Health Reform: Implications for Women's Access to Coverage and Care

Impact on Coverage

One of the major goals of the health reform law is to expand access to coverage to the uninsured, and the ACA requires almost all individuals to have some form of health coverage by 2014. The ACA accomplishes this by creating a system where nearly all individuals who are legally residing in the U.S. can obtain some form of insurance. Major changes include expanding eligibility for the public Medicaid program for many more low-income people, establishing tax credits and other incentives for smaller employers to cover their employees, and establishing new state-based “exchanges” or “marketplaces” through which all citizens can purchase insurance if they do not have another form of coverage. The 2012 ruling by the Supreme Court of the United States altered the enforcement capabilities of the Department of Health and Human Services regarding the Medicaid expansion, in effect making participation in the expansion optional for states.[endnote EN7987-1] Not all states are participating in the Medicaid expansion, significantly limiting insurance coverage for low-income women and men unless these states reverse course in the future. Over 1 million young adult women have already gained health insurance due to the ACA’s extension of dependent coverage through age 26 in the private sector and an estimated 13 million more uninsured women will gain coverage by 2016 as a result of the law’s larger coverage expansion.[endnote EN7987-2]

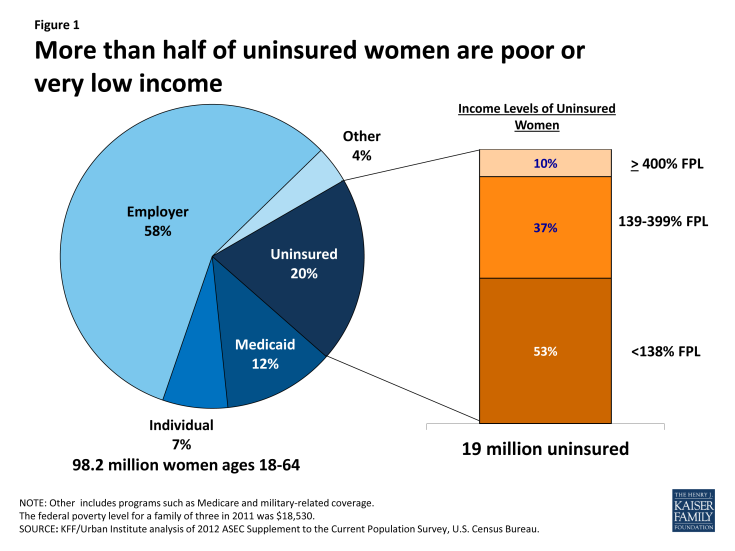

The majority of women (58%) are currently insured as a dependent or an employee through an employer sponsored insurance plan (Figure 1). In 2011, 12% of women were enrolled in Medicaid and 20% of women were uninsured. Women who are uninsured could potentially gain insurance through the Medicaid expansion and the health insurance exchanges. Just over half of uninsured women (53%) had incomes less than 138% of the federal poverty level and would qualify for Medicaid if all states participated in the expansion. Another 37% of uninsured women have incomes between 139% and 399% percent of poverty and could qualify for subsidies and tax credits in the exchanges. However, state decisions regarding the Medicaid expansion and insurance plan availability and affordability within marketplaces will play a significant role determining whether a majority of women will be able to gain insurance.

Employer-Sponsored Insurance

The ACA will allow individuals who currently have insurance to keep that coverage. Today, most women and men in the U.S. are covered by insurance obtained through the workplace. There are differences between coverage patterns, however, that can leave women exposed to losing coverage. Because women with employer-based insurance are almost twice as likely as men to be covered as dependents, they can be more vulnerable to losing their insurance should they become widowed, divorced or if their husbands lose their jobs.[endnote EN7987-3] Just over one third (35%) of women receive health coverage through their jobs compared to 44% of men.[endnote EN7987-4]

