A Look at Navigating the Health Care System: Medicaid Consumer Perspectives

Issue Brief

A Look at Navigating the Health Care System: Medicaid Consumer Perspectives

Issue Brief

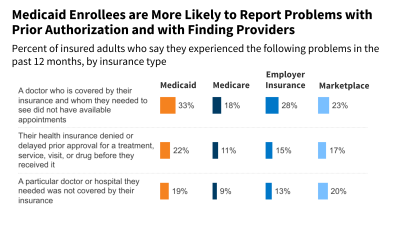

This brief gauges Medicaid enrollees’ perspectives on their health insurance, based on findings from KFF’s Survey of Consumer Experiences with Health Insurance, fielded February 21 through March 14, 2023. This brief provides an overview of the survey findings, describes Medicaid enrollees’ views of their health and health coverage, explores problems those with Medicaid experience, compares how Medicaid performs relative to Medicare and private coverage, and reviews variation in Medicaid experiences.