To Switch or Not to Switch: Are Medicare Beneficiaries Switching Drug Plans To Save Money?

APPENDIX 1: STUDY METHODOLOGY

The analysis for this study is based on a 5-percent random sample of Medicare beneficiaries, obtained from the Centers for Medicare & Medicaid Services (CMS), for each year from 2006 to 2010. The sample dataset includes information on the characteristics of beneficiaries from the Master Beneficiary Summary File and Part D plan information from the Part D Plan Characteristics Files (encrypted at the level of the contract ID and plan ID).

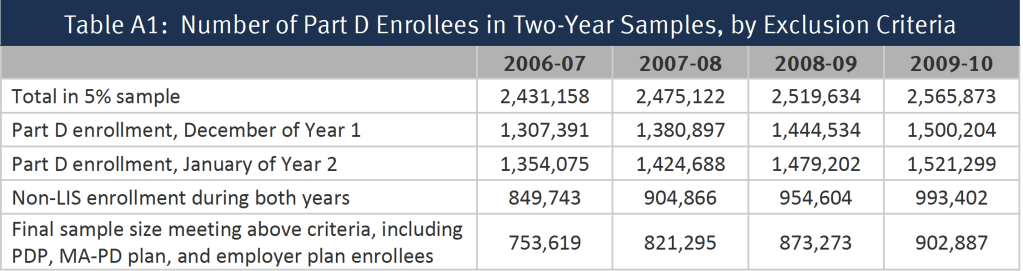

From the one-year samples, we matched beneficiaries across years to build a series of samples of beneficiaries who were enrolled in the Part D program for each of four two-year periods (2006-07, 2007-08, 2008-09, and 2009-10) (Table A1). To be included in a two-year sample, beneficiaries (1) must have participated in Part D in both December of the first year of a two-year pair and January of the second year and (2) must have been non-LIS in all months for which they were enrolled in a drug plan. Anyone who died prior to January of the second year is excluded from the analysis. By measuring enrollment in December of year one, we focus the study only on switches occurring in the annual enrollment period. This rule also allows inclusion of beneficiaries who entered the program during the full annual enrollment period for 2006, which extended from November 15, 2005 until May 15, 2006.