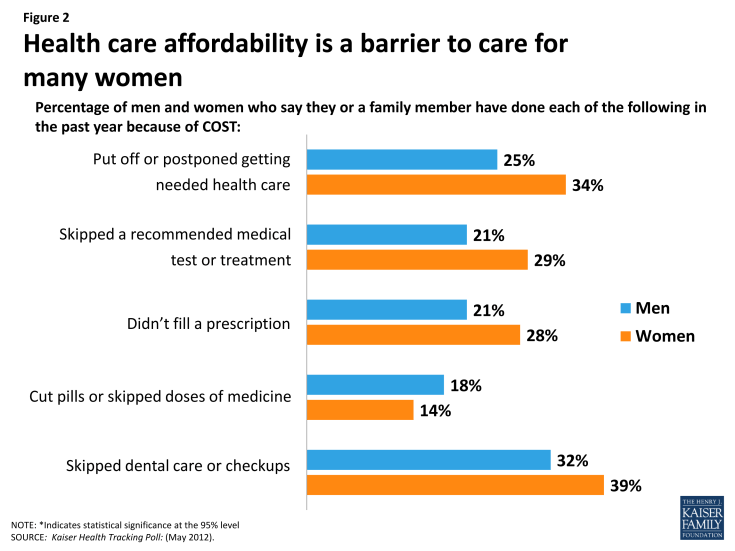

Affordability of care is a key issue for women, who are disproportionately low-income. Women are consistently more likely than men to report a wide range of cost-related barriers to care for themselves and their families, such as skipping needed care and forgoing prescription medicines because of the out-of-pocket costs (Figure 2). Out-of-pocket costs take many forms, including premiums, co-payments, and insurance plan caps on spending. Premiums are a major cost for both employers and employees, and family premium costs have risen 80 percent since 2003.[endnote EN7987-5] Premium costs have been particularly unaffordable for small employers, who have less bargaining power with insurers and are therefore less likely to offer coverage to their employees.

To encourage small employers to offer coverage and help address their affordability concerns, employers with 25 or fewer employees that do cover their employees will receive tax credits for the first two years of the ACA to help offset the insurance costs. The ACA had originally required large employers (more than 50 employees) to offer coverage to their employees by 2014 or pay a monetary penalty, but this requirement has been postponed until 2015. Small employers (50 or fewer employees) will be exempt from these penalties.

Health Insurance Marketplace

Small businesses and uninsured individuals will be able to purchase coverage from a choice of private or public plans that will be sold through new state-level health insurance “exchanges”, federally or state operated marketplaces of health plans that cover a defined set of services. These marketplaces will begin open enrollment in October 2013 for uninsured individuals and begin to offer coverage on January 1, 2014. In 2015, the Exchanges, or marketplaces, will be open to small businesses to obtain coverage for their employees (called the Small Business Health Options Program or SHOP). States have the option of establishing state-run marketplaces, partnering with the federal government to administer the marketplaces, or leaving the responsibility of running the marketplace to the federal government. As of June 2013, 16 states and the District of Columbia have decided to run their own marketplaces, 7 states have decided to establish a state-federal partnership, and 27 states have decided to leave the operations to the federal government.[endnote EN7987-6] Premiums in exchange plans will be set using a modified community rating, so that insurers will be prohibited from charging higher premiums based on sex, health status, or occupation. Premiums will only be allowed to vary by age (3 to 1) and tobacco use (1.5 to 1).

In addition to the changes in premium pricing, the law contains other provisions to make insurance more affordable for individuals and small employers seeking coverage for their workers in exchanges. Individuals and families with incomes between 100% and 399% of the federal poverty level ($19,530 for a family of three in 2013) will be eligible for a graduated system of subsidies or tax credits (that will vary by income) that they can use towards the cost of insurance premiums. Cost-sharing subsidies will also be available for individuals with household incomes between 100-250% of the federal poverty level and there will be caps on out-of-pocket costs to reduce financial burdens on these low-income families. The availability of these tax credits combined with a major expansion in Medicaid means that in states that choose to expand their Medicaid program, the majority of currently uninsured women, but not all, are likely to receive some form of federal financial assistance to obtain coverage in 2014 as a result of the health reform law (Appendix A).

Medicaid

The expansion of Medicaid is part of the foundation of the ACA’s coverage expansion and reduction in uninsured. The Medicaid program, the state-federal program for low-income people, has historically served as a critical safety-net for low-income mothers and pregnant women. Today, 12% of women are covered under Medicaid, and women comprise over two-thirds of adult Medicaid beneficiaries.[endnote EN7987-7] Historically, women have been more likely than men to qualify for Medicaid because, on average, women have lower incomes and they are also more likely to fall into one of the program’s eligibility categories: pregnancy, parent of a dependent child, over 65, or having a disability.

