Medicaid in the Territories: Program Features, Challenges, and Changes

Introduction

Individuals born in the U.S. territories are U.S. citizens or nationals, but Medicaid, like other public programs, operates differently in the territories than it does in the states. This brief examines key issues and trends in the U.S. territories’ Medicaid programs. The findings are drawn from a budget survey and interviews with Medicaid officials in four of the five U.S. territories — Puerto Rico, the U.S. Virgin Islands (USVI), Guam, and American Samoa. The survey and interviews were conducted by the Kaiser Family Foundation (KFF) and Health Management Associates (HMA) in July and August 2018.1 Due to wide variation in the structure and administration of the territories’ Medicaid programs, this brief does not provide a comprehensive overview of each territory’s program, but instead focuses on major issues and changes from fiscal years 2017 to 2019. Information was also drawn from other Kaiser Family Foundation briefs examining the impact of 2017 Hurricanes Irma and Maria on Puerto Rico and USVI. All territories but Puerto Rico follow the federal fiscal year, which begins on October 1, while Puerto Rico’s fiscal year begins July 1. Key findings from the surveys and interviews are included in the following areas: Medicaid financing, eligibility and enrollment, benefits, and provider access and delivery systems.

Background

The territories differ from the states on key demographic, economic and health status indicators. The population of the U.S territories ranges from approximately 51,000 people in American Samoa to nearly 3.3 million people in Puerto Rico.2 Recent data for Puerto Rico show a poverty rate 31 percentage points higher (42%) than that of the states (11%), and much older data for the other four territories show that between 22% and 57% of residents were living in poverty.3 In addition, territory residents often face heightened health challenges. For example, self-reported health is significantly more likely to be fair or poor in Guam (22%) and Puerto Rico (37%) than in the 50 states and D.C. (18%).4 Individuals in Guam and USVI also report needing to see a doctor in the previous 12 months but being unable to do so because of cost at significantly higher rates than individuals in the 50 states and D.C. While 13% of individuals report this access challenge in the 50 states and D.C., the rate jumps to 21% in Guam and 22% in USVI.5 Finally, the rates of Medicaid or CHIP coverage in the territories are equal to or higher than those in United States overall (21%) (see Table 1).

| Table 1: Medicaid and CHIP Enrollment in the U.S. Territories, July 2016 | |||

| Territory | Total Population Size | Number Covered by Medicaid and CHIP | Share Covered by Medicaid or CHIP |

| American Samoa | 51,500 | 40,517 | 79% |

| Guam | 167,400 | 35,798 | 21% |

| Northern Mariana Islands | 52,300 | 17,000 | 33% |

| Puerto Rico | 3,351,800 | 1,370,437 | 41% |

| U.S. Virgin Islands | 107,300 | 23,177 | 22% |

|

NOTES: Number of enrollees for American Samoa are estimates of the portion of the population below 200% FPL, the population which Medicaid pays for health care services. Enrollment figures for Puerto Rico include 89,372 children enrolled in CHIP as reported by Puerto Rico for July 2016.

SOURCES: MACPAC, Medicaid and CHIP in the Territories, (Washington, DC: MACPAC, October 2017), https://www.macpac.gov/publication/medicaid-and-chip-in-the-territories/. Kaiser Family Foundation analysis of population estimates from The World Factbook 2017. Washington, DC: Central Intelligence Agency, 2017, https://www.cia.gov/library/publications/the-world-factbook/index.html.

|

|||

Many of the territories face longstanding fiscal challenges. For example, in response to the economic crisis in Puerto Rico, Congress passed the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) in June 2016 to allow Puerto Rico to restructure its debts and manage its revenues and expenditures. PROMESA created the Financial Oversight and Management Board (FOMB), which in part requires Puerto Rico’s government to submit a fiscal plan that gains the FOMB’s approval.6 USVI has also faced financial challenges, as its economy declined by over 30% between 2008 and 2016, accompanied by population loss and job loss in certain industries.7 American Samoa reported that its economy is vulnerable and locally unsustainable, as federal grants comprise three quarters of the territory’s budget.

