.

Firm Participation

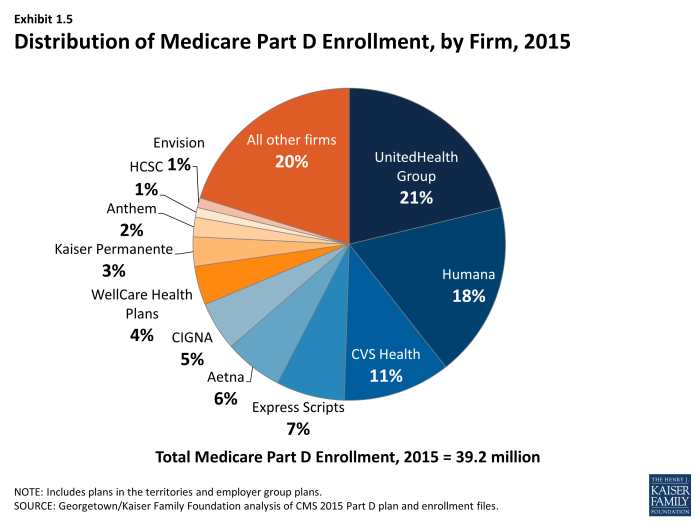

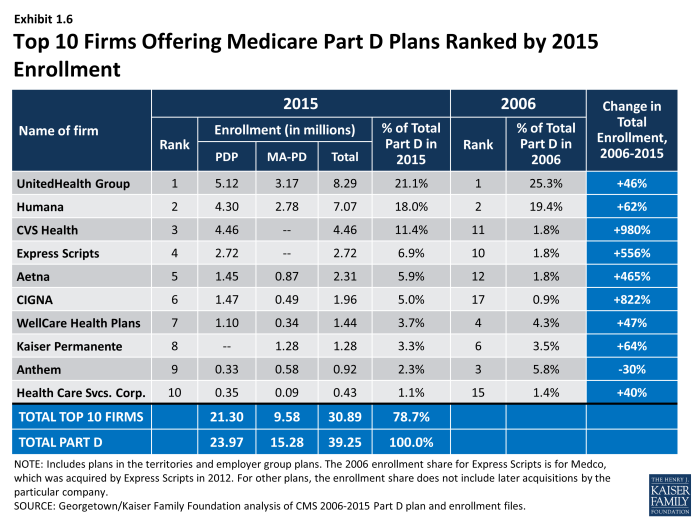

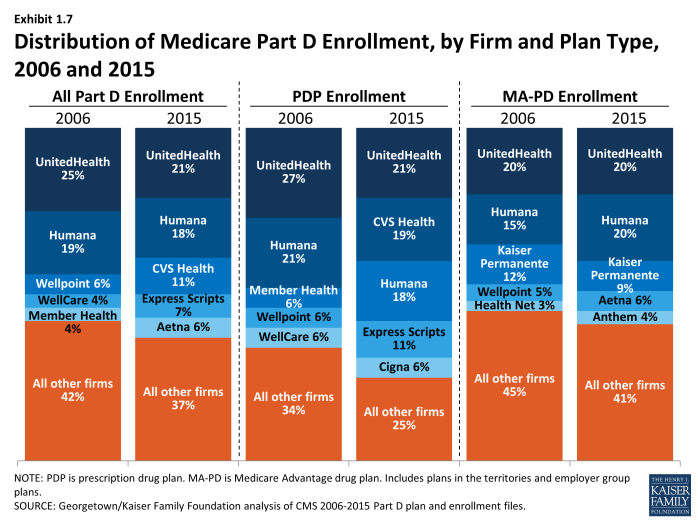

In 2015, the ten largest sponsors of Part D plans account for more than three-fourths of all enrollees, three firms account for half of all enrollees, and UnitedHealth alone accounts for more than one in five Part D enrollees (including 21 percent of PDP enrollees and 20 percent of MA-PD plan enrollees) (Exhibit 1.5).6 This pattern of a few plan sponsors having a substantial share of Part D enrollment has held over the program’s first ten years. The ten largest Part D plan sponsors in 2015 have enrolled 30.9 million beneficiaries in either a stand-alone PDP or an MA-PD plan (Exhibit 1.6).7 The share of enrollment in the ten largest plans in 2015 (79 percent) is higher than in 2006 (69 percent). In 2006, the top three firms also accounted for about half of all enrollees. Four firms that were in the top ten for 2006 have been acquired during the intervening years: three by CVS Health and one by Aetna.