The ACA aims to eliminate these restrictive “categorical” requirements and by basing eligibility solely on income, potentially expand Medicaid eligibility to all individuals with incomes up to 138% of FPL.[endnote EN7987-8] This opens the door for coverage to adults without children who typically have not been able to qualify for Medicaid, no matter how poor they are.

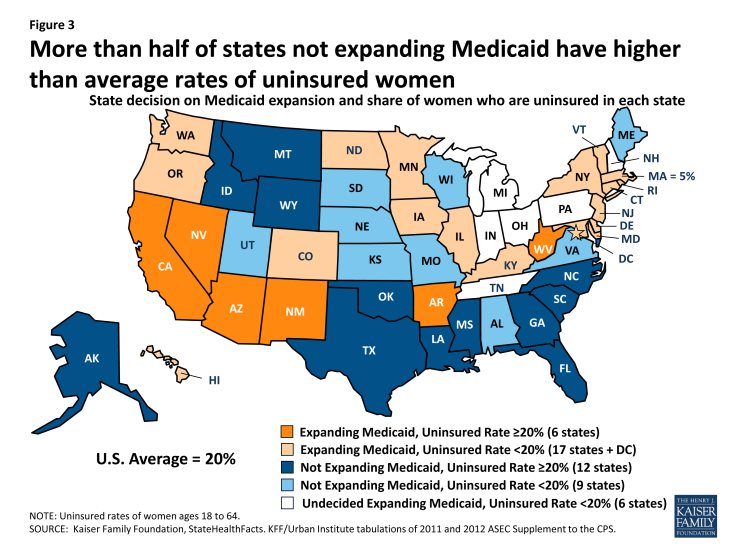

In June 2012 however, the Supreme Court altered the enforcement capabilities of the Department of Health and Human Services, preventing the Department from penalizing states that choose not to participate in the Medicaid expansion.[endnote EN7987-9] Effectively, this means that states now have the option to expand their Medicaid programs: as of August 2013, about half of states (24 plus the District of Columbia) have committed to expanding their Medicaid program, 21 states are not expanding their programs at this time, and 5 states are still debating the decision (Figure 3).[endnote EN7987-10] States can choose to expand their Medicaid programs in the future. Approximately 45% of women who are currently uninsured live in states that are choosing not expand their Medicaid programs, 45% live in states that are expanding, and 10% of women live in states that are still debating.[endnote EN7987-11]

Figure 3: More than half of states not expanding Medicaid have higher than average rates of uninsured women

Individuals under the poverty line will not qualify for assistance if they live in a state that does not expand Medicaid, unless they are already eligible but not enrolled in the program. As a result of some states deciding that they will not expand their Medicaid programs, it is estimated that as many as 6.4 million uninsured adults will not gain coverage.[endnote EN7987-12] States that are expanding their Medicaid programs will continue to operate their Medicaid programs under federal guidelines, and the federal government will finance the full costs of the expansion population through 2016, gradually reducing to 90% federal financing by 2020.

Individual Market

Currently, about seven percent of women purchase coverage through the individual insurance market. Historically, these plans have presented a range of challenges to women. In many states, insurers have been able to charge women who purchase individual insurance more than men for the same coverage, a practice called gender rating.[endnote EN7987-13] Yet, plans sold on the individual market often do not cover many important services for women, such as maternity care, mental health, and prescription drugs.[endnote EN7987-14] Individually purchased plans have also been able to refuse to renew coverage for individuals with health problems or raise the premium rates to levels that are unaffordable to many policy holders. In addition, they have been able to deny or limit coverage to individuals with a “preexisting condition” such as pregnancy, mental illness, or chronic condition.

The ACA makes many changes to this market. It subjects new individual insurance market plans to the same regulations as plans sold in health insurance exchanges. Therefore, it will ban the practices of gender rating, pre-existing condition exclusions, and varying premiums based on health status in the individual market starting in 2014. Furthermore, all plans sold on the individual market will have to cover a minimum level of services, which includes maternity care. While people will be able to continue to buy coverage through the individual insurance market subject to these changes, it is expected that many who currently purchase insurance on their own will seek coverage in plans within exchanges where they will be able to get subsidies should they qualify.