Recent natural disasters and other external factors exacerbated longstanding economic challenges in the territories. The 2017 hurricanes and their aftermath worsened the existing fiscal challenges in Puerto Rico and USVI by exacerbating outmigration of professionals and job loss; destroying homes, schools, and other buildings; and reducing tourism. While navigating its hurricane recovery and slow rebuilding processes, Puerto Rico has also taken steps to comply with the FOMB-approved fiscal plan that calls for spending cuts in the territory. In Guam, the North Korean missile crisis in 2017 and 2018 affected the territory’s tourism economy. Guam also suffered from Typhoon Mangkut in September 2018, and Super Typhoon Yutu tore through the Northern Mariana Islands (NMI) in October 2018, with both storms bringing widespread destruction.8

Context and Findings

Medicaid Financing

Unlike in the 50 states and D.C., annual federal funding for Medicaid in the territories is subject to a statutory cap and fixed matching rate. The territories’ federal matching rate (known as the federal medical assistance percentage, or FMAP) is fixed in statute, unlike the statutory formula for states, which is uncapped and adjusted annually based on a state’s relative per capita income. The ACA increased the traditional territory FMAP from 50% to 55% (plus 2.2 percentage points for 2014 and 2015) and provided the territories with a higher matching rate for non-disabled adults without children (87% in 2017). In contrast, Mississippi – a state with per capita income of $22,500 compared to Puerto Rico’s $12,0819 – receives a traditional FMAP of 74.63% in FFY 2019. Notwithstanding temporary relief funds discussed below, once a territory exhausts its capped federal funds, it no longer receives federal financial support for its Medicaid program during that fiscal year, placing additional pressure on territory resources if Medicaid spending continues beyond the federal cap. In this scenario, the effective FMAP rate is lower than the 55% set in statute.

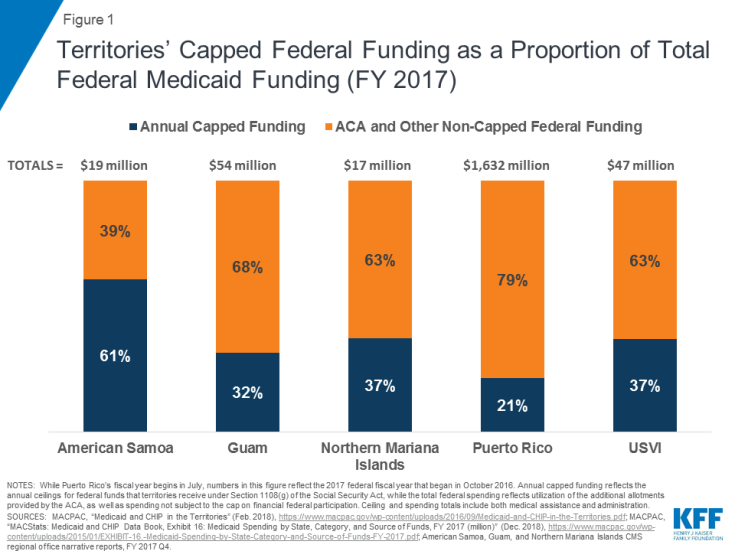

The federal government made a total of $7.3 billion in additional funds available across all five territories under the ACA, but most of these funds expire at the end of September 2019. The $7.3 billion consists of a $6.3 billion allotment available between July 2011 and September 2019 and another $1 billion in funds, provided in lieu of the territories creating their own health insurance exchanges, which expire at the end of December 2019.10 Of this $7.3 billion, Puerto Rico received the large majority ($6.3 billion). While Puerto Rico is the only territory that expects to exhaust its ACA funds before they expire, all territories have consistently relied on ACA dollars to fund their Medicaid programs beyond the federal caps (see Table 2). Specifically, federal funds from the caps represent 21 percent to 59 percent of annual federal Medicaid spending in the territories (see Figure 1). American Samoa described the impending 2019 expiration of the temporary ACA funds as “devastating,” while USVI anticipated a “giant” fiscal cliff after their expiration.