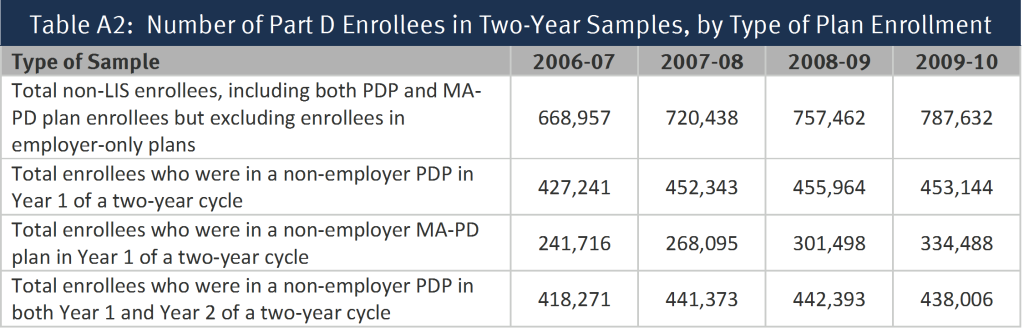

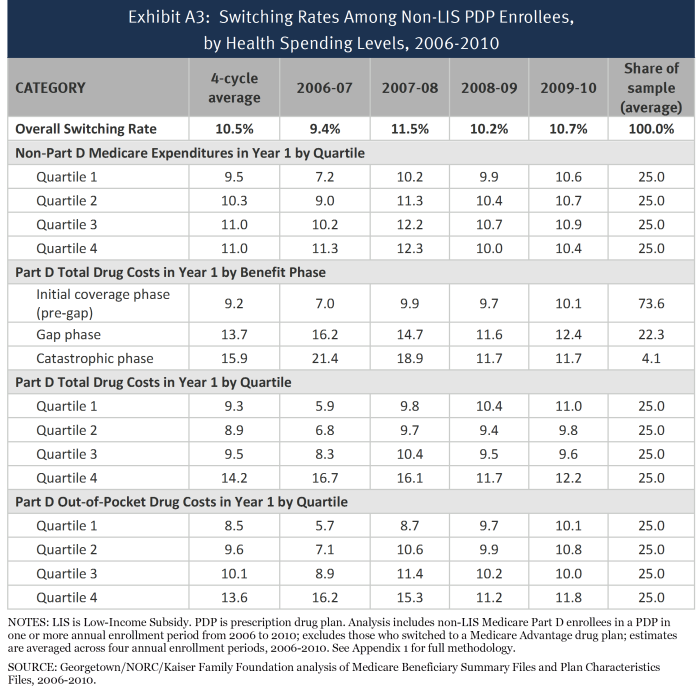

Separate sub-samples were created for those who were enrolled in a stand-along prescription drug plan (PDP) in the first year of each two-year cycle and those who were enrolled in a Medicare Advantage prescription drug (MA-PD) plan in the first year; most of the analysis reported here is based on the PDP sample (Table A2). Part D enrollees in employer-only plans were excluded from the analysis. For the segments of the analysis examining the impact of individual and plan characteristics, we further subset the sample to include only PDP enrollees who remained in a PDP in the second year. By excluding Part D enrollees who are in MA-PD plans before or after the annual enrollment period, we avoid the complications of the larger array of factors related to plan switching in the Medicare Advantage market. This last reduction to the sample eliminates those switching from a PDP to an MA-PD plan, therefore the rate of switching is reduced from 12.9 percent (averaged across the four annual enrollment periods) of the sample of all enrollees in a PDP entering the annual enrollment period to 10.5 percent of enrollees in PDPs both before and after.