Exemptions and Timeline

The law does exempt certain populations from the coverage mandate, including American Indians, undocumented immigrants, individuals with incomes below the tax filing threshold, and individuals whose cost of coverage exceeds 8% of their income. There are also exemptions for those with financial hardship or religious objections. Since 1996, legal immigrants have been barred from Medicaid and CHIP during their first five years in the country. States do have the option to eliminate this five year ban for pregnant women or children, but this has not been widely adopted. As a result, most legal immigrants still will not qualify for Medicaid for at least 5 years after they acquire residency,[endnote EN7987-15] although they will be eligible for premium subsidies in the new Exchanges if they meet the income requirements. Undocumented immigrants also do not have access to Medicaid coverage and will not be allowed to purchase coverage within state exchanges, even by paying the full cost out-of-pocket. They may be able to purchase individual insurance plan policies sold outside of exchanges.

While most of the insurance coverage expansions will take effect in 2014, some changes have already gone into effect. Most notably, plans are now required to allow policyholders to extend dependent coverage to individuals up to age 26, regardless of whether they are students or married. This extends a coverage option to an age group that has among the highest rate of being uninsured. In 2011, 25% of women between the ages of 19 and 25 were uninsured (3.7 million women).[endnote EN7987-16] Since this provision took effect in September 2010, more than 3 million adults between ages 19 and 25 have gained insurance coverage.[endnote EN7987-17] In addition, the federal government provides the states with financial assistance to manage high risk pools that extend coverage to those who are uninsured and considered uninsurable because of health problems. HHS estimates more than 86,000 individuals were enrolled in the Pre-existing Conditions Insurance Plans as of August 2012.[endnote EN7987-18] These pools will be in effect until 2014 when exchanges and Medicaid expansions will be in force.

Benefits and Access to Care

For the first time, federal law specifies a minimum package of services that must be offered for those obtaining coverage from qualified plans in the individual and small group markets, as well as the state exchanges. These benefits are referred to as the “essential health benefits” and broadly include: ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance abuse disorder services including behavioral health treatments, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, chronic disease management, and pediatric services including oral and vision care. The Essential Health Benefits Bulletin released by the Secretary of Health and Human Services in December 2011 outlines the general definition of each benefit category, but left the specifics to the states.[endnote EN7987-19] For those newly eligible for Medicaid, states will be required to either offer them coverage through their existing Medicaid programs or an alternative “benchmark” benefit package that must include at least the essential health benefit package offered by plans in the exchanges.

Preventive Care

The ACA includes some important new expansions and protections in the coverage of preventive services that began to take effect in 2010. The law requires that new private plans cover –without cost-sharing – all preventive services that have been evaluated to be “highly effective” by the U.S. Preventive Services Task Force (USPSTF) with an A or B rating as well as immunizations recommended by the Advisory Committee on Immunization Practices (ACIP) of the Centers for Disease Control and Prevention (Table 1). The USPSTF is an independent body that reviews the evidence and rates the efficacy of preventive services in a primary care setting. For example, all qualified health plans will need to cover annual mammography for women starting at age 40. The ACIP recommends vaccines for people of all ages, including the HPV vaccine for women and girls under 26 and men and boys under 21, meaning that the vaccine is now covered without cost sharing (no copays, deductibles, or co-insurance can be applied). For individuals in new small and large group plans, new individual insurance policies, and Medicare, coverage for all of these services is already in effect. In addition to the services recommended by these bodies, the ACA authorized the Health Resources and Services Administration (HRSA) to identify additional preventive services for women that are not already recommended by one of these groups. Based on recommendations from the Institute of Medicine,[endnote EN7987-20] HRSA added the following services:[endnote EN7987-21] FDA-approved prescription contraceptives, at least one annual “well woman” visit, domestic violence screening, breastfeeding supports, HPV testing, and screenings for STIs and gestational diabetes. New private plans began covering these additional services in August 2012, with an exception for certain religious employers regarding the contraception benefit. Although there are no requirements for Medicaid to cover these preventive services without cost-sharing, there is a financial incentive for the states to do so in the form of an enhanced federal payment match. As of October 2010, 31 states were already covering all preventive services important for women and nine of these states covered the services without cost sharing.[endnote EN7987-22]

