Wide Disparities in the Income and Assets of People on Medicare by Race and Ethnicity: Now and in the Future

Section 2: Financial Assets and Savings

This section describes the total savings of the Medicare population across race/ethnicity in 2012. Total savings include retirement account holdings (such as IRAs or 401Ks) and other financial assets, including savings accounts, bonds and stocks. Savings are presented on a per person basis; for married people, savings are divided equally between spouses to calculate per capita savings.

Key Findings:

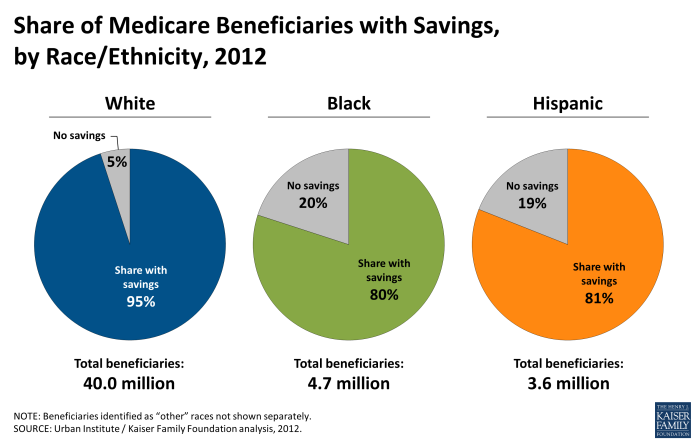

- Nearly all (92%) Medicare beneficiaries had some savings, but rates were higher among white beneficiaries (95%) than among black and Hispanic beneficiaries (80% and 81%, respectively). Similarly, one in 20 white beneficiaries did not have savings or were in debt compared to nearly one in five black beneficiaries and Hispanic beneficiaries.

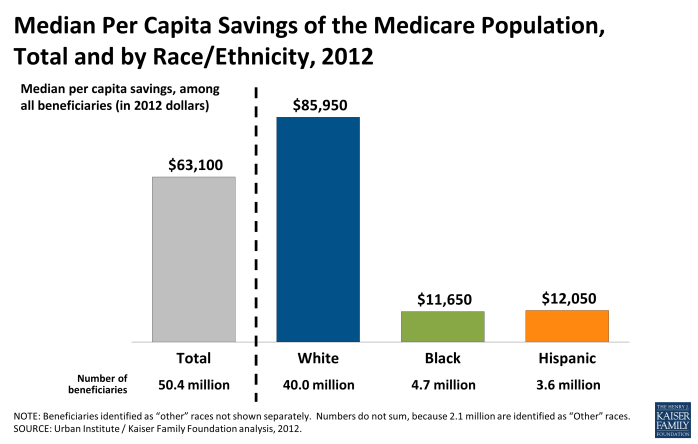

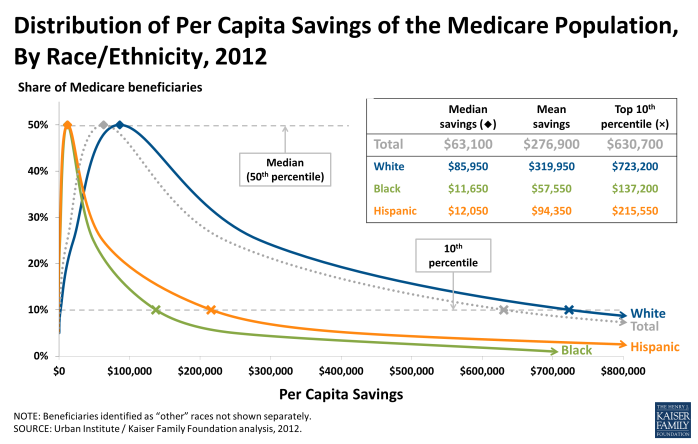

- Half of all Medicare beneficiaries had less than $63,100 in savings in 2012. Median savings for white beneficiaries ($85,950) were more than seven times the median savings for black beneficiaries ($11,650) and Hispanic beneficiaries ($12,050).

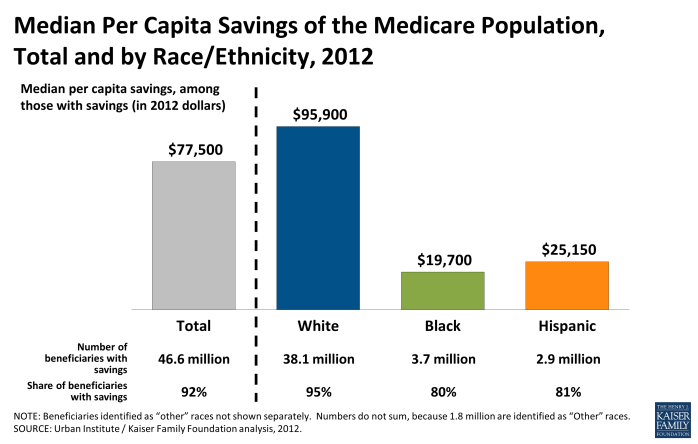

- Among beneficiaries with savings, half had less than $77,500 in savings in 2012; median savings for white beneficiaries ($95,900) were nearly five times the median savings for black beneficiaries ($19,700) and nearly four times the median savings for Hispanic beneficiaries ($25,150) in 2012.

- While the top 10 percent of all black and Hispanic beneficiaries had savings above $137,200 and $215,550, respectively, the top 10 percent of white beneficiaries had savings above $723,200 in 2012.