Patterns are similar for the PDP and MA-PD plan markets, viewed separately (Exhibit 1.7). In the PDP market alone, the top three sponsors (UnitedHealth, CVS Health, and Humana) account for nearly 60 percent of enrollment in 2015—slightly more than the 54 percent share held by the top three sponsors (UnitedHealth, Humana, and Member Health) in 2006. Among MA-PD plans, UnitedHealth and Humana each have 20 percent of the market in 2015, followed by Kaiser Permanente, with 9 percent; these are the same three sponsors that held the most MA-PD market share in 2006.

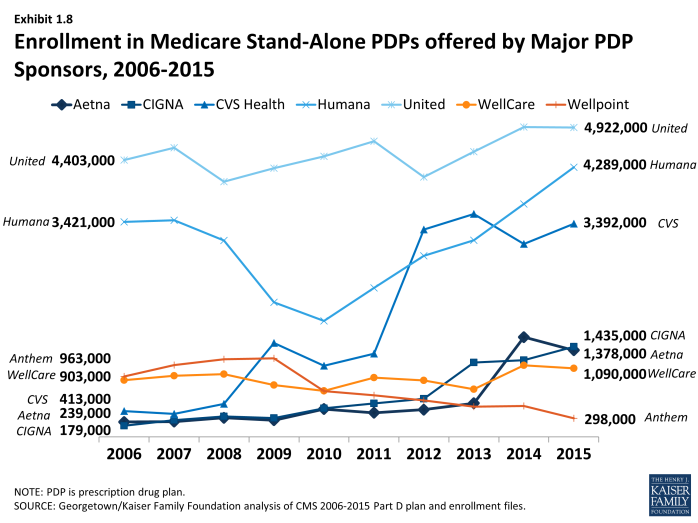

The growth pattern among the largest PDP sponsors illustrates some of the different strategies used since the start of the program (Exhibit 1.8). UnitedHealth has been the largest PDP sponsor since 2006, and Humana has generally been the second largest. CVS Health has used an acquisition strategy to move solidly into the third position. Aetna and Cigna have moved higher up in recent years, also through acquisitions. It is noteworthy that both acquiring firms in recently proposed mergers (Aetna and Anthem) lost enrollment in the PDP market from 2014 to 2015, whereas both firms to be acquired (Humana and Cigna) gained enrollment.

Seven of the top ten firms in 2015 sponsor both stand-alone PDPs and MA-PD plans. Kaiser Permanente is the only sponsor among the top ten that offers only MA-PD plans, and Anthem is the only other firm with more MA-PD enrollees than PDP enrollees. CVS Health and Express Scripts offer only PDPs. Other than Kaiser Permanente and Anthem, at least 60 percent of each of the top firms’ enrollment is in PDPs.

Enrollment growth since 2006 for CVS Health, Express Scripts, Aetna, and Cigna is due largely to acquisitions of other plan sponsors. CVS Health has used an acquisitions strategy to become the third largest sponsor in the Part D marketplace. The parent company now includes 5 of the 18 firms that had the most enrollees in 2006. Cigna and Aetna have grown their Part D market shares through similar acquisitions strategies. Express Scripts has grown both through its recent acquisition of Medco, but also through the overall increase in enrollment in employer-only plans since the RDS tax status change. Four plan sponsors dominate the employer-only segment of the Part D market, collectively accounting for about two-thirds of all enrollees in employer-only Part D plans: Express Scripts (34 percent), CVS Health (16 percent), UnitedHealth (10 percent), and Kaiser Permanente (7 percent).

National plan sponsors have dominated the Part D PDP market from the start. Firms serving all or most regions hold 94 percent of the PDP market in 2015, up from 89 percent from 2006. Most other sponsors with plans in no more than a few regions are local Blue Cross Blue Shield (BCBS) plans. Among the PDPs serving no more than a few regions, the only non-Blue plan with a PDP market share of greater than 1 percent in a region is the WPS Insurance Company, a not-for-profit plan sponsor with 7 percent of the market in Wisconsin. BCBS plans with large market share in their regions are the coalition of BCBS plans in the seven-state upper Midwest region (23 percent), the Health Care Service Corporation affiliates in Illinois (21 percent) and Oklahoma (14 percent), Arkansas BCBS (14 percent), the coalition of BCBS plans in southern New England (11 percent), and Blue Cross Blue Shield of Kansas (10 percent). Five regions have no PDP sponsored by a BCBS plan.