Primary Care

The importance of primary care in identifying and managing chronic health problems and improving use of preventive services is well established.[endnote EN7987-23] Yet, there has been a long-standing shortage of primary care providers, particularly physicians, for adults.[endnote EN7987-24] The ACA includes numerous payment incentives to draw more primary care providers to the health care workforce. This includes a 10% bonus in Medicare payment rates for primary care physicians, a temporary increase in Medicaid primary care payment rates, and policies that will promote coordinated primary care for high need individuals who are dually eligible for Medicaid and Medicare. Two-thirds (69%) of this dually eligible population are women.[endnote EN7987-25] In addition, the new law includes a provision that permits women in group health plans to have direct access to participating ob-gyns without needing a primary care provider referral.

Maternity Care

Childbirth and pregnancy-related conditions are leading causes of hospitalization in the U.S., accounting for nearly 25% of hospital stays.[endnote EN7987-26] Although the Pregnancy Discrimination Act requires that employers with at least 15 employees offer plans that cover expenses for pregnancy-related conditions on the same basis as for other medical conditions, coverage for maternity care is not currently included in many individual insurance plans. In this market, women typically have had to purchase a separate rider to cover maternity care which can be extremely costly and often requires a waiting period before the benefits are covered. As stated earlier, the ACA explicitly identifies maternity and well-baby care as part of the essential benefits package that must be offered by plans in the Exchanges and new plans offered in the individual and small group markets. In addition, new private plans will be required to cover without cost sharing prenatal visits, a wide range of preventive prenatal services, and breastfeeding supports and the costs of breast pump rentals for lactating women. All state Medicaid programs already cover pregnancy related care up to at least 60 days post-partum, and in fact, Medicaid currently covers 48% of all births nationwide.[endnote EN7987-27] Many women, however, lose Medicaid coverage after the post-partum period since they no longer qualify for coverage because income eligibility thresholds for parents are considerably lower than those for pregnant women.[endnote EN7987-28] In states that expand their Medicaid programs, millions of women will gain Medicaid, and the ACA will preserve continuity of coverage by helping low-income new mothers maintain their coverage before pregnancy, during the prenatal and postpartum period and beyond. The ACA also requires coverage of comprehensive tobacco cessation programs for pregnant women on Medicaid and increased support for reimbursement of nurse midwives, birth attendants, and free-standing birth centers. In addition, all newborns lacking any other acceptable coverage will be eligible for Medicaid.

The ACA includes a number of other new benefits for pregnant women and new mothers, such as education and support services to women with postpartum depression, as well as funding for research into the causes, diagnoses, and treatments of postpartum depression. While funding levels were specified in the ACA for FYs 2010-2012, funds were not appropriated by Congress; consequently, no grants were awarded.[endnote EN7987-29] There are new investments in maternal, infant and early childhood home visiting programs[endnote EN7987-30] that require states to conduct family and community health needs assessments as well as provide grants to deliver services to high-risk families. The program has been funded for five years at $1.5 billion, and 54 states and territories were awarded funding in 2012. The ACA increases reimbursement under Medicare to pay nurse midwives at 100% of the reimbursement rates of physicians. While Medicare covers few births, its payment schedule is used by many insurers. The health reform law also amends the Fair Labor Standards Act to require employers with at least 50 employees to provide break time to nursing mothers for up to one year after the child’s birth as well as a private space that is not a bathroom to express milk. By providing workplace protections, this new rule has the potential to improve breastfeeding rates for mothers returning to the workplace postpartum. As mentioned above, new private health plans are now required to provide breastfeeding supports, including lactation consultation with a certified consultant and breast pump rental for the duration of breastfeeding. However, as with all services, the type of breast pump is subject to insurers’ “reasonable medical management” practices. There have been some cases of plans that provide only manual breast pumps,[endnote EN7987-31] which is allowed under the law unless a physician recommends an electric pump due to medical necessity.

