Data Note: Public Worries About And Experience With Surprise Medical Bills

Democrats and Republicans in Congress have been working on legislation to protect patients from surprise medical bills. As of February 2020, no legislation has been passed. The term “surprise medical bills” is usually used to describe charges incurred when an insured individual inadvertently receives care from an out-of-network provider, however there are various other scenarios in which patients might encounter medical bills that they weren’t expecting.

The February KFF Health Tracking Poll gauged public worries about and experience with unexpected and surprise medical bills.

Two in three adults worry about unexpected medical bills

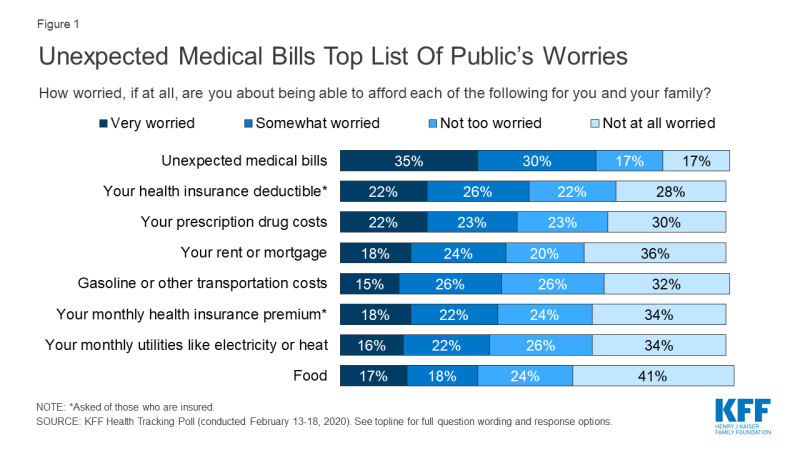

About two-thirds of Americans say they are either “very worried” (35%) or “somewhat worried” (30%) about being able to afford unexpected medical bills. This is larger than the share that say they are worried about affording a variety of expenses, including other types of health care costs as well as other household expenses. About half of insured adults say they worry about being able to afford their health insurance deductible (49%) and four in ten (40%) worry about being able to afford their premiums. More than four in ten adults overall worry about affording prescription drug costs (45%). Similar shares say they worry about affording their rent or mortgage (42%) and gasoline or other transportation costs (40%) and more than a third of adults say they worry about being able to afford utilities (38%) and food (34%).

Among insured adults, those ages 18-64 (65%) are more likely than those 65 and over (54%), most of whom have Medicare coverage, to say they are at least “somewhat worried” about unexpected medical bills. Among adults ages 18-64 without insurance, an even larger share (81%) say they are at least somewhat worried.

One-third of insured adults, 18-64, report RECEIVing An UNEXPECTED MEDICAL BILL IN THE PAST two YEARs

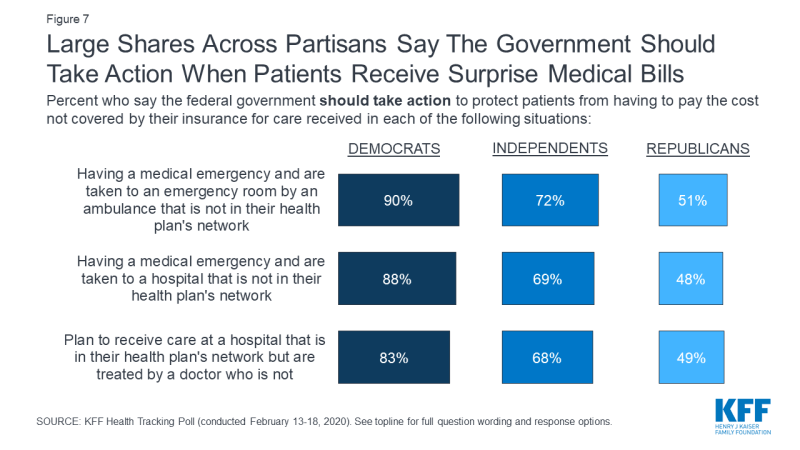

One-third of insured adults ages 18-64 say there has been a time in the past two years when they received an unexpected medical bill after they or a family member received care from a doctor, hospital, or lab that they thought was covered and their health plan either didn’t cover the bill at all or covered less than they expected. Overall, 16% of insured adults ages 18-64 say they have received a “surprise” bill related to care received from an out-of-network provider.