UnitedHealth and Humana have been the two largest Part D plan sponsors from the start of the program, but their combined share of enrollment has dropped from 45 percent in 2006 to 39 percent in 2015. UnitedHealth, due in part to its successful marketing relationship with AARP, has maintained its top position for all ten years of the program and has seen its enrollment grow by about 46 percent since 2006. Humana has maintained a strong Part D presence, due in part to offering the lowest PDP premiums in 2006 and retaining many of those enrollees over time despite premium increases for its older plans. While higher-than-average premium increases and a loss of LIS benchmark status in most regions contributed to a drop in Humana’s Part D enrollment between 2006 and 2010, Humana’s introduction of new lower-premium PDPs in 2011 and 2014 reversed this decline, contributing to a net enrollment gain of 62 percent in Humana’s Part D plans between 2006 and 2015.

Market Concentration

At the national level, the Part D market among PDPs is not concentrated. As measured by the Herfindahl-Hirschman index, a statistical measure of market competition, the index value of 1,362 falls a little below the threshold for a concentrated market.8

Within regions, however, the Part D (at the firm level), is moderately concentrated with an average index value across regions of 1,896. Overall, 30 of 34 regions qualify as moderately concentrated, while 2 are highly concentrated and 2 are not concentrated. The two regions classified as highly concentrated are Florida and Nevada.

If non-LIS and LIS beneficiaries are treated as separate markets in each region, both are more concentrated at the firm level than at the level of overall enrollment. In 2015, the LIS population reaches the level considered moderately concentrated in 25 of 34 regions and highly concentrated in another 3 regions. Comparable numbers for the non-LIS population are 20 moderately concentrated regions and 14 highly concentrated regions. The non-LIS market is considerably more concentrated than the LIS market, probably because the process for assigning LIS beneficiaries to benchmark plans reduces concentration. The most concentrated regions among non-LIS beneficiaries are Alaska, Arizona, Florida, Hawaii, New Jersey, and New York.

Proposed plan acquisitions of Humana by Aetna and Cigna by Anthem would increase market share among two of the top ten Part D plan sponsors. Should the proposed acquisition of Humana by Aetna be approved by federal regulators, the combined firm will increase its market share from 18 percent to 24 percent and surpass UnitedHealth to become the largest sponsor of Part D plans (both for PDPs and MA-PD plans). The share of enrollment for the top three firms would increase from 50 percent to 56 percent. The share of the top three firms for PDP enrollment would increase from 58 percent to 64 percent.

By contrast, the MA-PD plan market is less concentrated at the national level, but much more concentrated at the local level.9 Only three firms in the MA-PD market, accounting for about half of MA-PD plan enrollment (excluding special needs plans), offer plans in at least half the states. The vast majority of MA-PD plan sponsors are local or regional, offering plans in just one or two states. These firms collectively account for about 30 percent of MA-PD enrollment.