Family Planning and Teen Pregnancy Prevention

Contraception is one of the most widely used services among women. Most workers in employer-sponsored plans are currently covered for contraceptives.[endnote EN7987-32] Family planning counseling and FDA approved contraceptives were added as a preventive service for women that must be covered by new private plans as of August 2012. However, in response to objections from some religious employers that oppose the use of contraception, HHS issued an exemption from the contraceptive coverage requirement of the law for houses of worship. In July 2013, the Department of Health and Human Services issued a final rule stating that nonprofit religiously-affiliated employers, such as hospitals, charities, and universities that object to the use of birth control will not have to spend their funds on the coverage of contraceptives. Under this rule, the insurance companies that sell plans to these employers or the third-party administrators that operates plans for those with self-funded plans will have to arrange for or pay for contraceptives services without cost-sharing directly for any employees and their dependents who desire it. Non-profit employers in this situation have been given until January 2014 to comply with this regulation. A number of employers, including several for-profit businesses, have filed lawsuits in opposition to the contraceptive coverage requirement and are continuing to pursue their cases after the final rules were issued.

Medicaid, in contrast, already requires that states cover family planning services without cost-sharing, and the federal government provides an enhanced matching rate to states for these services. The ACA specifies that states that decide to offer newly eligible Medicaid enrollees a benchmark benefit plan must include coverage of family planning services to all qualifying individuals. Additionally, more than half of states (31) currently have limited-scope Medicaid programs that provide coverage for family planning benefits (contraceptive devices, medical visits, and STI screening services) for individuals who do not qualify for full Medicaid coverage.[endnote EN7987-33] This program, however, has historically required that states receive special permission from the federal government to operate these more limited scope Medicaid family planning programs – a complicated and time consuming process for state officials. The health reform law allows states to extend eligibility for family planning services to those with incomes below 185% of poverty without going through the process of filing for federal permission (some states can set higher income thresholds). States can do this by changing their own Medicaid rules through a state plan amendment to their Medicaid program. Ten states have done this already (California, Connecticut, Indiana, New Mexico, North Carolina, Ohio, Oklahoma, South Carolina, Virginia, and Wisconsin).[endnote EN7987-34]

The ACA also provides funding ($75 million/year) for a new program, the State Personal Responsibility Education Program (PREP), for states to provide evidence based sex education to reduce teen pregnancy rates and the incidence of sexually transmitted infections. In FY 2012, 49 states, the District of Columbia, Puerto Rico, and the Federated States of Micronesia received more than $43 million to fund local programs.[endnote EN7987-35] The ACA also restores $50 million a year for five years in funding for the State Title V Abstinence Education Grant Program which expired in 2009 and was originally authorized in the 1996 welfare reform law. This program supports state programs that promote “abstinence unless married” education, a program that has been highly controversial and is not evidence based.