| Table 2: Medicaid Funding and Spending in the U.S. Territories, FY 2017 (millions) | ||||

| Territory | Medicaid Funds | Total Additional ACA Funds11 | ||

| Federal Ceiling | Spending | |||

| Federal | Territory | |||

| American Samoa | $11.51 | $19 | $15 | $197.8 |

| Guam | $17.02 | $54 | $29 | $292.7 |

| Northern Mariana Islands | $6.34 | $17 | $13 | $109.2 |

| Puerto Rico | $347.4 | $1,632 | $805 | $6,325 |

| U.S. Virgin Islands | $17.3 | $47 | $23 | $298.7 |

|

NOTES: While Puerto Rico’s fiscal year begins in July, numbers in this table reflect the 2017 federal fiscal year that began in October 2016. Federal Medicaid ceilings reflect the annual ceilings for federal funds that territories receive under Section 1108(g) of the Social Security Act, while the actual federal spending reflects utilization of the additional allotments provided by the ACA, as well as spending not subject to the cap on financial federal participation. Ceiling and spending totals include both medical assistance and administration.

SOURCES: MACPAC, “Medicaid and CHIP in the Territories” (Feb. 2018), https://www.macpac.gov/wp-content/uploads/2016/09/Medicaid-and-CHIP-in-the-Territories.pdf; MACPAC, “MACStats: Medicaid and CHIP Data Book, Exhibit 16: Medicaid Spending by State, Category, and Source of Funds, FY 2017 (million)” (Dec. 2018), https://www.macpac.gov/wp-content/uploads/2015/01/EXHIBIT-16.-Medicaid-Spending-by-State-Category-and-Source-of-Funds-FY-2017.pdf; American Samoa, Guam, and Northern Mariana Islands CMS regional office narrative reports, FY 2017 Q4.

|

||||

Figure 1: Territories’ Capped Federal Funding as a Proportion of Total Federal Medicaid Funding (FY 2017)

Puerto Rico and USVI officials worry about the expiration of temporary Medicaid relief funds in September 2019. After Hurricanes Irma and Maria hit Puerto Rico and the USVI in September 2017, Congress included additional funding for these territories in the Bipartisan Budget Act (BBA) of 2018: $4.8 billion for Puerto Rico ($1.2 billion of which were conditional funds) and $142.5 million for USVI ($35.6 million of which were conditional). These relief funds do not require a local/territory match and will expire at the end of September 2019. Because of the 100% FMAP for these funds, both Puerto Rico and USVI saw their non-federal shares of Medicaid spending drastically decline in FY 2018 and FY 2019, but they anticipate a fiscal cliff after both the ACA and BBA funds expire in September 2019 that will require large increases in territory spending to make up for the loss of federal funds. As noted in a separate report, one Puerto Rico official said that, without additional support, the budget pressures could lead the uninsured population to increase from about 500,000 to over 1 million people.

The territories reported that paying for off-island services and enrollment increases were additional key upward pressures on Medicaid spending. Two territories — American Samoa and USVI — reported that off-island service referrals were significant factors in expenditure growth, driven by hurricane damage to the health care infrastructure in USVI and by the general lack of certain specialty services, such as knee replacement surgery, in American Samoa. Other current or expected expenditure drivers cited included enrollment increases in USVI, planned coverage of durable medical equipment in American Samoa, and pharmacy costs and reimbursement of a new private hospital in Guam.

Guam and Puerto Rico reported factors that could exert downward pressure on Medicaid spending. Guam reported that an increase in available on-island specialty services was resulting in fewer off-island transfers and helping to mitigate costs. In Puerto Rico, the FOMB finalized a fiscal plan in October 2018 that called for significant spending cuts.12 Under the plan, education and health care face the sharpest budget cuts, which could result in out-year reductions in Medicaid managed care spending. These cuts are designed to mitigate the increase in local funds after ACA and BBA funds expire, as Puerto Rico has traditionally expended beyond its annual federal cap to finance its health care system. In addition, the effects of Puerto Rico’s broader outmigration on Medicaid enrollment are unclear.

