2020 Employer Health Benefits Survey

Report

2020 Employer Health Benefits Survey

Report

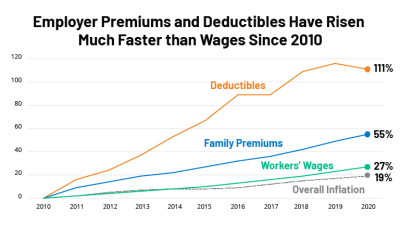

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, offer rates, wellness programs, and employer practices. Annual premiums for employer-sponsored family health coverage reached $21,342 this year, up 4% from last year, with workers on average paying $5,588 toward the cost of their coverage.