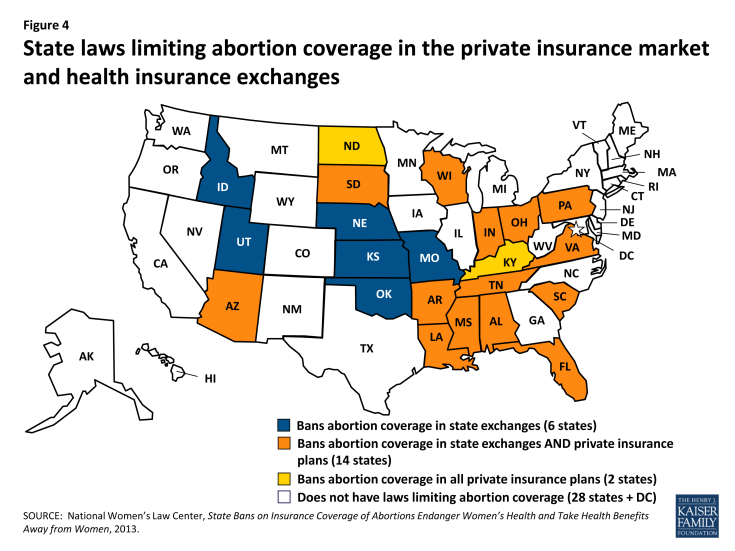

Abortion

The ACA outlines specific provisions regarding coverage for abortions. Under current law, the federal Hyde Amendment limits the use of federal funds for abortion only to cases when the pregnancy is a result of rape or incest or is a threat to the woman’s life. This rule limits abortion coverage for federal employees, Medicaid enrollees, and the Indian Health Service, and will remain in force under health reform. Abortions were not covered for women in the military, even in the case of rape or incest, until December 2012, when the Sheehan Amendment was passed as part of the 2013 National Defense Authorization Act, expanding access to abortion to include the Hyde Amendment limitations.[endnote EN7987-36] Furthermore, abortion coverage is specifically banned from being required as part of the essential benefits package offered by plans in exchanges and all of the exchanges must offer consumers the choice of at least one plan that does not provide abortion coverage. States may also enact legislation to ban any plan from offering abortion coverage, either in the exchange or more broadly in the private market and many states either have laws or are pressing forward with new laws that do that.[endnote EN7987-37] Six states have laws banning coverage of abortion in state health exchanges, fourteen states ban abortion coverage in both the exchanges and in the private insurance market, and two states ban abortion coverage in only the private market (Figure 4). Most of these states have exceptions for women whose pregnancies are a result of rape or incest, or put the mother’s life in danger, but two states (Louisiana and Texas) do not include exceptions. Additionally, plans participating in the marketplaces may not discriminate against any provider because of an unwillingness to provide, pay for, cover, or refer for abortions.

Figure 4: State laws limiting abortion coverage in the private insurance market and health insurance exchanges

In states that will have exchange plans that cover abortion, federal subsidy dollars will be limited to covering abortions only when the pregnancy endangers the life of the woman, or is the result of rape or incest, consistent with the current Hyde Amendment. Coverage for other abortions can be paid for with private, state or local funds. To ensure that federal funds are not used for abortion coverage, plans that do cover abortions beyond Hyde limitations must segregate funds and estimate the actuarial value of such coverage by taking into account the cost of the abortion benefit. This separate premium must be charged of all individuals who enroll in the plan (including men and women of all ages). For women on Medicaid, the state rules for Medicaid coverage will remain in effect. Currently, 17 states go beyond the federal limits on abortion coverage and offer coverage for other medically necessary abortions with state-only funds.[endnote EN7987-38]

Mental Health

Women experience higher rates of overall mental illness than men and often times experience episodes and illnesses differently.[endnote EN7987-39] The essential health benefits require private insurers to cover mental health screening and treatment services, which will expand access to millions of women. Currently, only 18% of individuals who purchase health insurance in the individual market have policies that cover mental health services.[endnote EN7987-40] While one out of every four women (26%) report they have been diagnosed with depression or anxiety in the past five years, only 35% of women reported discussing mental health topics with a physician or nurse.[endnote EN7987-41] In addition to increased access to general mental health services, women now are covered for the full cost of interpersonal and domestic partner violence screening and counseling services. Because women experience higher rates of depression and intimate partner violence, and are more likely to utilize mental health services, expanding access to and incorporating mental health screenings into routine care could have a major impact on the health of affected women.

Coverage for Older Women and Women with Disabilities

Medicare

Accounting for 56% of all Medicare beneficiaries, women on Medicare have significant health needs and on average live longer and experience higher rates of many chronic health conditions than men.[endnote EN7987-42] However, the program has relatively high cost- sharing requirements, which can be prohibitive for many seniors, particularly for older women, who have fewer financial resources than their male counterparts. In addition to affordability challenges, the Medicare program has had some notable gaps in coverage for long-term care, prescription drugs, and essential services such as vision and dental care. Furthermore, some preventive benefits important to older women’s health, such as mammography, clinical breast exams, bone density tests, and visits for Pap test and pelvic exams, have required 20% coinsurance which can serve as a barrier to getting these recommended services.[endnote EN7987-43] This is especially important as older women on Medicare have considerably lower median incomes than men ($21,853 and $27,480 respectively).[endnote EN7987-44]

