An Overview of Medicare

Issue Brief

An Overview of Medicare

Issue Brief

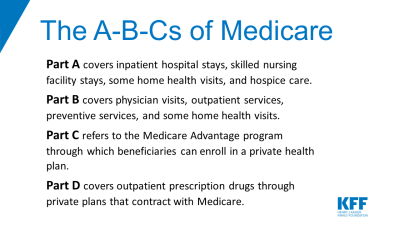

This issue brief provides an overview of Medicare, the health insurance program for people ages 65 and over and younger people with long-term disabilities. The brief review the characteristics of people on Medicare, what Medicare covers, benefit gaps and supplemental coverage, beneficiaries’ out-of-pocket health care spending, program spending and financing, payment and delivery system reform, and issues for the future of Medicare.