Market Share Among Part D Plans

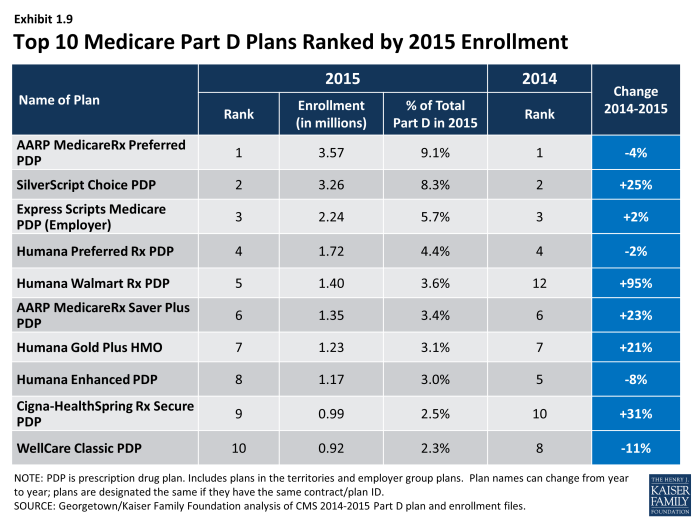

There has been some turnover among the top Part D plans from 2014 to 2015, with one plan moving into the top ten PDPs or MA-PD plans by enrollment (Exhibit 1.9). Humana’s Walmart Rx PDP, new in 2014, moved up to the fifth position, while Kaiser Permanente’s Senior Advantage dropped from the ninth to the eleventh spot. In addition to Humana Walmart Rx PDP, four other top plans gained significant numbers 0f enrollees from 2014 to 2015: Cigna-HealthSpring Rx Secure PDP, SilverScript Choice PDP, AARP MedicareRx Saver Plus PDP, and Humana Gold Plus HMO. The first two of these gained enrollees through consolidations of other plans offered in 2014 by the same sponsor. Three of the top plans in 2015 (Humana’s Preferred Rx PDP and Walmart Rx PDP and UnitedHealth’s AARP MedicareRx Saver Plus PDP) are recent entries to the market, featuring low initial premiums and tiered pharmacy networks.

Only three of the top ten PDPs or MA-PDs by enrollment in 2015 were among the top ten in 2006. They are UnitedHealth’s AARP MedicareRx Preferred PDP, Humana’s Enhanced PDP, and CVS Health’s SilverScript Choice PDP (renamed from SilverScript Basic in 2015) (Exhibit 1.9). Within many plan sponsors’ offerings, there have been significant changes in enrollment, partly due to sponsors adding, dropping, or consolidating plans. Six of the original top ten plans from 2006 exited the market due to consolidations by plan sponsors, some after being acquired by another sponsor.

Enrollment gains at the plan level between 2014 and 2015 were experienced by both plans raising premiums and plans with significant premium reductions. Two PDPs gaining large numbers of enrollees (Humana Walmart Rx PDP and UnitedHealth’s AARP MedicareRx Saver Plus PDP) raised premiums by more than 20 percent, but still had relatively low premiums compared to the competition. In particular, the Humana Walmart Rx PDP, which was introduced in 2014 and had the lowest premium in most regions in 2015 despite a premium increase, nearly doubled its enrollment (95 percent) between April 2014 and April 2015 and became the fourth largest PDP in 2015. By contrast, Humana’s more expensive plan (Humana Enhanced PDP) experienced a 8 percent loss in enrollment between 2014 and 2015, Over the program’s first decade, Humana has refreshed its offerings by introducing new low-premium plans while raising premiums for its older plans. Two other PDPs with large enrollment gains from 2014 to 2015 had significant premium reductions (SilverScript Choice PDP and Cigna-HealthSpring Rx Secure-Xtra PDP). It is unclear whether the gains were beneficiaries new to Medicare, transfers from other PDPs offered by the same sponsor, or switchers from plans offered by other sponsors.

Low premiums were associated with enrollment growth at times other than the annual open enrollment period. Humana has been most successful in this regard, benefiting from its strategy of offering PDPs with low premiums to capture a large share of the market. The firm’s Walmart Rx PDP enrolled 229,000 new members outside the annual enrollment period (February to December 2014) for a 35 percent increase in enrollment and another 164,000 new members (12 percent increase) between February and September 2015. Because most enrollees have no option to switch plans in these months, it is likely that most of these new enrollees are newly eligible Medicare beneficiaries opting for the least expensive plan. UnitedHealth’s AARP MedicareRx Saver Plus PDP and the WellCare Classic PDP, also offering some of the lowest PDP premiums during 2014, picked up substantial numbers of enrollees during 2014 and the UnitedHealth plan had further gains during 2015.

Enrollment shifts among the top plans and plan sponsors also have been brought about by automatic re-assignment of LIS beneficiaries. If a plan loses its designation as a benchmark plan (available to LIS beneficiaries for zero premium), CMS reassigns certain beneficiaries to a benchmark plan offered by the same sponsor if one is available; otherwise they are switched at random to a benchmark plan offered by another sponsor. In 2015, for example, Aetna and CVS Health each picked up nearly 90,000 enrollees through these types of reassignments. By contrast, three PDPs not designated as benchmark plans experienced disenrollment of LIS enrollees and thus had among the largest decreases in total enrollment from 2014 to 2015.

The most popular plans vary considerably by region. UnitedHealth and CVS Health each have the largest PDPs in nearly half of all regions in 2015.10 UnitedHealth’s AARP MedicareRx Preferred PDP is the largest PDP in 16 regions, and CVS Health’s SilverScript Choice PDP is the largest in 14 regions. Humana Preferred Rx PDP holds the lead in Colorado and Nevada. Humana Walmart Rx PDP and Cigna-HealthSpring Secure PDP have the largest shares of enrollment in the Idaho/Utah region and Hawaii, respectively.