The ACA makes several changes to Medicare that should reduce some of the out-of-pocket costs beneficiaries have incurred for drugs and preventive services. As discussed earlier, as of 2011, Medicare beneficiaries no longer have to pay any cost-sharing for all preventive services that the USPSTF has rated A or B which includes mammograms, pap smears, and bone density screenings (Table 2). In addition, all Medicare beneficiaries will be eligible to receive a personalized health plan that includes an annual comprehensive risk assessment. Prescription drug coverage is also a critically important issue for women on Medicare. The law makes some important changes to reduce the spending gap found in Medicare Part D prescription drug coverage, called the “doughnut hole.” By 2020, beneficiaries will be responsible for a 25% coinsurance rate when in the “doughnut hole,” down from the responsibility of 100% of costs today.[endnote EN7987-45] Enrollees received a $250 rebate if they had any spending in the coverage gap in 2010, and in 2011 received a 7% discount on generic drugs equaling a savings of approximately $604 per enrollee.[endnote EN7987-46] In 2012, the discounts increased to 50% on brand name medications and 14% on generics. There will continue to be a phased in discount program to reduce costs of both brand name and generic drugs for Medicare beneficiaries, saving beneficiaries nearly an average of $4,200 by 2021.

Long-Term Care

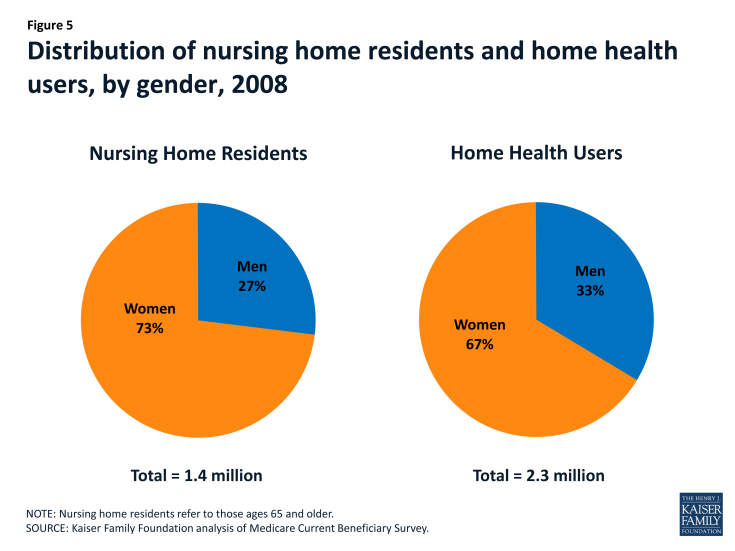

For frail and elderly women and their families, long-term care is a crucial concern. Women are more likely than men to both need long-term care services and to lack the social supports and resources needed to live independently in the community.[endnote EN7987-47] As a result, women comprise the majority of nursing home residents and home health users (Figure 5). Women who need long-term care services often pay sizable out-of-pocket costs for nursing home and community based care, as a result of the limited coverage for long-term care under both Medicare and private policies.[endnote EN7987-48]

The ACA originally included a new program to provide some assistance with long-term care costs via the Community Living Assistance Services and Support (CLASS) Act. This would have been a voluntary insurance program that working adults could purchase by making contributions through payroll deductions through their employer or on their own.[endnote EN7987-49] However, HHS Secretary Sebelius reported in October 2011 that the Department does not see a viable path forward and has stopped its implementation, and Congress has subsequently repealed this program.

Federal Offices on Women’s Health

The ACA codifies the establishment of Offices on Women’s Health in major federal agencies, including HHS, the Centers for Disease Control and Prevention, the Food and Drug Administration, Health Resources and Services Administration, and an office of Women’s Health and Gender-Based Research at the Agency for Healthcare Research and Quality. These offices establish goals, provide information on women’s health activities, and identify women’s health priorities within their respective agencies. The ACA also authorizes the establishment of an HHS Coordinating Committee on Women’s Health to coordinate the activities of these offices as well as a National Women’s Health Information Center to facilitate the exchange of information regarding health promotion, prevention, major advances in research, and other relevant developments in women’s health. While many of these offices existed before the ACA, the law offers additional protection by prohibiting termination, reorganization, or transfers of powers and responsibilities of the offices or other appointed position with primary responsibility over women’s health issues without the direct approval of Congress.

The ACA offers many opportunities to improve access to care and coverage for women of all ages, ranging from insurance system reforms, to lowering out-of-pocket costs, and securing comprehensive benefits packages that address women’s health needs across the course of their lives (Table 2). These issues are essential to women’s ability to obtain timely, appropriate care and preventive services.