Figure 2: One In Three Insured Adults, 18-64, Say Their Family Had An Unexpected Medical Bill; One In Six Had A Surprise Medical Bill

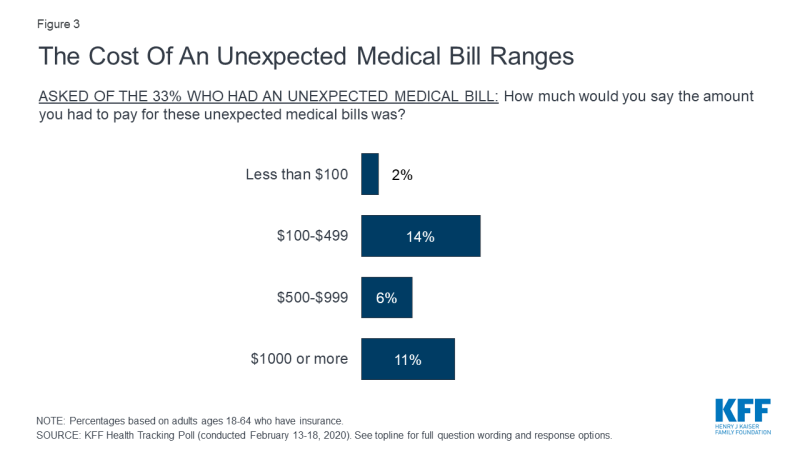

Unexpected medical bills can be of varying amounts. About half (49%) of those who report receiving an unexpected medical bill (16% of all insured adults ages 18-64) say the amount they were expected to pay was less than $500. One-third of those who received an unexpected bill (11% of all insured adults ages 18-64) say the amount was $1000 or more.

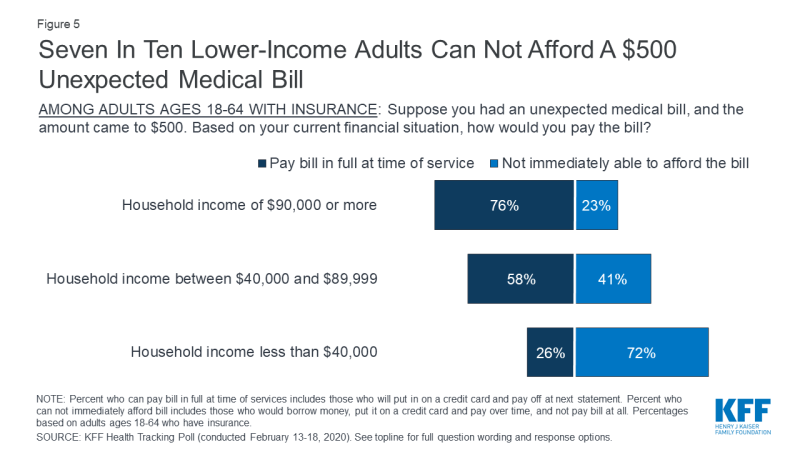

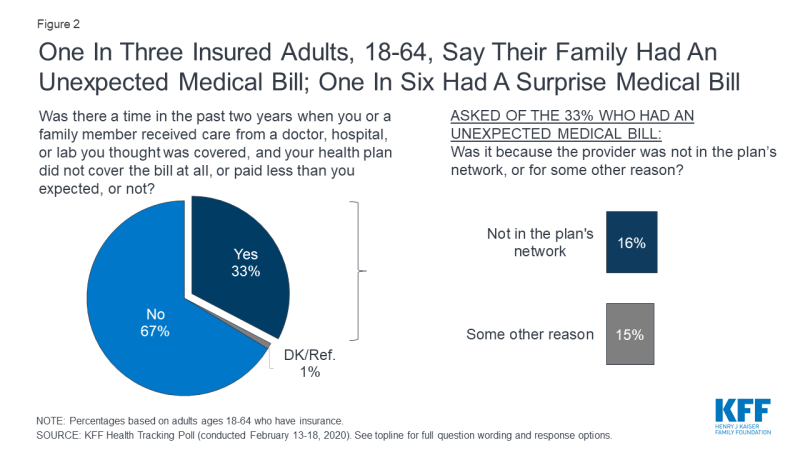

Even relatively small unexpected medical bills can present a financial hardship for some individuals. When asked how they would pay an unexpected $500 medical bill, 54% of insured adults, ages 18-64 say they would pay the bill in full at the time of service or put it on a credit card and pay it off at the next statement, while more than four in ten (45%) would not be able to immediately afford the $500 unexpected medical bill.