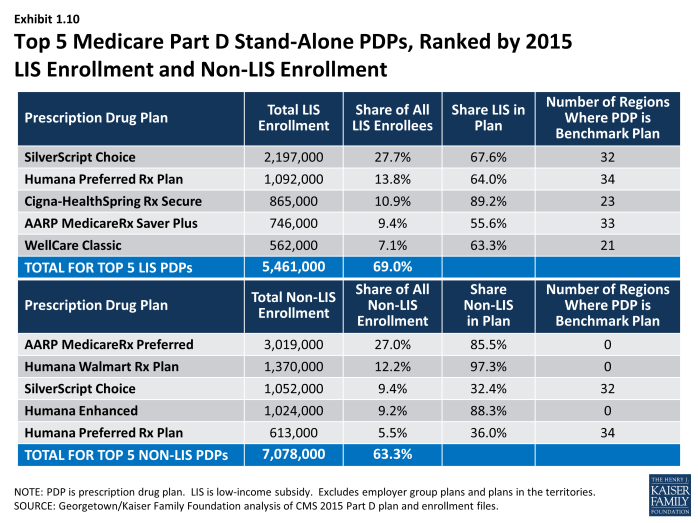

The most popular plans also differ for non-LIS and LIS beneficiaries. AARP MedicareRx Preferred PDP has enrolled 27 percent of all non-LIS beneficiaries nationally and has the most non-LIS enrollees in 29 of 34 PDP regions (Exhibit 1.10). The next most popular non-LIS plan, Humana’s Walmart Rx PDP, with 12 percent of non-LIS enrollees, has the most non-LIS enrollees in three regions, and local Blue Cross Blue Shield PDPs have the largest share of non-LIS enrollment in Arkansas and the upper Midwest region.

CVS Health’s SilverScript Choice PDP dominates the LIS market with more than one-fourth of national LIS enrollment (28 percent) and the highest share of LIS enrollees in 25 PDP regions. PDPs sponsored by Humana, Cigna, and WellCare have the most LIS enrollees in the other 9 PDP regions. Unlike the situation in recent years, four of the five PDPs with the most LIS enrollees have an enrollee mix with at least one-third non-LIS enrollees.

Plan Availability

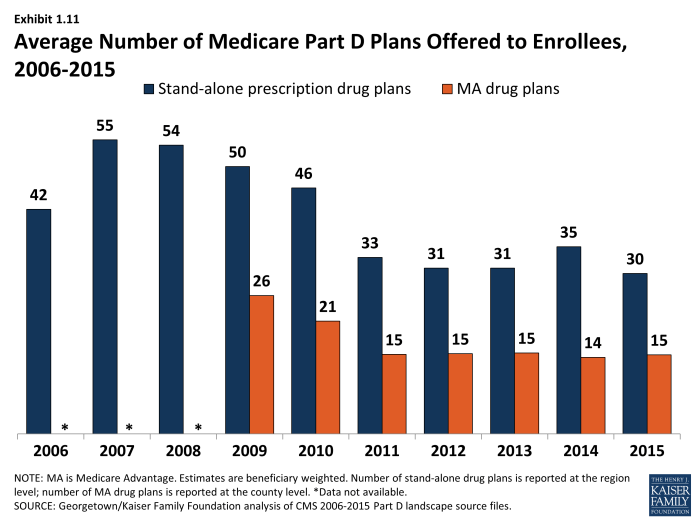

Choice remains plentiful in Part D; in 2015, the average Part D enrollee had a choice of 30 PDPs and 15 MA-PD plans. The average number of PDPs per region has come down from a high of 56 in 2007 and 35 in 2014 to 30 in 2015 (weighted by regional enrollment) (Exhibit 1.11). At least 24 PDPs are offered in every region this year (excluding the territories). In 2015, virtually all beneficiaries have at least one Medicare Advantage option with drug coverage as well, and the average beneficiary has 15 options for Medicare Advantage drug plan enrollment, down from 26 in 2009 and up from 14 in 2014.11