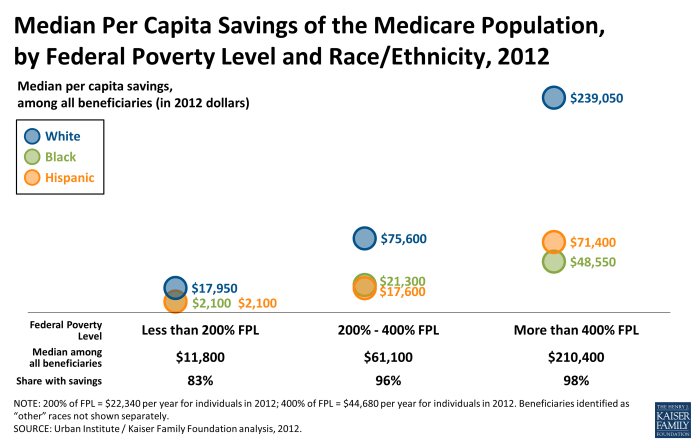

- The share of beneficiaries with any savings and the median savings among beneficiaries increased with income, with large racial/ethnic differences in savings across all income levels. Among beneficiaries who had incomes over 400 percent of the federal poverty level, median savings for white beneficiaries ($239,050) was nearly five times the median savings for black beneficiaries ($48,550) and more than three times the median savings for Hispanic beneficiaries ($71,400).

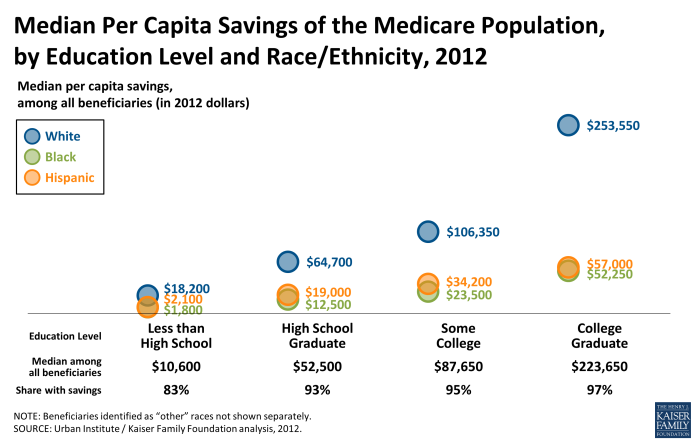

- Median savings were higher among beneficiaries with more years of education, but differences in savings by race/ethnicity were evident across all education groups with the greatest disparities among beneficiaries with the most years of education. Among college-educated beneficiaries, median savings for white beneficiaries ($253,550) was nearly five times the median savings for black beneficiaries ($52,250) and more than four times the median savings for Hispanic beneficiaries ($57,000) in 2012.

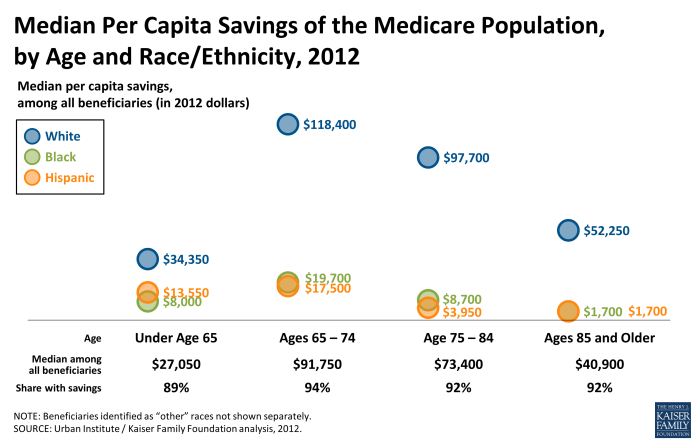

- Median savings were lowest among those age 85 and older ($40,900) and those under age 65 ($27,050), but median savings differed across race/ethnicity for all age groups. Among beneficiaries between the ages of 65 and 74, median savings among white beneficiaries ($118,400) was about six times the median savings among black and Hispanic beneficiaries $19,700 and $17,500, respectively) in 2012.

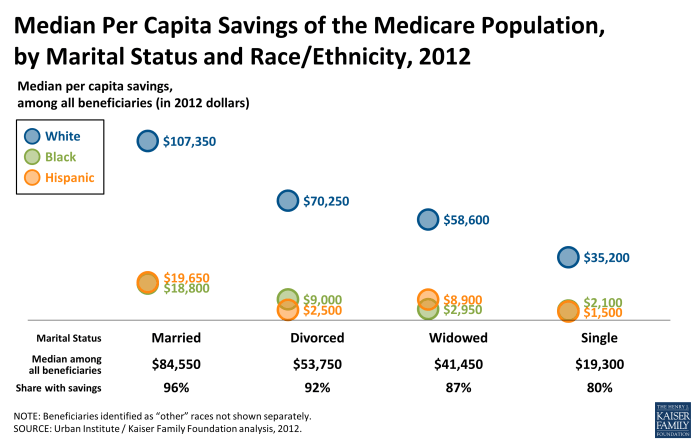

- Median per capita savings were higher among married beneficiaries ($84,550) than among divorced, widowed, or single beneficiaries ($53,750, $41,450, and $19,300, respectively), with racial/ethnic differences in median savings across all marital groups. Among married beneficiaries, median per capita savings among white beneficiaries was $107,350, between five and six times the median savings among black and Hispanic beneficiaries ($18,800 and $19,650, respectively) in 2012.

‹ Section 1: Income Section 3: Home Equity ›