Figure 4: More Than Four In Ten Insured Adults Ages 18-64 Could Not Afford A $500 Unexpected Medical Bill

While more than seven in ten insured adults ages 18-64 with household incomes of $90,000 or more (76%) say they would pay their bill in full at the time of service or put it on a credit card and pay it off at the next statement, seven in ten of those with household incomes under $40,000 (72%) would not immediately be able to afford a $500 unexpected medical bill.

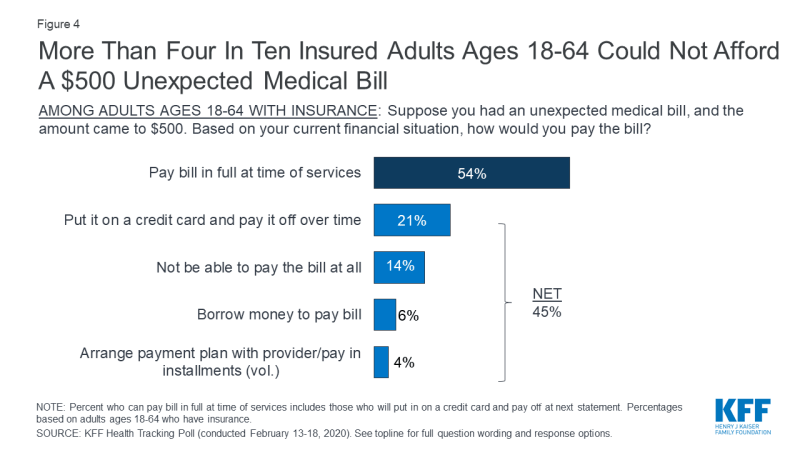

Public Wants Congress to take action on surprise Billing

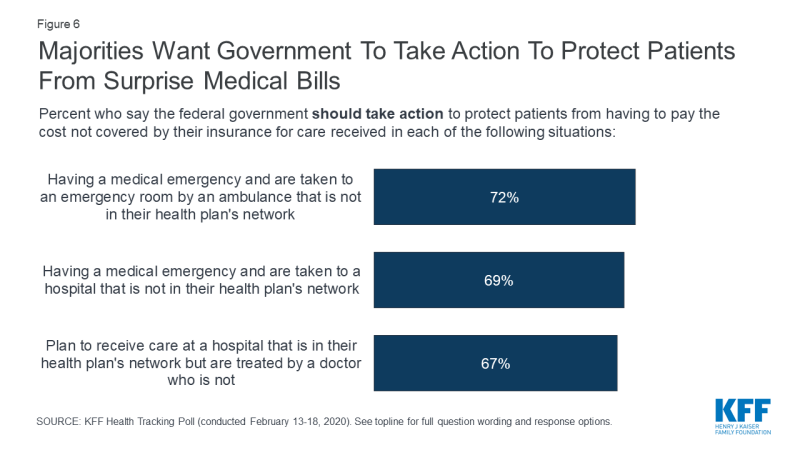

As Congress continues to work on legislation to address surprise medical bills, this month’s KFF Health Tracking Poll finds broad public support for federal government actions to protect patients. At least two-thirds of the public say the federal government should take action to protect patients from covering the cost of care when they are taken to an emergency room by an out-of-network ambulance (72%), when they are taken to an out-of-network emergency room during a medical emergency (69%), or when they are at an in-network hospital but treated by an out-of-network doctor or specialist (67%).

Across partisans, more than eight in ten Democrats and more than two-thirds of independents think the federal government should take action to protect patients from having to pay costs not covered by their insurance when they are taken to an emergency room by an out-of-network ambulance, taken to an out-of-network emergency room during a medical emergency, or when they are at an in-network hospital but treated by an out-of-network doctor. Among Republicans, about half think the federal government should take action to protect patients from surprise bills in these situations.