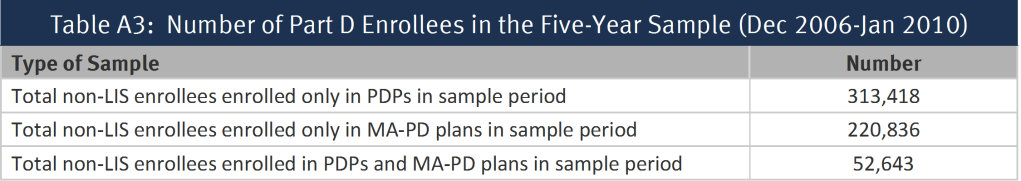

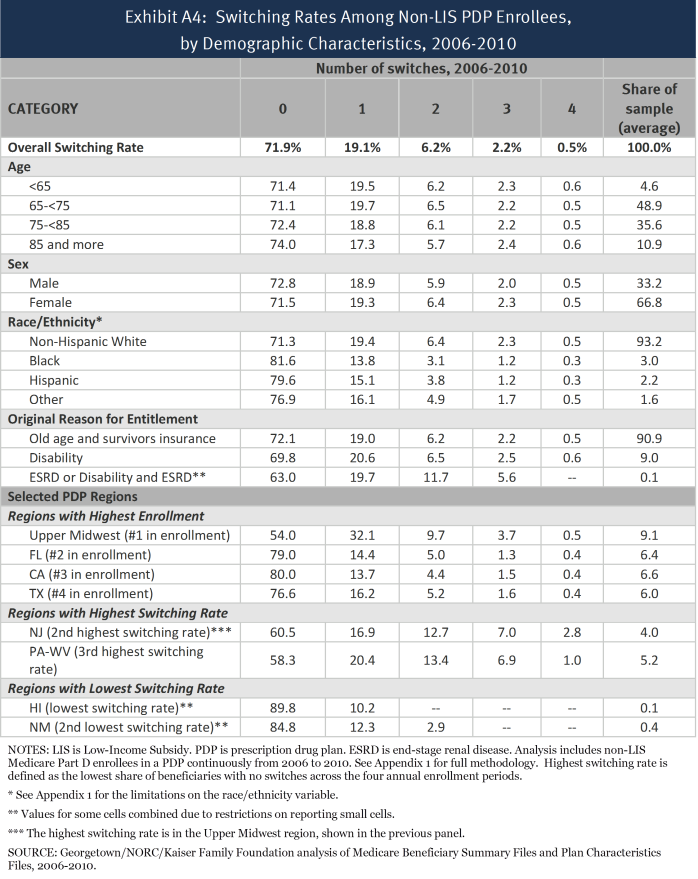

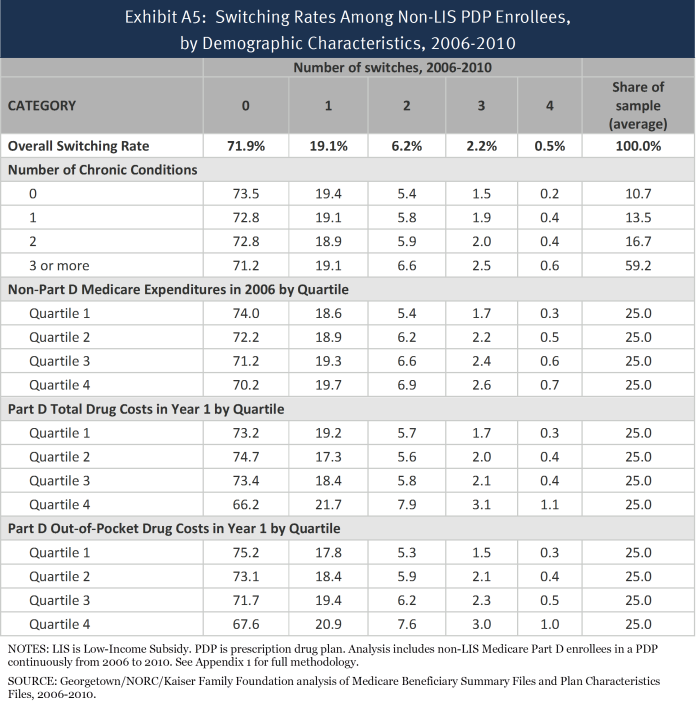

We built another sample of beneficiaries who were enrolled in the program for the entire 2006-2010 period (Table A3). To be included in the five-year sample, beneficiaries (1) must have participated in Part D continuously from December 2006 through January 2010 and (2) must have been non-LIS during all these months. We further subset the sample into three groups: those enrolled in PDPs throughout all 38 months of this time period, those enrolled in MA-PD plans for all 38 months, and those enrolled in some combination of PDPs and MA drug plans during the period.

For the non-LIS Part D enrollees in each two-year sample, we define a plan switch based on enrollment in a different plan in January of the second year, compared to December of the first year (plan elections made at any time during the annual enrollment period are effective on January 1). This approach is the same as that which MedPAC uses to assess the rate of Part D plan switching.1 The use of December-to-January to measure change in plans as the definition of a plan switch restricts the analysis to switching that occurs during the annual enrollment period that ends in December of each year, and excludes any plan switching that occurs in the additional open enrollment period available to Part D enrollees at the beginning of the year or other mid-year plan switches. The policy in effect between 2006 and 2010 allowed enrollees the opportunity to make one additional change in health plans in January, February, or March, as long as the change did not involve adding or dropping drug coverage.2 Measuring plan switches that occurred between December of year 1 and January of year 2 means that changes made in this additional open enrollment period were not captured in our analysis. In addition, enrollees may switch plans at any time during the year in special circumstances, such as moving to a new address with different plan options or moving into or out of an institution. As a result, our analysis has underestimated the overall rate of plan switching by some unknown degree. However, an examination of enrollment data in CMS’s monthly enrollment reports suggests that the use of these additional opportunities to switch plans is relatively low and their inclusion would not have a sizeable effect on the overall rates of plan switching measured here.

