Medicare Beneficiaries’ Out-of-Pocket Health Care Spending as a Share of Income Now and Projections for the Future

Report

Medicare Beneficiaries’ Out-of-Pocket Health Care Spending as a Share of Income Now and Projections for the Future

Report

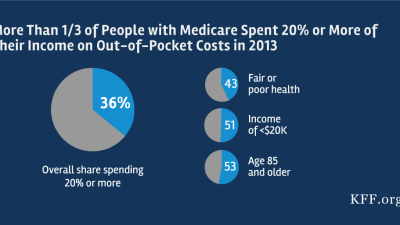

Medicare helps pay for the health care needs of 59 million people, including adults ages 65 and over and younger adults with permanent disabilities. Even so, many people on Medicare incur relatively high out-of-pocket costs for their health care. This report assesses the current and projected out-of-pocket health care spending burden among Medicare beneficiaries, analyzing spending as a share of Social Security income and total income, for beneficiaries overall, and by demographic, socioeconomic, and health status measures, for 2013 and projections for 2030.