Eligibility and Enrollment

The territories use different methods to set Medicaid eligibility levels. Guam, Puerto Rico, and USVI determine eligibility according to local poverty levels, while American Samoa does not determine eligibility on an individual basis. Instead, American Samoa receives federal Medicaid funds in proportion to the percentage of the population that would have incomes below 200% FPL and presumes eligibility for this population. NMI, which is the only territory that is eligible for Supplemental Security Income (SSI), ties eligibility for Medicaid to the income and resource requirements for SSI. Through statutory or waiver authority, all five territories are also exempt from covering certain mandatory Medicaid coverage groups, including poverty-related children and pregnant women and qualified Medicare beneficiaries.13 However, three territories have expanded Medicaid eligibility, with Guam, Puerto Rico, and USVI electing to cover the ACA’s new adult group with incomes up to 133% of the territories’ local poverty levels.

The 2017 hurricanes in Puerto Rico and USVI affected eligibility and enrollment trends in the two territories. Compared to one year earlier, Puerto Rico and USVI reported that their enrollment had increased in FY 2018. Puerto Rico reported that, after increasing in FY 2018 due to automatic one-year eligibility renewals implemented after the hurricanes, the territory expects the expiration of these automatic renewals and the ongoing outmigration to exert downward pressure on enrollment in FY 2019. The effects of Puerto Rico’s broader outmigration trends on Medicaid enrollment and its case mix are still unclear. Conversely, USVI reported that it expected enrollment to increase due to hurricane-related impacts and the ongoing phase-in of expansion populations and outreach to eligible individuals.

Other territories reported stable enrollment trends. Guam reported that its enrollment was stable and that it expected enrollment to remain the same in 2019 as well even with some upward enrollment pressure resulting from its previous ACA childless adult expansion and from migration related to the Compact of Free Association (COFA), an international agreement that applies to residents of the Marshall Islands, Micronesia, and Palau.14 American Samoa has a unique form of presumptive eligibility but noted that the size of the presumptively eligible population has remained flat or decreased due to outmigration over the past two to three years.

Benefits

Benefit coverage varies across the territories and in comparison to the states. While Guam, Puerto Rico, and USVI are required to cover all mandatory Medicaid benefits, only Guam does so.15 American Samoa and NMI operate their Medicaid programs under Section 1902(j) waivers, which allow the federal government to waive any Medicaid program requirements except for the statutory FMAP and ceiling on federal funds. Under these waivers, American Samoa and NMI are not required to cover all mandatory benefits. All territories, however, cover some optional benefits, including prescription drugs and dental services.16

Some officials cited long-term services and supports (LTSS), non-emergency medical transportation (NEMT), coverage of hepatitis C drugs, and durable medical equipment as Medicaid benefits that the territory was seeking to add. Guam was the only territory to report coverage of LTSS, although USVI reported that it was currently working internally and with stakeholders to implement LTSS coverage in the future, including implementation of a Health Home program for the aged. Puerto Rico reported that it had no plans in place to add LTSS coverage and that its benefit expansion priorities, when resources become available, are NEMT and coverage of hepatitis C antivirals. American Samoa reported that it had implemented two recent benefit expansions: coverage of off-island services through direct reimbursement as of FY 2018, and coverage of durable medical equipment as of FY 2019.17

Provider Access and Delivery Systems

Medicaid in the territories helps to finance public and private hospitals and clinics, some of which face resource challenges. While both private and public hospitals operate in Puerto Rico, the only two hospitals in USVI are public; there are no private acute care facilities in USVI.18 American Samoa, Guam, and NMI provide nearly all of their Medicaid services through one public hospital in each territory, although a private hospital that accepts Medicaid patients opened in Guam in 2015.19,20 Due to staffing and facility shortcomings, the hospitals in American Samoa, Guam, NMI, and USVI have struggled to maintain compliance with CMS standards for Medicare certification.21,22,23 All territories also operate federally qualified health centers (FQHCs) and community health centers.

The 2017 hurricanes had a significant impact on hospitals and clinics in Puerto Rico and USVI. Both Puerto Rico and USVI reported that hurricane damage has affected the availability of hospital services. For example, Puerto Rico reported that all hospitals are now up and running, but many have closed floors and are waiting for pending insurance claims, delaying repairs. Puerto Rico also reported that a decrease in births in the territory had led some hospitals to close their obstetrical units. In USVI, one of the territory’s two hospitals suffered extensive damage and still did not have an operating suite or the ability to do CAT scans at the time of the survey. While the other territory hospital was providing surgery, emergency, and ancillary services as of July 2018, its cancer center remained closed due to hurricane damage, and it was still waiting for complete federal assessments for determination of repair or rebuilding.