We do not count plan switches that are involuntary under the following two circumstances: (1) a plan enrollee whose plan (as designated by the contract ID and plan ID combination) changes, but where the old plan and the new plan are matched (“crosswalked”) and who accepts the automatic transfer to the crosswalked plan;3 and (2) any plan enrollee whose plan exits the program without any crosswalked plan and who therefore must select a new plan to remain in Part D.4 For the five-year sample, switches were defined in a comparable manner, taking into account only voluntary switches that occurred between December of one year and January of the next year.

Because the switching analysis presented here is based on individual decisions, the sample of beneficiaries for the analysis of each two-year file excludes newly eligible beneficiaries, beneficiaries who died during the relevant time period, and others who did not participate in Part D in both years. In addition, this analysis excludes from the estimate of switching rates various types of involuntary switches. As a result, the results reported here cannot be used to project the total net enrollment change from one year to the next. The net enrollment change is a product of how many people switch plans voluntarily, those who switch involuntarily as a result of plan exits, new enrollees to Part D, and those who have died or disenrolled from Part D.

The encryption of plan identifiers imposes some limitations on our study. Some plan sponsors operate under multiple contract numbers, often because they acquire the contract number from another plan sponsor through a corporate merger or acquisition. As a result, we cannot reliably distinguish between switches within plans offered by the same sponsor and those across plan sponsors. In addition, the use of encrypted plan identifiers makes it difficult to analyze plan characteristics that are not reported in the plan characteristics files. For example, we cannot look at externally derived measures of plan benefit designs or plan formularies, beyond measures included in the plan characteristics files (especially premiums, gap coverage, and deductibles).

Another limitation, especially for looking at the impact of plan characteristics, is that plans may change in multiple ways from one year to the next. As a result, it may be difficult to determine when a switch is more associated with one factor (such as a premium increase) or another (such as a deductible increase) when many beneficiaries in the sample are enrolled in the same plan. For example, some beneficiaries facing an increased deductible face the same premium change because they are in the same plan. This situation makes it more difficult to disentangle the effects of different plan characteristics and to interpret statistical significance tests. To mitigate this concern, we focused the analysis of changes in plan characteristics on years when changes were more common and where differences in switching rates were larger. We also put the variables measuring changes in plan premiums, deductibles, and gap coverage in a multivariate logistic regression, which should control for simultaneous plan changes. Parameters for all three types of benefit change were statistically significant, and the estimated odds ratios showed that the magnitude of the relationships was substantial.

In addition, the study is limited to the plan and beneficiary characteristics in the Medicare Beneficiary Summary File. We did not obtain for this study the prescription drug events (claims) for beneficiaries or claims from Medicare Parts A and B. Thus, we cannot calculate beneficiary risk scores or use measures of drug spending or other Medicare spending beyond the summary measures available in the Master Beneficiary Summary File. In addition, no measures of income or education are available, and the coding of race and ethnicity (as presented in Appendix 2, Exhibits A1 and A4) in the Medicare files raises issues.5 First, race and ethnicity are not divided into separate variables. For example, Hispanic beneficiaries who are black may be listed as Hispanic but not as black. Second, information on race is self-identified, typically either when someone first applies for a Social Security number or first applies for benefits (with some updating from a postcard survey). To address issues of accuracy and bias in the coding (especially for Hispanic and Asian/Pacific Islander beneficiaries), CMS has a second variable based on an imputation algorithm that largely relies on surnames and increases the number of beneficiaries coded as Hispanic or Asian/Pacific Islander.6 We have used the second variable for the tables in Appendix 2. However, the results based on race and ethnicity should be used with caution.

.