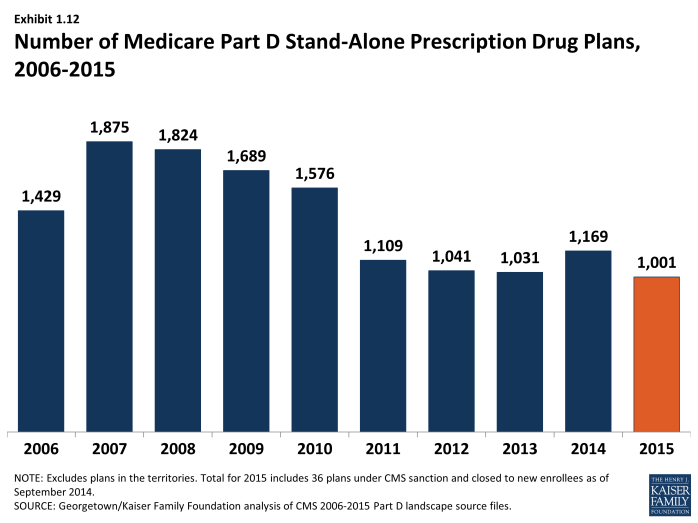

The number of PDPs offered was down by 14 percent from 2014 to 2015. There are 1,001 PDPs in 2015, well below the number of PDPs offered between 2006 and 2010. While the number of PDPs rose sharply between 2006 and 2007, the number decreased each year since (other than 2014) as a result of both marketplace and policy factors (Exhibit 1.12). Over its first ten years, the Part D market has witnessed several mergers between sponsoring organizations and consolidation of plan offerings by sponsors. In 2010, CMS issued regulations aimed at discouraging duplicative plan offerings and plans with low enrollment. For example, many sponsors now offer just two plan options (one basic and one enhanced) instead of the three options they had offered in previous years.

The drop in PDP offerings from 2014 to 2015 reflects plan terminations and a few offsetting new offerings. The only near-national plan sponsor leaving Part D, HealthMarkets, had never attracted significant enrollment in its two years. Three plan sponsors with a small regional presence also terminated contracts. In addition, Anthem terminated its MedicareRx Rewards PDPs in 24 regions. These PDPs entered the program in 2006, but enrollment had fallen steadily in recent years. The largest number of terminations (168 PDPs) reflected plan consolidations by five national plan sponsors and two local plan sponsors. Some consolidations resulted from earlier mergers among sponsors, and others were in response to CMS guidance on duplicative plan offerings. Partially offsetting the plan terminations were 70 new plans, nearly all from three national or near-national plan sponsors (EnvisionRx, Symphonix Health, and United American) with relatively few enrollees. There are two entirely new contracts offering one PDP in Colorado and two in Nevada. Together all the new plans attracted only 170,000 enrollees (about 1,000 enrollees for the new contracts). Over half (93,000) were in one new plan (sponsored by Blue Cross Blue Shield in the upper Midwest region); the rest averaged just over 1,000 enrollees per plan. Some enrollees in new PDPs appear to have shifted from others offered by the same sponsor.

Current CMS policies suggest that the number of PDPs might decline again in future years. In the call letter issued in early 2015 spelling out the terms of plan participation for the 2016 contract year, CMS reiterated the agency’s authority not to renew plans with low enrollment.12 Currently, 257 PDPs (26 percent of all PDPs in 2015) have fewer than 1,000 enrollees, the level at which CMS urges sponsors to consider plan withdrawal or consolidation; 63 of these PDPs have fewer than 100 enrollees each.13 The low-enrollment PDPs include the Symphonix Premier Rx and Symphonix Rite Aid Premier Rx PDPs in 25 regions, which were offered for the first time in 2014.

In addition to its policy on low-enrollment plans, CMS continues to maintain a policy that PDPs offered by the same sponsor must be meaningfully different from the sponsor’s other offerings. This policy encourages plan sponsors to reduce their PDP offerings, thereby simplifying the choice environment in Part D.

In 2015, 1,605 Medicare Advantage drug plans are offered, essentially the same number as the year before. The number of MA-PD plans increased by about 50 percent between 2006 and 2009, from 1,333 plans to 1,991 plans.14 However, the availability of MA-PD plans has fallen since then; the 1,605 MA-PD plans offered in 2014 is about 19 percent lower than at the peak. The number of MA-PD plans available to the average Medicare Part D enrollee has remained nearly constant at 15 plans since 2011.