Most territories have struggled with provider shortages. Prior to the hurricanes, Puerto Rico was already experiencing ongoing provider outmigration and shortages,24 which the territory attributed to lower reimbursement rates compared to the states. As of January 2017, 55 of Puerto Rico’s 78 municipalities contained at least one federally designated Health Professional Shortage Area (HPSA).25 Similarly, USVI was experiencing a shortage of health providers and services prior to the hurricanes, as the federal government had previously designated the entire territory a HPSA.26 The hurricanes further exacerbated the provider access challenges in Puerto Rico and USVI, with increased rates of provider outmigration. In American Samoa, Guam, and NMI, the public hospitals that provide most of their Medicaid services have historically faced staff shortages due to factors such as low staff salaries and poor infrastructure tied to high rates of uncompensated care and other economic forces.27,28 These provider shortages and the remote island geography of the territories in the South Pacific can require patients to travel long distances to receive medical services that are not available on-island. For example, residents in these three territories often travel thousands of miles to Hawaii, the Philippines, or New Zealand for care.

Some territories cite challenges with provider supply in certain services or specialties. For example, both USVI and American Samoa reported shortages of behavioral health (BH) providers. USVI reported that BH services were at the top of the list of health care needs and a “huge” challenge that has persisted for years. The need for BH services among USVI residents has only increased since the 2017 hurricanes. USVI noted shortages of various additional specialties. Puerto Rico reported general problems with provider availability, driven by the outmigration of providers to the states, a longstanding challenge that worsened after the 2017 hurricanes. Like USVI, Puerto Rico also faces a mental health crisis among its residents after the hurricanes. None of the territories cited access to primary care as an area of concern.

Puerto Rico and USVI reported updates about delivery system reforms. Among the territories, only Puerto Rico operates its Medicaid program through managed care organizations (MCOs). As part of Puerto Rico’s certified fiscal plan, the territory has shifted its managed care system from its previous eight regions with one plan available per region to one territory-wide region in which plans compete for providers and enrollees. In the midst of its recovery from the 2017 hurricanes, Puerto Rico continued work to launch the new system, and enrollment in the new plans began on November 1, 2018. The changes are intended to improve access by enabling enrollees to access medical services throughout the territory. Under the new contracts, capitation rates are risk-adjusted, providing higher payments for enrollees with high needs. The MCOs, in turn, are required to offer new prevention and care programs for enrollees with chronic conditions and high needs, such as cancer, diabetes, end-stage renal disease, chronic obstructive pulmonary disease (COPD) with asthma, hypertension, severe heart failure, and severe mental illness.29 In addition, USVI reported that it had received a Care Management grant from CMS and that various workgroups had formed to support work on this topic. The territory is also actively pursuing improvements to its behavioral health care system, including adding new providers, expanding facilities, and supporting a territory-wide Behavioral Health Planning and Advisory Council to oversee the changes.

Looking Ahead

While additional information and research are needed to better understand how Medicaid operates in the territories, it is clear that the federal financing caps present a challenge for all territories. These underlying financing issues will reemerge and may worsen when temporary federal Medicaid funds tied to the ACA and disaster relief expire in September and December 2019. Puerto Rico and USVI face the additional challenge of losing the 100% FMAP tied to the relief funds. Officials in the territories cite the difficulties of both managing their programs within these federal caps and raising the local 45% share to access those funds. These financing issues are at the core of ongoing challenges related to eligibility, benefit coverage, adequate provider access, and delivery system reforms. Financing changes in the form of increased federal matching rates, higher spending caps, or an elimination of the spending caps entirely could help catalyze changes and advances in these and other areas as the territories strategize to meet the health care needs of their Medicaid populations. On the other hand, expiration of temporary Medicaid funds without new resources to address the resulting fiscal cliff could have negative consequences for Medicaid coverage and services.